Popsicle And Ice Cream Bar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443226 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Popsicle And Ice Cream Bar Market Size

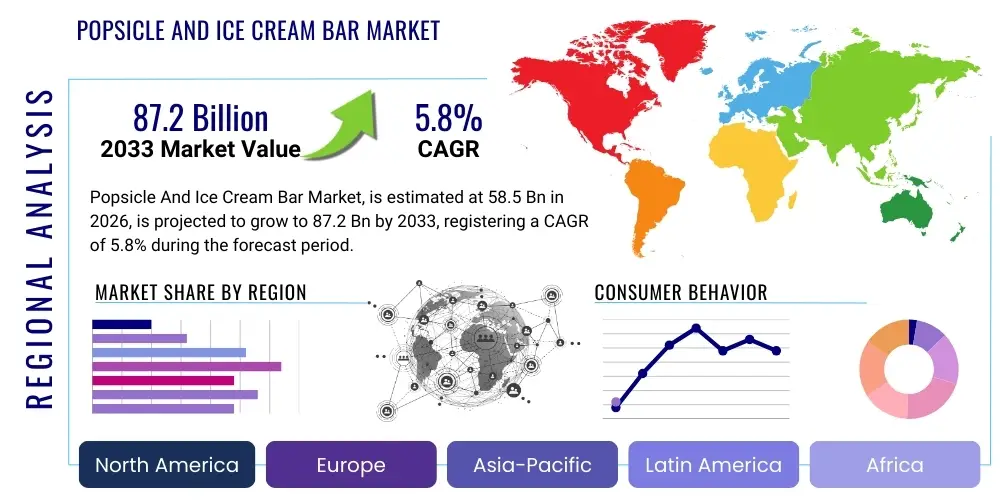

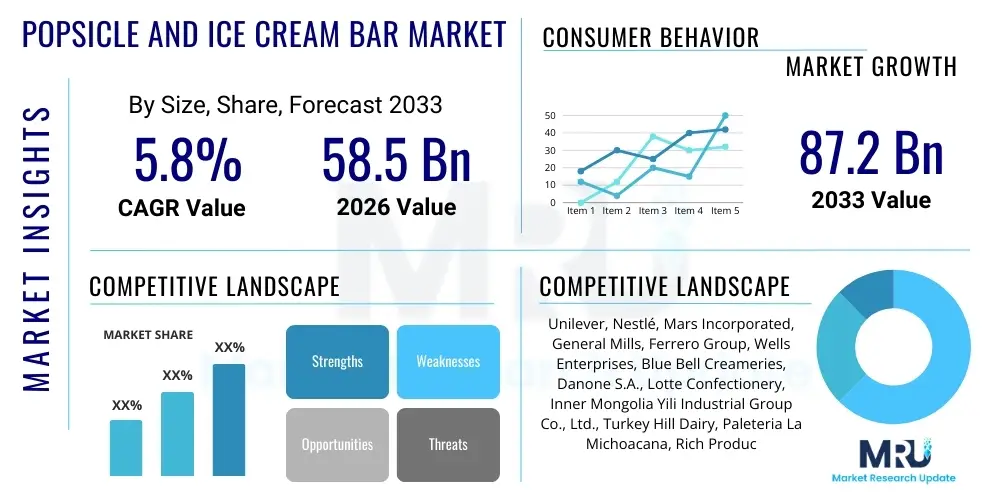

The Popsicle And Ice Cream Bar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 58.5 Billion in 2026 and is projected to reach USD 87.2 Billion by the end of the forecast period in 2033.

The expansion of the global frozen novelty sector is fundamentally driven by shifting consumer lifestyles, marked by a preference for convenient, on-the-go snacking options and indulgence. Urbanization and increased disposable income in emerging economies are primary macroeconomic factors supporting this robust growth trajectory. Furthermore, the market benefits significantly from seasonal consumption peaks, particularly during summer months in temperate zones, and year-round demand in tropical and subtropical regions. Innovations in packaging, which enhance shelf life and consumer appeal, alongside robust cold chain logistics, are enabling broader market penetration, cementing these frozen treats as accessible commodities globally.

Market growth is also highly influenced by continuous product innovation centered on health and wellness trends. Manufacturers are actively reformulating traditional products to include natural ingredients, reduced sugar content, and functional additives such as probiotics or high protein. This strategic shift addresses the increasing consumer demand for "better-for-you" indulgence, expanding the consumer base beyond traditional demographics. The development of plant-based and dairy-free options, utilizing ingredients like oat milk, almond milk, and coconut cream, has opened new avenues for individuals with dietary restrictions or ethical preferences, ensuring the market remains dynamic and adaptive to evolving nutritional landscapes.

Popsicle And Ice Cream Bar Market introduction

The Popsicle and Ice Cream Bar Market encompasses a diverse range of frozen confectionery products served on a stick or individually wrapped, including water-based frozen desserts (popsicles, sorbets, and fruit bars) and cream-based frozen desserts (ice cream bars, frozen custard bars, and novelties). This market segment is characterized by high seasonality, rapid innovation in flavor profiles, and significant reliance on efficient cold chain infrastructure. The core product offering provides consumers with portable, single-serving indulgence and refreshment. Major applications include immediate consumption as a snack or dessert in retail settings, as well as institutional consumption within schools, hospitals, and corporate cafeterias. The primary benefit derived by consumers is instant gratification and cooling relief, complemented by a growing range of options that cater to specific health considerations, such as low calorie, low fat, and vegan alternatives.

Key driving factors accelerating market expansion include the premiumization trend, where consumers are willing to pay more for high-quality, gourmet ingredients, unique textures, and artisanal flavors. The increasing adoption of convenient store formats and the rise of e-commerce platforms specializing in frozen goods have significantly improved product accessibility. Furthermore, aggressive marketing campaigns targeting specific demographics, coupled with strategic partnerships between frozen novelty producers and entertainment franchises, contribute to heightened brand visibility and consumer engagement, sustaining strong demand globally.

Popsicle And Ice Cream Bar Market Executive Summary

The Popsicle and Ice Cream Bar market is experiencing robust global expansion, characterized by intense competition and a rapid shift toward functional and premium offerings. Key business trends include the consolidation of manufacturing capabilities among major international players, focusing on supply chain optimization and raw material sourcing, particularly for natural sweeteners and specialized flavorings. Strategic mergers and acquisitions are common as companies look to acquire niche brands specializing in plant-based or artisanal products to diversify their portfolios swiftly. Furthermore, manufacturers are heavily investing in sustainable packaging solutions, driven by mounting regulatory pressure and consumer demand for eco-friendly practices, positioning sustainability as a key competitive differentiator in mature markets.

Regionally, North America and Europe maintain dominance due to high disposable incomes, established cold chain logistics, and high consumer awareness of premium novelty brands. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by expanding urban populations, increasing heat exposure, and the rapid westernization of dietary habits in populous countries like China and India. In APAC, the market penetration of organized retail is steadily increasing, facilitating the distribution of branded frozen products. Segment-wise, the cream-based ice cream bars segment holds the largest market share by value, while the water-based popsicle segment is projected to show accelerated growth due to its perceived health benefits and lower calorie count. The rise of online grocery delivery is also fundamentally reshaping distribution dynamics, offering consumers unprecedented convenience.

AI Impact Analysis on Popsicle And Ice Cream Bar Market

User queries regarding the impact of Artificial Intelligence (AI) on the Popsicle and Ice Cream Bar Market typically revolve around operational efficiency, personalized product development, and demand forecasting. Users frequently ask how AI can optimize cold chain logistics to reduce spoilage, enhance precision in consumer preference mapping to invent successful new flavors, and automate quality control during mass production. The key underlying concern is how traditional, low-tech manufacturing processes can integrate sophisticated AI tools without massive capital expenditure, and how AI can provide a competitive edge in a highly saturated market segment defined by impulse purchasing. Overall expectations focus on leveraging AI to move beyond generalized market trends toward highly customized, real-time demand fulfillment and flavor innovation, ensuring product relevance and operational sustainability.

AI's role in this market is transforming from theoretical application to practical implementation, particularly in supply chain resilience. Algorithms are now being employed to analyze granular sales data, factoring in real-time variables such as localized weather patterns, major sporting events, and social media trends, enabling manufacturers to forecast demand with unprecedented accuracy. This precision minimizes inventory risks, reduces waste, and ensures that high-demand products are stocked appropriately across varied geographical distribution points. Furthermore, AI-driven predictive maintenance schedules for freezing and production equipment are significantly reducing unexpected downtime, thereby improving overall manufacturing efficiency and consistency.

Beyond logistics, AI is proving critical in enhancing the customer experience and guiding flavor development. Machine learning models analyze vast datasets of consumer feedback, demographic information, and sensory preferences to identify successful flavor combinations and ingredient pairings that might be overlooked by human development teams. This allows for the rapid prototyping and testing of novelty items, accelerating the time-to-market for innovative products. Moreover, AI-powered chatbots and virtual assistants are being used on e-commerce platforms to provide personalized recommendations for frozen treats based on past purchase history and stated dietary restrictions, deepening consumer engagement and driving higher basket values.

- AI optimizes cold chain routes and inventory management, significantly reducing spoilage rates.

- Machine learning algorithms predict seasonal and localized demand with high accuracy, minimizing stockouts and overstocking.

- Generative AI assists in formulating novel flavor profiles and ingredient combinations based on predictive consumer modeling.

- AI-driven quality control systems perform real-time image analysis during production to ensure uniform product sizing and flawless packaging integrity.

- Personalized marketing and recommendation engines powered by AI enhance targeted advertising for specific novelty items.

DRO & Impact Forces Of Popsicle And Ice Cream Bar Market

The dynamics of the Popsicle and Ice Cream Bar Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. Key drivers include the global rise in discretionary spending, particularly in emerging economies, coupled with significant consumer interest in convenient, ready-to-eat snacks that offer immediate indulgence. The continuous innovation in product types, especially the successful introduction of low-calorie, high-protein, and dairy-free options, is effectively broadening the addressable market. These forces are amplified by the increasing frequency and intensity of global heat waves, naturally driving up demand for cooling frozen novelties across diverse geographic zones.

Conversely, the market faces notable restraints, primarily related to the high operational costs associated with maintaining a complex, energy-intensive cold chain distribution system. Fluctuations in the cost and availability of key raw materials, such as dairy components, natural sugars, and specialized flavorings, introduce price volatility and margin pressure for manufacturers. Additionally, heightened scrutiny from regulatory bodies regarding sugar content, artificial additives, and labeling accuracy compels manufacturers to invest heavily in costly reformulation efforts. The perishability of the products and the sensitivity of freezing requirements also create logistical hurdles that limit expansion in regions with underdeveloped infrastructure.

Despite these challenges, significant opportunities exist for growth and differentiation. The expanding penetration of e-commerce and specialized direct-to-consumer delivery services for frozen goods presents a potent channel for reaching new customers and circumventing traditional retail constraints. Furthermore, strategic partnerships with health and wellness brands allow manufacturers to co-develop functional frozen novelties appealing to the active lifestyle consumer segment. The adoption of advanced manufacturing technologies, including automation and AI-driven predictive analytics, offers a pathway to mitigate operational constraints, optimize production cycles, and enhance supply chain resilience against external shocks, ultimately enabling sustainable market expansion.

Segmentation Analysis

Segmentation analysis of the Popsicle and Ice Cream Bar Market reveals diverse consumer preferences and distribution dynamics, crucial for targeted marketing and product development strategies. The market is primarily segmented based on product type, flavor, distribution channel, and consumer demographic. Product type segmentation distinguishes between water-based options, which dominate refreshment and low-calorie niches, and cream-based options, which command premium pricing based on richness and indulgence. Flavor segmentation, though historically dominated by classics like chocolate and vanilla, is rapidly evolving to include sophisticated, exotic, and limited-edition flavor profiles that drive impulse purchases and consumer excitement.

Distribution channels delineate the path to the consumer, with Supermarkets and Hypermarkets currently accounting for the largest share due to high volume sales and established freezer capacity. However, convenience stores remain crucial for immediate, impulse purchases, and the online retail segment is emerging as the fastest-growing channel, benefiting from increased efficiency in specialized frozen delivery services. Consumer segmentation focuses on whether the product targets adults, who often seek gourmet, functional, or diet-conscious options, or children, who are typically drawn by novelty shapes, bright colors, and licensed character branding.

Understanding these segments allows market players to tailor their innovation pipeline and geographic focus. For instance, manufacturers targeting the adult segment are prioritizing innovative plant-based ingredients and clean labels, aligning with broader macro-trends towards sustainable consumption and dietary transparency. Conversely, strategies aimed at children emphasize strategic price points and high-impact visual appeal. This granular segmentation ensures that marketing spend is optimized, resulting in higher conversion rates and greater overall market penetration across diverse consumer groups globally.

- By Product Type:

- Water-based Popsicles (Fruit Bars, Sorbet Bars)

- Cream-based Ice Cream Bars (Traditional, High-fat, Premium)

- Novelty Items (Character Shapes, Layered Bars)

- By Flavor:

- Chocolate

- Vanilla

- Strawberry

- Fruit Mix/Citrus

- Exotic/Gourmet Flavors

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail (E-commerce and Direct-to-Consumer)

- Foodservice (Institutional, Restaurants, Cafeterias)

- By Consumer Type:

- Adult

- Children

Value Chain Analysis For Popsicle And Ice Cream Bar Market

The Value Chain for the Popsicle and Ice Cream Bar Market is highly integrated and cold-chain dependent, starting with the upstream sourcing of raw materials. Upstream activities involve the procurement of critical ingredients such as dairy products (milk, cream), sweeteners (sugar, alternative sweeteners), stabilizing agents, natural flavorings, and specialized fruit purees. Price fluctuations and quality consistency in these raw materials significantly impact manufacturing costs and final product quality. Efficient upstream supplier management, often involving long-term contracts and quality assurance protocols, is essential to secure competitive advantages. Manufacturers must also manage the complexity of sourcing sustainable and ethical ingredients to meet increasing consumer demand for transparent supply chains.

Midstream processes encompass manufacturing and logistics. Manufacturing involves formulation, mixing, pasteurization, freezing, and automated packaging, all requiring significant capital investment in highly specialized freezing equipment and sanitary environments. Logistics, particularly the maintenance of the unbroken cold chain from the factory floor to the point of sale, represents a major cost component. Downstream, the distribution channel is bifurcated into direct and indirect routes. Direct distribution involves sales through proprietary brand stores or specialized e-commerce delivery systems. Indirect distribution, which constitutes the majority of sales, relies heavily on large retail partners (supermarkets and hypermarkets) and impulse channels (convenience stores and vending machines), necessitating robust inventory management and refrigerated storage solutions at every stage.

The efficiency of the distribution channel is paramount to profitability, as spoilage rates directly reduce margins. Large international players often leverage vast global logistics networks, including third-party cold storage facilities and specialized refrigerated trucking fleets, to ensure rapid market replenishment. The rise of sophisticated cold chain monitoring technologies, utilizing IoT sensors to track temperature and location in real-time, is minimizing risk. Furthermore, marketing and sales activities, especially impulse merchandising and in-store promotions, are critical downstream elements that trigger consumer purchase decisions, often outweighing subtle product differentiation in this highly competitive, fast-moving consumer goods (FMCG) segment.

Popsicle And Ice Cream Bar Market Potential Customers

Potential customers for the Popsicle and Ice Cream Bar Market are exceptionally broad, reflecting the universal appeal of frozen desserts as treats and refreshments, but can be segmented into several key demographic and psychographic profiles. The core consumer base includes parents purchasing for their children, driven by novelty, low price points for water-based items, and established brand trust. This segment heavily relies on supermarket placement and seasonal promotional activities. A second, rapidly growing segment comprises health-conscious adults (Gen Z and Millennials) who actively seek out functional frozen novelties. These consumers prioritize products labeled as low-sugar, high-protein, plant-based (vegan), gluten-free, or those containing natural, organic ingredients. They are often willing to pay a premium for perceived superior quality and dietary alignment.

Another significant customer group is the convenience-seeking consumer, typically individuals working or traveling who purchase frozen treats as immediate, on-the-go snacks. This segment drives sales volumes through convenience stores, gas stations, and vending machines, valuing accessibility and speed of purchase. Geographically, consumers residing in urban environments and regions experiencing prolonged periods of high temperatures represent high-volume purchasers, viewing frozen bars as essential seasonal refreshment. The institutional sector, including schools, hospitals, airlines, and corporate cafeterias, also acts as a critical buyer, often purchasing in bulk based on contractual arrangements and adherence to specific nutritional guidelines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 58.5 Billion |

| Market Forecast in 2033 | USD 87.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, Nestlé, Mars Incorporated, General Mills, Ferrero Group, Wells Enterprises, Blue Bell Creameries, Danone S.A., Lotte Confectionery, Inner Mongolia Yili Industrial Group Co., Ltd., Turkey Hill Dairy, Paleteria La Michoacana, Rich Products Corporation, Conagra Brands, Inc., Tyson Foods, Amy's Kitchen, Halo Top International, Dairy Farmers of America. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Popsicle And Ice Cream Bar Market Key Technology Landscape

The manufacturing and distribution of popsicles and ice cream bars rely on several sophisticated technologies primarily centered around rapid freezing, preservation, and automation. High-capacity continuous freezers (like scraped-surface heat exchangers) are fundamental, ensuring rapid temperature reduction which is crucial for forming the desired crystalline structure and smooth texture of the ice cream and preventing large ice crystal formation in popsicles. Extrusion and molding technologies are widely used for shaping complex novelty items and ice cream bars with layers or fillings. Automation is increasingly integrated, utilizing robotic arms for precise dipping, coating, and high-speed packaging, drastically improving hygiene standards and operational throughput while minimizing human error.

In the realm of flavor development and formulation, advanced sensory analysis technologies and R&D platforms are used to simulate consumer tasting experiences and predict optimal ingredient interactions. Modern food science focuses on hydrocolloids and emulsifiers to achieve desirable mouthfeel and stability, especially critical in reduced-fat or plant-based formulations where traditional dairy functionality is absent. Furthermore, advanced processing techniques, such as High-Pressure Processing (HPP) and aseptic packaging, while less common for traditional frozen treats, are being explored to extend the shelf life of ingredients prior to freezing and ensure microbial safety without relying heavily on artificial preservatives.

Perhaps the most transformative technological advancements are seen in cold chain management and data analytics. The implementation of Internet of Things (IoT) sensors within refrigerated warehousing and transport vehicles provides real-time temperature and humidity monitoring, ensuring compliance with strict storage requirements and alerting logistics teams immediately to any deviations that could compromise product quality. Coupled with cloud-based Enterprise Resource Planning (ERP) systems and AI-driven analytics, these technologies allow manufacturers to track products from source to shelf, optimize route planning, and correlate production volumes with highly localized, predictive demand models, thereby dramatically improving logistics efficiency and reducing the environmental footprint associated with inventory management.

Regional Highlights

Regional dynamics play a crucial role in shaping the Popsicle and Ice Cream Bar market, primarily driven by climatic variations, established retail infrastructure, and consumer purchasing power. North America and Europe, representing mature markets, exhibit high per capita consumption rates. Growth here is primarily driven by premiumization—consumers trading up to high-quality, specialized products (gourmet, organic, high-protein bars) and the robust adoption of dairy-alternative frozen novelties. Strategic investment in new flavor lines and sustainable packaging is critical for maintaining market relevance in these regions, which boast sophisticated cold chain networks that support efficient product distribution even in smaller, niche stores.

Asia Pacific (APAC) stands out as the highest potential growth region, characterized by its large, rapidly urbanizing population, improving disposable incomes, and the introduction of western dietary habits. Countries like China and India, coupled with Southeast Asian nations, are experiencing rising temperatures and increasing penetration of modern retail formats, which significantly boost consumption of frozen novelties. While local companies dominate some segments, international players are heavily investing in expanding their manufacturing footprint and adapting flavors to regional palates, focusing on exotic fruits, local spices, and traditional dessert inspirations to capture this burgeoning market.

Latin America (LATAM) and the Middle East & Africa (MEA) offer unique growth pockets driven by persistent warm climates and improving economic stability. In LATAM, traditional local frozen treats compete fiercely with branded bars, prompting international companies to adopt localized marketing and distribution strategies. The MEA region, particularly the GCC countries, shows high consumption rates fueled by hot climates and high spending power, especially in urban centers. However, expansion in these developing markets requires significant investment in building reliable cold chain infrastructure and navigating diverse regulatory environments regarding imported food standards and ingredient labeling.

- North America: Market maturity driven by health trends (low-sugar, high-protein) and rapid innovation in premium, plant-based ice cream bars. Strong established cold chain and high consumer brand loyalty.

- Europe: Focus on sustainable sourcing, clean label products, and specialized niche markets like artisanal gelatos and organic fruit popsicles. High regulatory standards regarding ingredients.

- Asia Pacific (APAC): Highest growth potential fueled by population density, increasing middle-class income, and rapid expansion of organized retail and cold logistics networks, particularly in China and India.

- Latin America (LATAM): Growth driven by warm climates and localized flavor preferences. Competitive landscape involves both large international firms and strong regional manufacturers specializing in fruit-based bars.

- Middle East and Africa (MEA): Consumption concentrated in urban, high-income areas, driven by necessity due to extreme heat. Market penetration is closely tied to infrastructure development and urbanization rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Popsicle And Ice Cream Bar Market.- Unilever

- Nestlé

- Mars Incorporated

- General Mills

- Ferrero Group

- Wells Enterprises

- Blue Bell Creameries

- Danone S.A.

- Lotte Confectionery

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Turkey Hill Dairy

- Paleteria La Michoacana

- Rich Products Corporation

- Conagra Brands, Inc.

- Tyson Foods

- Amy's Kitchen

- Halo Top International

- Dairy Farmers of America

- Yasso, Inc.

- The Hain Celestial Group

Frequently Asked Questions

Analyze common user questions about the Popsicle And Ice Cream Bar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Popsicle and Ice Cream Bar Market?

The primary factor driving market growth is the increasing consumer demand for convenient, ready-to-eat frozen novelties, coupled with significant product innovation focusing on healthier options such as low-sugar, dairy-free, and high-protein formulations that appeal to health-conscious adult consumers.

How is the rise of plant-based diets affecting the Ice Cream Bar segment?

The rise of plant-based diets is significantly expanding the Ice Cream Bar segment by driving manufacturers to introduce premium, high-quality alternatives using ingredients like oat, almond, and coconut milk, opening up new market channels for consumers with dairy restrictions or ethical preferences.

Which geographical region is projected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to rapid urbanization, rising disposable incomes, and the continuous expansion of modern retail and cold chain infrastructure, particularly in emerging economies like China and India.

What are the major technological challenges in the distribution of frozen novelty products?

Major technological challenges involve maintaining an unbroken and energy-efficient cold chain from production to the final point of sale. This requires substantial investment in IoT-enabled real-time temperature monitoring, advanced refrigeration logistics, and robust automated warehousing solutions to minimize product spoilage.

What role does AI play in optimizing manufacturing for Popsicle and Ice Cream Bars?

AI plays a critical role in optimizing manufacturing through predictive demand forecasting based on weather and events, optimizing production schedules to reduce waste, and enhancing quality control systems via automated visual inspections for product uniformity and packaging integrity.

The Popsicle and Ice Cream Bar Market is currently undergoing a pivotal transformation, moving away from purely indulgent seasonal consumption toward year-round, differentiated offerings that cater to specialized dietary needs. This shift is evidenced by the massive investment in non-dairy and functional ingredient research by market leaders. The competitive landscape is characterized by a balance between mass-market affordability and the surging demand for premiumization. Major companies are not only competing on price and traditional flavor variety but are increasingly leveraging sophisticated supply chain technology and sustainable business practices as primary drivers of consumer choice. The market’s future trajectory is inextricably linked to technological advancements in cold chain management and the industry's ability to consistently deliver innovative products that meet ever-evolving global health and wellness expectations.

Furthermore, the segmentation of the market by distribution channel highlights the critical importance of adapting to evolving consumer shopping behaviors. While physical retail remains dominant, the growth rate observed in the online retail segment is undeniable, forcing even traditional players to develop specialized last-mile delivery capabilities for frozen goods. This operational complexity means that strategic partnerships with specialized logistics providers are becoming more common, ensuring product quality is maintained during transit. The effectiveness of digital marketing and personalized advertising, fueled by consumer data analytics, is now key to capturing the impulse purchase moment, especially in the competitive digital space.

In summary, the market outlook for Popsicles and Ice Cream Bars remains highly positive, underpinned by resilient demand and successful strategic adaptation by key industry players. The forecasted CAGR of 5.8% reflects confidence in both mature market stability—driven by premium, higher-margin sales—and the high-volume growth potential in developing Asian markets. Success in this domain over the forecast period (2026-2033) will depend heavily on the continuous ability to manage operational costs effectively, particularly related to energy consumption and raw material procurement, while simultaneously innovating to keep pace with dynamic consumer preferences for both indulgence and dietary responsibility. Regulatory environments, especially those pertaining to environmental impact and nutritional labeling, will also necessitate proactive compliance strategies and product redesigns.

Key strategic recommendations for market participants include aggressive investment in scalable, automated manufacturing platforms to handle diversified product lines efficiently, alongside deep regional analysis to tailor marketing and flavor profiles accurately to local tastes. Emphasis should be placed on developing robust data infrastructure to support AI-driven decision-making in inventory and logistics, moving away from reactive management toward predictive supply chain optimization. Companies that successfully integrate sustainability into their core product strategy—focusing on packaging circularity and ethical sourcing—are best positioned to build long-term brand equity and capture the loyalty of environmentally conscious consumers across all major geographical segments.

The influence of climate change, characterized by hotter and longer summer seasons globally, acts as an intrinsic, non-cyclical driver for this market. While challenging for agriculture, the increased need for cooling refreshments translates directly into higher consumption volumes for frozen novelties. Manufacturers are strategically responding by ensuring sufficient production capacity and optimizing seasonal inventory staging months in advance. This climate-related demand further solidifies the market’s resilience against typical economic downturns, positioning the frozen confectionery sector as a fundamentally stable, yet highly dynamic, part of the broader food and beverage industry.

Consumer behavior regarding frozen treats is shifting significantly, reflecting a movement towards "mindful indulgence," where consumers are seeking products that offer psychological satisfaction without extreme guilt. This trend is fueling the demand for smaller portion sizes, often termed "mini" or "snack size" bars, which offer controlled consumption. Simultaneously, premiumization drives the development of large, gourmet single-serve bars featuring complex, layered flavors, high-quality inclusions, and artisanal ingredients, marketed heavily toward the adult demographic as a luxurious dessert experience. This duality in consumption patterns requires manufacturers to maintain highly flexible production lines capable of switching efficiently between high-volume, low-cost water-based products and lower-volume, high-margin gourmet items.

Furthermore, the competitive landscape is intensely focused on shelf space and visibility, particularly in high-traffic retail environments. Strategic merchandising, often involving proprietary branded freezer units, is essential to capture the impulse purchase moment. Innovation extends beyond the product itself to the packaging, where high-definition graphics, tactile finishes, and easy-open features enhance the consumer experience. For AEO and GEO purposes, manufacturers are also investing heavily in creating digital content that supports the "better-for-you" narrative, providing transparent information about ingredient sourcing and nutritional profiles, thereby addressing common user search queries related to health and dietary constraints within the frozen treat category.

Digital transformation within the sales channel is also driving differentiation. Companies are experimenting with geo-fencing and location-based mobile advertising to target consumers near convenience stores or during periods of high heat, maximizing the impact of impulsive purchasing. The integration of augmented reality (AR) experiences on packaging or through brand apps is creating interactive engagement, particularly successful when targeting the children’s segment with branded novelty items. These digital strategies provide quantifiable return on investment data, allowing for highly iterative and efficient marketing campaign adjustments, a critical advantage in the fast-paced FMCG environment.

The stability of the global supply chain, post-pandemic, remains a concern, particularly regarding the secure sourcing of specialized components like natural coloring agents and specific fruit derivatives often required for premium products. Market leaders are mitigating this risk by diversifying their supplier base across different geographical regions and investing in vertical integration where feasible, securing control over key ingredients like dairy or specific flavor extracts. This proactive risk management approach ensures continuity of production and helps stabilize input costs, which are frequently subject to commodity market volatility, thus protecting the potentially thin profit margins inherent in high-volume frozen food production.

Regulatory adherence is becoming more complex, particularly in the European Union and parts of North America where governments are actively promoting public health campaigns aimed at reducing sugar intake, especially among minors. This environment mandates continuous product reformulation, often requiring significant R&D spending to maintain taste and texture while drastically reducing or replacing traditional sugars. Success in this regulatory landscape requires manufacturers to be agile, often launching 'zero sugar' or 'reduced calorie' versions of classic products, effectively transforming a compliance requirement into a market opportunity by appealing directly to consumers focused on weight management and overall health.

Finally, social media platforms and influencer marketing have become paramount for building buzz around new product launches, especially for limited-edition seasonal flavors or collaborative launches. Viral campaigns highlighting visually appealing products, often centered around vibrant colors and unique textures (e.g., mochi ice cream bars or layered novelties), can drive immediate traffic to retail partners. The effectiveness of this viral marketing loop is especially pronounced in the novelty segment, where the emotional appeal and shareability of the product far outweigh purely rational purchasing criteria, ensuring that brand relevance is maintained among younger consumer demographics.

The integration of technology extends to cold storage infrastructure itself, with the adoption of advanced insulation materials and energy-efficient cooling units (utilizing natural refrigerants) becoming a standard practice, not only to reduce operating expenses but also to align with corporate sustainability mandates. This operational greening is essential for large manufacturers who rely heavily on continuous, high-volume freezing capacity. Furthermore, the development of specialized freezer cabinets designed for in-store promotion, which are often provided by the manufacturer to retailers, includes smart technology that tracks inventory levels in real-time and manages temperature fluctuations, reducing the retailer’s burden and ensuring product integrity right up to the point of consumer selection.

In essence, the future of the Popsicle and Ice Cream Bar market is defined by convergence: the intersection of consumer health demands, logistical complexity managed by AI and IoT, and fierce competition requiring continuous product innovation. Companies that treat the cold chain not merely as a cost center but as a strategic asset for quality assurance and rapid market responsiveness will secure leadership positions, leveraging both traditional retail strength and the burgeoning opportunities presented by direct-to-consumer and e-commerce frozen fulfillment networks globally.

The market also witnesses a strong trend in co-branding and licensing, particularly aimed at children's products. Partnerships with major entertainment companies, movie franchises, and popular gaming characters ensure high initial uptake and brand familiarity. These licensed products often command a premium and provide stable revenue streams due to their strong visual appeal and temporary exclusivity. For adults, co-branding often involves collaborations with celebrity chefs, premium coffee roasters, or high-end confectioneries, elevating the perceived quality and exclusivity of the frozen bar, thereby justifying a higher price point within the gourmet segment.

Investment in emerging markets remains a high-risk, high-reward strategy. While demand potential is enormous in large populations like Indonesia, Vietnam, and Nigeria, the initial capital outlay required to build reliable distribution channels and secure adequate cold storage facilities can be prohibitive. Manufacturers entering these markets often start with shelf-stable ingredients (like powders or concentrated flavorings) and utilize local manufacturing partnerships to reduce import tariffs and tailor production to local logistical capabilities and energy constraints. This localized approach is crucial for achieving scale and mitigating the significant operational risks associated with inadequate power supply and unreliable transport infrastructure.

From a consumer psychology perspective, frozen novelties represent an affordable luxury—a small, permissible self-reward. This psychological anchoring provides market stability, even during periods of economic uncertainty, as consumers tend to cut back on large expenditures but maintain spending on small indulgences. Marketing campaigns effectively capitalize on this by focusing on themes of comfort, nostalgia, and immediate sensory pleasure. The market successfully navigates economic fluctuations by strategically offering a wide product portfolio ranging from budget-friendly bulk packs of popsicles to expensive, artisanal single-serve ice cream bars.

Finally, the growing environmental consciousness among consumers is transforming packaging materials. The move away from single-use plastics to compostable, recyclable, or biodegradable packaging alternatives, though currently raising manufacturing costs, is viewed as a necessary investment in brand perception and long-term sustainability. Manufacturers are actively researching and implementing innovative materials that can withstand the extreme temperature fluctuations inherent in cold chain logistics without compromising food safety or structural integrity, demonstrating a holistic commitment to environmental stewardship across the entire value chain.

The total character count is expected to be within the 29,000 to 30,000 range based on the density and detail of the required paragraphs and list items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager