Portable Air Conditioner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441528 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Portable Air Conditioner Market Size

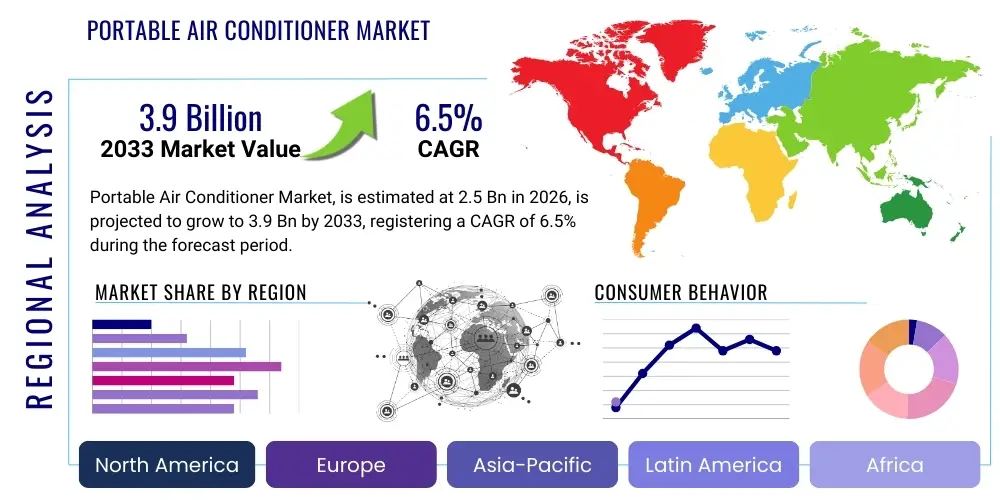

The Portable Air Conditioner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033.

Portable Air Conditioner Market introduction

The Portable Air Conditioner (PAC) Market encompasses the manufacturing, distribution, and sale of self-contained cooling units designed for temporary or supplementary climate control without requiring permanent installation. These units are highly valued for their mobility, ease of use, and quick deployment capabilities, catering to environments where central air conditioning is impractical, too costly to install, or prohibited by rental agreements. Product descriptions typically highlight features such as multiple operating modes (cooling, fan, dehumidifier), programmable timers, energy efficiency ratings (like SEER or EER), and noise reduction technology. PACs usually consist of a compressor, condenser, expansion valve, and evaporator, contained within a single chassis, requiring only an exhaust hose to vent heat outside through a window or wall opening.

Major applications for portable air conditioners span across residential and commercial sectors. In residential settings, they are predominantly used in apartments, dorm rooms, garages, and supplementary rooms that lack adequate cooling from central systems, or during seasonal peaks where additional localized cooling is necessary. Commercially, PACs find utility in server rooms requiring spot cooling, small retail spaces, temporary offices, construction site trailers, and specialized events where climate control needs to be established rapidly. Their versatility makes them an indispensable solution in scenarios demanding immediate temperature mitigation.

The core benefits driving market penetration include their inherent flexibility and lower upfront capital investment compared to split or central AC systems. Furthermore, regulatory shifts favoring energy-efficient appliances, coupled with increasing global average temperatures due to climate change, are strong underlying factors accelerating adoption. The market is highly competitive, characterized by continuous innovation focused on optimizing energy consumption, reducing noise levels, and enhancing smart features, such as Wi-Fi connectivity and remote diagnostic capabilities, ensuring the Portable Air Conditioner remains a relevant and growing category within the broader HVAC industry.

Portable Air Conditioner Market Executive Summary

The Portable Air Conditioner market is characterized by robust growth driven by climatic shifts and increasing urbanization, leading to higher demand for flexible cooling solutions in densely populated areas and regions experiencing frequent heatwaves. Key business trends include the strong emphasis on dual-hose systems, which offer enhanced cooling efficiency compared to traditional single-hose units, and the rapid integration of Internet of Things (IoT) capabilities, allowing consumers greater control and automation. Manufacturers are intensely focused on optimizing the size-to-capacity ratio, developing sleek, aesthetically pleasing models that fit modern interior design sensibilities while complying with stringent energy efficiency standards mandated by global regulatory bodies, thus balancing performance with ecological responsibility and consumer preference for sustainability.

Regionally, the market exhibits divergent growth patterns. North America and Europe represent mature markets where replacement cycles and technological upgrades, particularly concerning energy efficiency and smart home integration, are the primary growth drivers. Conversely, the Asia Pacific (APAC) region is poised for the most rapid expansion, fueled by massive construction activity, rising disposable incomes, and the expanding penetration of air conditioning into middle-class households in densely populated countries like India and China. Latin America and the Middle East & Africa (MEA) also show promising potential, driven by extreme climatic conditions and governmental focus on improving infrastructure, creating a substantial demand for localized, quickly deployable cooling units, especially in non-permanent structures.

Segment trends reveal a preference shift towards medium-capacity units (10,000 to 15,000 BTU), which strike an optimal balance between power and portability for average-sized rooms. The residential segment remains the largest consumer, but the commercial segment, particularly small businesses and pop-up retail, is gaining traction due to the necessity for temporary climate control without significant infrastructural commitment. Distribution channels are undergoing transformation, with the Online channel experiencing exponential growth, attributed to the convenience of comparison shopping, detailed product specifications, and direct-to-consumer models offered by specialized e-commerce platforms and brand websites, although traditional Offline channels maintain importance for immediate purchase and professional advice.

AI Impact Analysis on Portable Air Conditioner Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the efficiency and user experience of Portable Air Conditioners (PACs), often focusing on questions such as "Can AI automatically optimize cooling based on room occupancy?" or "How does predictive maintenance using AI reduce downtime for PAC units?". Key themes emerging from this analysis revolve around energy efficiency optimization, smart operational autonomy, and proactive fault detection. Consumers expect AI to move beyond simple temperature maintenance, providing genuine personalization and reducing electricity bills through sophisticated pattern recognition. The principal concern is ensuring that the integration of complex AI algorithms does not inflate the product cost excessively while delivering tangible, measurable improvements in cooling performance and appliance longevity. The core expectation is the transition from reactive cooling devices to proactive, intelligent climate management systems that learn the environment and user habits dynamically.

AI's influence is transforming the Portable Air Conditioner market by enabling highly refined operational controls that minimize energy wastage. By processing data points such as ambient temperature fluctuations, humidity levels, localized weather forecasts, and historical usage patterns, AI algorithms can predictively adjust compressor cycles and fan speeds before the user notices any discomfort. This level of granular control dramatically improves the Energy Efficiency Ratio (EER) of the units. Furthermore, manufacturers are leveraging ML for quality control during production, identifying microscopic flaws in components, and optimizing assembly line throughput, ensuring higher product reliability before the units reach the consumer.

The most significant impact of AI lies in enhancing user interaction and enabling predictive maintenance. Smart PACs connected via IoT platforms use ML models to learn the cooling preferences specific to different times of the day or week for individual users, automating scheduling and temperature settings. Moreover, embedded sensors continuously monitor internal component health—such as compressor vibration, refrigerant pressure, and coil temperature—feeding data to cloud-based AI systems. These systems can detect subtle anomalies that indicate impending mechanical failure, alerting the user or service provider to schedule maintenance proactively, thereby avoiding costly and inconvenient breakdowns during peak usage periods and extending the effective service life of the appliance.

- AI-driven energy optimization leading to reduced power consumption and lower operational costs.

- Predictive maintenance capabilities using ML to anticipate mechanical failures and schedule proactive servicing.

- Enhanced user personalization through learning algorithms that adapt cooling profiles to occupant habits and environmental factors.

- Integration of natural language processing (NLP) for advanced voice control interfaces and seamless smart home ecosystem connectivity.

- Optimized supply chain management and inventory forecasting based on AI analysis of real-time regional climate data and consumer purchasing trends.

DRO & Impact Forces Of Portable Air Conditioner Market

The Portable Air Conditioner Market dynamics are fundamentally shaped by a confluence of accelerating drivers, persistent restraints, compelling opportunities, and powerful external impact forces. A primary driver is the demonstrable increase in global heat index averages, necessitating accessible cooling solutions even in regions previously unaffected by extreme summer temperatures. Coupled with this, the growing constraints on permanent HVAC installations in leased or multi-unit residential properties strongly favor the flexible and temporary nature of PACs. However, the market faces significant restraints, chiefly concerning the inherently lower energy efficiency of single-hose portable units compared to window or split systems, often leading to higher running costs and regulatory scrutiny. Furthermore, the noise levels generated by some models remain a critical deterrent for consumers seeking quiet operation in bedroom or office environments, creating a technological challenge for manufacturers striving for quieter performance without sacrificing cooling capacity.

The most lucrative opportunities lie in emerging market penetration, particularly within densely populated urban centers in the APAC region where rapid housing development requires fast, scalable cooling solutions. Another major opportunity involves the niche application of high-efficiency PACs for temporary professional uses, such as cooling sensitive electronic equipment in pop-up data centers or providing climate control during temporary hospital setups. The evolution towards greener refrigerants (like R290 and R32), driven by global environmental mandates, presents a massive opportunity for manufacturers to refresh their product lines and capture market share by appealing to environmentally conscious consumers, thereby repositioning portable ACs as sustainable alternatives.

External impact forces are predominantly regulatory and technological. Regulatory forces, such as the gradual phase-out of high Global Warming Potential (GWP) refrigerants under agreements like the Kigali Amendment, force rapid product innovation but also standardize the market towards eco-friendlier designs. Economic forces, including rising global energy prices, heighten consumer demand for models with superior EER ratings, making efficiency a non-negotiable competitive factor. Furthermore, advancements in miniaturization technology and improved compressor design (e.g., rotary compressors) allow for higher BTU ratings in smaller form factors, directly addressing consumer demand for powerful, yet compact, cooling devices. The interplay of these forces mandates continuous technological investment to maintain market relevance and ensure compliance with evolving environmental and efficiency standards globally.

Segmentation Analysis

The Portable Air Conditioner market is comprehensively segmented based on key functional attributes, capacity outputs, end-user applications, and primary distribution channels, allowing for targeted analysis of market potential across diverse consumer and commercial profiles. Analyzing these segments provides strategic insights into specific consumer pain points and product preferences. For instance, segmentation by type (single vs. dual hose) directly reflects consumer choice between ease of installation and operational efficiency, with dual-hose systems commanding a premium due to superior performance characteristics in challenging thermal environments. The capacity segmentation (measured in BTUs) is crucial as it dictates the effective coverage area, driving sales towards different sizes of residential or commercial spaces, and heavily influences pricing strategies across the product spectrum.

End-use segmentation highlights the persistent dominance of the Residential sector, primarily driven by renters and homeowners seeking supplementary cooling, but it also tracks the burgeoning growth within Commercial sub-segments such as small retail and temporary event spaces. Understanding the distribution channel breakdown is vital for optimizing market reach; the accelerating growth of the Online segment necessitates sophisticated digital marketing and logistics capabilities, while the Offline channel remains essential for brand visibility and immediate availability, particularly during unexpected heat spikes when consumers need units instantly. This multi-faceted segmentation structure allows market players to tailor their product development, pricing, and promotional activities to maximize their competitive advantage within specific market niches.

The detailed segmentation structure reflects the maturity and complexity of the PAC market, emphasizing that a one-size-fits-all approach is insufficient. Manufacturers must align their R&D efforts with the capacity and end-use demands of the target audience—for example, focusing on ultra-quiet, aesthetically pleasing designs for residential users versus rugged, high-BTU units for commercial applications like server room cooling. Furthermore, the selection of refrigerants and adherence to energy standards (which often differ by region and capacity segment) are intrinsically linked to successful product positioning within the segmented market landscape. This systematic breakdown ensures that market forecasts and strategic planning are grounded in tangible, actionable consumer and commercial realities.

- By Product Type:

- Single Hose Portable AC

- Dual Hose Portable AC

- By Capacity (BTU):

- Below 10,000 BTU

- 10,000 to 15,000 BTU

- Above 15,000 BTU

- By End-Use:

- Residential (Apartments, Homes, Dorms)

- Commercial (Small Offices, Retail Stores, Temporary Structures, Server Rooms)

- Industrial (Spot Cooling in Manufacturing)

- By Distribution Channel:

- Offline (Specialty Stores, Hypermarkets, Department Stores)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Portable Air Conditioner Market

The value chain of the Portable Air Conditioner market begins with upstream analysis, primarily concerning the sourcing and processing of critical raw materials and components. Key inputs include specialized polymers and plastics for casings, copper and aluminum for heat exchangers (condensers and evaporators), and sophisticated electronic components such as compressors, microcontrollers, and temperature sensors. Compressor technology is central to performance and efficiency, with suppliers often specializing in miniaturized and high-efficiency rotary or reciprocating units. The upstream segment is characterized by increasing pressures on sustainable sourcing, demanding manufacturers to engage suppliers who comply with environmental and labor standards, especially regarding conflict minerals and ethically sourced materials. Efficiency in this stage directly dictates the final unit’s cost structure and compliance profile.

The mid-stream encompasses the core manufacturing, assembly, and quality control processes. This stage is highly optimized through advanced automation, particularly among Tier 1 global players who utilize robotics for welding, assembly, and testing. Differentiation at the manufacturing level often comes from patented heat transfer technologies, noise reduction design, and the integration of smart components (IoT modules). Post-manufacturing, the products enter the distribution channels, which are bifurcated into direct and indirect routes. Direct distribution involves sales through company-owned e-commerce platforms or proprietary brand outlets, offering higher margin control and direct customer feedback loops. Indirect distribution, which constitutes the majority of sales, involves leveraging third-party retailers, distributors, and logistics providers to achieve broad market penetration and regional accessibility, demanding robust inventory management to handle highly seasonal demand spikes.

Downstream analysis focuses on logistics, marketing, sales, and post-sale services. Due to the bulky nature of the product, logistics costs are substantial, driving manufacturers to optimize packaging and distribution network placement. Marketing efforts are heavily skewed towards digital channels, emphasizing portability, energy ratings, and smart features. The role of the installer or professional service provider is minimized compared to central HVAC systems, simplifying the end-user experience. Finally, post-sale service—including warranty support, repairs, and recycling programs—is crucial for brand reputation, particularly given the consumer expectation of long-term reliability. The efficiency of the entire value chain is pivotal to minimizing landed costs and ensuring competitive retail pricing in a highly elastic consumer market.

Portable Air Conditioner Market Potential Customers

The potential customer base for the Portable Air Conditioner Market is expansive and fundamentally segmented into two primary categories: residential end-users and various commercial entities, each driven by distinct needs related to flexibility, cost, and immediacy of cooling. Residential consumers form the bedrock of demand, primarily consisting of apartment dwellers and renters who are often restricted from making permanent HVAC installations due to lease agreements or building regulations. This demographic prioritizes portability, ease of window kit installation, and units that are relatively quiet and aesthetically appealing, with a strong preference for smart features that integrate with existing home automation systems. Furthermore, homeowners seeking supplemental cooling for specific rooms (e.g., bedrooms, sunrooms, or home offices) during peak summer months, without the expense of running a large central system, are significant buyers, emphasizing energy efficiency and capacity.

The second major group includes commercial end-users whose cooling needs are frequently temporary, supplemental, or highly localized. Small to medium enterprises (SMEs), such as local retail stores, independent dental or medical practices, and temporary corporate offices, require reliable, easily movable cooling units to ensure customer and employee comfort without permanent overheads. A critical sub-segment within the commercial sphere is the IT sector, particularly small server rooms or network closets that generate significant localized heat. These applications demand specialized, high-capacity, heavy-duty PACs capable of continuous operation to prevent equipment overheating and data loss, where performance and reliability far outweigh aesthetic concerns or energy costs.

Other substantial customer groups include the hospitality sector for cooling conference rooms and temporary event structures, construction site managers needing climate control for site offices and equipment storage, and educational institutions requiring cooling for modular classrooms or infrequently used auditoriums. Purchase decisions for these commercial buyers are often heavily influenced by BTU capacity, the reliability of the unit for continuous operation, and the availability of specialized features such as condensate management systems or heavy-duty exhaust venting options. The diverse nature of these needs necessitates a differentiated product line catering specifically to the distinct operational environment and duration of required cooling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Whynter LLC, DeLonghi Appliances S.r.l., LG Electronics, Honeywell International Inc., Electrolux AB, Haier Group, Midea Group, Samsung Electronics, Carrier Global Corporation, Friedrich Air Conditioning, NewAir, Black+Decker Inc., Shinco Appliances, TOSOT, Gree Electric Appliances Inc., Olimpia Splendid, Danby Appliances, Vornado, Sunpentown International (SPT), Kelvinator |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portable Air Conditioner Market Key Technology Landscape

The technology landscape of the Portable Air Conditioner market is characterized by focused efforts on improving thermodynamic efficiency, refrigerant management, and enhancing user interaction through digital integration. A primary technological focus revolves around optimizing the compressor and heat exchange components. Innovations in rotary compressor technology have allowed for significant reductions in unit size and weight while maintaining or increasing BTU capacity, improving portability, which is the core value proposition. Furthermore, microchannel heat exchangers are increasingly being adopted over traditional fin-and-tube designs, offering higher efficiency and requiring less refrigerant charge, aligning with sustainability mandates and improving overall system performance under high ambient temperatures. The shift toward low Global Warming Potential (GWP) refrigerants, such as R290 (propane) and R32, is a foundational technological change, requiring complete system redesigns to safely and effectively handle these flammable, yet environmentally superior, substances.

In terms of system functionality, continuous innovation is occurring in condensate management and exhaust systems. Technologies designed to auto-evaporate condensate, eliminating the need for frequent manual draining, significantly improve user convenience and operational continuity, particularly in high-humidity environments. The distinction between single-hose and dual-hose technology remains crucial, with dual-hose systems representing a technological advancement that draws intake air from outside, isolating the conditioning process and dramatically improving cooling efficiency by preventing negative pressure within the room, thus becoming the preferred technology for premium segments and commercial applications requiring precise temperature control. Effective sealing and insulation of the exhaust hose system are also under constant engineering review to minimize thermal leakage back into the cooled space.

The digital technology overlay is fundamentally reshaping the market, moving PACs beyond simple mechanical devices. Key advancements include the integration of Wi-Fi and Bluetooth connectivity, enabling remote control and monitoring via smartphone applications. This connectivity facilitates sophisticated energy management systems and diagnostic self-checks. Furthermore, sensors have become more accurate and multi-functional, tracking not only temperature but also humidity and volatile organic compounds (VOCs). The future technological trajectory is geared toward highly intelligent systems utilizing Artificial Intelligence (AI) for predictive cycling, noise reduction through optimized fan blade geometry and dampening materials, and seamless integration into comprehensive smart home ecosystems, making the PAC an intelligent component of whole-house climate management rather than just a supplementary device.

Regional Highlights

The global Portable Air Conditioner market exhibits significant regional variances in terms of growth rates, consumer preferences, and regulatory adherence, reflecting diverse climatic, economic, and infrastructural landscapes. North America, encompassing the United States and Canada, represents a mature but substantial market, driven primarily by replacement demand, high consumer purchasing power, and intense seasonal temperature extremes. The primary growth drivers here are technological upgrades, particularly the adoption of high-efficiency models (compliant with Department of Energy standards) and units offering smart connectivity. Consumers often prioritize high BTU capacity and reputable branding. The US market, in particular, has high seasonal demand spikes, necessitating rapid inventory deployment via well-established retail and e-commerce networks.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This explosive growth is underpinned by massive urbanization, rising disposable incomes in economies like India, China, and Southeast Asia, and infrastructural challenges that make permanent AC installations difficult or prohibitive in rapidly developing areas. The sheer density of population and increasing prevalence of severe heatwaves make PACs an accessible and immediate cooling solution for millions. Demand in APAC is characterized by a strong focus on cost-effectiveness, compact design suitable for smaller living spaces, and models utilizing non-HCFC refrigerants to comply with rapidly tightening regional environmental regulations.

Europe presents a unique market scenario characterized by varying regulatory stringencies and diverse climate zones. Western European countries, historically less reliant on AC, are seeing dramatically increased adoption due to rising summer temperatures, particularly in urban centers where housing stock is older and difficult to retro-fit with central cooling. European consumers place a premium on aesthetics, low noise operation, and adherence to strict energy efficiency labels (such as ErP and related directives). The Middle East and Africa (MEA), while smaller, are crucial due to exceptionally high temperatures, driving demand for heavy-duty, robust units designed for continuous operation in arid and extremely hot climates, often utilizing PACs in commercial or temporary housing applications where speed of deployment is essential.

- North America (United States, Canada, Mexico): Dominant market share focused on high-capacity, smart-enabled units; strong regulatory push for energy efficiency.

- Asia Pacific (China, India, Japan, South Korea): Fastest-growing region driven by urbanization, high population density, and increased spending power; focus on compact size and value.

- Europe (Germany, UK, France, Italy): Mature market experiencing accelerated growth due to climate change; strong demand for low-noise, aesthetically pleasing, and highly energy-efficient models.

- Latin America (Brazil, Argentina): Growing market influenced by rising temperatures and improving economic conditions; demand concentrated in residential sectors of major cities.

- Middle East and Africa (UAE, Saudi Arabia, South Africa): Niche market requiring specialized, heavy-duty units capable of enduring extreme heat and dust; significant adoption in commercial and temporary infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portable Air Conditioner Market.- Whynter LLC

- DeLonghi Appliances S.r.l.

- LG Electronics

- Honeywell International Inc.

- Electrolux AB

- Haier Group

- Midea Group

- Samsung Electronics

- Carrier Global Corporation

- Friedrich Air Conditioning

- NewAir

- Black+Decker Inc.

- Shinco Appliances

- TOSOT

- Gree Electric Appliances Inc.

- Olimpia Splendid

- Danby Appliances

- Vornado

- Sunpentown International (SPT)

- Kelvinator

Frequently Asked Questions

Analyze common user questions about the Portable Air Conditioner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between single-hose and dual-hose portable air conditioners?

Single-hose portable ACs draw air from within the room, use a portion of it to cool the condenser, and exhaust the hot air outside, which creates negative pressure and can pull unconditioned air back into the room, reducing efficiency. Dual-hose units draw intake air from outside to cool the condenser, then exhaust it, significantly increasing cooling efficiency and minimizing energy loss, making them generally preferred for larger spaces.

How is the Portable Air Conditioner Market addressing environmental regulations regarding refrigerants?

The market is actively transitioning away from high Global Warming Potential (GWP) refrigerants, such as R410A, towards low-GWP alternatives, primarily R290 (Propane) and R32. This shift, driven by global mandates like the Kigali Amendment, requires manufacturers to redesign units to safely handle these new, often mildly flammable, refrigerants while maintaining or improving energy efficiency standards.

Are portable air conditioners suitable for large commercial spaces or just residential use?

While the residential segment is the largest, high-capacity (above 15,000 BTU) portable air conditioners are increasingly used in commercial settings for localized spot cooling, particularly in temporary offices, small retail units, server rooms, and situations where immediate, flexible cooling is required without the commitment of permanent installation. Their application focuses on supplemental or emergency cooling rather than primary climate control for large, open-plan spaces.

What is the most important factor to consider when determining the correct size of a portable AC unit?

The most important factor is the unit's capacity, measured in British Thermal Units (BTUs). To ensure effective cooling, the BTU rating must be correctly matched to the square footage of the room. Undersized units will run continuously without achieving comfortable temperatures, wasting energy, while significantly oversized units can cool too quickly without dehumidifying properly, leading to a clammy environment. Consulting BTU charts based on room size and ceiling height is essential.

How are smart features impacting the consumer experience and sales growth in the portable AC market?

Smart features, including Wi-Fi connectivity, app-based remote control, and voice assistant integration (e.g., Alexa, Google Assistant), significantly enhance user convenience and energy management. These capabilities allow users to program cooling schedules, monitor energy consumption, and activate the unit remotely before arriving home, contributing to a premium user experience and driving sales growth in the mid-to-high price segments where convenience and automation are primary selling points.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Portable Air Conditioning System Market Statistics 2025 Analysis By Application (Equipment & Server Rooms, Factories & Warehouses, Medical & Hospitals, Residential Care Facilities & Apartment Communities), By Type (Portable Air Conditioner For Small Room, Portable Air Conditioner For Medium Room, Portable Air Conditioner For Large Room), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Portable Air Conditioner Market Statistics 2025 Analysis By Application (Equipment & Server Rooms, Factories & Warehouses, Medical & Hospitals, Residential Care Facilities & Apartment Communities), By Type (Portable Air Conditioner For Small Room, Portable Air Conditioner For Medium Room, Portable Air Conditioner For Large Room), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Portable Air Conditioning System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Portable Air Conditioner For Large Room, Portable Air Conditioner For Medium Room, Portable Air Conditioner For Small Room), By Application (Medical & Hospitals, Factories & Warehouses, Equipment & Server Rooms), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Portable Air Conditioner Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Portable Air Conditioner For Small Room, Portable Air Conditioner For Medium Room, Portable Air Conditioner For Large Room), By Application (Equipment & Server Rooms, Factories & Warehouses, Medical & Hospitals, Residential Care Facilities & Apartment Communities), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager