Power Steering Pressure Hose Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442596 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Power Steering Pressure Hose Market Size

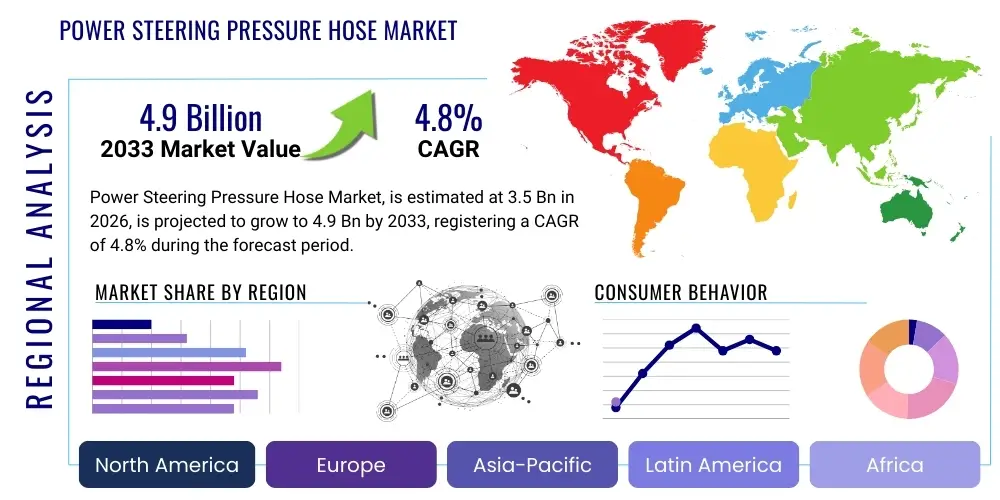

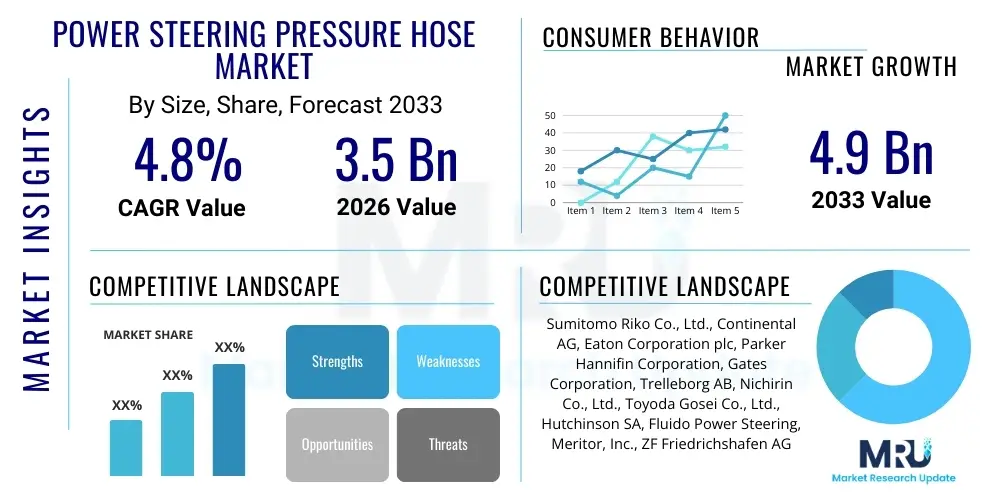

The Power Steering Pressure Hose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Power Steering Pressure Hose Market introduction

The Power Steering Pressure Hose Market encompasses the manufacturing, distribution, and sale of high-pressure hydraulic lines essential for transmitting pressurized fluid from the power steering pump to the steering gear assembly in vehicles utilizing traditional hydraulic power steering systems. These critical components are engineered to withstand extreme pressures, high temperatures, and constant vibration typical in automotive environments, ensuring smooth, responsive, and reliable steering control for the driver. The integrity of the pressure hose is paramount to vehicle safety and operational efficiency, preventing fluid leaks that could lead to complete system failure and loss of power assistance.

The core product, the power steering pressure hose, is typically constructed from robust synthetic rubber compounds, often incorporating internal reinforcement layers such as braided textile or steel wire to enhance burst strength and flexibility. Major applications span across passenger vehicles, light commercial vehicles (LCVs), and heavy-duty trucks, with demand driven primarily by Original Equipment Manufacturers (OEMs) for new vehicle assembly and the Aftermarket segment for replacement due to wear and tear. Key benefits offered by high-quality power steering hoses include superior resistance to ozone, oil, and heat aging, coupled with reduced noise, vibration, and harshness (NVH) characteristics, contributing directly to an improved driving experience.

Driving factors stimulating market growth include the continuously expanding global vehicle parc, particularly in emerging economies where vehicle ownership is rapidly increasing, consequently boosting replacement demand in the aftermarket. Furthermore, stringent safety regulations and the consumer expectation for reliable, long-lasting vehicle components necessitate the continuous adoption of advanced materials and manufacturing techniques by hose suppliers, thereby sustaining market value and technological advancement in this sector.

Power Steering Pressure Hose Market Executive Summary

The Power Steering Pressure Hose Market demonstrates stable growth, primarily anchored by the robust global automotive manufacturing sector and the consistent demands of the independent aftermarket for maintenance and repair. Current business trends indicate a significant push towards lightweighting materials, driven by regulatory pressures aiming to improve overall vehicle fuel efficiency and reduce emissions. Suppliers are increasingly focusing on multi-layered thermoplastic and specialized synthetic rubber formulations that offer comparable durability and pressure resistance while reducing the overall component weight compared to traditional rubber and steel assemblies. Furthermore, consolidation among Tier 1 suppliers is shaping competitive dynamics, enabling greater economies of scale and driving investments in automated production processes globally.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in both production and consumption, fueled by the massive automotive manufacturing hubs in China, India, and Southeast Asian nations, coupled with rapid urbanization leading to an expanding vehicle fleet. North America and Europe, while characterized by mature vehicle markets, maintain strong aftermarket demand due to their large existing vehicle parc and higher average age of vehicles requiring critical system replacements. The market is also witnessing a gradual shift in vehicle architecture towards Electronic Power Steering (EPS), especially in new compact and mid-sized vehicles, but the continued dominance of hydraulic power steering in heavy-duty, off-road, and certain high-performance segments ensures sustained demand for pressure hoses in the medium term.

Segment trends reveal that the Aftermarket segment is proving resilient and growth-oriented, particularly in value terms, offering higher margins compared to the competitive OEM supply chain. Segmentation by vehicle type shows passenger cars dominating volume, but the heavy commercial vehicle (HCV) segment offers strong stability due to the severe operating conditions these hoses endure, necessitating frequent, high-quality replacements. Material-wise, EPDM and specialized high-temperature resistant rubbers incorporating NVH dampening features are gaining prominence, addressing both performance requirements and driver comfort expectations across all key geographic markets.

AI Impact Analysis on Power Steering Pressure Hose Market

User queries regarding the impact of Artificial Intelligence (AI) in the power steering pressure hose domain largely revolve around manufacturing optimization, predictive failure analysis, and supply chain transparency. Common concerns address how AI can enhance quality control during high-volume production, predict material fatigue life in real-world operating conditions, and minimize downtime associated with hose failures in commercial fleets. Users are seeking quantifiable data on AI’s role in automating inspection processes for detecting minute material flaws or structural inconsistencies that conventional methods might miss. This indicates a primary user focus on utilizing AI to improve product reliability and streamline the complex global logistics required for timely delivery of these essential components to both OEM assembly lines and repair centers worldwide.

AI's influence is manifesting significantly in the smart manufacturing environment, where machine learning algorithms are utilized for real-time monitoring of extrusion and braiding processes, adjusting parameters instantly to ensure precise dimensional and material specifications, thereby drastically reducing waste and improving batch consistency. Furthermore, AI-driven predictive maintenance platforms are increasingly being adopted by large fleet operators, where sensor data collected from power steering systems (pressure fluctuations, temperature spikes) is analyzed by AI models to forecast the precise remaining useful life of the pressure hose, allowing for scheduled replacement before catastrophic failure, enhancing operational safety and efficiency.

The integration of AI also extends into advanced material science and R&D, where generative design algorithms are exploring novel hose structures and material compositions that optimize pressure resistance and flexibility simultaneously, speeding up the prototyping cycle. This shift from traditional iterative design to AI-assisted materials development promises hoses that are lighter, more durable, and better suited for the varying demands imposed by next-generation vehicle platforms, including hybrid and electric vehicles that still rely on hydraulic systems for various auxiliary functions.

- AI optimizes manufacturing parameters (extrusion, curing) for zero-defect production.

- Predictive analytics models forecast hose fatigue and failure points based on operational telemetry data.

- Machine learning enhances visual inspection systems for detecting micro-cracks and material inconsistencies.

- AI improves supply chain efficiency by optimizing inventory levels and predicting demand fluctuations for replacement parts.

- Generative design accelerates R&D for lightweight, high-performance hose materials.

DRO & Impact Forces Of Power Steering Pressure Hose Market

The dynamics of the Power Steering Pressure Hose Market are shaped by a complex interplay of growth drivers, critical restraints, and emerging opportunities. Key drivers include the massive size of the global automotive vehicle parc, guaranteeing constant replacement demand, particularly in older vehicles utilizing hydraulic systems, coupled with ongoing, albeit slower, production growth in new internal combustion engine (ICE) vehicles and hybrid models. Conversely, the market faces significant restraints, notably the volatility and increasing cost of raw materials such as synthetic rubber polymers, steel reinforcement wires, and specialized fluids, which compress manufacturer margins. Furthermore, the accelerating global transition towards Electric Power Steering (EPS) systems, which eliminate the need for traditional hydraulic hoses, presents a long-term structural restraint, particularly impacting the OEM segment.

Opportunities for market players lie primarily in the development and patenting of highly specialized hoses designed for extreme conditions, such as those used in heavy machinery, off-highway equipment, or performance vehicles, where durability demands exceed standard requirements. Moreover, the expanding aftermarket in high-growth regions like Southeast Asia and Latin America offers significant avenues for established global players to penetrate with quality replacement parts, often differentiating themselves through extended warranties and certified installation programs. Another critical opportunity involves leveraging material science advancements to create lighter, more flexible hoses suitable for constrained engine compartments while maintaining necessary pressure ratings, aligning with industry goals for mass reduction.

The impact forces currently defining the competitive landscape are centered around regulatory compliance and technological substitution. Regulatory bodies continually enforce stricter standards regarding fluid containment and vehicle safety, increasing the barrier to entry and necessitating high investment in quality control systems. Technological impact forces are dictated by the rapid shift towards electrification; while EPS substitution is inevitable, the need for pressure hoses in complex thermal management systems in EVs and highly specialized hydraulic functions in commercial trucks ensures that the technology remains relevant, albeit increasingly specialized. Market participants must strategically balance high-volume aftermarket supply with focused, high-value technological innovation for specialized OEM applications.

Segmentation Analysis

The Power Steering Pressure Hose market is segmented based on product type, material composition, vehicle type, sales channel, and geographic region, allowing for granular analysis of demand patterns and competitive positioning. Segmentation by sales channel, dividing the market into Original Equipment Manufacturer (OEM) and Aftermarket, is particularly vital, reflecting different pricing structures, volume requirements, and quality specifications. While OEM demand is highly price-sensitive and volume-driven, the Aftermarket requires extensive distribution networks and focuses heavily on product longevity and ease of installation for replacement purposes, driving distinct strategies for market players across these segments.

Material segmentation is equally crucial, ranging from standard EPDM rubber to advanced thermoplastic elastomers (TPEs) and specialized PTFE (Teflon) liners, each addressing specific performance needs related to temperature, chemical resistance, and flexibility. Vehicle type segmentation confirms passenger cars as the largest volume consumer, yet segmentation by commercial vehicles and off-highway equipment reveals segments with higher average transaction values due to the demanding operating environments that necessitate premium, highly durable hose assemblies. Understanding these segmentation nuances allows manufacturers to tailor their production capabilities and marketing efforts effectively.

- Product Type:

- Standard Pressure Hoses

- High-Performance/Reinforced Hoses

- Custom-Designed Assemblies

- Material Type:

- Rubber (EPDM, HNBR, Neoprene)

- Thermoplastic

- PTFE/Teflon Lined

- Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles (Construction, Agriculture)

- Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent and Authorized)

Value Chain Analysis For Power Steering Pressure Hose Market

The value chain for the Power Steering Pressure Hose Market begins with the upstream procurement of essential raw materials, including synthetic rubbers, chemical additives, steel or textile reinforcement materials (e.g., polyester or aramid fibers), and connectors/fittings (usually metal). Raw material suppliers, who often face significant commodity price volatility, hold considerable influence over the initial production costs. Manufacturers then engage in complex production processes involving rubber compounding, extrusion, braiding or spiraling of reinforcement layers, curing, and final assembly with end fittings. Efficiency in manufacturing—particularly minimizing waste and optimizing curing times—is crucial for maintaining competitive pricing, especially in the high-volume OEM segment.

The midstream involves the core manufacturing process, where specialized machinery is used to achieve the necessary pressure ratings and dimensional tolerances required by automotive specifications. Quality control and testing are rigorous at this stage, focusing on burst pressure, impulse testing, and resistance to environmental factors like ozone and heat. The subsequent distribution channel bifurcates into direct and indirect routes. Direct distribution channels primarily serve Original Equipment Manufacturers (OEMs), where delivery is Just-in-Time (JIT) to assembly plants, demanding flawless logistics coordination and a highly formalized supplier relationship managed through long-term contracts.

Indirect distribution is predominant in the Aftermarket segment, involving a network of distributors, wholesalers, regional warehouses, and finally, retail auto parts stores or specialized repair shops. Effective inventory management and geographic coverage are paramount in the aftermarket channel to ensure quick access to replacement parts across vast territories. Downstream activities involve professional installation by certified mechanics or DIY replacement by vehicle owners. The entire chain is heavily influenced by quality certifications (e.g., ISO/TS 16949) and requires robust traceability systems from raw material batch to final vehicle application, ensuring accountability and safety compliance across the lifespan of the product.

Power Steering Pressure Hose Market Potential Customers

The primary customers for the Power Steering Pressure Hose Market fall into two distinct but equally important categories: automotive manufacturers and vehicle owners/fleet operators seeking maintenance services. Automotive OEMs represent the largest volume buyers, procuring hoses directly for integration into new vehicle production lines (passenger cars, LCVs, and HCVs). These customers demand strict adherence to specifications, high consistency, and often require specialized design modifications tailored to specific vehicle models and powertrain architectures. Establishing and maintaining long-term contracts with major global OEMs (e.g., Toyota, Volkswagen, Ford) is a cornerstone of success for Tier 1 suppliers in this market.

The second major customer segment, the aftermarket, consists of a diverse group of end-users and intermediaries. This includes independent repair garages, franchised dealerships, specialized automotive service centers, and large commercial fleet operators (trucking, logistics, transit). These buyers prioritize durability, availability, ease of installation, and value proposition. Fleet operators, in particular, are sophisticated buyers who often purchase directly from large distributors or use predictive maintenance models to schedule bulk replacements, making hose longevity and guaranteed performance critical purchasing criteria.

Furthermore, specialized segments such as manufacturers of agricultural machinery, construction equipment, and other off-highway vehicles also constitute high-value potential customers. These applications require hoses engineered for extreme durability, higher pressure ratings, and superior resistance to abrasion and environmental contamination. Suppliers targeting these segments focus on customized, heavy-duty products that command premium pricing compared to standard automotive hoses, showcasing a strategic opportunity for differentiation within the overall market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Riko Co., Ltd., Continental AG, Eaton Corporation plc, Parker Hannifin Corporation, Gates Corporation, Trelleborg AB, Nichirin Co., Ltd., Toyoda Gosei Co., Ltd., Hutchinson SA, Fluido Power Steering, Meritor, Inc., ZF Friedrichshafen AG (Steering Division), MAHLE GmbH, Dana Incorporated, Delphi Technologies (BorgWarner Inc.), Metaldyne Performance Group, Mando Corporation, Unipress, Flexfab LLC, VOSS Automotive GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Steering Pressure Hose Market Key Technology Landscape

The technological landscape of the Power Steering Pressure Hose market is fundamentally driven by the need for enhanced durability, reduced Noise, Vibration, and Harshness (NVH), and compliance with increasing demands for lightweight vehicle components. A major technological focus involves the evolution of multi-layered hose construction. Modern pressure hoses often incorporate three or more layers, including an inner tube optimized for fluid compatibility and pressure sealing, reinforcement layers (e.g., spiral or braided high-tensile fibers), and an outer cover designed to resist environmental damage, abrasion, and ozone exposure. This complex layering minimizes volume expansion under pressure and significantly extends the service life, directly addressing vehicle reliability concerns.

Furthermore, critical advancements are being made in material science, particularly the utilization of advanced synthetic elastomers such as Hydrogenated Nitrile Butadiene Rubber (HNBR) and specific types of Fluorocarbon Elastomers (FKM). These materials offer superior thermal stability and chemical resistance compared to traditional EPDM or natural rubber, making them essential for applications in high-temperature engine bays or systems utilizing specialized modern hydraulic fluids. The integration of advanced thermoplastic materials, which provide excellent weight reduction and superior bending radius capabilities, is also growing, though rubber-based solutions still dominate due to cost efficiency and robust performance under impulse load conditions.

Another significant technological area is the development of specialized dampening technologies integrated within the hose assembly itself to mitigate steering system noise and vibration. This includes the implementation of specialized internal resonators or unique geometric designs that absorb hydraulic pulsations generated by the pump, preventing them from being transmitted through the steering column and into the vehicle cabin. Continuous innovation in quick-connect and specialized fitting designs is also vital, allowing for faster, more reliable connections during both OEM assembly and aftermarket repair, ensuring leak-free performance and compatibility across diverse vehicle platforms globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the engine of global power steering pressure hose production and consumption, accounting for the largest market share. This dominance is primarily driven by massive vehicle production volumes in China, Japan, India, and South Korea. Rapid urbanization, increasing disposable incomes, and the expansion of vehicle ownership translate directly into high OEM demand and a burgeoning aftermarket, particularly for LCVs and passenger cars. The presence of major Tier 1 and Tier 2 automotive component manufacturers in this region further solidifies its leading position.

- North America: North America represents a mature yet highly valuable market, characterized by strong OEM presence (especially for light trucks and SUVs, which often retain hydraulic systems) and a robust, high-value aftermarket. The average age of vehicles in the U.S. and Canada is relatively high, sustaining predictable and consistent replacement demand. Strict safety standards ensure a focus on high-quality, durable components, favoring global suppliers with proven reliability and certification records.

- Europe: The European market is technologically advanced, marked by stringent environmental regulations that push manufacturers towards lightweighting and optimal material use. While Europe is seeing a faster transition to EPS in smaller passenger vehicles, the demand remains stable for premium hoses in commercial vehicles and specialized, high-performance cars. The aftermarket is well-developed, driven by high service standards and consumer preference for quality spare parts sourced through authorized channels.

- Latin America (LATAM): LATAM is characterized by strong potential growth, with Brazil and Mexico serving as key manufacturing and demand centers. The market is highly price-sensitive, balancing the need for cost-effective replacement parts with adequate durability for often challenging road conditions. Market expansion here is tied directly to local economic stability and foreign investment in the automotive sector.

- Middle East and Africa (MEA): This region offers specialized demand related to extreme operating temperatures and harsh environments (dust, heat), necessitating hoses with superior thermal and abrasion resistance. Growth is concentrated in the Gulf Cooperation Council (GCC) states due to high vehicle ownership rates and infrastructure projects requiring heavy-duty vehicles, driving demand for robust and reliable components in both OEM and aftermarket sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Steering Pressure Hose Market.- Sumitomo Riko Co., Ltd.

- Continental AG

- Eaton Corporation plc

- Parker Hannifin Corporation

- Gates Corporation

- Trelleborg AB

- Nichirin Co., Ltd.

- Toyoda Gosei Co., Ltd.

- Hutchinson SA

- Fluido Power Steering

- Meritor, Inc.

- ZF Friedrichshafen AG (Steering Division)

- MAHLE GmbH

- Dana Incorporated

- Delphi Technologies (BorgWarner Inc.)

- Metaldyne Performance Group

- Mando Corporation

- Unipress

- Flexfab LLC

- VOSS Automotive GmbH

Frequently Asked Questions

Analyze common user questions about the Power Steering Pressure Hose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor constraining the long-term growth of the hydraulic power steering hose market?

The most significant long-term constraint is the accelerating global transition by automotive OEMs from traditional hydraulic power steering systems to Electric Power Steering (EPS), which completely eliminates the requirement for high-pressure fluid hoses in new vehicle platforms.

How do lightweighting trends affect the power steering pressure hose material selection?

Lightweighting trends push manufacturers towards utilizing advanced, high-strength thermoplastic elastomers (TPEs) and multi-layered synthetic rubber assemblies that provide comparable pressure resistance and flexibility while significantly reducing the overall weight compared to older, heavier rubber compounds or metallic components.

Which geographical region dominates the power steering pressure hose market, and why?

The Asia Pacific (APAC) region currently dominates the market due to its immense automotive manufacturing capacity, particularly in China and India, coupled with rapid expansion of the vehicle parc, generating high volumes of both OEM new assembly demand and robust aftermarket replacement needs.

Is there an increase in demand for power steering hoses in electric vehicles (EVs) or hybrid cars?

While the main steering mechanism in most EVs is EPS, certain high-performance EVs and hybrid vehicles still utilize hydraulic assistance for specialized functions, such as active suspensions or complex braking systems, maintaining a specialized, though smaller, niche demand for high-specification hoses.

What is the key technological innovation being implemented in modern power steering hoses?

A key technological innovation is the integration of advanced Noise, Vibration, and Harshness (NVH) dampening features, such as internal resonators or specialized hose geometry, designed to absorb hydraulic pump pulsations and prevent the transmission of undesirable noise into the vehicle cabin.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager