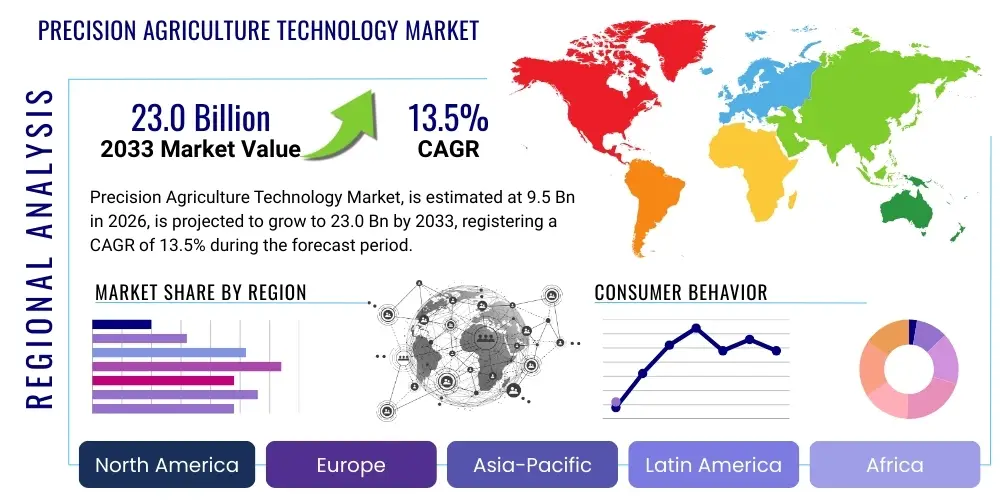

Precision Agriculture Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442407 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Precision Agriculture Technology Market Size

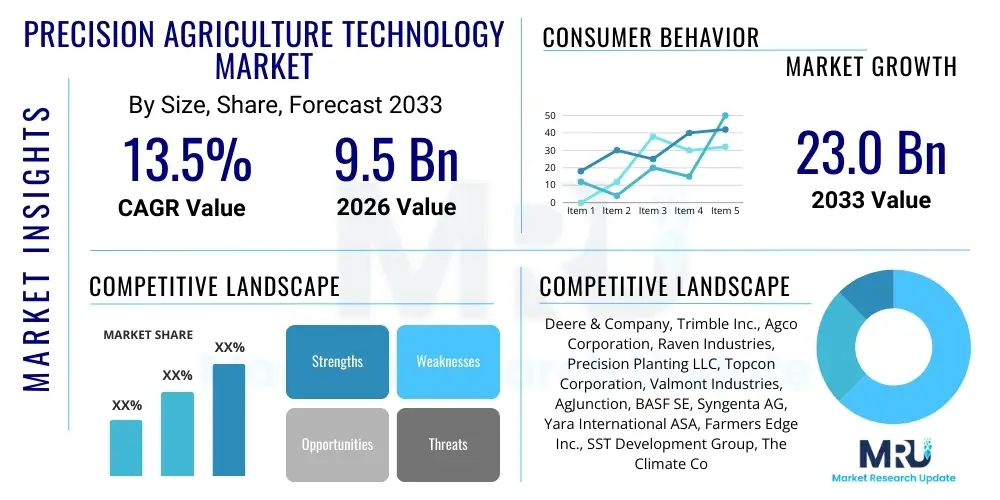

The Precision Agriculture Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at $9.5$ Billion USD in 2026 and is projected to reach $23.0$ Billion USD by the end of the forecast period in 2033.

Precision Agriculture Technology Market introduction

Precision Agriculture (PA) technology represents a paradigm shift in farming methodologies, moving from traditional, generalized resource application to localized, site-specific management strategies. This technological ecosystem utilizes advanced tools such as Global Positioning Systems (GPS), Geographic Information Systems (GIS), Internet of Things (IoT) sensors, robotics, and big data analytics to optimize farming inputs, enhance productivity, and minimize environmental impact. The core objective is to ensure that the right amount of input (water, fertilizer, pesticides) is applied at the right time and location within a field, maximizing return on investment while promoting sustainability. This includes real-time monitoring of crop health, soil conditions, and weather patterns, enabling farmers to make data-driven decisions swiftly and accurately.

Major applications of these technologies encompass variable rate application (VRA) for seeds and fertilizers, automated steering systems for tractors, drone-based aerial imaging for crop scouting, and sophisticated yield monitoring during harvest. These systems collectively address critical challenges facing modern agriculture, including fluctuating climate conditions, increasing demand for food due to global population growth, and stringent regulations concerning chemical usage and water conservation. The products within this market are segmented primarily into hardware components (sensors, drones, smart implements), software platforms (farm management systems, analytical tools), and services (data consultation, implementation, and maintenance).

The primary driving factors fueling market expansion include the increasing adoption of automated and connected machinery, the necessity for improved operational efficiency to combat rising labor costs, and a growing global focus on sustainable farming practices (Smart Farming). Furthermore, government initiatives in developed and developing economies supporting agricultural digitalization and providing subsidies for technology adoption are significantly contributing to market momentum. The inherent benefits, such as reduced waste, higher yields, and improved traceability, make PA technologies indispensable for future resilient food systems.

Precision Agriculture Technology Market Executive Summary

The global Precision Agriculture Technology Market is undergoing rapid digital transformation, characterized by significant investment in data analytics platforms and sophisticated sensor networks. Business trends indicate a strong move toward integrated solutions, where hardware manufacturers partner with software providers to offer comprehensive farm management ecosystems (FMS). Mergers and acquisitions are common, driven by the need for vertical integration and expansion into adjacent technologies like blockchain for supply chain transparency. Key strategic initiatives center on enhancing interoperability between different equipment brands and developing subscription-based "Agriculture-as-a-Service" models, lowering the entry barrier for smaller farms. The focus is shifting from simple automation to predictive intelligence, utilizing machine learning algorithms to forecast yields and disease outbreaks, thereby maximizing proactive management.

Regionally, North America and Europe currently dominate the market due to robust technological infrastructure, high adoption rates of advanced machinery, and substantial government support for digitalization in agriculture. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth CAGR over the forecast period, fueled by massive agricultural sectors in China and India and increasing awareness regarding resource management efficiency. Latin America also shows promising growth potential, particularly in large-scale commercial farming operations in countries like Brazil and Argentina, where yield optimization is paramount. The regional trends highlight a global necessity for climate-resilient farming, pushing developing economies towards rapid technology procurement, often skipping older technological iterations.

Segment trends emphasize the rapid proliferation of software and services, surpassing hardware sales in terms of growth velocity. While hardware (e.g., GPS devices and sensors) provides the fundamental data input, the value is increasingly being generated by specialized software that processes this massive data volume into actionable insights. Variable Rate Technology (VRT) is seeing intense adoption due to its direct measurable impact on input cost reduction, especially in fertilizer and pesticide application. Within components, drones and autonomous machinery are witnessing exponential growth, reflecting the industry’s trajectory towards fully automated, labor-independent farming operations, fundamentally changing the economics of agricultural production.

AI Impact Analysis on Precision Agriculture Technology Market

User inquiries regarding the integration of Artificial Intelligence (AI) in Precision Agriculture predominantly revolve around the practical applications of Machine Learning (ML) for predictive analytics, concerns about data privacy and ownership, and the required skill level for implementation. Users frequently ask how AI can specifically improve pest detection accuracy, optimize complex irrigation schedules based on real-time microclimate data, and automate robotic harvesting decisions. The primary expectations center on AI's ability to handle the complexity and sheer volume of data generated by modern farming equipment, converting disparate data streams (satellite imagery, ground sensors, machinery logs) into prescriptive instructions that enhance profitability and sustainability. Concerns often highlight the initial capital expenditure and the reliability of AI models in diverse environmental conditions. Ultimately, the market anticipates AI moving Precision Agriculture from merely descriptive monitoring to highly sophisticated, autonomous intervention systems.

- AI enables highly accurate disease and pest detection through advanced image recognition (drone and satellite imagery analysis).

- Predictive yield modeling utilizing historical data, environmental factors, and genetic information to forecast crop output with high precision.

- Optimization of resource allocation (water, fertilizer, energy) through machine learning algorithms that calculate the minimum effective dose per micro-zone.

- Automation of complex decision-making processes in autonomous farming equipment, including path planning and dynamic operational adjustments.

- Enhanced farm management systems offering prescriptive advice rather than just descriptive reports, optimizing planting and harvesting schedules.

- Development of robotic systems for precise weeding and harvesting, reducing dependence on manual labor and chemical inputs.

- Improved supply chain traceability and quality assurance using AI to monitor product status from field to consumer.

DRO & Impact Forces Of Precision Agriculture Technology Market

The dynamic expansion of the Precision Agriculture Technology Market is fundamentally propelled by the necessity to enhance global food security amidst escalating environmental pressures. The primary Drivers (D) include rapid advancements in IoT and connectivity infrastructure, decreasing sensor and satellite imagery costs, and compelling evidence of high Return on Investment (ROI) derived from targeted input usage. However, the market faces significant Restraints (R), such as the high initial investment required for sophisticated equipment and the inherent challenges related to interoperability between different vendor systems. Furthermore, the lack of standardized data protocols and the need for specialized technical knowledge among farming professionals act as substantial inhibitors to widespread adoption, particularly in emerging economies and smaller farm holdings. These factors necessitate intensive training and supportive government policies to overcome.

Numerous strategic Opportunities (O) exist within this evolving landscape, most notably the integration of 5G networks to facilitate real-time data transmission from remote fields, enabling the scaling of autonomous machinery and real-time decision support systems. There is also immense potential in expanding market reach into developing regions through customized, low-cost solutions, and leveraging AI/ML to create highly specialized, micro-climate-specific farming recommendations. The growing consumer demand for sustainably produced and traceable food products provides a powerful market pull, driving producers to adopt technologies that validate environmental stewardship. The shift toward vertical farming and controlled-environment agriculture also offers a new, high-growth application segment for precision technologies.

The Impact Forces shaping this market are multifaceted, combining economic, technological, and regulatory pressures. Economically, the volatility of commodity prices and input costs compels farmers to adopt PA to manage risk and maintain profitability, making efficiency a survival tool rather than just an advantage. Technologically, the ongoing miniaturization and increased power of processing units (edge computing) enable highly localized data processing, reducing latency and dependence on constant cloud connectivity. Regulatory forces, particularly stricter environmental protection mandates in regions like the European Union (Farm to Fork strategy), mandate the reduction of nitrogen fertilizer and pesticide use, creating a captive market for precision application technologies that comply with these limits, thus accelerating market penetration and driving innovation towards sustainable solutions.

Segmentation Analysis

The Precision Agriculture Technology Market is comprehensively segmented based on the technologies deployed, the components utilized, the specific applications addressed, and the scale of the farming operation. This segmentation allows for targeted market strategies, addressing the varying needs and investment capacities across the agricultural spectrum. Technology segmentation differentiates between systems focused on location accuracy (guidance), data acquisition (remote sensing), and resource application (VRT), recognizing the distinct technological expertise and infrastructure required for each. Component segmentation separates the tangible assets (hardware) from the intellectual and operational frameworks (software and services), highlighting the shift in value capture towards data-driven solutions. Application segmentation reflects the functional utility of the technology, crucial for quantifying ROI, while farm size segmentation acknowledges the differing economic models and complexity requirements between large commercial farms and smaller, often family-owned, operations.

- Technology:

- Guidance Systems (GPS/GNSS, Steering Systems)

- Remote Sensing (Drones/UAVs, Satellites, Ground-based Sensors)

- Variable Rate Technology (VRT) (Seeding, Fertilizing, Pesticide Application)

- Component:

- Hardware (Sensors, Automation & Control Devices, Display Devices, Drones/UAVs, GPS/GNSS Devices)

- Software (Farm Management Software, Data Analytics Software)

- Services (Consulting, Integration & Implementation, Maintenance & Support, Managed Services)

- Application:

- Yield Monitoring & Mapping

- Field Mapping & Soil Monitoring

- Crop Scouting

- Weather Tracking & Forecasting

- Irrigation Management

- Inventory Management

- Farm Size:

- Large Farms

- Medium-Sized Farms

- Small Farms

Value Chain Analysis For Precision Agriculture Technology Market

The value chain for Precision Agriculture Technology is intricate, involving multiple specialized stages starting from technology development to end-user implementation and ongoing data utilization. Upstream activities are dominated by specialized technology providers, including semiconductor manufacturers, sensor developers (e.g., IoT components), GNSS chip makers, and software developers focused on foundational AI/ML frameworks. These entities innovate the core technological building blocks—the physical components and underlying algorithms—that enable precision farming solutions. Success at this stage relies heavily on R&D investment, intellectual property protection, and adherence to ruggedization standards suitable for harsh agricultural environments. Key trends upstream involve the integration of edge computing capabilities directly into sensor devices, reducing reliance on centralized cloud processing for immediate actions.

Midstream activities involve the aggregation, integration, and distribution of these core technologies. This stage is dominated by major agricultural machinery manufacturers (OEMs), specialized PA solution providers (e.g., Trimble, Topcon), and sophisticated software providers who integrate hardware inputs into comprehensive Farm Management Systems (FMS). Distribution channels play a critical role, involving both direct sales models, particularly for large-scale enterprise software and high-value machinery, and indirect channels through established dealer networks and agricultural cooperatives. Dealers often provide crucial local support, maintenance, and training, acting as the primary interface between complex technology and the end-user farmer. The effectiveness of the midstream hinges on seamless system integration and robust service delivery capability.

Downstream activities focus on the end-user—the farmer—and the services that transform collected data into actionable results. This includes agronomic consulting, data processing services, and specialized third-party application providers who offer niche solutions (e.g., pest modeling, specific irrigation management). The success of the technology is ultimately validated downstream by measurable improvements in yield, efficiency, and sustainability. Direct distribution channels are often preferred for software services (Software-as-a-Service model) where continuous updates and support are provided remotely. Indirect channels, primarily agricultural retailers and agronomic service providers, remain vital for hardware sales and localized technical support, ensuring high uptime and user confidence in complex machinery and sensor networks. The increasing importance of data security and data-driven decision-making characterizes the final stage of the value chain.

Precision Agriculture Technology Market Potential Customers

The primary end-users and buyers of Precision Agriculture technologies span the entire spectrum of agricultural production, from large-scale commercial farming enterprises to smaller, specialized horticultural operations and government research entities. Large commercial farms, particularly those growing high-value commodity crops such as corn, soy, wheat, and cotton, represent the largest customer segment due to their significant land area, high operational expenditure, and substantial capital available for investment in advanced machinery like autonomous tractors, sophisticated VRT applicators, and comprehensive FMS. For these customers, the motivation is primarily driven by margin optimization, scale efficiency, and data-driven risk management.

Mid-sized and small farms, while facing greater budget constraints, are increasingly becoming viable customers, driven by the availability of more affordable, modular, and scalable solutions, particularly in the realm of sensor technology, subscription-based software services, and drone mapping. For these smaller operations, technology adoption is often focused on specific challenges, such as efficient water use in drought-prone areas or compliance with regional environmental mandates. Horticultural and specialty crop growers, including vineyards, orchards, and greenhouse operators, represent a distinct high-value segment demanding extreme precision due to the specialized, high-density nature of their crops, often requiring robotics and micro-zone management systems.

Beyond traditional farmers, key purchasers also include agricultural cooperatives and large food processing companies, which invest in PA solutions to improve the traceability and quality control of their supply chains, thus ensuring compliance with regulatory and consumer demands. Furthermore, governmental agricultural departments and academic research institutions purchase these technologies for large-scale field trials, research into sustainable practices, and the development of regional agricultural policy models. The commonality across all these customer segments is the shared objective of leveraging data intelligence to minimize waste, maximize output, and ensure the long-term viability and sustainability of food production systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $9.5$ Billion USD |

| Market Forecast in 2033 | $23.0$ Billion USD |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, Trimble Inc., Agco Corporation, Raven Industries, Precision Planting LLC, Topcon Corporation, Valmont Industries, AgJunction, BASF SE, Syngenta AG, Yara International ASA, Farmers Edge Inc., SST Development Group, The Climate Corporation (Bayer), Hexagon AB, CNH Industrial, Kubota Corporation, IBM, Microsoft Corporation, Cisco Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Agriculture Technology Market Key Technology Landscape

The technological landscape of the Precision Agriculture Market is defined by the convergence of several high-growth domains, fundamentally transforming how agricultural data is collected, processed, and acted upon. Satellite and aerial imaging systems, particularly those utilizing multispectral and hyperspectral sensors mounted on drones and satellites, provide high-resolution data on crop health (NDVI, thermal stress) and biomass variation, forming the basis for VRT decision-making. Simultaneously, advanced Global Navigation Satellite Systems (GNSS), including highly accurate Real-Time Kinematic (RTK) correction services, enable sub-inch positioning accuracy essential for auto-steer functions and repeatable field operations, significantly reducing overlap and input waste.

A critical layer in this landscape is the proliferation of IoT-enabled sensor networks and edge computing devices deployed in fields. These ground-based sensors monitor crucial environmental metrics—soil moisture, nutrient levels, pH, and localized microclimate data—in real-time. The adoption of edge computing processes data locally before transmission, enhancing system responsiveness and reducing the bandwidth strain often encountered in remote agricultural settings. This technological architecture is vital for applications like automated irrigation scheduling and immediate disease pressure warnings, ensuring timely intervention.

Furthermore, the market relies heavily on sophisticated Farm Management Systems (FMS) and analytical software platforms, which utilize Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These platforms integrate data from various sources (machinery, sensors, weather models) to generate prescriptive insights, manage farm logistics, and comply with regulatory reporting requirements. Robotics and automation, encompassing autonomous vehicles, robotic harvesters, and targeted spraying mechanisms, represent the cutting edge, promising a future of fully automated, labor-efficient farming. The synergy between these hardware components, high-speed connectivity (4G/5G), and intelligent software forms the backbone of modern precision farming operations.

Regional Highlights

- North America: Dominant market share due to high adoption rates, sophisticated farming practices, large average farm sizes, and early commercialization of PA technologies. Significant presence of key technology providers and high government subsidies for technology integration, especially in the US and Canada.

- Europe: Strong focus on regulatory compliance (e.g., EU Green Deal, Farm to Fork strategy) driving demand for resource efficiency and sustainability tools (VRT, precise spraying). High penetration of FMS software and strong collaborative R&D among machinery manufacturers and research institutes, particularly in Western European nations like Germany, France, and the Netherlands.

- Asia Pacific (APAC): Fastest growing regional market, driven by governments in China, India, and Japan prioritizing agricultural modernization to meet rising food demand and combat land degradation. Characterized by the increasing deployment of affordable drone technology and mobile-based FMS tailored to small farm holdings.

- Latin America: High growth driven by large-scale commercial farming (soya, corn) in Brazil and Argentina, where yield maximization is critical. Strong uptake of guidance systems and VRT technology to manage vast field areas efficiently, often funded by foreign direct investment and commodity exports.

- Middle East and Africa (MEA): Emerging market with significant potential, especially in arid and semi-arid regions where water scarcity is acute. Adoption is focused heavily on sophisticated irrigation management systems (IoT sensors, controlled environment agriculture) and climate-smart farming solutions supported by regional government initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Agriculture Technology Market.- Deere & Company

- Trimble Inc.

- Agco Corporation

- Raven Industries

- Precision Planting LLC (a subsidiary of Deere & Company)

- Topcon Corporation

- Valmont Industries

- AgJunction

- BASF SE

- Syngenta AG

- Yara International ASA

- Farmers Edge Inc.

- SST Development Group

- The Climate Corporation (Bayer)

- Hexagon AB

- CNH Industrial

- Kubota Corporation

- IBM

- Microsoft Corporation

- Cisco Systems

- TeeJet Technologies

- SenseFly (Parrot)

- PrecisionHawk

- AG Leader Technology

- Aurins

- Sentera

- Motorola Solutions

- Fujitsu Limited

Frequently Asked Questions

Analyze common user questions about the Precision Agriculture Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the adoption of Variable Rate Technology (VRT) in precision agriculture?

The primary driver for VRT adoption is the optimization of input resources, specifically fertilizers, seeds, and pesticides. VRT allows farmers to apply inputs only where needed based on spatial variability maps, leading to significant cost savings, higher yields, and reduced environmental impact through minimized chemical runoff and waste.

How does the integration of 5G technology specifically benefit precision farming operations?

5G technology provides the necessary high bandwidth and low latency for real-time data transfer from a massive network of field sensors, autonomous vehicles, and high-resolution imaging devices. This capability is crucial for implementing real-time decision support systems, remote operation of autonomous machinery, and instantaneous communication between integrated farm components.

What are the main barriers hindering the market growth of precision agriculture technologies in developing economies?

The main barriers include the high initial cost of purchasing and implementing advanced hardware and software, the lack of robust internet and communication infrastructure in rural areas, limited access to technical expertise and training, and the fragmented nature and smaller average size of farm holdings, making traditional large-scale machinery investment economically unviable.

Which component segment (Hardware, Software, or Services) is projected to experience the fastest growth rate?

The Software and Services segments are projected to experience the fastest growth. While hardware provides essential data acquisition, the increasing complexity of data analytics, the rise of subscription-based Farm Management Systems (FMS), and the need for ongoing integration support and agronomic consultation are driving exponential demand for intelligent software solutions and specialized services.

What is the role of Artificial Intelligence (AI) in enhancing crop protection efforts within precision agriculture?

AI significantly enhances crop protection by utilizing machine learning algorithms for rapid and highly accurate detection and identification of pests, diseases, and nutritional deficiencies from aerial and ground imagery. This allows for automated, targeted, and immediate intervention through robotic or VRT spraying systems, minimizing overall pesticide use and preventing widespread crop damage.

What are the key differences between guidance systems and remote sensing technologies?

Guidance systems, relying primarily on GNSS and RTK corrections, focus on navigation and position accuracy, ensuring farming equipment operates precisely on designated paths to reduce overlap and fuel consumption. Remote sensing technologies, such as drones and satellites with multispectral cameras, focus on collecting non-contact spatial data about the field and crop health, providing input for variable rate application decisions.

How does precision agriculture address global food security challenges?

Precision agriculture addresses food security by maximizing yield potential per unit of land and resource invested. By optimizing water, fertilizer, and pesticide application based on localized needs, it ensures resources are used efficiently, leading to higher, more consistent, and sustainable crop output, mitigating risks associated with climate variability and increasing global population demand.

Is data privacy a major concern for farmers adopting Precision Agriculture systems?

Yes, data privacy and ownership are significant concerns. Farmers generate vast amounts of valuable proprietary data regarding their operations and yields. The concern revolves around who owns this data, how it is stored and secured by technology vendors, and whether it could be used by third parties (such as commodity brokers or insurance companies) without the farmer's explicit and beneficial consent, necessitating robust data governance frameworks.

How are autonomous vehicles integrating into the precision agriculture workflow?

Autonomous vehicles, including tractors and specialized field robots, integrate by performing high-precision tasks such as planting, spraying, and harvesting without human intervention. They rely on GNSS guidance, integrated sensors, and AI-driven decision-making software to navigate fields, manage equipment, and dynamically adjust operations based on real-time data inputs from the FMS, significantly increasing operational hours and reducing labor dependency.

What role do public-private partnerships play in advancing precision agriculture adoption?

Public-private partnerships are crucial, as public entities often fund necessary infrastructure development (e.g., broadband and GNSS correction networks), provide research funding for new sustainable technologies, and offer subsidies or tax incentives to farmers. Private sector companies then leverage this supportive environment to commercialize and distribute the resulting advanced agricultural solutions, accelerating market penetration.

Define the concept of "Agri-tech Ecosystem" in the context of precision farming.

The Agri-tech Ecosystem refers to the interconnected network of technologies, services, companies, and stakeholders that collectively support precision farming. This includes hardware manufacturers, software developers, telecommunication providers, data consultants, research institutions, and financial services, all working synergistically to create a data-driven, optimized, and sustainable agricultural production environment.

In what ways do IoT sensors improve irrigation management efficiency?

IoT sensors, particularly soil moisture probes and weather stations, provide real-time, localized data on water requirements and environmental conditions. This data is fed into automated irrigation controllers, allowing for variable rate irrigation that applies the exact amount of water needed to specific zones, preventing both underwatering (yield loss) and overwatering (waste and nutrient leaching).

What is the significance of interoperability standards in the PA market?

Interoperability is critical because farms often utilize machinery and software from multiple vendors. Standardized communication protocols (like ISO-BUS) ensure that different brands of tractors, implements, and FMS platforms can seamlessly share data and operational instructions, minimizing compatibility issues, reducing integration costs, and allowing farmers greater flexibility in choosing the best equipment for specific tasks.

How does remote sensing contribute to early detection of plant stress?

Remote sensing technologies use multispectral cameras to measure light reflectance properties of crops. Changes in reflectance, particularly in the near-infrared spectrum (used to calculate indices like NDVI), often precede visible symptoms of plant stress (caused by drought, disease, or nutrient deficiency). This early detection capability allows for timely, targeted interventions before yield is significantly compromised.

Explain the primary economic benefit derived from precision agriculture investments.

The primary economic benefit is the increase in farm profitability achieved through input cost reduction and yield maximization. Precision techniques minimize the excessive use of expensive inputs like seeds, fertilizers, and fuel, while simultaneously ensuring that optimal growing conditions are maintained across the field, leading to a higher overall net income per acre.

Which application segment holds the largest market share currently?

Yield Monitoring and Mapping applications generally hold the largest market share. This application provides the fundamental performance data (where yield is highest or lowest) that justifies further investment in other precision technologies, serving as the essential first step in data-driven farm management and providing immediate, tangible ROI metrics.

What is the impact of rising labor costs on the precision agriculture market?

Rising agricultural labor costs, coupled with labor shortages, are a major catalyst for the precision agriculture market. This economic pressure forces farmers to adopt automation and robotics (e.g., autonomous vehicles, robotic weeding) to substitute manual labor, thereby maintaining operational capacity and increasing efficiency without dependence on an increasingly scarce human workforce.

How does precision agriculture support the growing consumer demand for traceable and sustainably sourced food?

Precision agriculture inherently enhances traceability by digitally recording every farm operation—from planting and input application to harvesting—with precise geospatial and temporal stamps. This detailed recordkeeping supports transparency and allows producers to provide verifiable evidence of sustainable and efficient resource management to consumers and regulatory bodies.

What challenges do vendors face when designing PA systems for small farm sizes?

Vendors face challenges related to cost-effectiveness and complexity. Small farms require technologies that are scalable, easy to operate without specialized training, and have a quick ROI despite smaller annual revenues. This necessitates the development of modular, affordable, and often mobile-based solutions rather than expensive, heavy machinery-dependent systems.

How is the concept of 'Big Data' utilized within Farm Management Systems (FMS)?

Big Data in FMS involves the collection, storage, and processing of massive, heterogeneous datasets (weather, soil, satellite imagery, machinery performance). FMS platforms use analytical tools and AI to normalize, interpret, and model this data, converting raw information into prescriptive insights for optimal farm operation planning, risk assessment, and long-term strategic decision-making.

Describe the role of cloud computing in modern precision agriculture infrastructure.

Cloud computing provides the centralized processing power and storage necessary to handle the enormous volumes of data generated by connected farms. It enables sophisticated AI/ML processing, facilitates secure data sharing among stakeholders, and supports the delivery of software-as-a-service (SaaS) applications, ensuring farmers have access to up-to-date analytics and decision models from any location.

What is the current trend regarding the adoption of unmanned aerial vehicles (UAVs) in the market?

UAV adoption is rapidly increasing, moving from basic image capture to highly functional applications. Modern agricultural drones are used for precise, high-resolution crop scouting, targeted spot spraying (micro-VRT), variable rate seeding, and structural inspection (e.g., irrigation pipes, fences), offering flexibility and speed unattainable by traditional manned aircraft or ground methods.

Which regional market is currently showing the most potential for growth, and why?

The Asia Pacific (APAC) region is demonstrating the highest growth potential. This is driven by large government initiatives aimed at agricultural modernization, a huge population necessitating maximum food production efficiency, and increasing disposable income allowing local farmers to invest in accessible technologies like low-cost sensors and drone mapping solutions.

How does the technological landscape of precision agriculture address climate change adaptation?

PA supports climate change adaptation by enabling farmers to manage volatility and increase resilience. Technologies facilitate optimal water usage (reducing vulnerability to drought), track microclimatic variations, and allow for adaptive planting schedules and crop varieties, ensuring resource scarcity and extreme weather events have a minimized negative impact on yield stability.

Explain the differentiation between direct and indirect distribution channels for PA equipment.

Direct distribution involves manufacturers selling high-value, complex equipment (like specialized autonomous machinery or enterprise FMS subscriptions) directly to large commercial farmers. Indirect channels, primarily traditional agricultural dealerships and co-ops, handle sales, training, financing, and maintenance for standardized equipment and components, offering crucial local support to smaller and geographically dispersed farm customers.

What role does blockchain technology have in the future of precision agriculture?

Blockchain technology is poised to enhance transparency and security in the agricultural supply chain. By providing an immutable, decentralized ledger, it can securely track product provenance from the field (recording PA data points like input use and harvest time) through processing and distribution, verifying sustainable practices and ensuring product authenticity for consumers.

What specific challenges are associated with implementing sensor networks in farm fields?

Key challenges include ensuring long-term sensor durability and reliability in harsh weather conditions (dust, moisture, extreme temperatures), managing power requirements for widespread deployment, dealing with connectivity issues in remote areas, and standardizing data formats to allow seamless integration with existing farm management software platforms.

How do GPS/GNSS systems contribute to reduced fuel consumption in farming operations?

High-accuracy GPS/GNSS systems enable autosteer and guidance technologies, which prevent equipment overlap during field operations like tilling, seeding, and spraying. By ensuring the tractor follows highly precise, repeatable paths with minimal deviation, these systems significantly reduce the distance traveled, resulting in substantial savings on fuel and labor costs over the farming season.

What is the main difference between conventional and precision agriculture?

Conventional agriculture applies uniform management decisions across an entire field based on average conditions, often resulting in resource waste and sub-optimal yields in localized areas. Precision agriculture uses site-specific data (variability maps, sensor readings) to tailor inputs and management actions to the specific needs of small zones within the field, maximizing efficiency and output locally.

Why is the service segment growing faster than the hardware segment in PA?

The service segment is growing rapidly because complex PA systems require continuous support, integration, and interpretation. Farmers rely on specialized managed services for data analytics, FMS maintenance, consulting on VRT prescription maps, and operational training. This ongoing need for specialized human and analytical support generates high recurring revenue for the service providers, outpacing the single-purchase nature of hardware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager