Polymyxins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441353 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Polymyxins Market Size

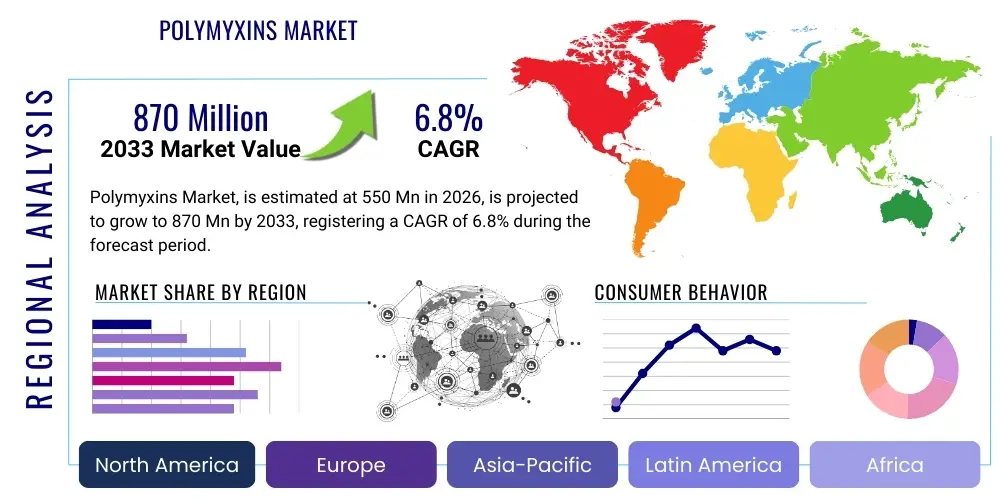

The Polymyxins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 870 Million by the end of the forecast period in 2033.

Polymyxins Market introduction

Polymyxins are a class of polypeptide antibiotics historically used for the treatment of Gram-negative bacterial infections. These antibiotics, primarily Polymyxin B and Polymyxin E (Colistin), function by disrupting the integrity of the bacterial outer membrane, leading to cell death. They are typically employed as last-resort drugs for infections caused by multidrug-resistant (MDR) organisms, particularly carbapenem-resistant Enterobacteriaceae (CRE), Pseudomonas aeruginosa, and Acinetobacter baumannii. The resurgence of polymyxins in clinical practice is directly correlated with the escalating global crisis of Antimicrobial Resistance (AMR), positioning them as vital agents in critical care settings where other treatments have failed, despite known nephrotoxicity risks.

The market growth is fundamentally driven by the severe limitations in the pharmaceutical pipeline for novel antibiotics effective against highly resistant Gram-negative pathogens. As resistance mechanisms, such as MCR-1 mediated colistin resistance, continue to spread globally, the demand for effective, albeit older, compounds like polymyxins remains high, especially in intensive care units (ICUs) and oncology units where immunocompromised patients are prevalent. Furthermore, advancements in therapeutic drug monitoring (TDM) and dosage optimization aimed at mitigating adverse effects are making polymyxin administration safer and more manageable, thus broadening their acceptable use profile in severe infection management.

Major applications of polymyxins include the treatment of ventilator-associated pneumonia (VAP), complicated urinary tract infections (cUTIs), and various forms of sepsis and bacteremia. Their primary benefit lies in their potent bactericidal activity against some of the most challenging pathogens identified today. The market dynamics are complex, balancing the urgent need for effective resistance countermeasures against the inherent toxicity challenges associated with these drugs, leading to continuous research in novel formulations and combination therapies designed to enhance efficacy and reduce systemic risk.

Polymyxins Market Executive Summary

The Polymyxins market is characterized by constrained supply, high demand driven by the global AMR crisis, and significant regulatory focus aimed at antibiotic stewardship. Business trends indicate a strategic focus among pharmaceutical manufacturers on improving manufacturing processes for purer products and investing in liposomal or inhaled delivery systems to overcome systemic toxicity hurdles. The reliance on generic versions of Colistin and Polymyxin B creates intense price competition in certain regional markets, while the specialized nature of their use ensures premium pricing for branded, reformulated versions targeting specific severe infections. Consolidation among smaller biotech firms focused on novel drug combinations with polymyxins is a notable emerging trend.

Regionally, the market exhibits bifurcation. Asia Pacific (APAC) and the Middle East & Africa (MEA) represent high-demand regions due to elevated rates of antibiotic overuse and subsequent high prevalence of MDR infections, fueling substantial consumption volume. Conversely, North America and Europe lead in terms of market value, driven by stringent regulatory frameworks ensuring quality and investment in advanced diagnostic tools and therapeutic drug monitoring protocols, which facilitate safer polymyxin usage. Government initiatives, such as incentives for new antibiotic development (e.g., in the US and EU), indirectly support the continued relevance and study of existing last-resort drugs like polymyxins.

Segment trends highlight the dominance of Polymyxin E (Colistin) due to its historical prevalence and established use in respiratory infections via inhalation, though Polymyxin B is gaining traction due to perceived lower neurotoxicity in some clinical contexts. The application segment is heavily weighted towards severe respiratory and bloodstream infections in hospital settings. Future growth hinges on successful development and regulatory approval of next-generation polymyxin analogs or safer combination regimens that minimize nephrotoxicity, expanding the viable patient population beyond the critically ill.

AI Impact Analysis on Polymyxins Market

User queries regarding AI's impact on the Polymyxins market frequently center on two major themes: predicting antimicrobial resistance (AMR) patterns and optimizing complex drug dosing. Users are concerned about how AI can rapidly identify novel resistance genes (like MCR-1) and track their geographical spread, enabling targeted use of last-resort antibiotics. Furthermore, there is significant interest in using AI algorithms to personalize polymyxin dosing regimes. Given the narrow therapeutic window and significant nephrotoxicity associated with these drugs, users are actively seeking AI solutions that can leverage real-time patient data (renal function, body weight, concurrent medications) to calculate optimal loading and maintenance doses, thereby maximizing efficacy while minimizing adverse effects. The expectation is that AI will transform polymyxin administration from an educated guess to a precision-guided therapy, extending the useful clinical life of these critical drugs.

AI is poised to revolutionize the stewardship of polymyxins by enhancing diagnostic capabilities and therapeutic precision. Machine learning models can analyze vast clinical datasets, identifying subtle patient characteristics that predict susceptibility to polymyxin-induced acute kidney injury (AKI), allowing clinicians to proactively adjust treatment plans or implement prophylactic measures. This predictive capacity moves beyond simple risk scoring to sophisticated patient profiling. Furthermore, AI-driven drug discovery platforms are being utilized to analyze the chemical space surrounding the polymyxin scaffold, searching for novel, less toxic derivatives or potentiation agents that can be co-administered to restore sensitivity in resistant strains. This accelerated R&D cycle promises to deliver the next generation of polymyxin-based therapeutics much faster than traditional methods.

The adoption of AI-powered clinical decision support systems (CDSS) specifically for polymyxin prescribing will standardize best practices across various healthcare institutions, a crucial step given the complexity of dosing. By integrating laboratory data, Electronic Health Records (EHRs), and pharmacokinetic/pharmacodynamic (PK/PD) models, AI systems provide instantaneous, evidence-based dosing recommendations. This not only improves patient outcomes but also optimizes drug utilization, which is critical for last-resort antibiotics. The integration challenges, including data standardization and clinician trust, remain key barriers, but the efficiency gains offered by AI in managing these high-risk, high-reward medications are undeniable and will drive significant investment in health technology infrastructure within critical care settings.

- AI-enabled precision dosing reduces nephrotoxicity risk by optimizing drug concentration.

- Machine learning models enhance antimicrobial stewardship by predicting resistance gene spread (e.g., MCR-1).

- AI accelerates the identification and synthesis of novel, less toxic polymyxin derivatives.

- Predictive analytics supports early detection of polymyxin-induced acute kidney injury (AKI).

- Clinical Decision Support Systems (CDSS) standardize complex polymyxin prescribing across hospitals.

DRO & Impact Forces Of Polymyxins Market

The dynamics of the Polymyxins market are fundamentally shaped by the delicate balance between increasing therapeutic necessity and inherent safety concerns. The primary Driver (D) is the relentless rise in multi-drug resistant (MDR) and extensively drug-resistant (XDR) Gram-negative infections globally, compelling clinicians to rely on polymyxins as the final therapeutic option when standard regimens fail. This urgent clinical need ensures sustained demand. Conversely, the critical Restraint (R) is the well-documented nephrotoxicity and neurotoxicity associated with polymyxin administration, which necessitates careful monitoring, limits usage duration, and requires specialized critical care management, thereby restricting their general applicability and contributing to physician reluctance. The major Opportunity (O) lies in developing sophisticated drug delivery systems, such as liposomal formulations, and combination therapies that enhance efficacy while simultaneously reducing systemic toxicity, opening pathways for broader indications and improved patient safety profiles. These internal forces are significantly amplified by external Impact Forces related to global regulatory incentives and the pace of AMR surveillance.

Impact Forces are external factors that exert considerable pressure on the market trajectory. Regulatory incentives, such as priority review vouchers or guaranteed market entry schemes offered by agencies like the FDA and EMA for novel antimicrobial agents, indirectly bolster the market for existing last-resort drugs by ensuring sustained focus on the high-need area of MDR pathogens. Furthermore, increasing global investments in public health infrastructure and surveillance networks (like WHO’s GLASS) generate accurate data on resistance patterns, justifying the strategic allocation and stocking of polymyxins in national essential medicine lists. On the demand side, the increasing global burden of healthcare-associated infections (HAIs), especially in ICUs where prolonged ventilation and invasive procedures are common, continually creates environments requiring potent, broad-spectrum or last-resort interventions.

The overall market trajectory is defined by the severity of the antibiotic resistance crisis. As the threat level of 'superbugs' increases, the restraints related to toxicity become relatively less impactful compared to the urgency of patient survival, further amplifying the driver. However, the future sustainability of the market is absolutely dependent on the realization of the opportunities presented by new formulations and combination regimens. Manufacturers that successfully navigate the complex safety profile of polymyxins through innovative delivery technologies will capture a disproportionately large share of the market, transforming these compounds from highly toxic necessities into precision-guided critical care tools.

Segmentation Analysis

The Polymyxins market is primarily segmented based on product type (Polymyxin B and Polymyxin E), application (specific types of infections), and end-user (healthcare settings). The segmentation allows for a granular analysis of clinical preferences and geographical usage patterns. Polymyxin E, commonly known as Colistin, currently holds the dominant share, largely due to its established use and lower manufacturing complexity compared to Polymyxin B, although its prodrug form requires enzymatic activation, adding variability to patient response. Polymyxin B is increasingly preferred in critical settings where rapid onset of action and lower risk of neurotoxicity are desired, leading to steady growth in its market share, particularly in developed economies that prioritize therapeutic precision.

From an application standpoint, the segmentation reflects the life-threatening nature of the infections targeted. Respiratory Tract Infections (especially VAP caused by resistant A. baumannii and P. aeruginosa) and Blood Stream Infections (sepsis and bacteremia) constitute the largest application segments. These conditions require immediate, aggressive intervention, justifying the risks associated with polymyxins. The segmentation by end-user strongly emphasizes tertiary care and specialized hospitals, which possess the necessary infrastructure (ICUs, dialysis units, infectious disease specialists) to safely administer and monitor patients receiving polymyxin therapy, differentiating them from general hospitals and smaller clinics.

Future segmentation trends suggest a growing differentiation within the application segment, focusing on combination therapies. As resistance spreads, polymyxins are increasingly co-administered with other antibiotics (such as carbapenems, rifampicin, or novel beta-lactamase inhibitors) to achieve synergistic effects. This trend is creating a niche for polymyxin-based combination products. Furthermore, the development of localized treatments, such as inhaled polymyxins for lung infections and intrathecal applications for central nervous system infections, will introduce new application sub-segments that are less dependent on systemic absorption and toxicity profiles.

- Product Type:

- Polymyxin B

- Polymyxin E (Colistin)

- Application:

- Central Nervous System (CNS) Infections

- Urinary Tract Infections (UTIs)

- Blood Stream Infections (BSIs/Sepsis)

- Respiratory Tract Infections (RTIs/VAP)

- Skin and Soft Tissue Infections

- Ophthalmic Applications

- End-User:

- Hospitals (Tertiary and Critical Care Centers)

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Research and Academic Institutions

- Route of Administration:

- Intravenous (IV)

- Inhaled/Nebulized

- Intrathecal/Intraventricular

- Topical

Value Chain Analysis For Polymyxins Market

The value chain for the Polymyxins market begins with upstream activities focused on complex biochemical synthesis and purification. Polymyxins are large, structurally intricate peptides, often produced through fermentation processes involving specific strains of Bacillus polymyxa, followed by rigorous purification steps. Given their use as last-resort drugs, quality control, purity, and consistency of the Active Pharmaceutical Ingredient (API) are paramount. Upstream analysis reveals reliance on a limited number of specialized API manufacturers, often based in Asia, which introduces supply chain vulnerabilities. Manufacturers are increasingly focused on optimizing fermentation yields and employing advanced chromatography techniques to reduce impurities that might contribute to toxicity.

Midstream activities involve formulation and finished drug manufacturing. This stage is critical for polymyxins, as innovative delivery systems (liposomes, specialized dry powder inhalers) are integral to differentiating products and mitigating toxicity. Pharmaceutical companies, including Contract Development and Manufacturing Organizations (CDMOs), are investing in technologies that enable the creation of stable, patient-friendly formulations. Due to the high regulatory hurdles and the need for sterile, often lyophilized, products, manufacturing expertise acts as a significant barrier to entry, concentrating production among established generic and specialty pharmaceutical firms.

Downstream analysis focuses on distribution and consumption. The distribution channel is predominantly indirect, utilizing specialized pharmaceutical distributors and hospital group purchasing organizations (GPOs) due to the drug’s high-alert status and restricted use. Direct distribution is limited primarily to institutional sales where specialized storage (often cold chain) is required. The end-users—critical care units and infectious disease specialists—require detailed educational support regarding appropriate dosing and monitoring. Effective distribution requires robust inventory management to prevent stock-outs, especially in regions with high AMR burden, linking demand forecasting closely with real-world resistance data.

Polymyxins Market Potential Customers

The primary end-users and potential customers of Polymyxins are institutions and medical professionals involved in the management of severe, drug-resistant bacterial infections. These drugs are not routinely dispensed in outpatient settings. The core market centers on large, tertiary care hospitals, particularly their Intensive Care Units (ICUs), Neonatal ICUs (NICUs), and Infectious Disease wards. These facilities handle the majority of complex nosocomial infections, such as Ventilator-Associated Pneumonia (VAP) and catheter-related bloodstream infections, which often necessitate the use of polymyxins. The infrastructure required for safe administration, including continuous renal replacement therapy (CRRT) facilities and advanced microbiological laboratories, dictates that specialized hospitals are the most critical consumers.

Beyond traditional acute care hospitals, specialized treatment centers focusing on high-risk patient populations represent significant potential customers. These include large burn centers, solid organ and hematopoietic stem cell transplantation units, and oncology hospitals. Patients in these environments are severely immunocompromised and highly susceptible to opportunistic MDR Gram-negative infections. The need for aggressive, life-saving therapy in these settings overrides many conventional toxicity concerns, making polymyxins essential components of their antimicrobial armamentarium. Furthermore, public health organizations and government stockpiling agencies, particularly in regions prone to biological threats or high incidence of infectious disease outbreaks, represent a growing customer base interested in maintaining national reserves of last-resort antibiotics.

Crucially, the potential customer base also includes infectious disease specialists and critical care physicians, who act as the ultimate prescribers and decision-makers regarding the adoption and usage protocols for new polymyxin formulations or combination therapies. Academic medical centers often serve as research hubs, pioneering the optimal use of polymyxins, including clinical trials on novel dosing regimens and localized delivery methods (e.g., nebulized polymyxins). Therefore, market outreach must be highly targeted, focusing on medical opinion leaders and institutional formulary committees rather than general practitioners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 870 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandoz (Novartis), Pfizer, GlaxoSmithKline (GSK), Mylan N.V., Teva Pharmaceutical Industries Ltd., Sanofi, Fresenius Kabi, EuroAPI, Merck & Co., Inc., Cipla Ltd., Wockhardt Ltd., Xellia Pharmaceuticals, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Melinta Therapeutics, Basilea Pharmaceutica, Shionogi Inc., Lupin Pharmaceuticals, Inc., Cumberland Pharmaceuticals Inc., Qilu Pharmaceutical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polymyxins Market Key Technology Landscape

The core technology landscape in the Polymyxins market is driven by the necessity to overcome the inherent limitations of these molecules, primarily their toxicity and poor penetration into certain tissues. The most significant technological advancements revolve around advanced drug delivery systems (DDS). Liposomal encapsulation technology is a leading area of research, aiming to package the polymyxin molecule within lipid bilayers. This approach theoretically restricts systemic exposure and concentrates the drug at the site of infection or within macrophages, significantly reducing the burden on renal tubules, thereby mitigating nephrotoxicity while potentially improving efficacy in lung tissues. Several firms are actively developing optimized liposomal formulations of both Polymyxin B and Colistin for clinical trials, promising a substantial shift in standard administration protocols.

Another crucial technological area is the development of inhalation and localized delivery technologies. Polymyxins are highly effective for treating Gram-negative pneumonia, but systemic administration often fails to achieve high concentrations in the lung parenchyma without causing systemic side effects. Specialized nebulizer technologies and dry powder inhalers designed for high-efficiency pulmonary delivery are emerging, enabling local treatment of VAP and cystic fibrosis-related infections. Furthermore, the technology surrounding therapeutic drug monitoring (TDM) is indispensable. Rapid, accurate assays and PK/PD modeling software are key technologies that allow clinicians to adjust dosing in real-time, moving away from fixed dosing and toward personalized medicine, maximizing the therapeutic index of these narrow-window drugs.

In addition to formulation science, significant investment is channeled into molecular diagnostics and resistance detection technologies. The emergence of plasmid-mediated resistance genes, such as MCR-1, necessitates rapid and high-throughput molecular diagnostic tools (e.g., PCR, sequencing) to guide therapy selection instantly. The market is also seeing the integration of Artificial Intelligence and bioinformatics for rapid structural modification screening, identifying subtle changes to the polymyxin scaffold that could retain antibacterial potency while minimizing interaction with mammalian cell membranes, thus creating next-generation, safer polymyxin analogs. This synergy between formulation chemistry, TDM software, and rapid diagnostics defines the modern technological frontier for polymyxins.

Regional Highlights

- North America: This region holds a significant market share by value, driven by high healthcare expenditure, sophisticated critical care infrastructure, and aggressive R&D investment, particularly in novel formulations and combination products. The US market is highly influenced by regulatory mechanisms (like the GAIN Act) that incentivize antibiotic development and support stewardship programs focusing on precise use of last-resort drugs. High usage rates are seen in complex tertiary hospitals, though strict antimicrobial stewardship programs limit overuse.

- Europe: The European market is characterized by strong regional initiatives to combat AMR (e.g., Joint Action on Antimicrobial Resistance and Healthcare-Associated Infections, EU-JAMRAI). Western European nations implement rigorous guidelines for polymyxin use, focusing heavily on TDM and combination therapies. Germany, France, and the UK are major consumers, balancing high quality of care with the need to address emerging resistance strains, especially from cross-border patient transfers.

- Asia Pacific (APAC): APAC is the fastest-growing market in terms of volume, attributed to a large population base, high incidence of hospital-acquired infections, and sometimes less stringent antibiotic use policies compared to Western regions, leading to a high prevalence of MDR pathogens. Countries like India, China, and Southeast Asian nations show massive demand for cost-effective generic Colistin, though challenges remain in ensuring standardized quality and implementing necessary supportive care for toxicity management.

- Latin America: This region demonstrates moderate growth, primarily driven by large public healthcare systems facing resource constraints and increasing resistance levels. The market often relies on imported generics. Education and standardized critical care protocols are essential growth drivers, aiming to elevate the safe usage profile of polymyxins in high-incidence zones.

- Middle East and Africa (MEA): The MEA region is characterized by exceptionally high rates of resistance, particularly among refugees and travelers, making polymyxins absolutely critical for survival in many ICUs. Demand is strong, especially for Colistin, but market growth is hampered by geopolitical instability and variable healthcare infrastructure, though key economies like Saudi Arabia and UAE are investing heavily in advanced hospital systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polymyxins Market.- Sandoz (Novartis)

- Pfizer

- GlaxoSmithKline (GSK)

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Fresenius Kabi

- EuroAPI

- Merck & Co., Inc.

- Cipla Ltd.

- Wockhardt Ltd.

- Xellia Pharmaceuticals

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson

- Melinta Therapeutics

- Basilea Pharmaceutica

- Shionogi Inc.

- Lupin Pharmaceuticals, Inc.

- Cumberland Pharmaceuticals Inc.

- Qilu Pharmaceutical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Polymyxins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Polymyxins market growth?

The central driver is the escalating global crisis of antimicrobial resistance (AMR), specifically the rise of multidrug-resistant (MDR) Gram-negative bacteria such as CRE and Acinetobacter baumannii, for which polymyxins are often the only viable last-resort therapeutic option.

What are the key toxicity concerns associated with polymyxins?

The primary safety concerns are nephrotoxicity (acute kidney injury) and neurotoxicity, which severely limit the dosage and duration of treatment, necessitating specialized critical care monitoring and Therapeutic Drug Monitoring (TDM) protocols during administration.

How is technology addressing the safety profile of polymyxins?

Key technological advancements include the development of sophisticated drug delivery systems, such as liposomal encapsulation and specialized inhaled formulations, designed to reduce systemic drug exposure and mitigate renal toxicity while concentrating the drug at the infection site.

Which geographical region exhibits the highest volume consumption of polymyxins?

The Asia Pacific (APAC) region currently demonstrates the highest volume consumption of polymyxins, driven by high rates of hospital-acquired infections (HAIs) and widespread prevalence of MDR pathogens across its densely populated economies.

What role does AI play in the clinical use of polymyxins?

AI is crucial for optimizing clinical use by facilitating precision dosing through predictive analytics based on real-time patient data, minimizing nephrotoxicity risks, and enhancing global surveillance of resistance genes like MCR-1.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager