Polytetrafluoroethylene (PTFE) Coatings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441076 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Polytetrafluoroethylene (PTFE) Coatings Market Size

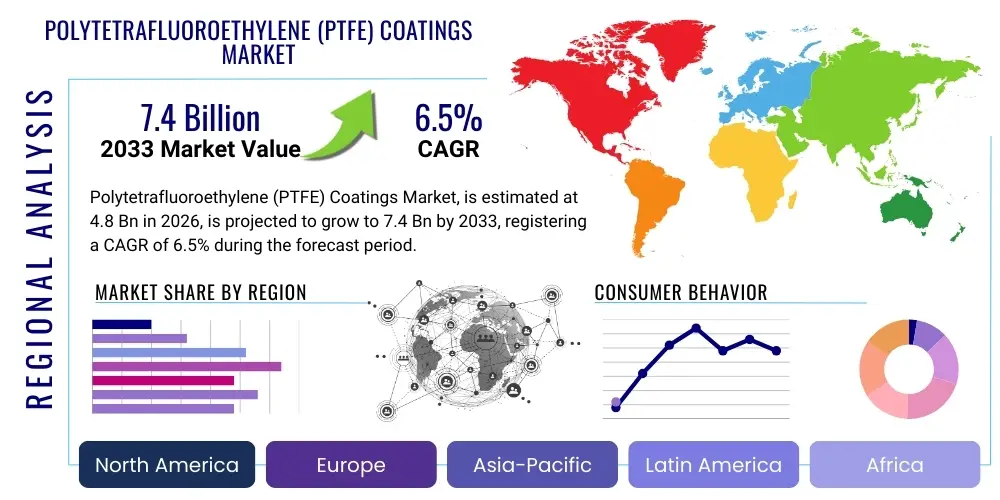

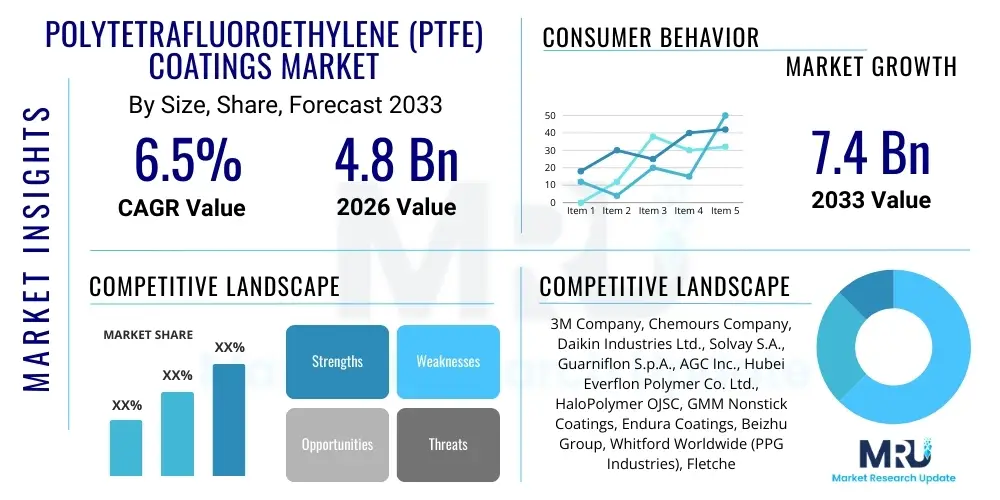

The Polytetrafluoroethylene (PTFE) Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Polytetrafluoroethylene (PTFE) Coatings Market introduction

The Polytetrafluoroethylene (PTFE) Coatings Market encompasses the global production, distribution, and application of fluoropolymer-based surface treatments designed to impart superior non-stick, low-friction, and chemical resistance properties to substrates. PTFE, a synthetic fluoropolymer of tetrafluoroethylene, is renowned for having one of the lowest coefficients of friction of any solid, making its coatings essential in environments requiring minimal adhesion and high thermal stability. These coatings are deployed across diverse sectors, including industrial processing, consumer goods (especially cookware), automotive, and aerospace industries, providing solutions for durability, efficiency, and maintenance reduction. The inherent benefits, such as resistance to extreme temperatures, chemical corrosion, and electrical insulation, cement PTFE’s position as a premium coating material.

Major applications of PTFE coatings span from critical industrial components, such as valves, pumps, and rollers, where friction reduction is paramount to extending equipment lifespan, to the mass market segment dominated by non-stick cooking surfaces. In the industrial segment, PTFE is vital for handling corrosive chemicals and ensuring smooth operation in high-temperature environments. Furthermore, in the medical device industry, PTFE coatings are applied to surgical instruments and catheters to enhance biocompatibility and maneuverability. The technological evolution in application methods, particularly the shift towards specialized primer systems and multi-layer coating processes, continually improves the adhesion and performance characteristics of the final coated products, broadening their functional utility and market reach.

The primary driving factors sustaining the robust growth of the PTFE coatings market include the stringent regulatory demands for high-purity, non-contaminating surfaces in the food processing and pharmaceutical industries, coupled with the increasing global need for energy-efficient industrial machinery. PTFE coatings contribute directly to energy savings by minimizing frictional losses in moving parts. Furthermore, the rapid industrialization across Asia Pacific regions, particularly in manufacturing and automotive sectors, fuels demand for high-performance surface protection. The continuous research and development focusing on enhancing the durability and abrasion resistance of PTFE formulations, often through hybridization with other polymers or fillers, further supports market expansion and secures its competitive edge over alternative coating technologies.

Polytetrafluoroethylene (PTFE) Coatings Market Executive Summary

The global Polytetrafluoroethylene (PTFE) Coatings market is characterized by mature business trends focusing on sustainability, specialized high-performance formulations, and consolidation among key manufacturers. Companies are increasingly investing in solvent-free and water-based dispersion technologies to comply with stricter environmental regulations concerning Volatile Organic Compounds (VOCs). The drive for specialization manifests in the development of hybrid PTFE coatings, which combine the non-stick attributes of PTFE with the wear resistance of ceramics or other fluoropolymers, catering specifically to high-stress industrial applications. Strategic mergers and acquisitions are common as large players seek to integrate downstream coating application expertise or expand geographic footprint, particularly into emerging economies where infrastructure development is accelerating.

Regionally, the market exhibits divergent growth profiles. North America and Europe represent mature markets defined by stringent quality standards and a strong emphasis on high-end, specialized industrial applications, including aerospace and medical devices. These regions are primary adopters of advanced, high-cost PTFE coating systems. Conversely, the Asia Pacific (APAC) region is the engine of volume growth, driven by massive manufacturing expansion, rapid urbanization, and increasing consumer affluence leading to higher demand for non-stick cookware. Countries like China and India are pivotal in driving both production capacity and consumption, particularly in general industrial and consumer segments. Latin America and MEA show nascent growth potential tied to oil and gas infrastructure expansion, requiring corrosion-resistant coatings.

Segment trends highlight the dominance of the dispersion/liquid form segment due to its versatility and suitability for precise, thin-film applications, although powder coating is gaining traction for heavy-duty, thicker industrial requirements owing to its reduced environmental impact. Application-wise, the food processing and industrial machinery segments remain foundational, but the automotive sector is showing significant acceleration. PTFE coatings are increasingly utilized in internal engine components and seals to improve fuel efficiency and reduce emissions. This sectoral shift necessitates continuous innovation in materials capable of withstanding extreme thermal cycling and aggressive fluids, thereby driving R&D focus toward chemically modified fluoropolymers.

AI Impact Analysis on Polytetrafluoroethylene (PTFE) Coatings Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the PTFE Coatings Market frequently center on optimizing material formulation, improving quality control during application, and enhancing predictive maintenance for coated industrial assets. Common questions relate to whether AI can accelerate the discovery of new, more durable fluoropolymer composites or how machine learning algorithms can minimize defects (like pinholes or inadequate adhesion) during complex coating processes. Users express concerns about the consistency of application methods across global facilities and look to AI-driven vision systems to standardize quality inspection. Expectations are high regarding AI's ability to model the long-term performance and degradation patterns of PTFE coatings under specific environmental stresses, thereby allowing for better product lifecycle management and customized coating solutions for end-users.

The core influence of AI is observed in streamlining the R&D cycle and enhancing manufacturing efficiency. In material science, AI algorithms are capable of simulating thousands of potential chemical compositions and predicting the resulting properties (e.g., coefficient of friction, thermal stability) before costly physical synthesis. This accelerates the development of specialized PTFE formulations, such as those blended with nanofillers or hybrid polymers designed for ultra-high wear resistance. For large-scale manufacturers, AI-powered predictive models optimize batch sizes, manage inventory of expensive raw materials (like TFE monomer), and adjust operational parameters (curing temperatures, spraying pressure) in real-time to maintain optimal coating uniformity, significantly reducing waste and rework.

Furthermore, AI is transformative in optimizing the supply chain and downstream application services. Machine learning is used to predict regional demand fluctuations based on industrial output and infrastructure spending, allowing coating suppliers to manage logistics and inventory more effectively. In the field of equipment maintenance, sensors embedded in critical industrial machinery monitor operational parameters, and AI analyzes this data to predict when the protective PTFE layer might begin to fail due to abrasion or chemical attack. This transition from reactive to predictive maintenance minimizes costly downtime for end-users in sectors like oil and gas, pharmaceuticals, and chemical processing, thereby enhancing the overall value proposition of high-quality PTFE coating solutions.

- AI-driven formulation discovery accelerates the development of next-generation, high-durability PTFE composites.

- Machine learning optimizes coating process parameters (temperature, humidity, spray) for uniform application and defect reduction.

- Predictive analytics models coating degradation, enabling proactive maintenance in industrial assets.

- Automated visual inspection systems utilizing AI enhance quality control, ensuring consistent adhesion and film thickness.

- Supply chain optimization using AI predicts raw material needs and manages global logistics for fluoropolymer precursors.

DRO & Impact Forces Of Polytetrafluoroethylene (PTFE) Coatings Market

The market dynamics of PTFE coatings are shaped by a complex interplay of drivers, restraints, and opportunities, all influenced by powerful external impact forces. Key drivers include the unparalleled performance characteristics of PTFE, such as its chemical inertness, exceptional thermal stability, and superior non-stick properties, which make it irreplaceable in demanding applications like pharmaceutical manufacturing, chemical processing tanks, and high-performance automotive seals. The global mandate for reducing industrial energy consumption further drives adoption, as low-friction PTFE surfaces significantly improve the mechanical efficiency of rotating equipment. Simultaneously, regulatory environments, particularly those enforced by the FDA and similar bodies, necessitate inert, easily cleanable surfaces in food contact and medical environments, reinforcing PTFE's market position.

However, significant restraints temper market growth. The high initial cost associated with PTFE coatings, stemming from expensive raw materials (fluoropolymers) and complex, energy-intensive application processes, often limits its use in highly price-sensitive or low-specification applications. Furthermore, concerns regarding environmental impact, specifically relating to the historical use of per- and polyfluoroalkyl substances (PFAS) in the manufacturing process, pose a regulatory challenge. While manufacturers have largely transitioned to PFOA-free processes, the public perception and ongoing regulatory scrutiny of all fluorochemicals remain a substantial hurdle. Additionally, the technical complexity required for proper substrate preparation and curing means that consistent quality coating application requires specialized expertise and capital investment, limiting market entry for smaller service providers.

Opportunities for growth are primarily concentrated in emerging applications and geographical expansion. The burgeoning electric vehicle (EV) sector offers a lucrative avenue, as PTFE coatings are critical for insulating battery components, wiring harnesses, and thermal management systems due to their excellent dielectric properties and high-temperature resistance. Another significant opportunity lies in developing sustainable, bio-based or fully recyclable fluoropolymer alternatives that maintain the core performance benefits while mitigating environmental concerns. The impact forces acting upon the market include rapid industrialization in APAC, technological advancements in nanoparticle fillers to improve wear resistance, and macroeconomic shifts, such as fluctuating oil prices which influence investment in the chemical and oil and gas processing sectors—major consumers of corrosion-resistant PTFE coatings. The regulatory force, particularly concerning chemical safety and VOC emissions, is arguably the most dominant impact force, continuously pushing the industry toward sustainable, waterborne formulations.

Segmentation Analysis

The Polytetrafluoroethylene (PTFE) Coatings market is comprehensively segmented based on its form, application technique, end-use industry, and geography, enabling precise analysis of market dynamics and targeted strategic planning. Segmentation by form is crucial as it dictates the method of application and suitability for different substrates, distinguishing between liquid dispersions, which offer flexibility and thin-film precision, and powder coatings, which provide thick, durable layers suitable for large industrial components. The segmentation reflects a highly diversified market where product selection is rigorously tied to the required performance specification, such as abrasion resistance, non-stick performance, or dielectric strength.

Analysis by end-use industry confirms the market's widespread integration across core global manufacturing sectors. The Industrial Processing sector, encompassing chemical, textile, and machinery manufacturing, remains the largest consumer, primarily due to the need for corrosion protection and friction reduction in continuous operation environments. However, the Consumer Goods segment, dominated by non-stick cookware, holds substantial volume share and is particularly sensitive to consumer trends and marketing efforts related to safety (PFOA-free) and durability. Rapid growth is anticipated in specialized segments like the Medical and Aerospace industries, where the coatings address extremely high performance and regulatory standards, necessitating premium, often customized, PTFE formulations.

Further segmentation by application technique, such as spraying, dipping, and roller coating, dictates the achievable film thickness and consistency, affecting efficiency and cost. Geographic segmentation is vital, identifying APAC as the dominant volume driver and North America/Europe as the primary regions for value-added, high-specification products. This detailed segmentation matrix allows market participants to tailor their offerings, distribution networks, and R&D focus to maximize penetration in high-potential niches, such as high-temperature sealing solutions within the semiconductor manufacturing equipment segment or specialized non-stick solutions for baking trays in the commercial food service industry, illustrating the granular nature of demand within the broader market.

- By Form:

- Liquid/Dispersion

- Powder

- By Application Technique:

- Spraying (Air, Electrostatic)

- Dipping/Flow Coating

- Roll Coating

- By End-Use Industry:

- Industrial Processing (Chemical, Textile, Pulp & Paper)

- Food Processing & Cookware

- Automotive & Transportation

- Aerospace

- Medical Devices

- Electrical & Electronics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Polytetrafluoroethylene (PTFE) Coatings Market

The value chain of the PTFE Coatings market begins with the upstream sourcing of raw materials, primarily tetrafluoroethylene (TFE) monomer, which is highly capital-intensive to produce, establishing a high barrier to entry at this stage. Key chemical manufacturers control the polymerization of TFE into high-molecular-weight PTFE resin. This upstream segment is characterized by complex chemical synthesis and requires specialized fluorochemical expertise. Strategic integration between monomer producers and PTFE resin manufacturers is critical for ensuring feedstock stability and controlling material quality, which fundamentally dictates the performance characteristics of the final coating product. Price fluctuations in raw materials, driven by petrochemical market dynamics, directly impact the profitability of downstream coating formulators.

Moving downstream, the PTFE resin is processed into various forms suitable for coating application, predominantly as water-based dispersions or fine powders. Coating formulators specialize in blending PTFE with other polymers (like PFA or FEP), primers, pigments, and functional additives (e.g., ceramics, carbon fibers) to create application-specific coating formulations that enhance adhesion, wear resistance, or color stability. This stage involves significant intellectual property regarding formulation science and product customization. The distribution channel then facilitates the movement of these formulations, utilizing both direct sales to large industrial customers who apply the coatings in-house and, more commonly, indirect channels through specialized coating applicators or distributors.

The coating application stage is where value addition is maximized, requiring sophisticated equipment (e.g., electrostatic spray guns, specialized curing ovens) and highly skilled labor. Direct channels typically involve large, vertically integrated industrial manufacturers (e.g., major chemical processors or aerospace firms) applying the coatings to their own components. Indirect channels, through professional, certified coating service providers, handle the majority of outsourced application needs, particularly for complex component geometries or smaller batch sizes. These applicators form a critical link to the end-users (potential customers) across industrial, automotive, and consumer sectors, ensuring that the finished product meets precise technical specifications regarding film thickness, porosity, and adherence, thereby closing the loop between resin production and final performance delivery.

Polytetrafluoroethylene (PTFE) Coatings Market Potential Customers

The potential customer base for Polytetrafluoroethylene (PTFE) coatings is vast and highly diversified, spanning nearly every sector that requires low friction, chemical inertness, or high thermal resistance. The most significant end-users are concentrated within heavy industrial processing industries, including chemical manufacturing plants that utilize large reactors, pipes, and valves requiring protection from aggressive corrosive media. The pharmaceutical industry is a key buyer, needing non-contaminating, easily sterilizable surfaces for processing equipment, tablet presses, and containment vessels. Furthermore, major original equipment manufacturers (OEMs) of textile machinery, packaging equipment, and construction apparatus constitute a substantial customer segment seeking to maximize operational uptime by reducing component wear and enabling faster cleanup.

In the consumer goods segment, manufacturers of high-quality cookware remain foundational customers. These buyers demand durable, PFOA-free non-stick systems that can withstand high temperatures and daily use. This segment is characterized by high volume and intense competition, often driving innovation toward multi-layer hybrid PTFE systems that promise extended lifespan. Another critical customer segment comprises the automotive and aerospace industries. Automotive manufacturers purchase PTFE coatings for seals, gaskets, fuel system components, and increasingly for internal engine parts where friction reduction boosts fuel economy. Aerospace clients utilize these coatings for crucial functions such as corrosion control on airframe components and reducing friction in mechanical actuation systems, often demanding adherence to highly specific military or aviation standards.

Emerging and high-growth potential customers include manufacturers within the burgeoning renewable energy sector, particularly those involved in producing wind turbine components and specialized sealing systems for advanced battery technology in Electric Vehicles (EVs). Additionally, the rapidly expanding semiconductor industry relies heavily on ultra-high purity PTFE liners and components within chemical delivery systems to prevent particulate contamination during wafer fabrication. These diverse customer needs underscore the flexibility of PTFE coatings, necessitating a supplier base capable of delivering standard formulations for mass-market applications and bespoke, highly specialized materials for niche, high-value industrial and technological requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Chemours Company, Daikin Industries Ltd., Solvay S.A., Guarniflon S.p.A., AGC Inc., Hubei Everflon Polymer Co. Ltd., HaloPolymer OJSC, GMM Nonstick Coatings, Endura Coatings, Beizhu Group, Whitford Worldwide (PPG Industries), Fletcher Industries, Asahi Glass Co., Metal Coatings Corp., ISQ Chemicals, Trelleborg AB, Impreglon GmbH, Tecnoseal, and Fluoro-Lon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polytetrafluoroethylene (PTFE) Coatings Market Key Technology Landscape

The technological landscape of the PTFE Coatings market is characterized by continuous innovation focused on overcoming the inherent weaknesses of pure PTFE, primarily its relatively poor abrasion and wear resistance, while adhering to increasingly strict environmental mandates. A key technological trend is the development of advanced multi-layer systems. These systems typically employ a specialized primer layer to maximize adhesion to the substrate (metals, ceramics, or composites), followed by a mid-coat often incorporating reinforcement agents like PFA, FEP, or ceramic particles to enhance toughness, and finally, a PTFE topcoat for the ultimate non-stick and low-friction finish. This tiered approach allows formulators to customize the mechanical properties without sacrificing the fluoropolymer benefits, significantly extending the service life of coated components in demanding industrial environments.

Another crucial area of technological advancement involves the shift towards environmentally sound application processes and formulations. The industry has largely transitioned away from coatings using PFOA (Perfluorooctanoic acid) as a processing aid, necessitating the development of alternative emulsifiers and polymerization methods. The focus is now heavily on water-based PTFE dispersions, which significantly reduce the emission of Volatile Organic Compounds (VOCs) compared to older solvent-based systems. Furthermore, advancements in powder coating technology, particularly specialized electrostatic application methods for fluoropolymers, offer a solvent-free alternative that minimizes material waste and achieves highly uniform, thick films, often favored in large-scale industrial pipe and vessel lining applications requiring maximum corrosion protection and durability.

Material science innovation also plays a vital role, centering on the incorporation of high-performance fillers to create hybrid coatings. Nanotechnology is increasingly used, introducing ceramic nanoparticles, carbon nanotubes, or specific inorganic pigments into the PTFE matrix. These fillers dramatically improve the hardness, load-bearing capability, and thermal conductivity of the resulting coating without compromising the non-stick quality, opening up new applications in areas like dry-lubrication systems and high-temperature sealing devices. Sophisticated surface treatment technologies, such as plasma pretreatment of the substrate, are also being adopted by high-end applicators to chemically activate the surface, ensuring superior mechanical interlocking and chemical bonding for highly reliable coating performance, particularly important in aerospace and medical device applications where coating failure is catastrophic.

Regional Highlights

The global distribution of the PTFE Coatings market reflects distinct stages of industrial maturity and regulatory focus across key geographical regions. North America and Europe command a leading share in terms of value, driven by high demand for specialized, high-performance coatings in the aerospace, medical, and high-purity industrial sectors. These regions are characterized by stringent quality controls, robust safety regulations, and a mature infrastructure for advanced coating application services. Investment in R&D for next-generation, sustainable, and PFOA-free formulations is highest here, driven by consumer awareness and governmental mandates, making them centers for technological innovation and high-margin product consumption.

The Asia Pacific (APAC) region is poised for the highest growth rate, predominantly in volume terms, owing to the unprecedented expansion of manufacturing capabilities across countries such as China, India, South Korea, and Southeast Asia. The surging demand for affordable non-stick cookware from a growing middle class, coupled with massive capital investments in chemical processing, power generation, and automotive manufacturing, fuels the need for basic and intermediate-grade PTFE coatings. While price sensitivity remains higher in this region, the increasing adoption of higher quality, multi-layer systems in critical industrial facilities in Japan and South Korea contributes significantly to overall regional market growth and sophistication.

Latin America and the Middle East & Africa (MEA) represent significant emerging markets, with growth primarily linked to the oil and gas sector, mining operations, and burgeoning infrastructure projects. In MEA, the need for advanced corrosion protection in harsh desert and coastal environments drives the demand for thick, durable PTFE linings in pipes, storage tanks, and critical equipment exposed to extreme temperatures and corrosive substances. While these regions currently account for a smaller overall market share, continuous investment in energy infrastructure and industrial diversification positions them as critical areas for future market expansion, especially for suppliers focused on heavy-duty industrial coatings.

- North America: Focus on high-value aerospace, medical, and regulatory-compliant industrial coatings; Strong emphasis on R&D for PFOA-free and environmentally conscious solutions.

- Europe: Leading adoption of advanced water-based dispersion technologies; High demand from automotive and premium consumer goods sectors; Strict VOC regulations driving innovation.

- Asia Pacific (APAC): Volume leader and fastest-growing region; Driven by cookware manufacturing, industrial expansion in China and India, and increasing localized production capacity.

- Latin America: Growth tied to infrastructure development, mining, and chemical processing industries; Demand focused on basic corrosion and friction reduction coatings.

- Middle East & Africa (MEA): Significant potential driven by large-scale oil and gas projects requiring highly durable, high-temperature, corrosion-resistant fluoropolymer linings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polytetrafluoroethylene (PTFE) Coatings Market.- 3M Company

- Chemours Company

- Daikin Industries Ltd.

- Solvay S.A.

- Guarniflon S.p.A.

- AGC Inc. (Asahi Glass Co.)

- Hubei Everflon Polymer Co. Ltd.

- HaloPolymer OJSC

- GMM Nonstick Coatings

- Endura Coatings

- Beizhu Group

- Whitford Worldwide (PPG Industries)

- Fletcher Industries

- Metal Coatings Corp.

- ISQ Chemicals

- Trelleborg AB

- Impreglon GmbH

- Tecnoseal

- Fluoro-Lon

- Shanxi Huasheng Chemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Polytetrafluoroethylene (PTFE) coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of PTFE coatings over standard industrial finishes?

The primary advantages are unparalleled non-stick properties, extremely low coefficient of friction (making it a superior dry lubricant), chemical inertness, and high thermal stability, allowing it to withstand temperatures up to 260°C (500°F). This combination makes PTFE ideal for corrosion protection, high-temperature sealing, and minimizing component wear in critical industrial machinery, significantly enhancing efficiency and durability.

How is the PTFE Coatings market addressing environmental concerns related to PFOA and sustainability?

The industry has largely transitioned to PFOA-free processes in the manufacturing of PTFE coatings, using alternative processing aids to comply with global regulations such as REACH and EPA standards. Furthermore, there is a strong shift towards developing and implementing water-based PTFE dispersions, which significantly reduce VOC (Volatile Organic Compound) emissions during application, promoting more sustainable and environmentally compliant coating solutions across all end-use sectors.

Which end-use industry is the largest consumer of PTFE coatings, and why?

The Industrial Processing sector, encompassing chemical, textile, and general machinery manufacturing, is the largest consumer. This is driven by the absolute necessity for corrosion resistance against aggressive chemicals, the need for low-friction surfaces to minimize wear and energy consumption in machinery, and the requirement for easy cleanability in high-volume production environments, where PTFE offers irreplaceable protective layers for equipment such as reactors, pipes, and rollers.

What technological advancements are improving the durability and wear resistance of PTFE coatings?

Key technological advancements include the use of multi-layer coating systems that incorporate intermediate reinforcement coats, and the blending of PTFE with high-performance fillers. The incorporation of ceramic particles, carbon fibers, or specialized proprietary polymers enhances the mechanical strength, hardness, and abrasion resistance of the coating, effectively extending the lifespan of PTFE-coated parts in high-stress, dynamic applications like heavy-duty bearings and sliding components.

Is the market for PTFE coatings expected to grow faster in consumer or industrial applications?

While the consumer sector (cookware) provides massive volume and steady demand, the industrial and specialized applications, particularly in the growing automotive (EVs), medical device, and aerospace segments, are projected to drive higher value growth. These sectors require premium, customized, and high-specification PTFE formulations that command higher pricing and are less susceptible to economic fluctuations compared to mass-market consumer goods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager