Potassium Carbonate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441410 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Potassium Carbonate Market Size

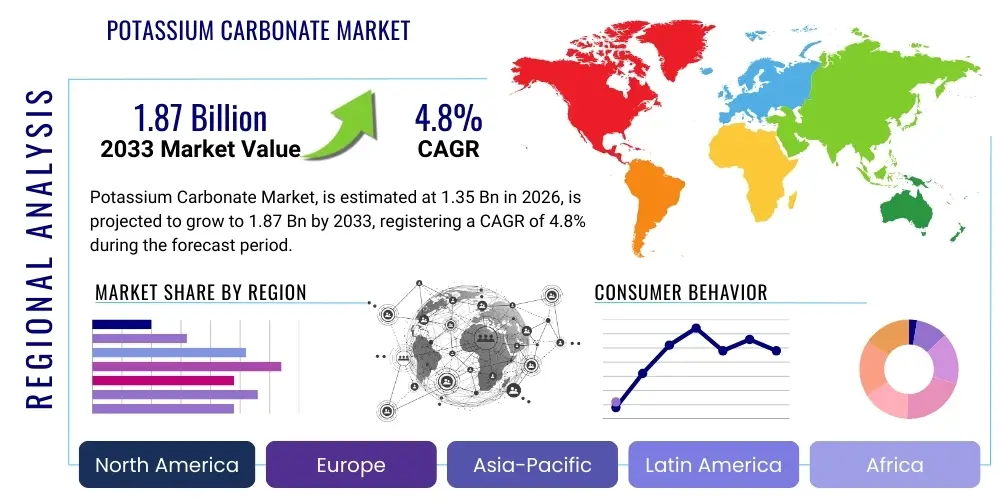

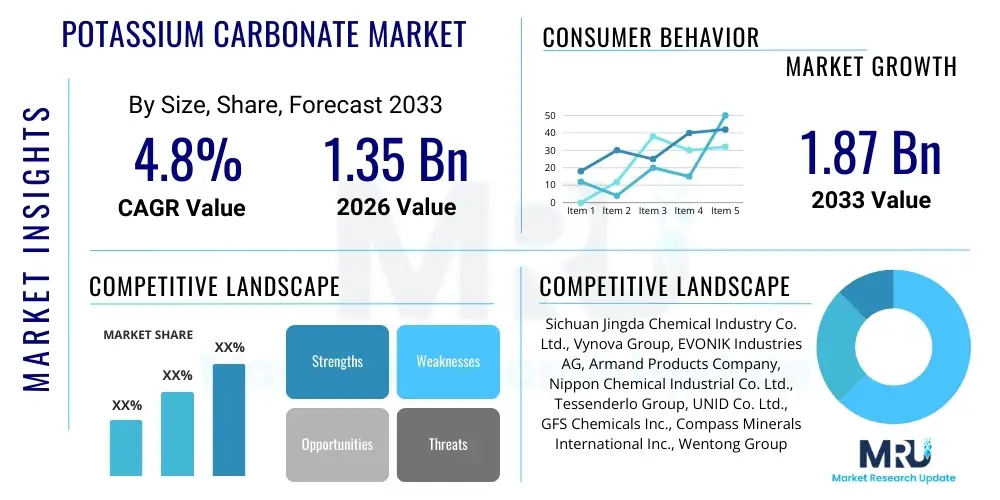

The Potassium Carbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 1.87 Billion by the end of the forecast period in 2033.

Potassium Carbonate Market introduction

Potassium Carbonate (K₂CO₃) is a white salt, soluble in water, and frequently used in its anhydrous form. It serves as a vital intermediate chemical in numerous industrial processes, recognized particularly for its non-chlorine composition which makes it preferable in sensitive agricultural and industrial applications. The production of potassium carbonate typically involves the reaction of potassium hydroxide (KOH) with carbon dioxide (CO₂). This compound’s increasing adoption is intrinsically linked to global industrialization, especially within glass manufacturing, where it improves clarity and stability, and in the production of high-quality liquid fertilizers that offer superior nutrient delivery without the risks associated with chloride ions. Market expansion is significantly driven by sustainable agricultural trends and the technological advancements in manufacturing methods that enhance purity and reduce production costs.

The product is highly versatile, finding critical applications across several major sectors. In agriculture, it functions primarily as a source of potassium, a macronutrient essential for plant growth, osmotic regulation, and enzyme activation. Its use in specialized fertilizers, such as potassium nitrate and monopotassium phosphate, is escalating due to rising global demand for efficient crop yields and limited arable land. Furthermore, potassium carbonate is indispensable in the pharmaceutical industry, often used as a buffering agent or an ingredient in effervescent tablets. Its role as a flux in the production of specialty glass, television tubes, and optical lenses provides a stable, high-value demand stream.

Key driving factors underpinning the market include the robust growth of the global agricultural sector, particularly in emerging economies where food security remains a primary concern, necessitating the use of high-efficacy fertilizers. The proliferation of electronic devices and advanced display technologies also fuels demand, as K₂CO₃ is critical for manufacturing specialized glass required for these applications. However, market dynamics are also influenced by fluctuating raw material prices, primarily potassium chloride and energy costs, which necessitate careful supply chain management. Despite these challenges, the unique benefits of potassium carbonate—such as its low toxicity and effectiveness in various chemical reactions—ensure sustained demand, solidifying its position as a cornerstone chemical in the industrial landscape.

Potassium Carbonate Market Executive Summary

The Potassium Carbonate Market is poised for steady growth, driven primarily by strong demand from the agricultural sector, particularly for high-quality, non-chloride-based liquid fertilizers, and sustained expansion in the electronics and specialty glass manufacturing industries. Business trends indicate a shift towards localized production and the establishment of robust supply chain networks to mitigate geopolitical risks and raw material volatility. Key manufacturers are focusing on capacity expansion and operational efficiencies, particularly utilizing energy-saving technologies like membrane cell processes, to maintain competitive pricing. Strategic alliances and long-term contracts with major end-users, especially fertilizer producers and glass makers, are defining the competitive landscape. Innovation in product delivery, such as offering finer grades for specialized catalyst applications, is also contributing significantly to market value capture.

Regionally, Asia Pacific (APAC) currently dominates the market and is projected to exhibit the highest growth rate during the forecast period. This dominance is attributed to rapid industrialization, massive investments in infrastructure (including electronics manufacturing hubs), and the overwhelming need for increased agricultural output in countries like China and India. North America and Europe, while mature markets, maintain significant demand due to stringent environmental regulations favoring non-chloride potassium sources and robust specialty chemical and pharmaceutical sectors. The European Union’s focus on sustainable agriculture acts as a powerful catalyst for high-purity potassium carbonate usage. Latin America is emerging as a significant market, driven by its large agricultural base and increasing adoption of modern farming techniques, necessitating advanced fertilizer compounds.

In terms of segmentation, the powdered form holds the largest share due to its versatility and ease of handling in dry applications, including fertilizer blends and catalyst preparation. However, the liquid form is gaining momentum rapidly, driven by the increasing popularity of fertigation and foliar spray applications in precision agriculture. Application-wise, the fertilizer segment remains the primary revenue generator, but the glass and ceramics segment, especially specialty glass for high-definition displays and optical fibers, shows superior value growth potential. The technical grade of potassium carbonate accounts for the majority of the market volume, primarily due to its widespread use in industrial fluxes and general chemical synthesis, while the high-purity and food grades command a premium price point due to their mandatory adherence to strict regulatory standards for pharmaceutical and food applications.

AI Impact Analysis on Potassium Carbonate Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Potassium Carbonate market frequently revolve around themes of operational efficiency, raw material price prediction, and optimized application in precision agriculture. Users are concerned with how AI can mitigate supply chain risks, forecast demand fluctuations based on global agricultural trends, and optimize the energy-intensive production process of K₂CO₃. Key expectations center on predictive maintenance for manufacturing equipment, enhancing the purity yield through data-driven process control, and leveraging AI-powered sensors in smart farms to precisely determine the optimal dosage and timing for potassium carbonate-based fertilizers, thereby reducing waste and environmental impact. Furthermore, there is significant interest in using AI for rapid quality control and identification of contaminants in high-purity grades required by the pharmaceutical and food industries, ensuring compliance and market safety.

- Supply Chain Resilience: AI algorithms enhance supply chain management by predicting potential disruptions, optimizing inventory levels of key precursors (like KOH and CO₂), and establishing dynamic sourcing strategies for potassium chloride feedstock, minimizing costly delays and ensuring stable production outputs.

- Optimized Manufacturing Processes: Machine learning models are deployed to analyze real-time sensor data from reactors and crystallizers, enabling precise control over temperature, pressure, and concentration, leading to optimized energy consumption, reduced chemical waste, and increased yield of high-ppurity potassium carbonate.

- Precision Agriculture Integration: AI-driven agronomy platforms utilize satellite imagery and soil data to recommend tailored fertilization schedules using K₂CO₃-based compounds, ensuring maximum nutrient uptake by crops, reducing fertilizer overuse, and improving overall farming profitability, thereby stimulating demand for specialized grades.

- Market Demand Forecasting: AI analyzes macro-economic indicators, climate patterns, and global food consumption trends to provide highly accurate forecasts for potassium carbonate demand in the agricultural and industrial sectors, allowing manufacturers to adjust production capacity proactively.

- Quality Control and Inspection: Computer vision and advanced data analysis are used for non-destructive quality inspection of finished potassium carbonate products, ensuring compliance with strict specifications required for pharmaceutical and electronic applications, and automating contaminant detection in real-time.

DRO & Impact Forces Of Potassium Carbonate Market

The Potassium Carbonate market dynamics are profoundly shaped by significant Drivers, persistent Restraints, and lucrative Opportunities. A primary driver is the accelerating trend toward sustainable and precision agriculture globally. As farmers seek higher yields from limited land, the adoption of specialized, non-chloride fertilizers, derived from potassium carbonate, becomes paramount. Simultaneously, the burgeoning demand for high-end electronics, including smartphones, OLED screens, and specialized optics, which require K₂CO₃ for specialty glass production, provides robust industrial demand. These structural demands ensure continued market growth, irrespective of minor economic downturns. Additionally, potassium carbonate's role as a mild alkalinizing agent in environmental applications, such as flue gas desulfurization (FGD), is also contributing to its diversified market portfolio, especially in regions with strict air quality regulations.

Conversely, the market faces considerable restraints. The intense price volatility of raw materials, particularly potassium chloride (MOP) and potassium hydroxide (KOH), significantly impacts production costs and profit margins for manufacturers. Furthermore, the production of K₂CO₃ is energy-intensive, and rising global energy prices put upward pressure on the final product cost, sometimes leading end-users to seek cheaper, albeit less effective, substitutes like sodium carbonate in certain low-grade applications. Regulatory challenges concerning chemical handling, storage, and disposal, although necessary for safety, add complexity and operational expenditure for market players. Competition from low-cost producers, particularly in regions with limited environmental enforcement, also poses a threat to established high-purity suppliers.

Opportunities in the market center around innovation in downstream applications and geographical expansion. The growing pharmaceutical and food industries present opportunities for high-purity and pharmaceutical-grade potassium carbonate, which fetch significantly higher margins. Investment in R&D aimed at developing more energy-efficient production technologies, such as improved carbonation or crystallization processes, offers a path to competitive advantage. Geographically, emerging economies in Africa and Southeast Asia, characterized by rapid urbanization and expansion of commercial farming, represent untapped potential for market entry. The push toward developing potassium batteries for energy storage could also emerge as a long-term transformative opportunity, although currently, this application remains niche. The combined effect of these forces—strong application demand counterbalanced by raw material and energy cost pressures—results in a moderately high positive impact on overall market growth.

Segmentation Analysis

The Potassium Carbonate Market is comprehensively segmented based on its grade, form, and primary application, allowing for a detailed understanding of market dynamics and revenue generation across various industrial sectors. This multi-dimensional segmentation highlights the critical differences in purity requirements, physical state preferences, and final consumption industries. The Grade segment—comprising Technical, Food, and Pharmaceutical—is particularly insightful, as it reflects the stringent regulatory standards and price sensitivity associated with end-use. Technical grade dominates volume, driven by high consumption in glass and chemical synthesis, whereas Pharmaceutical and Food grades command superior pricing due to the necessity of high purity and compliance with international safety protocols. The market’s segmentation reveals a dual pattern: high volume in industrial applications and high value derived from specialized, sensitive applications.

Analyzing the market by Form—Powder, Granular, and Liquid—shows distinct consumer preferences linked to ease of use and application method. Powder remains the standard for dry mixing and certain chemical reactions due to its high surface area. However, the Liquid segment is experiencing the fastest growth, primarily due to the global shift towards precision farming techniques such as fertigation (applying fertilizer through irrigation systems) and foliar sprays, where liquids offer superior absorption and dispersion. The Application segmentation clearly defines the primary demand vectors, with Fertilizers leading by a significant margin due to global food demand and the shift to non-chloride nutrient sources. Following fertilizers, the Glass and Ceramics sector represents a stable, high-volume consumer, particularly for specialized optical and electronic glass where K₂CO₃ acts as a critical fluxing agent to achieve high refractive index and excellent clarity.

The strategic analysis of these segments is crucial for market stakeholders, enabling tailored marketing strategies and product development focus. For instance, manufacturers targeting the fast-growing electronics sector must prioritize investing in purification technologies to meet the extreme purity requirements of the Glass segment, while those focusing on agriculture must optimize logistics for bulk handling and distribution of both powdered and liquid forms. Understanding the regional consumption patterns within these segments—such as high fertilizer demand in APAC and high pharmaceutical demand in North America and Europe—further refines competitive strategy and resource allocation, optimizing profitability across the diverse application landscape.

- By Grade

- Technical Grade

- Food Grade

- Pharmaceutical Grade

- By Form

- Powder

- Granular

- Liquid

- By Application

- Fertilizers

- Glass and Ceramics

- Detergents and Soaps

- Food Additives

- Pharmaceuticals

- Dyes and Pigments

- Other Chemical Applications (e.g., Flue Gas Desulfurization, Catalysts)

Value Chain Analysis For Potassium Carbonate Market

The value chain for the Potassium Carbonate market begins with the procurement of essential raw materials, primarily high-purity potassium chloride (MOP) or potassium hydroxide (KOH), and carbon dioxide (CO₂). The upstream segment is dominated by large mining corporations and chlor-alkali producers. Access to reliable and cost-effective supplies of MOP and KOH is a key determinant of competitive advantage, as these materials constitute a significant portion of the final product cost. Manufacturers who are vertically integrated, often owning the potassium mining operations or co-located with chlorine-alkali plants, benefit from lower logistical costs and greater control over material quality and stability. The quality of the upstream process dictates the purity level of the intermediate potassium hydroxide, which in turn affects the final grade achievable for potassium carbonate, especially critical for pharmaceutical and electronic applications.

The midstream segment involves the manufacturing process itself, typically executed through methods such as the Engel process or, more commonly today, reacting CO₂ with high-purity potassium hydroxide. This phase is characterized by high capital expenditure, significant energy consumption, and the need for sophisticated purification and crystallization techniques to produce the desired grades and forms (powder, granular, liquid). Manufacturers focus intensely on optimizing energy usage and maximizing yield purity to enhance profitability. Following production, the logistics and distribution segment takes over. Due to potassium carbonate being a specialty chemical with specific handling requirements, established distribution channels that ensure safe and timely delivery are crucial. Direct sales are common for large industrial buyers (e.g., major fertilizer companies or glass manufacturers), establishing long-term, direct contractual relationships that ensure supply stability.

The downstream segment encompasses the various end-user industries. The product reaches end-users both directly and indirectly. Direct distribution is favored when supplying large volume users like major fertilizer formulators or specialty glass production facilities, allowing manufacturers to maintain better price control and direct customer relationships. Indirect distribution involves reliance on regional chemical distributors, specialty compounders, and wholesalers, particularly for reaching smaller consumers, such as regional paint manufacturers, local food processors, or small pharmaceutical companies. The final consumers, which include farmers, glass fabricators, detergent makers, and drug formulators, drive the demand specifications. Feedback from the downstream sector regarding particle size, solubility, and contamination levels directly influences the upstream production adjustments, completing the cycle and ensuring the final product meets the diverse, evolving requirements of the global market.

Potassium Carbonate Market Potential Customers

Potential customers for the Potassium Carbonate Market are highly diverse, spanning essential sectors such as agriculture, manufacturing, healthcare, and food processing, each demanding specific grades and forms of the chemical. The largest group of customers consists of fertilizer manufacturers and formulators who purchase large volumes of technical grade K₂CO₃, primarily for producing liquid and water-soluble specialty fertilizers like potassium nitrate or blending it into custom NPK mixtures. These customers prioritize high solubility, rapid nutrient availability, and the non-chloride nature of the compound, which is essential for high-value or salt-sensitive crops. The increasing global focus on high-efficiency fertigation systems further solidifies these agricultural companies as the cornerstone buyers, demanding consistent supply and competitive pricing for bulk procurement.

The second major cohort comprises specialty glass and ceramics manufacturers, particularly those involved in producing advanced display screens (OLED, LCD), optical fibers, scientific laboratory equipment, and cathode ray tubes (though diminishing). These customers require very high-purity potassium carbonate, as impurities can drastically impair the optical clarity and electrical properties of the final glass product. For them, purity, consistency, and particle size distribution are paramount, often overriding cost considerations. The electronics industry’s persistent innovation cycle ensures sustained, premium demand from this segment. Furthermore, the pharmaceutical and food and beverage industries represent smaller volume but high-value customers, requiring meticulously purified and regulated Food Grade or Pharmaceutical Grade K₂CO₃. They use it as an alkalizing agent, buffering agent, or leavening agent (in food), prioritizing regulatory compliance (e.g., USP, FCC standards) and comprehensive quality documentation.

Other crucial segments include producers of detergents and soaps, where potassium carbonate is used as a builder or softener, especially in liquid and soft soap formulations, and chemical synthesis companies utilizing it as a mild base or drying agent in the production of various dyes, pigments, and fine chemicals. Furthermore, environmental technology companies that employ K₂CO₃ in flue gas desulfurization and carbon capture processes are emerging customers, driven by global environmental mandates. The purchasing decisions across these diverse customer bases are guided by specific parameters: agriculture seeks bulk supply and low chloride content; electronics demands ultra-high purity; and pharmaceuticals mandate certified compliance and minimal microbial load, compelling suppliers to tailor their offerings rigorously.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 1.87 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sichuan Jingda Chemical Industry Co. Ltd., Vynova Group, EVONIK Industries AG, Armand Products Company, Nippon Chemical Industrial Co. Ltd., Tessenderlo Group, UNID Co. Ltd., GFS Chemicals Inc., Compass Minerals International Inc., Wentong Group, Shanxi Leixin Chemical Co. Ltd., Sociedad Química y Minera de Chile (SQM), ICL Group Ltd., Haifa Group, Henan Xinfa Chemical Co. Ltd., Wuxi Yueda Chemical Co. Ltd., Qingdao Hanpu Chemical Co. Ltd., Jiangsu Jingye Chemical Co. Ltd., Sinofert Holdings Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Potassium Carbonate Market Key Technology Landscape

The manufacturing technology landscape for potassium carbonate is characterized by mature chemical processes undergoing incremental optimization to improve purity, yield, and energy efficiency. Historically, the traditional methods like the Engel process involved complex reaction steps, but modern production predominantly relies on reacting high-purity potassium hydroxide (KOH) solution with carbon dioxide (CO₂) to achieve direct carbonation. This process is favored because it allows for easier control over impurities and is highly adaptable to creating the ultra-high purity grades required by sensitive end-use sectors like electronics and pharmaceuticals. Key technological improvements focus on enhancing the efficiency of the CO₂ absorption and the subsequent crystallization and drying phases. Specifically, manufacturers are employing advanced heat exchangers and vacuum crystallizers to minimize energy consumption, which is critical given the volatile cost of utilities.

A significant technological focus area involves the purification and separation processes, especially for achieving Pharmaceutical and Food Grade K₂CO₃. Techniques such as multi-stage crystallization, ion exchange, and membrane filtration are essential for removing trace heavy metals and chloride ions, ensuring the product meets stringent international regulatory standards (e.g., European Pharmacopoeia, US Food Chemical Codex). The ability of a manufacturer to consistently produce these high-purity grades dictates their market positioning and ability to capture premium value segments. Furthermore, advancements in process control, heavily leveraging automation and sensor technology, ensure batch-to-batch consistency. These sophisticated control systems minimize human error, reduce batch failure rates, and provide instantaneous feedback for process adjustment, contributing significantly to operational excellence and cost reduction.

Looking ahead, emerging technological developments are centered around sustainable manufacturing and the circular economy. This includes exploring methods to source CO₂ from industrial waste streams (carbon capture and utilization), which not only provides a cheaper raw material but also aligns with environmental sustainability goals. Another area of R&D is the potential use of microreactor technology for continuous synthesis, which could offer enhanced reaction kinetics and tighter control over particle size distribution compared to traditional large batch reactors. While currently nascent, these innovative approaches promise further reductions in energy input and improvements in product quality, solidifying the market's trajectory towards sustainable and highly efficient chemical production methods.

Regional Highlights

The global Potassium Carbonate market exhibits significant variation in demand and supply dynamics across key geographical regions, with Asia Pacific (APAC) currently dominating both consumption and production capacity. The robust growth in APAC is underpinned by several factors: rapidly expanding agricultural sectors in countries like India and Southeast Asia striving for food security; massive infrastructure development fueling demand for construction chemicals; and, most crucially, the region’s status as a global manufacturing hub for electronics (including displays, mobile devices, and optical components) which rely heavily on high-purity K₂CO₃ for specialty glass production. China, in particular, possesses vast production capacity and strong internal demand, setting the pace for regional market trends. The shift toward modern, precision farming techniques in Australia and Japan also contributes to the increased requirement for liquid and non-chloride potassium fertilizers, driving value growth in the specialized segments.

North America and Europe represent mature, high-value markets characterized by stringent regulatory environments and a strong emphasis on specialized applications. In North America, demand is stable, driven by the pharmaceutical industry (requiring ultra-high purity grades), specialized chemical synthesis, and steady consumption in niche agriculture, particularly for high-value crops where superior nutrient quality is prioritized. European consumption is similarly focused on quality, heavily influenced by EU regulations promoting sustainable fertilizers and chemicals, which favors potassium carbonate over lower-cost, chloride-containing alternatives. The advanced glass manufacturing and automotive sectors in Germany and other Western European nations ensure continuous demand for technical grade K₂CO₃. Although volume growth is slower than in APAC, these regions command premium prices due to the requirement for certified, high-standard materials and predictable supply chains, maintaining high revenue contribution.

The Latin America (LATAM) and Middle East & Africa (MEA) regions are emerging markets showcasing high growth potential, albeit from a smaller base. LATAM's growth is inherently linked to its expansive agricultural output, where countries like Brazil and Argentina are significantly increasing their use of compound fertilizers to boost crop yields for global export. The adoption of modern farming practices is accelerating here, driving demand for imported or locally produced specialty fertilizers containing K₂CO₃. In the MEA region, market growth is primarily spurred by investments in local chemical manufacturing and diversification efforts away from oil economies. The limited water resources in the Middle East drive the need for efficient irrigation techniques (like drip irrigation and fertigation), which subsequently boosts the requirement for liquid potassium fertilizers. While local production infrastructure is less developed compared to APAC, increasing foreign direct investment in chemical processing capacity signals future expansion. These dynamics necessitate global producers to tailor their logistical and product offerings specifically to address the unique agricultural and industrial development trajectories of these high-potential regions.

- Asia Pacific (APAC): Dominates the market in volume and growth rate, fueled by electronics manufacturing expansion and intensive agriculture (China, India).

- North America: Stable market with high demand from pharmaceutical, specialty chemical, and advanced glass industries; strict regulatory adherence drives premium pricing.

- Europe: Characterized by high-value consumption, driven by sustainable agriculture mandates and sophisticated industrial applications, including high-end automotive glass and advanced ceramics.

- Latin America (LATAM): High growth potential linked to expanding commercial agriculture (Brazil, Argentina) and increasing adoption of efficiency-enhancing fertilizers.

- Middle East and Africa (MEA): Emerging market with growing demand driven by necessity for water-efficient farming methods (fertigation) and nascent local chemical production capacity investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Potassium Carbonate Market.- Sichuan Jingda Chemical Industry Co. Ltd.

- Vynova Group

- EVONIK Industries AG

- Armand Products Company

- Nippon Chemical Industrial Co. Ltd.

- Tessenderlo Group

- UNID Co. Ltd.

- GFS Chemicals Inc.

- Compass Minerals International Inc.

- Wentong Group

- Shanxi Leixin Chemical Co. Ltd.

- Sociedad Química y Minera de Chile (SQM)

- ICL Group Ltd.

- Haifa Group

- Henan Xinfa Chemical Co. Ltd.

- Wuxi Yueda Chemical Co. Ltd.

- Qingdao Hanpu Chemical Co. Ltd.

- Jiangsu Jingye Chemical Co. Ltd.

- Sinofert Holdings Ltd.

- Mitsui Chemicals Inc.

Frequently Asked Questions

Analyze common user questions about the Potassium Carbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the increasing demand for Potassium Carbonate in the fertilizer segment?

The primary driving factor is the global transition towards precision agriculture and the need for non-chloride potassium sources. Potassium Carbonate-based fertilizers, being chloride-free, prevent salt accumulation in soil, making them ideal for sensitive, high-value crops and efficient fertigation systems, thereby optimizing nutrient delivery and crop yield in modern farming practices globally.

How does the production of specialty glass influence the Potassium Carbonate Market?

Specialty glass manufacturing, particularly for electronic displays, optical lenses, and pharmaceutical vials, heavily relies on high-purity Potassium Carbonate (K₂CO₃). K₂CO₃ acts as a fluxing agent, lowering the melting point and enhancing the refractive index, clarity, and chemical stability of the glass. The persistent global growth of the consumer electronics industry ensures a continuous, high-value demand stream for ultra-pure technical grades of K₂CO₃.

Which geographical region holds the largest market share and why is it expected to grow the fastest?

Asia Pacific (APAC), led by China and India, holds the largest market share. This region is projected to grow the fastest due to massive investments in electronics manufacturing and the compelling need to improve agricultural output for rapidly increasing populations. Strong government support for modern manufacturing and farming techniques further accelerates the consumption of both industrial and fertilizer grades of Potassium Carbonate in the APAC region.

What are the main technical challenges faced by manufacturers in the Potassium Carbonate market?

Key technical challenges include managing the high energy intensity required for the carbonation and drying processes, ensuring stable and cost-effective procurement of volatile raw materials (Potassium Chloride and KOH), and achieving the extreme purity levels demanded by the pharmaceutical and electronics sectors. Manufacturers must continuously invest in process optimization and advanced purification technologies to maintain profitability and regulatory compliance.

What is the difference in application and value between Technical Grade and Pharmaceutical Grade Potassium Carbonate?

Technical Grade Potassium Carbonate is used in high-volume industrial applications like glass manufacturing, general chemical synthesis, and basic fertilizer blends, and it typically commands a lower price. Pharmaceutical Grade, conversely, is subjected to rigorous purity testing for minimal contaminants (like heavy metals) and is used in low volume, high-value applications such as buffering agents and effervescent tablet formulation in the healthcare sector, consequently commanding a significant price premium.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager