Precision Cancer Diagnostic Tests Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442495 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Precision Cancer Diagnostic Tests Market Size

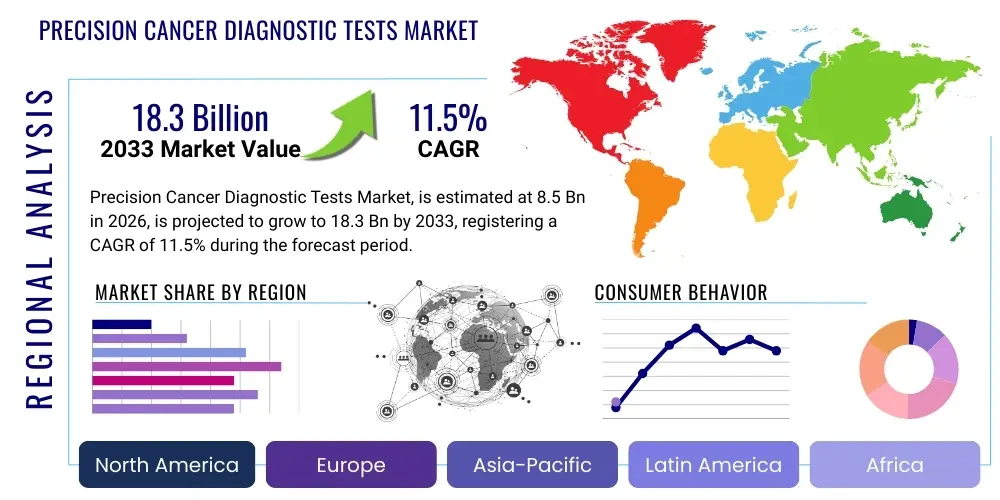

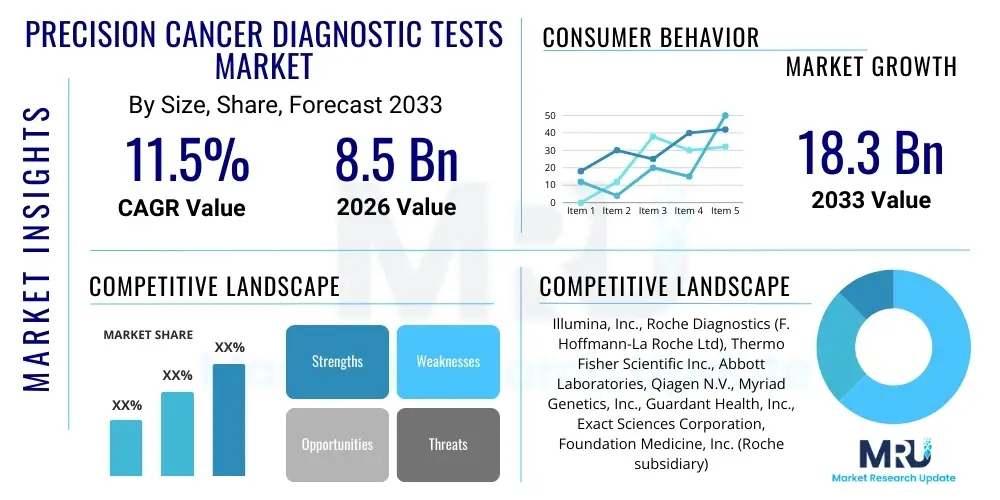

The Precision Cancer Diagnostic Tests Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.3 Billion by the end of the forecast period in 2033.

Precision Cancer Diagnostic Tests Market introduction

Precision Cancer Diagnostic Tests encompass a sophisticated suite of molecular and genomic profiling tools designed to identify specific biomarkers, mutations, and genetic alterations associated with individual patient tumors. Unlike traditional diagnostics, these advanced tests enable clinicians to tailor treatment strategies, select optimal targeted therapies, and predict patient response and prognosis with unprecedented accuracy. The core principle involves analyzing nucleic acids, proteins, and metabolites in biological samples (blood, tissue, or urine) to understand the unique biological fingerprint of the cancer. This paradigm shift from a one-size-fits-all approach to personalized oncology is fundamentally reshaping cancer care, providing opportunities for earlier detection and improved therapeutic efficacy. Key products include next-generation sequencing (NGS) panels, polymerase chain reaction (PCR) assays, immunohistochemistry (IHC), and liquid biopsy tests.

The major applications of precision cancer diagnostics span early disease screening, companion diagnostics for targeted drug selection, monitoring of minimal residual disease (MRD), and assessing resistance mechanisms during treatment. The immediate benefits derived from these tests include reduced adverse effects associated with ineffective therapies, significant cost savings in the long term by avoiding unnecessary treatments, and substantially improved patient outcomes through highly individualized care paths. Furthermore, precision diagnostics are integral to accelerating clinical trials for novel oncological agents, providing necessary stratification criteria for trial participants. The market growth is inherently tied to the increasing global incidence of various cancer types, coupled with the rapid expansion of the targeted therapeutics pipeline that necessitates corresponding companion diagnostic tools for commercial viability and clinical utility.

Driving factors for this market are multi-faceted, stemming primarily from continuous technological advancements in genomics and proteomics, leading to reduced sequencing costs and faster turnaround times. Strong governmental and private funding for cancer research, alongside favorable regulatory pathways for breakthrough diagnostic devices, further propel adoption. Critically, the growing clinical acceptance and integration of molecular tumor boards into standard oncology practice underscore the recognized clinical utility of these tests. Additionally, the rising elderly population, which is more susceptible to cancer, contributes to an expanding patient pool requiring sophisticated diagnostic interventions to manage complex disease profiles effectively.

Precision Cancer Diagnostic Tests Market Executive Summary

The Precision Cancer Diagnostic Tests Market is characterized by robust growth driven by significant advancements in genomic technologies and the escalating demand for personalized medicine across major global economies. Business trends highlight a strong emphasis on strategic collaborations between diagnostic developers, pharmaceutical companies, and centralized reference laboratories to co-develop companion diagnostics (CDx) that align with emerging targeted oncology drugs. Investment is heavily concentrated in developing high-throughput, non-invasive liquid biopsy platforms, aiming to capture circulating tumor DNA (ctDNA) for real-time monitoring, thereby transitioning diagnostics from static, pre-treatment assessments to dynamic, ongoing patient management tools. Furthermore, there is a clear trend toward decentralizing testing capabilities, moving complex genomic analysis from specialized centers to regional hospitals through user-friendly, automated systems, which is crucial for broadening market penetration and accessibility, particularly in emerging healthcare settings.

Regionally, North America maintains market leadership, underpinned by substantial healthcare expenditure, early adoption of cutting-edge technologies like NGS, and favorable reimbursement policies established by major payers, including Medicare and private insurers. However, the Asia Pacific (APAC) region is poised to exhibit the highest CAGR during the forecast period. This accelerated growth in APAC is fueled by improving healthcare infrastructure, massive untapped patient populations, increasing awareness among oncologists regarding molecular testing benefits, and proactive governmental initiatives focused on controlling non-communicable diseases, including cancer. Europe continues to be a crucial market, defined by strong centralized healthcare systems and rigorous regulatory standards (such as the IVDR), which, while presenting temporary challenges, ensure high-quality diagnostic performance and structured adoption frameworks.

Segment trends reveal that the technology segment is dominated by Next-Generation Sequencing (NGS) due to its capability to simultaneously analyze hundreds of cancer-related genes, offering comprehensive genomic profiling (CGP). Liquid biopsy is emerging as the fastest-growing subsegment, reflecting the demand for minimally invasive and repeatable testing procedures. In terms of application, personalized therapeutic selection remains the largest driver, directly correlating with the availability of FDA-approved targeted therapies. Conversely, the end-user segment shows hospitals and cancer centers as the primary consumers, although centralized reference laboratories are crucial for processing complex, high-volume molecular tests. The sustained focus across all segments is on improving assay sensitivity and specificity while reducing overall testing costs to ensure broader clinical applicability and access.

AI Impact Analysis on Precision Cancer Diagnostic Tests Market

User inquiries regarding the impact of Artificial Intelligence (AI) on precision cancer diagnostics consistently center around its ability to manage the overwhelming volume and complexity of genomic, proteomic, and clinical data generated by high-throughput tests like NGS and spatial transcriptomics. Users frequently ask about AI's role in improving diagnostic accuracy, accelerating biomarker discovery, and optimizing treatment selection algorithms. Key themes include the desire to validate how machine learning can interpret nuanced patterns in liquid biopsy data to detect cancer earlier than current methods, and concerns about data privacy, standardization, and the clinical validation rigor required for AI-derived diagnostic tools. Expectations are high concerning AI's potential to automate complex image analysis (digital pathology) and integrate disparate data sources (e.g., electronic health records with genomic profiles) to create truly predictive diagnostic models, thereby reducing human error and improving operational efficiency in the diagnostic workflow.

AI’s influence is profound, acting as an essential computational layer that transforms raw diagnostic data into actionable clinical intelligence. For instance, sophisticated machine learning models are being developed to identify novel genomic signatures that correlate with response to immunotherapies, a task far too complex for manual human review or traditional biostatistics alone. This capability significantly shortens the time required for target identification and validation, accelerating the launch of both novel diagnostic tests and associated drugs. Furthermore, AI is crucial in managing data integrity and facilitating quality control across high-volume diagnostic labs, ensuring reproducibility and reliability, which are paramount in regulatory environments. It also enables the development of adaptive testing strategies, allowing diagnostic panels to evolve based on real-world patient outcomes and emerging scientific literature.

The operational integration of AI tools, particularly deep learning for image recognition and natural language processing (NLP) for integrating unstructured clinical notes, is streamlining diagnostic reporting. This allows oncologists to receive highly synthesized, clinically relevant summaries that integrate molecular findings with patient history, drastically improving the speed of clinical decision-making. As diagnostic platforms become more comprehensive—incorporating multi-omics data (genomics, transcriptomics, metabolomics)—AI becomes indispensable for pattern recognition that links genotype to phenotype, refining risk stratification models, and enhancing the ability of precision tests to guide complex therapeutic regimens, especially in hard-to-treat cancers where traditional diagnostic markers lack sensitivity.

- AI accelerates the interpretation of complex Next-Generation Sequencing (NGS) and multi-omics data sets, reducing diagnostic turnaround time.

- Deep learning algorithms enhance the accuracy of digital pathology by automating tumor classification and grading.

- Machine learning facilitates the discovery and validation of novel cancer biomarkers and predictive signatures.

- AI optimizes clinical trial matching by accurately identifying patients based on highly specific genomic profiles derived from precision tests.

- It enables personalized treatment recommendation systems by integrating diagnostic results with historical patient outcome data.

- AI algorithms improve the sensitivity and specificity of liquid biopsy analysis for detecting minimal residual disease (MRD) and early recurrence.

DRO & Impact Forces Of Precision Cancer Diagnostic Tests Market

The trajectory of the Precision Cancer Diagnostic Tests Market is strongly influenced by a synergistic interplay of drivers, restraints, and opportunities, creating powerful impact forces. Key drivers include the overwhelming global burden of cancer, the pharmaceutical industry’s pivot towards targeted therapies requiring co-developed companion diagnostics, and substantial technological leaps, notably in sequencing speed and cost reduction. These drivers exert a significant upward force on market expansion. Restraints, such as high initial test costs, complexity in reimbursement coverage determination (especially across varied global healthcare systems), and the need for highly specialized infrastructure and skilled personnel in clinical labs, present frictional impediments to widespread adoption. Opportunities reside predominantly in the non-invasive testing space (liquid biopsy), the integration of multi-omics approaches for more comprehensive tumor profiling, and the expansion into early disease screening and monitoring applications. The combination of these factors dictates market velocity and penetration.

One primary driver is the demonstrable improvement in patient prognosis afforded by precision diagnostics. When clinicians utilize molecular profiling to identify optimal therapies, patients experience better response rates and fewer unnecessary side effects associated with ineffective systemic treatments. This evidence base, supported by robust clinical trials and professional society guidelines, creates a significant pull factor for diagnostic adoption. Conversely, a major restraining force is the regulatory complexity and slow pace of establishing clinical utility in specific, niche cancer populations, which can delay market entry and limit reimbursement coverage for newly developed tests. Furthermore, standardization challenges across different diagnostic platforms and laboratories—specifically, ensuring inter-laboratory comparability of results—continue to be a hurdle that must be overcome for generalized clinical acceptance.

The defining opportunity that dictates the market’s future shape is the increasing utility of precision diagnostics beyond the initial staging phase, moving into therapeutic monitoring and disease surveillance. Liquid biopsy, in particular, offers the opportunity to replace invasive, painful tumor biopsies with simple blood draws for tracking tumor evolution, emergence of drug resistance mutations, and confirmation of treatment efficacy. The impact forces are further amplified by the push for precision public health, where large-scale genomic data collection and analysis, often facilitated by AI, enable better preventative strategies and personalized screening programs. The pressure from payers to demonstrate improved cost-effectiveness through better patient stratification is a crucial impact force, rewarding those diagnostic solutions that deliver superior clinical and economic value.

Segmentation Analysis

The Precision Cancer Diagnostic Tests Market is segmented based on the type of technology employed, the specific application of the test, the type of cancer targeted, and the end-user utilizing the diagnostics. Understanding these segmentations is critical for market stakeholders to tailor product development, marketing strategies, and distribution channels. The technological landscape is highly dynamic, witnessing a shift from traditional single-gene tests toward comprehensive, multiplexed genomic and proteomic platforms. The application segment reflects the diagnostic workflow, ranging from initial screening and risk assessment to complex companion diagnostics and recurrent disease monitoring. Geographic and end-user segmentation provides insight into the infrastructure maturity and adoption rates across different clinical settings globally, revealing where specialized testing services are most concentrated and where growth opportunities are greatest.

- By Technology:

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- Microarrays

- In Situ Hybridization (ISH)

- Other Technologies (Mass Spectrometry, etc.)

- By Application:

- Therapeutic Selection (Companion Diagnostics)

- Screening and Early Detection

- Prognosis and Risk Assessment

- Monitoring and Recurrence Detection (Minimal Residual Disease - MRD)

- By Cancer Type:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Melanoma

- Hematological Malignancies (Leukemia, Lymphoma)

- Other Cancers

- By End User:

- Hospitals and Cancer Centers

- Diagnostic and Reference Laboratories

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Precision Cancer Diagnostic Tests Market

The Value Chain for the Precision Cancer Diagnostic Tests Market is complex and highly integrated, spanning from raw material suppliers to final healthcare providers. The upstream analysis involves the sourcing and manufacturing of critical components, including sequencing consumables, specialized reagents, antibodies, and high-precision instrumentation. Key upstream players are technology providers who specialize in genomics and molecular biology tools, ensuring quality control and supply chain reliability are paramount, given the high sensitivity required for precision diagnostics. Success at this stage relies heavily on intellectual property protection and economies of scale in manufacturing specialized chemical and biological components. Efficient upstream operations directly influence the overall cost and accessibility of the final diagnostic test.

The midstream segment is dominated by the diagnostic test developers and service providers. This stage involves the research and development of diagnostic assays, strict clinical validation, regulatory approval (e.g., FDA or EMA clearance), and subsequent commercialization. For centralized testing, this includes the operation of large-scale reference laboratories capable of high-throughput NGS processing. For decentralized testing, it involves the manufacturing and distribution of IVD kits. Distribution channels are bifurcated into direct sales teams targeting large hospital networks and indirect sales via third-party distributors, particularly prevalent in regions with complex logistical challenges or fragmented healthcare markets. Maintaining regulatory compliance, securing strategic partnerships with pharma companies for CDx development, and demonstrating superior clinical validity are critical midstream success factors.

Downstream analysis focuses on the delivery and adoption of the diagnostic test results by end-users, encompassing hospitals, oncology clinics, and academic centers. The final steps include test prescription, sample collection, analysis, interpretation of highly complex genomic reports, and integration of the results into the patient’s clinical management plan. Direct channels often involve in-house hospital laboratories running decentralized tests, offering rapid results. Indirect channels rely on samples being shipped to centralized reference labs. Reimbursement mechanisms, coverage policies, and the availability of skilled oncology professionals capable of interpreting molecular reports are vital downstream determinants of market success and clinical impact. Educational initiatives targeting clinicians are essential to ensure appropriate utilization of the often-complex diagnostic information.

Precision Cancer Diagnostic Tests Market Potential Customers

The primary potential customers and end-users of Precision Cancer Diagnostic Tests are hospitals and comprehensive cancer centers, which serve as the central hubs for initial diagnosis, treatment planning, and longitudinal patient management. These institutions require robust, validated testing platforms to comply with professional guidelines and to offer state-of-the-art care, making them the largest purchasing segment, particularly for decentralized, point-of-care diagnostics and in-house laboratory services. The demand from hospitals is driven by the need for quick turnaround times for critical therapeutic decisions, high patient volumes, and the necessary integration of multidisciplinary care teams, including molecular tumor boards that rely heavily on precision diagnostic data to inform chemotherapy, targeted therapy, and immunotherapy decisions.

A second major customer segment consists of independent clinical diagnostic and reference laboratories, often performing complex, high-volume testing, such as comprehensive genomic profiling (CGP) using NGS. These labs act as outsourcing partners for smaller clinics and hospitals that lack the specialized equipment or expertise. Potential customers in this category prioritize test accuracy, high throughput capacity, competitive pricing, and broad geographical reach. Their purchasing decisions are heavily influenced by reimbursement codes and the ability to process a wide variety of sample types efficiently, including challenging specimens like small biopsies and liquid biopsies. Furthermore, regulatory compliance and accreditation status are paramount considerations for these sophisticated service providers.

The third significant customer group involves pharmaceutical and biotechnology companies. These entities utilize precision diagnostic services and products, primarily companion diagnostics (CDx), during the clinical development phase of novel oncology drugs and post-market surveillance. For pharma companies, the diagnostic test is integral to the drug's label and commercial success, ensuring only patients likely to respond are treated. Academic and research institutions also constitute key potential customers, driven by the need for advanced molecular tools for translational research, biomarker discovery, and conducting investigator-initiated clinical trials. Their focus is often on early-stage technologies and maximizing data generation capabilities to uncover new therapeutic pathways.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Illumina, Inc., Roche Diagnostics (F. Hoffmann-La Roche Ltd), Thermo Fisher Scientific Inc., Abbott Laboratories, Qiagen N.V., Myriad Genetics, Inc., Guardant Health, Inc., Exact Sciences Corporation, Foundation Medicine, Inc. (Roche subsidiary), Becton, Dickinson and Company (BD), Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., NeoGenomics Laboratories, Inc., Grifols S.A., Natera, Inc., Seimens Healthineers AG, Hologic, Inc., Bio-Techne Corporation, PerkinElmer, Inc., Eiken Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Cancer Diagnostic Tests Market Key Technology Landscape

The technological landscape of the Precision Cancer Diagnostic Tests Market is dominated by molecular biology techniques aimed at providing high-resolution genomic and proteomic profiles of tumors. Next-Generation Sequencing (NGS) platforms, particularly those utilizing Massive Parallel Sequencing, represent the foundational technology, enabling comprehensive genomic profiling (CGP) by simultaneously assaying hundreds of cancer-related genes or even the entire exome or genome. Recent technological shifts involve transitioning NGS from large benchtop machines to smaller, faster, and more integrated systems, enhancing accessibility for clinical laboratories. The ongoing challenge is improving library preparation automation and minimizing input DNA requirements, particularly for challenging samples like fine-needle aspirates or liquid biopsy samples with low analyte concentration. Furthermore, the development of synthetic long-read sequencing technologies offers improved ability to detect complex structural variants crucial in certain cancer types.

Liquid Biopsy technology stands out as the most disruptive innovation, focusing on the analysis of circulating tumor cells (CTCs), cell-free DNA (cfDNA), circulating tumor DNA (ctDNA), exosomes, and other biomarkers shed into peripheral blood. This technology is revolutionizing disease monitoring by providing a non-invasive means to assess therapeutic response, track minimal residual disease (MRD), and detect resistance mutations earlier than traditional imaging. Technological advancements in liquid biopsy focus intensely on maximizing sensitivity and specificity—achieving high detection rates for extremely low concentrations of ctDNA (often measured in parts per million). Techniques such as digital droplet PCR (ddPCR) and highly sensitive customized NGS panels are crucial in this segment, pushing the boundaries of early detection and recurrence surveillance in high-risk patients, especially for cancers where tissue biopsy is difficult or impossible to perform repeatedly.

Beyond genomics, the landscape also relies heavily on advanced immunodiagnostics, including highly multiplexed immunohistochemistry (IHC) and in situ hybridization (ISH) techniques, which remain standard of care for identifying key protein biomarkers (like PD-L1, HER2, and hormone receptors). The integration of digital pathology with AI tools is transforming these traditional methods by automating slide analysis and quantifying biomarker expression with objective measures. Additionally, the emergence of spatial transcriptomics and spatial proteomics is allowing researchers and diagnostic developers to map molecular events within the tumor microenvironment with unprecedented spatial resolution. These multi-omic approaches, which combine genomic data with expression and protein data, are expected to fuel the next wave of highly predictive precision diagnostic tests, requiring sophisticated bioinformatics and computational pipelines to harness the voluminous data generated.

Regional Highlights

The adoption and market maturity of Precision Cancer Diagnostic Tests exhibit significant variation across major global regions, influenced by healthcare spending, regulatory frameworks, and technological infrastructure. North America, particularly the United States, represents the largest and most mature market segment. This dominance is attributed to high disease burden, rapid technology uptake, presence of major diagnostic companies and reference laboratories (like Illumina, Guardant Health, and Foundation Medicine), and strong financial support via established private and public reimbursement mechanisms. The FDA's accelerated approval process for novel IVDs and companion diagnostics further encourages innovation and market entry.

Europe constitutes the second largest market, characterized by centralized healthcare systems and regulatory harmonization efforts under the In Vitro Diagnostic Regulation (IVDR). While adoption is high in key economies like Germany, the UK, and France, fragmentation in reimbursement policies across different national health systems can occasionally impede widespread market penetration. However, the region benefits from strong academic research and clinical trial networks that actively integrate precision diagnostics into patient care protocols, focusing particularly on lung, breast, and colorectal cancer screening and treatment optimization.

Asia Pacific (APAC) is projected to be the fastest-growing regional market, driven by rapidly improving healthcare infrastructure, substantial government investment in genomic initiatives (e.g., in China and India), and a large, expanding patient pool. The shift from centralized to decentralized testing is accelerating in APAC, supported by strategic partnerships between global diagnostic firms and local distributors. While cost sensitivity remains a factor, increasing patient awareness and the urgent need to manage rising cancer incidence are creating immense opportunities for affordable, scalable diagnostic solutions, particularly in countries like Japan, South Korea, and Australia, which have established advanced oncology practice standards.

- North America (U.S. and Canada): Market leader due to high technology adoption, established reimbursement pathways, and concentration of key industry players, focusing heavily on NGS and liquid biopsy for therapeutic monitoring and CGP.

- Europe (Germany, UK, France): Strong adoption driven by robust public healthcare systems and clinical guidelines; market growth influenced by successful implementation of centralized molecular testing centers.

- Asia Pacific (China, Japan, India): Highest growth rate projected due to rising cancer incidence, increasing public health expenditure, and rapid development of domestic diagnostic manufacturing capabilities and research infrastructure.

- Latin America (Brazil, Mexico): Emerging market characterized by selective adoption in private hospital sectors and growing demand for affordable diagnostic kits, supported by increasing collaborations with international organizations.

- Middle East and Africa (MEA): Nascent but growing market focusing on establishing modern cancer treatment centers; penetration is currently concentrated in Gulf Cooperation Council (GCC) countries with high healthcare spending capacities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Cancer Diagnostic Tests Market.- Illumina, Inc.

- Roche Diagnostics (F. Hoffmann-La Roche Ltd)

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Qiagen N.V.

- Myriad Genetics, Inc.

- Guardant Health, Inc.

- Exact Sciences Corporation

- Foundation Medicine, Inc. (Roche subsidiary)

- Becton, Dickinson and Company (BD)

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- NeoGenomics Laboratories, Inc.

- Grifols S.A.

- Natera, Inc.

- Seimens Healthineers AG

- Hologic, Inc.

- Bio-Techne Corporation

- PerkinElmer, Inc.

- Eiken Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Precision Cancer Diagnostic Tests market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional cancer diagnostics and precision cancer diagnostic tests?

Traditional cancer diagnostics typically classify cancer based on morphology (cell appearance) and anatomical location, offering broad treatment guidelines. Precision cancer diagnostic tests, conversely, analyze specific molecular and genomic biomarkers, mutations, or genetic alterations unique to an individual tumor. This molecular data enables oncologists to tailor treatment precisely, selecting targeted therapies or immunotherapies that are most likely to be effective for the patient's unique cancer profile, resulting in higher efficacy and reduced unnecessary systemic toxicity. The precision approach shifts the focus from treating the location of the tumor to treating its specific biological mechanism.

How is the clinical utility of liquid biopsy tests validated in the context of precision oncology?

The clinical utility of liquid biopsy is validated primarily through its ability to accurately detect circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) and provide actionable information that changes patient management, thereby improving outcomes. Key areas of validation include companion diagnostics (CDx) for drug selection (e.g., detecting EGFR mutations in lung cancer), monitoring therapeutic response in real-time without invasive tissue sampling, and surveillance for minimal residual disease (MRD). Validation studies rigorously compare liquid biopsy results against gold-standard tissue biopsy and demonstrate high concordance rates, alongside a clear link between test results and measurable patient benefits, such as progression-free survival or overall survival improvement.

What role does Next-Generation Sequencing (NGS) play in driving the Precision Cancer Diagnostic Tests Market?

NGS is the cornerstone technology driving market expansion because it allows for high-throughput, comprehensive genomic profiling (CGP). Unlike single-gene tests, NGS can analyze hundreds of clinically relevant genes simultaneously, identifying various mutation types, including single nucleotide variants, insertions/deletions, and structural rearrangements, all in a single assay. The declining cost and increasing speed of NGS have made CGP economically viable in clinical settings. This technology provides the breadth of data required to match patients to the increasing portfolio of targeted therapies and immunotherapy agents, serving as the essential tool for personalized oncology treatment planning.

What are the primary financial challenges impacting the widespread adoption of precision diagnostics?

The primary financial challenges include the high initial cost of sophisticated molecular tests, particularly comprehensive NGS panels and advanced liquid biopsies, which require expensive instrumentation and complex bioinformatics pipelines. Furthermore, inconsistent or fragmented reimbursement policies across different geographical regions and payer systems pose a significant barrier. While the long-term clinical and economic benefits (avoiding expensive, ineffective drugs) are clear, securing broad coverage for novel, high-cost tests often requires extensive evidence demonstrating clear clinical utility and cost-effectiveness, slowing down widespread adoption, especially in emerging markets.

How is AI integration expected to enhance the accuracy and efficiency of precision cancer diagnostics in the near future?

AI integration is anticipated to revolutionize the market by handling the massive datasets generated by multi-omics precision tests. Specifically, machine learning algorithms will enhance accuracy by rapidly identifying subtle, complex patterns in genomic data or digital pathology images that are invisible to the human eye, improving biomarker discovery and tumor classification. Efficiency will be boosted through automated data interpretation, streamlined quality control checks, and the creation of highly synthesized, actionable clinical reports, significantly reducing the diagnostic turnaround time and ensuring consistent, objective result analysis across diverse clinical laboratory settings globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager