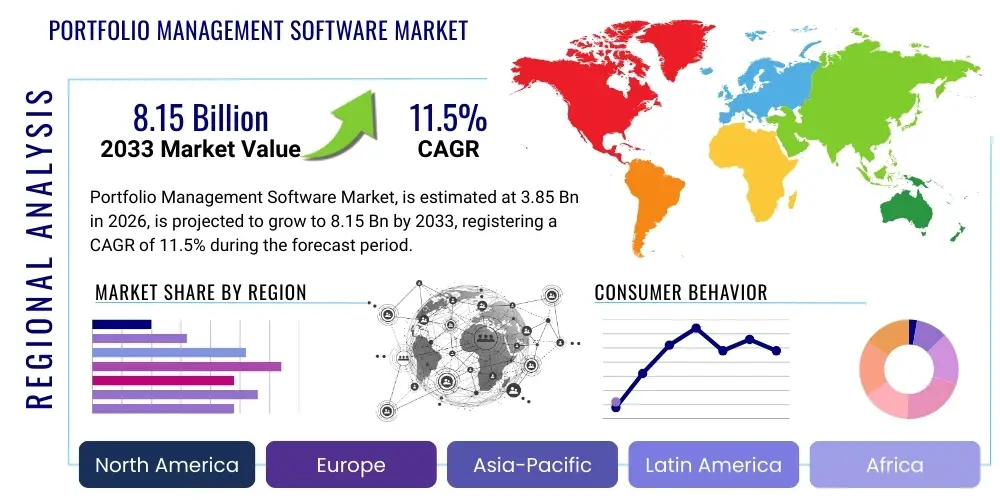

Portfolio Management Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443100 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Portfolio Management Software Market Size

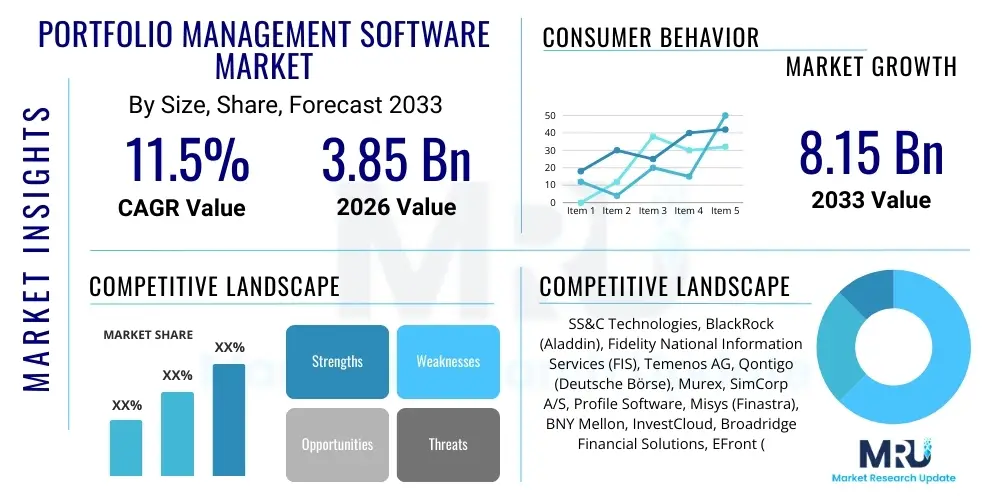

The Portfolio Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $3.85 Billion in 2026 and is projected to reach $8.15 Billion by the end of the forecast period in 2033.

Portfolio Management Software Market introduction

Portfolio Management Software (PMS) refers to specialized technological solutions designed to assist financial institutions, asset managers, wealth advisors, and individual investors in monitoring, analyzing, and optimizing their investment portfolios. These systems centralize data related to assets, trades, performance metrics, risk exposures, and compliance mandates. The core product provides tools for real-time reporting, scenario modeling, asset allocation optimization, and comprehensive client reporting, thereby enhancing decision-making efficiency and regulatory adherence across investment operations.

Major applications of PMS span across institutional investment firms, hedge funds, mutual funds, private equity firms, and corporate treasuries. Benefits derived from utilizing these platforms include improved transparency into investment holdings, reduction in operational errors through automation of middle and back-office tasks, sophisticated risk management capabilities, and the ability to scale investment operations without commensurate increases in headcount. The adoption of PMS is critical for firms seeking a competitive edge in a rapidly evolving, data-intensive financial landscape.

Key driving factors accelerating market growth include the increasing complexity of global financial instruments, the stringent regulatory environment requiring detailed reporting and compliance checks, and the continuous push for digitalization within the wealth and asset management sectors. Furthermore, the rising adoption of cloud-based solutions offering greater flexibility, lower total cost of ownership (TCO), and easier integration with other financial systems is fueling the expansion of the Portfolio Management Software Market globally.

Portfolio Management Software Market Executive Summary

The Portfolio Management Software market demonstrates robust growth, primarily driven by the imperative among financial services firms to automate manual processes and integrate advanced analytical tools for enhanced alpha generation. Current business trends indicate a significant shift toward Software-as-a-Service (SaaS) models, offering greater scalability and accessibility, particularly for smaller and mid-sized advisory firms. Integration capabilities, specifically open APIs enabling seamless linkage with CRM systems, custodial platforms, and market data providers, are emerging as key differentiators among vendors, focusing the market competition on technological interoperability and user experience.

Regionally, North America maintains its dominance due to the presence of major financial hubs, high technology adoption rates, and a mature regulatory framework demanding sophisticated compliance solutions. Asia Pacific (APAC) is projected to exhibit the fastest growth, propelled by the rapid expansion of wealth management services in emerging economies like China and India, coupled with increasing foreign institutional investment flows that necessitate robust local portfolio tracking systems. Europe presents steady growth, primarily focused on compliance requirements stemming from directives such as MiFID II and PRIIPs, driving demand for comprehensive regulatory reporting features within PMS.

Segment trends highlight the leading position of the On-Premise deployment type currently, although Cloud deployment is rapidly gaining momentum and is expected to surpass On-Premise solutions within the forecast period, driven by operational flexibility and cost efficiency. Among end-users, the Wealth Management Firms segment remains the largest consumer base, utilizing PMS for tailored client advice and personalized investment strategies. However, the rise of Family Offices and Independent Financial Advisors (IFAs) as a demanding segment is pushing vendors to develop modular, scalable, and affordable solutions tailored to their specific operational needs and lower budget constraints.

AI Impact Analysis on Portfolio Management Software Market

Common user questions regarding AI's impact on Portfolio Management Software frequently revolve around the disruption of traditional analyst roles, the reliability of algorithmic trading recommendations, and the security implications of utilizing machine learning models on sensitive financial data. Users often inquire whether AI-driven PMS will lead to superior risk-adjusted returns compared to human-managed portfolios, and specifically how AI models handle extreme market volatility or "black swan" events. Furthermore, regulatory compliance related to autonomous decision-making and the explainability of AI (XAI) in investment strategies are significant concerns that users frequently raise, driving market expectations for transparent and auditable AI tools within PMS platforms.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming the capabilities and functional scope of Portfolio Management Software. AI algorithms now perform complex data aggregation and predictive modeling that far exceeds traditional quantitative analysis, enabling financial institutions to process vast amounts of structured and unstructured data, including market sentiment derived from news feeds and social media. This enhanced analytical capability allows for more dynamic asset allocation adjustments and highly personalized portfolio construction, moving beyond static models to proactive risk mitigation and opportunity identification.

Moreover, AI is dramatically improving operational efficiency within the back and middle office functions supported by PMS. Tasks such as trade reconciliation, compliance checks, data validation, and automated report generation are being streamlined, significantly reducing human error and operational costs. While AI adoption introduces challenges related to data quality and the need for specialized quantitative talent, its ability to offer truly bespoke client experiences and provide deep, forward-looking insights solidifies its role as the central innovation driver within the future of portfolio management.

- Enhanced Predictive Analytics: AI models forecast market movements and asset correlations more accurately than traditional statistical methods, optimizing tactical asset allocation.

- Automated Compliance Monitoring: Real-time surveillance systems utilizing AI flag potential breaches of investment mandates, regulatory limits (e.g., MiFID II), and internal risk policies instantly.

- Hyper-Personalized Client Portfolios: Machine learning algorithms analyze individual risk tolerance, goals, and behavioral patterns to construct portfolios dynamically tailored to each client.

- Improved Risk Management: AI identifies hidden or systemic risk factors by analyzing complex dependencies across global markets, leading to more robust stress-testing scenarios.

- Algorithmic Trading Execution: Integration of AI-driven execution management systems (EMS) within PMS minimizes slippage and optimizes trade routing for improved transaction costs.

- Natural Language Processing (NLP): Used to extract market sentiment from news articles, earnings reports, and regulatory filings, integrating qualitative factors into quantitative models.

- Operational Efficiency: Automation of data entry, reconciliation processes, and reporting cycles, reducing the manual workload for investment operations teams.

DRO & Impact Forces Of Portfolio Management Software Market

The Portfolio Management Software market is shaped by a confluence of driving forces, inherent limitations, and untapped growth opportunities, collectively dictating its trajectory. Key drivers include the exponential increase in global financial data volume, compelling firms to adopt sophisticated software for efficient data processing and insight generation, alongside the intensifying regulatory pressure requiring transparent and auditable record-keeping. Restraints primarily revolve around the high initial capital expenditure associated with implementing complex PMS solutions, particularly for smaller firms, and the inherent difficulty in migrating legacy systems and ensuring data integrity during the transition phase. Opportunities are vast, centered on the expansion of cloud-based SaaS offerings and the development of specialized PMS solutions targeting emerging high-growth segments like cryptocurrency portfolio management and Environmental, Social, and Governance (ESG) investing strategies.

Market growth is significantly impacted by the acceleration of digital transformation within financial institutions. The necessity for integrated front, middle, and back-office functionalities, provided by modern PMS platforms, has become non-negotiable for competitive efficiency. Furthermore, the rising popularity of robo-advisory services, which rely heavily on scalable, automated portfolio management engines, continues to expand the potential user base beyond traditional high-net-worth clients, democratizing access to professional investment management tools. This demand necessitates flexible, API-driven architectures that can support various investment models simultaneously.

The complexity of integrating modern, often cloud-native PMS with disparate, older core banking or custody systems presents a notable impact force, often leading to prolonged implementation cycles and unexpected costs. However, the sustained impact of technological advancements, particularly in AI and predictive analytics, serves as a powerful accelerator, promising a future where portfolio management is increasingly proactive and less reactive. Successfully navigating these forces—leveraging innovation while mitigating integration risks—will define the winners in the competitive landscape.

Segmentation Analysis

The Portfolio Management Software market is comprehensively segmented based on various technical and functional criteria, including Component, Deployment Type, Enterprise Size, and End-User. This granular segmentation allows market participants to tailor their solutions and marketing strategies to specific needs within the financial ecosystem. The Component segmentation distinguishes between pure software applications and accompanying services such crucial as implementation, consulting, and maintenance. Deployment options highlight the transition from traditional On-Premise infrastructure to highly flexible Cloud-based platforms. Analyzing the market by Enterprise Size reveals differential adoption patterns, with large enterprises focusing on highly customized, integrated solutions, while Small and Medium Enterprises (SMEs) prioritize cost-effective, readily available SaaS options. Finally, the End-User segmentation provides insight into the primary consumption drivers across wealth management, investment banking, and independent advisory sectors.

- By Component:

- Software

- Services (Consulting, Integration and Implementation, Support and Maintenance)

- By Deployment Type:

- On-Premise

- Cloud (SaaS, Private Cloud)

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By End-User:

- Investment Management Firms

- Wealth Management Firms

- Hedge Funds

- Banks and Financial Institutions

- Independent Financial Advisors (IFAs)

- Family Offices

Value Chain Analysis For Portfolio Management Software Market

The value chain for Portfolio Management Software is characterized by a series of specialized activities, starting from core technology development and culminating in end-user implementation and support. Upstream activities involve the development of core software modules, including data integration tools, quantitative analysis engines, and user interface design. This stage is dominated by specialized software vendors who invest heavily in R&D, focusing on incorporating the latest technologies like AI, blockchain for secure ledger tracking, and advanced cloud computing architectures to ensure scalability and robustness. Key considerations at this stage include intellectual property protection and securing access to reliable, real-time financial data feeds, which are often sourced from third-party market data providers.

Midstream activities encompass the distribution and deployment phases. Distribution channels are typically a mix of direct sales, particularly for large institutional clients requiring highly customized enterprise solutions, and indirect channels involving system integrators, value-added resellers (VARs), and strategic partnerships with global consulting firms. The rise of cloud deployment has streamlined this stage, allowing vendors to deliver software updates and maintenance services automatically via subscription models. Effective deployment requires specialized integration services to link the PMS platform with the client’s existing custodian systems, core banking platforms, and regulatory reporting infrastructure.

Downstream activities focus heavily on client servicing, maintenance, and ongoing optimization. This includes providing high-level technical support, implementing regulatory updates promptly, and offering consulting services to help financial firms maximize the utility of the software for performance attribution and risk modeling. Direct engagement via dedicated client success teams is critical, especially given the continuous evolution of financial products and regulatory frameworks. The value chain emphasizes efficiency in data handling and security at every step, ensuring the delivered solution provides tangible return on investment (ROI) through enhanced compliance, reduced operational costs, and improved investment performance.

Portfolio Management Software Market Potential Customers

The primary end-users and buyers of Portfolio Management Software span the entire spectrum of the financial services industry, ranging from large, multinational asset managers to small, independent financial advisory practices. Institutional investors, such as large pension funds and sovereign wealth funds, are critical buyers, requiring enterprise-grade solutions capable of managing highly complex, multi-asset global portfolios and adhering to stringent governance structures. Investment banks utilize PMS tools extensively within their asset management divisions and proprietary trading desks for real-time risk exposure monitoring and scenario planning, making them a high-value customer segment.

Wealth Management Firms and Private Banks constitute the largest segment of potential customers by volume. These institutions leverage PMS to provide highly personalized advice, manage bespoke client portfolios, and generate clear, consolidated performance reports tailored for high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals. The demand in this segment is increasingly focused on platforms offering robust client portals and mobility solutions, enabling advisors to engage clients effectively and securely across digital channels. The emphasis here is on user experience (UX) and seamless integration with CRM systems.

Furthermore, the growth of smaller, Independent Financial Advisors (IFAs) and dedicated Family Offices represents a significant and growing customer base for modular, subscription-based PMS platforms. These smaller entities seek solutions that are cost-efficient, easy to deploy (Cloud/SaaS preferred), and provide core functionality like automated billing, basic performance reporting, and regulatory filing support without the need for extensive in-house IT infrastructure. The fragmentation of the advisory market is thus accelerating the demand for scalable, accessible PMS solutions targeting the SME segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.85 Billion |

| Market Forecast in 2033 | $8.15 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SS&C Technologies, BlackRock (Aladdin), Fidelity National Information Services (FIS), Temenos AG, Qontigo (Deutsche Börse), Murex, SimCorp A/S, Profile Software, Misys (Finastra), BNY Mellon, InvestCloud, Broadridge Financial Solutions, EFront (BlackRock), Risk Management Solutions (RMS), Charles River Development (CRD), Enfusion, TIBCO Software, Calypso Technology, Portfolio Management International (PMI), FactSet Research Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portfolio Management Software Market Key Technology Landscape

The technological landscape of the Portfolio Management Software market is rapidly evolving, driven primarily by the need for better data handling, advanced computational power, and seamless integration capabilities. Cloud computing remains the foundational technology, with providers increasingly offering multi-tenant SaaS platforms that ensure high availability, elasticity, and simplified maintenance. This shift to the cloud facilitates faster deployment cycles and allows firms to pivot resources away from managing infrastructure towards core investment strategy. Security technologies, including advanced encryption methods, multi-factor authentication, and robust data isolation techniques, are paramount, especially as sensitive client and portfolio data are increasingly hosted off-premise.

Beyond cloud infrastructure, the integration of cutting-edge analytical tools is defining competitive differentiation. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are fundamental for advanced functionalities such as predictive performance attribution, automated risk monitoring, and the development of sophisticated quantitative investment models. Natural Language Processing (NLP) is also critical, used for analyzing vast textual data (e.g., regulatory filings, market news) to generate sentiment scores that feed directly into trading decisions. These technologies are moving PMS beyond simple record-keeping into strategic intelligence platforms.

Furthermore, Distributed Ledger Technology (DLT), including blockchain, is starting to gain traction, particularly in simplifying reconciliation processes and improving the transparency and security of asset ownership records. Open Banking initiatives and the widespread adoption of standardized Application Programming Interfaces (APIs) are essential, enabling PMS platforms to communicate effectively and securely with custodians, prime brokers, and external data vendors. This emphasis on connectivity and interoperability ensures that modern PMS acts as a central hub for the entire investment technology ecosystem.

Regional Highlights

- North America: This region holds the largest market share, driven by a highly mature financial services industry, stringent regulatory oversight (e.g., SEC regulations), and the early adoption of advanced fintech solutions. The presence of major vendors and large institutional asset managers in financial hubs like New York and Boston ensures sustained demand for high-end, integrated portfolio management systems. Innovation in AI and robo-advisory services also originates largely from this region, cementing its technological lead.

- Europe: Characterized by steady growth, the European market is heavily influenced by cross-border regulatory frameworks such as MiFID II and GDPR. This regulatory environment necessitates robust PMS platforms with highly developed compliance and reporting modules. The UK, Germany, and Switzerland are key contributors, with rising demand for solutions that simplify multi-jurisdictional reporting and support ESG integration into portfolio screening.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. Market expansion is fueled by rapidly increasing wealth creation in countries like China, India, and Southeast Asia, leading to a proliferation of wealth management and asset management firms. The push for digitalization, coupled with increasing foreign investment requiring sophisticated management tools, is driving demand for flexible, cloud-based solutions tailored to diverse local markets.

- Latin America (LATAM): Growth in LATAM is more moderate but accelerating, primarily centered in economic powerhouses like Brazil and Mexico. The market is evolving, moving away from manual processes towards automated solutions, driven by competitive pressures and the desire for greater operational efficiency. Adoption is often focused on core functionality and risk management, leveraging local vendors or global players offering regionally adapted solutions.

- Middle East and Africa (MEA): This region is experiencing nascent yet focused growth, spurred by institutional modernization efforts in sovereign wealth funds (SWFs) and large regional banks, particularly in the UAE and Saudi Arabia. The development of regional financial centers and the need for sophisticated risk and governance frameworks are key drivers, with cloud adoption beginning to overcome initial security and regulatory reservations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portfolio Management Software Market.- SS&C Technologies Holdings, Inc.

- BlackRock (Aladdin)

- Fidelity National Information Services (FIS)

- Temenos AG

- Qontigo (Deutsche Börse)

- Murex

- SimCorp A/S

- Profile Software

- Finastra

- BNY Mellon

- InvestCloud

- Broadridge Financial Solutions

- EFront (BlackRock)

- Risk Management Solutions (RMS)

- Charles River Development (CRD)

- Enfusion

- TIBCO Software

- Calypso Technology

- Portfolio Management International (PMI)

- FactSet Research Systems

Frequently Asked Questions

Analyze common user questions about the Portfolio Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Portfolio Management Software Market?

The primary driver is the accelerating need for financial institutions to comply with increasingly complex and evolving global regulatory mandates (e.g., MiFID II, Dodd-Frank). These regulations necessitate sophisticated, auditable, real-time reporting capabilities that only modern Portfolio Management Software (PMS) platforms can efficiently provide, thereby reducing operational risk and ensuring legal compliance.

How is the adoption of cloud deployment affecting the market competitive landscape?

Cloud deployment (SaaS) is democratizing access to professional PMS, intensely affecting the competitive landscape. It lowers the barrier to entry for Small and Medium Enterprises (SMEs) and Independent Financial Advisors (IFAs) by eliminating large upfront capital expenditure, forcing traditional on-premise vendors to rapidly transition to subscription-based, scalable cloud offerings focused on high interoperability and integration via open APIs.

Which geographic region is expected to show the highest growth rate (CAGR) in PMS adoption?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is fueled by substantial wealth creation, the institutionalization of local investment firms, and aggressive digital transformation initiatives across major financial hubs in countries such as China, India, and Singapore.

What role does Artificial Intelligence (AI) play in modern Portfolio Management Software?

AI plays a transformative role by enhancing predictive analytics, enabling automated risk management, and facilitating hyper-personalization of investment strategies. AI algorithms analyze vast datasets to identify non-obvious correlations, optimize asset allocation dynamically, and automate critical back-office functions, moving PMS from passive reporting tools to active decision-support systems.

What is the main challenge faced by firms adopting new Portfolio Management Software?

The main challenge is the complexity and cost associated with integrating the new PMS platform with existing legacy systems, particularly core banking, custody, and disparate data sources. Data migration, ensuring data integrity during the transition, and training staff on new complex interfaces represent significant operational hurdles that often extend implementation timelines and increase overall project costs.

The imperative for enhanced efficiency and robust compliance solutions remains the bedrock of demand, ensuring the Portfolio Management Software market's sustained expansion. As financial instruments become more intricate and regulatory frameworks evolve globally, the sophistication required from PMS platforms will only intensify. Future market leadership will be determined by providers who successfully leverage advanced technologies like AI/ML to offer scalable, secure, and fully integrated investment ecosystem management solutions.

The ongoing trend towards consolidation within the fintech sector means that established vendors are increasingly acquiring specialized smaller firms to rapidly integrate niche functionalities, such as specific ESG modeling or sophisticated alternative asset tracking capabilities, into their core offerings. This strategic maneuvering is aimed at providing 'all-in-one' platforms that reduce the need for multiple vendor solutions among institutional clients, simplifying IT overhead and strengthening vendor lock-in. Furthermore, the focus on user experience (UX) and intuitive interface design is becoming a critical competitive factor, recognizing that the efficiency gains promised by complex software must be accessible to end-users across various levels of technical expertise, from quantitative analysts to relationship managers.

Investment in cybersecurity remains a non-negotiable component of modern PMS development. Given the critical and confidential nature of the data managed—including client holdings, trade records, and proprietary investment strategies—firms demand platforms with resilience against sophisticated cyber threats. The adoption of technologies such as homomorphic encryption and secure multi-party computation is being explored to allow for analysis on encrypted data, offering a future path toward enhanced data privacy without compromising analytical depth. This continuous focus on data governance and security acts both as a restraining factor due to compliance costs and a critical enabling factor for enterprise-level adoption.

The market for Portfolio Management Software is increasingly specialized, segmented not just by deployment type but also by asset class focus. There is growing demand for dedicated systems optimized for alternative investments, including hedge funds with complex fee structures, private equity requiring waterfall calculations, and the emerging class of digital assets (cryptocurrencies). These niche requirements necessitate modular software architectures that can be configured specifically for the unique reporting, valuation, and regulatory considerations of these specialized asset types. Vendors who can quickly adapt their platforms to handle these non-traditional assets are gaining significant traction among innovative investment firms.

Regional dynamics continue to emphasize the need for localization. While North American and European firms focus on optimization and regulatory deep dives, the APAC and LATAM markets prioritize foundational deployment and achieving basic operational scale. This geographical disparity drives product development, requiring global vendors to offer tiered solutions—from lightweight, fast-to-deploy options for emerging markets to highly customized, enterprise-grade solutions for established financial centers. The success of a PMS platform relies heavily on its ability to integrate with local market data providers and comply with specific country-level financial reporting standards, illustrating the critical nature of robust implementation services in the global marketplace.

Finally, the growing environmental consciousness is manifesting as a tangible market demand for ESG integration tools within PMS. Investors increasingly mandate that their portfolios align with sustainability criteria, requiring software to screen investments, measure the carbon footprint of holdings, and generate comprehensive non-financial performance reports. This drives innovation in data sourcing and visualization, pushing vendors to partner with specialist ESG data providers. The ability of a PMS solution to seamlessly incorporate these metrics and attribute portfolio performance based on sustainability factors is rapidly becoming a standard requirement rather than a niche feature, fundamentally reshaping the software's functional scope and market value proposition.

The regulatory burden, particularly in the post-financial crisis era, has necessitated continuous expenditure on upgrading and replacing obsolete PMS infrastructure. The pressure to maintain real-time compliance checks across complex trading strategies and asset classes mandates the use of highly automated and intelligent systems. This environment creates a strong incentive for financial institutions to invest in integrated solutions that offer a unified view of risk and performance across the entire firm, moving away from disparate systems that often lead to data inconsistencies and reporting gaps. The consolidation of various front, middle, and back-office functions into a single PMS architecture is a major theme driving large-scale vendor selection processes.

Furthermore, the competitive landscape is being defined by the breadth of the ecosystem that a PMS provider can support. Open architecture platforms that facilitate easy integration with a variety of third-party applications—such as specialized risk modeling tools, alternative data providers, and tax optimization engines—are gaining favor. This open approach allows clients to build a 'best-of-breed' solution tailored to their specific investment philosophy without being locked into a single vendor's limitations. The availability of well-documented APIs and strong developer support is becoming a significant criterion in vendor selection, prioritizing flexibility and future-proofing in technological investment decisions.

The segment of Independent Financial Advisors (IFAs) and RIAs (Registered Investment Advisors) continues to present a high-growth opportunity for SaaS-based PMS providers. These smaller firms, often constrained by resources, require solutions that are intuitive, require minimal IT staff, and offer strong support for client relationship management alongside portfolio tracking. The emphasis is on automation features, particularly for rebalancing, fee calculation, and client onboarding, allowing advisors to focus more on client engagement rather than administrative tasks. This segment is driving innovation in user interfaces and mobile accessibility within the PMS domain.

Technological advancement is also being driven by the need for better data visualization capabilities. As data complexity increases, sophisticated graphical user interfaces (GUIs) are required to translate complex risk metrics, performance attribution analyses, and large-scale asset allocation insights into easily digestible formats for both portfolio managers and end-clients. Dashboards offering customizable, drill-down views and real-time alerts are essential features that enhance decision-making speed and client communication transparency. Vendors are utilizing modern web technologies and advanced data rendering techniques to meet these high expectations for clarity and speed.

The transition toward integrated data management solutions is also impacting the market. Modern PMS platforms are increasingly incorporating native functionalities for data warehousing and data governance, recognizing that the quality and consistency of input data are foundational to effective portfolio management. By offering centralized data control, these platforms reduce the reliance on separate data mastering solutions, offering a more streamlined and cost-effective approach to maintaining high-quality, actionable portfolio intelligence.

The demand for specialized risk management modules within PMS remains exceptionally high. Modern risk management extends beyond standard volatility and concentration risks to encompass liquidity risk, counterparty risk, and complex scenario stress testing often required by regulators. PMS vendors are embedding advanced quantitative models, including Monte Carlo simulations and proprietary optimization algorithms, directly into their platforms. This integration allows managers to proactively quantify and hedge various risk exposures instantaneously, improving the overall resilience of the managed portfolios against market shocks.

Finally, global vendors are strategically expanding their service offerings to include regulatory advisory and implementation support services. This holistic approach helps clients not only deploy the software but also navigate the intricate process of adhering to cross-border regulations. By offering bundled software and professional services, vendors position themselves as strategic partners rather than mere technology providers, strengthening client relationships and increasing the total value of the contract. This move towards 'solutions selling' is a defining characteristic of the high-end, institutional segment of the Portfolio Management Software Market.

The competitive differentiation is increasingly centered on the ability to handle heterogeneous data formats, especially given the influx of alternative data sources (e.g., satellite imagery, credit card transactions, social media feeds) utilized by sophisticated quantitative hedge funds. PMS must demonstrate extreme flexibility in ingesting, cleaning, and incorporating these unconventional datasets into traditional alpha-generation models. This requirement pushes the technological boundaries towards highly scalable data lake architectures and robust data governance frameworks integrated within the core portfolio engine.

The development cycle for new PMS features is being accelerated by agile methodologies and continuous integration/continuous deployment (CI/CD) pipelines. In the fast-paced financial technology sector, vendors cannot afford lengthy release cycles. Clients demand rapid updates to adapt to market structure changes, new financial products, and evolving regulatory interpretations. This operational agility is most effectively supported by cloud-native architectures, allowing vendors to push updates with minimal disruption to client operations, thereby enhancing the platform's reliability and perceived value.

Within the End-User segment, Institutional Investment Firms, particularly large pension funds and endowment funds, are focused on achieving stringent internal benchmarks and managing extremely long-term liabilities. Their demand focuses on highly complex performance attribution systems that can dissect returns across various managers, strategies, and time horizons, alongside robust liquidity management tools necessary for managing large, often illiquid, asset allocations. Customization and the ability to handle bespoke investment mandates are paramount for satisfying this demanding customer base, often requiring extensive implementation and consulting services.

The impact of distributed teams and global operations, particularly post-pandemic, has solidified the necessity for web-based, collaborative PMS platforms. Investment teams spanning multiple geographies require real-time access to consolidated portfolio information and tools that facilitate synchronized decision-making. Security protocols related to remote access, coupled with geographically compliant data hosting requirements, are critical design considerations. The market favors platforms that inherently support global regulatory and language requirements without necessitating separate instances or complex regional deployments.

Market segmentation based on Component reveals the increasing reliance on specialized services. While the core software remains the intellectual property, the successful implementation, integration, and ongoing optimization of PMS require high-level technical consultancy. The Services component, including tailored training, data migration support, and ongoing technical maintenance contracts, often constitutes a significant and growing portion of the total contract value, reflecting the complexity of integrating these enterprise systems into a client's established operational framework. This services revenue stream provides vendors with predictable, recurring income.

The emphasis on mobile functionality is increasing, particularly for wealth managers and IFAs who frequently interact with clients away from the office. Mobile applications linked to the core PMS provide advisors with secure, real-time access to client portfolios, performance dashboards, and the ability to run quick scenario analyses or initiate trade requests on the go. While institutional users require high-end desktop interfaces for deep analysis, the wealth management segment drives the need for highly secure, feature-rich mobile platforms designed for engagement and immediate data access.

The competitive differentiation for smaller PMS vendors often lies in targeting underserved segments or providing highly specialized integrations. For instance, some firms focus exclusively on fixed income or derivatives portfolio management, offering specialized calculation engines and analytical tools superior to generalist platforms in those specific asset classes. This niche specialization allows them to compete effectively against larger, integrated solution providers, though they often rely on partnerships to cover the broader front-to-back office functional requirements.

In summary, the Portfolio Management Software market is experiencing a profound technological and structural evolution. Driven by regulatory intensity, the proliferation of complex assets, and the transformative power of AI and cloud computing, the market continues its robust growth trajectory. Success for vendors hinges on providing integrated, secure, and technologically agile solutions that empower financial professionals to navigate market complexity, optimize performance, and maintain flawless compliance in an increasingly digital world.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager