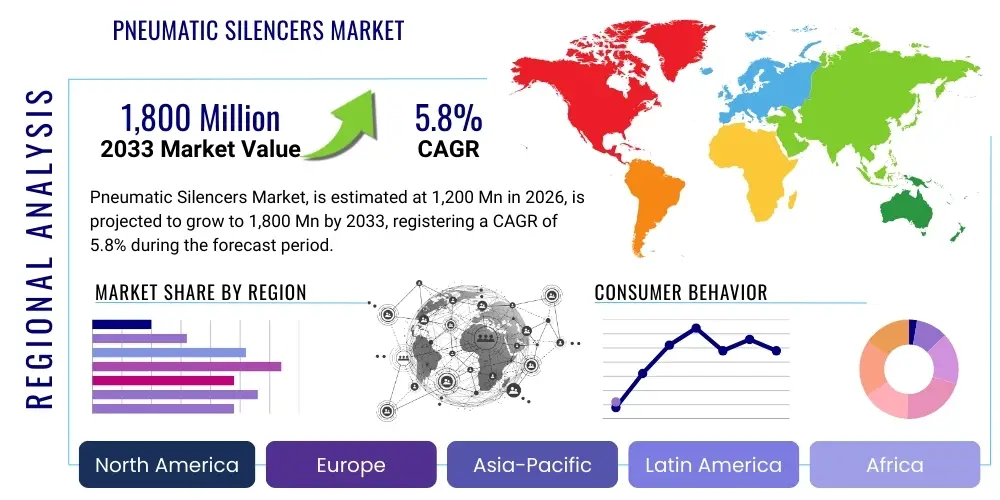

Pneumatic Silencers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443366 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Pneumatic Silencers Market Size

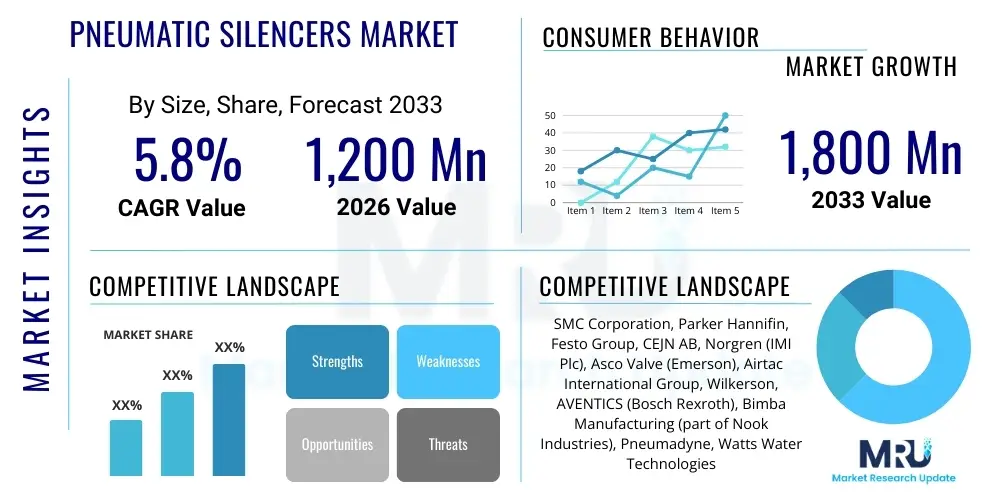

The Pneumatic Silencers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1,200 Million in 2026 and is projected to reach USD 1,800 Million by the end of the forecast period in 2033.

Pneumatic Silencers Market introduction

The Pneumatic Silencers Market is fundamentally driven by the stringent global regulations pertaining to industrial noise pollution and workplace safety standards, particularly within automated manufacturing environments. Pneumatic silencers, or mufflers, are essential components integrated into pneumatic systems, designed primarily to mitigate the high-decibel noise generated by rapidly exhausting compressed air from valves, cylinders, and other air-operated equipment. These devices function by diffusing and dampening the velocity and pressure of the escaping air, thus reducing acoustic emissions to acceptable levels as mandated by regulatory bodies like OSHA and the EU Noise Directive. The market encompasses a variety of materials, including sintered bronze, porous plastic, stainless steel, and composite materials, catering to diverse operational requirements such as high temperature, corrosive environments, or cleanroom specifications.

The primary applications of pneumatic silencers span across numerous heavy and light industries, including automotive assembly, packaging machinery, food and beverage processing, pharmaceuticals, robotics, and general factory automation. In highly automated production lines, where thousands of pneumatic cycles occur per hour, the cumulative noise without effective silencing would pose significant health hazards to workers, leading to operational downtime and non-compliance penalties. Therefore, the implementation of robust and efficient silencers is a critical aspect of system design, ensuring both operational efficiency and environmental compliance. Furthermore, modern silencers often feature characteristics that minimize back pressure, ensuring that the performance and cycle time of the pneumatic equipment remain unaffected, which is a key requirement for precision industries.

Key benefits derived from the adoption of pneumatic silencers include enhanced worker comfort and safety by reducing occupational hearing loss risks, improved machinery longevity by mitigating vibration associated with sudden air bursts, and mandatory regulatory adherence. The driving factors sustaining market growth include the rapid global expansion of industrial automation (Industry 4.0), especially in emerging economies, the rising focus on preventive maintenance and asset management within manufacturing plants, and continuous innovation in material science leading to more compact, corrosion-resistant, and high-flow silencer designs. The demand for lightweight and aesthetically integrated components in modern robotics further propels the need for specialized plastic and composite silencers, contributing significantly to overall market dynamism.

Pneumatic Silencers Market Executive Summary

The Pneumatic Silencers Market is experiencing stable growth propelled by increasing regulatory pressure concerning occupational health and safety across major industrialized nations and the continued global shift toward highly automated manufacturing systems. Business trends indicate a strong preference for high-flow, low-maintenance silencers, driving manufacturers to focus on innovative sintered polyethylene and stainless steel designs that offer superior chemical resistance and reduced contamination risks, essential for sectors like medical device manufacturing and food processing. Strategic partnerships between pneumatic component suppliers and system integrators are increasingly common, facilitating the bundled sale of valves, cylinders, and appropriate silencing solutions, thereby accelerating market penetration and adoption rates globally. Furthermore, the trend toward modular and customizable automation cells necessitates silencers that are easily integrated and adapted to diverse machine layouts.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely fueled by aggressive governmental investments in industrial infrastructure and the relocation of global manufacturing bases to countries like China, India, and Southeast Asian nations. North America and Europe, representing mature industrial landscapes, focus heavily on replacement and upgrade cycles, adhering strictly to stringent noise emission standards, which mandate the continuous improvement or overhaul of legacy pneumatic systems. The European market, in particular, is highly sensitive to ecological factors, driving demand for materials that are recyclable and processes that minimize environmental impact. Meanwhile, Latin America and the Middle East and Africa (MEA) exhibit burgeoning potential, particularly within the oil and gas, construction, and nascent automotive manufacturing sectors, although adoption is often price-sensitive, favoring durable, standardized metal silencers.

Segmentation trends highlight the dominance of sintered materials, primarily sintered bronze and polyethylene, owing to their cost-effectiveness and excellent noise reduction capabilities across standard pressure ranges. However, the high-pressure and high-corrosion segment is increasingly dominated by specialized metallic silencers, such as those made from 316L stainless steel, crucial for chemical and marine applications. In terms of end-use, the automotive industry remains the largest consumer, given its extensive use of robotics and automation cells, followed closely by the packaging and material handling sectors. There is a perceptible trend toward hybrid silencers that incorporate both porous media and resonant chambers to achieve broader frequency dampening, optimizing performance in highly dynamic pneumatic applications where precise noise control is paramount.

AI Impact Analysis on Pneumatic Silencers Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Pneumatic Silencers Market frequently revolve around three core themes: predictive maintenance for component failure, optimization of pneumatic system efficiency, and the role of AI-driven design in acoustic engineering. Users are concerned about how AI analytics can predict when a silencer might become clogged or worn, impacting system back pressure and cycle time, thus necessitating replacement. Furthermore, there is interest in how AI can optimize the entire pneumatic circuit, including the silencers, to minimize energy consumption while maintaining required noise levels. The consensus expectation is that while AI will not directly replace the physical silencer component, it will revolutionize the management, monitoring, and future design of these components, making pneumatic systems smarter, safer, and significantly more energy efficient through continuous operational feedback and self-correction.

AI's primary influence will manifest through advanced sensor integration (Industrial IoT) and machine learning algorithms that monitor system acoustics and pressure differential in real-time. By continuously analyzing the relationship between valve actuation, air flow, and emitted noise, AI can detect subtle deviations indicating partial clogging or material degradation in the silencer before they lead to noticeable performance drops or non-compliance issues. This shift from reactive to proactive maintenance drastically reduces unexpected downtime and extends the operational life of both the silencer and the associated pneumatic components. This integration also leads to highly personalized maintenance schedules based on actual usage patterns rather than generalized operating hours.

Moreover, AI simulation and generative design tools are beginning to influence the physical design process of silencers. By inputting parameters such as required flow rate, maximum permissible back pressure, and target acoustic attenuation curve, AI algorithms can rapidly generate novel internal geometries and material combinations that traditional engineering methods might overlook. This leads to the creation of bespoke, high-performance silencers that are lighter, more compact, and optimized for specific machine profiles. This analytical approach also facilitates the selection of the optimal silencer type and size during the initial pneumatic system design phase, minimizing trial-and-error and speeding up time-to-market for new automated machinery.

- AI-driven Predictive Maintenance: Monitoring silencer integrity via pressure drop and acoustic signature analysis to preemptively detect clogging or degradation.

- Acoustic Profiling Optimization: Using machine learning to fine-tune pneumatic exhaust sequencing to minimize overall ambient noise floor within production halls.

- Generative Design for Acoustics: Employing AI to simulate and design novel internal geometries for silencers, maximizing noise reduction while minimizing size and back pressure.

- Energy Efficiency Management: Integrating silencer performance data into overall AI-managed system optimization to reduce compressed air waste associated with inefficient venting.

- Automated Compliance Reporting: Utilizing AI to track and document noise levels, ensuring continuous regulatory compliance without manual intervention.

DRO & Impact Forces Of Pneumatic Silencers Market

The Pneumatic Silencers Market is strongly impacted by a dual set of forces: stringent regulatory mandates driving mandatory adoption (Drivers) and the inherent necessity for cost-effective solutions (Restraints), while technological advancements offer substantial growth pathways (Opportunities). The overarching impact force stems from the irreversible trend of global industrial automation; as more processes rely on compressed air for motion control, the need for effective noise abatement scales proportionally. This dependency ensures that the silencer market remains intrinsically linked to capital expenditure cycles in manufacturing and infrastructure development worldwide. The push for sustainability also acts as a profound influence, demanding silencers that not only reduce noise but are also durable, energy-efficient, and manufactured from environmentally responsible materials.

Drivers: A primary driver is the non-negotiable requirement for compliance with occupational health and safety regulations, particularly those established by OSHA in the US, the European Agency for Safety and Health at Work (EU-OSHA), and equivalent bodies globally. These regulations set clear limits on permissible noise exposure, compelling industries to install or upgrade silencing components rigorously. The rapid growth of sectors such such as medical devices, semiconductor manufacturing, and food and beverage processing, which demand clean, controlled environments, fuels the demand for specialized, non-corrosive silencers made of plastics or stainless steel that prevent particle shedding. Furthermore, the pursuit of efficiency in Industry 4.0 environments requires robust components that guarantee low back pressure, thus maintaining machine performance—a specification increasingly met by advanced silencer technologies.

- Regulatory Compliance: Stringent global noise pollution standards compelling mandatory installation and maintenance of silencers.

- Industrial Automation Surge: Exponential growth in the deployment of pneumatic cylinders, valves, and robotic systems globally, particularly in APAC.

- Focus on Worker Safety: Increased corporate focus on reducing occupational hearing loss and improving overall workplace environment quality.

- Demand for High-Purity Applications: Growth in pharmaceutical and food processing demanding stainless steel and specific polymer silencers to maintain cleanliness and prevent contamination.

Restraints: Despite the crucial function of silencers, market growth faces restraints primarily centered on maintenance and cost challenges. Silencers, particularly those utilizing sintered media, are prone to clogging by oil mist, dust, and contaminants inherent in industrial compressed air systems, leading to increased back pressure, reduced machine performance, and ultimately, system failure if not maintained. This required periodic replacement and cleaning adds to the operational cost, sometimes leading end-users, especially small and medium enterprises (SMEs), to opt for cheaper, lower-quality alternatives or delay replacement. Furthermore, the perceived commoditization of basic pneumatic components means that pricing pressure is intense, particularly in high-volume, standard material segments, squeezing manufacturer margins and potentially slowing R&D investment in foundational technologies.

- Clogging and Maintenance Issues: Susceptibility of porous media to contamination from compressed air lubricants and particulates, necessitating frequent replacement or cleaning.

- Perceived Commoditization: Intense pricing competition, particularly for standard brass and bronze silencers, limiting investment in advanced materials.

- Back Pressure Concerns: Poorly specified or clogged silencers introduce excessive back pressure, leading to reduced efficiency and operational performance of pneumatic equipment.

Opportunities: Significant opportunities lie in the development and adoption of smart, self-monitoring silencers integrated with IoT platforms. These "smart silencers" can continuously report their internal pressure drop, alerting maintenance crews before significant performance loss occurs, thereby overcoming the major restraint of clogging. Another substantial opportunity resides in advanced material science, particularly the utilization of specialized polymers and ceramics for creating high-flow, corrosion-resistant, and lighter-weight components suitable for aerospace, defense, and mobile automation sectors. Geographic expansion into developing markets in Africa and Latin America, coupled with localized manufacturing strategies, presents a pathway for robust long-term growth. Furthermore, the increasing complexity of robotic systems demands highly customized, multi-stage silencing solutions rather than generic mufflers, offering higher-value product segments.

- Integration of Smart Sensing Technology: Developing IoT-enabled silencers to monitor back pressure and predict maintenance requirements.

- Advanced Material Development: Creating new porous composites and ceramics for superior flow rates, temperature tolerance, and corrosion resistance.

- Micro-Silencer Development: Catering to the miniaturization trend in electronics manufacturing and laboratory automation requiring extremely small, precision-engineered mufflers.

- Customized Acoustic Engineering: Offering bespoke silencing solutions for complex, high-performance machinery and specialized industrial applications.

Segmentation Analysis

The Pneumatic Silencers Market is highly fragmented and segmented across several critical dimensions, primarily based on the material used for the porous media, the type of connection employed, and the end-use application industry. This segmentation reflects the diverse operational environments and technical specifications required by end-users, ranging from low-cost general automation to highly demanding, contaminant-sensitive applications. Understanding these segments is crucial for market stakeholders, as product selection is highly dependent on factors like operating pressure, temperature extremes, required flow rate, and regulatory cleanliness mandates. The material segment remains the most influential factor determining performance characteristics and pricing structure within the market.

In terms of connection type, threaded silencers (NPT, BSPT) dominate due to their widespread use and ease of installation in existing pneumatic infrastructures. However, press-in and quick-connect types are gaining traction in modular and rapidly assembled automation systems where speed and flexibility are prioritized. The end-use segmentation is dynamic, with the automotive sector being the perennial heavyweight, but the packaging and electronics industries are showcasing accelerating growth rates due to their high dependency on rapid-cycle pneumatic control systems. Furthermore, market segmentation by flow rate capacity, categorized as low, medium, and high flow, dictates the size and internal structure of the silencer, directly impacting its noise attenuation efficiency and back pressure characteristics.

- By Material Type:

- Sintered Metal (Bronze, Stainless Steel 303, 316L)

- Plastic/Polymer (Sintered Polyethylene, Polypropylene)

- Non-Sintered (Felt/Mesh/Fiber)

- By Connection Type:

- Threaded (NPT, BSPT, Metric)

- Press-In/Push-to-Connect

- Flanged

- By Flow Rate:

- Low Flow

- Medium Flow

- High Flow

- By End-Use Industry:

- Automotive

- Packaging & Material Handling

- Robotics & Assembly

- Food & Beverage Processing

- Pharmaceutical & Medical Devices

- Chemical & Petrochemical

- Textile

Value Chain Analysis For Pneumatic Silencers Market

The value chain for the Pneumatic Silencers Market begins with the sourcing of raw materials, primarily metallic powders (bronze, stainless steel) and specialized polymers (polyethylene, polypropylene), which are the core inputs for the sintering process. Upstream activities involve specialized material processing and compounding, where quality control and consistency of particle size are paramount for achieving specific porosity levels—the defining factor for a silencer's acoustic performance and flow characteristics. Suppliers of highly specialized metallic alloys and high-purity plastics hold significant influence in the initial stages, dictating material cost and quality, especially for critical applications demanding 316L stainless steel for corrosion resistance or food-grade polymers.

Midstream activities encompass the manufacturing and assembly phase, which involves precision sintering, machining (for threads and interfaces), and quality testing. Major manufacturers leverage advanced sintering technologies to create components with optimized internal structures that maximize sound dampening while minimizing back pressure. Distribution channels are varied: Direct sales are common for large OEM (Original Equipment Manufacturer) agreements where silencers are bundled with comprehensive pneumatic systems, providing high-volume, stable revenue streams. Indirect channels, primarily specialized industrial distributors and wholesale pneumatic component suppliers, serve the vast MRO (Maintenance, Repair, and Operations) segment, offering regional availability and localized technical support for replacement parts and upgrades.

Downstream analysis focuses on the end-users—the diverse range of manufacturing and processing industries. The effectiveness of the silencer is realized at this stage, contributing directly to operational efficiency and regulatory compliance. The interaction between distributors and end-users often involves detailed technical consultation to ensure the correct specification (size, material, flow) is selected for the specific application environment. Customer feedback regarding clogging rates, noise reduction efficacy, and durability cycles back to manufacturers, driving continuous product improvement and the development of application-specific designs. The success of the downstream operation relies heavily on efficient inventory management within the distribution network to ensure immediate availability of commonly required sizes and materials.

Pneumatic Silencers Market Potential Customers

Potential customers for the Pneumatic Silencers Market are extensive and encompass any industry utilizing compressed air for automated processes, motion control, or tooling. The primary demographic includes large-scale manufacturing Original Equipment Manufacturers (OEMs) who integrate pneumatic systems into machinery such as robotic arms, CNC equipment, and dedicated assembly lines. These customers demand high volumes of reliably specified silencers during the initial build phase of their equipment. The next major customer segment is the Maintenance, Repair, and Operations (MRO) departments of established industrial facilities that require silencers for replacement, system upgrades, or compliance remediation on existing machinery.

Specifically, the end-user base is highly diversified. The automotive and auto component manufacturing industry remains a cornerstone due to its heavy reliance on high-cycle pneumatic clamping, welding, and material handling systems. Packaging and bottling companies are also significant consumers, needing silencers for high-speed filling, sealing, and conveying operations. Furthermore, the specialized segments, such as aerospace, medical device manufacturing, and semiconductor fabrication, represent high-value customers that purchase premium-grade stainless steel or polymer silencers, prioritizing cleanliness, non-shedding characteristics, and resistance to harsh cleaning agents over initial cost. These specialized sectors often dictate unique specifications, driving innovation toward custom solutions.

Emerging markets in Asia and Latin America represent a rapidly expanding customer base, particularly in general engineering and infrastructure projects where initial cost is a key factor, often leading to high demand for standardized sintered bronze products. Ultimately, the purchasing decisions of these diverse customers are driven by a triad of factors: regulatory necessity, the need to maintain optimal machine performance (low back pressure), and the operational cost associated with durability and replacement frequency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,200 Million |

| Market Forecast in 2033 | USD 1,800 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMC Corporation, Parker Hannifin, Festo Group, CEJN AB, Norgren (IMI Plc), Asco Valve (Emerson), Airtac International Group, Wilkerson, AVENTICS (Bosch Rexroth), Bimba Manufacturing (part of Nook Industries), Pneumadyne, Watts Water Technologies, Pisco, Silvent AB, V.P. Instruments, Humphrey Products, Allied Witan Company, Waircom, Camozzi Group, Flow International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pneumatic Silencers Market Key Technology Landscape

The technology landscape of the Pneumatic Silencers Market is characterized by a mature core technology base—primarily sintered porous media—but with continuous innovation focused on material science, geometry optimization, and integration of smart features. Sintering technology itself has evolved to allow for greater control over pore size and distribution, which is crucial for achieving high attenuation rates while minimizing the pressure drop, ensuring optimal energy efficiency in pneumatic systems. Manufacturers are increasingly utilizing advanced scanning electron microscopy (SEM) techniques during R&D to characterize and tailor the internal structure of porous components, specifically targeting broad-spectrum noise reduction across different frequencies generated by fast-acting exhaust cycles.

A significant technological shift involves the adoption of engineered polymers, such as high-density sintered polyethylene (HDPE), especially in applications where weight reduction, corrosion resistance, and non-metallic contamination are critical concerns, such as in laboratory automation and food processing. These plastic silencers offer equivalent acoustic performance to traditional sintered bronze but are significantly lighter and more resistant to chemical exposure. Furthermore, the development of multi-stage or hybrid silencers represents a key innovation. These designs combine porous media (for high-frequency noise absorption) with expansion chambers or resonant cavities (for lower-frequency dampening) to provide a more comprehensive and application-specific noise reduction profile, often necessary for meeting the most stringent noise standards in complex machinery.

The most forward-looking technological advancement lies in the convergence of physical components with Industrial IoT (IIoT). Smart silencers are being developed with embedded micro-sensors capable of measuring minute changes in upstream and downstream pressure differentials. This continuous monitoring capability allows for real-time diagnostics of the silencer's state, enabling predictive maintenance algorithms to schedule replacements precisely before clogging begins to impair machine performance. This integration transforms the silencer from a passive component into an active, data-generating asset within the wider smart factory ecosystem, addressing the long-standing industry challenge of operational efficiency loss due to unanticipated silencer failure. Advanced simulation tools (CFD and FEA) are also now routine in the design process, accelerating the time required to develop and validate highly efficient, custom-geometry silencers.

Regional Highlights

The regional dynamics of the Pneumatic Silencers Market are segmented based on maturity of industrialization, regulatory stringency, and rate of technological adoption. Asia Pacific (APAC) is the dominant and fastest-growing region, driven by massive investments in manufacturing, particularly in China, India, and Southeast Asian countries. The sheer volume of new factory establishments, coupled with government initiatives promoting domestic automation (e.g., Made in China 2025), results in high demand for pneumatic components, including silencers, both for OEM integration and MRO. While price sensitivity can be high, the scale of deployment guarantees substantial market growth, focusing initially on standard, robust metal silencers, but rapidly shifting towards higher-performance solutions as quality control standards rise.

North America and Europe represent mature markets characterized by stringent and well-enforced occupational noise regulations. Growth in these regions is primarily driven by replacement demand, upgrades to meet evolving compliance standards, and the sophisticated requirements of precision industries like aerospace and medical manufacturing. The emphasis here is on high-quality materials (stainless steel, specialized polymers) and components that offer minimal back pressure and extended service life. European countries, particularly Germany and Italy, home to major automation and machinery manufacturers, exhibit high demand for energy-efficient components that align with regional sustainability directives. The adoption of smart, IIoT-enabled silencers for predictive maintenance is most prevalent in these highly digitized manufacturing environments.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets with significant potential, linked largely to growth in infrastructure, automotive manufacturing (Mexico, Brazil), and resource processing (oil and gas, mining). Market penetration is currently lower compared to APAC or North America, but increasing foreign direct investment in manufacturing and heightened awareness of workplace safety standards are accelerating adoption. MEA's market is highly influenced by large-scale petrochemical projects demanding durable, explosion-proof silencers resistant to harsh environmental conditions, creating niche segments for high-specification metal components.

- Asia Pacific (APAC): Highest volume growth driven by rapid industrial expansion, OEM establishment, and evolving compliance requirements in China and India.

- Europe: Focus on replacement, advanced material silencers, stringent compliance, and early adoption of smart, energy-efficient pneumatic technology.

- North America: Stable demand driven by highly automated sectors (automotive, aerospace) and strict adherence to OSHA workplace noise exposure limits.

- Latin America & MEA: Emerging potential, concentrated demand in automotive and resource extraction sectors, with growing awareness of safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pneumatic Silencers Market.- SMC Corporation

- Parker Hannifin

- Festo Group

- CEJN AB

- Norgren (IMI Plc)

- Asco Valve (Emerson)

- Airtac International Group

- Wilkerson

- AVENTICS (Bosch Rexroth)

- Bimba Manufacturing (part of Nook Industries)

- Pneumadyne

- Watts Water Technologies

- Pisco

- Silvent AB

- V.P. Instruments

- Humphrey Products

- Allied Witan Company

- Waircom

- Camozzi Group

- Flow International

Frequently Asked Questions

Analyze common user questions about the Pneumatic Silencers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a pneumatic silencer and why is it mandatory?

The primary function is to significantly reduce the high-decibel noise produced by exhausting compressed air from pneumatic valves and equipment. They are mandatory in most industrial environments to comply with occupational health and safety regulations (e.g., OSHA, EU directives), preventing worker hearing damage and ensuring a safe, compliant workplace.

How does silencer material choice affect performance and application suitability?

Material choice dictates durability, resistance to corrosion, and permissible operating environments. Sintered bronze is standard and cost-effective; sintered polyethylene is ideal for light weight, corrosion resistance, and clean applications (preventing metal contamination); and 316L stainless steel is required for high-pressure, high-temperature, or harsh chemical processing environments.

What is the main operational concern related to pneumatic silencers?

The main operational concern is clogging, which occurs when oil mist, dust, or contaminants accumulate in the porous media. Clogging increases back pressure in the pneumatic system, leading to slower machine cycle times, reduced efficiency, increased energy consumption, and ultimately, potential system failure if not addressed promptly through maintenance or replacement.

How is Industry 4.0 influencing the future design of silencers?

Industry 4.0 is driving the development of "smart silencers" equipped with integrated IoT sensors. These components monitor pressure differential in real-time, allowing systems to predict clogging and schedule predictive maintenance, thereby maximizing uptime and optimizing system performance seamlessly within automated manufacturing frameworks.

Which geographical region exhibits the fastest growth rate for the Pneumatic Silencers Market?

The Asia Pacific (APAC) region currently exhibits the fastest growth rate, largely driven by the massive ongoing expansion of manufacturing infrastructure, rapid adoption of factory automation, and increasing enforcement of industrial safety standards across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager