PPS Film Adhesive Tape Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441663 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

PPS Film Adhesive Tape Market Size

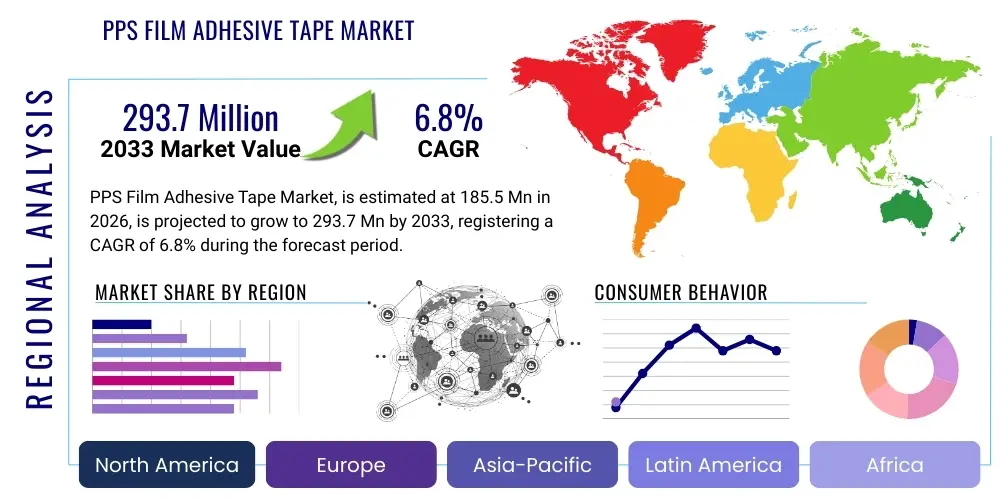

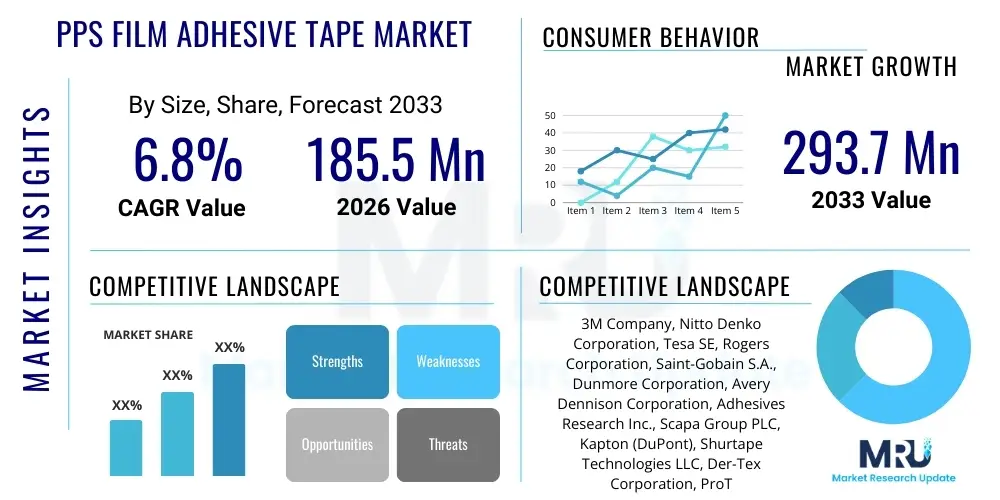

The PPS Film Adhesive Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 293.7 million by the end of the forecast period in 2033.

PPS Film Adhesive Tape Market introduction

The PPS (Polyphenylene Sulfide) Film Adhesive Tape Market encompasses high-performance adhesive solutions utilizing PPS film as the substrate, often coated with specialized pressure-sensitive adhesives (PSAs), thermosetting adhesives, or silicone-based formulations. PPS is a semi-crystalline, high-performance thermoplastic known for its exceptional thermal stability, chemical resistance, and inherent flame retardancy. These tapes are specifically engineered for critical applications where standard polymers fail due to extreme temperature fluctuations, exposure to harsh chemicals, or stringent regulatory requirements regarding flammability and dielectric properties. The primary function of PPS adhesive tapes includes high-temperature masking, electrical insulation, thermal management, wire harnessing, and protective layering in demanding environments. Their unique properties allow them to perform reliably in continuous operating temperatures far exceeding those tolerated by conventional polymer films like PET or PVC, making them essential components in modern high-reliability systems.

The market growth is substantially driven by the accelerating demand for miniaturized and high-density electronic devices, particularly in the semiconductor manufacturing and battery technology sectors. As electronic components become smaller and generate more heat, efficient thermal insulation and robust structural integrity become paramount, necessitating the superior mechanical and thermal characteristics of PPS tapes. Key applications include insulating components within Electric Vehicle (EV) battery packs, thermal barriers in aerospace structures, and masking during plasma spraying or high-temperature coating processes. Furthermore, the stringent safety standards imposed across industries like automotive and aerospace, particularly concerning fire resistance and electrical safety, favor the adoption of PPS tapes due to the material's UL94 V-0 rating potential and inherent dielectric strength.

Major applications of PPS Film Adhesive Tape span across several high-value industries. In the automotive sector, they are critical for wire wrapping and insulation in engine compartments, sensors, and electronic control units (ECUs). In electronics, they are used for insulation, grounding, and surface protection during assembly processes, especially in flexible printed circuits (FPCs) and high-power density modules. The benefits derived from utilizing these tapes include enhanced operational safety, extended component lifespan, reduced maintenance costs, and improved overall system performance under thermal and chemical stress. These tapes facilitate advanced manufacturing processes that require resistance to aggressive cleaning agents and extreme heat, thus positioning PPS adhesive tape as an indispensable material for future industrial advancements.

PPS Film Adhesive Tape Market Executive Summary

The global PPS Film Adhesive Tape Market is poised for substantial expansion, reflecting sustained investment across critical industrial sectors requiring high thermal and chemical resistance. Business trends indicate a strong focus on customization and formulation development, moving towards thinner, lighter, and more conformable tapes that maintain high dielectric strength for next-generation electronics and EV battery architecture. Major manufacturers are prioritizing backward integration to secure PPS polymer supply and improve cost efficiencies, alongside expanding their specialized coating capabilities. The competitive landscape is characterized by innovation focused on developing specialized adhesives, such as high-performance acrylic or silicone PSAs, optimized for PPS film to meet demanding industry specifications like those in aerospace and high-speed rail. Strategic alliances and mergers targeting niche thermal management expertise are increasingly shaping the market structure, aiming to capture the growing opportunity presented by the energy storage transition.

Regionally, Asia Pacific (APAC) currently dominates the market share and is projected to exhibit the fastest growth rate throughout the forecast period, primarily driven by massive investments in electronics manufacturing, semiconductor fabrication, and the burgeoning electric vehicle production base in countries like China, South Korea, and Japan. North America and Europe maintain significant market shares, characterized by high adoption rates in the aerospace & defense sector and stringent regulatory requirements that necessitate the use of high-performance materials. These developed regions are focusing on high-margin, specialized applications, including medical device sterilization components and advanced industrial processing equipment, ensuring sustained demand for premium PPS adhesive solutions.

Segmentation trends highlight the increasing demand for high-temperature silicone adhesive tapes paired with PPS film due to their unmatched thermal performance in continuous operation environments exceeding 200°C. Application segmentation reveals the electronics and automotive segments as the primary revenue generators, driven by the shift towards smaller, more powerful electronic modules and the mass production of EVs, which inherently require robust thermal management solutions. Within the product type, tapes incorporating thicker PPS films (e.g., 50µm or higher) continue to find strong use in heavy industrial insulation and barrier applications, while thinner films (e.g., 25µm) are increasingly preferred in compact electronic assemblies where space and weight saving are critical design constraints, underscoring a trend toward optimization in material usage across all market verticals.

AI Impact Analysis on PPS Film Adhesive Tape Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the PPS Film Adhesive Tape Market largely revolve around three core themes: optimization of manufacturing processes, predictive failure analysis in end-use applications, and AI's role in accelerating material discovery and formulation. Users commonly ask how AI can refine coating thickness uniformity, minimize waste during tape conversion, and optimize curing processes to enhance adhesive performance consistency. There is also significant interest in using machine learning algorithms to analyze material stress data, predicting when and where PPS tape components might fail under extreme thermal cycling or chemical exposure in complex systems like autonomous vehicles or industrial robots. Furthermore, the market anticipates AI accelerating R&D by simulating molecular interactions, thereby speeding up the development of novel adhesive chemistries that better bond with PPS film, ultimately leading to higher reliability and reduced time-to-market for specialized tape products.

- AI-driven Predictive Maintenance: Enables end-users, particularly in automotive and aerospace, to monitor the performance lifespan of PPS tape installations, predicting degradation caused by thermal stress or vibration, thereby reducing unplanned downtime.

- Manufacturing Optimization: Implementation of machine learning models to analyze real-time production data, optimizing parameters such as coating speed, curing temperature, and tension control, leading to improved quality consistency and reduced material scrap rates.

- Automated Quality Control (QC): Utilizing AI-powered computer vision systems for high-speed detection of microscopic defects, such as pinholes, uneven coating, or contamination, ensuring tapes meet ultra-high purity standards required for semiconductor and medical applications.

- Material Informatics: AI accelerates the discovery and design of novel adhesive formulations (e.g., specific silicone or acrylic chemistries) that exhibit improved long-term adhesion and thermal stability when applied to the unique surface properties of PPS film.

- Supply Chain Resilience: Machine learning algorithms enhance supply chain forecasting for raw materials (PPS resin, specialized solvents, release liners), helping manufacturers navigate volatile commodity markets and ensuring stable production planning.

DRO & Impact Forces Of PPS Film Adhesive Tape Market

The PPS Film Adhesive Tape market dynamics are significantly influenced by a confluence of accelerating drivers and persistent restraints, creating a challenging yet opportunistic landscape. Key drivers include the relentless global transition towards electric mobility and sustainable energy solutions, which necessitate superior thermal and electrical insulation components, a function perfectly served by PPS tapes. Furthermore, the miniaturization trend in high-performance electronics demands materials capable of handling extreme heat density. Restraints mainly stem from the high raw material costs associated with specialized PPS polymer resin and high-temperature PSAs, which limit adoption in cost-sensitive, large-volume applications. Additionally, the complexity involved in achieving consistent, defect-free coating on PPS film, combined with technical challenges in ensuring long-term adhesion stability across diverse environmental conditions, poses technical hurdles for manufacturers. Opportunities are vast, focused primarily on expanding applications in renewable energy infrastructure, such as solar panel construction and wind turbine component insulation, alongside developing biocompatible PPS tapes for advanced medical device packaging and sterilization processes. The market impact forces suggest that technological innovation centered around cost-effective production methods and enhanced adhesive performance will be crucial determinants of market trajectory over the forecast period.

The primary driving force remains the increasing electrification across various industrial domains. Electric vehicles rely heavily on PPS tapes for insulating battery cells, modules, and complex wire harnesses within high-voltage systems where temperatures can spike dramatically. Similarly, the aerospace industry utilizes these tapes for weight reduction and increased safety in fuselage insulation and engine components, complying with rigorous thermal shock and flammability standards. This structural demand provides a stable foundation for market growth, incentivizing manufacturers to scale up production capacities. However, the reliance on a limited number of specialized polymer producers contributes significantly to price volatility, making supply chain management a core challenge. The specialized processing requirements for PPS, which demands high temperatures during both film extrusion and subsequent coating/curing stages, also acts as a constraint, demanding substantial capital investment in machinery and expertise, restricting entry for general adhesive tape manufacturers.

Opportunities are predominantly emerging from untapped niche markets and technological convergence. The integration of advanced driver-assistance systems (ADAS) and autonomous driving technology requires more complex sensor arrays and control units, all demanding robust thermal and electromagnetic interference (EMI) shielding, often incorporating PPS film tapes. Furthermore, research into flexible electronics and wearable technology opens avenues for ultra-thin, highly flexible PPS tapes capable of maintaining integrity during continuous bending and high-humidity exposure. Successfully navigating the high capital expenditure associated with manufacturing while strategically targeting these high-growth, high-margin opportunities, particularly in Asia's electronics and battery megafactories, will define success for market participants. The overall impact of these forces is heavily skewed towards positive growth, provided companies can manage the inherent cost structure and technological complexities associated with high-performance polymer processing.

Segmentation Analysis

The PPS Film Adhesive Tape market is comprehensively segmented based on product type, adhesive type, film thickness, and end-user application, allowing for a detailed understanding of demand patterns and strategic market positioning. Product type segmentation typically differentiates between single-sided and double-sided tapes, catering to varying structural and mounting requirements. Adhesive type segmentation is crucial, as the performance envelope of the tape is largely defined by the adhesive chemistry, particularly separating high-temperature silicone-based formulations from specialized acrylic or rubber-based systems. Film thickness is a key performance parameter, balancing mechanical strength against flexibility and weight, segmenting the market into ultra-thin (for electronics) and thick (for heavy industrial insulation) categories. Finally, the end-user landscape provides the most critical insight, identifying major consumption centers such as the robust automotive sector, the rapidly expanding electronics and semiconductor industry, and the highly regulated aerospace and defense sectors, all dictating specific material performance standards and certification requirements.

Analyzing these segments reveals dynamic shifts in market concentration. The fastest-growing segment is projected to be double-sided PPS tape utilizing high-temperature silicone adhesive, driven by its necessity in bonding heat-dissipating components within enclosed electronic assemblies and EV battery modules where secure, long-term adhesion under continuous thermal cycling is required. Conversely, while smaller in volume, the aerospace segment commands the highest average selling prices (ASPs) due to stringent specification adherence, extensive qualification procedures, and low volume, custom-order requirements. Understanding the interplay between film thickness and end-use application is paramount; for instance, the semiconductor industry heavily favors films less than 25µm for temporary wafer mounting or masking during etching processes, whereas industrial furnace insulation might require films exceeding 100µm for enhanced mechanical barrier protection. This granular segmentation aids in tailoring product development efforts to match precise industry needs.

The increasing focus on sustainable manufacturing and materials is subtly influencing segmentation. While PPS itself is highly durable, there is growing pressure to develop adhesive systems that are solvent-free or utilize water-based formulations, particularly in the acrylic segment, to meet environmental regulations, especially in Europe. This shift is creating a sub-segment focused on eco-friendly, high-performance tapes, though silicone-based solutions remain dominant where extreme thermal performance is non-negotiable. Furthermore, specialized segmentation based on electrical properties, such as high-voltage insulation tapes or tapes with specific dielectric constants, is becoming more prevalent as the demand for advanced electronic protection and high-power transmission increases, necessitating continuous innovation within core product lines to maintain competitive advantage.

- By Product Type:

- Single-Sided PPS Film Adhesive Tape

- Double-Sided PPS Film Adhesive Tape

- By Adhesive Type:

- Silicone-Based Adhesive Tapes

- Acrylic-Based Adhesive Tapes

- Rubber-Based Adhesive Tapes (Limited Use)

- Thermosetting Adhesive Tapes

- By Film Thickness:

- Below 25 µm (Microns)

- 25 µm – 50 µm

- Above 50 µm

- By End-User Application:

- Automotive (EV Batteries, Engine Components, Wire Harnessing)

- Electronics and Semiconductor (PCB Masking, Insulation, FPC Manufacturing)

- Aerospace and Defense (Thermal Insulation, Structural Bonding, Wire Wrapping)

- Industrial (Powder Coating Masking, High-Temperature Processing)

- Healthcare and Medical Devices (Sterilization, Insulation)

- Energy (Renewable Energy Components, Power Generation)

Value Chain Analysis For PPS Film Adhesive Tape Market

The value chain for the PPS Film Adhesive Tape market is complex, beginning with the specialized petrochemical industry providing raw materials and extending through sophisticated manufacturing and specialized distribution channels to high-tech end-users. The upstream segment is dominated by a few global chemical giants responsible for synthesizing high-purity PPS resin (polyphenylene sulfide) and manufacturing the specialized adhesive chemistries (silicone polymers, acrylic monomers). This phase is characterized by high capital intensity and proprietary technology, leading to significant leverage for raw material suppliers, which impacts the final tape cost structure. Key activities here include polymerization, extrusion of the PPS film substrate, and chemical synthesis of high-performance PSAs designed to withstand extreme temperatures and chemical exposure.

The midstream phase involves the core manufacturing and conversion processes. Tape manufacturers source the PPS film and adhesive materials, then undertake highly specialized coating processes, utilizing technologies like hot melt, solvent coating, or transfer coating, followed by curing and slitting. Maintaining uniform coating thickness and high bond strength without compromising the thermal integrity of the PPS film is a critical value-add activity in this stage. Quality assurance, ensuring compliance with standards such as UL and various military specifications, adds significant value and complexity. Direct distribution channels involve tape manufacturers selling directly to large OEMs in the automotive or aerospace industries, allowing for close technical collaboration and customized product development, which is essential for high-performance applications.

Downstream analysis focuses on distribution and end-user consumption. Indirect distribution relies on specialized industrial distributors and converters who often modify the tape (die-cutting, laminating) before supplying smaller volume end-users across diverse industrial sectors. End-users, such as Tier 1 automotive suppliers or electronic contract manufacturers, are primarily interested in the tape's functional performance—its ability to insulate, protect, or mask reliably under stringent conditions. The final phase involves the post-sale technical support and qualification process, which is particularly vital in the aerospace and medical sectors where detailed documentation and traceable compliance records are mandatory, thereby locking in customer loyalty and justifying the premium pricing associated with PPS film adhesive tapes.

PPS Film Adhesive Tape Market Potential Customers

Potential customers for PPS Film Adhesive Tape are primarily concentrated in industries demanding superior material performance under harsh operating conditions, where failure due to thermal stress or chemical attack is unacceptable and costly. The largest volume consumers are original equipment manufacturers (OEMs) and Tier 1 suppliers in the automotive industry, specifically those involved in the fabrication and assembly of electric vehicle (EV) battery packs, charging infrastructure, and advanced engine control units (ECUs). These customers require tapes for electrical insulation, wire bundling, and thermal shielding within high-voltage systems. Another crucial customer base includes electronic manufacturing service (EMS) providers and semiconductor foundries, utilizing PPS tapes for high-temperature masking during wave soldering, conformal coating protection, or temporary bonding during wafer processing stages, prioritizing tapes with excellent dielectric properties and residue-free removal.

Beyond these high-volume sectors, high-value customers exist within the aerospace and defense sectors, including airframe manufacturers and component suppliers. These entities purchase PPS tapes for insulation within engine nacelles, aircraft wire harnessing, and structural components where adherence to strict flame-retardant standards (e.g., FAR 25.853) is mandatory, making performance compliance more critical than cost. Furthermore, customers in the industrial sector, such as manufacturers of powder coating equipment, specialized furnaces, and high-temperature industrial machinery, represent significant potential, utilizing PPS tapes for long-duration masking applications requiring continuous thermal stability above 200°C. Finally, the growing medical device manufacturing sector is emerging as a niche consumer, seeking tapes for insulation in diagnostic equipment or for components that require high-temperature sterilization, demanding tapes that are chemically inert and potentially biocompatible.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 293.7 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Nitto Denko Corporation, Tesa SE, Rogers Corporation, Saint-Gobain S.A., Dunmore Corporation, Avery Dennison Corporation, Adhesives Research Inc., Scapa Group PLC, Kapton (DuPont), Shurtape Technologies LLC, Der-Tex Corporation, ProTapes & Specialties, Teraoka Seisakusho Co., Ltd., SEKISUI CHEMICAL CO., LTD., Cantech Industries, Intertape Polymer Group (IPG), Boyd Corporation, LINTEC Corporation, and FLEXcon Company, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PPS Film Adhesive Tape Market Key Technology Landscape

The technological landscape of the PPS Film Adhesive Tape market is characterized by advancements in three primary areas: film extrusion, adhesive formulation, and coating/curing processes. PPS film manufacturing requires high-precision extrusion technologies to achieve uniform thickness and optimal mechanical properties, especially for ultra-thin films required in sensitive electronic applications. Manufacturers leverage sophisticated biaxial orientation techniques and precision die control to enhance the film's tensile strength, dimensional stability, and dielectric performance across a wide temperature range. This material science focus is crucial, as the base PPS film must maintain integrity when subjected to subsequent high-temperature coating and end-use stresses. Furthermore, surface treatment technologies, such as plasma etching or corona treatment, are frequently employed to enhance the low surface energy of PPS, thereby improving the adhesion interface with specialized PSAs.

Adhesive formulation technology represents the second critical pillar. Given the high-temperature requirements (often exceeding 200°C for short durations or 180°C continuously), conventional acrylics often fail. Consequently, major technological investments are channeled into developing highly stable, specialty silicone adhesives that exhibit excellent shear strength and minimal outgassing, crucial for aerospace and cleanroom electronics applications. Recent innovations focus on UV-curable and solvent-free adhesive systems to meet stricter environmental regulations and reduce manufacturing cycle times. The challenge lies in creating an adhesive that not only bonds effectively to the chemically inert PPS but also maintains its elasticity and adhesive strength under continuous thermal cycling, a persistent issue in EV battery assemblies where component expansion and contraction stress the adhesive bond lines.

The third area involves advanced coating and converting technologies. Precision coating methods, including slot die and gravure coating, are essential to ensure the homogenous application of expensive, high-performance adhesives, minimizing waste and ensuring precise thickness control. Automation and inline inspection systems, often incorporating AI vision systems, are increasingly being adopted to detect and eliminate microscopic defects, which are unacceptable in high-reliability applications. Furthermore, the converting process utilizes advanced rotary or laser die-cutting techniques to create precise shapes and intricate designs required for masking and insulation within complex electronic devices, ensuring high throughput and material efficiency. The convergence of these three technological streams defines the performance edge in the competitive PPS film adhesive tape market.

Regional Highlights

- Asia Pacific (APAC): Dominant market share and highest growth rate due to vast electronics, semiconductor, and EV manufacturing bases; focused on high-volume, cost-competitive solutions. Key consuming nations include China, Japan, and South Korea.

- North America: Mature market characterized by high-value applications in aerospace and defense; strong focus on R&D for next-generation automotive electronics and stringent compliance standards.

- Europe: High adoption in specialized industrial processes, precision machinery, and adherence to strict environmental and flammability standards (e.g., DIN, REACH); steady demand from the region’s established automotive industry.

- Latin America (LATAM): Emerging market driven by industrial modernization, growth in local automotive assembly, and expansion of power generation infrastructure.

- Middle East and Africa (MEA): Growth driven by investments in oil & gas exploration (requiring high chemical resistance) and large-scale infrastructural projects demanding durable insulation materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PPS Film Adhesive Tape Market.- 3M Company

- Nitto Denko Corporation

- Tesa SE

- Rogers Corporation

- Saint-Gobain S.A.

- Dunmore Corporation

- Avery Dennison Corporation

- Adhesives Research Inc.

- Scapa Group PLC

- Kapton (DuPont)

- Shurtape Technologies LLC

- Der-Tex Corporation

- ProTapes & Specialties

- Teraoka Seisakusho Co., Ltd.

- SEKISUI CHEMICAL CO., LTD.

- Cantech Industries

- Intertape Polymer Group (IPG)

- Boyd Corporation

- LINTEC Corporation

- FLEXcon Company, Inc.

Frequently Asked Questions

Analyze common user questions about the PPS Film Adhesive Tape market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of PPS Film Adhesive Tape over standard tapes like PET or Kapton?

PPS Film Adhesive Tape offers superior chemical resistance, exceptional dimensional stability, and excellent dielectric properties, particularly when exposed to moisture or aggressive solvents. Unlike many polyimides (Kapton), PPS can maintain high mechanical strength and thermal stability up to continuous operating temperatures of 200°C, and offers inherent flame retardancy (often meeting UL94 V-0 requirements) at a potentially lower cost point than high-grade Kapton alternatives, making it ideal for harsh industrial and automotive environments.

Which key industries are driving the current demand for PPS Film Adhesive Tapes?

The automotive industry, especially the Electric Vehicle (EV) sector, is the primary driver, utilizing PPS tapes extensively for battery pack insulation, module wrapping, and wire harnessing in high-voltage systems. Additionally, the electronics and semiconductor industry relies on PPS tapes for high-temperature masking during processing and for electrical insulation in miniaturized, heat-intensive components, ensuring long-term reliability and compliance with strict safety standards.

How is the high cost of PPS resin affecting market adoption and innovation?

The high cost of raw PPS resin acts as a major market restraint, limiting its adoption in non-critical, high-volume applications where cheaper alternatives suffice. However, this restraint concurrently drives innovation toward developing thinner PPS films and optimizing adhesive coating weight while maintaining performance, focusing manufacturers on high-margin, specialized applications where the material's failure is costlier than the tape itself, thereby justifying the premium price.

What is the future outlook for PPS tapes in the flexible electronics segment?

The future outlook is highly positive. As flexible printed circuits (FPCs) and foldable devices require materials that withstand continuous flexing and localized heating, ultra-thin PPS tapes (below 25 µm) with conformable, high-performance adhesives are increasingly being developed. These tapes offer the necessary thermal dissipation and structural integrity required to enable next-generation flexible displays and wearable technology, acting as crucial insulators and protective barriers.

What role does Asia Pacific play in the global supply chain for PPS Film Adhesive Tapes?

Asia Pacific (APAC) is paramount, serving as both the largest consumer and the most significant manufacturing hub for PPS Film Adhesive Tapes. The region houses the world's largest electronics contract manufacturers and EV battery producers, leading to immense demand volume. Furthermore, many major global tape converters have established large-scale production facilities in APAC to be closer to these key end-users, solidifying the region's central role in both supply and consumption dynamics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager