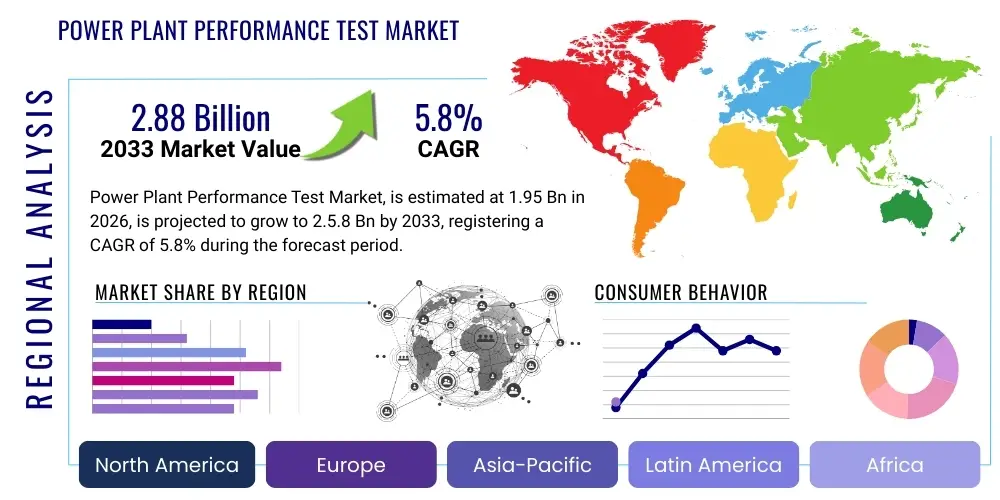

Power Plant Performance Test Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441060 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Power Plant Performance Test Market Size

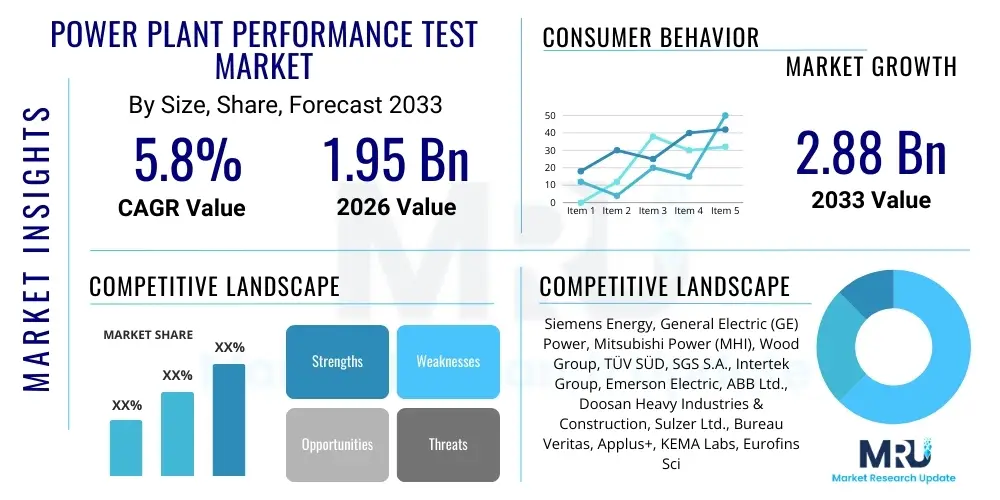

The Power Plant Performance Test Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.88 Billion by the end of the forecast period in 2033.

Power Plant Performance Test Market introduction

The Power Plant Performance Test Market encompasses specialized services and solutions designed to measure, verify, and optimize the operational efficiency and capacity of power generation units across various technologies, including thermal, nuclear, and renewable sources. These tests are crucial for ensuring regulatory compliance, minimizing operational expenses, and maximizing the lifespan of critical power assets. Products and services range from initial baseline testing and contractual guarantees verification to ongoing condition monitoring and diagnostic analysis, employing sophisticated instrumentation and data analytics to assess key performance indicators such as heat rate, thermal efficiency, and auxiliary power consumption. The fundamental objective is to confirm that the plant operates according to design specifications and contractual agreements, particularly following commissioning, maintenance overhauls, or fuel changes.

Major applications of performance testing include verifying the efficiency gains resulting from upgrades or retrofits, identifying specific sources of operational degradation, and providing actionable data for predictive maintenance scheduling. Benefits derived from rigorous performance testing are substantial, leading directly to reduced fuel consumption, lowered emissions, and enhanced overall grid stability. For large utility operators, accurate performance monitoring translates into significant cost savings and improved profitability. Furthermore, the increasing complexity of modern power systems, especially the integration of intermittent renewable energy sources, necessitates more frequent and sophisticated testing protocols to maintain system reliability and dispatchability.

The primary driving factors propelling this market include stringent global environmental regulations mandating higher efficiency standards, the aging infrastructure of existing conventional power plants requiring life extension and optimization, and the economic pressure on operators to reduce production costs. The shift towards natural gas combined cycle plants (NGCC) and the focus on digital transformation, utilizing real-time data acquisition and simulation tools, are also fundamentally reshaping the demand for specialized performance testing expertise. Additionally, the proliferation of large-scale renewable projects, such as offshore wind and solar farms, requires specialized performance verification methodologies tailored to their specific operational profiles and grid connectivity requirements.

Power Plant Performance Test Market Executive Summary

The Power Plant Performance Test Market is experiencing robust growth driven by global mandates for energy efficiency improvements and the increasing complexity of mixed energy grids. Key business trends include the strong adoption of cloud-based performance monitoring platforms, the integration of Artificial Intelligence (AI) for anomaly detection and predictive modeling in test data analysis, and a heightened focus on digital twin technology to simulate and optimize performance under various operating conditions without physical intervention. Service providers are increasingly offering comprehensive, long-term performance management contracts rather than standalone testing events. Regional trends indicate significant expansion in the Asia Pacific (APAC) region, particularly driven by large-scale power infrastructure development and modernization programs in China and India, while North America and Europe prioritize regulatory compliance and asset life optimization of mature generation fleets. The shift towards decarbonization efforts also mandates specialized testing services for hydrogen-ready turbines and battery energy storage systems (BESS).

Segment trends highlight the dominance of the testing services segment over hardware and software sales, reflecting the need for specialized engineering expertise and certified methodologies. By power generation source, the thermal power segment (coal and gas) remains the largest revenue contributor due to the high financial impact of efficiency deviations, although the renewable energy segment (wind and solar) is exhibiting the highest Compound Annual Growth Rate (CAGR). Technology segmentation shows a strong pivot towards automated and remote testing procedures utilizing advanced sensors and Industrial Internet of Things (IIoT) infrastructure, reducing downtime and improving data accuracy. This move minimizes human error and allows for continuous performance monitoring, shifting testing from reactive verification to proactive operational assurance.

AI Impact Analysis on Power Plant Performance Test Market

Common user questions regarding AI's impact on Power Plant Performance Testing often center on the practical replacement of manual testing procedures, the reliability of AI-driven anomaly detection, and the costs associated with integrating machine learning models into existing Operational Technology (OT) infrastructure. Users frequently ask if AI can accurately predict performance degradation before standard instrumentation detects issues, how AI handles complex, non-linear relationships between variables (like ambient temperature and heat rate), and the security implications of utilizing cloud platforms for processing sensitive operational data. The consensus expectation is that AI will move performance testing from periodic assessments to continuous, real-time monitoring, offering enhanced diagnostic capabilities and enabling highly precise predictive maintenance schedules. Key themes revolve around improving measurement uncertainty, automating data validation, and developing 'digital twins' that allow operators to simulate performance test outcomes under diverse scenarios.

- AI-driven anomaly detection identifies subtle deviations in performance parameters far earlier than traditional statistical methods, enabling preventative action.

- Machine Learning algorithms optimize performance testing scheduling by analyzing operational profiles and predicting ideal maintenance windows, minimizing plant downtime.

- Digital Twin technology, underpinned by AI, simulates complex physical test procedures virtually, reducing the need for costly and disruptive physical testing runs.

- Automated data validation and cleaning using AI significantly reduces measurement uncertainty and improves the accuracy of heat rate and efficiency calculations.

- Natural Language Processing (NLP) assists in standardizing and streamlining the generation of complex performance test reports, improving communication and compliance documentation.

DRO & Impact Forces Of Power Plant Performance Test Market

The market dynamics are defined by several critical factors, including the imperative to meet stringent environmental regulations and the escalating cost pressures faced by power generators (Drivers). However, high initial investment costs associated with advanced monitoring hardware and the inherent complexity of integrating diverse legacy systems (Restraints) present significant challenges. Opportunities arise from the rapidly expanding renewable energy sector requiring specialized testing protocols, the move towards digitalization and remote diagnostics, and the growing demand for asset life extension services in developed economies. These forces collectively amplify the need for highly specialized and accurate performance measurement services, driving investment towards automated, data-centric solutions that offer immediate operational insight and quantifiable returns on investment (Impact Forces).

The primary driver remains the global push for operational efficiency to comply with stricter emissions standards (such as CO2 and NOx caps), making heat rate optimization an economic necessity. Furthermore, contractual obligations linked to power purchase agreements often mandate verified performance levels, fueling the recurring demand for compliance testing services. Conversely, a major restraint is the lack of standardized testing protocols across different geographical regions and technologies, which complicates cross-border service deployment and necessitates custom solutions. The resistance to high capital expenditure for state-of-the-art sensor arrays and data acquisition systems in budget-constrained utilities also slows market penetration, particularly in emerging economies where operational costs often take precedence over long-term efficiency investments.

Opportunities are predominantly emerging from the rapid decarbonization trend, which requires performance verification for innovative technologies like hydrogen co-firing, carbon capture systems, and utility-scale battery storage. The convergence of IT and OT facilitates the deployment of advanced software solutions for predictive performance management, offering service providers a high-margin revenue stream through recurring subscriptions. The impact forces manifest strongly in the competitive landscape, where firms must continuously innovate their diagnostic methodologies and software capabilities to provide faster, more reliable, and less intrusive testing services. The regulatory environment acts as a constant multiplier, ensuring that performance validation remains a mandatory component of power plant lifecycle management, thereby sustaining foundational market demand.

Segmentation Analysis

The Power Plant Performance Test Market is meticulously segmented based on the type of power source, the specific services offered, the component being tested, and the deployment methodology utilized. This detailed segmentation allows market players to tailor specialized offerings, such as continuous monitoring solutions for gas turbines or high-precision heat rate calculations for thermal boilers. The dominant segmentation factor remains the Service Type, which reflects the high requirement for expert consultation, data analysis, and report generation rather than just equipment provision. Understanding these segments is crucial for strategic planning, as the fastest growth is observed in segments supporting emerging technologies and digitalization, such as remote monitoring and AI-based diagnostics.

- By Power Source

- Thermal Power (Coal, Gas, Oil)

- Nuclear Power

- Renewable Energy (Wind, Solar, Hydro, Geothermal)

- By Component Tested

- Boiler and Heat Recovery Steam Generator (HRSG)

- Steam Turbine and Gas Turbine

- Generators and Electrical Systems

- Condensers and Cooling Towers

- Balance of Plant (BOP) Equipment

- By Service Type

- Contractual and Acceptance Testing

- Baseline and Compliance Testing

- Diagnostic and Optimization Testing

- Continuous Performance Monitoring (CPM) Services

- Consulting and Engineering Services

- By Deployment Type

- On-site/Manual Testing

- Remote/Automated Testing

- Cloud-Based Performance Management

Value Chain Analysis For Power Plant Performance Test Market

The value chain for the Power Plant Performance Test Market begins with upstream activities focused on the development and manufacturing of highly specialized sensors, data acquisition systems (DAS), and analytical software platforms. Key upstream players include instrument manufacturers providing high-accuracy pressure, temperature, and flow measurement tools, often meeting specific industry standards like ASME PTC. These manufacturers ensure the quality and calibration of the foundational equipment necessary for accurate data collection during testing. Following manufacturing, midstream activities involve the crucial steps of system integration, software customization, and the training of certified performance engineers who execute the complex test procedures on-site, ensuring adherence to regulatory and contractual protocols.

Downstream activities are dominated by the delivery of testing services, data processing, reporting, and long-term performance monitoring contracts. These services are typically executed by independent engineering consultancies, specialized power services divisions of large Original Equipment Manufacturers (OEMs), or dedicated third-party testing firms. The distribution channel is predominantly direct, involving direct negotiation and contract signing between the testing service provider and the power plant owner or operator (Direct Channel). However, indirect distribution is also gaining traction through partnerships with large industrial automation firms or maintenance providers who integrate performance testing capabilities into broader asset management contracts (Indirect Channel).

The crucial value addition occurs in the data interpretation phase, where raw data is transformed into actionable insights regarding heat rate deviations, component fouling, or maintenance necessities. Service providers that leverage advanced analytics, AI, and digital twin models capture the highest value. The efficiency of the distribution channel is directly linked to the speed and reliability of data transfer, especially for remote and continuous monitoring services, which rely heavily on secure and high-speed telemetry systems. Successful market players optimize their value chain by controlling the quality of upstream instrumentation while maximizing the efficiency and sophistication of their downstream analytical service delivery.

Power Plant Performance Test Market Potential Customers

The primary customers in the Power Plant Performance Test Market are organizations that own, operate, or maintain large-scale power generation assets where efficiency and regulatory compliance are paramount concerns. These end-users are highly motivated to invest in testing services because performance degradation directly impacts their operational expenditure (fuel costs) and regulatory standing. The customer base is heterogeneous, ranging from massive national utilities managing interconnected grids to independent power producers (IPPs) operating single facilities, all requiring specialized performance verification services tailored to their specific technology mix and contractual needs.

Key segments of potential customers include investor-owned utilities (IOUs) and government-owned utilities, which represent the largest volume purchasers of performance testing services due to their extensive asset portfolios, covering conventional thermal, nuclear, and large hydro resources. Independent Power Producers (IPPs) are another critical segment, often requiring rigorous acceptance testing and periodic verification to meet the stringent terms of their Power Purchase Agreements (PPAs) with grid operators. Furthermore, large industrial complexes, such as petrochemical plants or manufacturing facilities that operate their own captive power generation units (cogeneration or combined heat and power systems), are increasingly utilizing performance testing to optimize their integrated energy usage and ensure localized energy security.

Specific end-user/buyer categories also encompass Original Equipment Manufacturers (OEMs) who utilize performance testing to validate contractual guarantees for newly installed or refurbished turbines and boilers, acting as purchasers of third-party verification services. Financial institutions and insurance companies often commission independent performance assessments as part of due diligence processes related to mergers, acquisitions, or project financing for energy assets. These customers demand highly standardized, independent, and verifiable test results to accurately assess asset valuation and risk exposure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, General Electric (GE) Power, Mitsubishi Power (MHI), Wood Group, TÜV SÜD, SGS S.A., Intertek Group, Emerson Electric, ABB Ltd., Doosan Heavy Industries & Construction, Sulzer Ltd., Bureau Veritas, Applus+, KEMA Labs, Eurofins Scientific, Testo SE & Co. KGaA, Clean Air Engineering, Vaisala, Fluke Corporation, Parker Hannifin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Plant Performance Test Market Key Technology Landscape

The technological landscape of the Power Plant Performance Test Market is rapidly evolving, moving away from purely manual, intrusive procedures towards integrated, digital, and remote monitoring solutions. The adoption of advanced sensor technology, particularly high-accuracy, ruggedized instrumentation compliant with international standards (such as ASME PTC 46 for Overall Plant Performance), is fundamental. Crucially, the growth of the Industrial Internet of Things (IIoT) provides the backbone for seamless data acquisition, allowing thousands of real-time operational parameters to be collected simultaneously and transmitted securely to centralized analytical platforms. This IIoT framework supports the transition to Continuous Performance Monitoring (CPM), which offers operators persistent insight into efficiency drift, unlike traditional periodic testing.

A significant technological shift involves the widespread implementation of specialized software for thermodynamic modeling and simulation. Digital Twin technology is emerging as a cornerstone, creating virtual replicas of physical power plant assets. These digital twins are continually fed real-time sensor data, enabling engineers to simulate the effects of various operational adjustments or maintenance actions on performance metrics before implementing them in the physical plant. This simulation capability drastically reduces risks associated with optimization attempts and enhances the accuracy of performance prediction and diagnostic analysis, providing significant value beyond simple data measurement. Furthermore, advanced software solutions incorporate Automated Test Procedure (ATP) generation and AI-based diagnostics to analyze complex datasets, pinpointing subtle inefficiencies that might be missed during standard review processes.

The integration of machine learning and cloud computing is also vital. Cloud platforms allow for massive computational power necessary for running complex analytical models across entire fleets of power plants, facilitating comparative performance benchmarking. Machine learning algorithms are utilized to process historical data and establish precise baseline performance curves, from which performance degradation rates can be accurately predicted. Key innovations also include non-intrusive testing techniques (NITT), which minimize downtime by utilizing technologies such as ultrasonic flow meters or thermal imaging, offering quick preliminary assessments without requiring system shutdown. Cybersecurity protocols are increasingly integrated into these technology stacks to ensure the integrity of highly sensitive operational data transmitted over IIoT networks, protecting against unauthorized access or tampering that could compromise test validity.

Regional Highlights

Geographical analysis reveals distinct maturity levels and growth trajectories across different regions, driven primarily by power generation mix, regulatory frameworks, and capital investment levels.

- Asia Pacific (APAC): Represents the fastest-growing market segment, fueled by massive capacity additions in coal, gas, and renewable sectors (especially China, India, and Southeast Asia). The focus here is split between verifying the performance of newly commissioned plants (acceptance testing) and rapidly optimizing existing coal fleets for improved efficiency and emissions control. Regulatory push for air quality improvement in major metropolitan areas is a key market accelerator.

- North America: A mature market characterized by the need for asset life extension and regulatory compliance, particularly for aging gas turbine fleets. Demand is strong for advanced, non-intrusive diagnostic testing and continuous performance monitoring services, utilizing digital twins and AI to maximize efficiency and minimize heat rates under fluctuating load demands.

- Europe: Driven by strict decarbonization targets and the rapid phase-out of coal, leading to high demand for performance testing services for highly efficient gas-fired plants, nuclear facilities, and the burgeoning offshore wind and utility-scale solar sectors. Emphasis is placed on contractual performance verification for complex renewable assets and optimizing efficiency under integrated grid conditions.

- Latin America: Characterized by fluctuating investment and a reliance on hydropower, the market shows steady demand for baseline and diagnostic testing services, particularly in countries like Brazil and Mexico, focusing on optimizing existing thermal and hydroelectric assets for reliable performance and grid stability.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Middle East, driven by significant investments in new gas and solar thermal power generation capacity. The climate mandates the use of highly specialized testing methodologies for assessing the impact of extreme heat and dust on turbine performance and cooling system efficiency, leading to high uptake of advanced optimization services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Plant Performance Test Market.- Siemens Energy

- General Electric (GE) Power

- Mitsubishi Power (MHI)

- Wood Group

- TÜV SÜD

- SGS S.A.

- Intertek Group

- Emerson Electric

- ABB Ltd.

- Doosan Heavy Industries & Construction

- Sulzer Ltd.

- Bureau Veritas

- Applus+

- KEMA Labs (CESI)

- Eurofins Scientific

- Testo SE & Co. KGaA

- Clean Air Engineering

- Vaisala

- Fluke Corporation

- Parker Hannifin

Frequently Asked Questions

What is the primary function of performance testing in a thermal power plant?

The primary function is to accurately measure and verify the plant's operational efficiency, specifically the heat rate and capacity output, against design specifications and contractual guarantees (e.g., ASME PTC standards). This ensures regulatory compliance, optimizes fuel consumption, and identifies specific degradation sources.

How does digital twin technology enhance performance testing methodologies?

Digital twin technology creates a high-fidelity virtual model of the power plant, allowing operators to simulate performance test outcomes and optimization strategies under varying conditions without impacting the physical asset. This reduces downtime and enhances the accuracy of diagnostic analysis and predictive maintenance planning.

Which segment of the Power Plant Performance Test Market is experiencing the highest growth rate?

The Continuous Performance Monitoring (CPM) Services segment, supported by remote/automated deployment and advanced analytics, is exhibiting the highest growth. This is driven by the industry's shift toward real-time optimization and condition-based monitoring, moving beyond traditional periodic testing.

What role do regulatory standards like ASME PTC play in market demand?

Regulatory and industry standards, such as ASME Performance Test Codes (PTC), establish the standardized procedures and required accuracy levels for performance measurement. Compliance with these stringent standards is mandatory for contractual verification and insurance purposes, consistently driving demand for certified testing services.

What are the main challenges to adopting advanced performance testing in emerging markets?

Key challenges include the high upfront capital expenditure required for sophisticated IIoT sensors and data acquisition systems, the complexity of integrating advanced digital platforms with older, legacy operational technology (OT), and the lack of readily available specialized local engineering expertise for data interpretation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager