Polyurethane Foaming Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442868 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Polyurethane Foaming Machines Market Size

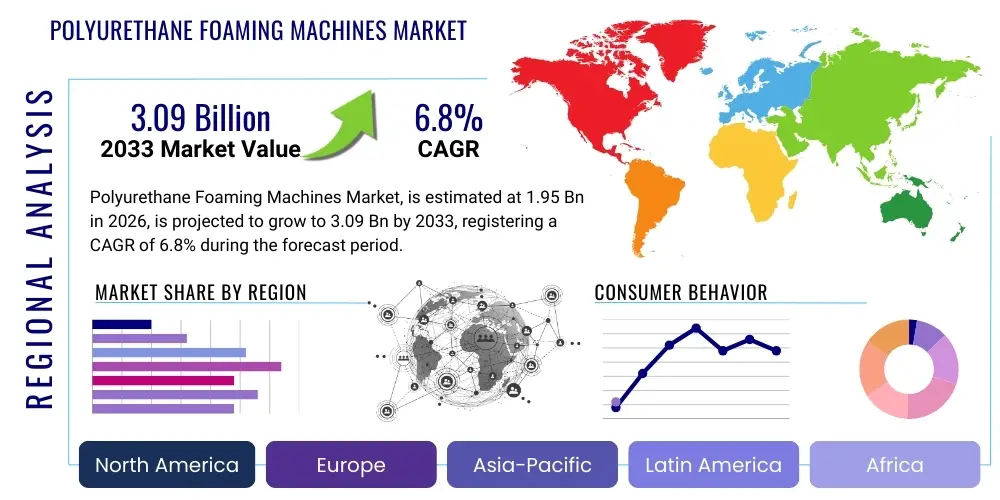

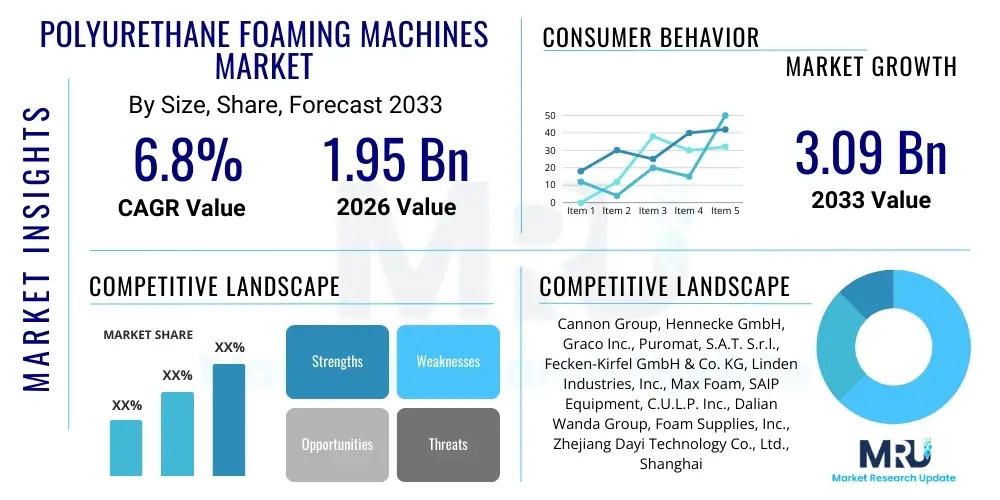

The Polyurethane Foaming Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.09 Billion by the end of the forecast period in 2033.

Polyurethane Foaming Machines Market introduction

Polyurethane foaming machines are specialized industrial equipment designed to accurately meter, mix, and dispense liquid polyurethane components (Isocyanate and Polyol) to create foam products. These machines are pivotal in numerous manufacturing sectors, enabling the production of items ranging from rigid insulation panels and flexible automotive seating to specialized molded components. The complexity of these systems varies significantly, encompassing low-pressure machines suitable for small-scale operations or intricate molding processes, and high-pressure machines favored for high-volume production lines requiring superior mixing quality and repeatability. The core functionality revolves around achieving precise stoichiometry and optimal mixing velocity to ensure consistent foam density, cell structure, and reaction kinetics, which are critical determinants of the final product's physical properties.

Major applications of polyurethane foaming machines span critical industries such as construction, automotive, furniture, and refrigeration. In the construction sector, these machines produce rigid polyurethane foam for insulation, contributing significantly to energy efficiency standards in modern buildings. The automotive industry utilizes them extensively for manufacturing comfortable yet durable seat cushions, headliners, and interior components, emphasizing lightweighting and safety. Furthermore, the burgeoning demand for highly efficient cold chain logistics and domestic appliances drives the need for advanced foaming machines to inject insulation into refrigerators, freezers, and cold storage facilities, maintaining precise temperature control.

The market growth is fundamentally driven by the escalating global focus on energy conservation, particularly the adoption of stricter building codes mandating high-performance thermal insulation. The increasing global population and urbanization fuel demand in the furniture and bedding sectors, requiring high-quality flexible foam production. Technological advancements in machine design, such as enhanced dosing accuracy through magnetic couplings and sophisticated process control via IoT integration, are further driving adoption. These machines offer unparalleled material versatility, allowing manufacturers to adapt quickly to evolving material formulations, including sustainable bio-based polyols and reduced volatile organic compound (VOC) systems, making them indispensable in modern manufacturing ecosystems.

Polyurethane Foaming Machines Market Executive Summary

The Polyurethane Foaming Machines market is experiencing robust expansion, driven primarily by strong underlying growth in construction activities across emerging economies and the imperative for enhanced thermal insulation globally. Key business trends include the shift toward fully automated, digitally integrated foaming lines that prioritize minimized waste, faster cycle times, and enhanced safety protocols. Manufacturers are increasingly integrating features such as real-time quality monitoring, predictive maintenance capabilities, and remote diagnostic tools to offer comprehensive solutions rather than just equipment, fostering long-term service contracts. Furthermore, consolidation among mid-tier equipment providers and strategic alliances between machine manufacturers and chemical suppliers are shaping the competitive landscape, aiming to offer integrated material and machinery packages.

Regionally, Asia Pacific (APAC) dominates the market, propelled by massive infrastructure projects, burgeoning automotive manufacturing hubs in countries like China and India, and rapidly expanding cold storage facilities. North America and Europe, while mature, exhibit high demand for high-end, precision machines capable of handling specialized rigid foam applications and meeting stringent environmental regulations, driving innovation toward greener blowing agents and solvent-free cleaning systems. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, driven by rapid urbanization and investment in residential construction, creating significant opportunities for mid-range, reliable dispensing equipment suitable for foundational industrial needs.

Segment-wise, the high-pressure foaming machine segment maintains the largest market share due to its superior mixing efficiency and suitability for large-volume production, particularly in rigid foam insulation and automotive applications. However, the low-pressure and spray foam equipment segments are witnessing high growth rates, catering to specialized, smaller-batch molding and on-site construction insulation needs, respectively. The dominance of the rigid foam application segment is attributed to the sustained global emphasis on energy-efficient building envelopes, although the flexible foam segment, supported by the booming bedding and furniture industry, remains a substantial and steady contributor to market revenue.

AI Impact Analysis on Polyurethane Foaming Machines Market

Common user questions regarding AI’s impact on the Polyurethane Foaming Machines Market typically revolve around operational efficiency, material wastage reduction, and predictive quality control. Users frequently inquire about how AI algorithms can optimize mixing ratios in real-time to compensate for ambient temperature changes or slight variations in raw material viscosity, ensuring consistent foam properties. Concerns are often raised about the cost of implementing AI-driven sensor arrays and data processing infrastructure, alongside questions about cybersecurity risks associated with networked manufacturing systems. Expectations center on achieving zero-defect production runs, minimizing downtime through accurate predictive maintenance scheduling, and accelerating the development of new foam formulations by simulating reaction dynamics digitally.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operation and maintenance of polyurethane foaming machines, moving them from reactive to highly predictive and adaptive systems. AI models analyze vast streams of operational data, including pressure readings, temperature profiles, dosing pump performance, and cycle times, identifying subtle patterns indicative of impending component failure or quality drift long before they manifest as operational issues. This predictive capability significantly boosts overall equipment effectiveness (OEE) by reducing unplanned downtime and optimizing maintenance schedules based on actual usage and condition, rather than fixed time intervals.

Furthermore, AI algorithms are crucial in enhancing material utilization efficiency. By analyzing historical batch data against foam quality outcomes, ML models can provide instantaneous feedback to the process control system, allowing for minute adjustments to pump speeds and ingredient temperatures during a run. This real-time process optimization ensures the precise consumption of expensive polyol and isocyanate components, leading to substantial cost savings and minimizing material scrap. This technological evolution allows manufacturers to achieve higher levels of product consistency, a critical factor in regulated sectors like aerospace and medical devices, driving future investment in smart foaming equipment.

- AI-driven real-time material parameter adjustments for improved consistency.

- Predictive maintenance analytics reducing unplanned equipment downtime by up to 30%.

- Automated quality control via image recognition for defect detection in molded parts.

- Optimization of mixing head pressure and temperature profiles based on environmental conditions.

- Simulation models accelerated by ML to rapidly test new foam formulations (digital prototyping).

- Enhanced energy efficiency through AI-managed heating and cooling cycles of raw materials.

- Supply chain optimization by correlating production schedules with raw material procurement forecasts.

DRO & Impact Forces Of Polyurethane Foaming Machines Market

The dynamics of the Polyurethane Foaming Machines market are primarily shaped by robust infrastructural investment (Driver) coupled with the volatility of raw material costs (Restraint). The pervasive global movement towards mandatory energy-efficient construction standards provides a compelling, structural impetus for market expansion, ensuring steady demand for high-quality rigid foam insulation machines. Conversely, the market’s reliance on petrochemical-derived polyols and isocyanates exposes it to geopolitical and commodity price fluctuations, which can significantly impact manufacturers' profit margins and procurement strategies. Opportunities largely reside in the development and scaling of machines compatible with sustainable, bio-based polyurethane systems, addressing both environmental concerns and future regulatory pressures, thereby creating new market niches for advanced equipment.

Drivers: The dominant market driver remains the rapid globalization of construction and infrastructure development, particularly in emerging economies where large-scale projects necessitate high-volume, continuous foam production. Additionally, the automotive sector’s drive towards electric vehicles (EVs) mandates lighter components and enhanced battery insulation, significantly increasing the complexity and demand for precision flexible and microcellular foaming machines. Stringent governmental regulations, such as the European Union’s Energy Performance of Buildings Directive (EPBD) and similar standards in North America and APAC, enforce the adoption of superior insulation materials, directly stimulating investment in state-of-the-art foaming technology capable of handling advanced chemistries.

Restraints: Significant restraints include the high initial capital expenditure associated with high-pressure, fully automated foaming lines, which poses a barrier to entry for small and medium-sized enterprises (SMEs). Furthermore, the operational complexity and the specialized technical expertise required for maintaining and calibrating these sophisticated machines often lead to scarcity of skilled labor, constraining operational efficiency in certain regions. Environmental concerns surrounding traditional blowing agents (e.g., HCFCs and HFCs) necessitate costly equipment modifications and reformulations, temporarily slowing down investment cycles as manufacturers adapt to environmentally friendly alternatives like HFOs and water-blown systems.

Opportunities: Key opportunities are rooted in the expansion of high-growth application areas such as renewable energy components (wind turbine blades, solar panel backing), and specialized medical applications requiring precision molded foams. The increasing sophistication of the cold chain logistics sector, especially in vaccine storage and food preservation, demands mobile and precise foam dispensing units for refrigerated transport and static storage facilities. Furthermore, digitalization trends, including the integration of IoT sensors and AI-driven process control, represent a major avenue for equipment manufacturers to differentiate their offerings and capture higher-value segments through enhanced efficiency and remote service capabilities.

Segmentation Analysis

The Polyurethane Foaming Machines Market is systematically segmented based on technological parameters (Machine Type), operational capacity (Output Volume), and functional application (End-User Industry). Analyzing these segments provides crucial insights into market dynamics, revealing where investment is flowing and which end-use sectors are dictating technological evolution. Machine Type segmentation, distinguishing between high-pressure and low-pressure units, is fundamental, reflecting the trade-off between mixing efficiency, initial cost, and operational complexity. High-pressure systems dominate high-volume industrial applications requiring superior mechanical properties, whereas low-pressure systems offer flexibility and lower cost suitable for smaller operations and specialized molding.

The Output Volume segmentation (e.g., continuous output, intermittent/batch output) directly correlates with the scale of the manufacturing operations served, ranging from small-scale molders to massive construction insulation panel lines. Furthermore, the segmentation by End-User Industry (Construction, Automotive, Appliances, Furniture) is essential for strategic planning, as each sector presents unique demands regarding foam density, formulation compatibility, and machine ruggedness. The robust growth in the construction segment, driven by thermal efficiency needs, ensures its continued dominance, while the highly specified demands of the automotive sector drive innovation in dispensing technology.

Understanding the interplay between these segments is vital. For instance, the high-pressure machine segment aligns heavily with the construction and automotive sectors, demanding large-scale, automated production lines. Conversely, spray foam machines, a specific subtype, cater almost exclusively to on-site construction and roofing applications, representing a specialized, high-growth niche within the end-user landscape. Future growth will be highly influenced by the ability of manufacturers to offer modular, flexible systems that can easily adapt their output volume and material compatibility to serve the diversifying needs across all major end-user verticals, emphasizing sustainability in material handling and processing.

- By Machine Type: High-Pressure Foaming Machines, Low-Pressure Foaming Machines, Spray Foam Machines, Elastomer Casting Machines.

- By Output Volume: Continuous Output Systems, Intermittent/Batch Foaming Systems.

- By End-User Industry: Construction (Insulation Panels, Doors, Windows), Automotive (Seating, Headliners, Interior Components), Appliances (Refrigerators, Freezers), Furniture & Bedding (Mattresses, Cushions), Others (Medical, Aerospace, Pipe Insulation).

- By Application: Rigid Foam, Flexible Foam, Integral Skin Foam, Polyurea/Coatings.

Value Chain Analysis For Polyurethane Foaming Machines Market

The value chain for the Polyurethane Foaming Machines market begins with the upstream suppliers of critical raw materials, primarily specialized components like precision pumps, mixing heads, dosing units, and sophisticated electronic control systems (PLCs, sensors). The performance and reliability of the final foaming machine are heavily dependent on the quality and precision engineering of these components, making strong partnerships with specialized component manufacturers crucial for equipment providers. Upstream analysis focuses on managing the supply risk of high-precision stainless steel parts and advanced electronic modules, often requiring global sourcing strategies to ensure supply chain resilience and cost optimization, especially given the global shortage of microcontrollers and specialized sensors.

The core manufacturing stage involves the machine builders who design, assemble, and rigorously test the foaming systems. These manufacturers invest heavily in research and development to integrate new technologies, such as advanced magnetic bearings for pumps, improved dynamic mixing techniques, and complex software for process automation and remote diagnostics. Following manufacturing, the distribution channel plays a vital role. Direct sales channels are frequently employed for large, custom-engineered high-pressure lines, allowing machine builders to maintain direct control over installation, commissioning, and specialized training. Conversely, indirect distribution through regional distributors and specialized system integrators is common for standardized low-pressure and spray foam machines, leveraging local market knowledge and service networks.

The downstream analysis focuses on the end-user applications—the foam product manufacturers in sectors like construction and automotive. The success of the machine builder is ultimately measured by the long-term performance and efficiency delivered to these downstream clients. Post-sales service, including preventative maintenance, spare parts supply, and chemical compatibility consulting, represents a significant and high-margin revenue stream for machine manufacturers. The entire chain is characterized by strong technical dependency, where chemical suppliers, machine builders, and end-users must collaborate closely to optimize foam formulation delivery and processing parameters for specific product outcomes.

Polyurethane Foaming Machines Market Potential Customers

The primary customer base for Polyurethane Foaming Machines consists of large-scale industrial manufacturers who require continuous, high-volume production of foam components for integration into their final products. This includes leading global producers of insulation panels and prefabricated building components, who invest in sophisticated, multi-component high-pressure systems to meet demanding thermal efficiency specifications. These customers prioritize machine reliability, throughput capacity, and the ability to seamlessly switch between different material formulations, often demanding bespoke engineering solutions tailored to their factory layout and specific product geometry.

A significant segment of potential customers includes Original Equipment Manufacturers (OEMs) within the automotive and appliance sectors. Automotive OEMs, and their Tier 1 suppliers, utilize these machines for the production of flexible molded parts (seats, steering wheels) and specialized rigid encapsulation (battery packs, electronic components). Appliance manufacturers (refrigerators, freezers) are consistently upgrading their foaming equipment to handle newer, more environmentally friendly blowing agents and achieve thinner, more efficient insulation walls, seeking machines that guarantee zero leakage during the foaming process to ensure product longevity and efficiency.

Finally, a rapidly growing segment comprises specialized contractors and small-to-medium enterprises (SMEs) focused on niche applications, such as custom molding, prototyping, and on-site insulation services. These smaller players typically invest in more modular, user-friendly low-pressure or mobile spray foam units. Their purchasing decisions are often driven by ease of operation, minimal maintenance requirements, and relatively lower initial investment costs, catering to localized construction projects, custom furniture manufacturing, or specialized pipe insulation applications where flexibility and mobility are paramount.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.09 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cannon Group, Hennecke GmbH, Graco Inc., Puromat, S.A.T. S.r.l., Fecken-Kirfel GmbH & Co. KG, Linden Industries, Inc., Max Foam, SAIP Equipment, C.U.L.P. Inc., Dalian Wanda Group, Foam Supplies, Inc., Zhejiang Dayi Technology Co., Ltd., Shanghai Jieming Polyurethane Equipment Co., Ltd., Demak Group, Laader Berg AS, Gusmer Corporation, IPI srl, Sunkist Chemical Machinery Co., Ltd., Admiral Machine Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyurethane Foaming Machines Market Key Technology Landscape

The technological landscape of the Polyurethane Foaming Machines market is defined by advancements aimed at increasing precision, automation, and environmental compatibility. A key development is the widespread adoption of servomotor-driven dosing pumps, replacing traditional hydraulic systems. Servomotor technology allows for highly accurate, closed-loop control over the volumetric output of both the polyol and isocyanate components, ensuring stoichiometric precision even during rapid changes in production speed. This not only guarantees superior foam quality and repeatability but also contributes significantly to energy efficiency compared to legacy equipment. Furthermore, the development of high-shear dynamic mixing heads is crucial, particularly for processing high-viscosity or heavily filled formulations, optimizing the blend before injection and reducing material waste.

Digitalization and connectivity are fundamentally reshaping machine design. Modern foaming machines are equipped with advanced Human Machine Interfaces (HMIs) and integrated PLC systems capable of running complex control logic, enabling features like recipe management, automatic sequencing, and integration with broader factory management systems (MES/ERP). The integration of Internet of Things (IoT) sensors throughout the system—monitoring everything from raw material temperature in storage tanks to curing conditions in molds—facilitates comprehensive data logging. This collected data is leveraged for sophisticated analytics, enabling manufacturers to troubleshoot issues remotely and provide proactive customer support, transitioning the industry toward a 'machine-as-a-service' model.

Another major technological focus is the development of machines compatible with sustainable raw materials and eco-friendly blowing agents. The phasing out of harmful greenhouse gas (GHG) producing blowing agents necessitates re-engineering of the entire delivery system, including tank pressurization, component chilling, and precise handling of newer alternatives like Hydrofluoroolefins (HFOs) and supercritical CO2. Equipment manufacturers are also innovating in the realm of material recirculation and cleanup systems, introducing solvent-free or minimal-solvent flushing mechanisms to reduce operational environmental impact and lower consumable costs. These technological pushes ensure compliance with evolving global environmental standards while maintaining high production throughput.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region in the Polyurethane Foaming Machines Market. This dominance is driven by massive governmental investments in infrastructure (roads, rail, ports) and housing projects, particularly in China, India, and Southeast Asian nations. The region serves as a global manufacturing hub for appliances and automotive parts, sustaining high demand for both rigid and flexible foam production equipment. Adoption rates are also accelerating due to the increasing awareness and enforcement of local energy-saving building codes.

- Europe: Europe represents a mature but technologically advanced market, characterized by stringent environmental regulations and a high demand for premium, precision foaming equipment. The focus here is heavily on machines compatible with low Global Warming Potential (GWP) blowing agents and systems that enable circular economy practices, such as demolding aids and recycling compatible foam systems. Germany and Italy, being home to key machinery manufacturers, remain central to innovation and high-value exports within the sector.

- North America: North America is a significant market, driven primarily by robust demand in residential and commercial construction (particularly spray foam applications) and a large, sophisticated automotive industry prioritizing noise, vibration, and harshness (NVH) reduction using specialized flexible foams. Investment is heavily directed towards automated, large-scale production lines and machines integrated with advanced IoT for remote monitoring and efficiency gains, especially in states with extreme climate variations requiring superior insulation.

- Latin America (LATAM): LATAM is an emerging market with substantial growth potential, fueled by increasing urbanization and the need for modern, energy-efficient housing solutions. Brazil and Mexico are key regional contributors, showing rising demand for mid-range, reliable foaming equipment for appliance insulation and general construction materials. Market penetration is gradually increasing as local manufacturers look to modernize their production facilities.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated around the Gulf Cooperation Council (GCC) countries due to large-scale development projects (e.g., NEOM in Saudi Arabia). Extreme climatic conditions necessitate exceptional thermal insulation, creating strong demand for high-performance rigid foam production capabilities. Africa's market growth is tied to industrialization and the foundational development of reliable cold chain logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyurethane Foaming Machines Market.- Cannon Group

- Hennecke GmbH

- Graco Inc.

- Puromat

- S.A.T. S.r.l.

- Fecken-Kirfel GmbH & Co. KG

- Linden Industries, Inc.

- Max Foam

- SAIP Equipment

- C.U.L.P. Inc.

- Dalian Wanda Group

- Foam Supplies, Inc.

- Zhejiang Dayi Technology Co., Ltd.

- Shanghai Jieming Polyurethane Equipment Co., Ltd.

- Demak Group

- Laader Berg AS

- Gusmer Corporation

- IPI srl

- Sunkist Chemical Machinery Co., Ltd.

- Admiral Machine Company

Frequently Asked Questions

Analyze common user questions about the Polyurethane Foaming Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of polyurethane foaming machines are most commonly used in industrial manufacturing?

The most commonly used types are High-Pressure Foaming Machines, favored for large-volume, high-precision applications like insulation panels and automotive parts due to superior mixing efficiency, and Low-Pressure Foaming Machines, preferred for smaller batch sizes, integral skin foams, and specialized molding where operational flexibility is key.

How are environmental regulations impacting the design and function of new foaming equipment?

Environmental regulations, particularly those phasing out high Global Warming Potential (GWP) blowing agents, necessitate significant machine redesigns. New equipment must handle alternative agents such as HFOs and water-based systems, requiring specialized pumps, precise temperature controls, and enhanced sealing systems to ensure accurate and safe dispensing.

Which end-user industry drives the highest demand for Polyurethane Foaming Machines?

The Construction industry is the primary driver of demand, specifically for machines producing rigid polyurethane foam utilized in high-performance thermal insulation panels, building envelopes, and spray foam applications, driven by increasingly strict global energy efficiency standards and mandates.

What is the role of IoT and AI integration in modern polyurethane foaming processes?

IoT sensors and AI algorithms enable advanced process control by providing real-time data on material parameters, machine health, and quality output. This allows for predictive maintenance, remote diagnostics, and automated, real-time adjustments to component mixing ratios, significantly enhancing operational efficiency and reducing material waste.

What are the primary factors restraining growth in the polyurethane foaming machines market?

Key restraints include the substantial initial capital investment required for automated, high-pressure equipment, the ongoing volatility and high cost of critical raw materials (polyols and isocyanates), and the persistent challenge of securing and retaining the highly skilled technical labor required to operate and maintain these complex systems effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager