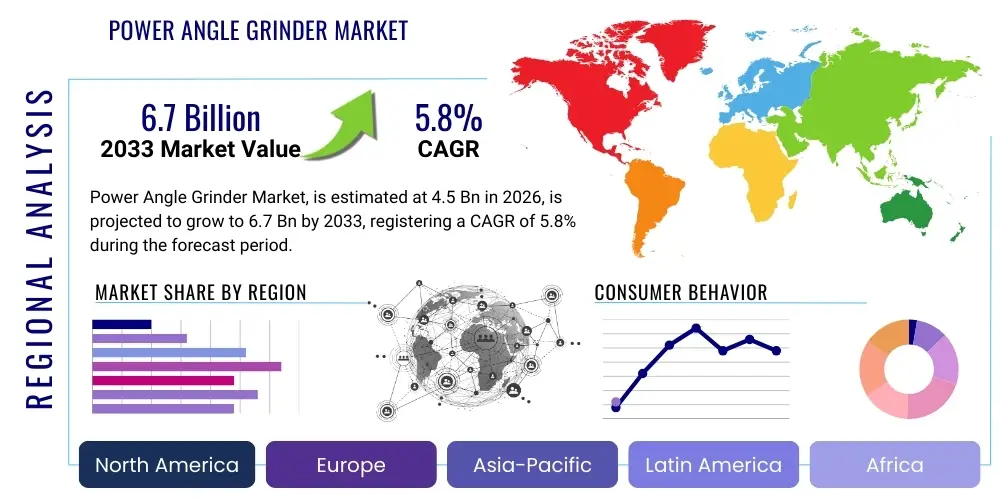

Power Angle Grinder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442745 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Power Angle Grinder Market Size

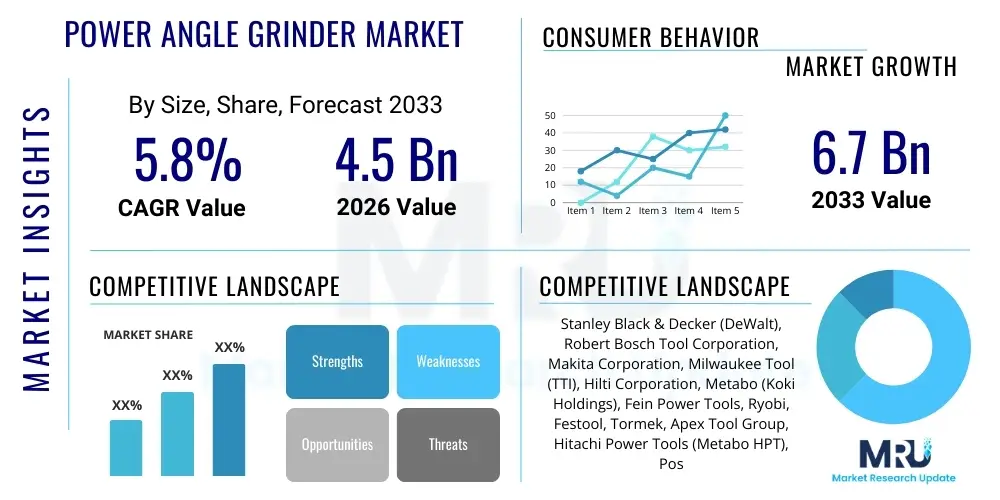

The Power Angle Grinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Power Angle Grinder Market introduction

The Power Angle Grinder Market encompasses the global sales and distribution of handheld power tools used primarily for cutting, grinding, polishing, and sanding various materials, including metal, stone, and concrete. These versatile tools are characterized by a rotating abrasive disc or wheel mounted at a perpendicular angle to the motor, offering high power output essential for rigorous industrial and construction tasks. Modern angle grinders are increasingly adopting advanced technologies such as brushless motors, improved battery systems, and enhanced safety features, driving efficiency and portability across end-user industries.

The primary application sectors leveraging power angle grinders include infrastructure development, residential and commercial construction, automotive repair and manufacturing, and heavy metal fabrication. The robustness and adaptability of angle grinders make them indispensable across these domains, particularly for finishing work, preparing surfaces, and precise material removal. Product innovation is focusing on ergonomic designs to reduce operator fatigue and integrated safety mechanisms, such as kickback control and anti-vibration handles, aligning with stricter occupational health and safety standards worldwide.

Key benefits driving market penetration include their unparalleled efficiency in cutting hardened materials, portability (especially cordless models), and multifunctionality. Driving factors fueling market growth include the rapid expansion of global construction activities, particularly in emerging economies, coupled with increasing demand for professional-grade, high-performance tools in the manufacturing sector. Furthermore, the continuous replacement of older, less efficient corded models with advanced cordless lithium-ion battery-powered units is significantly contributing to the overall market expansion.

Power Angle Grinder Market Executive Summary

The global Power Angle Grinder Market is experiencing substantial momentum driven by robust infrastructural investments and the ongoing shift toward cordless power tool solutions. Business trends indicate a strong competitive focus on product differentiation through battery longevity, motor power density, and sophisticated electronic controls that enhance user safety and tool performance. Major market players are heavily investing in R&D to integrate smart features, such as Bluetooth connectivity for inventory management and real-time diagnostics, thereby catering to the growing digitalization of professional workspaces and industrial maintenance operations.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market segment, attributable to massive urbanization projects, accelerated industrialization, and favorable government spending on infrastructure, particularly in countries like China, India, and Southeast Asia. North America and Europe maintain leading positions in terms of adopting premium, high-performance cordless grinders, driven by stringent labor efficiency requirements and a higher acceptance rate of advanced, ergonomic power tools. The shift from corded to cordless remains the most significant macro trend impacting geographical sales distributions and inventory stocking strategies.

Segmentation trends confirm that the cordless segment, particularly those utilizing 18V or higher voltage lithium-ion battery platforms, is poised for the most rapid growth, displacing traditional corded units in many professional applications where maneuverability is paramount. By disc size, the 4-inch to 6-inch segment dominates the market due to its versatility and suitability for common applications in construction and metal fabrication. Application-wise, the metalworking and construction sectors collectively account for the largest market share, consistently demanding durable, high-torque tools capable of heavy-duty usage in demanding environmental conditions.

AI Impact Analysis on Power Angle Grinder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Power Angle Grinder Market typically center on how predictive maintenance, smart diagnostics, and automated quality control can be integrated into these traditionally mechanical tools. Common concerns revolve around the cost implications of integrating AI components, the reliability of embedded sensors in harsh industrial environments, and the actual value proposition for the end-user. Users are eager to understand if AI can genuinely extend tool lifespan, minimize downtime through predictive failure alerts, and optimize grinding performance based on real-time feedback regarding material density or motor load.

The integration of AI, while nascent, is expected to revolutionize tool management and operational efficiency, rather than directly impacting the core grinding mechanism. AI models, coupled with IoT sensors embedded within the grinder, facilitate the creation of digital twins for fleet management. This allows contractors and industrial maintenance teams to monitor usage patterns, vibration anomalies, and thermal performance. The resulting data is processed by AI algorithms to forecast component failure, such as brush wear, bearing degradation, or battery performance decline, enabling just-in-time maintenance scheduling and significantly reducing unexpected operational outages.

Furthermore, AI-driven feedback loops can assist in optimizing the tool's performance settings. For instance, in automated grinding processes, AI can dynamically adjust speed and torque based on sensor readings detecting surface resistance or material type, ensuring optimal material removal rates and preventing overheating or excessive disc wear. While fully autonomous grinding remains a niche application, the primary immediate impact of AI is transforming the angle grinder from a simple mechanical device into a connected, intelligent asset within the broader ecosystem of industrial IoT, improving safety compliance and overall asset utilization efficiency across large construction and manufacturing enterprises.

- Predictive Maintenance: AI algorithms analyze vibration and temperature data to forecast tool failure, maximizing uptime.

- Optimized Asset Management: Integration with cloud platforms enables AI-powered tracking of tool usage, location, and service history for large fleets.

- Dynamic Performance Adjustment: AI adjusts motor speed and torque in real-time based on workload and material input, improving efficiency and disc life.

- Enhanced Safety Monitoring: Machine learning models detect unsafe operating conditions (e.g., excessive kickback angles) and initiate immediate protective shutdowns.

- Automated Quality Control: AI-vision systems, when used in conjunction with automated grinding cells, monitor the consistency and finish of processed materials.

- Battery Health Optimization: AI prolongs battery lifespan by optimizing charging cycles and discharge rates based on user patterns.

DRO & Impact Forces Of Power Angle Grinder Market

The market dynamics for power angle grinders are shaped by a confluence of powerful drivers (D), significant restraints (R), and latent opportunities (O), which collectively define the impact forces governing industry growth and strategic direction. Primary drivers include sustained global expansion in construction and infrastructure development, particularly in fast-growing urban centers, and the inherent need for high-quality finishing tools in metal fabrication and automotive maintenance sectors. The shift toward advanced ergonomic and safety features is also forcing product refreshment cycles, boosting demand for next-generation models, particularly those featuring brushless motor technology and superior battery endurance, which offer measurable efficiency gains over legacy equipment.

However, the market faces notable restraints, including intense price competition, particularly from low-cost manufacturers based in Asia, which challenges the profitability margins of premium brand manufacturers. Furthermore, the inherent safety hazards associated with angle grinders—such as kickback injuries and exposure to dust and noise—necessitate stringent regulatory oversight and complex design requirements, increasing manufacturing costs. The cyclical nature of the construction industry also introduces volatility, impacting short-term demand fluctuations, especially during economic downturns or periods of high raw material prices that delay large-scale projects.

Significant opportunities are emerging from the accelerating transition to cordless tools across professional segments, driven by advancements in lithium-ion battery energy density, making cordless high-power grinding viable for continuous heavy-duty use. The aftermarket segment for consumables (grinding discs, cut-off wheels) presents a lucrative, high-margin revenue stream closely tied to the installed base of tools. Moreover, untapped potential exists in developing specialized grinders for niche applications, such as composites manufacturing or renewable energy infrastructure maintenance, demanding precision tools with enhanced dust protection and material-specific torque settings. The need for smarter, connected tools further opens doors for software and service revenue models.

Segmentation Analysis

The Power Angle Grinder Market is comprehensively segmented based on product type (corded vs. cordless), mode of operation (electric vs. pneumatic), disc size, and end-user application, providing a granular view of market dynamics and targeted consumer needs. Understanding these segmentation nuances is crucial for manufacturers to tailor their product development strategies and marketing efforts toward high-growth niches. The market structure reflects a transitionary phase, where robust, powerful corded units still dominate fixed-location industrial settings, while highly flexible and portable cordless models capture the increasing mobility requirements of modern construction and field service technicians.

The Cordless segment, driven by rapid improvements in battery technology (e.g., higher amp-hour ratings and faster charging cycles), is witnessing the fastest adoption rate, particularly in North America and Europe. Meanwhile, pneumatic grinders, though less prevalent overall, maintain critical importance in environments where spark risk must be minimized or where abundant compressed air infrastructure is readily available, such as shipyards and certain automotive assembly plants. Differentiation based on disc size is primarily dictated by the required application depth and material density; smaller discs (4-4.5 inches) are ideal for light cutting and detail work, whereas larger industrial grinders (7-9 inches) are reserved for heavy-duty metal removal and concrete processing.

- By Type:

- Corded

- Cordless

- By Operation:

- Electric

- Pneumatic

- By Disc Size (Wheel Diameter):

- 4-4.5 inches

- 5-6 inches

- 7-9 inches

- Above 9 inches (Industrial)

- By Application:

- Metalworking and Fabrication

- Construction and Infrastructure

- Automotive and Aerospace

- Shipbuilding and Marine

- General Maintenance and Repair (MRO)

- By End-User:

- Professional/Industrial Users

- DIY/Consumer Users

Value Chain Analysis For Power Angle Grinder Market

The value chain for the Power Angle Grinder Market begins with upstream activities involving the sourcing and processing of essential raw materials, including specialized plastics for housings, high-grade steel for gears and spindles, and copper wiring for motor windings. Critical components, such as brushless DC (BLDC) motors, lithium-ion battery cells (for cordless models), and advanced electronic controls (PCBs), are often procured from specialized third-party suppliers, particularly those focused on power electronics and high-density battery technology. Efficient upstream management is critical for ensuring material quality, cost control, and supply chain resilience, especially given the global volatility in commodity prices and the concentrated sourcing of high-performance battery cells.

The manufacturing and assembly stage involves the integration of these components, focusing heavily on precision engineering, quality control, and adherence to international safety standards (e.g., UL, CE). Core manufacturing expertise lies in winding efficiency, thermal management, and robust gear train design to withstand high torque loads and prolonged operational usage in harsh environments. Post-manufacturing, the value chain progresses to the downstream segment, encompassing packaging, logistics, distribution, and ultimately, sales and after-sales service. The downstream process is highly optimized to ensure product availability across diverse geographical regions and regulatory landscapes.

Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves sales to large industrial customers, governmental entities, or major retail chains through dedicated sales forces, facilitating tighter control over pricing and customer relationships. Indirect distribution, which constitutes the majority of sales, relies heavily on a network of industrial distributors, specialized hardware stores, e-commerce platforms, and home improvement centers. E-commerce platforms are growing rapidly in importance, offering broader geographic reach and direct-to-consumer convenience, while professional distributors offer specialized technical support and inventory management services essential for professional trade users. After-sales service, including warranty claims and availability of replacement parts, remains a crucial element in maintaining brand loyalty and perceived product value.

Power Angle Grinder Market Potential Customers

The primary end-users and potential buyers of power angle grinders are broadly categorized into professional industrial users, including large construction companies, metal fabrication shops, and infrastructure development firms, and the consumer/DIY segment, encompassing homeowners and small-scale hobbyists. Professional customers demand high-end, heavy-duty grinders with superior power output, extended durability, and advanced safety features, often purchasing units in bulk or as part of larger tool fleet acquisitions. These users prioritize reliability, tool longevity, and compatibility with standardized battery platforms to minimize operational complexities and maximize productivity on job sites.

Within the industrial segment, metalworking and fabrication shops constitute the largest consumer base, utilizing angle grinders extensively for welding preparation, removing excess weld material, surface conditioning, and precision cutting of steel, aluminum, and alloys. The construction industry employs grinders across residential, commercial, and infrastructure projects for cutting rebar, concrete, masonry, and tile. Specialized sectors like shipbuilding and aerospace maintenance also represent significant potential customers, requiring tools designed for use in confined spaces and demanding materials, often necessitating dust and spark mitigation features.

The DIY and consumer segment, while purchasing lower-power and typically smaller-sized grinders, represents a high-volume market driven by price sensitivity and general maintenance requirements around the home or small workshop. E-commerce is the dominant purchasing channel for this group. However, the most valuable customers remain the professional tradesmen—electricians, plumbers, masons, and general contractors—who rely on daily use of high-performance cordless grinders. Manufacturers focus on building strong ecosystems around their battery platforms to capture and retain these professional buyers, ensuring future cross-selling opportunities for drills, saws, and other complementary power tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker (DeWalt), Robert Bosch Tool Corporation, Makita Corporation, Milwaukee Tool (TTI), Hilti Corporation, Metabo (Koki Holdings), Fein Power Tools, Ryobi, Festool, Tormek, Apex Tool Group, Hitachi Power Tools (Metabo HPT), Positec Tool Corporation (Worx), Chervon Group (EGO), Snap-on Incorporated, SKIL Power Tools, Dongcheng Tools, Zhejiang Salamander Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Angle Grinder Market Key Technology Landscape

The technology landscape of the Power Angle Grinder Market is undergoing a rapid evolution, primarily centered around maximizing power efficiency, enhancing user safety, and improving portability. The most pivotal technological shift is the widespread adoption of Brushless DC (BLDC) motors, replacing traditional brushed motors. BLDC motors offer superior performance characteristics, including significantly higher power-to-weight ratios, reduced maintenance requirements due to the absence of brushes (eliminating a major wear component), and greater energy efficiency, which is vital for extending battery run-time in cordless models. This technology allows manufacturers to deliver corded-level power and durability in increasingly compact and lightweight battery-powered formats, thereby accelerating the professional segment's migration to cordless ecosystems.

Battery technology, particularly high-capacity lithium-ion cells (such as 21700 formats) and intelligent battery management systems (BMS), forms the second critical pillar of innovation. Modern BMS actively monitor cell temperature, voltage, and current to prevent overheating, overcharging, and deep discharge, optimizing overall pack longevity and safety. Furthermore, battery platforms are converging toward high-voltage systems (18V/20V and 54V/60V systems), enabling angle grinders to tackle extremely demanding applications previously reserved for gasoline or high-amperage corded units. Fast-charging technology, reducing downtime to less than an hour, is another major differentiator preferred by professional users, ensuring continuous workflow on busy construction sites.

Safety and control systems represent the third major area of technological advancement. Modern grinders incorporate sophisticated electronic controls such as 'Kickback Control' or 'E-Clutch,' which instantaneously shut down the motor upon detecting a sudden binding or jam of the wheel, drastically reducing the risk of severe user injury. Anti-vibration technologies, utilizing dampened handles and internal balancing mechanisms, are standard features aimed at mitigating Hand-Arm Vibration Syndrome (HAVS), thereby complying with increasingly strict occupational health standards. Additionally, the integration of connectivity (IoT via Bluetooth) is emerging, enabling users or fleet managers to track tool diagnostics, location, and usage hours, moving the industry toward 'Smart Tool' management systems that optimize maintenance schedules and inventory tracking.

Regional Highlights

The global market for power angle grinders exhibits distinct regional growth patterns, largely correlating with infrastructural investment levels, industrial output, and adoption rates of advanced cordless technology. North America remains a highly mature and premium market, characterized by professional users demanding the highest performance, durability, and safety features. The region is a dominant consumer of high-voltage cordless grinders (18V and above), driven by strict job site safety regulations and high labor costs, making tool efficiency paramount. The United States and Canada represent primary growth drivers due to steady residential construction and significant investments in infrastructure modernization and industrial maintenance, where top-tier brands like Milwaukee, DeWalt, and Hilti command significant market share and brand loyalty.

Europe mirrors North America in its focus on cordless technology and professional-grade tools, but with a unique emphasis stemming from stringent environmental and occupational safety regulations. Countries like Germany and the UK show strong demand for anti-vibration technology and comprehensive dust extraction systems to comply with health standards. Western Europe continues to drive technological adoption, whereas Central and Eastern European countries, while growing, often retain a stronger preference for cost-effective, durable corded units for long-duration industrial applications. The replacement cycle in Europe is accelerating due to the desire for ergonomic tools that comply with ISO standards and reduce physical strain on the workforce.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by unprecedented infrastructure expansion, rapid industrialization, and massive urbanization initiatives across populous countries such as China, India, and Indonesia. While price sensitivity is high, leading to a strong presence of local and regional manufacturers offering cost-effective solutions, the professional segment is increasingly migrating to premium global brands for reliability and service support. The demand here is dual-natured: high volume for entry-level tools in developing areas, and increasing sophistication for advanced tools in established manufacturing hubs (e.g., Japan, South Korea). The Middle East and Africa (MEA) region, particularly the GCC countries, shows moderate growth driven by large-scale oil and gas projects and public construction, often importing high-specification tools suitable for extremely harsh climate conditions.

- North America: Market leader in premium, high-voltage cordless adoption; driven by labor efficiency and stringent safety standards in construction and automotive sectors.

- Europe: High focus on ergonomic tools and anti-vibration technology due to occupational health mandates; strong replacement market for professional corded to cordless transition.

- Asia Pacific (APAC): Fastest growing market fueled by infrastructure and urbanization; dual market structure encompassing high-volume low-cost tools and rapidly growing premium segments.

- Latin America: Emerging market with growth tied directly to economic stability and mining/infrastructure investments; significant penetration potential for affordable professional tools.

- Middle East and Africa (MEA): Growth concentrated in major economic hubs and resource extraction industries; preference for robust, durable tools capable of high-heat and dusty environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Angle Grinder Market.- Stanley Black & Decker (DeWalt, Black+Decker, Porter-Cable)

- Robert Bosch Tool Corporation

- Makita Corporation

- Techtronic Industries Co. Ltd. (TTI) (Milwaukee Tool, Ryobi, AEG)

- Hilti Corporation

- Koki Holdings Co., Ltd. (Metabo HPT, Metabo)

- Fein Power Tools GmbH

- Apex Tool Group, LLC

- Positec Tool Corporation (Worx, Kress)

- Chervon Group (EGO, SKIL)

- Snap-on Incorporated

- Emerson Electric Co. (RIDGID)

- Dongcheng Tools Co., Ltd.

- Tormek AB

- Channellock, Inc.

- C. & E. Fein GmbH

- IRWIN Tools (Newell Brands)

- Wurth Group

Frequently Asked Questions

Analyze common user questions about the Power Angle Grinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the cordless angle grinder segment?

The primary driver is the significant advancement in lithium-ion battery technology, specifically increased energy density and higher voltage platforms (18V and 60V). This allows cordless units to achieve power and run-time comparable to corded models, fulfilling professional demands for mobility, efficiency, and safety without power cords.

How do brushless motors benefit power angle grinders compared to traditional brushed motors?

Brushless motors offer substantially greater efficiency, higher power-to-weight ratios, and require zero maintenance over their lifespan because they eliminate consumable carbon brushes. This results in longer tool life, reduced heat generation, and maximized battery run-time for cordless models, enhancing overall return on investment for professional users.

Which application segment holds the largest market share for power angle grinders globally?

The Metalworking and Fabrication segment holds the largest market share. Angle grinders are indispensable for tasks such as preparing metal surfaces for welding, cutting rebar, grinding welds smooth, and deburring edges in automotive, manufacturing, and heavy fabrication industries worldwide.

What are the key safety features mandated in modern professional angle grinders?

Key safety features include Kickback Control (E-Clutch), which instantly shuts off the motor when the wheel binds; soft start mechanisms to prevent jerk upon activation; and anti-vibration systems integrated into handles to mitigate long-term operator health risks (HAVS). Automatic spindle locks and robust guard systems are also standard.

Is the Asia Pacific (APAC) region expected to dominate the Power Angle Grinder Market in the future?

Yes, APAC is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, massive government investment in infrastructure projects, and the accelerating pace of industrial manufacturing expansion across key nations like China and India, significantly increasing the demand for all types of power tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager