Polishing Drum Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441695 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Polishing Drum Machine Market Size

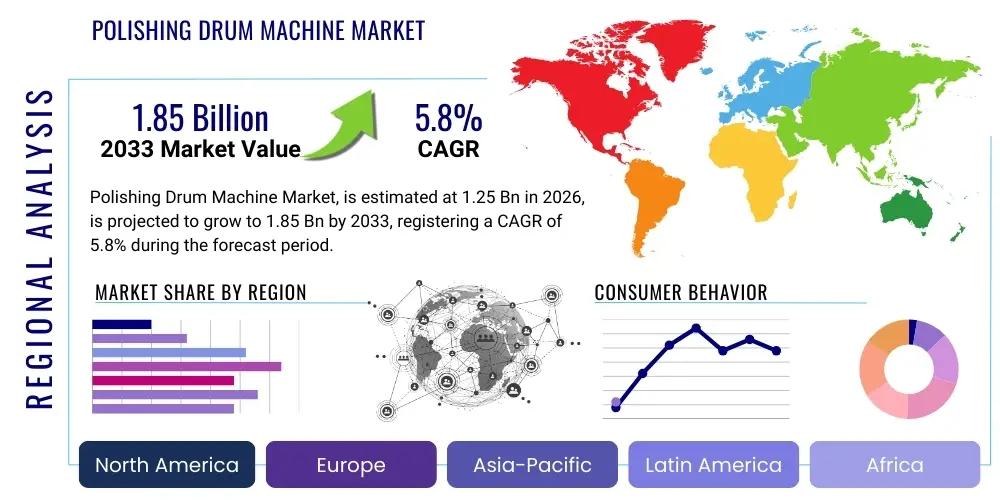

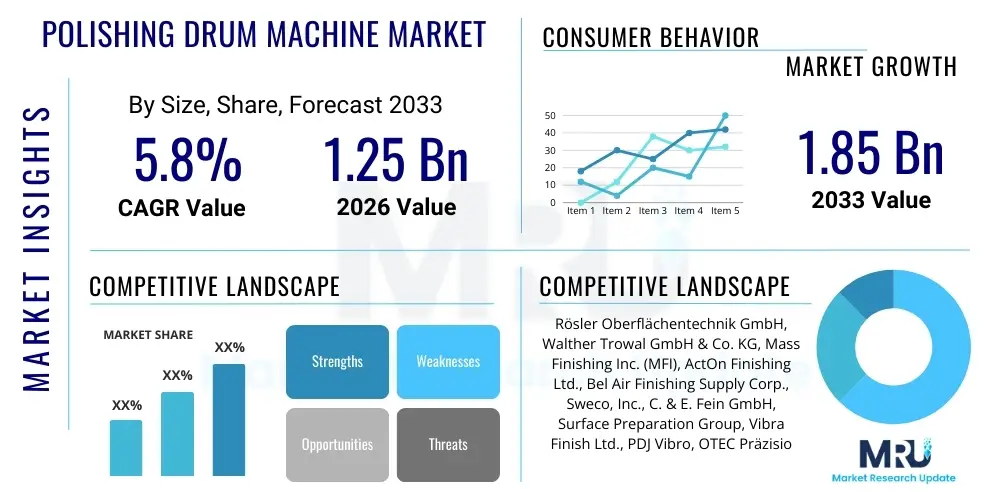

The Polishing Drum Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the escalating demand for high-precision finishing processes across various manufacturing sectors, including automotive components, aerospace parts, medical devices, and consumer electronics. Manufacturers are increasingly adopting automated finishing solutions to improve surface quality, reduce manual labor costs, and enhance production efficiency, positioning drum polishing technology as a critical investment for maintaining competitive product standards globally.

Market expansion is also supported by technological advancements focusing on dry polishing techniques, continuous feed systems, and improved abrasive media longevity. The push towards sustainable manufacturing practices further encourages the adoption of these machines, as modern systems often minimize water usage and chemical waste compared to traditional manual or chemical finishing methods. While initial investment costs remain a moderate barrier, the long-term operational savings and consistent quality output offered by automated polishing drums justify the capital expenditure for mid-to-large scale industrial operations seeking mass customization capabilities and streamlined quality control.

Polishing Drum Machine Market introduction

The Polishing Drum Machine Market encompasses equipment designed for mass finishing applications, specifically focused on deburring, surface smoothing, and achieving a high-gloss polish on large volumes of small-to-medium sized components. These machines operate using a revolving barrel or drum, where components, abrasive media (such as ceramics, plastic, or organic materials), and a finishing compound are tumbled together to achieve the desired surface refinement. Key applications span high-demand industries like jewelry manufacturing, precision engineering for engine components, orthopedic implant finishing in the medical sector, and surface preparation in the electronics industry. The primary benefits include consistency in finishing quality, reduced processing time compared to manual methods, scalability for high-volume production, and improved component longevity through stress relief on sharp edges. The market growth is fundamentally driven by the global expansion of manufacturing automation, stringent quality requirements for finished goods, and the increasing complexity of materials requiring specialized surface treatment, such as additive manufactured (3D printed) parts and advanced alloys used in aerospace.

Polishing Drum Machine Market Executive Summary

The Polishing Drum Machine Market exhibits robust business trends characterized by a shift toward customized automation and integration into smart factory ecosystems (Industry 4.0). Demand is rising for modular, flexible systems capable of handling diverse materials and part geometries, focusing on reducing cycle times and minimizing media consumption. Regionally, the Asia Pacific (APAC) dominates the market, driven by massive manufacturing output in China, India, and Southeast Asian nations, alongside accelerating adoption of automated finishing technologies in the automotive and electronics supply chains. North America and Europe maintain significant market shares, concentrating on advanced applications demanding extremely high tolerances, such as medical and aerospace components, thereby driving demand for sophisticated drum designs and process monitoring capabilities. Segment trends show significant growth in the automatic systems segment over semi-automatic variants, largely due to labor cost pressures and the pursuit of repeatable quality. Furthermore, the specialized media segment, particularly high-density ceramic and advanced polymer media, is experiencing increased demand, reflecting the necessity for optimized finishing solutions tailored to complex modern materials.

AI Impact Analysis on Polishing Drum Machine Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operations and optimization capabilities within the Polishing Drum Machine Market, moving beyond simple automation to predictive performance and adaptive control. Common user questions revolve around how AI can minimize process variability, predict the optimal media-to-part ratio for new materials, and estimate the remaining lifespan of abrasive media and equipment components. Users are concerned with achieving 'first-time-right' finishing outcomes and reducing the extensive human expertise currently required for setting up complex tumbling parameters (speed, duration, compound concentration). AI addresses these concerns by analyzing real-time sensor data—vibration, temperature, noise levels, and optical inspection results—to dynamically adjust polishing cycles. This shift enables self-optimizing drum machines, promising enhanced energy efficiency, reduced waste, and superior surface finish consistency, thereby elevating the overall quality assurance standards across high-precision manufacturing environments.

- AI-driven Predictive Maintenance: Utilizing ML algorithms to forecast equipment failure, optimizing uptime, and reducing unexpected shutdowns.

- Automated Parameter Optimization: AI models determine the optimal drum speed, cycle time, and media composition based on input material properties and desired finish specifications.

- Real-time Quality Control: Integrating machine vision and AI to inspect parts during or immediately after the cycle, identifying micro-defects invisible to human operators.

- Consumption Forecasting: ML used to predict media, compound, and energy consumption, leading to optimized inventory management and lower operating costs.

- Process Traceability and Documentation: AI facilitates the creation of detailed digital twins of the finishing process, essential for regulatory compliance in aerospace and medical sectors.

DRO & Impact Forces Of Polishing Drum Machine Market

The Polishing Drum Machine Market is influenced by a powerful combination of Driving factors, Restraints, and Opportunities, collectively summarized as the Impact Forces shaping its trajectory. The primary Driver is the increasing need for high-quality, standardized surface finishing across manufacturing sectors, propelled by global competition and stricter product performance requirements. Furthermore, labor costs and the scarcity of skilled manual labor strongly push manufacturers toward automated drum polishing solutions. However, the market faces significant Restraints, particularly the high initial capital investment required for advanced automated systems and the complexity associated with tuning parameters for specific alloys or intricate component geometries, often requiring specialized training. Opportunities lie in the development of specialized drum machines for niche applications, such as post-processing of Additive Manufacturing (AM) parts, and the implementation of IoT and AI for process optimization. These forces collectively dictate market adoption rates, favoring solutions that offer high flexibility, lower total cost of ownership (TCO), and superior integration capabilities within existing production lines.

Segmentation Analysis

The Polishing Drum Machine Market is extensively segmented based on Machine Type, Operation Mode, Application, and End-use Industry, reflecting the diverse requirements of industrial finishing processes globally. Analyzing these segments provides strategic insights into areas of highest growth and technological penetration. The Machine Type segmentation differentiates between standard tumbling barrels, centrifugal barrel finishing machines, and specialized vibratory finishers, each suited for different component sizes and required finishing intensity. Operation Mode segmentation, covering automatic and semi-automatic systems, is critical for understanding automation trends, with automatic systems increasingly dominant due to their integration capabilities and reduced reliance on manual labor. Furthermore, segmentation by Application (deburring, polishing, surface preparation) and End-use Industry (Automotive, Aerospace, Medical) highlights where precision finishing requirements are driving the highest demand and technological investment.

The automotive sector currently represents a major consumer base, requiring drum polishing for engine components, transmission parts, and structural elements to ensure optimal performance and longevity. However, the fastest-growing segment is anticipated to be the Medical sector, driven by stringent regulatory standards for surface quality on implants, surgical instruments, and prosthetic components, necessitating specialized, sterile finishing processes. The shift toward smaller, high-value components is favoring centrifugal systems, which offer shorter cycle times and higher finishing energy compared to traditional tumbling barrels, signaling a technological pivot in market demand.

- By Machine Type:

- Standard Tumbling Barrels

- Centrifugal Barrel Finishing Machines

- Vibratory Finishing Machines

- By Operation Mode:

- Automatic

- Semi-Automatic

- By Application:

- Deburring and Deflashing

- Surface Smoothing and Edge Radiusing

- Mirror Polishing and High-Gloss Finishing

- By End-use Industry:

- Automotive

- Aerospace and Defense

- Medical Devices

- Electronics and Semiconductors

- Jewelry and Consumer Goods

- Heavy Machinery and General Manufacturing

Value Chain Analysis For Polishing Drum Machine Market

The value chain for the Polishing Drum Machine Market begins with the upstream suppliers of raw materials, including specialized steel and alloy manufacturers for drum construction, motor and control system component providers (PLCs, sensors, drives), and chemical/abrasive media manufacturers. The quality and cost of these upstream inputs significantly influence the final product's performance and market price. Following material sourcing, the manufacturing phase involves complex precision engineering, assembly, and rigorous testing of the drum machines. This phase often includes specialized software development for automated control systems, representing a growing source of value addition.

The midstream involves the distribution channel, which is typically bifurcated into direct sales channels for large industrial clients (often incorporating installation, training, and maintenance contracts) and indirect sales through specialized distributors and agents, particularly reaching small and medium-sized enterprises (SMEs). Distributors provide crucial local market knowledge, technical support, and immediate availability of consumables like abrasive media and compounds. The downstream part of the chain focuses on the end-users—the manufacturers who integrate these machines into their production lines. Value addition at this stage includes long-term maintenance services, supply of proprietary finishing compounds, and process consultancy aimed at optimizing the user's specific finishing tasks, ensuring the machine operates at peak efficiency for complex components.

Polishing Drum Machine Market Potential Customers

The primary consumers (end-users/buyers) of Polishing Drum Machines are large-scale manufacturing facilities that require high throughput and consistent surface finishing for mechanical components. These include Tier 1 and Tier 2 suppliers in the automotive industry focusing on parts like gears, bearing races, and fasteners, where surface integrity is paramount for performance and longevity. The aerospace sector represents a critical high-value customer segment, utilizing drum polishing for turbine blades, structural fittings, and precision hydraulic components to meet extremely strict standards for material integrity and fatigue resistance. Furthermore, the medical device industry, specifically manufacturers of orthopedic implants (hip and knee joints), dental fixtures, and sophisticated surgical instruments, relies heavily on these machines to achieve biocompatible, mirror-smooth surfaces free from microscopic contamination or stress points.

Beyond these precision industries, general metalworking shops and jewelry manufacturers constitute another substantial customer base. Jewelry production demands aesthetic finishing quality, making vibratory and centrifugal finishing methods essential for mass production of consistent, blemish-free components. As manufacturing trends shift towards customized, low-volume, high-mix production, especially post-COVID-19, smaller job shops that specialize in 3D-printed metal components are becoming increasingly important customers. These shops require versatile drum machines capable of efficiently removing support structures and smoothing the rough surface texture inherent in additive manufacturing processes, thereby driving demand for advanced, flexible systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rösler Oberflächentechnik GmbH, Walther Trowal GmbH & Co. KG, Mass Finishing Inc. (MFI), ActOn Finishing Ltd., Bel Air Finishing Supply Corp., Sweco, Inc., C. & E. Fein GmbH, Surface Preparation Group, Vibra Finish Ltd., PDJ Vibro, OTEC Präzisionsfinish GmbH, Trenn-Dich-Rein GmbH, Technovax, Inc., KREIDER FINISHING, Inc., Metal Finishings Inc., Rollwasch Italiana S.p.A., Giant Finishing Inc., Bula Industrie AG, Vibroser, Giesler GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polishing Drum Machine Market Key Technology Landscape

The technological landscape of the Polishing Drum Machine Market is currently characterized by advancements aimed at increasing efficiency, precision, and environmental sustainability. A major development involves the shift from traditional wet finishing to advanced dry finishing or micro-finishing techniques, which utilize specialized organic or ceramic media and minimize water consumption, addressing environmental regulations and lowering associated disposal costs. Furthermore, the integration of advanced motion control systems, driven by sophisticated programmable logic controllers (PLCs) and variable frequency drives (VFDs), allows for precise control over rotational speed and tilt angle, enabling optimized finishing cycles tailored to highly sensitive or geometrically complex parts.

Another crucial technological evolution is the implementation of remote monitoring and diagnostics through IoT sensors embedded within the drum machines. These sensors track vital operational parameters such as vibration intensity, compound concentration, temperature, and media wear levels. This data is critical for enabling predictive maintenance schedules and ensuring process repeatability, crucial features for high-volume manufacturing environments operating under Industry 4.0 principles. Finally, significant research and development efforts are focused on developing specialized, chemically enhanced abrasive media, including media designed specifically for post-processing titanium alloys, high-performance ceramics, and additive manufactured components, where standard finishing methods prove insufficient.

Regional Highlights

North America Polishing Drum Machine Market Analysis

The North American market, comprising the United States and Canada, represents a mature, high-value segment characterized by stringent quality control standards, particularly within the aerospace, defense, and medical device manufacturing sectors. Demand here is less focused on volume and more on achieving ultra-high precision and complying with strict regulatory frameworks, such as FDA approval for medical components and FAA standards for aerospace parts. The region shows a strong preference for fully automatic, highly specialized finishing systems that offer complete process traceability and reduced reliance on manual intervention. Investment in advanced manufacturing, particularly in the rapidly growing 3D printing sector, is fueling the adoption of specialized drum machines tailored for surface finishing metal and polymer prototypes and end-use parts.

Market growth in North America is driven by modernization initiatives and the reshoring of manufacturing operations, which necessitates adopting the most efficient and automated machinery available to mitigate high domestic labor costs. Key trends include the integration of robotic arms for loading and unloading components, minimizing handling damage, and the adoption of closed-loop water treatment and recycling systems to meet increasingly tough environmental regulations imposed at the state and federal levels. The competitive environment is shaped by both domestic manufacturers known for customized solutions and strong representation from leading European precision finishing equipment suppliers, resulting in a market focused heavily on technical performance and after-sales service quality.

Europe Polishing Drum Machine Market Analysis

Europe holds a commanding position in the Polishing Drum Machine Market, primarily due to Germany's strength in precision engineering and machinery manufacturing, coupled with the strong presence of automotive, luxury goods, and specialized industrial sectors across the region. European adoption is fundamentally driven by the pursuit of engineering excellence and adherence to high environmental standards (e.g., EU Green Deal initiatives). Manufacturers here actively seek systems that offer superior energy efficiency, minimal noise levels, and advanced wastewater treatment capabilities, positioning sustainability as a core purchasing criterion alongside technical performance.

The market is highly sophisticated, exhibiting strong demand for centrifugal finishing technology due to its superior efficiency for treating small, intricate parts used in watchmaking, medical implants, and complex automotive safety systems. Furthermore, European machine builders are leaders in developing highly modular and flexible drum systems that can be rapidly reconfigured to handle diverse batch sizes and material types, essential for meeting the demands of the region's diverse manufacturing base. Regulatory pressures, such as REACH regulations concerning chemical usage, continue to influence the consumption of polishing compounds, driving innovation towards safer, high-performance, and eco-friendly finishing solutions within the region.

Asia Pacific (APAC) Polishing Drum Machine Market Analysis

The Asia Pacific region represents the largest and fastest-growing market for Polishing Drum Machines globally, underpinned by vast industrial bases in China, Japan, South Korea, and increasingly, Southeast Asian nations like Vietnam and Thailand. This rapid expansion is directly linked to the region’s status as the global manufacturing hub for electronics, consumer goods, and automotive production. Demand is characterized by a dual requirement: low-cost, high-volume production systems needed in general manufacturing (China, Vietnam), and highly precise, automated systems required by technologically advanced industries (Japan, South Korea) focusing on semiconductors and high-end automotive components.

Market penetration is being driven by government policies supporting industrial automation and the significant investments made by local manufacturers to upgrade machinery and improve product quality to meet international export standards. While price sensitivity is high in certain segments, the increasing focus on advanced manufacturing processes, particularly in the electronics assembly sector where micro-finishing is critical, is boosting the uptake of centrifugal and highly accurate vibratory systems. Furthermore, the burgeoning electric vehicle (EV) component supply chain throughout APAC demands highly refined surface finishes for batteries and powertrain components, ensuring continued strong growth in the medium-term forecast period.

Latin America Polishing Drum Machine Market Analysis

The Latin American market, though smaller compared to APAC or Europe, is demonstrating steady growth, primarily led by industrial activities in Brazil and Mexico, particularly within the automotive and mining equipment manufacturing sectors. Market dynamics in this region are often influenced by local economic stability and foreign investment, especially from U.S. and European companies establishing localized manufacturing hubs (e.g., automotive assembly plants in Mexico). The demand for polishing drum machines is mostly concentrated on robust, reliable, and easy-to-maintain equipment suitable for continuous operation.

While automation adoption is generally slower than in developed regions, there is a clear, escalating trend towards semi-automatic and entry-level automatic systems to improve efficiency and component consistency in existing factories. Key segments driving demand include automotive parts finishing, general metal fabrication, and the local production of consumer durables. Challenges remain concerning the availability of specialized consumables and adequate technical service, making system reliability and localized support critical factors for vendor selection in the Latin American market.

Middle East and Africa (MEA) Polishing Drum Machine Market Analysis

The Middle East and Africa market is currently nascent but poised for moderate expansion, fueled primarily by diversification efforts away from oil and gas dependency, particularly in Saudi Arabia and the UAE, which are investing heavily in defense manufacturing, aerospace maintenance (MRO), and light industrialization. Demand for polishing drum machines is highly localized and project-specific, often tied to large-scale infrastructure projects requiring quality-finished mechanical components or the establishment of new domestic assembly operations.

Growth in this region is also supported by the presence of large repair and overhaul (R&O) facilities for aircraft and military equipment, which necessitate precision surface finishing capabilities. Adoption rates are characterized by the purchase of advanced, but sometimes high-specification, equipment driven by international standards and foreign partnership requirements. The African segment remains fragmented, though emerging industrial hubs in South Africa and North Africa show potential demand, largely focused on general deburring and heavy machinery component finishing.

- North America: Focus on aerospace, medical implants, and 3D printing post-processing, favoring high-precision automation (USA, Canada).

- Europe: Leading in technological adoption, strong demand for centrifugal systems, driven by strict environmental and quality standards (Germany, Italy, UK).

- Asia Pacific (APAC): Largest and fastest-growing market, driven by high-volume automotive and electronics manufacturing (China, Japan, South Korea).

- Latin America: Moderate growth fueled by the automotive supply chain and industrial resilience (Brazil, Mexico).

- Middle East and Africa (MEA): Emerging market focused on industrial diversification, defense MRO, and infrastructure projects (UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polishing Drum Machine Market.- Rösler Oberflächentechnik GmbH

- Walther Trowal GmbH & Co. KG

- Mass Finishing Inc. (MFI)

- ActOn Finishing Ltd.

- Bel Air Finishing Supply Corp.

- Sweco, Inc.

- C. & E. Fein GmbH

- Surface Preparation Group

- Vibra Finish Ltd.

- PDJ Vibro

- OTEC Präzisionsfinish GmbH

- Trenn-Dich-Rein GmbH

- Technovax, Inc.

- KREIDER FINISHING, Inc.

- Metal Finishings Inc.

- Rollwasch Italiana S.p.A.

- Giant Finishing Inc.

- Bula Industrie AG

- Vibroser

- Giesler GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Polishing Drum Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between vibratory and centrifugal polishing drum machines?

Vibratory machines use low-frequency vibration suitable for deburring and delicate finishing of large or delicate components. Centrifugal barrel machines use high rotational forces to achieve faster, more aggressive finishing and highly refined polishing, ideal for smaller, high-precision parts where cycle time is critical.

How is the Polishing Drum Machine Market adapting to the challenges posed by Additive Manufacturing (3D Printing)?

The market is adapting by developing specialized post-processing drum machines and media designed to remove support structures, smooth surface roughness (stair-stepping effect), and achieve high-quality surface finishes on complex 3D-printed metal and polymer parts efficiently, driving new application growth.

Which end-use industry contributes most significantly to the demand for high-precision drum machines?

The Aerospace and Medical Devices industries contribute most significantly to the demand for high-precision drum machines, as components in these sectors require stringent surface integrity, traceability, and minimal dimensional change to ensure safety, reliability, and biological compatibility.

What technological trends are reducing the environmental impact of drum polishing operations?

Key technological trends include the shift towards dry finishing methods, which eliminate wastewater generation; the development of biodegradable polishing compounds; and the integration of highly efficient closed-loop water and media recycling systems to minimize waste and chemical consumption.

What factors determine the optimal abrasive media selection for a polishing drum process?

Optimal abrasive media selection is determined by the component material (hardness, alloy type), the initial surface condition, the desired final finish (Ra value), and the component geometry. Common media types include ceramic (aggressive cutting), plastic (softer, lighter finishing), and organic materials (high-gloss polishing).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager