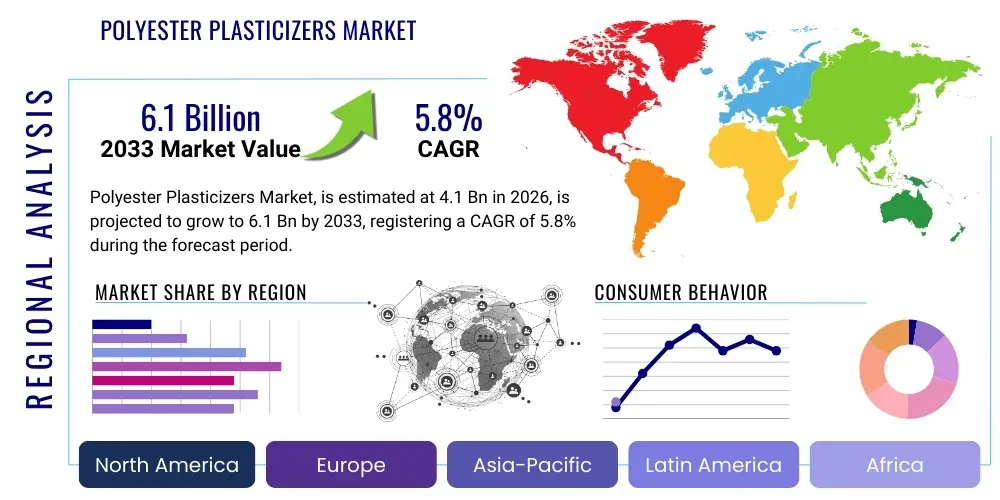

Polyester Plasticizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443458 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Polyester Plasticizers Market Size

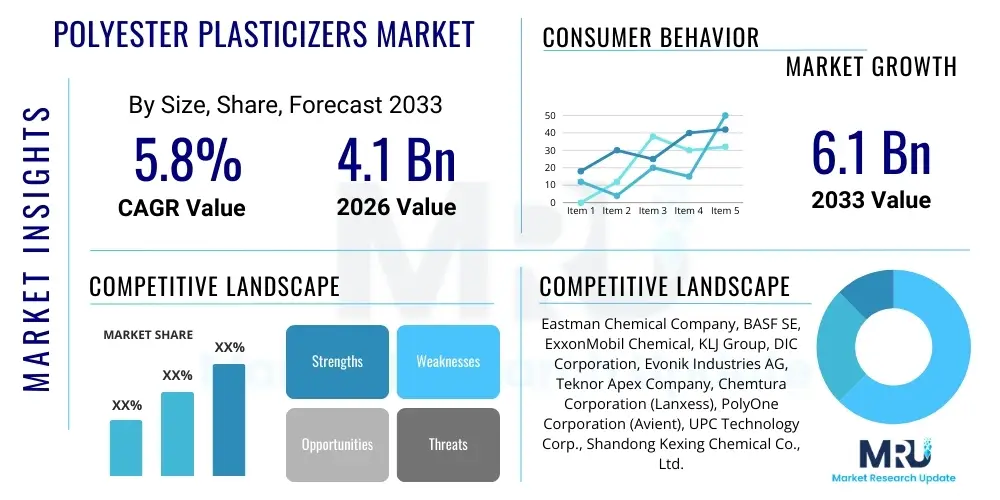

The Polyester Plasticizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-performance, non-phthalate plasticizing solutions, particularly within the sensitive sectors of medical devices, food contact applications, and specialized automotive components. The inherent low volatility and superior permanence characteristics of polymeric plasticizers position them favorably against conventional monomeric alternatives, ensuring sustained growth across mature and emerging economies.

Polyester Plasticizers Market introduction

The Polyester Plasticizers Market is defined by the production and utilization of long-chain polymeric esters, typically derived from the reaction of polyols (like glycols) and polycarboxylic acids (like adipic acid or sebacic acid). These high molecular weight compounds function as critical additives, primarily used to enhance the flexibility, durability, and processing characteristics of rigid polymers, most notably Polyvinyl Chloride (PVC). Unlike traditional phthalate plasticizers which suffer from migration and extraction issues, polyester plasticizers offer superior resistance to heat, oil, and migration, making them essential components in applications requiring long service life and stringent safety standards, such as wire and cable insulation, roofing membranes, and specialized protective coatings. The shift towards non-phthalate solutions globally, fueled by restrictive regulatory frameworks in North America and Europe, is the primary accelerator for market expansion and innovation.

Major applications of polyester plasticizers span across the construction, automotive, consumer goods, and medical sectors. In construction, they are indispensable in manufacturing durable flooring, wall coverings, and geomembranes due to their low-migration properties which maintain product integrity over decades. The automotive industry utilizes these plasticizers in dashboards, interior trims, and sealants where resistance to high temperatures and exposure to oils and fuels is paramount. Furthermore, the specialized benefits of polyester plasticizers include excellent compatibility with various polymer matrices, superior UV resistance, and minimal volatility, which significantly contributes to reducing volatile organic compound (VOC) emissions in end products. These attributes collectively drive their adoption as substitutes for general-purpose plasticizers in high-specification formulations.

Driving factors for this market include the global regulatory pressure banning or limiting the use of certain conventional phthalates (such as DEHP), leading manufacturers to actively seek safer, high-molecular-weight alternatives. Additionally, the increasing demand for flexible PVC products with enhanced performance characteristics—suchified by longer warranties and service life requirements—infrastructural projects, especially in rapidly industrializing regions like Asia Pacific, necessitate the use of stable and permanent plasticizers. Technological advancements focusing on developing bio-based polyester plasticizers, utilizing raw materials derived from renewable sources like plant oils, are also opening significant commercial opportunities and appealing to environmentally conscious industries and consumers.

Polyester Plasticizers Market Executive Summary

The Polyester Plasticizers Market is experiencing a pivotal transition characterized by strategic capacity expansion in APAC and a strong emphasis on sustainability and regulatory compliance in Western markets. Business trends highlight increasing vertical integration among major chemical producers aiming to secure stable supplies of precursor materials, such as adipic acid and various glycols, thereby optimizing cost structures and ensuring quality control across the production chain. Furthermore, the market is witnessing robust merger and acquisition activity as specialized plasticizer manufacturers seek to consolidate intellectual property related to novel, high-performance, and bio-based polymeric esters. This strategic movement is designed to capture market share quickly in sectors demanding niche, customized plasticizing solutions, particularly for high-end automotive interior components and medical tubing requiring extremely low extractability and high purity.

Regional trends indicate that the Asia Pacific region, driven by infrastructural spending in China and India, remains the dominant consumption hub, exhibiting the highest growth trajectory due to burgeoning construction and industrial manufacturing sectors. Conversely, stringent environmental and health regulations, particularly REACH in Europe and similar frameworks in North America, are mandating rapid innovation, pushing these regions toward premium, specialty polyester plasticizers and pioneering bio-based alternatives. Europe, in particular, serves as the innovation center, focusing heavily on circular economy principles and sustainable sourcing, making it a critical market for high-value, environmentally preferred products. The disparity between mass-market, cost-sensitive production in Asia and performance-driven, sustainable innovation in the West shapes global pricing and technology adoption strategies.

Segment trends confirm the rising preference for general-purpose polymeric plasticizers, such as those derived from adipate and sebacate chemistries, due to their broad compatibility and competitive pricing compared to highly specialized phthalate replacements. The wire and cable application segment continues to be a crucial growth driver, demanding superior thermal stability and electrical performance provided uniquely by polyester plasticizers, especially for critical infrastructure projects and high-voltage transmission lines. Moreover, the segmentation based on raw material highlights a growing shift toward renewable raw materials, although conventional petroleum-derived polyesters currently maintain the majority market share. This shift, however, is indicative of future market direction, where environmental certifications and Life Cycle Assessment (LCA) scores will become increasingly decisive factors in procurement decisions, thus favoring manufacturers committed to sustainable chemistry.

AI Impact Analysis on Polyester Plasticizers Market

User inquiries regarding AI's influence in the Polyester Plasticizers Market predominantly center on how artificial intelligence can accelerate the discovery of novel, non-migratory plasticizer formulations, optimize complex chemical production processes, and enhance supply chain resilience against raw material volatility. Key themes reveal user expectations that AI/Machine Learning (ML) algorithms will significantly reduce the R&D cycle time required to synthesize and test new polymeric structures that comply with evolving regulatory standards while maintaining or improving performance metrics such as permanence, thermal resistance, and cost-effectiveness. Specific concerns frequently relate to integrating predictive maintenance models into esterification reactors to minimize downtime and maximize yield, alongside utilizing ML for predictive raw material procurement strategies, particularly concerning volatile feedstocks like phthalic anhydride or various glycols, thereby mitigating market risks.

AI is set to revolutionize the formulation phase by employing high-throughput virtual screening techniques. Traditional chemical synthesis and testing of plasticizers are time-consuming and expensive. AI models, trained on vast datasets of existing polymer-plasticizer interactions, solubility parameters, and regulatory data, can rapidly predict the performance characteristics (e.g., glass transition temperature reduction, migration rate) of hypothetical new polyester structures. This predictive capability drastically narrows the experimental space, allowing chemists to focus only on the most promising candidates, thereby accelerating the launch of highly specialized, compliant, and cost-effective plasticizers, particularly bio-based variants whose chemical complexity often requires extensive testing.

Furthermore, the implementation of AI across the operational value chain enhances manufacturing efficiency and sustainability. Generative design tools can optimize reactor geometries and process parameters for maximizing esterification conversion rates and minimizing energy consumption during purification steps. In supply chain management, AI algorithms analyze real-time global logistics data, geopolitical risks, and commodity price fluctuations to advise procurement teams on optimal timing and sourcing locations for feedstocks, reducing overall operational expenditure and ensuring continuous production flow. This integration of AI shifts the market dynamic from reactive problem-solving to proactive, data-driven optimization, providing a significant competitive advantage to early adopters in the Polyester Plasticizers manufacturing space.

- AI accelerates R&D for novel, compliant non-phthalate polyester formulations.

- Machine Learning optimizes esterification process parameters, enhancing yield and purity.

- Predictive analytics models improve raw material procurement and supply chain resilience.

- AI-driven quality control systems detect minute variations in plasticizer batch consistency.

- Generative chemistry aids in designing sustainable, high-performance bio-based polymeric plasticizers.

DRO & Impact Forces Of Polyester Plasticizers Market

The Polyester Plasticizers Market is profoundly influenced by a complex interplay of regulatory drivers, cost restraints, and innovation-led opportunities, collectively shaping the market's trajectory. Key drivers include the stringent governmental regulations in developed regions, such as the European Union and North America, effectively banning or limiting the use of high-risk phthalate plasticizers, thereby creating a compelling necessity for manufacturers to adopt non-phthalate alternatives like polyesters. Concurrently, the increasing consumer preference and corporate mandates for sustainable, low-VOC products drive demand, particularly in automotive interiors and residential construction materials, where indoor air quality is a growing concern. These regulatory and societal forces act as powerful propellers for market growth and material substitution, ensuring that polyester plasticizers remain a strategic material class for the polymer industry.

Restraints primarily revolve around the high cost structure and volatile availability of key raw materials, such as specific diols and dibasic acids (e.g., adipic acid, sebacic acid, or azelaic acid). The manufacturing process for polymeric plasticizers is often more complex and energy-intensive than that for simpler monomeric plasticizers, contributing to higher final product costs, which can limit adoption in extremely cost-sensitive, large-volume applications. Furthermore, market penetration is occasionally hampered by performance characteristics; specifically, while polyester plasticizers offer low migration, some exhibit higher viscosity and require different processing temperatures compared to general-purpose monomeric plasticizers, demanding significant retooling or process adaptation by end-users, posing a tangible barrier to rapid substitution.

Opportunities for market stakeholders center on the rapid development and commercialization of bio-based polyester plasticizers derived from renewable resources, capitalizing on the high demand for environmentally friendly chemical inputs. The shift towards specialized, high-performance applications—such as advanced wire and cable compounds requiring extreme flame retardancy and thermal stability, or medical grades demanding zero leachability—provides avenues for premium pricing and differentiated product offerings. The overall impact of these forces is overwhelmingly positive; while cost volatility acts as a dampener, the regulatory push and innovation-driven opportunities necessitate market growth and structural transition toward higher-performing, safer polymeric materials, ensuring robust growth over the forecast period, especially in specialty segments.

Segmentation Analysis

The Polyester Plasticizers Market segmentation provides a granular view of consumption patterns, driven primarily by the type of polyester chemistry, the resulting functional properties, and the diverse end-use applications. Key segmentation categories include classification by Type (Adipates, Sebacates, Trimellitates, and others), by Application (PVC Compounds, Rubber, Coatings & Adhesives, and others), and by End-Use Industry (Automotive, Construction, Wire & Cable, Medical, and Consumer Goods). The adipate-based segment currently dominates the market due to its excellent balance of cost, performance, and compatibility across various polymer systems, serving as the workhorse of the polymeric plasticizer family, particularly in film and sheet applications.

Further analysis reveals that the Wire & Cable segment holds a significant market share, attributing to the critical need for plasticizers that provide long-term heat aging stability, low volatility, and minimal migration to maintain insulation integrity in demanding environments. This segment's requirements often surpass the capabilities of monomeric plasticizers, firmly cementing the role of high-molecular-weight polyesters. The Construction industry, encompassing roofing, flooring, and piping, is also a massive consumer, particularly sensitive to the permanence and UV stability offered by these plasticizers, which ensures extended product life cycle and reduced maintenance costs for infrastructure projects. Geographically, segmentation highlights the concentrated demand in Asia Pacific’s manufacturing hubs, contrasted with the high-value, stringent demand profiles of North American and European specialty markets.

The ongoing trend of specialization within plasticizer chemistry is crucial for future growth. While commodity polyesters are vital for volume, the fastest growth is observed in niche segments utilizing specialty polyols or multi-functional acids to achieve tailored properties, such as enhanced flame retardancy or improved low-temperature flexibility, which are critical for electric vehicle battery components and specialized medical devices. Understanding these segment dynamics is essential for manufacturers to align their R&D and commercial strategies with the most lucrative, performance-driven application areas that are less susceptible to economic volatility and offer higher profit margins.

- By Type: Adipates, Sebacates, Trimellitates, Other Polymeric Plasticizers (e.g., Azelates).

- By Application: PVC Compounds, Coatings & Adhesives, Rubber & Elastomers, Sealants, Others.

- By End-Use Industry: Wire & Cable, Automotive, Construction, Consumer Goods, Medical & Healthcare, Packaging.

Value Chain Analysis For Polyester Plasticizers Market

The value chain for the Polyester Plasticizers Market begins with the upstream procurement of essential petrochemical raw materials. These primarily include dibasic acids, such as adipic acid, phthalic anhydride, and sebacic acid (though sebacic acid often has bio-based routes), and various polyols/alcohols like glycols (e.g., ethylene glycol, propylene glycol, dipropylene glycol). The cost and availability of these precursor chemicals, which are heavily reliant on global crude oil prices and petrochemical capacity utilization, significantly dictate the final price and profitability of polyester plasticizers. Key challenges at this stage involve managing price volatility and securing long-term supply agreements, prompting larger manufacturers to integrate upstream where feasible to mitigate supply chain disruptions and achieve economies of scale in bulk chemical synthesis.

Midstream activities involve the specialized manufacturing process, primarily esterification or transesterification, where the acids and alcohols are reacted under high temperature and vacuum, often utilizing catalysts, to form the high-molecular-weight polyester plasticizers. This stage requires significant capital investment in reaction vessels, distillation equipment, and sophisticated quality control measures, especially to ensure low levels of residual alcohol or unreacted acid, which can affect the plasticizer's performance and regulatory compliance. Efficiency in this manufacturing stage, particularly minimizing energy consumption and optimizing batch size, is crucial for maintaining competitive pricing against commodity plasticizers. The resulting product is then formulated, packaged, and stored before distribution.

The downstream segment involves the distribution channels and end-user consumption. Distribution typically occurs through specialized chemical distributors who provide technical support and manage inventory for smaller compounders, or directly from the manufacturer to large-scale polymer compounding facilities, especially those in the wire & cable and automotive sectors. End-users, such as PVC compound manufacturers, automotive OEMs, and construction material producers, incorporate the plasticizers during the compounding or extrusion phase to achieve the desired flexibility and permanence of the final polymer product. Direct distribution is favored for large, consistent orders, while indirect distribution via regional specialty chemical partners facilitates market penetration into diverse, geographically dispersed small and medium-sized enterprises (SMEs). This network efficiency is paramount for ensuring timely delivery and technical advisory services critical for high-specification polymer formulation.

Polyester Plasticizers Market Potential Customers

The primary customers and end-users of polyester plasticizers are large-scale industrial processors operating within sectors demanding durable, long-lasting, and highly stable polymer products. The most significant customer segment consists of PVC compounders who specialize in formulating flexible PVC products for construction and wire & cable applications. These buyers prioritize polyester plasticizers due to their superior low-migration characteristics, which prevent plasticizer loss and maintain the physical properties of the PVC over extended periods, a mandatory requirement for electrical insulation and high-performance roofing membranes. As these compounders operate globally, they require suppliers capable of guaranteeing consistent product quality and adhering to region-specific regulatory standards, such as those related to fire safety and heavy metal content.

Another crucial customer group includes automotive component manufacturers and Tier 1 suppliers. These buyers utilize polyester plasticizers in critical interior and exterior parts—such as instrument panels, door trim, seals, and gaskets—where heat resistance, fogging resistance (low volatility), and oil resistance are non-negotiable performance criteria. The demanding specifications within the automotive industry, particularly the push toward low-VOC emissions for improved cabin air quality and the need for materials capable of withstanding extreme temperature fluctuations, make polyester plasticizers a preferred choice over monomeric alternatives. These relationships are often long-term, established through rigorous qualification processes ensuring material compatibility and reliable supply throughout the vehicle's production lifecycle.

Furthermore, specialized segments such as medical device manufacturers, particularly those producing blood bags, IV tubing, and other sterile flexible components, represent a high-value customer base. Due to the inherent risk of fluid contamination and the critical safety requirements in medical environments, these customers demand extremely low leachability and high biocompatibility, characteristics strongly supported by high-molecular-weight polymeric plasticizers. Finally, manufacturers of specialized coatings, adhesives, and sealants, who require improved flexibility and permanence in their formulations for extreme outdoor or industrial use, also constitute a growing base, seeking the superior hydrolytic stability and resistance to solvents provided by polyester chemistry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, BASF SE, ExxonMobil Chemical, KLJ Group, DIC Corporation, Evonik Industries AG, Teknor Apex Company, Chemtura Corporation (Lanxess), PolyOne Corporation (Avient), UPC Technology Corp., Shandong Kexing Chemical Co., Ltd., Shenzhen Sanhuan New Materials Co., Ltd., Polynt-Reichhold Group, Jiangsu Biliton Chemical Co., Ltd., Emerald Kalama Chemical (Lanxess), Mitsubishi Chemical Corporation, Hanwha Chemical, Velsicol Chemical, Rianlon Corporation, ADEKA Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyester Plasticizers Market Key Technology Landscape

The technological landscape of the Polyester Plasticizers Market is dominated by advancements aimed at increasing efficiency, enhancing performance metrics, and achieving sustainability targets. The core manufacturing technology remains batch or continuous esterification, but modern processes incorporate advanced process control systems (APCS) and specialized catalysts (often organometallic or acidic) to improve reaction kinetics, increase conversion rates, and minimize side product formation. Continuous flow reactors are increasingly being adopted by major players as they offer better control over reaction temperature and residence time, leading to superior product consistency, higher throughput, and reduced energy usage compared to traditional batch operations, which is critical for meeting high-volume commodity demand while maintaining purity standards necessary for specialty grades.

A significant technological focus is on developing high-performance polyester plasticizers that address specific deficiencies inherent in earlier generations, such as poor low-temperature flexibility or limited compatibility with non-PVC polymers. This involves molecular engineering, where chemists manipulate the chain length, branching, and selection of specific polyols and dibasic acids (e.g., incorporating branched chain structures or cyclic components) to tailor glass transition temperatures and viscoelastic properties precisely. Furthermore, the technology for minimizing volatile residuals, particularly unreacted raw materials, is paramount. Advanced stripping and purification techniques, often involving multi-stage vacuum distillation or specialized filtration, are employed to achieve the ultra-low volatility required for automotive fogging compliance and medical device safety regulations.

The most transformative technology trend is the research into and industrialization of bio-based polyester plasticizers. This involves replacing traditional petrochemical feedstocks with renewable sources such as bio-derived succinic acid, sebacic acid from castor oil, or bio-glycols. Technological challenges here include scaling up the production of these bio-monomers cost-effectively and ensuring that the resultant bio-plasticizers match or exceed the performance of their petrochemical counterparts, particularly regarding thermal stability and compatibility. Companies are investing heavily in fermentation and catalytic conversion technologies to create a robust and sustainable supply chain for these green plasticizers, aiming to secure long-term market advantage as sustainability becomes a core purchasing criterion globally.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by massive infrastructure investment, rapid urbanization, and a burgeoning automotive manufacturing sector, particularly in China, India, and Southeast Asian nations. Although regulatory pressures are less severe than in Europe, the growing middle class and increasing environmental awareness are slowly shifting demand towards higher quality, low-migration polyesters in durable goods and essential utilities like telecommunication cables.

- North America: Characterized by stringent regulatory environments (e.g., California’s restrictions on phthalates) and a focus on high-performance applications. The demand is concentrated in the specialized automotive, medical, and high-end construction sectors. The market here is mature but innovative, with a strong emphasis on securing non-phthalate and increasingly bio-based polymeric solutions, positioning it as a high-value market segment.

- Europe: The European market is defined by pioneering regulatory frameworks like REACH, making it a critical hub for innovation in sustainable and safe plasticizers. European manufacturers are leading the transition to bio-based and highly specialized polyester plasticizers to meet strict environmental and health standards. Consumption is robust in the high-specification wire & cable, resilient flooring, and automotive industries, prioritizing product permanence and minimal environmental impact.

- Latin America (LATAM): Growth in LATAM is moderate but steady, driven by urbanization and industrial expansion in Brazil and Mexico. The market is moderately price-sensitive, balancing the adoption of traditional polyester plasticizers with increasing awareness of global environmental trends, leading to gradual migration away from older, restricted monomeric alternatives, especially in critical construction projects.

- Middle East and Africa (MEA): This region is an emerging market, driven by large-scale infrastructure and construction projects, particularly in the Gulf Cooperation Council (GCC) countries. The demand is primarily focused on construction materials and protective coatings required for harsh environmental conditions (high heat and UV exposure), where the superior permanence and durability of polyester plasticizers provide essential performance benefits over general-purpose plasticizers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyester Plasticizers Market.- Eastman Chemical Company

- BASF SE

- ExxonMobil Chemical

- KLJ Group

- DIC Corporation

- Evonik Industries AG

- Teknor Apex Company

- Lanxess AG (acquiring Chemtura plasticizers assets)

- Avient Corporation (formerly PolyOne Corporation)

- UPC Technology Corp.

- Shandong Kexing Chemical Co., Ltd.

- Shenzhen Sanhuan New Materials Co., Ltd.

- Polynt-Reichhold Group

- Jiangsu Biliton Chemical Co., Ltd.

- Emerald Kalama Chemical (now part of Lanxess)

- Mitsubishi Chemical Corporation

- Hanwha Chemical

- Velsicol Chemical

- Rianlon Corporation

- ADEKA Corporation

Frequently Asked Questions

Analyze common user questions about the Polyester Plasticizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes polyester plasticizers from conventional phthalate plasticizers?

Polyester plasticizers, often called polymeric plasticizers, are high-molecular-weight compounds that offer significantly lower migration and volatility compared to conventional phthalates (like DOP/DEHP). This superior permanence makes them ideal for applications requiring long service life and exposure to high temperatures or solvents, such as automotive components, wire insulation, and medical devices, aligning with stricter global regulatory standards.

Which end-use industry is the largest consumer of polyester plasticizers?

The Wire & Cable industry is currently the largest consumer of polyester plasticizers. These plasticizers provide the necessary thermal aging stability, non-migration properties, and long-term electrical insulation performance essential for critical infrastructure cables and high-voltage transmission lines, where material degradation over time poses safety risks.

How do regulatory changes impact the Polyester Plasticizers Market growth?

Regulatory changes, particularly those enacted in Europe (REACH) and North America restricting or banning specific phthalates, are the primary growth drivers. These mandates force manufacturers to substitute restricted chemistries with safer, high-performance alternatives like polyesters, thereby accelerating market adoption and technological investment in non-phthalate solutions globally.

What are the key raw materials used in the manufacture of polyester plasticizers?

The key raw materials are dibasic acids (such as adipic acid, phthalic anhydride, or sebacic acid) and various polyols or glycols (such as ethylene glycol or propylene glycol). The choice of acid and alcohol determines the final plasticizer's molecular weight, chain length, and resulting performance characteristics.

What is the market outlook for bio-based polyester plasticizers?

The outlook for bio-based polyester plasticizers is extremely positive. Driven by corporate sustainability goals and consumer demand for green chemistry, bio-based variants derived from renewable resources (like vegetable oils or bio-succinic acid) are projected to exhibit the highest growth rate, offering premium pricing opportunities and significant competitive advantage in environmentally conscious markets like Europe and North America.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager