Polyoxyethylene Sorbitan Fatty Acid Esters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441736 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Polyoxyethylene Sorbitan Fatty Acid Esters Market Size

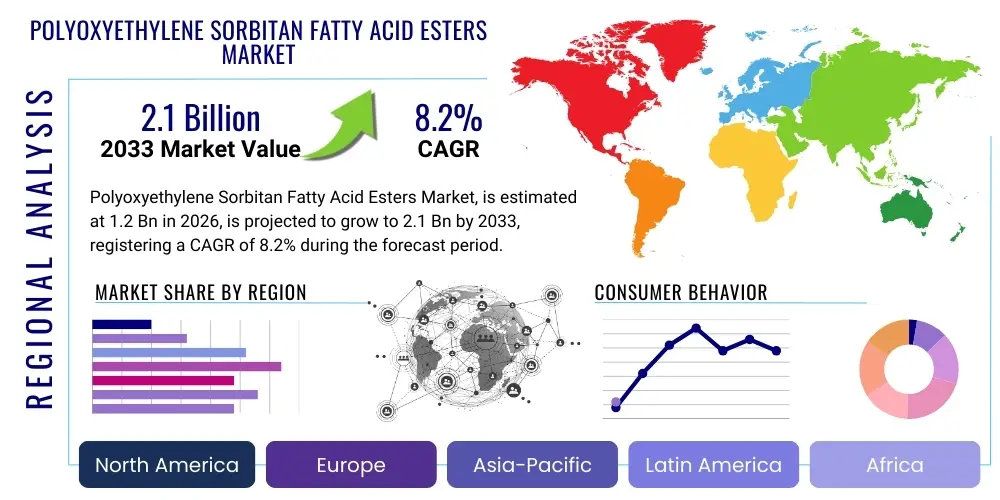

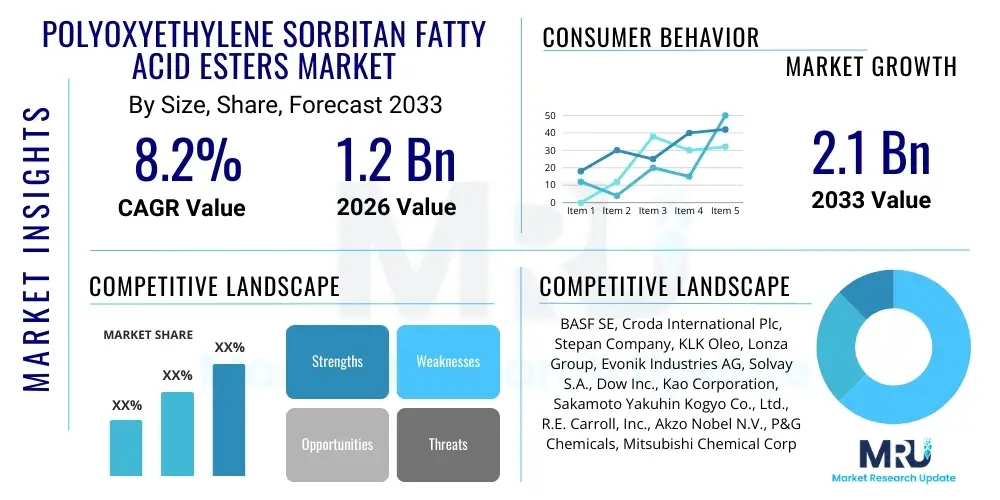

The Polyoxyethylene Sorbitan Fatty Acid Esters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Polyoxyethylene Sorbitan Fatty Acid Esters Market introduction

Polyoxyethylene Sorbitan Fatty Acid Esters, commonly known as Polysorbates (such as Polysorbate 20, 40, 60, and 80), represent a crucial class of nonionic surfactants derived from ethoxylated sorbitan and various fatty acids, including lauric, palmitic, stearic, and oleic acid. These esters are distinguished by their excellent emulsifying, solubilizing, and stabilizing properties, making them indispensable components across diverse industrial sectors. The versatility of these compounds, particularly their ability to maintain stable oil-in-water emulsions, drives their high demand in sophisticated formulations within pharmaceuticals, cosmetics, and food processing. Market growth is primarily fueled by the expanding applications in drug delivery systems and the rising consumer preference for high-quality, stable personal care products.

The core product description focuses on their amphiphilic nature, allowing them to bridge immiscible phases. In pharmaceutical applications, Polysorbates serve critical functions, enhancing the bioavailability and solubility of poorly water-soluble active pharmaceutical ingredients (APIs), stabilizing biological formulations (like monoclonal antibodies and vaccines), and functioning as effective wetting agents. Beyond pharmaceuticals, their application in the food industry as emulsifiers in baked goods, ice creams, and dressings ensures desired texture and extended shelf life. The stringent quality requirements in these end-use industries necessitate high-purity and consistent product specifications, influencing manufacturing processes and supply chain dynamics.

Major driving factors include the rapid expansion of the biopharmaceutical sector, which relies heavily on Polysorbates for stability, and the burgeoning demand for processed foods in developing economies. Furthermore, the global trend towards specialized personal care products, including sunscreens and anti-aging creams requiring complex emulsion stability, significantly boosts consumption. However, regulatory scrutiny, particularly concerning potential impurities and sourcing sustainability, remains a continuous factor influencing market strategies and product innovation.

Polyoxyethylene Sorbitan Fatty Acid Esters Market Executive Summary

The Polyoxyethylene Sorbitan Fatty Acid Esters market is exhibiting robust expansion driven by critical technological advancements in pharmaceutical formulation and consistent demand from the functional food and beverage sector. Business trends indicate a strong move toward sustainable sourcing of fatty acids (like palm kernel oil or coconut oil derivatives) and stricter quality control protocols to meet pharmacopeial standards (USP/EP/JP). Strategic collaborations between major chemical manufacturers and pharmaceutical companies are intensifying to ensure specialized supply chain resilience for high-grade Polysorbates. Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily due to rapid industrialization, burgeoning domestic pharmaceutical production, and increasing per capita spending on cosmetics and processed foods in countries like China and India. Conversely, North America and Europe maintain dominance in terms of value, owing to high adoption rates in advanced biopharmaceutical research and adherence to stringent regulatory frameworks.

Segment trends reveal that the Pharmaceutical grade segment is experiencing the highest growth rate, overshadowing the Food and Industrial grades, driven by the escalating research and development activities in biologics and biosimilars. Polysorbate 80 dominates the product type segment due to its widespread use in stabilizing protein therapeutics and vaccines, although Polysorbate 20 remains critical in certain delicate cosmetic formulations. Furthermore, the application segment emphasizes the dominance of drug delivery systems, closely followed by topical preparations and food emulsification. Manufacturers are investing heavily in purification technologies to mitigate the risk of oxidative degradation and impurity formation, which are critical concerns in sensitive pharmaceutical applications, thus driving segment differentiation based on purity and stability specifications.

Overall, the market landscape is characterized by moderate consolidation among large global chemical players who command significant market share through established supply networks and strong regulatory compliance. Emerging small and medium enterprises (SMEs) often specialize in niche segments, such as highly purified, excipient-grade products derived from non-GMO or sustainable sources. The primary strategic focus for market participants involves capacity expansion, vertical integration to secure feedstock supply, and portfolio diversification into higher-margin specialized esters to capitalize on the sustained growth projected across all major end-use sectors, while simultaneously addressing environmental, social, and governance (ESG) factors in sourcing and production.

AI Impact Analysis on Polyoxyethylene Sorbitan Fatty Acid Esters Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Polyoxyethylene Sorbitan Fatty Acid Esters market often center on optimizing complex synthesis routes, predicting stability profiles in various formulations, and enhancing supply chain resilience. Key themes include how AI and machine learning (ML) can accelerate the discovery and selection of novel surfactant variants or optimize existing Polysorbate analogues for improved performance in challenging environments, such as high-concentration protein solutions or extreme pH levels. Concerns frequently revolve around the initial investment required for integrating AI into chemical manufacturing processes and whether predictive maintenance models can reliably reduce downtime associated with polymerization or purification steps. Expectations focus heavily on AI’s ability to ensure consistent batch-to-batch quality, rapidly identify and troubleshoot deviations in critical quality attributes (CQAs), and manage the complex global logistics inherent in supplying pharmacopeial-grade esters, particularly by forecasting demand fluctuations accurately across diverse end-use industries.

- AI-driven optimization of reaction conditions in esterification and ethoxylation processes, leading to enhanced yield and purity of Polysorbates.

- Machine learning models used for predicting the long-term stability and compatibility of Polysorbates in biopharmaceutical formulations, minimizing costly degradation studies.

- Implementation of predictive quality control systems utilizing AI to monitor critical process parameters (CPPs) in real-time, ensuring adherence to stringent Pharmacopeial standards (e.g., controlling ethylene oxide residues).

- AI integration into supply chain management for demand forecasting, raw material procurement (fatty acids, sorbitol), and optimizing global distribution routes, mitigating price volatility and supply disruptions.

- Accelerated discovery of novel surfactant chemistries and screening of Polysorbate alternatives using computational chemistry and ML algorithms to find bio-compatible and sustainable substitutes.

- Robotic process automation (RPA) powered by AI in laboratory settings for high-throughput testing and analysis of Polysorbate functional properties.

- Enhanced environmental monitoring and sustainability tracking using AI to minimize waste generation and optimize energy consumption during manufacturing.

DRO & Impact Forces Of Polyoxyethylene Sorbitan Fatty Acid Esters Market

The market for Polyoxyethylene Sorbitan Fatty Acid Esters is subject to a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively define the impact forces shaping its trajectory. Key drivers include the exponential growth of the global biopharmaceutical sector, necessitating highly stable and reliable excipients for protein stabilization in liquid formulations, alongside the increasing complexity of cosmetic formulations demanding advanced emulsification capabilities. Restraints primarily involve stringent regulatory oversight, particularly concerns related to residual ethylene oxide and 1,4-dioxane impurities, and the inherent susceptibility of Polysorbates to oxidative degradation (leading to product failure in sensitive drug products), prompting the need for robust quality control. Opportunities lie in the development of next-generation, high-purity, and stable analogues, the exploration of sustainable sourcing strategies (bio-based fatty acids), and expanding applications in specialized fields like nano-emulsions and targeted drug delivery systems, enabling sustained high-value growth across the forecast period.

Impact forces on the market are multifaceted, combining economic, technological, and regulatory pressures. Economically, the volatility in raw material prices (especially vegetable oils and petrochemicals derived from ethylene oxide) directly impacts manufacturing costs and profit margins. Technologically, innovation centers on purification techniques, enzymatic synthesis methods, and the creation of highly refined grades tailored specifically for sensitive applications like cell culture media and gene therapies. Regulatory forces impose significant operational constraints; for instance, the requirement for detailed documentation on excipient origin and stability testing mandates continuous investment in compliance infrastructure. Furthermore, competitive intensity among key players to secure long-term supply agreements with major pharmaceutical consumers accentuates the importance of product quality and supply chain resilience as critical market differentiators, ensuring that compliance and stability remain paramount impact forces.

The market’s direction is being substantially steered by the pharmaceutical sector’s shift towards complex large molecule therapeutics. This shift elevates the requirements for excipient performance, transforming Polysorbates from simple emulsifiers into critical functional stabilizers. The associated risk of product recalls or formulation failure due to excipient instability means that manufacturers who can guarantee superior oxidative stability and low impurity profiles will disproportionately capture market share, turning regulatory compliance and advanced purification capabilities into decisive competitive advantages.

Segmentation Analysis

The Polyoxyethylene Sorbitan Fatty Acid Esters market is systematically segmented based on product type, application, grade, and geographical region to provide granular insights into market dynamics and consumption patterns. Segmentation by product type primarily includes Polysorbate 20 (Polyoxyethylene (20) Sorbitan Monolaurate), Polysorbate 40 (Monopalmitate), Polysorbate 60 (Monostearate), and Polysorbate 80 (Monooleate), each possessing unique Hydrophilic-Lipophilic Balance (HLB) values suitable for distinct emulsification and solubilization tasks. Application segmentation highlights the dominance of pharmaceuticals (drug stabilization, solubilization, and emulsification) and food and beverage (emulsifiers, stabilizers), followed by cosmetics and personal care, and industrial applications (lubricants, textiles). The grade differentiation—Pharmaceutical Grade, Food Grade, and Industrial Grade—reflects the purity standards and the intended end-use, with Pharmaceutical Grade commanding a significant price premium due to rigorous testing and documentation requirements.

- By Product Type:

- Polysorbate 20 (Monolaurate)

- Polysorbate 40 (Monopalmitate)

- Polysorbate 60 (Monostearate)

- Polysorbate 80 (Monooleate)

- Others (e.g., Polysorbate 65, 85)

- By Application:

- Pharmaceuticals (Drug Delivery, Biologics Stabilization, Vaccines)

- Food and Beverage (Emulsifiers, Whipping Agents, Solubilizers)

- Cosmetics and Personal Care (Creams, Lotions, Shampoos)

- Industrial (Agrochemicals, Textile Processing, Lubricants)

- Others (Chemical Synthesis, Laboratory Reagents)

- By Grade:

- Pharmaceutical Grade

- Food Grade (E-numbers)

- Industrial Grade

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Polyoxyethylene Sorbitan Fatty Acid Esters Market

The value chain for Polyoxyethylene Sorbitan Fatty Acid Esters is intricate, commencing with the sourcing of critical raw materials, extending through complex manufacturing and purification processes, and concluding with distribution to diverse end-use sectors. Upstream analysis focuses heavily on the procurement of feedstock: fatty acids (derived mainly from vegetable oils like coconut, palm kernel, or tallow, determining the specific Polysorbate type) and petrochemical derivatives, specifically sorbitol and ethylene oxide. Volatility in agricultural commodity markets significantly impacts the cost structure at this stage. Securing high-quality, sustainably sourced fatty acids is becoming a crucial factor, especially for companies targeting the European and North American consumer markets. Manufacturing involves the esterification of sorbitol with fatty acids, followed by ethoxylation, a highly controlled process that determines the degree of polymerization (e.g., the '20' in Polysorbate 20), which is critical for achieving the desired functional properties and HLB value. Purification, particularly for Pharmaceutical Grade esters, is the most value-adding and complex step, ensuring the removal of trace impurities like 1,4-dioxane and residual ethylene oxide, which are strictly regulated.

Downstream analysis highlights the complexity of distribution channels, which must cater to the specialized needs of different industries. Direct distribution channels are predominantly used for large-volume pharmaceutical and biopharmaceutical clients, where technical support, detailed regulatory documentation (Drug Master Files, DMFs), and rigorous quality agreements are mandatory. This direct approach ensures supply chain integrity and traceability. Conversely, indirect distribution through specialized chemical distributors and regional agents is common for smaller clients in the cosmetics, food, and general industrial sectors. These distributors manage inventory, provide technical sales support, and facilitate the handling of diverse packaging requirements. The competitive edge downstream is often achieved through logistical efficiency, superior technical service, and the ability to consistently provide product grades that meet the specific pharmacopeial standards of various regions (USP, EP, JP).

The most critical pressure point in the value chain remains the midstream manufacturing and quality assurance stage. As Polysorbates are ubiquitous in sensitive drug formulations, any compromise in purity can lead to catastrophic product failures, making the investment in advanced analytical capabilities and cGMP (current Good Manufacturing Practice) compliant facilities a non-negotiable requirement. Furthermore, the push towards green chemistry and sustainable sourcing is gradually shifting value capture towards those suppliers who can demonstrate full vertical integration and traceability from the source of the fatty acid up to the final purified excipient.

Polyoxyethylene Sorbitan Fatty Acid Esters Market Potential Customers

The primary consumers and buyers of Polyoxyethylene Sorbitan Fatty Acid Esters span three major high-value industries: pharmaceuticals, food and beverage, and cosmetics. In the pharmaceutical sector, potential customers include large multinational drug manufacturers, contract manufacturing organizations (CMOs), and biotechnology firms specializing in biologics, vaccines, and biosimilars, all requiring Pharmaceutical Grade Polysorbates for stabilizing protein drugs and enhancing solubility. These customers prioritize excipient stability, low impurity profiles, and comprehensive regulatory documentation (DMF status). The shift toward complex injectable therapies and specialized ophthalmic and parenteral solutions is expanding the buyer base within this segment. Major potential buyers often enter into long-term supply contracts to ensure consistent quality and volume, given the critical nature of these excipients in drug efficacy and safety profiles.

In the food and beverage industry, the potential customer base encompasses global packaged food companies, bakery manufacturers, confectioners, and dairy processors. These entities utilize Food Grade Polysorbates (recognized by specific E-numbers in Europe, such as E433 for Polysorbate 80) as emulsifiers to prevent phase separation, stabilize froths, improve dough handling, and extend the shelf life of products like non-dairy creams, ice cream, and salad dressings. Buyers in this segment seek cost-effectiveness, ease of incorporation, and compliance with national food safety standards. Their purchasing decisions are often driven by bulk pricing and consistent supply availability, making them volume-sensitive customers.

The cosmetics and personal care sector represents another significant purchasing segment, comprising manufacturers of skin care products (creams, lotions), hair care products (shampoos, conditioners), and color cosmetics. Polysorbates function here as solubilizers for fragrances and essential oils, and as co-emulsifiers to create stable, aesthetically pleasing product textures. These customers demand specialized grades that are often perceived as "natural" or sustainably sourced, where possible, aligning with contemporary consumer trends. Technical support regarding formulation and compatibility testing is highly valued by these buyers, often small to medium-sized private label manufacturers who are constantly innovating new product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Croda International Plc, Stepan Company, KLK Oleo, Lonza Group, Evonik Industries AG, Solvay S.A., Dow Inc., Kao Corporation, Sakamoto Yakuhin Kogyo Co., Ltd., R.E. Carroll, Inc., Akzo Nobel N.V., P&G Chemicals, Mitsubishi Chemical Corporation, J.M. Huber Corporation, Clariant AG, Gattefossé, Ashland Inc., Emery Oleochemicals, Galaxy Surfactants. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyoxyethylene Sorbitan Fatty Acid Esters Market Key Technology Landscape

The technology landscape for Polyoxyethylene Sorbitan Fatty Acid Esters is highly focused on enhancing purity, stability, and sustainable manufacturing practices. The core manufacturing process involves esterification followed by ethoxylation, but the innovation lies in process refinement. Modern technologies emphasize continuous flow chemistry over traditional batch processes to achieve tighter control over the degree of ethoxylation, thereby ensuring highly uniform product quality and minimizing the formation of unwanted side products like polyethylene glycols (PEGs) and 1,4-dioxane. Advanced analytical techniques, such as high-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS), are crucial for certifying Pharmacopeial Grade material, particularly for detecting and quantifying trace impurities, which is a major technological differentiator among leading suppliers.

Another pivotal technological area is the development of stabilization methods. Since Polysorbates are prone to oxidative cleavage, leading to free fatty acid formation and potential protein aggregation in drug products, manufacturers are exploring novel anti-oxidant strategies and specialized packaging technologies to extend shelf life and maintain integrity during storage and use. Enzymatic synthesis of these esters represents a growing technological opportunity. While traditional synthesis is purely chemical, enzymatic methods offer a greener, more selective route, potentially leading to products with fewer impurities and better control over the molecular structure, which is highly appealing to the bio-based chemical industry segment seeking sustainable solutions.

Furthermore, technology is being applied to feedstock sourcing. The development of specialized processes for utilizing fatty acids derived from non-GMO or entirely plant-based sources, rather than relying on synthetic or less traceable derivatives, addresses consumer and regulatory demands for sustainability and supply chain transparency. These technological advancements not only improve product quality but also serve as a crucial barrier to entry, ensuring that only manufacturers with significant R&D investment and process optimization capabilities can reliably serve the high-specification pharmaceutical and high-end cosmetic markets. Nanotechnology also plays a role, utilizing Polysorbates as key stabilizing agents in the creation of nano-emulsions for improved drug and nutrient delivery.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive growth in domestic pharmaceutical manufacturing (especially generics and biosimilars in China and India), rising disposable incomes leading to higher demand for processed foods and premium cosmetics, and favorable government initiatives supporting the chemical and biotech industries. Japan, South Korea, and Southeast Asian nations also contribute significantly through robust cosmetic and functional food sectors, positioning APAC as both a major consumption hub and a competitive production base.

- North America: North America holds a dominant market share in terms of value, primarily due to the extensive presence of major biopharmaceutical companies and advanced R&D activities, which necessitate large volumes of high-purity Polysorbates for stabilizing protein therapeutics and vaccines. Strict regulatory frameworks (FDA) ensure a high barrier for entry, favoring established suppliers capable of maintaining rigorous quality standards and comprehensive regulatory filing support (DMFs).

- Europe: Europe is a mature market characterized by stringent cosmetic and food regulations (e.g., REACH, E-number approvals). The region’s strength lies in its strong cosmetic manufacturing base and established pharmaceutical excipient supply chains. Growth is steady, fueled by innovation in sustainable chemistry, with manufacturers focusing on creating bio-based and highly traceable Polysorbate derivatives to meet evolving ESG criteria and consumer preferences.

- Latin America (LATAM): The LATAM market, while smaller, is expanding steadily, particularly in large economies like Brazil and Mexico. Growth is propelled by increasing investment in local food processing facilities and the gradual expansion of local pharmaceutical production capacity, aiming to reduce reliance on imports. Price competitiveness and general-purpose industrial applications often characterize the consumption patterns in this region.

- Middle East and Africa (MEA): MEA presents niche growth opportunities, primarily concentrated in the Gulf Cooperation Council (GCC) countries due to rising healthcare investment and expanding food security initiatives. The market currently relies heavily on imports, but local manufacturing efforts, especially in personal care and specialty chemicals, are starting to drive localized demand for various grades of Polysorbates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyoxyethylene Sorbitan Fatty Acid Esters Market.- BASF SE

- Croda International Plc

- Stepan Company

- KLK Oleo

- Lonza Group

- Evonik Industries AG

- Solvay S.A.

- Dow Inc.

- Kao Corporation

- Sakamoto Yakuhin Kogyo Co., Ltd.

- R.E. Carroll, Inc.

- Akzo Nobel N.V.

- P&G Chemicals

- Mitsubishi Chemical Corporation

- J.M. Huber Corporation

- Clariant AG

- Gattefossé

- Ashland Inc.

- Emery Oleochemicals

- Galaxy Surfactants

Frequently Asked Questions

Analyze common user questions about the Polyoxyethylene Sorbitan Fatty Acid Esters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Polysorbate 80 in pharmaceutical formulations?

Polysorbate 80 (Polyoxyethylene (20) Sorbitan Monooleate) is predominantly used in pharmaceuticals as a nonionic surfactant and emulsifier, crucial for solubilizing poorly water-soluble drugs and, more critically, stabilizing biological formulations like monoclonal antibodies and vaccines against aggregation and denaturation during processing and storage.

Which Polyoxyethylene Sorbitan Fatty Acid Ester segment is experiencing the fastest growth?

The Pharmaceutical Grade segment, particularly Polysorbate 20 and Polysorbate 80, is exhibiting the fastest growth due to the global surge in biopharmaceutical research and development, necessitating high-purity excipients for complex therapeutic protein stabilization and vaccine manufacturing.

How does the sourcing of raw materials affect Polysorbate market dynamics?

Raw material sourcing, primarily fatty acids (lauric, palmitic, stearic, oleic) derived from vegetable oils, heavily influences cost and sustainability profiles. Increasing consumer and regulatory pressure favors bio-based, traceable, and sustainably sourced fatty acids, compelling manufacturers to secure vertical integration and adhere to strict sourcing certifications to maintain market competitiveness.

What are the main regulatory challenges faced by Polysorbate manufacturers?

The main regulatory challenges include adhering to strict limits on potentially toxic impurities, such as residual ethylene oxide and 1,4-dioxane, especially in Pharmaceutical and Food Grades. Maintaining comprehensive regulatory documentation (like Drug Master Files) and demonstrating product stability and batch-to-batch consistency according to global pharmacopeial standards (USP, EP, JP) is mandatory.

Which geographic region is expected to dominate the Polyoxyethylene Sorbitan Fatty Acid Esters market growth?

The Asia Pacific (APAC) region is expected to dominate market growth during the forecast period, driven by rapid expansion of localized generic and biosimilar drug production, increasing disposable incomes supporting the processed food sector, and a booming regional cosmetics industry, creating substantial demand across all key grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager