Precision Copper Alloy Rod Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441451 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Precision Copper Alloy Rod Market Size

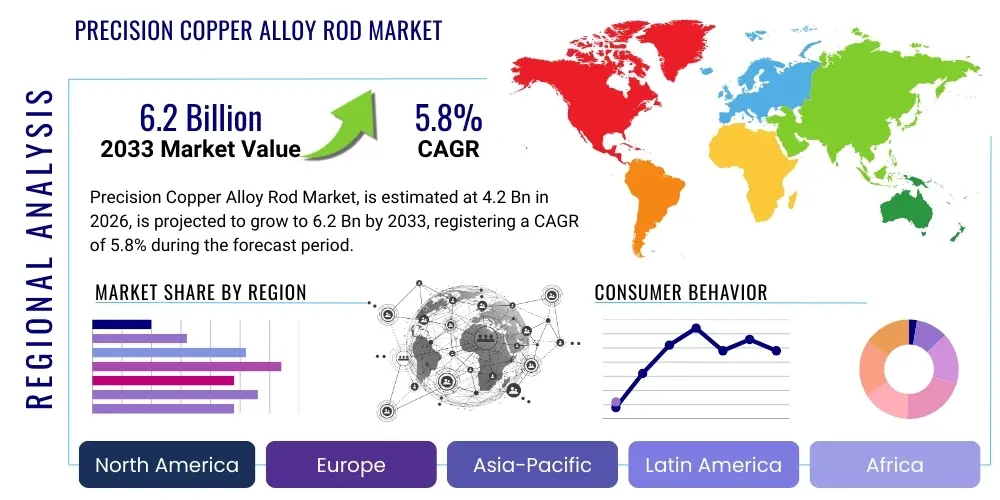

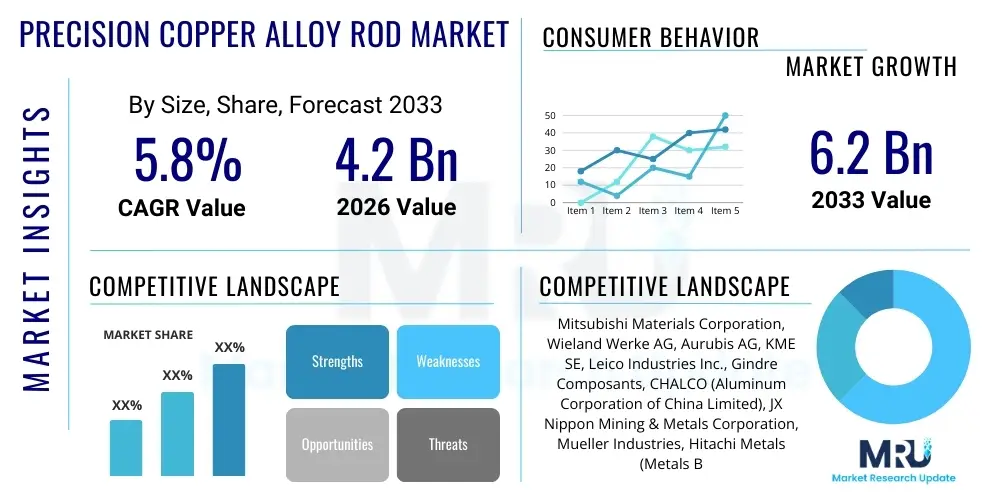

The Precision Copper Alloy Rod Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Precision Copper Alloy Rod Market introduction

Precision copper alloy rods are highly engineered metal products characterized by extremely tight dimensional tolerances, superior surface finish, and optimized metallurgical properties tailored for specific high-performance applications. These alloys, which include brasses, bronzes, and specialized copper-nickel or copper-beryllium compositions, are crucial components where reliability, electrical conductivity, thermal performance, and corrosion resistance are non-negotiable requirements. The manufacturing process involves specialized continuous casting, extrusion, and drawing techniques, often followed by annealing or aging treatments, to achieve precise mechanical strength and crystalline structures essential for end-use performance, particularly in miniaturized or high-frequency environments.

The primary applications of precision copper alloy rods span several high-growth industrial sectors. In the electrical and electronics industry, they are indispensable for creating connectors, switches, terminals, and heat sinks due to their excellent conductivity and heat dissipation capabilities. The automotive sector utilizes them extensively for complex wiring harnesses, sensor housings, and braking system components, demanding materials that withstand high vibration and harsh thermal cycles. Furthermore, the defense and aerospace industries rely on these precision materials for specialized fasteners, electrical contacts, and hydraulic components where material failure is unacceptable, thereby justifying the higher manufacturing cost associated with tight tolerances.

Key driving factors accelerating market expansion include the global push toward electrification in the transportation sector, the proliferation of 5G and subsequent telecommunication infrastructure build-out, and the increasing demand for high-density, reliable electronic devices. The superior material benefits—such as exceptional machinability, anti-corrosion properties, and high mechanical fatigue resistance—position these precision rods as critical enablers for next-generation technology development. Manufacturers are continuously investing in advanced metallurgical research to develop new alloys that offer improved performance characteristics, such as higher stress relaxation resistance for complex electronic springs and contacts, thus maintaining market momentum.

Precision Copper Alloy Rod Market Executive Summary

The Precision Copper Alloy Rod Market is witnessing robust growth, underpinned by significant technological advancements across key end-use industries, particularly electronics manufacturing and automotive electrification. Business trends indicate a strong focus on backward integration among major producers to control raw material quality and stabilize pricing, given the volatility of global copper markets. Furthermore, market competition is increasingly shifting towards specialization, with companies differentiating themselves by offering ultra-high-precision rods (tolerances below 5 microns) and specialized alloys optimized for thermal management in data centers and electric vehicle battery systems. Strategic partnerships between alloy manufacturers and precision component fabricators are becoming common to ensure supply chain efficiency and joint material specification development.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, driven primarily by massive investments in consumer electronics production, semiconductor fabrication, and the rapid expansion of EV manufacturing bases in China, South Korea, and Japan. North America and Europe maintain strong demand, particularly in high-reliability segments such as aerospace, medical devices, and industrial machinery, where stringent quality standards necessitate the use of premium precision copper alloys. The Middle East and Africa (MEA) and Latin America are showing nascent growth, primarily linked to infrastructure projects requiring durable electrical transmission components and localized manufacturing development initiatives.

Segmentation trends reveal that C26000 (Cartridge Brass) and C51000 (Phosphor Bronze) alloy types continue to command a substantial market share due to their versatile mechanical and electrical properties, making them staples in connector manufacturing. However, the fastest growth is observed in high-performance alloys like Copper-Beryllium (C17200) and high-copper alloys, which are essential for applications requiring extreme strength and exceptional conductivity, such as specialized automotive sensors and high-frequency communication components. The segment defined by rod diameter and form factor (e.g., hexagonal or square rods for specific machining operations) is also seeing enhanced differentiation as machining technology advances, requiring materials optimized for high-speed CNC processes.

AI Impact Analysis on Precision Copper Alloy Rod Market

Common user questions regarding AI's influence in the precision copper alloy rod sector typically center on how artificial intelligence can enhance material quality, reduce production waste, and optimize complex manufacturing logistics. Users are concerned with predictive modeling capabilities—specifically, whether AI can accurately forecast material defects before they occur in the high-tolerance drawing process, or if it can manage dynamic copper pricing volatility in procurement strategies. The consensus expectation is that AI will primarily revolutionize the operational efficiency and quality assurance domains. AI systems are being leveraged to analyze real-time sensor data from casting furnaces, rolling mills, and drawing benches to maintain optimal temperature profiles, tension levels, and dimensional consistency, thereby minimizing deviations and enhancing the yield of high-precision products. Furthermore, machine learning models are increasingly used for demand forecasting and inventory management, ensuring manufacturers can respond swiftly to the highly volatile and customized requirements of the aerospace and electronics supply chains.

- AI-driven predictive maintenance reduces machinery downtime, crucial for continuous, high-precision rod production.

- Enhanced quality control systems utilize machine vision and AI algorithms for instantaneous defect detection, exceeding human inspection capabilities.

- Optimization of alloy composition mixing and thermal treatment cycles using machine learning ensures consistent metallurgical properties, particularly important for specialized high-strength alloys.

- Improved supply chain resilience through predictive analytics that forecast raw material (copper and alloying elements) price fluctuations and availability risks.

- Process parameter optimization (e.g., drawing speed, lubrication consistency) leads to higher material yield and reduced scrap rates in high-tolerance fabrication.

DRO & Impact Forces Of Precision Copper Alloy Rod Market

The dynamics of the Precision Copper Alloy Rod Market are governed by a compelling mix of drivers, significant restraints, and clear opportunities, all amplified by intrinsic market forces. The primary drivers include the exponential growth in electric vehicle (EV) production, which necessitates robust, high-conductivity copper alloys for battery connections, busbars, and charging infrastructure. Concurrently, the global rollout of 5G and the increasing sophistication of data centers require precision rods for high-performance connectors that must handle elevated current densities and thermal loads without degradation. These technological shifts are creating sustained, high-volume demand for superior quality, high-reliability materials.

However, the market faces notable restraints, chiefly the inherent volatility in global copper prices, which directly impacts manufacturing costs and profit margins. Producing rods to extremely tight tolerances also requires sophisticated machinery and highly skilled labor, resulting in significant capital expenditure and a high barrier to entry for new players. Furthermore, the substitution threat from lighter materials, such as aluminum and specialized plastics, in certain non-critical applications where conductivity is secondary to weight reduction, poses a constant competitive challenge, pushing copper alloy manufacturers toward performance differentiation.

Opportunities for market growth lie in the development and commercialization of advanced copper alloys with enhanced performance characteristics, such as high-strength, lead-free brasses that comply with increasingly strict environmental regulations (e.g., REACH and RoHS directives). The rapid expansion of specialized industries like medical device manufacturing (MRI components, surgical tools) and advanced robotics also offers niche high-value markets demanding customized precision rods. The major impact forces are the regulatory pressure toward sustainability (driving demand for recyclable and non-toxic materials) and the accelerating pace of miniaturization in electronics, which constantly demands tighter dimensional controls and improved thermal management from raw materials.

Segmentation Analysis

The Precision Copper Alloy Rod Market is systematically segmented based on material composition, application area, and specific physical attributes such as rod form and diameter. This stratification allows manufacturers to tailor production capabilities and marketing efforts towards distinct end-user needs, acknowledging the vast differences in performance requirements between, for example, an automotive sensor connector and an aerospace hydraulic component. Segmentation is crucial for accurately gauging demand in high-growth niches, especially those requiring exotic alloys like Copper-Tellurium or specialized bronzes optimized for wear resistance in mechanical systems. The differentiation based on standards compliance (e.g., ASTM, DIN, JIS) further defines market segments, catering to geographically specific engineering requirements.

- By Alloy Type:

- Brass Rods (e.g., C36000, C26000)

- Bronze Rods (e.g., Phosphor Bronze C51000, Aluminum Bronze)

- High Copper Alloys (e.g., C11000, C10200)

- Specialty Alloys (e.g., Copper-Nickel, Copper-Beryllium, Copper-Tellurium)

- By Application:

- Electrical and Electronics (Connectors, Switches, Relays, Terminals)

- Automotive (Braking Systems, Sensors, Engine Components, EV Infrastructure)

- Industrial Machinery (Bushings, Gears, Valve Components)

- Building and Construction (Plumbing Fixtures, Architectural Components)

- Aerospace and Defense (Fasteners, Hydraulic Fittings)

- By Form Factor:

- Round Rods

- Hexagonal Rods

- Square Rods

- Custom Profiles

- By End-User Industry:

- OEMs (Original Equipment Manufacturers)

- Tier 1 and Tier 2 Component Suppliers

- Precision Machining Workshops

Value Chain Analysis For Precision Copper Alloy Rod Market

The value chain for precision copper alloy rods begins intensely in the upstream segment with the sourcing of primary copper and alloying elements such as zinc, tin, nickel, and beryllium. Securing high-purity copper cathodes and controlling the consistency of alloying elements are foundational to achieving the final precision properties. Major producers often maintain long-term contracts with copper mining and refining operations to mitigate supply risks and manage price volatility. The initial processing involves induction melting and continuous or semi-continuous casting to produce billet stock, demanding stringent temperature and impurity control to ensure a homogenous microstructure before subsequent forming processes.

The midstream phase, which encompasses the core manufacturing process, is highly capital-intensive and critical for precision attributes. This involves hot extrusion or hot rolling of the billets, followed by multiple stages of cold drawing and annealing. Achieving precision tolerances—often measured in single-digit micrometers—requires advanced drawing equipment, specialized dies, sophisticated lubrication, and strict control over heat treatment cycles to optimize grain structure and mechanical strength. Quality control and testing (metallographic analysis, non-destructive testing, dimensional measurement) at this stage are paramount before the material is cut, finished, and packaged according to specific customer requirements.

Downstream analysis involves distribution and end-user engagement, where direct and indirect channels play crucial roles. Direct sales are common for large OEMs in the automotive and aerospace sectors, often involving custom specifications and long-term contracts with material manufacturers. Indirect distribution relies on specialized metal service centers and distributors who offer inventory management, cutting services, and prompt delivery to smaller machining workshops and Tier 2 suppliers. The final value addition occurs when end-users machine the precision rods into complex components like high-density connectors or specialized fasteners, leveraging the material's superior machinability and consistent quality to ensure component performance and reliability.

Precision Copper Alloy Rod Market Potential Customers

The primary customers for precision copper alloy rods are entities requiring materials with guaranteed mechanical and electrical performance in critical, often harsh, operating environments. Large-scale Original Equipment Manufacturers (OEMs) in the automotive industry, particularly those specializing in Electric Vehicle (EV) systems, represent a substantial and rapidly expanding customer base. These manufacturers require precision alloys for battery terminals, charging ports, and advanced sensor components that must maintain structural integrity and low resistance connectivity under prolonged high-current loads and extreme thermal cycling, making material consistency crucial for product safety and efficiency.

Another significant customer segment includes electronics and telecommunications hardware manufacturers. As devices become smaller and data transmission speeds increase (e.g., in 5G infrastructure and data centers), the demand for connectors, switches, and relays made from high-performance copper alloys (such as high-conductivity brasses and copper-nickel alloys) with exceptional stress relaxation resistance intensifies. These customers prioritize alloys that allow for ultra-fine machining and maintain spring properties over extended service life, which is essential for ensuring reliable signal integrity in complex printed circuit board (PCB) assemblies.

Furthermore, specialized aerospace, defense, and medical device manufacturers constitute high-value, albeit lower volume, customers. In these sectors, material failure is catastrophic, driving a stringent preference for certified, traceable precision rods like Copper-Beryllium, which offers the highest strength combined with good conductivity. Potential buyers in these fields include military contractors fabricating munitions components, aircraft manufacturers needing high-pressure hydraulic fittings, and medical equipment firms producing highly reliable diagnostic and surgical instruments where material precision directly impacts patient safety and equipment reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsubishi Materials Corporation, Wieland Werke AG, Aurubis AG, KME SE, Leico Industries Inc., Gindre Composants, CHALCO (Aluminum Corporation of China Limited), JX Nippon Mining & Metals Corporation, Mueller Industries, Hitachi Metals (Metals Business of Hitachi Ltd.), Ningbo Jintian Copper (Group) Co., Ltd., Halcor S.A., National Bronze & Metals, Inc., Concast Metal Products Co., Copper & Brass Sales (Ryerson), Aviva Metals Inc., MKM Mansfelder Kupfer und Messing GmbH, Luvata Group, Diehl Metall Stiftung & Co. KG, IBC Advanced Alloys Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Copper Alloy Rod Market Key Technology Landscape

The technological advancement in the precision copper alloy rod market focuses heavily on achieving metallurgical purity and sub-micrometer dimensional accuracy while optimizing production efficiency. Continuous casting technology, particularly up-casting and horizontal casting methods, represents a crucial technology as it allows for the production of billets with highly uniform grain structures and minimized inclusion defects, which are prerequisite for successful cold drawing into precision rods. These advanced casting techniques enable better control over the solidification rate, mitigating issues like porosity and segregation that compromise the final material performance, especially in high-strength specialty alloys like copper-chromium or copper-zirconium required for elevated temperature applications.

Furthermore, state-of-the-art cold drawing and extrusion processes define the precision achievable in the rods. Manufacturers are adopting advanced multi-stage drawing machines equipped with sophisticated sensor arrays and laser micrometer feedback systems. These systems provide real-time dimensional corrections, allowing operators to maintain tolerances often tighter than standard industry specifications. The utilization of specialized, wear-resistant carbide dies and high-performance lubricants is also critical in minimizing surface defects and ensuring superior finish, which is essential for subsequent high-speed machining operations performed by end-users in the automotive and electronics sectors.

Beyond forming technologies, surface treatment and annealing techniques are undergoing continuous refinement. Hydrogen atmosphere annealing is increasingly employed for high-purity copper rods to prevent oxidation and maintain maximum electrical conductivity. Moreover, research is focused on developing novel alloying methods, including powder metallurgy techniques for creating metal matrix composites (MMCs) based on copper, which offer bespoke combinations of strength and conductivity unattainable through traditional melt processes. These technological thrusts are aimed at supporting the next generation of power electronics and miniaturized components where thermal management and long-term reliability are paramount design considerations.

Regional Highlights

The geographical distribution of the Precision Copper Alloy Rod Market reflects global manufacturing centers and technological innovation hubs, with distinct demand drivers characterizing each major region. Asia Pacific (APAC) stands as the undisputed market leader, propelled by its vast capacity in consumer electronics assembly, semiconductor manufacturing, and electric vehicle production. Countries like China, South Korea, and Japan not only consume the majority of the precision rods but also host several of the world's largest copper alloy manufacturers, benefitting from government initiatives supporting local manufacturing and massive infrastructure projects.

North America and Europe represent mature markets characterized by high demand for quality, specialized alloys used in high-reliability applications, including aerospace, defense, and high-precision medical devices. While the volume growth may be slower compared to APAC, the average selling price (ASP) of precision rods is generally higher due to stringent regulatory standards (e.g., REACH compliance in Europe) and the necessity for highly specialized, often customized, material specifications required by leading multinational corporations headquartered in these regions. Innovation in materials science, particularly concerning lead-free and high-strength compositions, is often pioneered here.

The Latin America (LATAM) and Middle East and Africa (MEA) regions collectively account for a smaller but growing share. Demand in MEA is primarily driven by investments in large-scale power generation, electrical grid infrastructure upgrades, and oil and gas sector maintenance, requiring robust, corrosion-resistant copper alloys. LATAM's growth is tied to automotive assembly operations and moderate industrial expansion. Both regions rely significantly on imported precision rods but are beginning to develop local processing capabilities to meet escalating demand, particularly in sectors related to renewable energy installation and telecommunications network expansion.

- Asia Pacific (APAC): Dominant region driven by EV mass production, 5G deployment, and consumer electronics manufacturing; high volume consumption of standard and specialized brass/bronze alloys.

- North America: Focus on high-performance sectors like aerospace, defense, and high-reliability industrial machinery; strong demand for certified Copper-Beryllium and other ultra-precision specialty alloys.

- Europe: Driven by strict regulatory adherence (lead-free, RoHS), automotive industry innovation, and industrial automation; emphasis on metallurgical quality control and material traceability.

- Latin America (LATAM): Emerging demand linked to infrastructure improvements, localized automotive manufacturing, and mining industry requirements for durable electrical components.

- Middle East and Africa (MEA): Growth spurred by power and energy infrastructure investments and expansion of telecommunications networks, demanding standard and anti-corrosion copper alloy rods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Copper Alloy Rod Market.- Mitsubishi Materials Corporation

- Wieland Werke AG

- Aurubis AG

- KME SE

- Leico Industries Inc.

- Gindre Composants

- CHALCO (Aluminum Corporation of China Limited)

- JX Nippon Mining & Metals Corporation

- Mueller Industries

- Hitachi Metals (Metals Business of Hitachi Ltd.)

- Ningbo Jintian Copper (Group) Co., Ltd.

- Halcor S.A.

- National Bronze & Metals, Inc.

- Concast Metal Products Co.

- Copper & Brass Sales (Ryerson)

- Aviva Metals Inc.

- MKM Mansfelder Kupfer und Messing GmbH

- Luvata Group

- Diehl Metall Stiftung & Co. KG

- IBC Advanced Alloys Corp.

- Boliden AB

- Shree Extrusions Ltd.

- Jiangsu Changbao Steel Tube Co., Ltd.

- Metrod Ltd.

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Precision Copper Alloy Rod Market between 2026 and 2033?

The Precision Copper Alloy Rod Market is projected to grow at a stable Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven by sustained demand from the electrical and automotive sectors.

Which specific alloy types are experiencing the fastest growth in demand within the precision rod market?

High-performance specialty alloys, particularly Copper-Beryllium (C17200) and other high-copper alloys, are witnessing the fastest growth due to their essential role in electric vehicle components, specialized defense applications, and miniaturized, high-reliability electronic connectors.

How does the volatile price of raw copper impact the profitability and market strategy of precision rod manufacturers?

Copper price volatility is a significant restraint; manufacturers mitigate this risk by engaging in long-term raw material contracts, implementing advanced hedging strategies, and focusing on high-value, high-precision products where material cost is amortized across superior performance and tight tolerances.

What role does Artificial Intelligence (AI) play in improving the quality assurance of precision copper alloy rods?

AI is crucial for quality assurance through advanced analytics and machine vision systems that provide real-time monitoring of manufacturing parameters (casting temperature, drawing tension). This allows for instantaneous detection and correction of micro-defects, ensuring the final rod meets critical dimensional and metallurgical specifications.

Which geographical region holds the largest market share and what are its primary market drivers?

Asia Pacific (APAC) holds the largest market share, primarily driven by massive capacity expansions in Electric Vehicle (EV) production, robust growth in consumer electronics manufacturing, and significant government investments in 5G and industrial infrastructure development across countries like China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager