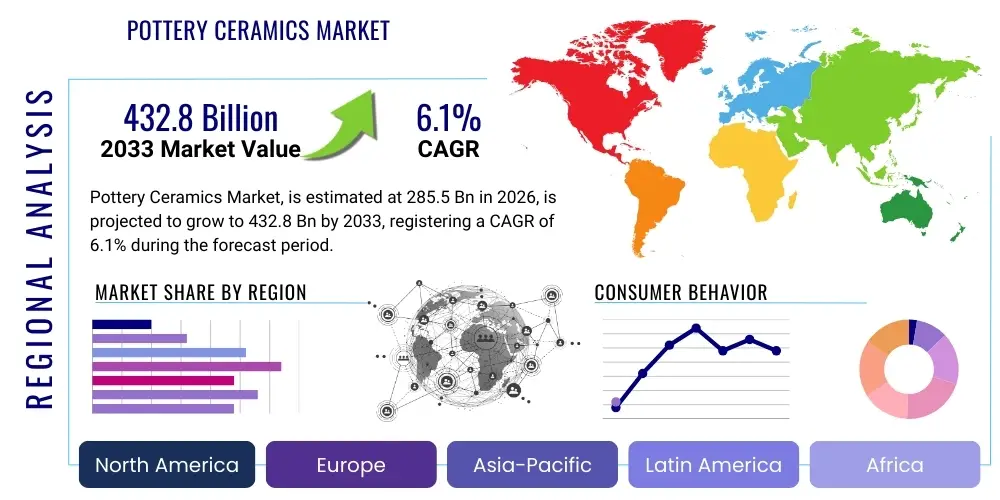

Pottery Ceramics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442962 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Pottery Ceramics Market Size

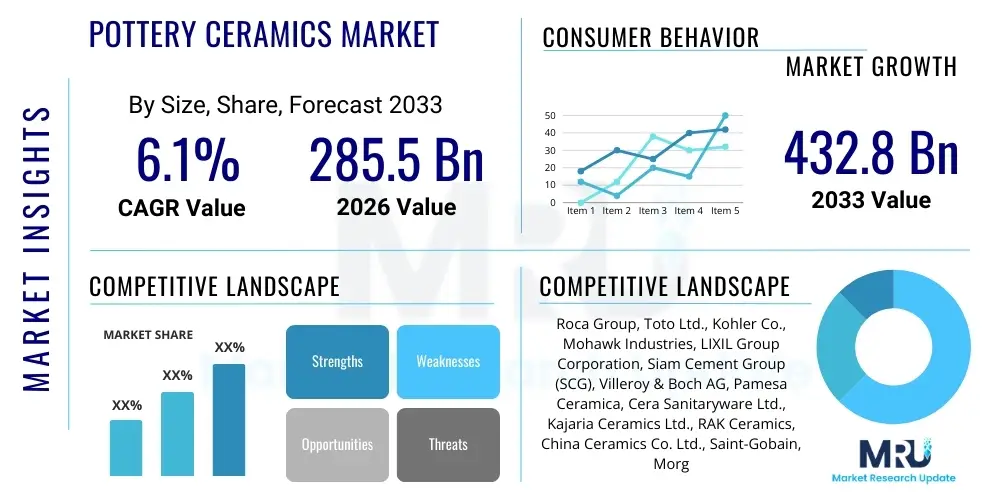

The Pottery Ceramics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 285.5 Billion in 2026 and is projected to reach USD 432.8 Billion by the end of the forecast period in 2033. This steady expansion is largely driven by escalating urbanization rates globally, particularly across emerging economies in Asia Pacific, which fuels demand for ceramic tiles, sanitary ware, and other essential construction components. Furthermore, the increasing consumer preference for aesthetically pleasing and high-durability tableware and decorative pottery is contributing significantly to the residential segment's growth, ensuring robust market trajectory over the next decade.

Market valuation reflects the diverse application portfolio of pottery ceramics, spanning traditional uses in art and functional ware to advanced applications in industrial settings. The core market includes structural ceramics (bricks, tiles), sanitary ware (toilets, sinks), and traditional pottery (tableware, decorative arts). The shift towards high-performance materials in construction, emphasizing low-maintenance and long-lasting finishes, structurally supports the ceramics sector. Manufacturers are increasingly adopting energy-efficient firing techniques and incorporating recycled materials to meet stringent environmental regulations and consumer sustainability demands, thereby opening new avenues for growth and specialization.

The market dynamics are highly influenced by global macroeconomic conditions, particularly infrastructure spending and the housing market health. While raw material cost fluctuations (clay, feldspar, silica) pose occasional constraints, continuous advancements in glazing technology and automated production systems are enhancing operational efficiency and product quality. The anticipated CAGR of 6.1% accounts for both traditional segment stability and rapid expansion in premium and technical ceramics used in automotive, electronics, and medical industries, where strict tolerance and high thermal resistance are critical requirements, diversifying the overall revenue streams of the market.

Pottery Ceramics Market introduction

The Pottery Ceramics Market encompasses the production, distribution, and sale of finished products derived primarily from clay, fired at high temperatures to achieve permanence and hardness. Products range from functional household items like tableware, mugs, and vases, to large-scale industrial goods such as bricks, roofing tiles, sanitary ware, and sophisticated technical ceramics utilized in demanding environments. Major applications include residential and commercial construction, interior decoration, utilities infrastructure, and specialized industrial sectors like electronics and healthcare. The inherent durability, chemical resistance, aesthetic versatility, and thermal stability of ceramics make them irreplaceable across numerous end-use sectors, solidifying their fundamental role in modern infrastructure and daily life.

Key driving factors propelling market expansion include rapid global urbanization leading to increased construction activities, rising disposable incomes in emerging markets spurring demand for premium and decorative pottery, and technological innovations enhancing material strength and manufacturing precision. Moreover, the inherent benefits of pottery ceramics, such as their longevity, ease of cleaning, and relatively low environmental impact compared to plastics (when considering product lifespan), contribute significantly to their sustained market relevance. Advances in digital printing technologies are enabling manufacturers to produce complex, highly customized decorative patterns on tiles and tableware, catering to evolving consumer design preferences and expanding the market’s aesthetic potential.

The product landscape is broadly categorized into structural clay products, sanitary ware, tiles, refractories, and advanced ceramics. While the construction segment remains the largest volume consumer, the fastest growth is observed in the fine ceramics and advanced technical ceramics segments, driven by stringent performance requirements in aerospace and high-temperature industrial applications. The market is characterized by a mix of large international corporations leveraging scale and automation, and numerous small-to-medium enterprises focusing on niche artistic or artisanal pottery, ensuring a competitive and diversified supply chain catering to global consumer and industrial needs effectively.

Pottery Ceramics Market Executive Summary

The Pottery Ceramics Market is poised for substantial growth, underpinned by strong business trends focusing on sustainability and automation, favorable regional trends centered in the Asia Pacific construction boom, and segment trends prioritizing performance and aesthetic customization. Business trends highlight a significant shift towards Industry 4.0 integration, utilizing automated kilns, robotic handling systems, and advanced process control to improve yield, reduce energy consumption, and ensure consistent product quality. Furthermore, increasing regulatory pressure concerning emissions and waste management is driving investment in closed-loop manufacturing systems and the development of sustainable, low-firing temperature ceramic bodies, presenting both a challenge and an opportunity for established manufacturers to innovate their production models and achieve greener certifications.

Regionally, Asia Pacific maintains its dominance, driven by massive governmental investments in infrastructure development, coupled with a booming residential sector across countries like China, India, and Southeast Asia. This region not only serves as the largest consumer but also as the primary global manufacturing hub, leveraging lower operational costs and abundant raw material supply. Conversely, mature markets in North America and Europe emphasize premium, designer ceramics and high-specification technical ceramics, often incorporating smart technology features such as self-cleaning or antimicrobial surfaces in sanitary ware, reflecting higher disposable income and specialized industrial needs. Latin America and MEA are experiencing gradual growth, closely tied to fluctuations in commodity prices and localized construction project cycles.

Segment trends reveal robust demand across all major categories. The ceramic tiles segment is benefiting from renovation activities and new construction, particularly with large-format and thin-profile tiles gaining popularity due to ease of installation and modern appearance. The tableware segment is witnessing a bifurcation: growth in disposable, durable foodservice ceramics and simultaneous growth in high-end, handcrafted artisanal pottery driven by consumer desire for unique, personalized home décor. The technical ceramics segment—including alumina, zirconia, and silicon carbide—is exhibiting exceptional growth owing to their indispensable use in electric vehicles, semiconductor manufacturing, and advanced medical implants, demanding materials with superior mechanical and electrical properties, thus representing the most valuable high-margin segment in the forecast period.

AI Impact Analysis on Pottery Ceramics Market

Analysis of common user questions regarding AI's impact on the Pottery Ceramics Market reveals key themes centered around manufacturing efficiency, design innovation, and supply chain responsiveness. Users frequently ask: "How can AI optimize kiln firing schedules to reduce energy consumption and defects?" and "Will AI generative design tools replace traditional ceramic artists or enhance their capabilities?" There are significant concerns about the initial investment required for AI implementation in traditionally low-tech manufacturing environments, alongside expectations that AI will solve persistent material science challenges, such as predicting shrinkage and warpage during firing. The general consensus points toward AI becoming a critical tool for minimizing waste, enhancing personalized mass production, and ensuring product consistency across global operations, thereby significantly improving profit margins and accelerating new product development cycles.

The primary influence of Artificial Intelligence lies in predictive maintenance and quality control within manufacturing. AI-powered vision systems are deployed on production lines to detect minute surface flaws, color variations, and dimensional inaccuracies in real-time, far surpassing the capabilities of human inspectors. Furthermore, Machine Learning algorithms are proving invaluable in optimizing complex parameters within the firing process. Kiln performance is often erratic due to fuel source variability and atmospheric changes; AI models analyze sensor data (temperature profiles, humidity, gas consumption) to dynamically adjust controls, ensuring optimal firing curves for maximum material integrity and energy efficiency, which is crucial given the high thermal energy requirements of ceramic production.

Beyond the factory floor, AI is transforming ceramic design and raw material sourcing. Generative Adversarial Networks (GANs) are beginning to assist designers in rapidly exploring thousands of novel glaze combinations and complex 3D surface textures that adhere to manufacturing constraints, significantly shortening the product design lifecycle. In the supply chain, AI algorithms analyze market demand fluctuations and geopolitical risks to optimize the procurement of critical raw materials (e.g., specific clays, pigments, and stabilizers), ensuring just-in-time inventory management and reducing logistical bottlenecks, thereby enhancing the overall resilience and profitability of the pottery ceramics supply chain ecosystem globally.

- AI-driven optimization of kiln firing cycles reduces energy consumption by 15-25%.

- Predictive maintenance using ML algorithms minimizes costly unplanned downtimes of critical machinery.

- AI vision systems ensure real-time, high-precision quality control, detecting micro-defects invisible to the human eye.

- Generative AI tools accelerate new ceramic product and glaze design iterations.

- Machine learning optimizes raw material blend ratios for consistency and cost efficiency.

- Demand forecasting models improve inventory management and production scheduling accuracy.

DRO & Impact Forces Of Pottery Ceramics Market

The Pottery Ceramics Market is shaped by powerful synergistic and countervailing forces summarized by Drivers, Restraints, and Opportunities (DRO). Major drivers include the accelerating pace of global construction and infrastructure development, particularly in emerging markets, necessitating vast quantities of ceramic tiles, sanitary ware, and structural clay products. Simultaneously, the rising consumer appetite for premium, aesthetically sophisticated, and technologically enhanced ceramic products (e.g., antimicrobial sanitary ware or self-heating mugs) in developed economies further stimulates market growth. These growth catalysts are strongly amplified by impact forces such as stringent building codes demanding fire-resistant and durable materials, where ceramics inherently excel.

However, the market faces significant restraints. The energy-intensive nature of ceramic firing processes contributes substantially to operational costs, making the industry highly vulnerable to volatile natural gas and electricity prices. Additionally, securing consistent access to high-quality raw materials (specific clays and minerals) and managing complex logistics across fragmented supply chains pose perennial challenges. Environmental regulations regarding industrial emissions and waste disposal, particularly in Europe and North America, necessitate substantial capital investment in green technologies, which can restrain the competitiveness of smaller manufacturers. Furthermore, the availability of alternative, often cheaper, substitutes like plastic flooring or composite sanitary fixtures in price-sensitive segments presents ongoing competitive pressure.

Despite these challenges, substantial opportunities exist. The burgeoning field of technical and advanced ceramics—used in high-growth sectors like electric vehicle batteries, aerospace components, and advanced medical diagnostics—offers significantly higher margins and substantial growth potential outside traditional construction. Furthermore, the global emphasis on sustainability drives opportunity for manufacturers who can master low-carbon production methods and utilize recycled or waste materials (like fly ash) in their formulations. Digital transformation, including e-commerce platforms for decorative ceramics and the adoption of automation/AI across manufacturing, promises future efficiency gains and broader market reach, allowing producers to capitalize on personalized consumer trends globally.

Segmentation Analysis

The Pottery Ceramics Market is fundamentally segmented based on product type, end-use application, and geographical region, reflecting the diverse manufacturing processes and end-user requirements inherent in the industry. Understanding these segments is crucial for strategic planning, as market dynamics and profitability vary significantly between high-volume, low-margin structural ceramics and low-volume, high-margin technical ceramics. Product segmentation typically includes categories such as Tiles, Sanitary Ware, Tableware, and Advanced/Technical Ceramics, each driven by distinct market forces—construction activities for tiles, public health standards for sanitary ware, and disposable income for tableware. The application segmentation further refines this view, separating residential, commercial, and industrial consumption patterns.

The dominance of the Tile segment is undeniable, fueled by both massive urbanization projects and the pervasive trend of home renovation worldwide, seeking materials that offer durability, hygiene, and aesthetic appeal. Within the end-use segment, residential applications consistently account for the largest market share, driven by consumer spending on home furnishings and construction. However, the commercial segment, including hospitals, hotels, and office buildings, demands higher specification products, particularly in terms of slip resistance, durability, and specialized antimicrobial properties, leading to higher average selling prices in this application area. Geographically, segmentation highlights the distinct regional manufacturing capabilities and consumption patterns, with Asia Pacific leading both production and consumption.

Detailed segmentation analysis allows manufacturers to tailor their production capabilities and market strategies. For instance, companies focusing on technical ceramics must invest heavily in R&D and specialized equipment (e.g., hot isostatic pressing), targeting specific industrial clients requiring precise material properties. Conversely, those focusing on tableware prioritize design, brand visibility, and efficient distribution channels, often leveraging digital commerce platforms. The increasing regulatory emphasis on water efficiency also drives innovation and segmentation within the sanitary ware market, favoring manufacturers producing low-flow, high-performance toilets and faucets, thus creating a distinct sub-segment focused on ecological efficiency and water conservation standards across different jurisdictions.

- By Product Type:

- Tiles (Floor Tiles, Wall Tiles, Roof Tiles)

- Sanitary Ware (Toilets, Wash Basins, Cisterns)

- Tableware (Dinner Sets, Mugs, Bowls, Cups)

- Decorative Ceramics (Vases, Figurines, Art Pottery)

- Technical/Advanced Ceramics (Alumina, Zirconia, Silicon Carbide, Nitride Ceramics)

- Refractory Ceramics

- Structural Ceramics (Bricks, Pipes)

- By Application:

- Residential Construction and Renovation

- Commercial Buildings (Hotels, Hospitals, Retail)

- Industrial (Automotive, Aerospace, Electronics, Healthcare)

- Utilities and Infrastructure

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Pottery Ceramics Market

The value chain for the Pottery Ceramics Market is complex, beginning with the upstream extraction and processing of fundamental raw materials—primarily clays (kaolin, ball clay), feldspar, silica sand, and various mineral additives used for strength and coloration. Upstream analysis focuses heavily on supply chain reliability, quality consistency, and transportation logistics, as raw material costs significantly influence the final product cost. Manufacturers often seek long-term contracts or vertical integration to secure stable access to high-grade, specialized clays necessary for white ware and technical ceramics, where material purity is paramount. The efficiency of the raw material preparation stage, including crushing, grinding, and mixing, directly impacts the quality and homogeneity of the final ceramic body, making technological investments here critical.

Midstream activities involve the core manufacturing processes: forming (casting, pressing, extrusion), drying, glazing, and high-temperature firing in kilns. This stage is capital-intensive and subject to strict quality control, with automation playing an increasingly important role in optimizing energy use and reducing defect rates. Manufacturers leverage advanced machinery for rapid, large-scale production, especially in tiles and sanitary ware. Downstream analysis focuses on distribution channels and end-user engagement. Given the weight and fragility of many ceramic products, logistics and inventory management are crucial, demanding efficient warehousing and specialized transportation methods to minimize breakage and delivery costs across global markets.

The distribution channel is typically multifaceted, involving both direct and indirect routes. Large industrial and technical ceramic suppliers often utilize direct sales forces to engage with B2B customers (e.g., automotive OEMs or construction contractors), necessitating specialized technical knowledge and long-term relationships. For consumer-focused products like tiles and sanitary ware, indirect channels—comprising wholesale distributors, specialized retail outlets, large home improvement stores (DIY), and increasingly, dedicated e-commerce platforms—are dominant. The rise of digital commerce has dramatically altered the downstream landscape for decorative and artisanal pottery, allowing smaller producers to bypass traditional intermediaries and reach niche international audiences directly, optimizing margin capture and enhancing brand visibility through engaging digital content and direct-to-consumer fulfillment models.

Pottery Ceramics Market Potential Customers

Potential customers for the Pottery Ceramics Market span across diverse sectors, broadly categorized into construction, commercial hospitality, specialized industrial users, and individual residential consumers. The largest and most consistent end-users are those involved in new residential and commercial construction and refurbishment projects. These customers—including building developers, general contractors, interior designers, and architects—require vast quantities of ceramic tiles for flooring and walls, and substantial volumes of sanitary ware (toilets, basins, bath fixtures). Their purchasing decisions are primarily influenced by durability standards, regulatory compliance, aesthetic options (color, texture, size), and competitive pricing, making them bulk buyers focused on long-term performance and cost-effectiveness over the life cycle of the installation.

A rapidly growing segment of potential customers includes specialized industrial sectors. Manufacturers in automotive (specifically electric vehicles requiring thermal management components), aerospace (seeking lightweight, heat-resistant parts), electronics (substrates and insulators), and healthcare (bioceramics for implants and dental applications) represent highly lucrative, high-value customers for technical ceramics. These end-users prioritize specific material properties—such as extreme hardness, low dielectric loss, high melting point, or biocompatibility—over aesthetic appeal. Engagement with this segment requires specialized technical sales teams, adherence to stringent quality certifications (e.g., ISO, FDA clearances), and continuous research collaboration to meet evolving technological needs, positioning them as key drivers for innovation and high-margin revenue.

Finally, the individual consumer and the hospitality sector form the critical customer base for tableware and decorative pottery. Residential consumers, driven by interior design trends, cultural preferences, and personal income, purchase ceramic items for daily use and aesthetic enhancement of their homes, often valuing brand recognition, artisan quality, and unique design. The hospitality industry (hotels, restaurants, catering services) demands robust, chip-resistant, and easily stackable ceramics that can withstand rigorous commercial cleaning and heavy use, often procuring items through specialized commercial distributors. Marketing efforts targeting this segment emphasize design appeal, practicality, and establishing strong brand narratives around heritage or modernity to capture evolving consumer tastes and maintain loyalty.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285.5 Billion |

| Market Forecast in 2033 | USD 432.8 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roca Group, Toto Ltd., Kohler Co., Mohawk Industries, LIXIL Group Corporation, Siam Cement Group (SCG), Villeroy & Boch AG, Pamesa Ceramica, Cera Sanitaryware Ltd., Kajaria Ceramics Ltd., RAK Ceramics, China Ceramics Co. Ltd., Saint-Gobain, Morgan Advanced Materials, CoorsTek Inc., 3M Advanced Materials Division, Corning Inc., Murata Manufacturing Co., Ltd., Kyocera Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pottery Ceramics Market Key Technology Landscape

The technology landscape in the Pottery Ceramics Market is rapidly evolving, moving away from traditional batch processing toward highly automated, continuous production systems underpinned by Industry 4.0 principles. A cornerstone of this evolution is the advancement in fast-firing technology, where new kiln designs and thermal control systems significantly reduce firing cycles—sometimes from days to mere hours—leading to drastic reductions in energy consumption and increased production capacity, particularly beneficial for high-volume tile and sanitary ware manufacturing. Furthermore, digital glazing and 3D printing technologies are revolutionizing design and customization. High-definition digital inkjet printers allow for the application of complex, photo-realistic designs and textures onto ceramic surfaces with high repeatability and minimal waste, facilitating short production runs of custom designs that cater to bespoke market demands.

In terms of material science, significant technological focus is directed toward enhancing the performance characteristics of ceramic bodies and glazes while optimizing resource use. Innovations include the development of porous ceramics for filtration and biomedical applications, ultra-high-temperature resistant materials for technical uses, and low-temperature sintering ceramics (LTS) that require less thermal energy during production, addressing critical sustainability concerns. Advanced milling and dispersion techniques are ensuring ultra-fine particle size distribution in raw material mixes, leading to denser, stronger, and more consistent final products. Moreover, the integration of nanoscale materials is enabling the creation of smart ceramics with features like self-cleaning (photocatalytic glazes) and anti-microbial properties, adding functional value beyond traditional aesthetic and structural utility, particularly relevant in public health and healthcare environments.

Automation remains a core technological focus. Robotic handling systems are now standard in large-scale facilities for tasks such as casting, glazing, stacking, and packaging, reducing labor costs and improving workplace safety while ensuring consistent quality control that minimizes human error. The increasing adoption of Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) tools allows for precise mold creation and rapid prototyping, especially essential in the complex geometry required for sanitary ware and advanced ceramic components. Looking forward, the application of sensors and IoT devices integrated throughout the production line provides real-time data crucial for AI-driven process optimization, marking a shift toward fully autonomous and data-centric ceramic manufacturing plants that maximize throughput and material utilization rates effectively.

Regional Highlights

The Asia Pacific (APAC) region dominates the Pottery Ceramics Market, holding the largest share in both production and consumption. This supremacy is fueled by massive infrastructure investments, rapid urbanization, and a burgeoning middle class across nations like China, India, and Vietnam. China remains the undisputed global leader in the production of ceramic tiles and sanitary ware, leveraging economies of scale, extensive raw material reserves, and significant government support for manufacturing sectors. However, rising labor costs and stringent environmental policies are prompting some manufacturers to diversify production to lower-cost neighboring countries in Southeast Asia. The regional demand is characterized by high volume, particularly for economically priced structural and functional ceramics required for large-scale housing projects, alongside an increasing preference for premium imported decorative items.

Europe represents a mature but highly valuable market, distinguished by its focus on high-quality, design-led, and premium ceramics. Countries like Italy, Spain, and Germany are global leaders in ceramic tile design and advanced manufacturing technology, prioritizing aesthetic innovation, sustainability credentials, and adherence to high European Union (EU) standards for environmental performance and product longevity. European consumption is driven by refurbishment and renovation activities, rather than new construction, emphasizing niche markets such as designer sanitary ware and high-specification technical ceramics for industrial machinery and aerospace applications. Regulatory drivers, specifically those promoting energy efficiency and circular economy principles, heavily influence product development here, favoring manufacturers who can demonstrate lower embedded carbon in their products.

North America exhibits high consumption driven by a strong housing market recovery and significant investment in commercial infrastructure. While the region is a major consumer of ceramic products, a large portion of its demand is met through imports, primarily from APAC and Europe, due to high domestic manufacturing costs. The market is characterized by consumer demand for large-format tiles, technologically integrated sanitary ware (e.g., smart toilets), and unique decorative pottery. The Middle East and Africa (MEA), particularly the GCC states, show robust, though cyclical, growth tied to oil price stability and major real estate and tourism infrastructure projects. These regions often demand high-end, often imported, products that convey luxury and sophisticated design, especially within the hospitality and residential premium segments, relying heavily on international suppliers for material standards and innovation.

- Asia Pacific (APAC): Dominates global production and consumption; driven by urbanization, infrastructure development (China, India); focus on volume production and competitive pricing.

- Europe: Characterized by high value, design innovation, and sustainability; strong market for premium tiles, sanitary ware (Italy, Spain); emphasis on technical ceramics for industrial use.

- North America: Significant net importer; strong consumer demand for high-end, large-format tiles and smart sanitary ware; growth linked to residential remodeling and commercial investment.

- Latin America (LATAM): Growth fluctuates with commodity cycles; localized production focuses on essential construction materials; increasing penetration of imported specialty products.

- Middle East & Africa (MEA): High demand for luxury, large-scale imported ceramics driven by commercial and high-end residential projects in GCC countries; reliant on international supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pottery Ceramics Market.- Roca Group

- Toto Ltd.

- Kohler Co.

- Mohawk Industries

- LIXIL Group Corporation

- Siam Cement Group (SCG)

- Villeroy & Boch AG

- Pamesa Ceramica

- Cera Sanitaryware Ltd.

- Kajaria Ceramics Ltd.

- RAK Ceramics

- China Ceramics Co. Ltd.

- Saint-Gobain

- Morgan Advanced Materials

- CoorsTek Inc.

- 3M Advanced Materials Division

- Corning Inc.

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Dongpeng Ceramic Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Pottery Ceramics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for ceramic tiles globally?

The primary factor driving global demand for ceramic tiles is accelerating urbanization and massive infrastructural development, particularly in Asia Pacific. Ceramic tiles are essential, durable components for flooring, walls, and facades in both residential and commercial new construction projects, fueling high-volume consumption.

How is sustainability impacting production processes in the pottery ceramics industry?

Sustainability demands are forcing manufacturers to invest in lower-carbon production methods, such as fast-firing kilns and the use of Low-Temperature Sintering (LTS) ceramic bodies, which significantly reduce energy consumption. Furthermore, there is an increasing focus on closed-loop systems and incorporating recycled waste materials into ceramic formulations to minimize environmental impact.

Which segment of the ceramics market offers the highest growth potential in terms of value?

The Technical and Advanced Ceramics segment offers the highest growth potential in terms of value. This segment includes materials like zirconia and alumina, which are critical components for high-growth, high-value industries such as electric vehicles, advanced medical devices (bioceramics), and semiconductor manufacturing, demanding superior performance characteristics.

What role does automation play in modern ceramic manufacturing?

Automation, including robotic handling systems, smart sensors, and AI-driven process control, plays a crucial role in modern ceramic manufacturing by improving product quality consistency, reducing labor costs, optimizing complex kiln firing cycles for energy efficiency, and minimizing defect rates through real-time inspection.

What are the main challenges faced by manufacturers in the pottery ceramics market?

The main challenges are the high volatility of energy prices (natural gas and electricity) due to the energy-intensive firing process, and strict governmental environmental regulations concerning emissions and waste disposal, which necessitate continuous, costly technological upgrades and investments in cleaner production technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager