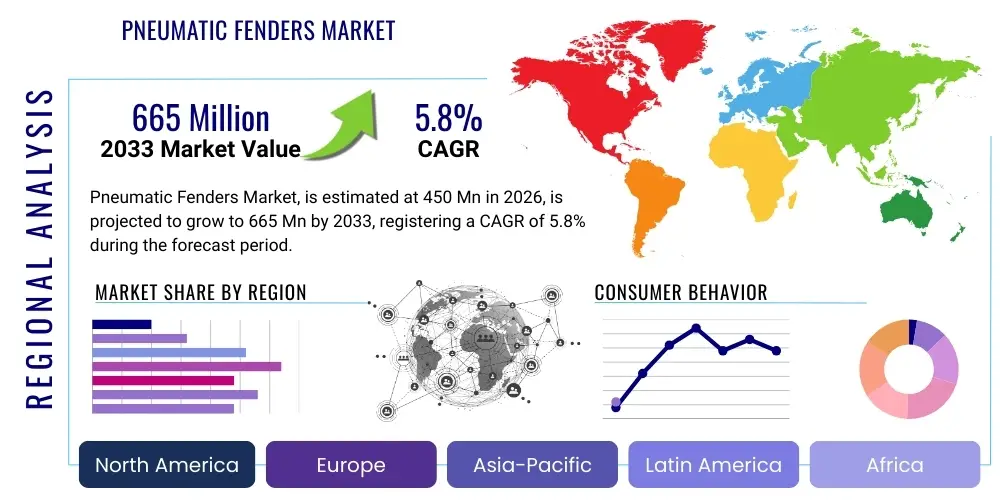

Pneumatic Fenders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441720 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Pneumatic Fenders Market Size

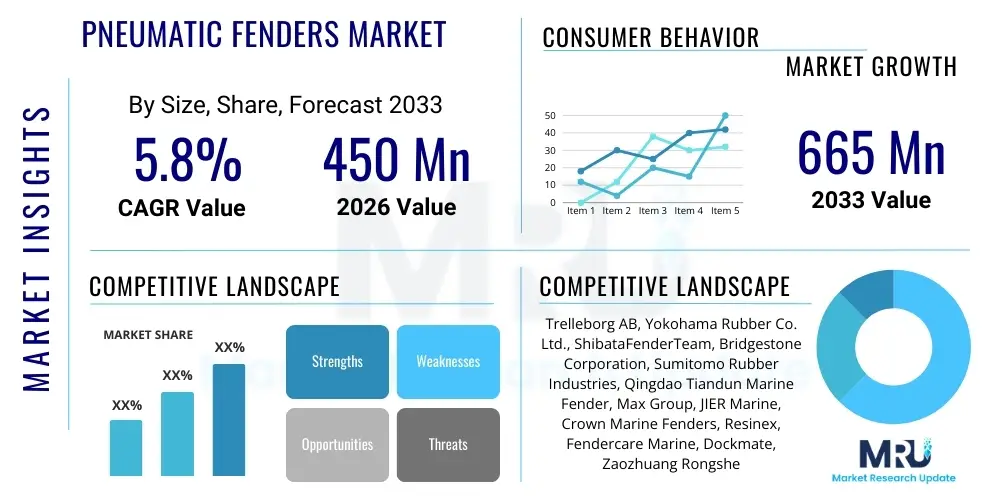

The Pneumatic Fenders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Pneumatic Fenders Market introduction

The Pneumatic Fenders Market encompasses the production, distribution, and utilization of pressurized rubber structures designed to absorb the kinetic energy of ships and vessels during berthing, mooring, or ship-to-ship (STS) transfer operations. These devices, primarily utilizing compressed air, function as crucial protective buffers, minimizing collision damage to ships and port infrastructure. Key products include Yokohama-type pneumatic fenders, foam-filled fenders, and hydro-pneumatic variants, engineered to meet stringent international standards set by bodies such as the OCIMF (Oil Companies International Marine Forum) and ISO (International Organization for Standardization). Major applications span commercial ports, liquefied natural gas (LNG) terminals, offshore platforms, and naval fleets, where reliable energy absorption capacity is paramount for safe operations.

The primary benefits of pneumatic fenders include their high energy absorption capacity coupled with a relatively low reaction force, making them ideal for handling large displacement vessels, including VLCCs (Very Large Crude Carriers) and container ships. Their inherent elasticity and standardized maintenance procedures contribute to operational efficiency and reduced downtime. Furthermore, they are highly versatile, capable of being deployed rapidly in various environmental conditions and are often chosen for temporary mooring systems and emergency repair scenarios due to their ease of relocation.

Driving factors propelling market expansion are fundamentally linked to the growth in global seaborne trade, necessitated by increasing industrial output and consumer demand. Significant investment in port infrastructure modernization, especially in developing economies of Asia Pacific and the Middle East, requires high-performance marine protection systems. Furthermore, stricter maritime safety regulations and the expansion of the offshore energy sector, particularly floating offshore wind farms and oil and gas terminals requiring complex ship interaction management, continuously bolster the demand for certified and robust pneumatic fender solutions.

Pneumatic Fenders Market Executive Summary

The Pneumatic Fenders Market is characterized by steady technological refinement aimed at enhancing durability, optimizing energy absorption characteristics, and integrating smart monitoring systems. Key business trends indicate a shift towards specialized, custom-engineered fender solutions that cater specifically to the requirements of LNG carriers and mega container vessels, which exert significantly higher impact forces. Strategic consolidation through mergers and acquisitions is evident among leading manufacturers seeking to expand their global service networks and leverage material science advancements, particularly in developing highly durable rubber compounds capable of withstanding extreme UV exposure and abrasive marine environments.

Regionally, Asia Pacific maintains the dominant market share, driven by rapid port expansion projects in China, India, and Southeast Asia, reflecting booming maritime logistics activity and naval modernization programs. Europe and North America represent mature markets focused on replacing aging infrastructure and adopting premium, maintenance-friendly fender systems to comply with rigorous safety and environmental regulations. Emerging regions like the Middle East and Africa (MEA) are experiencing high growth, fueled by substantial investments in hydrocarbon export terminals and strategic maritime trade corridors, necessitating robust ship protection systems for large tanker operations.

Segment trends reveal that the High-Pressure Pneumatic Fenders segment remains the largest revenue contributor due to its widespread adoption in high-traffic commercial ports and STS operations involving large vessels. However, the Hydro-Pneumatic Fenders segment is experiencing accelerated growth, particularly in naval and specialized marine applications, attributed to their exceptional performance characteristics in tidal areas and for submarine berthing. The application segment growth is primarily propelled by the Commercial Shipping sector, although the Offshore Wind segment is expected to demonstrate the highest CAGR as global renewable energy infrastructure continues its aggressive expansion.

AI Impact Analysis on Pneumatic Fenders Market

User inquiries regarding AI's impact on the Pneumatic Fenders Market frequently center on predictive maintenance, sensor integration, and operational efficiency improvements. Users are keen to understand how AI algorithms can analyze real-time data collected from fender impact sensors (suchometers) to predict structural fatigue, optimize inflation pressures, and schedule proactive maintenance, thereby extending product lifespan and reducing operational risks. There is also significant interest in using machine learning to simulate complex berthing scenarios under adverse weather conditions, providing port operators with optimal approach guidance and confirming the adequacy of the fender setup before the vessel arrives. The core expectation is that AI integration will shift the industry from reactive maintenance to intelligent, data-driven asset management, enhancing safety compliance and cost-effectiveness across port operations.

- Implementation of AI-driven Predictive Maintenance (PdM) algorithms to monitor internal pressure, rubber integrity, and impact frequency.

- Integration of Smart Fenders featuring embedded IoT sensors that transmit real-time kinetic energy absorption data for operational optimization.

- Optimization of berthing maneuvers using machine learning models trained on historical vessel interaction data, improving safety margins.

- Automated anomaly detection within fender systems, signaling minor damage or deflation before catastrophic failure occurs.

- Enhanced inventory management for spare parts and scheduled replacement based on predicted wear rates calculated by AI models.

DRO & Impact Forces Of Pneumatic Fenders Market

The market dynamics are governed by a complex interplay of growth drivers stemming from global trade and infrastructure spending, constraints related to operational logistics and material stability, and significant opportunities arising from specialized market needs and technological integration. The primary driver remains the continuous increase in the size of the global shipping fleet, particularly ultra-large container vessels (ULCVs) and large LNG carriers, which demand proportionally larger and more robust energy absorption systems. Safety mandates issued by regulatory bodies worldwide force vessel owners and terminal operators to routinely upgrade their fender protection, providing consistent market impetus. However, the market faces restraints primarily due to the high initial capital investment required for high-grade pneumatic fenders and the logistical challenges associated with their necessary periodic maintenance, repair, and replacement, especially in remote offshore locations.

A significant opportunity exists in the growing demand for specialized hydro-pneumatic fenders used in niche maritime operations, such as military docking facilities and offshore renewable energy installations where tidal variations or specialized vessel forms require variable displacement and reaction force control. Further growth is anticipated through the development of environmentally friendly materials that minimize the leaching of microplastics or harmful chemicals into marine ecosystems, catering to increasingly strict environmental regulations in developed nations. Innovation focused on lightweight, yet highly resilient, composite materials also presents a pathway for market differentiation.

The impact forces influencing the market are multifaceted. Regulatory influence (R) is high, mandating continuous investment in certified equipment. Economic impact (E) is moderate to high, as global trade fluctuations directly affect port throughput and subsequent demand for fendering solutions. Technological advancements (T) have a moderate impact, primarily through material science and the integration of IoT/AI for smart monitoring, which enhances product value proposition. The competitive impact (C) is significant, characterized by a few major global players competing aggressively on product certification, price, and after-sales service, putting pressure on smaller, regional manufacturers to specialize or consolidate.

Segmentation Analysis

The Pneumatic Fenders Market segmentation offers a granular view of demand patterns, classified primarily by construction type, application, and distribution channel. Understanding these segments is crucial for strategic planning, as different end-user sectors exhibit varying requirements regarding energy absorption, fender diameter, durability, and certification standards. The market continues to evolve towards product differentiation, with manufacturers optimizing material formulations and internal pressure mechanisms to meet sector-specific demands, particularly those from the high-specification offshore and naval domains.

- By Type

- High-Pressure Pneumatic Fenders

- Low-Pressure Pneumatic Fenders

- Hydro-Pneumatic Fenders

- Others (e.g., specialized submarine fenders)

- By Application

- Commercial Ports and Terminals (Container, Bulk Cargo, General Cargo)

- Ship-to-Ship (STS) Transfers

- Offshore Oil & Gas and Renewable Energy Platforms

- Naval and Military Operations

- By Distribution Channel

- Direct Sales (Manufacturer to End-User)

- Distributors and Agents

- Online Channels (Limited, primarily for parts/accessories)

Analysis by Type

The High-Pressure Pneumatic Fenders segment dominates the market by volume and value. These fenders, typically standardized according to ISO 17357-1:2014, are the default choice for general port operations and most large commercial vessel transfers, offering a robust balance of high energy absorption and relatively low reaction force at standard working pressures. Their standardized design ensures interchangeability and established repair procedures, contributing significantly to their widespread global adoption. Market growth within this segment is sustained by continuous fleet expansion and the mandatory replacement cycle of existing port equipment, ensuring a stable revenue stream for key manufacturers.

Conversely, the Hydro-Pneumatic Fenders segment, while smaller, is projected to register the fastest growth rate. These specialized fenders are partially water-filled, allowing for precise control over the energy absorption curve and reaction force, making them indispensable for handling specialized vessels, particularly submarines and specific types of ROROs (Roll-on/Roll-off vessels) where the contact surface or water level variation is critical. The growing deployment of floating infrastructure, such as FLNG (Floating Liquefied Natural Gas) terminals and floating docks, further necessitates the use of these advanced, high-precision fendering systems, requiring specialized engineering expertise for both manufacturing and deployment.

Low-Pressure Pneumatic Fenders, characterized by larger diameters and lower internal pressures, typically serve smaller vessels or are utilized as secondary protection barriers. While facing increasing competition from foam-filled fenders in certain recreational or smaller vessel segments, they maintain relevance in specific older port configurations or lighter duty applications where extreme impact forces are not expected. Manufacturers are investing in material improvements across all types to enhance puncture resistance and overall operational longevity under harsh marine conditions, focusing on the quality of the outer tire net and rubber compounds.

Analysis by Application

The Commercial Ports and Terminals segment represents the largest application area, driven by the sheer volume of global cargo movement. Container terminals, in particular, require reliable and durable pneumatic systems to manage the frequent and high-energy berthing of modern mega-ships. Investments in smart port technologies, which include integrating fenders with real-time data monitoring systems, are becoming a standard feature in newly developed and modernized commercial terminals globally, ensuring operational efficiency and maximizing quay utilization during high-traffic periods.

The Ship-to-Ship (STS) Transfers segment is also a critical revenue driver, particularly in the oil and gas sector where large tankers transfer crude oil or LNG offshore to maintain supply chain flexibility or bypass congested ports. Safety and regulatory compliance are exceptionally high in STS operations, necessitating the use of certified, high-performance pneumatic fenders often coupled with ancillary equipment such as mooring hawser monitoring systems. The demand in this segment is strongly correlated with fluctuations in global energy trading and offshore production activities.

The Offshore Oil & Gas and Renewable Energy segment presents a burgeoning market opportunity. Floating structures, including FPSOs (Floating Production Storage and Offloading) and the foundation structures of offshore wind turbines, require highly specialized fendering solutions to accommodate continuous, low-amplitude movements and extreme weather conditions. The aggressive build-out of offshore wind farms, particularly in the North Sea and Asia Pacific, is generating substantial demand for custom-sized, highly robust pneumatic fenders capable of prolonged exposure with minimal maintenance requirements. Naval and Military Operations constitute a stable but specialized market, requiring fenders that meet strict military specifications for resilience, rapid deployment, and minimal signature.

Value Chain Analysis For Pneumatic Fenders Market

The value chain for the Pneumatic Fenders Market begins with upstream activities focused on raw material sourcing, primarily high-quality synthetic and natural rubber compounds, reinforcing fibers (like nylon or polyester cord), and metallic components for connecting fixtures and valve systems. The performance and lifespan of pneumatic fenders are critically dependent on the integrity and chemical stability of the rubber matrix, necessitating strong relationships between manufacturers and specialized rubber compound suppliers. Fluctuations in the global price of crude oil, a key feedstock for synthetic rubber, directly impact the upstream production costs. Quality control at this stage, particularly ensuring resistance to ozone cracking and seawater degradation, is paramount for product certification and end-user satisfaction.

Midstream activities involve the specialized manufacturing process, including vulcanization, molding, and assembly under strict ISO 17357 standards. Manufacturers must invest heavily in specialized plant equipment capable of handling large molding processes and quality assurance testing (e.g., hydrostatic pressure tests and energy absorption verification). Due to the heavy nature and complex certification requirements of pneumatic fenders, manufacturing processes tend to be centralized among a few global leaders. This stage also includes the crucial step of integrating pressure monitoring systems and anti-burst technology for enhanced safety and compliance, driving specialization in manufacturing expertise.

Downstream activities focus on logistics, distribution, and after-sales service. Distribution channels include direct sales to major port authorities, naval commands, or offshore operators for large-scale projects, and indirect sales through specialized maritime agents and distributors who handle smaller orders, localized service, and emergency replacements. Due to the critical role of these safety devices, after-sales support, including inflation management services, repair kits, and certified repair workshops, forms a major component of the value proposition. The indirect channel often leverages local expertise to navigate complex regional customs and maintenance standards, providing localized inventory holdings to reduce delivery times for emergency replacements.

Pneumatic Fenders Market Potential Customers

The primary end-users and buyers of pneumatic fenders are entities operating within the global maritime infrastructure and transportation ecosystem. This includes governmental agencies, multinational corporations, and private operators who manage significant assets interacting with the sea. The largest customer segment consists of Port and Terminal Authorities globally, ranging from large container ports handling millions of TEUs (Twenty-foot Equivalent Units) annually to specialized LNG and petrochemical terminals that require tailored safety solutions. These customers prioritize long-term durability, low maintenance overhead, and compliance with national and international maritime regulations.

Another major customer group comprises Ship Owners and Operators, particularly those involved in STS transfer operations, such as crude oil tankers, bulk carriers, and specialized chemical carriers. For these buyers, pneumatic fenders are essential operational assets that directly influence insurance premiums and operational safety protocols. Their purchasing decisions are often guided by class society recommendations and the need for portable, rapidly deployable systems that can protect both vessels during close quarters maneuvering, irrespective of the receiving facility's infrastructure quality.

Further key customers include Offshore Energy Developers and Service Companies involved in the construction and maintenance of oil rigs, floating platforms (FPSOs, FSOs), and increasingly, offshore wind farms. These projects demand highly resilient, often custom-engineered hydro-pneumatic solutions designed to endure harsh, dynamic environmental loads over decades. Lastly, global Naval Forces represent a stable customer base, requiring fenders that meet highly specialized military specifications for stealth, rapid inflation/deflation, and maximum resistance to extreme impact conditions during complex docking procedures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trelleborg AB, Yokohama Rubber Co. Ltd., ShibataFenderTeam, Bridgestone Corporation, Sumitomo Rubber Industries, Qingdao Tiandun Marine Fender, Max Group, JIER Marine, Crown Marine Fenders, Resinex, Fendercare Marine, Dockmate, Zaozhuang Rongsheng Rubber Co. Ltd., Anchor Marine, Ocean Science and Engineering, Inc., Mair Rubber and Plastics, Sea Guard Fenders, Guangzhou Hisea Marine Equipment Co. Ltd., Jiangsu Yasheng Rubber Products Co. Ltd., Unique Polymer Systems (UPS). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pneumatic Fenders Market Key Technology Landscape

The technology landscape in the Pneumatic Fenders Market is primarily driven by material science innovation and the increasing digitalization of maritime assets. Core technology revolves around advanced compounding of rubber materials, specifically developing synthetic elastomer blends that offer superior resistance to environmental stressors such as UV radiation, ozone, extreme temperatures, and fatigue cycling inherent in high-frequency use. Manufacturers are continually refining the cord reinforcement layers within the fender body, typically using high-tenacity nylon or polyester fabrics, to enhance bursting strength and overall structural integrity under high impact pressures, directly impacting the certified lifespan and reliability of the product.

A major technological frontier is the integration of Smart Fenders, enabled by IoT (Internet of Things) technology. This involves embedding sophisticated sensors—including accelerometers, pressure transducers, and acoustic emission sensors—into the fender body and its accessories. These sensors capture real-time operational data, such as impact velocity, total absorbed energy, angle of contact, and internal pressure fluctuations. This data is wirelessly transmitted to port management systems or vessel operators, allowing for instant assessment of berthing severity, immediate alerts regarding dangerous pressure drops, and critical data inputs for predictive maintenance models powered by AI algorithms.

Further technological advancements focus on specialized product design, such as the evolution of Hydro-Pneumatic Fenders. These systems incorporate ballast water control mechanisms, often automated, to maintain optimized performance characteristics regardless of significant changes in draft or tide. The technology ensures that a portion of the vessel's kinetic energy is absorbed by the movement of water within the fender system, leading to highly controlled and reduced reaction forces, which is essential for specialized docking facilities. Additionally, manufacturers are focusing on improved valve and inflation technology to ensure easier maintenance and faster response times for deployment and recovery operations, ultimately enhancing operational flexibility for the end-user.

Regional Highlights

The global distribution of demand for pneumatic fenders is highly correlated with the volume of maritime trade and the level of port infrastructure investment across distinct geographical zones. Regional dynamics are influenced by local regulatory environments, the presence of major shipping lanes, and strategic geopolitical investments in naval capabilities and offshore energy projects.

Asia Pacific (APAC)

APAC represents the largest and fastest-growing market for pneumatic fenders globally. This dominance is attributable to the region housing some of the world's busiest ports (e.g., Shanghai, Singapore, Shenzhen) and its continuous investment in expanding commercial and naval infrastructure. Countries like China and India are aggressively modernizing their ports to handle the next generation of mega-vessels, driving massive demand for High-Pressure Pneumatic Fenders. The rapid growth of LNG trade in countries like Japan, South Korea, and emerging markets in Southeast Asia further accelerates the adoption of specialized fendering solutions for LNG terminals and STS transfers. Local manufacturing capacity in APAC is also expanding, leading to intense price competition but also increased localized innovation in materials science.

Europe

Europe holds a significant market share, characterized by its mature regulatory environment and a strong focus on advanced, high-specification products. Western European ports are focused on replacement cycles and adopting smart, sensor-integrated fenders to meet stringent safety and environmental standards. The region is also a key center for the offshore energy market, particularly offshore wind and specialized naval shipbuilding, which drives high demand for custom-engineered hydro-pneumatic and foam-filled fenders. Compliance with complex EU directives regarding material traceability and environmental impact strongly influences procurement decisions, favoring manufacturers offering certified, premium solutions.

North America

The North American market is stable, driven by critical infrastructure maintenance and naval requirements. Demand is high for robust, durable fenders used in major ports along the US and Canadian coastlines, focusing on long lifespan and minimal total cost of ownership. The growth of energy export terminals, especially along the Gulf Coast, and the ongoing modernization of US Naval facilities contribute significantly to market size. Compliance with high national safety standards and Buy American Act provisions (in some cases) means regional demand often focuses on quality and certification over absolute lowest price, facilitating the adoption of high-end pneumatic solutions.

Middle East and Africa (MEA)

MEA is emerging as a high-growth region, primarily due to large-scale investment in oil and gas export infrastructure and the strategic development of maritime hubs along key trade routes (e.g., UAE, Saudi Arabia, Egypt). These projects require large-diameter, heavy-duty pneumatic fenders to handle VLCCs and ULCCs (Ultra Large Crude Carriers) during berthing and STS operations. Economic diversification efforts across the GCC (Gulf Cooperation Council) countries, coupled with investments in commercial logistics, are propelling demand. The African component of the MEA market is gradually increasing, focusing on port efficiency improvements in resource-rich nations.

Latin America (LATAM)

LATAM presents a moderate but consistent market, largely tied to the commodity export sector (iron ore, agricultural products, oil). Port modernization projects, particularly in Brazil, Chile, and Panama (driven by the Canal traffic), stimulate demand for high-capacity pneumatic fendering systems. Economic stability and governmental spending on infrastructure are key determinants of market growth in this region, often favoring cost-effective, durable solutions that can withstand the demanding operational environments associated with bulk commodity loading.

- Asia Pacific (APAC): Dominant market, characterized by rapid port expansion, high manufacturing activity, and booming STS transfer demand, particularly in China and Southeast Asia.

- Europe: Mature market focused on technology replacement, compliance with strict environmental rules, and high demand from the specialized offshore wind sector.

- North America: Stable market sustained by naval upgrades, infrastructure maintenance, and stringent regulatory requirements prioritizing certified, high-quality fenders.

- Middle East and Africa (MEA): High-growth potential fueled by major investments in strategic oil and gas terminals and maritime logistics hubs.

- Latin America (LATAM): Growth linked to commodity export volume and ongoing regional port modernization projects aimed at increasing capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pneumatic Fenders Market.- Trelleborg AB

- Yokohama Rubber Co. Ltd.

- ShibataFenderTeam

- Bridgestone Corporation

- Sumitomo Rubber Industries

- Qingdao Tiandun Marine Fender

- Max Group

- JIER Marine

- Crown Marine Fenders

- Resinex

- Fendercare Marine

- Dockmate

- Zaozhuang Rongsheng Rubber Co. Ltd.

- Anchor Marine

- Ocean Science and Engineering, Inc.

- Mair Rubber and Plastics

- Sea Guard Fenders

- Guangzhou Hisea Marine Equipment Co. Ltd.

- Jiangsu Yasheng Rubber Products Co. Ltd.

- Unique Polymer Systems (UPS)

Frequently Asked Questions

Analyze common user questions about the Pneumatic Fenders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between high-pressure and hydro-pneumatic fenders?

High-pressure pneumatic fenders utilize compressed air only and are standardized for general use, offering high energy absorption. Hydro-pneumatic fenders use both compressed air and water ballast, providing optimized low reaction force and controlled energy absorption crucial for submersible or highly tidal applications.

Which factors govern the selection of the correct size and type of pneumatic fender for a port?

Selection is determined by the vessel's displacement (size), berthing velocity, desired stand-off distance from the quay, maximum allowable hull pressure, and site-specific environmental factors like tidal range and prevailing weather conditions, often guided by ISO 17357 standards.

How does the implementation of IoT technology affect the maintenance of pneumatic fenders?

IoT integration allows for real-time monitoring of internal pressure and impact loads (smart fendering), facilitating predictive maintenance (PdM). This reduces unexpected failures, optimizes inflation levels, extends the product lifespan, and lowers overall operational risk.

What is the role of certification bodies like OCIMF and ISO in the pneumatic fenders industry?

These bodies establish critical safety and performance standards (e.g., ISO 17357), ensuring fenders meet minimum requirements for quality, safety, and durability. Compliance is mandatory for use in many major ports and all regulated ship-to-ship transfer operations.

Is the market shifting toward foam-filled fenders as a substitute for pneumatic fenders?

While foam-filled fenders are gaining traction, especially in smaller vessel and some naval applications due to their puncture resistance, pneumatic fenders maintain dominance for high-energy absorption requirements (VLCCs, container ships) due to their superior performance characteristics regarding low reaction force relative to absorbed energy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager