PP Reusable Bags Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441843 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

PP Reusable Bags Market Size

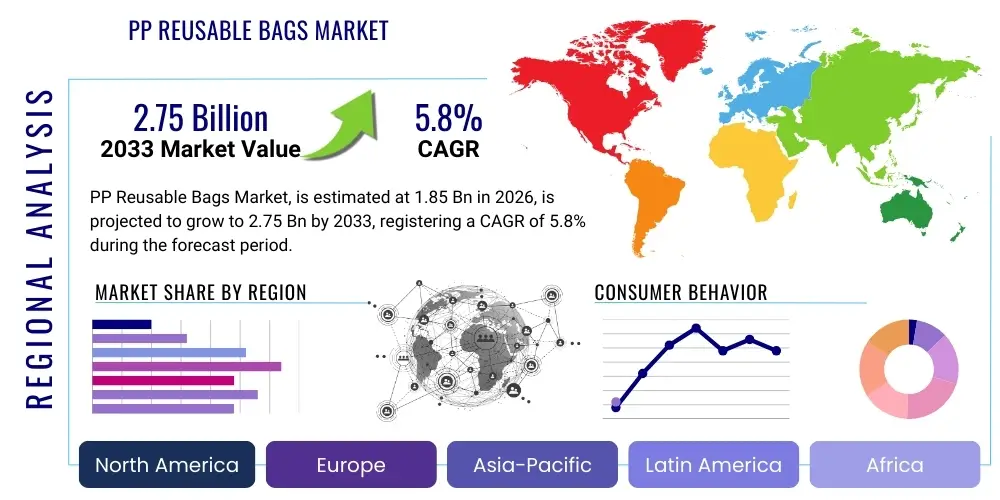

The PP Reusable Bags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.75 Billion by the end of the forecast period in 2033.

PP Reusable Bags Market introduction

The PP Reusable Bags Market encompasses the manufacturing, distribution, and sale of shopping and packaging bags predominantly made from Polypropylene (PP), specifically utilizing woven or non-woven PP fabrics. These bags are distinguished by their durability, high load-bearing capacity, water resistance, and ability to be used multiple times, positioning them as a sustainable alternative to single-use plastics and traditional paper bags. The primary applications span across grocery retail, promotional advertising, consumer goods packaging, and specialized industrial uses where robust, long-lasting containment solutions are required. The versatility of PP material allows for customization in terms of size, aesthetic design, and printing capabilities, making them highly attractive for branding initiatives across various sectors, thereby strengthening their market penetration. The adoption is intrinsically linked to global legislative efforts aimed at plastic waste reduction.

A key driving factor propelling the growth of this market is the intensifying worldwide regulatory crackdown on single-use plastic bags, including outright bans or imposition of high levies, compelling both retailers and consumers to transition toward more sustainable reusable options. The growing consumer awareness regarding environmental sustainability and the visible impact of plastic pollution has generated significant demand pressure on corporations to adopt eco-friendly packaging solutions. Furthermore, advances in manufacturing technology, particularly in producing non-woven PP fabrics that offer improved aesthetics and feel while maintaining high strength, are enhancing product appeal. The inherent benefits of PP reusable bags, such as superior tear resistance and extended product lifecycle compared to biodegradable or paper alternatives, offer long-term cost efficiencies for frequent users and retailers managing high volume operations.

The product description highlights PP reusable bags as essential tools in the circular economy, often being recyclable at the end of their prolonged lifespan, which contributes positively to reducing landfill waste. Major applications include high-volume retail sectors such as supermarkets and hypermarkets, specialized boutique stores utilizing them for brand messaging, and increasingly, within e-commerce logistics for last-mile delivery where durability is paramount. Benefits extend beyond environmental preservation to include enhanced corporate social responsibility (CSR) profiles for businesses and providing a continuous, cost-effective branding opportunity due to the bag's visibility and repeated use. These cumulative factors establish a strong foundation for sustained market expansion, particularly in densely populated urban areas with strict waste management policies and high consumer purchasing power focused on ethical consumption.

PP Reusable Bags Market Executive Summary

The PP Reusable Bags Market is characterized by robust growth fueled primarily by stringent environmental regulations targeting single-use plastics across developed and emerging economies, driving a fundamental shift in packaging strategies across the retail and consumer goods sectors. Key business trends include aggressive vertical integration by major manufacturers aiming to control raw material supply chains and optimize production efficiency, alongside a pronounced focus on product innovation, such as developing lighter yet stronger woven and non-woven PP materials. Furthermore, strategic partnerships between PP bag producers and large multinational retailers are defining bulk procurement standards and accelerating the market penetration of standardized, high-quality reusable shopping solutions. The competitive landscape is becoming increasingly segmented, with specialized firms focusing on high-end promotional bags and larger conglomerates dominating the volume-driven grocery retail segment, emphasizing competitive pricing and logistical excellence.

Regionally, Asia Pacific (APAC) stands out as the highest growth potential region, driven by rapid urbanization, increasing consumer spending power, and the swift adoption of plastic ban policies across major economies like India and China, creating massive latent demand for sustainable alternatives. North America and Europe, while representing mature markets, are experiencing growth through higher consumer compliance rates and the normalization of reusable bag use, supported by advanced recycling infrastructure and premium branding opportunities facilitated by high-quality PP materials. Trends in these regions favor premiumization, focusing on aesthetic design, durability, and certification of sustainable sourcing, which supports higher average selling prices (ASPs). The Middle East and Africa (MEA) are emerging areas, where market expansion is heavily dependent on governmental environmental commitments and foreign investment in modern retail infrastructure, particularly concerning food security and modern trade development.

Segment trends reveal that the Shopping Bags application segment maintains market dominance due to high volume requirements from grocery and general merchandise retailers. However, the Promotional Bags segment is experiencing accelerated growth as businesses increasingly recognize PP reusable bags as effective, mobile advertising vehicles with significant reach and frequency. In terms of material segmentation, Non-Woven PP bags are capturing market share owing to their softness, lower production cost for medium-duty applications, and superior printability, making them ideal for promotional and light retail use. Conversely, Woven PP bags, known for their extreme durability and high weight tolerance, remain indispensable for heavy-duty industrial packaging and large grocery hauls, particularly in markets where consumers prefer maximized utility and extended product lifecycles, ensuring a balanced growth trajectory across all material types.

AI Impact Analysis on PP Reusable Bags Market

User queries regarding the impact of Artificial Intelligence (AI) on the PP Reusable Bags Market predominantly revolve around optimizing manufacturing efficiency, improving supply chain resilience, and enhancing consumer personalization and predictive demand forecasting. Users seek to understand how AI algorithms can manage the volatile global polypropylene raw material prices, automate quality control inspections for woven and non-woven fabric consistency, and refine complex logistics networks crucial for distributing bulky products like reusable bags globally. Key concerns center on the capital investment required for AI integration within existing legacy manufacturing plants and ensuring that AI-driven personalization strategies comply with privacy regulations, especially concerning point-of-sale data gathered to predict optimal inventory levels for different retail bag types across regional store networks. Furthermore, there is significant interest in using AI to model the effectiveness of promotional bag campaigns by tracking consumer behavior and reuse patterns.

The immediate and tangible impact of AI is primarily concentrated in the operational segment, utilizing Machine Learning (ML) algorithms for predictive maintenance of specialized sewing and cutting machinery, minimizing unexpected downtime and maximizing throughput. AI-driven vision systems are dramatically improving quality assurance, instantly identifying minute defects in bag stitching, handle attachment strength, and print alignment, ensuring high-quality products meet stringent retail standards and prolonging the bag’s useful life, which reinforces its reusable credential. In inventory management, AI tools analyze historical sales data, seasonal fluctuations, and external factors (like regulatory changes or competitor strategies) to generate highly accurate forecasts, reducing overproduction and minimizing storage costs—a critical factor for low-margin commodity items like standard retail bags. This integration fundamentally enhances the market's agility and cost-competitiveness.

In the future, AI's role will likely extend into advanced material science and sustainable sourcing. AI and computational chemistry can simulate new polymer formulations or composite structures involving recycled PP content, accelerating the development of next-generation, ultra-lightweight, and 100% recyclable PP fabrics, thus reinforcing the market’s sustainability narrative. Furthermore, AI-powered design tools will enable mass customization, allowing retailers to quickly prototype and order personalized bag designs tailored to localized marketing campaigns, enhancing the promotional segment's effectiveness. The overall influence of AI is to transform the manufacturing process from a reactive, labor-intensive system into a highly automated, demand-responsive, and quality-controlled operation, ensuring the PP reusable bag market can scale efficiently to meet rapidly expanding global regulatory demand while maintaining high environmental performance standards.

- AI optimizes production scheduling and machinery utilization, reducing manufacturing lead times.

- Machine Learning (ML) enhances predictive demand forecasting, minimizing inventory waste and stockouts in retail supply chains.

- AI-driven vision systems automate and accelerate quality control inspections of fabric consistency and bag construction integrity.

- Algorithms manage raw material procurement risk by forecasting polypropylene price volatility.

- AI aids in developing advanced, sustainable PP formulations with higher recycled content and durability characteristics.

- Personalization engines use consumer data to recommend optimal bag designs and order volumes for regional retail operations.

DRO & Impact Forces Of PP Reusable Bags Market

The PP Reusable Bags Market is primarily driven by global legislative shifts towards sustainability, particularly the widespread implementation of plastic bag bans and taxes which fundamentally alter consumer and retailer behavior. Major drivers include increasing consumer environmental consciousness, aggressive corporate sustainability goals (CSR initiatives), and the superior durability and branding utility offered by PP materials compared to paper or bio-plastics. Restraints, however, include the persistent volatility in the price of virgin polypropylene resin, which directly impacts manufacturing costs and profit margins, and the significant logistical challenge associated with the bulky nature of the finished bags, which increases transportation and warehousing expenses. Furthermore, intense competition from alternative reusable materials, such as cotton, jute, and recycled PET (rPET), presents a substitution threat, particularly in premium market segments where consumers prioritize natural fibers or perceived higher sustainability scores, thereby limiting the ceiling of PP market expansion.

Opportunities in this market are abundant, centered around emerging economies in Asia and Africa where large populations and developing modern retail sectors present substantial untapped demand following initial plastic ban implementation. Specific opportunities include specializing in highly customized, heavy-duty industrial packaging applications that require PP's unique strength, and innovation in the recycling loop, focusing on developing efficient collection and processing infrastructure for end-of-life PP bags to create a true closed-loop system, thereby enhancing the material's environmental standing. Investment in advanced manufacturing techniques, such as automation and large-scale printing capabilities, allows manufacturers to achieve economies of scale and offer highly competitive pricing, unlocking opportunities in large-scale government and institutional procurement contracts focused on sustainability and standardized reusable packaging solutions.

The key impact forces dictating market dynamics are dominated by Regulatory Force and Consumer Preference Force. Regulatory Force—specifically, the expansion and strict enforcement of single-use plastic restrictions globally—acts as the primary external accelerator, making reusable bags a necessity rather than an option. The Consumer Preference Force is equally vital; as consumers become more educated, their willingness to pay a slight premium for reusable and branded bags increases, particularly if those bags are perceived to be high quality and durable (characteristics inherent to PP). Economic forces related to raw material costs and global supply chain disruptions introduce intermittent volatility, acting as a frictional constraint on steady growth, requiring manufacturers to implement sophisticated risk hedging and diversification strategies to maintain operational stability and profitability throughout the forecast period, emphasizing the need for robust long-term planning.

Segmentation Analysis

The PP Reusable Bags Market is meticulously segmented based on material type (Woven vs. Non-Woven), primary application (Shopping, Grocery, Promotional, Industrial), and distribution channel (Supermarkets/Hypermarkets, Online Retail, Convenience Stores). This structure allows for precise analysis of market demand drivers, catering directly to the varied needs of industrial end-users seeking maximal strength and retail customers demanding aesthetic appeal and cost-efficiency. Non-Woven PP bags currently dominate the retail segment due to their flexibility in design, comfortable texture, and cost-effectiveness for bulk promotional giveaways, while Woven PP bags hold a strong position in logistics and heavy-duty industrial packaging where structural integrity under extreme loads is non-negotiable, ensuring market fragmentation is strategically utilized for specialized growth.

The application segmentation is crucial for understanding demand elasticity and price sensitivity. The Grocery Bag segment, characterized by high volume and functional necessity, is relatively price-sensitive and driven by long-term procurement contracts with large supermarket chains, demanding consistent quality and efficient logistics. In contrast, the Promotional Bags segment is driven by marketing budgets, prioritizing high-definition printing capabilities and unique structural designs to maximize brand visibility and recall. This divergence means manufacturers must employ distinct production lines and marketing strategies tailored to the unique performance requirements and purchasing criteria of each application category, recognizing that a standard bag designed for grocery use may not meet the aesthetic or durability requirements for a premium retail promotion.

Distribution channel analysis underscores the evolving retail landscape. While traditional Supermarkets and Hypermarkets remain the dominant point of sale for reusable bags, facilitating consumer adoption at the transaction point, the Online Retail channel is experiencing rapid growth. E-commerce platforms are increasingly utilizing durable PP bags for internal logistics and specialized product deliveries, recognizing their value in protecting goods and reducing secondary packaging needs, thereby creating a lucrative new stream of specialized, higher-specification bulk orders. The increasing maturity of online retail in emerging markets is further diversifying the distribution landscape, pushing manufacturers to adapt their logistical frameworks to handle smaller, geographically dispersed fulfillment requirements in addition to traditional container-load shipments to major retail hubs.

- By Type:

- Woven PP Bags

- Non-Woven PP Bags

- By Application:

- Shopping Bags

- Grocery Bags

- Promotional Bags

- Industrial Packaging

- Specialty Retail Bags

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail Channels

- Direct Sales (B2B Industrial)

Value Chain Analysis For PP Reusable Bags Market

The value chain for the PP Reusable Bags Market begins with the upstream segment, dominated by petrochemical producers supplying polypropylene resin pellets, the primary raw material. This stage is highly susceptible to global crude oil price fluctuations and involves complex chemical processing, which determines the quality and cost base of the final product. Key activities upstream involve the sourcing and synthesis of monomers, followed by polymerization into the required polymer grades (for both weaving and non-woven applications). Manufacturers then procure this resin and convert it into PP sheets or rolls of woven/non-woven fabric through extrusion, spinning, and bonding processes. Efficiency in this initial conversion stage, particularly minimizing material waste and optimizing energy usage, is crucial as it significantly dictates the final product cost and environmental footprint, demanding precision technology and large-scale manufacturing capacity for competitive advantage.

The midstream stage involves the core manufacturing activities: cutting the PP fabric rolls, high-frequency sealing or stitching the bag components, and intricate printing (gravure, screen, or flexographic) required for branding and promotional designs. This stage adds the most substantial value in terms of customization and finished product quality, requiring specialized machinery and skilled labor. Downstream activities encompass warehousing, inventory management, and distribution to various end-users. The distribution channels are bifurcated into direct and indirect methods. Direct distribution typically involves B2B sales to large industrial customers or major retail chains placing bulk, long-term orders, requiring streamlined logistics and direct contractual relationships. This channel prioritizes volume efficiency and contractual reliability, often bypassing several intermediaries to maintain cost competitiveness and quality control over the final delivered product.

The indirect distribution channel leverages various intermediaries, including wholesalers, distributors, specialized packaging brokers, and, increasingly, e-commerce fulfillment partners, to reach smaller retail outlets, convenience stores, and specialized promotional agencies. This channel is crucial for maximizing market reach and addressing the fragmented demand often characteristic of promotional goods and regional retail chains. Both channels must manage the significant logistical challenge posed by the bags’ volume-to-weight ratio, necessitating optimized packaging and efficient container utilization to keep freight costs manageable. Strategic distribution channel management, balancing cost-efficiency with market reach, is pivotal for sustaining profitability, especially given the low-margin nature of high-volume reusable bags, demanding continuous optimization of the entire logistical framework from factory gate to final point of sale.

PP Reusable Bags Market Potential Customers

The primary customer base for PP reusable bags is highly diverse, centered on entities requiring durable, branded, and environmentally compliant packaging or carrying solutions. The largest segment comprises large retail enterprises, specifically major supermarket and hypermarket chains globally. These entities are mandated by law or pressured by consumer trends to offer reusable options at the point of sale, making them consistent, high-volume buyers of standardized grocery bags. Their purchasing decisions are driven by cost-per-unit, durability standards, and the manufacturer's capacity to handle massive, geographically diverse orders. Secondary large institutional buyers include governmental bodies and educational institutions procuring bags for organized events, public outreach programs, or internal waste management initiatives, where robustness and bulk quantity are key determinants.

A rapidly expanding customer segment includes businesses utilizing PP bags for promotional and marketing purposes. This encompasses diverse industries such as fast-moving consumer goods (FMCG) companies, luxury brand retailers, financial services, and telecommunication providers. For these customers, the PP reusable bag functions as a high-visibility marketing asset, valuing customization, superior print quality, and aesthetic appeal over minimal unit cost. They often require smaller, highly tailored batches with complex graphic designs and specific material finishes (e.g., laminated non-woven PP). The purchase motivation here is driven by brand extension, event sponsorship, and generating long-term consumer exposure, treating the bag as an element of sophisticated consumer interaction and loyalty building.

Furthermore, specialized industrial and logistics companies constitute a critical customer segment, primarily utilizing high-strength woven PP bags for heavy-duty applications such as bulk packaging of grains, cement, fertilizers, and specific manufacturing components. These industrial buyers prioritize technical specifications, including UV resistance, burst strength, and specialized closures, over retail aesthetic considerations. The emerging potential customer base also includes e-commerce giants and third-party logistics (3PL) providers who are integrating reusable packaging into their supply chain for inter-facility transfers and premium delivery services, seeking durable, standardized containers that can withstand repeated use in high-throughput fulfillment centers, ensuring product integrity while meeting sustainability mandates and reducing reliance on single-use transit packaging.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ultra Poly, Sarcina Nonwovens, Shish Industries, Berry Global, Novolex, Interpak, Starlinger & Co. GmbH, United Bags, American Plastics Company, Earthwise Bag Company, Command Packaging, Elif Packaging, Rani Plast, LC Packaging, Sonoco Products Company, Mondi Group, Smurfit Kappa, Huhtamaki, DS Smith, Printpack |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PP Reusable Bags Market Key Technology Landscape

The manufacturing technology underpinning the PP Reusable Bags Market primarily relies on advanced extrusion, weaving, and non-woven bonding processes, complemented by sophisticated printing technologies. For Woven PP bags, the critical technology involves circular weaving looms that produce high-strength tubular fabric, minimizing seams and maximizing structural integrity required for heavy loads. Recent technological advancements focus on high-speed, automated lamination processes (BOPP lamination) that apply protective films to the woven surface, enhancing water resistance, tear strength, and providing a superior, high-definition printing substrate. This integration of lamination technology has allowed woven bags to penetrate aesthetic-driven retail segments previously dominated by non-woven variants, bridging the gap between durability and visual appeal for premium heavy-duty carriers.

In the Non-Woven PP segment, the predominant technology is Spunbond and Meltblown processes, which are optimized for rapid, continuous fabric production with customizable thickness and tensile strength. Key innovations here center on reducing the weight of the fabric while maintaining performance metrics, often achieved through fine-tuning the fiber diameter and utilizing advanced bonding agents, leading to lighter, more cost-effective promotional bags. Furthermore, the integration of automation in the bag conversion stage—specifically ultrasonic welding and automated stitching robots—has significantly improved production throughput and consistency, mitigating reliance on manual labor and enabling rapid scaling of output to meet sudden increases in global demand, a necessity driven by swift regulatory changes across geographical markets.

Beyond material formation and assembly, printing technology represents a critical competitive differentiator. Flexographic and rotogravure printing presses adapted for PP surfaces are essential for producing the vibrant, high-quality graphics demanded by promotional and retail branding customers. Modern printing advancements include solvent-free, eco-friendly ink systems that reduce the bag's environmental impact while ensuring high color fastness and durability, crucial for a product designed for extended use. The emerging technological focus is on enhancing the recyclability of the final product, specifically developing single-material structures (e.g., all-PP laminate bags) that eliminate mixed materials, simplifying the mechanical recycling process and improving the overall sustainability profile, thereby securing the market's relevance in the context of increasingly stringent extended producer responsibility (EPR) schemes.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of future market growth, fueled by rapid economic development, massive population density, and aggressive governmental implementation of plastic reduction policies, particularly in economic giants like China, India, and Southeast Asian nations. The region benefits from a low-cost manufacturing base, making it both a massive consumer and a major global exporter of PP reusable bags. Demand is skyrocketing, especially in the organized retail sector and rapidly growing e-commerce logistics, requiring significant investment in localized production capacity and efficient domestic supply chains to satisfy the sheer volume of mandated replacement bags.

- North America: This region is characterized by high consumer awareness and a complex regulatory patchwork, with state- and municipality-level bans driving adoption. North America is a mature market focused heavily on premium, high-quality, branded reusable bags, often incorporating recycled PP content to meet corporate sustainability mandates. The market is defined by sophisticated retail supply chain demands and a strong emphasis on customizable, promotional products where high-definition printing and superior finishing techniques are preferred, leading to higher average selling prices (ASPs) compared to commodity markets.

- Europe: Europe represents a highly regulated market, driven by the EU Single-Use Plastic Directive and robust national circular economy mandates. The focus is overwhelmingly on sustainability, demanding products that are not only reusable but also easily recyclable and ideally made from post-consumer recycled (PCR) PP content. Innovation is concentrated on developing highly durable, closed-loop recycling solutions and achieving product certifications that verify material sourcing and ethical production, with strong demand from major supermarket chains committed to zero-waste objectives and long-term bag standardization.

- Latin America (LATAM): Growth in LATAM is variable but accelerating, driven by the expansion of modern retail formats and early adoption of plastic restrictions in key economies like Brazil, Mexico, and Chile. The market is price-sensitive, balancing the need for compliance with the economic realities of local consumers, favoring cost-effective non-woven PP options for high volume. Infrastructure development for recycling and sophisticated logistics remains a challenge, but urbanization and increased foreign retail investment are steadily enhancing the market's demand profile.

- Middle East and Africa (MEA): This region is an emerging frontier, with market growth heavily reliant on government initiatives to tackle coastal plastic pollution and rapid infrastructure development in urban centers, particularly the Gulf Cooperation Council (GCC) nations and South Africa. Demand is bifurcated, covering large infrastructure project requirements (woven industrial bags) and developing consumer retail needs. Regulatory enforcement is key to unlocking the large-scale potential, with sustainability goals often tied to broader national visions for environmental management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PP Reusable Bags Market.- Ultra Poly

- Sarcina Nonwovens

- Shish Industries

- Berry Global

- Novolex

- Interpak

- Starlinger & Co. GmbH

- United Bags

- American Plastics Company

- Earthwise Bag Company

- Command Packaging

- Elif Packaging

- Rani Plast

- LC Packaging

- Sonoco Products Company

- Mondi Group

- Smurfit Kappa

- Huhtamaki

- DS Smith

- Printpack

Frequently Asked Questions

Analyze common user questions about the PP Reusable Bags market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption and growth of the PP Reusable Bags Market globally?

The primary driver is the rapid global proliferation of stringent governmental regulations, including bans and significant taxes on single-use plastic bags, compelling retailers and consumers to immediately transition to durable, multi-use alternatives like PP reusable bags for compliant shopping solutions.

How do Woven PP bags differ structurally and functionally from Non-Woven PP bags?

Woven PP bags are manufactured by interlacing PP tapes, resulting in superior strength, high load-bearing capacity, and tear resistance, making them ideal for heavy-duty industrial and large grocery applications. Non-Woven PP bags are manufactured by thermally or chemically bonding fibers, offering better printability, a softer texture, and lower cost for promotional and lighter retail use.

Which geographical region exhibits the highest growth potential for PP Reusable Bags and why?

The Asia Pacific (APAC) region, specifically emerging economies like India and China, demonstrates the highest growth potential due to rapid urbanization, expanding organized retail infrastructure, and the implementation of large-scale, mandatory plastic ban policies covering vast consumer bases, creating unprecedented demand volume.

What are the main sustainability challenges facing the PP Reusable Bags Market?

Despite being reusable, the main sustainability challenge involves the difficulty in establishing efficient and standardized end-of-life collection and mechanical recycling infrastructure for polypropylene, coupled with market demands for using more Post-Consumer Recycled (PCR) content in new bag production to truly close the material loop.

How is technology, such as AI, being applied to optimize the production of reusable PP bags?

AI integration focuses on enhancing operational efficiency through predictive maintenance of manufacturing machinery, utilizing machine learning for highly accurate demand forecasting to prevent overproduction, and employing AI-driven vision systems for automated, high-speed quality control inspections during the fabrication process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager