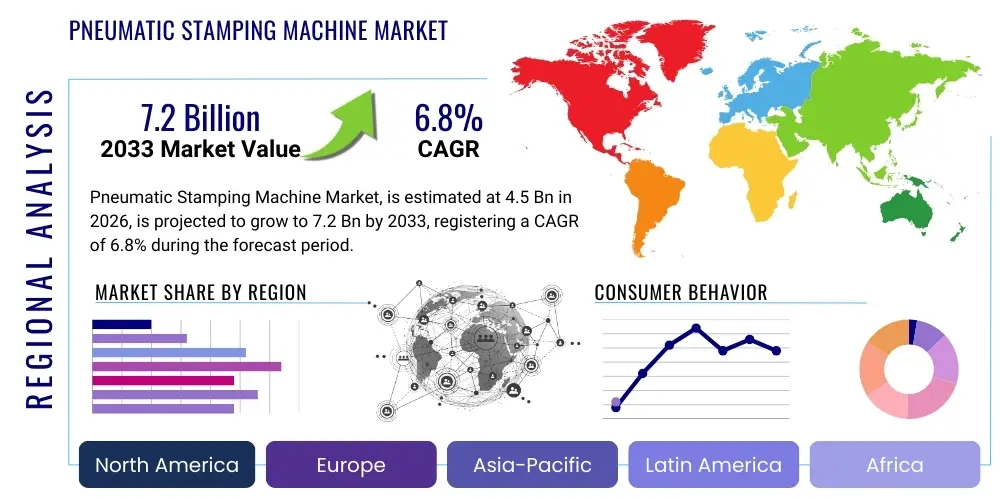

Pneumatic Stamping Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442906 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Pneumatic Stamping Machine Market Size

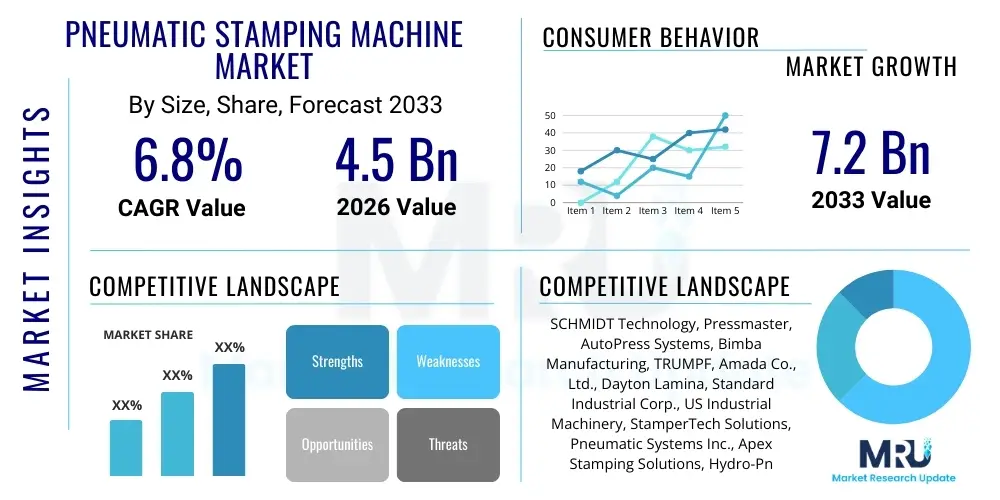

The Pneumatic Stamping Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Pneumatic Stamping Machine Market introduction

The Pneumatic Stamping Machine Market encompasses equipment utilized across diverse industrial sectors for precision material processing tasks such as forming, cutting, bending, and marking through the application of compressed air energy. These machines offer a high degree of versatility, combining mechanical force with pneumatic actuation to deliver consistent and repeatable stamping results. The core functionality revolves around converting stored pneumatic energy into rapid, high-impact force, making them ideal for high-volume production environments where speed and reliability are paramount. Unlike hydraulic or mechanical presses, pneumatic stamping machines are generally characterized by lower energy consumption, reduced maintenance complexity, and superior operational flexibility, positioning them as essential assets in modern automated production lines.

The operational efficiency of pneumatic stamping machines is heavily favored in applications demanding strict tolerance levels and minimal material deformation outside the intended stamping zone. Key product types range from compact benchtop units, primarily used for small component assembly and marking in electronics and medical device manufacturing, to large floor-standing systems deployed in automotive and aerospace industries for structural component fabrication. The market growth is intricately linked to the global resurgence in manufacturing activities, particularly the shift towards lightweighting in transportation and the increasing demand for miniaturization in consumer electronics, both of which require precise, controlled force application that pneumatic technology expertly provides. Furthermore, their inherent safety features, stemming from predictable and controllable force delivery mechanisms, contribute significantly to their adoption over older, less regulated mechanical alternatives.

Major applications of these machines include automotive parts assembly (e.g., connectors, brackets), electronic component fabrication (e.g., terminal crimping, casing formation), production of household appliances, and specialized medical implant marking. Key benefits driving market expansion include enhanced operational speed, precise depth control, simplified tooling changes, and reduced capital expenditure compared to heavy hydraulic systems. Driving factors revolve around the imperative for manufacturers to improve production throughput, minimize waste, and adhere to increasingly stringent quality standards, particularly in high-value manufacturing segments where defect rates must be exceptionally low. The increasing integration of sensor technology and digital control systems further enhances the market appeal by enabling real-time monitoring and predictive maintenance capabilities.

Pneumatic Stamping Machine Market Executive Summary

The Pneumatic Stamping Machine Market is experiencing robust growth fueled by technological advancements in automation and a global shift toward efficient, energy-saving manufacturing processes. Business trends indicate a strong preference among major manufacturers for integrated stamping solutions that offer quick changeover capabilities and compatibility with Industry 4.0 principles, including connectivity and data exchange. The market competition is defined by innovation in force monitoring systems and the development of modular machine designs that allow for easy customization and scalability. Key companies are focusing on mergers and acquisitions to consolidate technological expertise, particularly in areas related to high-speed cycling and noise reduction, thereby addressing core operational challenges faced by end-users. The rising cost of labor in developed economies is further accelerating the demand for fully automated pneumatic stamping cells, pushing manufacturers to invest heavily in robotics integration alongside the stamping units.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, attributed primarily to the massive expansion of the electronics, automotive, and general fabrication industries in countries like China, India, and Vietnam. North America and Europe, while mature markets, exhibit steady demand driven by the replacement of aging mechanical infrastructure with modern, safety-compliant pneumatic systems, focusing heavily on high-precision applications, especially in the aerospace and medical device sectors. The stringent regulatory environment in Western economies regarding worker safety and noise pollution mandates the adoption of advanced pneumatic machinery. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising uptake, supported by government initiatives aimed at boosting domestic industrial capacity and establishing local manufacturing hubs, requiring reliable and cost-effective stamping solutions.

Segment trends highlight the increasing demand for high-pressure range pneumatic stamping machines capable of handling robust materials required for electric vehicle components and structural aerospace parts. By operation, the fully automatic segment is projected to outpace the semi-automatic segment, driven by the desire for minimal human intervention and improved consistency in mass production settings. Furthermore, there is a pronounced trend toward incorporating specialized tooling and die-sets optimized for complex geometries, enabling pneumatic machines to handle tasks previously reserved for larger, more complex hydraulic presses. The automotive industry remains the largest end-user, but the medical device sector is demonstrating the fastest CAGR due to the increasing need for high-precision, clean-room compatible stamping processes for disposable devices and surgical instruments.

AI Impact Analysis on Pneumatic Stamping Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Pneumatic Stamping Machine Market frequently revolve around predictive maintenance capabilities, optimization of stamping parameters, and quality control automation. Users are keen to understand how AI algorithms can analyze real-time data streams from force sensors, pressure gauges, and cycle time logs to anticipate component failure before it occurs, thereby maximizing uptime. A core theme is the expectation that AI integration will lead to 'self-optimizing' presses capable of adjusting air pressure, stroke speed, and dwell time based on material variations or ambient temperature changes, ensuring consistent output quality without manual intervention. Furthermore, there is significant interest in using machine vision coupled with deep learning models to instantly inspect stamped parts for micro-cracks, burrs, or dimensional deviations, moving beyond traditional statistical process control (SPC) to achieve near-zero defect rates in highly critical applications.

- AI-driven Predictive Maintenance: Analyzing machine vibration and pneumatic pressure fluctuations to forecast potential component failure, significantly reducing unplanned downtime.

- Optimized Stamping Parameters: Utilizing machine learning algorithms to dynamically adjust pressure and speed based on material input variability, ensuring uniform output quality.

- Automated Quality Inspection: Deployment of high-speed computer vision systems paired with AI for instantaneous, objective defect detection in stamped components.

- Energy Efficiency Management: AI monitoring and optimization of air consumption cycles, minimizing operational costs and improving sustainability metrics.

- Design Optimization: Leveraging generative design AI to suggest improved tooling geometries that enhance die life and stamping precision.

DRO & Impact Forces Of Pneumatic Stamping Machine Market

The market dynamics for Pneumatic Stamping Machines are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively define the Impact Forces influencing market trajectory. A primary driver is the accelerating trend of industrial automation across developing economies, driven by the need for increased production capacity and consistency, particularly in mass manufacturing sectors such as electronics and automotive. The inherent advantages of pneumatic systems, including their lower operational costs compared to hydraulic alternatives and their suitability for rapid cycle times, strongly support their continued adoption. Concurrently, global focus on workplace safety standards compels manufacturers to replace older, less secure mechanical presses with modern pneumatic systems that offer better control over force application and integrated safety mechanisms, such as light curtains and dual-hand control systems, acting as a crucial underlying impact force.

However, the market faces notable restraints that could impede exponential growth. One significant challenge is the inherent limitation of force output compared to high-tonnage hydraulic presses, restricting the pneumatic systems primarily to lighter gauge materials or smaller component stamping, thereby limiting market penetration in heavy fabrication industries. Furthermore, the efficiency of pneumatic systems is directly tied to the availability and quality of compressed air infrastructure, and poor maintenance of air lines can lead to pressure drops and inconsistent stamping results, posing a reliability concern for some end-users. The initial capital investment for high-precision, fully automated pneumatic stamping cells, especially those integrated with robotics and advanced sensors, can be substantial, representing a barrier to entry for Small and Medium Enterprises (SMEs).

Despite these restraints, significant opportunities exist for market expansion. The increasing demand for micro-stamping processes in medical devices and miniaturized electronics presents a niche where the fine control and precision offered by pneumatic systems are superior. Secondly, the market is poised to capitalize on the growing focus on sustainable manufacturing, as pneumatic machines are generally more energy-efficient when performing lighter duties than their hydraulic counterparts. Finally, geographical expansion into emerging industrial clusters in Southeast Asia and Latin America, coupled with the development of smart, connected pneumatic machines (IoT integration), offers manufacturers a clear path for revenue diversification and long-term competitive advantage. These opportunities serve as powerful catalysts, shaping the long-term impact forces towards innovation and specialized application development within the stamping sector.

Segmentation Analysis

The Pneumatic Stamping Machine Market is comprehensively segmented based on machine type, operational capability, pressure range, and end-user industry, enabling a detailed analysis of market drivers and niche opportunities. Segmentation allows stakeholders to accurately gauge demand fluctuations and technological requirements across different industrial verticals, ensuring product development aligns with specific application needs, such as high-speed forming for electronics or high-force marking for durable goods. The differentiation between benchtop and floor-standing units reflects the diverse scale of manufacturing operations, while the split between semi-automatic and fully automatic systems highlights the varying degrees of automation maturity across regions and industries. Understanding these segments is critical for manufacturers targeting specific operational niches requiring controlled force stamping.

- By Type:

- Benchtop Pneumatic Stamping Machines

- Floor-standing Pneumatic Stamping Machines

- By Operation:

- Semi-automatic Pneumatic Stamping Machines

- Fully Automatic Pneumatic Stamping Machines

- By Pressure Range:

- Low Pressure (Up to 1 Ton)

- Medium Pressure (1 Ton to 5 Tons)

- High Pressure (Above 5 Tons)

- By End-User Industry:

- Automotive

- Electronics and Electrical Components

- Aerospace and Defense

- Medical Devices

- General Manufacturing and Fabrication

Value Chain Analysis For Pneumatic Stamping Machine Market

The value chain for the Pneumatic Stamping Machine Market begins with upstream activities involving the sourcing of core components and raw materials. Key inputs include high-grade steel and alloys for the machine frame and dies, precision pneumatic components (cylinders, valves, air preparation units), and sophisticated electronic control systems (PLCs, sensors). Suppliers of these specialized components, particularly those providing high-durability seals and rapid-response pneumatic valves, hold significant leverage due to the quality requirements of high-cycle stamping operations. Effective upstream management focuses on ensuring material quality, maintaining robust supply agreements, and mitigating the volatility associated with commodity price fluctuations, which directly influence the final cost structure of the machine.

The core manufacturing stage involves design, assembly, and rigorous testing of the stamping machines. Manufacturers differentiate themselves through proprietary press designs, integration of advanced safety features, and the development of user-friendly HMI (Human Machine Interface) controls. This stage adds the most significant value, translating raw materials and components into a high-precision, functional capital asset. Downstream activities commence with the marketing, distribution, and installation of the equipment. Distribution channels are typically a combination of direct sales for large, customized orders and partnerships with specialized industrial distributors or machine tool dealers, especially for standardized benchtop models. Post-sales services, including maintenance contracts, spare parts supply, and operator training, form a crucial component of the downstream value stream, ensuring customer satisfaction and long-term operational efficiency.

The distribution network for pneumatic stamping machinery relies heavily on specialized technical sales teams who can provide tailored advice on machine sizing and tooling requirements. Direct channels are preferred for high-value contracts with major automotive or aerospace clients, facilitating closer integration and customized solutions. Indirect channels, utilizing regional distributors, are essential for reaching smaller manufacturing operations and providing localized support and rapid delivery of standard inventory items. The effectiveness of the value chain is increasingly measured by its ability to integrate digitally, allowing for real-time tracking of machine performance and remote diagnostic support, thereby enhancing the overall service delivery model and customer relationship management.

Pneumatic Stamping Machine Market Potential Customers

Potential customers for Pneumatic Stamping Machines span a broad spectrum of the manufacturing economy, primarily encompassing industries that require repetitive, high-precision force application for component fabrication, assembly, or marking tasks. The largest segment of buyers resides within the automotive sector, including Tier 1 and Tier 2 suppliers responsible for producing metal brackets, small vehicle components, electrical connectors, and safety features. These customers demand machines capable of continuous operation, high tolerance consistency, and easy integration into existing robotic assembly lines. The push towards Electric Vehicle (EV) manufacturing further drives demand, as new battery components and lightweight chassis parts require specialized, precise forming and joining techniques achievable with advanced pneumatic presses.

Another significant customer base includes the Electronics and Electrical industries, particularly manufacturers of consumer electronics, circuit boards, and industrial controls. These applications require high-speed, low-force stamping for delicate material handling, terminal crimping, and housing assembly, where the controllability of pneumatic systems is highly valued. The medical device manufacturing sector represents a high-growth customer segment, focusing on micro-stamping for components used in surgical instruments, implants, and disposable diagnostic tools, where material cleanliness and dimensional accuracy are non-negotiable regulatory requirements. These buyers prioritize validation capabilities, clean room compatibility, and exceptional repeatability above raw tonnage capacity, making specific pneumatic models highly desirable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCHMIDT Technology, Pressmaster, AutoPress Systems, Bimba Manufacturing, TRUMPF, Amada Co., Ltd., Dayton Lamina, Standard Industrial Corp., US Industrial Machinery, StamperTech Solutions, Pneumatic Systems Inc., Apex Stamping Solutions, Hydro-Pneumatic Machines, Precise Automation Co., Power Press Technology, Global Machinery Group, HMT Stamping, QuickStamp Inc., Fabri-Tech Automation, Precision Engineering Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pneumatic Stamping Machine Market Key Technology Landscape

The technological landscape of the Pneumatic Stamping Machine Market is characterized by continuous refinement aimed at improving precision, speed, and energy efficiency. A pivotal advancement is the transition from purely mechanical air systems to sophisticated servo-pneumatic architectures. Servo-pneumatic technology integrates electronic control loops with conventional pneumatic actuation, allowing for highly accurate control over ram position, velocity, and force profile throughout the entire stamping cycle. This contrasts sharply with traditional systems that offer only on/off or binary force control. The adoption of high-speed proportional valves and advanced PLC interfaces enables manufacturers to program complex motion profiles, resulting in reduced noise, minimal vibration, and the ability to handle complex deep drawing or forming operations with enhanced reliability and repeatability, crucial for high-value components.

Furthermore, sensor integration and monitoring technologies have become standard requirements for modern pneumatic stamping machines. Pressure transducers, load cells, and linear encoders are routinely embedded within the press structure to provide real-time feedback on applied force and displacement. This data is utilized for Statistical Process Control (SPC) and is fundamental for quality assurance, allowing operators to detect and reject faulty parts based on deviations from programmed force signatures. The ability to monitor signature curves—the correlation between force and displacement over time—is critical for validating part integrity without destructive testing. Manufacturers are also increasingly incorporating advanced air preparation units that ensure clean, dry, and consistently pressurized air, mitigating system wear and prolonging the lifespan of internal pneumatic components, contributing to lower total cost of ownership (TCO).

The integration of Industry 4.0 principles, specifically the Industrial Internet of Things (IIoT), is reshaping the landscape. New generations of stamping machines are equipped with network connectivity (Ethernet, Wi-Fi) to transmit operational data to centralized cloud platforms. This connectivity facilitates remote diagnostics, over-the-air software updates, and sophisticated data analytics for overall equipment effectiveness (OEE) calculation. The adoption of Quick Die Change (QDC) systems, utilizing pneumatic clamps and automated bolster movement, significantly reduces machine downtime during tooling changeovers, enhancing flexibility in multi-product manufacturing environments. These technological shifts are not merely incremental improvements but fundamentally transform the pneumatic stamper from a standalone mechanical device into a digitally integrated, high-precision manufacturing asset.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global market, driven by high-volume manufacturing across automotive, electronics, and general fabrication sectors in China, India, and South Korea. Rapid industrialization, favorable government policies supporting local manufacturing, and the presence of major electronics assembly hubs create unparalleled demand for high-speed, reliable pneumatic stamping solutions. The region acts as the primary production base for global supply chains, necessitating continuous investment in advanced automation equipment to maintain cost competitiveness and quality standards.

- North America: The North American market is characterized by a strong focus on high-precision applications, particularly in aerospace, defense, and high-end medical devices. Demand is driven by the need to adhere to stringent quality control standards and safety regulations. Manufacturers prioritize sophisticated, digitally controlled pneumatic presses capable of complex, low-volume, high-value component production. Investment in automating existing production facilities to counter rising labor costs is a key regional driver.

- Europe: Europe represents a mature market emphasizing operational efficiency, safety compliance (CE marking), and sustainable manufacturing practices. Germany, Italy, and France are leaders in adopting servo-pneumatic technology for automotive component manufacturing and specialized machinery construction. The European market exhibits high demand for modular and energy-efficient stamping solutions, driven by strong regulatory pressure to reduce industrial energy consumption and noise pollution.

- Latin America: This region is an emerging market seeing steady growth, primarily focused on automotive assembly and consumer goods production in Brazil and Mexico. Market penetration is gradually increasing as local manufacturers upgrade outdated equipment. The demand here is centered around robust, easy-to-maintain pneumatic machines that offer reliable performance in often volatile economic and infrastructural environments.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states, propelled by diversification away from oil dependence into general manufacturing and infrastructure projects. The development of industrial zones and increased foreign direct investment (FDI) are generating new opportunities for suppliers of standard and semi-automatic pneumatic stamping machines suitable for light fabrication and assembly tasks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pneumatic Stamping Machine Market.- SCHMIDT Technology

- Pressmaster

- AutoPress Systems

- Bimba Manufacturing

- TRUMPF

- Amada Co., Ltd.

- Dayton Lamina

- Standard Industrial Corp.

- US Industrial Machinery

- StamperTech Solutions

- Pneumatic Systems Inc.

- Apex Stamping Solutions

- Hydro-Pneumatic Machines

- Precise Automation Co.

- Power Press Technology

- Global Machinery Group

- HMT Stamping

- QuickStamp Inc.

- Fabri-Tech Automation

- Precision Engineering Group

Frequently Asked Questions

Analyze common user questions about the Pneumatic Stamping Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What advantages do pneumatic stamping machines offer over hydraulic or mechanical presses?

Pneumatic stamping machines typically offer faster cycle speeds, superior cleanliness (no oil leaks like hydraulic systems), lower initial capital investment for low to medium tonnage, and highly precise force control, making them ideal for assembly, marking, and light forming applications that require rapid repeatability.

In which industries are high-pressure pneumatic stamping machines most commonly utilized?

High-pressure pneumatic stamping machines (above 5 tons) are primarily used in the Automotive industry for structural components and brackets, and in specialized General Manufacturing where controlled high force is necessary for heavy-duty assembly tasks and piercing thicker gauge materials.

How is Industry 4.0 influencing the design and functionality of modern pneumatic stampers?

Industry 4.0 integrates pneumatic stampers with IIoT connectivity and advanced sensors, enabling real-time data collection, remote monitoring, and AI-driven predictive maintenance. This shift optimizes Overall Equipment Effectiveness (OEE) and allows for dynamic adjustment of stamping parameters based on production variables.

What is the primary constraint limiting the market size of pneumatic stamping technology?

The main constraint is the physical limitation on maximum tonnage output. While highly precise, pneumatic systems are generally unsuitable for extremely heavy-duty stamping or deep drawing operations involving very thick materials, which remain the domain of hydraulic or large mechanical presses.

What role does servo-pneumatic technology play in enhancing stamping precision?

Servo-pneumatic technology uses electronic controls and proportional valves to precisely regulate air flow and cylinder movement throughout the entire stroke. This allows for customized force curves, precise ram positioning, and reduced vibration, drastically improving repeatability and product quality, especially for complex micro-stamping tasks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager