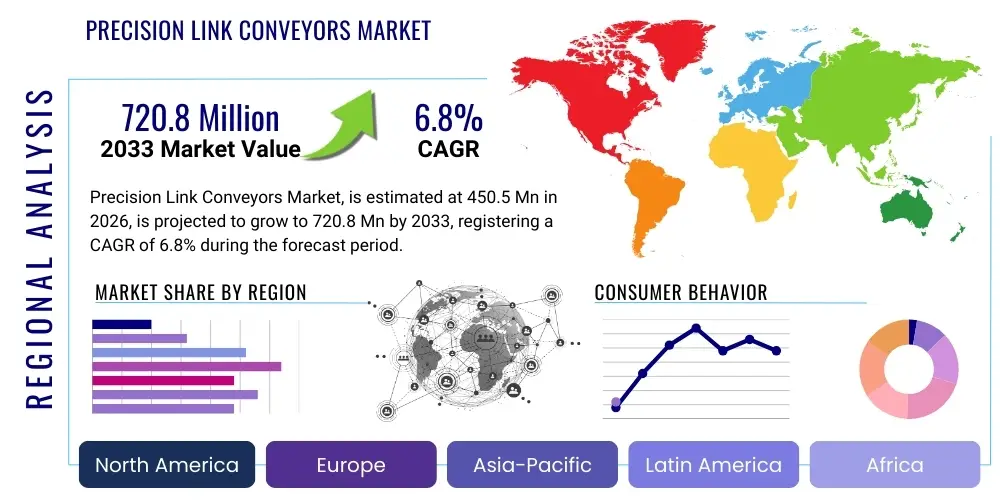

Precision Link Conveyors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441483 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Precision Link Conveyors Market Size

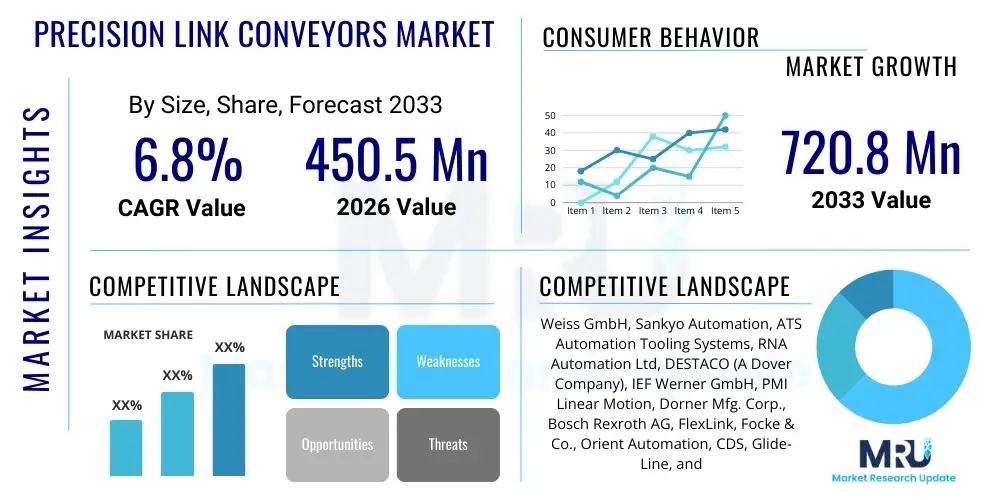

The Precision Link Conveyors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 720.8 million by the end of the forecast period in 2033. This consistent growth trajectory is driven primarily by the escalating demand for automated, high-speed assembly processes across critical manufacturing sectors such as electronics, medical devices, and pharmaceuticals, where positional accuracy is paramount.

Precision Link Conveyors Market introduction

Precision Link Conveyors (PLCs) are specialized material handling systems engineered to provide highly accurate, repetitive indexing and positioning of workpieces within automated assembly lines. Unlike traditional belt or chain conveyors, PLCs utilize a rigid mechanical link chain system, often incorporating cam mechanisms or servo drives, to ensure the carried fixture plate stops at each station with micron-level positional repeatability. These systems are indispensable in environments requiring stringent quality control and complex multi-stage operations, forming the backbone of modern synchronous assembly processes.

The product description centers on high positional accuracy, high throughput capacity, and modular design allowing for flexible integration into existing automation cells. Major applications include the assembly of small, high-value components such as micro-switches, medical disposables, automotive electronic control units (ECUs), and specialized consumer electronics. The primary benefits derived from using PLCs include reduced cycle times, minimized scrap rates due to improved placement accuracy, and enhanced overall operational stability compared to non-synchronous alternatives.

Key driving factors fueling market expansion are the global push toward Industry 4.0 adoption, increasing labor costs necessitating higher levels of automation, and the proliferation of complex, miniaturized products requiring delicate and precise handling during manufacturing. Furthermore, the robust construction and long service life of these systems appeal to manufacturers seeking sustainable, long-term automation investments.

Precision Link Conveyors Market Executive Summary

The Precision Link Conveyors market exhibits robust growth, catalyzed by significant business trends including the rapid expansion of electric vehicle (EV) battery and electronics assembly lines, and the pharmaceutical industry's need for faster, compliant packaging systems. Companies are focusing on developing modular, easily reconfigurable PLC systems that integrate seamlessly with robotic pick-and-place units and vision inspection systems, shifting the competitive landscape towards providers offering comprehensive automation solutions rather than standalone hardware. Supply chain resilience, following recent global disruptions, is also prioritizing localized manufacturing of conveyor systems, particularly in key consumer electronics hubs.

Regionally, Asia Pacific (APAC), led by China, Japan, and South Korea, dominates the market due to massive investments in semiconductor fabrication and consumer electronics manufacturing infrastructure. North America and Europe demonstrate mature market characteristics, focusing primarily on high-precision segments such as aerospace, medical device assembly, and high-specification automotive components, with significant R&D spending directed towards advanced servo-driven indexers. Emerging markets in Southeast Asia are rapidly adopting entry-level and mid-range precision solutions to modernize their burgeoning manufacturing bases.

Segment trends reveal a strong preference for large-pitch precision link conveyors, accommodating larger fixtures required for EV modules and complex diagnostic equipment. In terms of drive technology, servo-driven indexing systems are rapidly gaining share over traditional cam-driven mechanisms due to their superior flexibility, programmability, and ability to dynamically adjust cycle times, aligning perfectly with the demands of highly flexible production environments. End-user demand remains highest from the consumer electronics and medical sectors, reflecting the high volume and inherent complexity of products manufactured within these industries.

AI Impact Analysis on Precision Link Conveyors Market

User inquiries regarding AI's impact on Precision Link Conveyors primarily center on themes of predictive maintenance, real-time positional correction, and optimizing overall line throughput. Users frequently question how AI algorithms can analyze vibration data and temperature fluctuations collected from conveyor drive systems to forecast potential mechanical failures, thereby minimizing costly unplanned downtime. Another core concern involves leveraging machine learning for dynamic load balancing and synchronization, particularly in complex, multi-station assembly environments where the timing between PLCs, robotics, and vision systems must be perfectly coordinated. Users expect AI to enhance the reliability and flexibility of these high-cost capital assets.

The implementation of edge AI processing units within the control architecture of PLCs is transforming their operational intelligence. These systems can process sensor data—such as tension, motor current, and acoustic signatures—in real-time, identifying subtle anomalies indicative of wear on link components or timing belts long before manual inspection detects an issue. This shift from reactive or time-based maintenance to true condition-based monitoring significantly extends the mean time between failures (MTBF) and optimizes maintenance scheduling, directly impacting the operational expenditure (OPEX) of high-volume manufacturers.

Furthermore, AI-driven process optimization is enabling PLCs to adapt their indexing speed and acceleration profiles based on upstream material flow and downstream bottleneck accumulation. By integrating with the factory MES (Manufacturing Execution System), AI can intelligently modulate the conveyor’s movement parameters, ensuring maximum throughput utilization while maintaining critical positional accuracy. This level of dynamic adaptation is essential for future 'smart factories' that prioritize flexibility and rapid product changeovers, solidifying the role of intelligent PLCs as foundational components of next-generation automation.

- AI enhances predictive maintenance through real-time vibration and acoustic analysis.

- Machine learning algorithms optimize conveyor synchronization and throughput in complex assembly cells.

- Integration of vision systems with AI allows for instantaneous feedback and micro-corrections of workpiece placement.

- AI-driven control systems enable dynamic acceleration and deceleration profiles for energy efficiency and reduced mechanical stress.

- Optimization of maintenance scheduling and parts inventory based on projected component lifespan.

DRO & Impact Forces Of Precision Link Conveyors Market

The growth trajectory of the Precision Link Conveyors market is fundamentally shaped by the increasing necessity for high-speed, highly repeatable automation (Drivers), counterbalanced by significant capital expenditure requirements and complexity in maintenance (Restraints). Opportunities emerge primarily from the expansion into new high-tech sectors like micro-optics and specialized semiconductor packaging, demanding ever-higher accuracy standards. The critical Impact Forces determining market direction include the accelerating pace of Industry 4.0 adoption and stringent regulatory standards in the medical device industry, which mandates verifiable and consistent production processes.

Primary drivers include the pervasive trend of miniaturization in electronics, demanding tighter tolerances than standard conveyor systems can provide. The automotive sector's pivot towards electric vehicles requires precise, synchronous assembly of battery packs and intricate electronic modules, generating substantial demand for reliable PLCs. Furthermore, the long-term cost benefits derived from reduced component damage and higher quality output solidify the investment justification for these advanced systems, particularly in high-wage economies where automation is key to competitive advantage.

Restraints largely revolve around the high initial investment cost, which can be prohibitive for Small and Medium-sized Enterprises (SMEs), and the requirement for highly skilled technicians for complex setup, programming, and mechanical maintenance. While opportunities exist in developing highly modular, cost-effective standard models and leveraging global contract manufacturers to drive down production costs, the technological complexity of achieving micro-positional accuracy remains a significant barrier to entry for new competitors and limits adoption in low-margin manufacturing environments.

Segmentation Analysis

The Precision Link Conveyors market is segmented based on the critical attributes of their mechanical design, operational parameters, and end-user application environments. Key segmentation factors include the type of drive mechanism employed (Cam-Driven vs. Servo-Driven), the size characteristics (Link Pitch), and the specific industrial sector utilizing the equipment. Analyzing these segments provides a nuanced view of market demand, highlighting areas of rapid innovation, such as the increasing shift toward highly flexible servo-driven systems, and stable demand, such as standard pitch systems utilized in established consumer goods production.

Segmentation by link pitch—categorized typically into small, medium, and large—is crucial as it directly correlates with the size and weight of the assembled product. Small pitch conveyors are essential for micro-assembly (e.g., watch components, micro-sensors), while large pitch conveyors are mandated for heavier assemblies like EV battery trays or large medical diagnostic devices. Understanding this dimension helps manufacturers tailor fixture design and capacity, ensuring optimal performance for highly specific client requirements.

The detailed segmentation also facilitates targeted market strategies. For instance, the demand for PLCs in the pharmaceutical segment is intensely focused on compliance, sterile operation, and easy cleanability, necessitating specific materials and sealed designs, distinct from the requirements of the high-throughput, dry manufacturing environments found in electronics assembly. This differentiation drives product development and regulatory adherence within specialized sub-markets, ensuring that product offerings meet the unique technical and operational needs of diverse industrial clientele.

- By Drive Type:

- Cam-Driven Precision Link Conveyors

- Servo-Driven Precision Link Conveyors

- By Link Pitch Size:

- Small Pitch (e.g., under 50mm)

- Medium Pitch (e.g., 50mm to 100mm)

- Large Pitch (e.g., over 100mm)

- By Application:

- Electronics Assembly (Consumer Electronics, Semiconductors)

- Medical Device Manufacturing (Diagnostics, Disposables)

- Automotive Components Assembly (ECUs, Sensors, EV Battery Modules)

- Pharmaceutical & Cosmetic Packaging

- General Industrial Automation

Value Chain Analysis For Precision Link Conveyors Market

The value chain for the Precision Link Conveyors market begins with upstream component suppliers, primarily focused on high-precision mechanical components such as hardened steel links, precision machined chassis components, specialized bearings, and high-performance servo motors and drives. The quality of these upstream inputs is non-negotiable, as they directly determine the operational lifespan, positional accuracy, and repeatability of the final conveyor system. Critical suppliers also include providers of advanced control systems and sensors necessary for high-speed indexing and integration with supervisory factory software.

In the midstream, the value creation shifts to core manufacturing and assembly processes carried out by Original Equipment Manufacturers (OEMs). This stage involves sophisticated engineering design, thermal treatment of moving components to ensure durability, and the high-precision assembly of the links, fixtures, and drive mechanisms. Differentiation at this stage is achieved through proprietary link geometries, advanced noise reduction techniques, and the integration of highly reliable indexing mechanisms. Direct distribution channels are often favored by leading OEMs, utilizing in-house engineering sales teams who can provide customized configuration and application engineering support directly to sophisticated end-users requiring complex integrated automation solutions.

Downstream activities involve system integration, installation, commissioning, and long-term service and maintenance. System integrators play a vital, often indirect, role by combining the PLC with peripheral equipment (robots, vision systems, feeders) into a functional assembly line. Post-sales services, including routine calibration and parts supply for specialized link components, represent a significant revenue stream. Indirect channels, such as regional distributors, typically handle sales of standardized or lower complexity modular systems, extending the market reach into smaller manufacturing facilities that might not require extensive bespoke engineering.

Precision Link Conveyors Market Potential Customers

Potential customers for Precision Link Conveyors are predominantly large-scale, high-volume manufacturers operating in sectors where product quality and assembly speed are critical competitive factors. These end-users are characterized by having multi-shift operations, stringent quality control requirements (e.g., ISO, GMP compliance), and substantial investments in synchronous, fixed-automation processes. The primary buyers are production engineers, automation managers, and capital expenditure procurement departments within these highly regulated and technology-intensive industries.

The largest cohort of potential buyers resides in the consumer electronics and semiconductor packaging industry. These companies require PLCs for assembling miniature components such as camera modules, smart device internal assemblies, and specialized chip carriers, where tolerance stacking requires extreme positional fidelity at high cycle rates. The relentless consumer demand for smaller, faster, and more complex electronic devices drives continuous investment in advanced PLC technology capable of handling these evolving production challenges.

Furthermore, the medical device sector—including manufacturers of syringes, infusion pumps, diagnostic cartridges, and complex surgical tools—represents a rapidly growing customer segment. For these buyers, the non-negotiable requirements of sterility, traceability, and absolute consistency mandate the use of precision synchronization tools like PLCs. The pharmaceutical sector also utilizes these systems extensively for vial filling, blister packaging, and secondary packaging operations that must comply with strict validation protocols, making PLCs essential capital equipment for maintaining regulatory compliance and high throughput.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 720.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weiss GmbH, Sankyo Automation, ATS Automation Tooling Systems, RNA Automation Ltd, DESTACO (A Dover Company), IEF Werner GmbH, PMI Linear Motion, Dorner Mfg. Corp., Bosch Rexroth AG, FlexLink, Focke & Co., Orient Automation, CDS, Glide-Line, and Hiwin Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Link Conveyors Market Key Technology Landscape

The technology landscape of the Precision Link Conveyors market is defined by continuous evolution towards higher velocity, greater positional accuracy, and enhanced digital integration. The foundational technology remains the mechanical precision chain and linkage system, designed for zero backlash and minimal component wear, often utilizing specialized materials and surface treatments for durability. However, the most significant recent technological shift is the transition from purely mechanical cam-driven indexing mechanisms, which offer robust, fixed timing, to fully programmable, electronically controlled servo-driven systems. Servo technology allows for custom acceleration and deceleration profiles, enabling smoother operation, reduced vibration, and the ability to change indexing parameters instantly for product changeovers, drastically improving operational flexibility.

Advanced sensor technology, particularly high-resolution encoders and non-contact displacement sensors, are crucial for maintaining and verifying positional accuracy in real-time. These sensors feed data back to the central Programmable Logic Controller (PLC) or Industrial PC, ensuring the system can automatically compensate for minor mechanical drift or temperature variations. Furthermore, the integration of Industrial Internet of Things (IIoT) concepts is prevalent, involving embedding wireless connectivity and standardized communication protocols (e.g., OPC UA) into the conveyor controls. This allows for seamless data exchange with factory supervisory systems (SCADA, MES), facilitating centralized monitoring, remote diagnostics, and aggregated performance analysis.

Material science innovation also plays a critical role, particularly in reducing maintenance and enhancing cleanroom compatibility. The adoption of specialized polymers and anti-corrosive coatings for fixtures and links is essential for applications in the food, pharmaceutical, and medical sectors. Future technological trends point towards the integration of magnetic levitation or linear motor technology in combination with traditional link mechanisms for ultra-high-speed, non-contact positioning accuracy, though this remains an emerging, high-cost niche. The ongoing challenge is balancing the need for mechanical robustness and stiffness with the dynamic flexibility afforded by advanced electronic control and data utilization.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC holds the dominant share in the Precision Link Conveyors Market, largely driven by its unparalleled scale in electronics manufacturing, particularly in consumer devices and semiconductor assembly (backend packaging). Countries like China, South Korea, Taiwan, and Japan are massive investment hubs for high-throughput, synchronous automation required to meet global production demands. The rapid establishment of Gigafactories for EV battery production in the region further accelerates the demand for robust, large-pitch PLCs required for precise module assembly and handling. The focus here is primarily on scalability and maximizing throughput efficiency.

- North America Market Maturity and High Value: The North American market is characterized by high demand from regulated, high-value industries, specifically medical device manufacturing, specialized aerospace components, and sophisticated automotive electronics. Manufacturers prioritize systems with the highest levels of positional accuracy and traceability, often favoring advanced servo-driven systems for maximum flexibility and compliance validation. Investment decisions are driven less by sheer volume and more by the need for quality assurance, high complexity handling, and integration with domestic robotics systems.

- European Market for Specialized Automation: Europe represents a mature market with strong growth emanating from advanced pharmaceutical packaging, specialized machinery manufacturing, and high-specification automotive production (internal components and sensors). European manufacturers, especially those in Germany and Switzerland, are early adopters of Industry 4.0 principles, integrating PLCs deeply into digitally connected factory environments. Emphasis is placed on energy efficiency, modularity (to facilitate rapid line retooling), and long-term mechanical reliability, reflecting the region's focus on sustainable, high-precision engineering.

- Latin America (LATAM) Emerging Adoption: The LATAM market, while smaller, is exhibiting steady growth, particularly in automotive component assembly (Mexico and Brazil) and consumer goods manufacturing. Adoption here is often focused on replacing older, less accurate handling systems with standardized, medium-pitch PLCs to improve quality control and reduce reliance on manual labor. Price sensitivity is higher compared to developed regions, leading to a balanced adoption of both cam-driven systems (for established processes) and mid-range servo systems (for new lines).

- Middle East and Africa (MEA) Infrastructure Development: The MEA region is at an early stage of adoption, with demand linked to infrastructure projects, localized light industrial manufacturing expansion, and growth in the regional pharmaceutical sector (e.g., Saudi Arabia, UAE). Market demand is concentrated on standard, reliable systems used for packaging and light assembly, often procured via international system integrators. Long-term growth prospects are tied to government initiatives promoting industrial diversification and manufacturing self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Link Conveyors Market.- Weiss GmbH

- Sankyo Automation

- ATS Automation Tooling Systems

- RNA Automation Ltd

- DESTACO (A Dover Company)

- IEF Werner GmbH

- PMI Linear Motion

- Dorner Mfg. Corp.

- Bosch Rexroth AG

- FlexLink

- Focke & Co.

- Orient Automation

- CDS (Cam Driven Systems)

- Glide-Line

- Hiwin Corporation

- Shuttleworth, LLC

- Motion Index Drives, Inc.

- Mikron Automation

- Fortive Corporation (through subsidiary brands)

- Parker Hannifin Corp.

Frequently Asked Questions

Analyze common user questions about the Precision Link Conveyors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Precision Link Conveyor over a standard belt conveyor?

The primary advantage is positional repeatability, typically in the range of ±0.01mm to ±0.05mm. PLCs use a rigid, synchronized mechanical chain and link system, ensuring fixtures stop at critical stations with micro-level accuracy, which is essential for automated assembly of delicate components.

How do Servo-Driven PLCs differ from traditional Cam-Driven systems in terms of operational flexibility?

Servo-Driven PLCs offer dynamic, programmable indexing profiles, allowing users to instantly adjust acceleration, speed, and dwell times via software. Cam-Driven systems are fixed by the mechanical design of the cam, requiring physical changeover for new parameters, limiting flexibility for rapid product changeovers.

Which industrial sectors are driving the highest demand for large-pitch Precision Link Conveyors?

The highest demand for large-pitch PLCs (typically >100mm) is driven by the automotive sector, specifically for the synchronous assembly of heavy Electric Vehicle (EV) battery modules, and the medical sector for manufacturing large diagnostic equipment.

What are the key factors determining the lifespan and maintenance cost of a Precision Link Conveyor system?

Lifespan and cost are determined by the quality of the hardened steel components (links, pins), the frequency of lubrication, and the use of sophisticated predictive maintenance sensors. Regular calibration and preventing overloads are critical to minimizing frictional wear and extending service life.

Is the integration of vision systems critical for modern Precision Link Conveyors?

Yes, the integration of high-speed vision systems is critical. Vision systems verify the exact position and orientation of parts on the conveyed fixtures immediately prior to critical operations (e.g., soldering, dispensing), feeding back data for quality assurance and robotic fine-tuning, thereby maximizing first-pass yield.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager