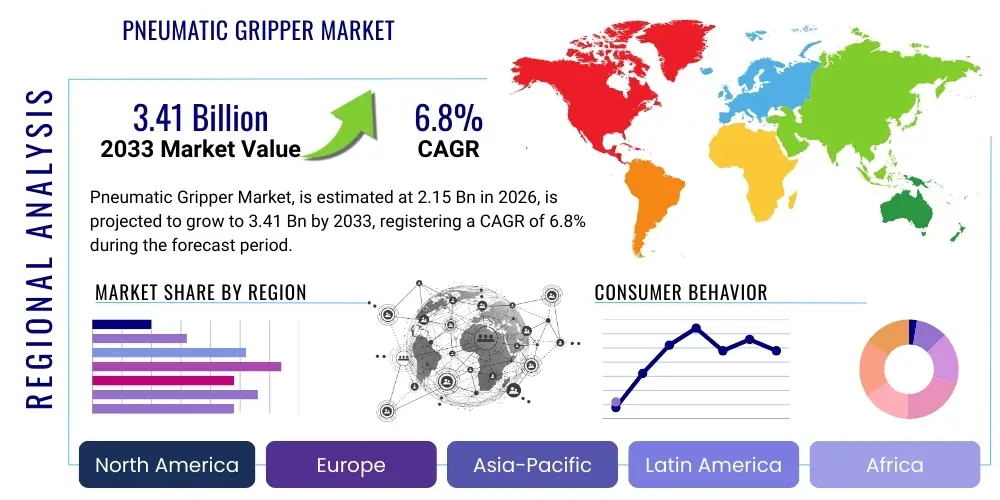

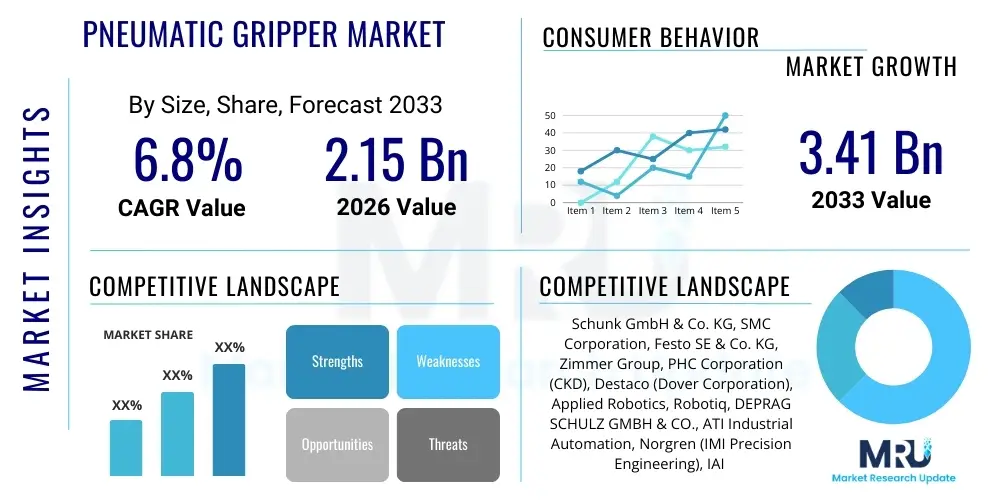

Pneumatic Gripper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441835 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Pneumatic Gripper Market Size

The Pneumatic Gripper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.15 billion in 2026 and is projected to reach $3.41 billion by the end of the forecast period in 2033.

Pneumatic Gripper Market introduction

Pneumatic grippers are essential end-of-arm tooling (EOAT) components utilized in industrial automation systems, designed to grasp, hold, and manipulate objects using compressed air. These devices translate pneumatic energy into mechanical motion, facilitating high-speed pick-and-place operations and material handling across various manufacturing processes. The fundamental operating mechanism involves pistons and jaws, providing reliable clamping force suitable for handling diverse materials ranging from delicate components to heavy industrial parts, making them critical elements in assembly lines and packaging systems globally.

The primary applications of pneumatic grippers span high-volume industries such as automotive manufacturing, electronics assembly, food and beverage processing, and pharmaceuticals. Their inherent robustness, simplicity of integration, and favorable cost-to-performance ratio compared to electric or hydraulic counterparts drive their widespread adoption. Key benefits include fast cycle times, high gripping force density, durability in harsh environments, and inherent compliance, which allows them to adapt easily to minor variations in workpiece geometry. The continuous evolution of manufacturing towards Industry 4.0 principles, emphasizing efficiency and repeatability, further cements the pneumatic gripper's foundational role in modern robotic automation setups.

Major driving factors influencing market expansion include the global surge in industrial robotics deployment, particularly in emerging economies focused on modernizing production infrastructure. The increasing demand for automation solutions in non-traditional sectors like logistics and medical devices, coupled with technological advancements leading to lighter, more precise, and energy-efficient pneumatic gripper designs, contribute significantly to market acceleration. Furthermore, the necessity for enhanced worker safety and consistent quality control necessitates the shift from manual labor to automated gripping solutions, underpinning steady market growth.

Pneumatic Gripper Market Executive Summary

The Pneumatic Gripper Market is characterized by robust growth driven by accelerating adoption of industrial automation and smart manufacturing initiatives worldwide. Business trends indicate a strong competitive focus on developing modular designs, enabling quicker integration and greater flexibility for complex handling tasks. Key manufacturers are investing heavily in lightweight materials and miniature pneumatic solutions to cater to smaller, collaborative robot (cobot) applications, emphasizing ease of programming and high duty cycles. The shift towards standardized interfaces and smart sensors integrated within the grippers to provide real-time feedback on grip force and object detection represents a critical evolution, addressing the industrial requirement for enhanced process control and predictive maintenance capabilities across automated lines.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market, propelled by massive capital investment in manufacturing capacity expansion, particularly in China, South Korea, and Japan, across the automotive and electronics sectors. North America and Europe maintain significant market shares, characterized by demand for high-precision, technologically advanced pneumatic solutions driven by stringent regulatory environments and a focus on advanced material handling in specialized fields like aerospace and pharmaceuticals. Segment trends highlight the dominance of parallel grippers due to their versatility and suitability for general industrial tasks, although the growth rate of specialized angular and three-jaw grippers is increasing as applications demand higher dexterity and complex workpiece manipulation, especially within demanding assembly operations requiring precise centering.

AI Impact Analysis on Pneumatic Gripper Market

User queries regarding AI's impact on pneumatic grippers primarily center on how artificial intelligence enhances decision-making, predictive maintenance, and the integration of these tools within increasingly complex robotic cells. Users are concerned with whether AI integration will make pneumatic systems obsolete or if it will primarily serve to optimize existing pneumatic infrastructure. Key themes revolve around improving gripper adaptability—allowing the tool to dynamically adjust force or positioning based on real-time feedback and machine learning algorithms—and leveraging AI to predict operational failure of pneumatic components, thereby minimizing downtime. Expectations are high for AI-driven vision systems that can guide precise gripping of randomly oriented parts, significantly improving throughput in unstructured environments, which addresses the critical need for flexibility in modern high-mix, low-volume production.

- AI optimizes gripper force settings and cycle timing for energy efficiency and reduced wear.

- Predictive maintenance algorithms analyze pneumatic pressure and usage patterns to forecast component failure.

- Enhanced integration with AI-powered vision systems allows grippers to handle randomized or non-standard parts (bin picking).

- Machine learning facilitates dynamic adjustment of gripping parameters based on real-time material and task requirements.

- AI enables faster commissioning and self-tuning of pneumatic robotic cells, simplifying deployment.

DRO & Impact Forces Of Pneumatic Gripper Market

The Pneumatic Gripper Market is propelled by robust drivers, constrained by specific technological hurdles, but holds substantial opportunities for strategic expansion, underpinned by significant economic and industrial impact forces. Key drivers include the acceleration of automation across global manufacturing industries, driven by labor cost optimization and the pursuit of repeatable quality. However, the market faces restraints primarily related to the lower energy efficiency compared to electric grippers and the inherent requirement for compressed air infrastructure, which can introduce maintenance complexities and potential leakage issues. Opportunities lie in developing smart pneumatic grippers with integrated Internet of Things (IoT) capabilities and modular designs suitable for collaborative robot applications, allowing seamless integration into flexible production lines. The primary impact force remains the pervasive adoption of Industry 4.0 standards, mandating connected and optimized material handling solutions.

Segmentation Analysis

The Pneumatic Gripper Market segmentation provides a granular understanding of the diverse product offerings and their specialized applications across end-user industries. The market is broadly categorized based on the functional type of the gripper (parallel, angular), the configuration of the jaws (2-jaw, 3-jaw), and the specific industry where the solution is deployed. Parallel grippers currently dominate the market due to their straightforward operation, high clamping accuracy, and versatility in handling objects of varying sizes with minimal setup adjustments. Conversely, angular grippers, while less common, are indispensable for specific tasks requiring components to be rotated or articulated during the handling process, often found in specialized machine tending or intricate assembly operations.

Analyzing the segmentation by application reveals a strong concentration in sectors demanding high throughput and precision, such as automotive assembly lines and electronics manufacturing, where fast cycle times and reliable gripping are paramount to operational success. The increasing sophistication of automated processes is driving demand for multi-jaw grippers and specialized miniature pneumatic devices tailored for handling small, delicate components found in medical devices or consumer electronics. This trend towards customization ensures that pneumatic technology remains relevant amidst the rising competition from electric grippers, particularly by excelling in environments requiring high force-to-weight ratios and tolerance to contaminants often found in industrial settings like foundries or heavy material handling operations.

- By Type:

- Parallel Grippers

- Angular Grippers

- Toggle Grippers

- Specialty/Others

- By Function:

- 2-Jaw Grippers

- 3-Jaw Grippers

- Multi-Jaw Grippers (4-Jaw and above)

- By Application/Industry:

- Automotive Manufacturing

- Electronics and Semiconductor

- Food & Beverage and Packaging

- Pharmaceuticals and Medical Devices

- Machine Tools and Metal Working

- Logistics and Warehouse Automation

- Others (Aerospace, Consumer Goods)

Value Chain Analysis For Pneumatic Gripper Market

The value chain for the Pneumatic Gripper Market begins with the upstream suppliers of raw materials, including specialized alloys, aluminum, seals, and advanced polymer compounds necessary for manufacturing the robust bodies, pistons, and jaw mechanisms. Key component suppliers, specializing in compressed air system fittings, solenoid valves, and pneumatic logic control units, also play a critical role, ensuring the consistent supply of components that dictate the gripper's performance and reliability. Efficiency and cost optimization at this stage are crucial, as raw material price fluctuations directly impact the final product cost. Effective upstream management involves long-term procurement contracts and quality assurance checks to guarantee material durability under high-stress industrial conditions.

Midstream activities involve core manufacturing, assembly, and integration. Leading manufacturers focus on precision machining, surface treatments (for corrosion resistance), and meticulous assembly processes, often integrating specialized sensors for feedback and control. The distribution channel is bifurcated into direct and indirect routes. Direct sales are common for highly customized or large-scale integrated robotic solutions, where manufacturers work closely with system integrators and large original equipment manufacturers (OEMs). Indirect channels rely heavily on a network of authorized distributors, resellers, and value-added system integrators who provide localized inventory, technical support, and installation services to smaller and mid-sized end-users globally.

Downstream analysis focuses on installation, maintenance, and end-user deployment. System integrators are critical downstream partners, adapting the gripper to specific robotic arms and programming the handling sequence for optimal efficiency in the final application, such as high-speed pick-and-place or complex machine tending. After-sales support, including spare parts supply, technical troubleshooting, and scheduled maintenance, is vital for long-term customer retention. The effectiveness of the indirect channel in providing prompt regional service heavily influences market perception and brand loyalty, emphasizing the need for robust training programs for distributor technical teams to maintain product integrity and operational performance in the field.

Pneumatic Gripper Market Potential Customers

Potential customers for pneumatic grippers encompass a wide array of manufacturers and automation users seeking dependable, high-speed material handling solutions, with a dominant concentration among large-scale enterprises driving capital investment in automated assembly lines. The primary buyers are production managers, automation engineers, and procurement specialists within the manufacturing sectors, who prioritize solutions offering high throughput, reliable repeatability, and low operational downtime. These end-users typically purchase grippers as integral components of larger robotic work cells or automated machinery packages, demanding seamless mechanical and control integration with existing factory infrastructure. The increasing adoption of smaller, localized automation solutions also targets small-to-medium enterprises (SMEs) entering basic automation, preferring pneumatic systems for their relatively lower entry cost compared to electric alternatives.

The automotive industry represents a cornerstone customer segment, utilizing robust pneumatic grippers for handling heavy body parts, engine components, and specialized assembly tasks that require significant clamping force. Electronics and semiconductor manufacturers are increasingly crucial customers, requiring miniature, clean-room compliant pneumatic grippers for handling delicate wafers, circuit boards, and minute consumer electronic parts with high precision and gentle force control. Furthermore, the burgeoning logistics and e-commerce sector is rapidly becoming a significant buyer, employing pneumatic solutions for automated sortation, packaging, and palletizing operations within high-volume warehouse environments, where speed and versatility in handling diverse package sizes are essential operational requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 billion |

| Market Forecast in 2033 | $3.41 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schunk GmbH & Co. KG, SMC Corporation, Festo SE & Co. KG, Zimmer Group, PHC Corporation (CKD), Destaco (Dover Corporation), Applied Robotics, Robotiq, DEPRAG SCHULZ GMBH & CO., ATI Industrial Automation, Norgren (IMI Precision Engineering), IAI America Inc., SAS Automation LLC, Camozzi Automation S.p.A., WEISS Robotics GmbH & Co. KG, ZAYER S.A., GRIPPER, HIWIN Corporation, MKS Instruments, PHD Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pneumatic Gripper Market Key Technology Landscape

The technological landscape of the Pneumatic Gripper Market is rapidly evolving, moving beyond simple actuation to incorporate sophisticated sensing, control, and material innovations. A key technology advancement involves the development of lightweight materials, such as high-strength aluminum alloys and composites, which reduce the mass of the end-effector. This reduction in weight is critical for improving robot arm speed, maximizing payload capacity, and facilitating the use of grippers on collaborative robots (cobots), where safety standards mandate lower inertia in tooling. Further innovation is focused on improving internal sealing and air consumption efficiency, addressing the historical restraint related to energy losses in traditional pneumatic systems.

Integrated sensor technology represents another significant area of technological focus. Modern pneumatic grippers are frequently equipped with magnetic position sensors for precise jaw location monitoring, pressure sensors to ensure accurate and repeatable gripping force application, and often, integrated inductive or capacitive proximity sensors for object detection. This sensory feedback loop is crucial for high-precision assembly tasks and for interfacing the gripper seamlessly with complex programmable logic controllers (PLCs) or robot controllers. The digitalization of the pneumatic system, facilitated by IO-Link communication standards, allows for remote diagnostics, parameter adjustments, and streamlined data collection, supporting the demands of the smart factory environment.

The emergence of adaptive and soft pneumatic gripping technologies is opening new application possibilities, particularly in the food and beverage industry and advanced electronics handling. Adaptive finger designs, often utilizing bellows or flexible membranes, allow the gripper to conform to the shape of irregular or fragile objects without causing damage, overcoming the limitations of rigid traditional parallel jaws. Furthermore, advancements in specialized valve technology, including miniature proportional valves, enable exceptionally fine control over gripping speed and force profiles, expanding the utility of pneumatic solutions in applications previously reserved for electric servo grippers, thus enhancing pneumatic systems competitiveness in high-accuracy handling tasks.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global pneumatic gripper market, fueled by massive investment in automated manufacturing infrastructure, particularly in electronics, automotive, and emerging electric vehicle (EV) production hubs in China, South Korea, and Japan. The region benefits from lower operating costs and government initiatives promoting industrial modernization, leading to rapid adoption of robotic systems requiring reliable pneumatic EOAT for high-volume production.

- North America: The North American market is characterized by high demand for advanced, flexible automation solutions, driven by aerospace, pharmaceutical, and logistics sectors. Emphasis is placed on integrating pneumatic grippers with collaborative robots (cobots) and incorporating advanced feedback sensors for detailed data analytics, supporting premium, high-mix manufacturing operations.

- Europe: Europe is a mature market focusing on precision engineering, led by Germany and Italy. Regulatory pressure for energy efficiency drives innovation towards optimized air consumption designs. The market is strong in specialized machine tools, customized assembly lines, and food processing, demanding hygiene-compliant and highly reliable pneumatic solutions.

- Latin America (LATAM): LATAM represents an emerging market where automation penetration is accelerating, particularly in Mexico (driven by automotive proximity to the US) and Brazil (industrial sector growth). The demand is centered on cost-effective, durable pneumatic grippers for basic material handling and packaging tasks as companies begin their automation journey.

- Middle East and Africa (MEA): MEA is the smallest but growing region, driven by diversification efforts outside of oil and gas, focusing on developing domestic manufacturing capabilities, especially in packaging and construction materials in the UAE and Saudi Arabia. Market growth is heavily influenced by large-scale infrastructure projects requiring robust automation equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pneumatic Gripper Market.- Schunk GmbH & Co. KG

- SMC Corporation

- Festo SE & Co. KG

- Zimmer Group

- PHC Corporation (CKD)

- Destaco (Dover Corporation)

- Applied Robotics

- Robotiq

- DEPRAG SCHULZ GMBH & CO.

- ATI Industrial Automation

- Norgren (IMI Precision Engineering)

- IAI America Inc.

- SAS Automation LLC

- Camozzi Automation S.p.A.

- WEISS Robotics GmbH & Co. KG

- ZAYER S.A.

- GRIPPER

- HIWIN Corporation

- MKS Instruments

- PHD Inc.

Frequently Asked Questions

Analyze common user questions about the Pneumatic Gripper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of pneumatic grippers over electric grippers?

Pneumatic grippers generally offer higher force-to-size ratios, faster cycle times, lower initial purchase cost, and superior performance in harsh, dirty, or humid environments, making them ideal for rapid, high-force material handling applications.

Which industrial sectors are the largest consumers of pneumatic gripper technology?

The largest consuming sectors are automotive manufacturing for heavy component handling, electronics and semiconductor industries requiring high-precision miniature grippers, and the food and beverage sector relying on high-speed packaging and sorting solutions.

How is Industry 4.0 influencing the design of modern pneumatic grippers?

Industry 4.0 drives the integration of smart sensors and IO-Link communication into grippers, enabling real-time monitoring of grip force, position feedback, predictive maintenance diagnostics, and seamless data exchange within the factory network for enhanced operational transparency.

What is the projected Compound Annual Growth Rate (CAGR) for the Pneumatic Gripper Market?

The Pneumatic Gripper Market is projected to experience a CAGR of approximately 6.8% during the forecast period (2026–2033), driven primarily by global expansion in industrial automation and robotic deployment across APAC.

What factors determine the selection between 2-Jaw and 3-Jaw pneumatic grippers?

2-Jaw parallel grippers are preferred for general handling of square or rectangular parts; 3-Jaw grippers are selected when precise centering and symmetrical gripping of cylindrical objects are essential, commonly used in machine tending applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager