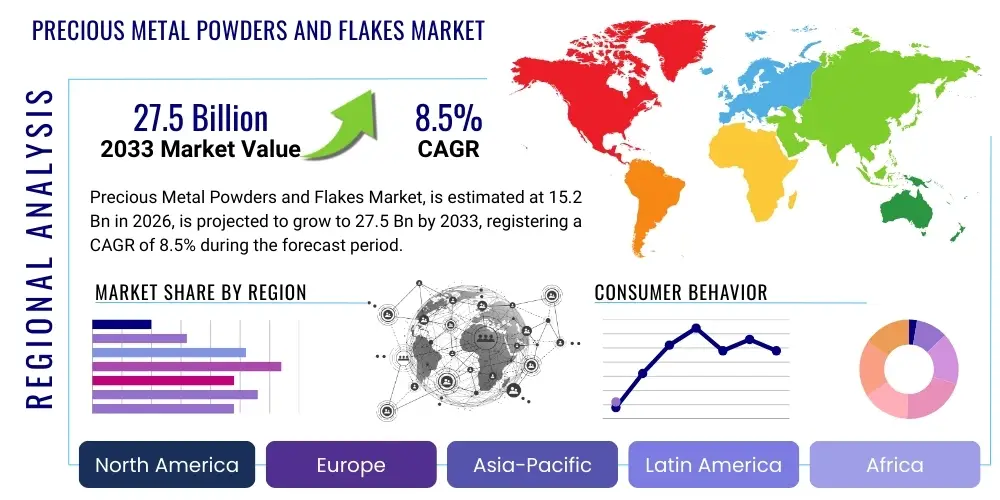

Precious Metal Powders and Flakes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443621 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Precious Metal Powders and Flakes Market Size

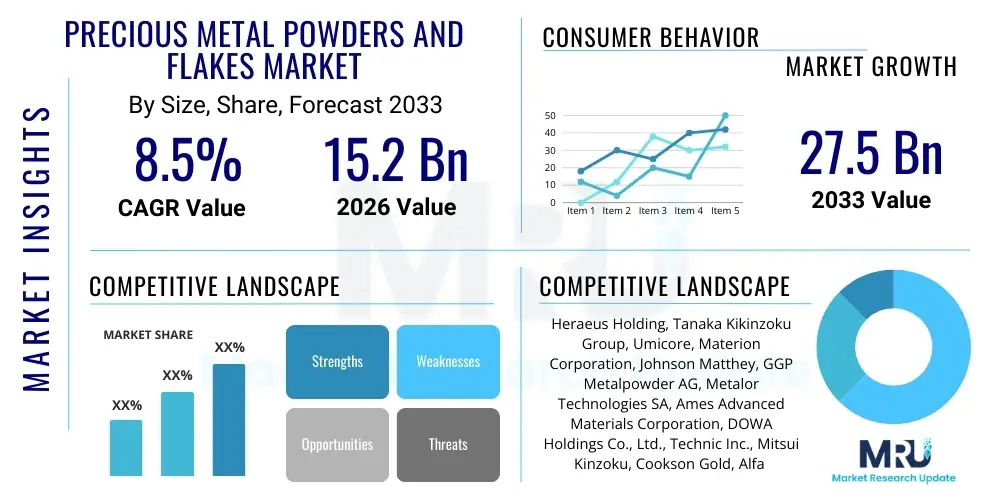

The Precious Metal Powders and Flakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Precious Metal Powders and Flakes Market introduction

The Precious Metal Powders and Flakes Market encompasses highly specialized, fine-grained materials derived from noble metals such as gold, silver, platinum, palladium, rhodium, and ruthenium. These materials are characterized by ultra-high purity, controlled particle morphology (ranging from spherical powders to planar flakes), and specific surface chemistries optimized for advanced industrial applications. Their unique electrical conductivity, catalytic efficiency, and corrosion resistance make them indispensable components in modern high-tech sectors, driving significant market expansion globally. The demand is heavily influenced by rapid technological advancements requiring miniaturization and enhanced performance in electronic components.

Major applications for these materials span across conductive inks and pastes used in printed electronics, multilayer ceramic capacitors (MLCCs), advanced biomedical devices, automotive catalytic converters, and high-performance aerospace coatings. Silver powders and flakes are predominant in thick film pastes for solar cells and RFID tags due to their exceptional conductivity and cost-effectiveness, while gold and platinum group metals (PGMs) are critical in high-reliability applications, including medical sensors and high-temperature thermocouples. The growing proliferation of 5G technology, the Internet of Things (IoT), and complex medical diagnostics acts as a foundational driver for market growth.

The primary benefits offered by precious metal powders and flakes include superior electrical and thermal performance, chemical inertness, and stability under extreme conditions. Driving factors for the market include increasing capital expenditure in consumer electronics manufacturing in Asia Pacific, stringent environmental regulations boosting demand for PGM-based catalysts in the automotive sector, and the acceleration of additive manufacturing (3D printing) which requires spherical, high-purity metal powders. Furthermore, the rising adoption of flexible electronics necessitates customized flake geometries and particle sizes, pushing continuous innovation in material science and powder production techniques.

Precious Metal Powders and Flakes Market Executive Summary

The Precious Metal Powders and Flakes Market is experiencing robust growth fueled primarily by technological advancements in electronics and renewable energy. Business trends indicate a shift towards ultra-fine particle sizes and advanced coating technologies to meet the demands of device miniaturization and high-density circuitry. Key industry players are focusing on backward integration, securing reliable sources of precious metals (including urban mining and recycling), and investing heavily in research and development to tailor particle morphology for specific deposition techniques, such as inkjet printing and aerosol jet printing. Furthermore, the increasing volatility in precious metal prices necessitates sophisticated hedging strategies and optimized inventory management across the supply chain, influencing profitability margins significantly.

Regionally, Asia Pacific maintains its dominance, largely driven by powerhouse manufacturing economies like China, South Korea, and Japan, which are the primary global hubs for consumer electronics, automotive production, and solar energy generation. North America and Europe show substantial growth in specialized, high-value segments, particularly in aerospace, medical implants, and advanced catalyst development, capitalizing on stringent regulatory standards and high R&D intensity. Emerging markets in Latin America and the Middle East are witnessing gradual uptake, primarily focused on localized electronics assembly and automotive catalyst replacement markets, presenting long-term expansion opportunities.

Segment trends reveal that Silver powder and flakes hold the largest market share due to their widespread use in photovoltaic cells and conventional electronics, although the Platinum Group Metals (PGMs) segment is projected to exhibit the highest CAGR, propelled by the urgent global transition towards electric vehicles (EVs) and tighter emission standards requiring advanced catalytic converters and fuel cell components. In terms of end-use, the Electronics & Electrical segment remains the largest consumer, while the Healthcare & Medical Devices segment, driven by the need for biocompatible and highly reliable sensing elements, is anticipated to grow at an accelerating pace throughout the forecast period. The evolution of additive manufacturing techniques requiring metal powders with extremely narrow particle size distributions further underscores the specialization within the market.

AI Impact Analysis on Precious Metal Powders and Flakes Market

User queries regarding the intersection of AI and the Precious Metal Powders and Flakes Market frequently revolve around topics such as optimizing particle synthesis processes, ensuring quality consistency in high-volume production, and predicting price fluctuations of input metals. Users are keen to understand how AI-driven simulation tools can accelerate the discovery of new alloys or tailored particle chemistries needed for next-generation devices, such as high-frequency 5G components or ultra-stable biomedical sensors. There is also significant interest in AI's role in enhancing resource efficiency, particularly in refining and recycling processes, which are complex and critical due to the high value of the materials involved, ensuring minimal waste and maximizing yield from secondary sources. Furthermore, supply chain resilience, managed through AI-driven predictive logistics and demand forecasting, is a major concern for manufacturers dealing with globally sourced, highly valuable commodities.

- AI optimizes material synthesis parameters (e.g., temperature, reaction time, flow rates) to achieve precise particle size distribution and morphology.

- Predictive maintenance models utilizing machine learning reduce equipment downtime and improve yield rates in atomization and chemical reduction processes.

- Computer vision systems, powered by deep learning, enable real-time, high-throughput quality control of powder and flake consistency and purity.

- AI algorithms analyze global supply chain data and geopolitical risks to forecast precious metal price volatility and optimize procurement strategies.

- Machine learning accelerates the design and screening of novel precious metal alloys and composites for specialized applications like 3D printing and catalysis.

- Enhanced sorting and extraction efficiency in precious metal recycling (urban mining) through AI-driven process control and separation technologies.

DRO & Impact Forces Of Precious Metal Powders and Flakes Market

The market dynamics for precious metal powders and flakes are shaped by a complex interplay of strong technological drivers, significant financial constraints, and emerging strategic opportunities, all converging to create a dynamic impact force structure. The primary driver is the pervasive trend of miniaturization in electronics, demanding materials with ultra-high performance in compact forms, coupled with the rapid expansion of electric vehicle production, which requires increased loading of platinum and palladium in catalytic converters and fuel cells. However, this growth trajectory is severely constrained by the extreme volatility and high cost associated with sourcing precious metals, coupled with strict environmental and security regulations governing their handling and transport, which raise operational complexity and capital investment barriers significantly.

Impact forces are generated by external technological shifts, such as the adoption of advanced manufacturing techniques like cold spraying and laser sintering (3D printing), which specifically require highly spherical and densely packed metal powders, opening entirely new avenues for demand in aerospace and customized medical device sectors. Opportunities are robustly present in the development of sustainable, low-loading catalysts for various chemical processes and in advancing the next generation of medical diagnostics, where precious metal flakes ensure superior signal stability and longevity. Furthermore, leveraging advanced recycling technologies (urban mining) represents a crucial opportunity to mitigate supply risks and reduce environmental footprint, thereby stabilizing long-term supply chains against resource depletion.

The market’s overall momentum is thus defined by the balance between indispensable necessity—precious metals often lack suitable substitutes in high-reliability applications—and the economic barriers posed by material cost. Successfully navigating this landscape requires companies to focus intensely on improving material yield, innovating in lower-cost manufacturing methods (e.g., chemical precipitation over traditional atomization), and establishing robust closed-loop recycling programs. Geopolitical stability also acts as a critical external impact force, given that mining and refining operations for PGMs are highly concentrated in specific regions, making supply chains susceptible to disruptions and impacting global metal prices.

Segmentation Analysis

The Precious Metal Powders and Flakes Market is meticulously segmented based on the type of metal, the form factor (powder or flake), the manufacturing process used, and the diverse range of end-use applications, reflecting the heterogeneity of demand across high-tech industries. The differentiation by metal type is crucial as it dictates the functional properties, with silver dominating based on volume for conductivity, while platinum group metals lead in catalytic and high-temperature applications. Furthermore, the segmentation by form is vital; spherical powders are optimized for flowability in 3D printing and high-density components, whereas flakes are specifically engineered for maximum surface area coverage and electrical conductivity in pastes and inks, requiring distinct production methods and specialized surface treatments to prevent oxidation and improve dispersion in matrices.

Analysis of the end-use segmentation highlights the critical dependency of the electronics industry, which consumes the largest volume for components such as multilayer ceramic capacitors (MLCCs), thick film resistors, and display technology. However, the fastest-growing application segments include advanced medical devices, where reliability and biocompatibility are paramount, and the automotive sector, driven by the global shift towards stricter emission standards and the nascent but rapidly expanding hydrogen fuel cell economy. These segmentations allow market participants to tailor their material specifications, ensuring alignment with precise industry requirements for purity, size, surface area, and shape, thereby maximizing product performance and commercial viability in highly regulated environments.

The manufacturing process segmentation, including atomization, chemical precipitation, and physical vapor deposition (PVD), also plays a pivotal role, as the chosen method directly impacts the final particle characteristics and cost structure. Chemical precipitation typically yields finer, highly specialized powders and flakes suitable for high-end conductive inks, while atomization processes are favored for producing the large volumes of spherical powders required for additive manufacturing. Understanding these distinct segments is essential for strategic planning, allowing companies to invest in the most promising material science innovations and capitalize on niche, high-margin applications while managing the scale required for mass-market segments like solar energy components.

- By Metal Type:

- Silver Powder and Flakes

- Gold Powder and Flakes

- Platinum Powder and Flakes

- Palladium Powder and Flakes

- Rhodium Powder and Flakes

- Ruthenium Powder and Flakes

- By Form:

- Powder (Spherical, Dendritic, Irregular)

- Flakes (Micron-sized, Nanoscale)

- By End-Use Application:

- Electronics and Electrical Components (MLCCs, Resistors, Conductive Pastes)

- Automotive (Catalytic Converters, Sensors)

- Healthcare and Medical Devices (Implants, Sensors, Diagnostics)

- Chemical and Petrochemical (Catalysis)

- Jewelry and Decorative

- Aerospace and Defense

- Others (Solar Cells, Additive Manufacturing)

- By Manufacturing Process:

- Chemical Reduction/Precipitation

- Atomization (Gas, Water)

- Electrolysis

- Physical Vapor Deposition (PVD)

Value Chain Analysis For Precious Metal Powders and Flakes Market

The value chain for the Precious Metal Powders and Flakes Market is characterized by high security, high complexity, and rigorous refinement processes due to the intrinsic value and required purity of the raw materials. The upstream segment involves the mining and primary refining of raw precious metal ores, often supplemented increasingly by secondary refining, which involves recycling high-content scrap materials (urban mining) from electronics waste and spent catalysts. Securing reliable and ethically sourced raw material supply is the fundamental challenge in the upstream process, as price volatility and geopolitical factors heavily influence material costs and availability. Primary producers often integrate forward into initial material refinement to control purity, which is paramount for the subsequent powder and flake manufacturing stages.

The central manufacturing phase involves highly specialized processing techniques, such as atomization (for spherical powders) and chemical precipitation (for fine, irregular powders and flakes). This midstream segment is capital-intensive, requiring specialized equipment and stringent quality control protocols to ensure precise particle morphology, size distribution (often in the nanometer to micron range), and surface finish. Manufacturers specializing in powders and flakes often apply proprietary surface coatings to improve dispersion in end-user formulations (like conductive inks) and enhance material longevity. These specialized material suppliers serve as the critical bridge between bulk metal refiners and advanced end-use manufacturers.

Distribution channels for these high-value materials are tightly controlled and specialized, often relying on direct sales or certified, secure distributors, minimizing the risk of theft or diversion. Downstream integration is observed when major electronic or automotive manufacturers establish joint ventures or direct long-term supply agreements with powder producers to ensure a stable supply of custom-specification materials. The end-user segment—comprising electronics, automotive, and medical device manufacturers—integrates the powders and flakes into complex components (e.g., using screen printing for conductive inks or sintering for structural parts), focusing on achieving optimal device performance and adhering to rigorous industry standards like automotive AEC-Q standards or medical ISO regulations.

Precious Metal Powders and Flakes Market Potential Customers

Potential customers for Precious Metal Powders and Flakes are concentrated in high-technology, high-reliability, and advanced manufacturing sectors that require materials with unparalleled performance characteristics, particularly in terms of electrical conductivity, catalytic efficiency, or biocompatibility. The primary buyers are large-scale manufacturers of passive electronic components, notably those producing Multilayer Ceramic Capacitors (MLCCs) and thick-film hybrid circuits, who utilize silver and palladium powders to create high-density conductive layers. Another significant customer base includes specialized chemical and automotive companies relying on Platinum Group Metal (PGM) powders for high-efficiency catalysts critical for emission control systems and hydrogen fuel cell development, driving demand for rhodium, platinum, and palladium.

Furthermore, the rapidly expanding field of additive manufacturing (3D printing) presents a growing segment of potential customers, including aerospace, defense contractors, and medical device firms, who require highly flowable, spherical metal powders (often gold or platinum alloys) for selective laser melting (SLM) and electron beam melting (EBM) processes used to create complex, lightweight, high-performance parts. In the medical sector, end-users are manufacturers of cardiac pacemakers, neurostimulation devices, and advanced biosensors, prioritizing extremely high purity gold and platinum powders/flakes for their inertness and reliable signal transmission within the human body. These buyers prioritize product consistency, validated performance data, and stringent quality documentation over cost alone, reflecting the mission-critical nature of their applications.

The solar energy industry, specifically photovoltaic (PV) cell manufacturers, also constitutes a substantial customer segment, purchasing large volumes of silver flakes and powders for front and back electrode pastes necessary for current collection in crystalline silicon cells. The demand from this segment is highly sensitive to the energy efficiency targets of solar modules and the cost-effectiveness of material application techniques. Therefore, powder and flake manufacturers must continuously innovate to reduce particle size and optimize sintering properties to maximize electrical throughput while maintaining stable pricing relative to global metal indices, catering to both high-volume commodity buyers and highly specialized, low-volume, high-value component manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus Holding, Tanaka Kikinzoku Group, Umicore, Materion Corporation, Johnson Matthey, GGP Metalpowder AG, Metalor Technologies SA, Ames Advanced Materials Corporation, DOWA Holdings Co., Ltd., Technic Inc., Mitsui Kinzoku, Cookson Gold, Alfa Aesar (Thermo Fisher Scientific), BASF SE (Catalysts Division), PGM-TRON, Atlantic Equipment Engineers, Powder Alloy Corporation, Poudres Metalliques. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precious Metal Powders and Flakes Market Key Technology Landscape

The technological landscape of the Precious Metal Powders and Flakes Market is defined by the constant pursuit of tighter particle size control, precise morphology tailoring, and enhanced surface chemistry to optimize material performance in advanced applications. Key production technologies include chemical reduction methods, such as co-precipitation and polyol processes, which are highly effective for creating nano-scale powders and ultra-thin flakes, essential for high-resolution conductive inks used in flexible electronics and printing techniques. Atomization, specifically gas atomization and plasma atomization, dominates the production of high-purity, perfectly spherical powders crucial for the demanding requirements of metal additive manufacturing (3D printing) in aerospace and medical sectors, ensuring high density and flowability during laser sintering.

A significant area of technological advancement involves surface modification and coating techniques. Manufacturers frequently apply organic or inorganic coatings (e.g., polymer layers or silica shells) to silver flakes and powders to improve their dispersibility in solvent-based or water-based pastes, enhance their anti-tarnishing properties, and control their sintering temperature. This surface engineering is critical for applications like low-temperature conductive pastes used in printed circuit boards (PCBs) and RFID tags, where high conductivity must be maintained without damaging sensitive substrates. Process control relies heavily on advanced analytical instruments, including scanning electron microscopy (SEM), transmission electron microscopy (TEM), and laser diffraction particle analyzers, to ensure product consistency batch-to-batch.

Emerging technologies include plasma synthesis and inert gas condensation, which allow for the production of highly crystalline, ultra-fine nanoparticles with tailored surface areas, particularly important for maximizing the catalytic activity of PGMs in fuel cells and environmental systems. Furthermore, the integration of computational materials science and AI-driven simulation tools is becoming prevalent, enabling producers to predict how changes in precursor concentration or processing temperature will affect the final material properties, drastically cutting down on experimental R&D cycles and accelerating the development of specialized materials tailored for next-generation applications like high-frequency electronics (5G/6G) where dielectric properties and skin effect minimization are paramount.

Regional Highlights

Regional dynamics within the Precious Metal Powders and Flakes Market are highly asymmetrical, reflecting global concentrations of advanced manufacturing and resource availability. Asia Pacific (APAC) holds the undisputed leading position in terms of market share and consumption volume, driven by its massive electronics manufacturing base, particularly in China, South Korea, and Taiwan, which demand vast quantities of silver and palladium powders for consumer electronics and solar photovoltaic applications. The rapid expansion of automotive production and the transition to electric mobility in these regions further solidify APAC's dominance, making it the primary focal point for capacity expansion and supply chain investment by global players.

North America and Europe represent mature markets characterized by stringent quality standards and high R&D activity, focusing on high-value, low-volume applications. North America is a critical region for specialized powders used in aerospace, defense, and advanced medical device manufacturing, prioritizing gold and high-purity PGM materials where reliability trumps cost. European demand is robustly supported by the strong automotive industry, particularly for advanced catalytic materials meeting Euro 7 emission standards, and by significant investment in hydrogen fuel cell technology, which is highly reliant on sophisticated platinum and palladium catalysts. These regions typically lead in innovation related to production techniques and sustainable sourcing, including urban mining.

Latin America and the Middle East & Africa (MEA) currently constitute smaller market shares but offer long-term potential. MEA’s market is largely driven by its primary role in PGM mining (South Africa being a major source) and subsequent export, coupled with localized demand for catalyst replacement in the petrochemical and automotive sectors. Latin America is seeing gradual growth driven by expanding domestic electronics assembly plants and increasing investment in automotive manufacturing hubs, although regulatory environments and technological maturity levels vary significantly across countries. Strategic market penetration in these regions often focuses on partnerships to establish local processing capabilities, capitalizing on proximity to raw material sources and growing domestic industrialization.

- Asia Pacific (APAC): Dominates due to the colossal consumer electronics manufacturing industry, high adoption rates of solar power, and large-scale automotive production; key countries include China, Japan, South Korea, and Taiwan.

- North America: Focuses on high-reliability, specialty applications in aerospace, defense, and medical devices; strong R&D presence in additive manufacturing using spherical gold and platinum powders.

- Europe: Driven by stringent environmental regulations necessitating advanced PGM catalysts for automotive emissions control and significant investment in hydrogen fuel cell technologies; key markets are Germany and the UK.

- Middle East and Africa (MEA): Crucial source region for PGMs; demand primarily stems from petrochemical refining catalysts and mineral processing, with gradual growth in localized automotive and electronics repair sectors.

- Latin America: Emerging market characterized by increasing industrialization and expanding automotive manufacturing base; growth tied to infrastructure development and electronics assembly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precious Metal Powders and Flakes Market.- Heraeus Holding

- Tanaka Kikinzoku Group

- Umicore

- Materion Corporation

- Johnson Matthey

- GGP Metalpowder AG

- Metalor Technologies SA

- Ames Advanced Materials Corporation

- DOWA Holdings Co., Ltd.

- Technic Inc.

- Mitsui Kinzoku

- Cookson Gold

- Alfa Aesar (Thermo Fisher Scientific)

- BASF SE (Catalysts Division)

- PGM-TRON

- Atlantic Equipment Engineers

- Powder Alloy Corporation

- Poudres Metalliques

- SAFINA, a.s.

- A-L-M S.A.

Frequently Asked Questions

Analyze common user questions about the Precious Metal Powders and Flakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Precious Metal Powders and Flakes Market?

The market is primarily driven by the exponential demand for miniaturized electronic components (e.g., MLCCs), the rapid adoption of 5G infrastructure requiring high-performance conductive materials, and stringent global regulations boosting the need for Platinum Group Metal (PGM) catalysts in the automotive and chemical sectors.

Which precious metal dominates the market volume?

Silver powders and flakes dominate the market volume due to their superior electrical conductivity and relative cost-effectiveness, making them essential in high-volume applications such as photovoltaic cells, conductive pastes, and thick-film technology for general electronics.

How does additive manufacturing influence the demand for precious metal powders?

Additive manufacturing (3D printing) creates significant demand for highly spherical, high-purity precious metal powders (especially gold and platinum alloys). These powders are required for creating complex, customized, high-value components for aerospace, defense, and critical medical implants through techniques like selective laser melting (SLM).

What is the main challenge facing manufacturers in this market?

The primary challenge is managing the extreme price volatility and high cost of the raw precious metals, which requires sophisticated inventory management, effective hedging strategies, and substantial investment in recycling and urban mining technologies to stabilize the supply chain and maintain profitability.

Which geographical region leads the consumption of these materials?

Asia Pacific (APAC) leads the global consumption, primarily due to the concentration of major manufacturing hubs for consumer electronics, automotive components, and solar energy technologies in countries such as China, South Korea, and Japan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager