Polymer Additive Manufacturing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442636 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Polymer Additive Manufacturing Market Size

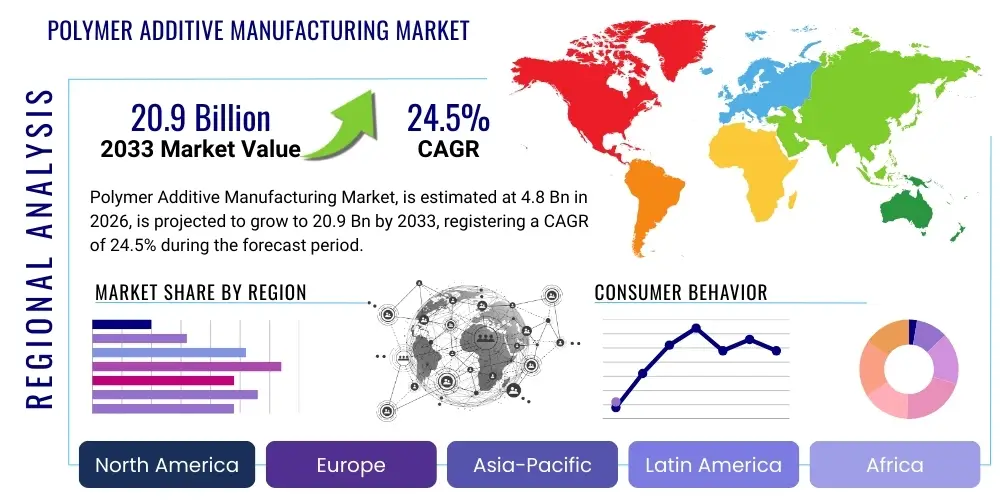

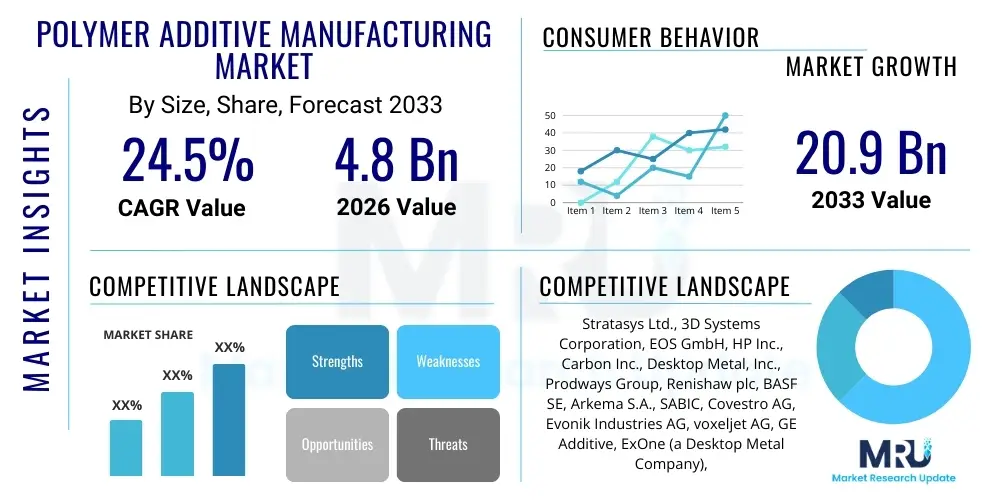

The Polymer Additive Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 20.9 Billion by the end of the forecast period in 2033.

Polymer Additive Manufacturing Market introduction

Polymer Additive Manufacturing (PAM), commonly known as 3D printing for plastics, encompasses a suite of technologies used to create three-dimensional objects layer-by-layer from polymer materials. This methodology revolutionizes traditional manufacturing processes by enabling highly complex geometries, rapid prototyping, and customized production runs. Key technologies within this domain include Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM), Stereolithography (SLA), and Multi Jet Fusion (MJF). PAM is fundamentally changing supply chains across various sectors due to its inherent flexibility and design freedom, moving beyond just prototyping to the creation of functional, end-use components.

The primary products in this market are the polymer powders, filaments, and resins used as feedstocks, alongside the additive manufacturing hardware and specialized software required for design optimization and process control. Major applications span high-value sectors such as aerospace and defense for lightweight components, healthcare for personalized medical devices and implants, and automotive for rapid tooling and customized interior parts. The technology allows manufacturers to iterate designs quickly, significantly reducing time-to-market for new products and optimizing material usage, thereby supporting sustainability goals.

The market growth is substantially driven by the increasing demand for customized and complex parts across critical industries, coupled with continuous advancements in polymer materials science. The expansion of accessible, industrial-grade 3D printing solutions and the declining cost of equipment further propel market penetration. Furthermore, the imperative for resilient and localized supply chains, highlighted by recent global disruptions, positions Polymer Additive Manufacturing as a strategic technology for dispersed and on-demand production.

Polymer Additive Manufacturing Market Executive Summary

The Polymer Additive Manufacturing (PAM) market is entering a phase of rapid industrialization, transitioning from a niche prototyping tool to a robust method for mass customization and low-to-mid volume production of end-use parts. Key business trends indicate significant investment in automation, post-processing solutions, and the development of high-performance engineering polymers like PEEK and PEKK, which are crucial for demanding applications in aerospace and medical sectors. Strategic partnerships between material suppliers and equipment manufacturers are accelerating material certification and process standardization, addressing previous limitations regarding repeatability and quality control necessary for regulated industries. Furthermore, the integration of digital threads and cloud-based manufacturing platforms is enhancing efficiency and facilitating decentralized production models.

Regionally, North America and Europe currently dominate the market due to robust R&D ecosystems, high adoption rates in aerospace and automotive industries, and strong governmental support for advanced manufacturing technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by significant manufacturing base expansion, particularly in China and India, and rising demand from consumer electronics and medical device manufacturing. Latent markets in Latin America, the Middle East, and Africa are showing nascent growth, primarily focusing on localized manufacturing of medical components and maintenance parts.

In terms of segmentation, the end-use parts application segment is expected to experience exponential growth, rapidly outpacing traditional prototyping and tooling applications. Technology-wise, powder bed fusion technologies such as Selective Laser Sintering (SLS) and Multi Jet Fusion (MJF) are gaining traction for their ability to produce highly dense, isotropic parts economically, challenging the established position of Fused Deposition Modeling (FDM). Material segments are shifting towards high-performance materials, although commodity plastics like Nylon (PA) and ABS maintain substantial volume usage in general manufacturing and consumer goods.

AI Impact Analysis on Polymer Additive Manufacturing Market

User inquiries regarding AI in Polymer Additive Manufacturing frequently revolve around optimizing design processes, predicting material performance, and automating production workflows. Common themes include how AI can accelerate Generative Design to produce topology-optimized components, whether Machine Learning models can accurately forecast material defects during the printing process, and the potential for AI-driven process monitoring to ensure consistent quality in batch production. Users are keenly interested in reducing material waste, shortening iteration cycles, and integrating complex sensor data into actionable insights, viewing AI as the critical enabler for scaling PAM into true industrial manufacturing.

The application of Artificial Intelligence is fundamentally transforming the Polymer Additive Manufacturing landscape by addressing core challenges related to design complexity, process stability, and quality assurance. AI algorithms are crucial in developing sophisticated generative design tools that automatically create lightweight, high-performance structures that are impossible to design manually, optimizing parameters such as stiffness, weight, and thermal performance based on specific application requirements. Furthermore, AI-powered image recognition and sensor fusion are being deployed to monitor print jobs in real-time, detecting anomalies and allowing for immediate process correction, thereby drastically reducing the failure rate and improving throughput.

Beyond the immediate production floor, AI plays a vital role in material science and supply chain management within the PAM ecosystem. Machine Learning is used to analyze vast datasets relating to new polymer compositions and processing parameters, accelerating the discovery and qualification of novel materials with specific mechanical properties. In the supply chain, predictive analytics driven by AI optimizes inventory management for specialized powders and resins, anticipates equipment maintenance needs, and coordinates distributed manufacturing networks efficiently, moving the industry closer to a fully autonomous, digitized factory environment.

- AI-driven Generative Design for topology optimization and material efficiency.

- Machine Learning models for predictive failure detection and quality control during printing.

- Automated process parameter optimization based on real-time sensor data feedback.

- Accelerated material development and qualification through data-driven analysis.

- Intelligent scheduling and load balancing in distributed additive manufacturing networks.

DRO & Impact Forces Of Polymer Additive Manufacturing Market

The Polymer Additive Manufacturing market is driven by compelling factors such as the increasing need for customization in medical and consumer markets, coupled with advancements in material science that introduce high-performance polymers suitable for demanding applications. However, restraints persist, notably the high initial investment cost for industrial-grade systems and the relative slowness of print speeds compared to traditional mass manufacturing techniques like injection molding. Opportunities abound in the development of hybrid manufacturing systems, expansion into emerging markets, and the standardization of regulatory frameworks. These factors are critically influenced by the competitive landscape, technological maturity, and the shifting dynamics of global supply chains, collectively shaping the market's trajectory.

Drivers: A principal driver is the demand for lightweight, fuel-efficient parts, particularly in the aerospace and automotive sectors, where weight reduction directly translates into operational savings and performance gains. Moreover, the unparalleled ability of PAM to enable mass customization is transforming the healthcare sector, allowing for patient-specific implants, prosthetics, and surgical guides, which traditional methods cannot economically achieve. The continuous evolution of 3D printing software and post-processing automation is also enhancing the appeal of PAM by making the overall workflow more efficient and cost-competitive for low-to-medium volume production runs. Regulatory easing and the formal certification of AM parts for critical applications further validate the technology's readiness for industrial scale.

Restraints: Significant limitations include the inherent challenge of ensuring material consistency and part repeatability across large batches, which remains a regulatory hurdle for safety-critical applications. The limited availability of specialized, high-temperature, and flame-retardant polymers compared to the vast material portfolio available for conventional manufacturing also constrains adoption in certain industries. Furthermore, the lack of a standardized, industry-wide qualification process for AM parts creates hesitation among large-scale manufacturers requiring stringent quality certifications. Scaling the technology beyond prototypes requires substantial investment in ancillary infrastructure for automated powder handling, cleaning, and surface finishing, driving up the total cost of ownership.

Opportunities: Major opportunities lie in the expansion of polymer binder jetting technology, which promises faster build rates and cost reductions, particularly for high-volume polymer parts. The integration of 4D printing capabilities, allowing parts to change shape or function post-production, presents future high-value applications. Furthermore, the transition toward decentralized, distributed manufacturing networks, enabled by secure digital blueprints and local production hubs, offers resilience against supply chain shocks. The recycling and reuse of polymer powders and resins, focusing on circular economy principles, also represents a growing area for technological and commercial development.

Impact Forces: The market is significantly impacted by competitive forces, where established equipment manufacturers are challenged by new entrants offering specialized, cost-effective solutions. Technological impact forces, particularly the convergence of AM with Artificial Intelligence and IoT, are accelerating process control and optimization. Economic impacts include fluctuating polymer feedstock prices, though the overall economic benefit of reduced inventory and logistics costs generally outweighs material price volatility. Finally, social forces, such as the increasing emphasis on sustainable manufacturing and localized production, favor the growth of polymer additive techniques.

Segmentation Analysis

The Polymer Additive Manufacturing market is comprehensively segmented based on technology, material, application, and end-use industry, providing a granular view of market dynamics and adoption patterns. The technological segmentation differentiates between established methods like FDM and SLA, and emerging, high-throughput industrial solutions such as SLS and MJF, reflecting the shift from desktop to production-scale systems. Material segmentation highlights the dominance of standard polymers (Nylon, ABS) but notes the rapid growth in high-performance polymers necessary for engineering and medical applications. Application and end-use segmentation reveal the critical pivot toward manufacturing end-use parts, driven by sectors demanding customized, complex components like aerospace and healthcare.

The segmentation by application is particularly informative, showing the evolution of 3D printing from being predominantly used for concept models and prototypes to becoming an integral part of jigs, fixtures, and finally, direct end-use components. This transition signifies the maturing of the technology and its acceptance by manufacturing professionals for critical functional parts. Analyzing these segments helps stakeholders identify high-growth areas, such as personalized medicine where material biocompatibility is paramount, and industrial tooling where durability and speed are key selection criteria. The interplay between technology speed and material properties dictates the viability of PAM across different manufacturing environments.

- By Technology:

- Selective Laser Sintering (SLS)

- Fused Deposition Modeling (FDM) / Fused Filament Fabrication (FFF)

- Stereolithography (SLA) / Digital Light Processing (DLP)

- Multi Jet Fusion (MJF)

- Binder Jetting (Polymer)

- PolyJet/Material Jetting

- By Material Type:

- Nylon (Polyamide)

- ABS (Acrylonitrile Butadiene Styrene)

- PLA (Polylactic Acid)

- High-Performance Polymers (PEEK, PEKK, ULTEM)

- Composites and Others (e.g., carbon fiber filled)

- By Application:

- Prototyping and Concept Modeling

- Tooling, Jigs, and Fixtures

- End-Use Parts Manufacturing

- By End-Use Industry:

- Automotive

- Aerospace and Defense

- Healthcare and Dental

- Consumer Goods and Electronics

- Industrial/General Manufacturing

- Education and Research

Value Chain Analysis For Polymer Additive Manufacturing Market

The value chain for the Polymer Additive Manufacturing market begins with upstream material synthesis and extends through hardware manufacturing, software development, printing services, and finally, post-processing and end-user application. Upstream activities involve specialized chemical companies developing and supplying high-quality polymer powders, filaments, and resins. This segment is highly competitive and crucial, as material quality directly determines the performance and acceptance of the final printed part. Innovation here focuses on developing cost-effective, durable, and application-specific materials, including bio-compatible and high-temperature resistant polymers.

The midstream focuses on hardware and software providers. Equipment manufacturers design, produce, and distribute the complex AM systems (SLS, MJF, FDM machines). Simultaneously, specialized software providers offer solutions for CAD/CAE integration, print preparation (slicing), machine control, and generative design. The distribution channel is bifurcated: direct sales channels are typically used for large, industrial-scale equipment and enterprise contracts, allowing for direct service and integration support. Indirect channels, involving resellers and distributors, are more common for desktop and mid-range professional printers, offering localized support and broader market reach.

Downstream activities center on service bureaus and end-users. Service bureaus provide on-demand manufacturing services, acting as vital intermediaries for companies that require AM parts but cannot justify the capital investment in their own machines. End-users integrate the technology directly into their internal manufacturing workflows, managing design, printing, and post-processing in-house. Post-processing (cleaning, sanding, coloring, curing) is a critical bottleneck often overlooked, yet essential for achieving final part quality. The effectiveness of the value chain relies heavily on seamless digital integration from design to final inspection.

Polymer Additive Manufacturing Market Potential Customers

Potential customers for Polymer Additive Manufacturing solutions span a diverse range of sophisticated industries, united by a need for customization, complexity, and optimized supply chains. The primary end-users or buyers of PAM products and services are engineering departments, R&D centers, and production facilities seeking to leverage additive technologies for competitive advantage. The profile of a potential customer is typically an organization operating in highly regulated or high-mix, low-volume environments where the flexibility of AM outweighs the speed of traditional methods.

In the healthcare sector, customers include medical device manufacturers requiring FDA-approved materials for implants and prosthetics, and hospitals seeking customized surgical guides and anatomical models. Within the automotive industry, Tier 1 suppliers and OEMs use PAM for rapid iteration of prototypes, specialized tooling (jigs and fixtures), and increasingly, internal and exterior customized components. Aerospace and defense potential customers, characterized by extremely high certification requirements, seek PAM for lightweight, complex ducting, interior components, and specialized tooling designed to withstand extreme thermal or mechanical stress.

Furthermore, consumer goods and electronics companies represent a growing customer base, utilizing the technology for highly customized products, small-batch luxury items, and intricate tooling for injection molds. These customers prioritize design freedom and the ability to respond rapidly to changing consumer trends. Overall, the ideal customer for the Polymer Additive Manufacturing market is one focused on product innovation, supply chain resilience, and requiring components with high complexity or stringent performance specifications that benefit significantly from material optimization and consolidation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 20.9 Billion |

| Growth Rate | 24.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stratasys Ltd., 3D Systems Corporation, EOS GmbH, HP Inc., Carbon Inc., Desktop Metal, Inc., Prodways Group, Renishaw plc, BASF SE, Arkema S.A., SABIC, Covestro AG, Evonik Industries AG, voxeljet AG, GE Additive, ExOne (a Desktop Metal Company), Formlabs, Inc., Ultimaker (Merged with MakerBot), Zortrax S.A., SLM Solutions Group AG (N.B. specialized in metal, but influential in AM ecosystem) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polymer Additive Manufacturing Market Key Technology Landscape

The Polymer Additive Manufacturing technology landscape is characterized by a rapid evolution toward faster, more precise, and scalable production systems, moving beyond simple fused deposition methods to advanced powder and liquid-based techniques. Selective Laser Sintering (SLS) remains a foundational technology, favored for its ability to produce highly functional, durable parts with excellent mechanical properties and geometric freedom, utilizing engineering-grade nylon powders. However, the requirement for complex powder handling and inert gas environments has spurred the growth of alternatives. Multi Jet Fusion (MJF), pioneered by HP, has significantly disrupted the market by offering comparable part quality at speeds several times faster than traditional SLS, leveraging an efficient thermal process and fusing agents, thereby accelerating its adoption for high-volume polymer part manufacturing.

FDM and Fused Filament Fabrication (FFF) technologies, while initially associated with prototyping and hobbyist markets, have been industrialized through high-temperature machines capable of processing challenging materials like ULTEM and PEEK. These industrial FDM systems are critical for applications requiring high strength-to-weight ratios and high thermal resistance, particularly in aerospace jigs and fixtures. Meanwhile, liquid resin technologies, including Stereolithography (SLA) and Digital Light Processing (DLP), have seen advancements in material chemistry, offering enhanced resolution and surface finish, crucial for applications in dental aligners, jewelry, and high-fidelity consumer products where aesthetic quality is paramount.

Emerging and specialized technologies, such as polymer Binder Jetting, represent the next frontier, promising the ability to produce large batches of polymer parts quickly and cost-effectively by selectively depositing a binder onto a powder bed, followed by curing. This technology minimizes waste and offers significant scalability potential. The convergence of hardware and advanced software, particularly algorithms that optimize print orientation, support structure generation, and real-time process monitoring (often utilizing embedded sensors and AI), defines the current competitive technology landscape. Standardization efforts are concentrating on defining open material architectures to enhance versatility and reduce dependency on proprietary material cartridges, driving down operational costs for end-users.

Regional Highlights

The global Polymer Additive Manufacturing market exhibits distinct regional dynamics driven by differing industrial structures, R&D investments, and regulatory environments. North America, encompassing the United States and Canada, stands as the largest and most mature market. This dominance is attributed to early adoption of AM in the aerospace and defense sectors, robust venture capital funding directed towards AM startups, and the presence of major industry pioneers and equipment manufacturers. The region's strong commitment to advanced medical device manufacturing further fuels demand, especially for patient-specific polymer components. High academic research investment ensures a continuous pipeline of innovation in materials and process controls.

Europe represents the second-largest market, characterized by high adoption rates in the automotive sector, particularly in Germany and France, where AM is integral to both performance prototyping and specialized tooling. The region benefits from strong governmental initiatives supporting 'Industry 4.0' and advanced manufacturing research (e.g., Horizon Europe programs). Eastern Europe is emerging as a critical manufacturing hub, rapidly integrating AM technologies to modernize its industrial base. The concentration of leading material suppliers and sophisticated machinery manufacturers, such as those based in Germany, underpins Europe's technological leadership in the PAM space.

The Asia Pacific (APAC) region is projected to register the fastest growth, largely driven by expanding manufacturing capacity in China, Japan, and South Korea, coupled with massive infrastructure investments. China's shift from being the "world's factory" to a hub for high-tech innovation is accelerating the adoption of industrial 3D printing, especially in consumer electronics and dental care. While APAC started with a focus on cost-effective FDM solutions, there is increasing investment in high-end industrial systems (SLS, MJF) to meet stringent quality requirements. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares, with growth primarily concentrated in localized applications, particularly in oil & gas maintenance (MEA) and specific healthcare niches (Brazil, Mexico), focusing on immediate operational efficiency gains.

- North America: Market leader; strong adoption in Aerospace, Defense, and Healthcare; headquarters for key AM technology providers; high R&D spending.

- Europe: High industrial integration, particularly in Automotive and Industrial Machinery; strong governmental support for Industry 4.0; center for materials science and equipment innovation.

- Asia Pacific (APAC): Fastest-growing region; driven by manufacturing expansion in China and India; increasing integration in Consumer Electronics and Dental applications; rising demand for industrial-grade systems.

- Latin America (LATAM): Nascent market, primarily focused on localized medical device production and industrial tooling; reliance on imported technology.

- Middle East and Africa (MEA): Growth driven by energy sector maintenance (Oil & Gas) and governmental efforts to diversify economies through technology adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polymer Additive Manufacturing Market.- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- HP Inc.

- Carbon Inc.

- Desktop Metal, Inc.

- Prodways Group

- Renishaw plc

- BASF SE

- Arkema S.A.

- SABIC

- Covestro AG

- Evonik Industries AG

- voxeljet AG

- GE Additive

- ExOne (a Desktop Metal Company)

- Formlabs, Inc.

- Ultimaker (Merged with MakerBot)

- Zortrax S.A.

- SLM Solutions Group AG

Frequently Asked Questions

Analyze common user questions about the Polymer Additive Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between industrial Polymer AM processes like SLS and MJF?

SLS (Selective Laser Sintering) uses a high-powered laser to fuse polymer powder particles, generally requiring longer cooling times and inert atmospheres. MJF (Multi Jet Fusion) uses fusing and detailing agents, followed by a thermal energy source, enabling faster throughput and often more isotropic part properties suitable for higher volume manufacturing.

Is Polymer Additive Manufacturing suitable for producing large-scale end-use components?

Yes, technological advancements are enabling the production of increasingly large and functional end-use components, moving beyond prototyping. While traditional AM technologies had size constraints, industrial systems now offer larger build volumes and specialized methods like FDM and specific powder bed fusion systems are routinely used for manufacturing sizable jigs, fixtures, and production parts in automotive and aerospace.

How is the lack of standardized certification impacting the Polymer AM market?

The lack of universal, standardized certification processes for materials and parts creates regulatory uncertainty, hindering mass adoption, especially in highly regulated sectors like aerospace and medical devices. Industry stakeholders and organizations like ASTM and ISO are actively working to establish comprehensive standards to ensure consistent quality, repeatability, and material qualification, which will unlock further industrial growth.

Which high-performance polymers are driving growth in critical AM applications?

High-performance polymers such as PEEK (Polyether Ether Ketone), PEKK (Polyether Ketone Ketone), and ULTEM (Polyetherimide) are crucial drivers. These materials offer superior mechanical strength, chemical resistance, and high temperature tolerance, making them essential for demanding applications in aerospace, oil & gas, and patient-specific medical implants where traditional plastics would fail.

What role does sustainability play in the Polymer Additive Manufacturing industry?

Sustainability is a significant factor, driven by the technology's inherent ability to minimize material waste through optimized geometries and less subtractive processing. Further efforts include developing recyclable polymer powders, enabling localized production to reduce transportation emissions, and utilizing recycled or bio-based feedstock materials, positioning AM as an environmentally conscious manufacturing alternative.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager