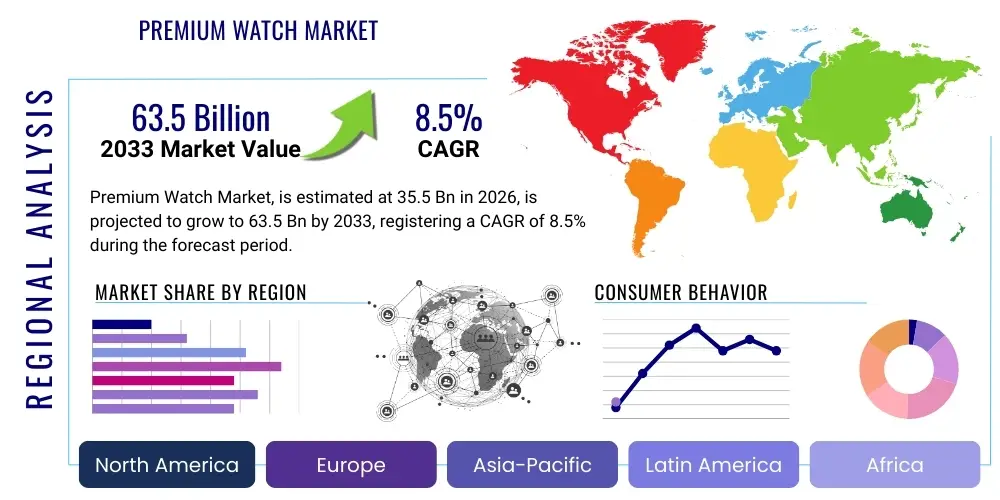

Premium Watch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441884 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Premium Watch Market Size

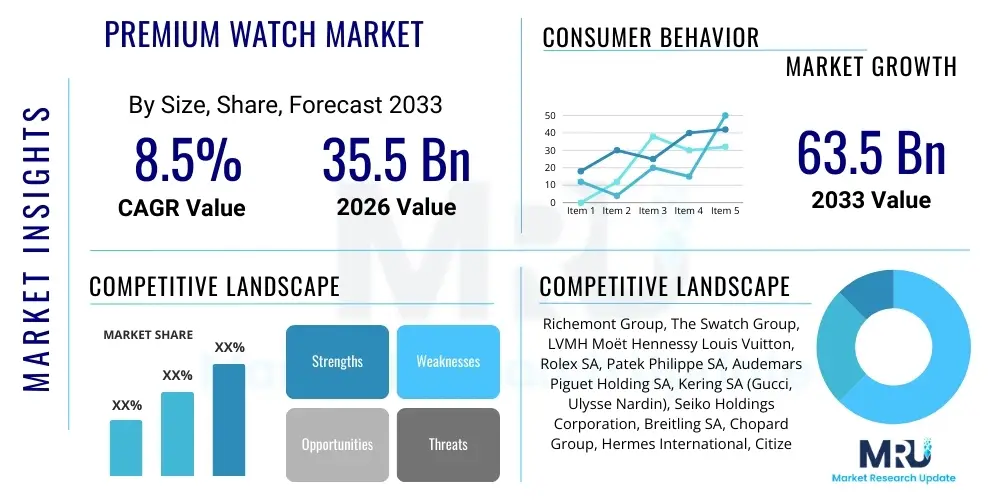

The Premium Watch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $35.5 Billion in 2026 and is projected to reach $63.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising disposable income among affluent consumers globally, particularly in emerging economies of Asia Pacific, coupled with the enduring consumer demand for high-end mechanical movements, craftsmanship, and brand heritage.

The valuation reflects sustained investment in product innovation, the effective integration of digital marketing strategies emphasizing exclusivity, and the successful navigation of supply chain complexities, especially concerning rare materials and highly skilled labor. The resilience of luxury goods, often viewed as investment assets, further underpins the consistent growth trajectory observed, ensuring that premium watches maintain their status as essential symbols of social standing and personal achievement.

Premium Watch Market introduction

The Premium Watch Market encompasses timepieces characterized by superior craftsmanship, highly precise mechanical or quartz movements, utilization of precious metals and gemstones, and association with established luxury brands having significant heritage. These products are positioned at the high end of the luxury spectrum, appealing to consumers seeking enduring quality, exclusivity, and status signaling. The core product categories include mechanical automatic watches, complicated timepieces (such as chronographs and tourbillons), and high-jewelry watches. Major applications extend beyond basic timekeeping; premium watches are critically utilized as collector items, investment assets, and fashion statements, often serving as heirloom pieces passed down through generations.

The fundamental benefits offered by premium watches include unmatched durability, exceptional aesthetic appeal derived from intricate design and finishing, and the psychological satisfaction of owning a piece of mechanical artistry. These watches are typically made from materials like platinum, gold, titanium, and high-grade stainless steel, ensuring longevity and maintaining intrinsic value. The market's growth is predominantly driven by increasing wealth concentration globally, particularly the growth of the High-Net-Worth Individual (HNWI) segment, coupled with successful brand storytelling that reinforces scarcity and historical provenance. Furthermore, the robust secondary market, driven by online platforms and authenticated dealers, has bolstered consumer confidence in the long-term value retention of these luxury items, fueling primary market demand.

Key driving factors supporting the market include the cultural shift towards appreciating traditional craftsmanship in an increasingly digital world, the successful utilization of celebrity endorsements and limited-edition releases to generate immediate demand, and the strategic expansion of luxury retail infrastructure into high-potential geographic areas. Additionally, technological advancements focused on material science, such as ceramic composites and specialized alloys, are enabling brands to offer lightweight yet extremely durable watches, further enticing performance-oriented consumers and collectors.

Premium Watch Market Executive Summary

The Premium Watch Market is undergoing robust evolution, characterized by pronounced shifts towards digital engagement, sustainable sourcing practices, and strategic consolidation among leading industry players. Current business trends indicate a significant acceleration in Direct-to-Consumer (DTC) sales channels, propelled by brands seeking greater control over pricing, inventory management, and customer experience, minimizing reliance on traditional third-party retailers. Furthermore, the authentication and grading of pre-owned luxury watches have become formalized business segments, integrating the secondary market directly into the ecosystem of major brands, which enhances market liquidity and consumer trust in the long-term value proposition of premium timepieces.

Regionally, Asia Pacific, led by Mainland China and India, remains the dominant growth engine, attributed to rapid urbanization and the expansion of the upper-middle class and affluent populations who view luxury watches as essential status symbols. North America and Europe maintain strong market shares, focusing predominantly on highly complicated watches and niche independent brands. Europe, particularly Switzerland, continues to dominate the production landscape, utilizing its unparalleled heritage and technological expertise in micromechanics. These regional dynamics highlight a bifurcated market: established Western markets prioritize heritage and investment value, while APAC markets emphasize brand recognition and immediate luxury signaling.

Segmentation trends reveal significant consumer interest in the high-end mechanical automatic category, which commands the largest market share due to its fusion of traditional artistry and modern engineering. In terms of distribution, specialized boutiques and authorized online channels are seeing the fastest growth, offering curated experiences and ensuring product authenticity. Consumer preference analysis shows a growing demand for environmentally and ethically sourced materials, prompting manufacturers to invest in responsible supply chains for metals and straps. The market is also experiencing polarization, with high-complication models (above $25,000) and entry-level luxury watches (below $5,000) growing rapidly, squeezing the traditional mid-range luxury segment.

AI Impact Analysis on Premium Watch Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Premium Watch Market primarily revolve around two major themes: enhancement of the customer experience and optimization of supply chain efficiency. Consumers and industry stakeholders are keen to understand how AI tools can personalize luxury shopping journeys, predict micro-trends in aesthetics and complications, and authenticate pre-owned watches with higher accuracy to combat counterfeiting. Key concerns include maintaining the human element and artisanal exclusivity inherent in luxury goods while leveraging technological speed. The expectation is that AI will be integrated discreetly, primarily serving back-end operations such as inventory forecasting, predictive maintenance for specialized machinery, and advanced anomaly detection in quality control, rather than directly influencing the core product craftsmanship.

- AI-powered Demand Forecasting: Optimizing production planning based on real-time luxury consumer sentiment and regional economic indicators.

- Enhanced Counterfeit Detection: Utilizing machine vision and deep learning algorithms for rapid authentication of pre-owned watches, stabilizing the secondary market.

- Personalized Customer Journeys: Implementing AI chatbots and recommendation engines tailored to HNWI purchasing patterns and collection interests.

- Supply Chain Optimization: Managing inventory of rare materials (e.g., specialized metals, unique gemstones) through predictive logistical tools.

- Advanced Quality Control: Employing AI vision systems for minute defect detection in movement finishing and case assembly, exceeding human capability.

DRO & Impact Forces Of Premium Watch Market

The dynamics of the Premium Watch Market are shaped by a powerful interplay of drivers, restraints, and opportunities, collectively forming complex impact forces. A primary driver is the burgeoning global population of affluent individuals coupled with a cultural shift that prioritizes experiential luxury and tangible assets. The sustained marketing efforts by heritage brands that emphasize storytelling, exclusivity, and limited production runs also significantly impact purchasing decisions. Restraints include the reliance on highly specialized labor and artisanal skills, making scalability difficult and increasing production costs. Furthermore, economic volatility and geopolitical instability can rapidly suppress discretionary luxury spending, particularly in crucial emerging markets, impacting overall revenue stability. The persistent threat of sophisticated counterfeiting, although addressed by technological means, remains a tangible restraint affecting brand integrity and consumer confidence.

Opportunities for growth are abundant, notably through the digital transformation of the sales ecosystem, including the adoption of blockchain technology for immutable provenance tracking and the expansion of curated online platforms. The focus on sustainability—from ethical sourcing of gold and diamonds to minimizing environmental impact in manufacturing—presents an opportunity for brands to appeal to younger, socially conscious luxury consumers. Additionally, product diversification into smart-luxury hybrid watches that maintain traditional mechanical integrity while offering subtle connected functionalities represents a critical pathway for market penetration among tech-savvy elites. These strategic pivots allow traditional luxury houses to innovate without compromising core values.

The impact forces influencing the market are structural and economic. Structural forces involve the high barriers to entry due to necessary capital investment in precision manufacturing and the established dominance of Swiss watchmaking houses, which control critical intellectual property and supply networks. Economic forces, such as fluctuating exchange rates and commodity prices (especially gold and platinum), directly affect manufacturing costs and global pricing strategies. The convergence of these drivers and restraints dictates market intensity, leading to fierce competition among established brands to secure exclusive retail space, proprietary movement technology, and the loyalty of influential collectors, thereby pushing the industry towards continuous incremental innovation and strategic marketing campaigns.

Segmentation Analysis

The Premium Watch Market is comprehensively segmented across several dimensions, providing manufacturers and marketers with targeted insights into consumer preferences and distribution effectiveness. Key segments include product type (mechanical, quartz, smart-hybrid), material used (precious metal, stainless steel, ceramic/titanium), price point (entry-level luxury, ultra-luxury, haute horlogerie), and distribution channel (boutiques, online retail, department stores). This detailed segmentation allows brands to tailor their manufacturing output and marketing narratives to specific consumer groups, maximizing profitability and managing brand positioning within the crowded luxury space.

The mechanical segment consistently generates the highest revenue due to its association with craftsmanship, collectability, and investment value, while the quartz segment primarily targets consumers seeking brand prestige at a lower entry price point. Material segmentation highlights the dominance of precious metals (gold, platinum) in the ultra-luxury segment, whereas high-tech materials like ceramic and titanium are gaining traction among consumers prioritizing durability and modern aesthetics. Analyzing the distribution channels reveals a growing reliance on brand-owned boutiques and authenticated online platforms, reinforcing control over the end-user experience and ensuring product authenticity in an increasingly digital shopping environment.

- By Product Type:

- Mechanical Automatic

- Quartz

- Smart Luxury/Hybrid

- By Material:

- Precious Metals (Gold, Platinum)

- Stainless Steel

- Titanium and Ceramic

- Other Exotic Materials

- By End-User:

- Men

- Women

- Unisex/Collector

- By Distribution Channel:

- Exclusive Brand Boutiques

- Authorized Dealers/Multi-brand Retailers

- E-commerce (Brand Websites and Third-Party Luxury Platforms)

- Department Stores

- By Price Range:

- $1,000 to $5,000 (Entry Luxury)

- $5,001 to $25,000 (Mid-Range Luxury)

- Above $25,000 (Haute Horlogerie/Ultra-Luxury)

Value Chain Analysis For Premium Watch Market

The value chain for the Premium Watch Market is intensive, spanning from raw material extraction to final retail. Upstream analysis focuses heavily on the procurement of high-grade materials, including specialized alloys, certified precious metals, and rare components like balance springs and specific gemstones. Manufacturers engage in rigorous quality control and often vertically integrate, owning specialized production facilities (e.g., movement assembly, case manufacturing) to ensure exclusivity and protect proprietary technology. The critical upstream activities involve precision engineering, micromechanics R&D, and securing ethical sourcing certifications for all raw components, which significantly influences the final product cost and prestige.

Downstream analysis centers on sophisticated marketing, distribution, and after-sales service. Distribution channels are highly selective, primarily leveraging authorized dealers, exclusive brand boutiques, and carefully vetted e-commerce platforms to maintain brand integrity and control pricing. Direct distribution is gaining momentum, allowing brands to forge stronger relationships with collectors and control the end-to-end customer journey, including personalized fitting and presentation. Post-sale activities, such as long-term servicing, repair, and authentication, are crucial components of the value chain, ensuring the long-term functioning and preservation of the watch's intrinsic value.

The distribution network is segmented into direct (brand-owned boutiques and official websites) and indirect (third-party authorized retailers and multi-brand luxury watch stores). Direct channels provide higher profit margins and better customer data, while indirect channels offer broader geographical reach and penetration into diverse local markets. The increasing digitization of luxury sales mandates that brands invest heavily in omnichannel strategies, ensuring a seamless, authenticated, and highly personalized experience whether the customer interacts online or in a physical boutique, reinforcing the exclusivity inherent in the premium product.

Premium Watch Market Potential Customers

The primary consumers, or end-users, of the Premium Watch Market are predominantly High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) globally. These buyers possess substantial disposable income and view luxury watches not merely as timepieces but as tangible assets, status indicators, and collector items. The target demographic also includes an expanding segment of young, upwardly mobile professionals in emerging markets (often referred to as 'HENRYs' - High Earners, Not Rich Yet) who purchase entry-level luxury watches as milestones of professional success and a means of aspiring to higher luxury tiers.

Beyond wealth, potential customers can be categorized based on motivation: serious collectors driven by movement complication, historical provenance, and brand scarcity; fashion-conscious buyers seeking aesthetic alignment with current trends; and legacy purchasers focused on acquiring heirloom pieces for generational transfer. A growing subset includes female consumers seeking gender-specific designs or smaller versions of iconic mechanical men's watches. Brands focus their outreach by targeting specific demographics with tailored complications and material choices, such as targeting serious male collectors with chronographs and tourbillons, and female consumers with jewelry watches featuring specific gem settings.

The successful conversion of potential customers relies heavily on exclusivity, personalized clienteling, and robust after-sales support that underscores the product's enduring value. Digital platforms facilitate engagement with younger buyers, utilizing social media and digital content to emphasize craftsmanship and brand heritage. Ultimately, the potential customer base seeks validation, exclusivity, and a product that transcends mere functionality, providing emotional connection and a reliable store of wealth, particularly in times of economic uncertainty.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $35.5 Billion |

| Market Forecast in 2033 | $63.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Richemont Group, The Swatch Group, LVMH Moët Hennessy Louis Vuitton, Rolex SA, Patek Philippe SA, Audemars Piguet Holding SA, Kering SA (Gucci, Ulysse Nardin), Seiko Holdings Corporation, Breitling SA, Chopard Group, Hermes International, Citizen Watch Co. Ltd., Franck Muller, Hublot (LVMH), Richard Mille, Bremont Watch Company, A. Lange & Söhne (Richemont), Vacheron Constantin (Richemont), Omega (Swatch Group), Cartier (Richemont) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Premium Watch Market Key Technology Landscape

The technology landscape within the Premium Watch Market is dual-faceted, combining centuries-old micromechanical precision with modern material science and digital integration. Key technological advancements center on the refinement of movement components to enhance accuracy, longevity, and resistance to magnetic fields and temperature fluctuations. Innovations such as silicon-based components (e.g., hairsprings and escapements) are widely adopted across high-end Swiss manufacturers. Silicon offers extreme resistance to magnetism, superior consistency, and requires no lubrication, significantly improving timekeeping stability and extending service intervals. The commitment to in-house movement development (manufacture movements) remains a critical technological differentiator, symbolizing complete control over quality and proprietary design.

Material technology is equally vital, driving the development of new alloys and composites that offer unique aesthetic and functional properties. Ceramic, known for its scratch resistance and lightweight nature, is increasingly utilized for cases and bezels. High-grade titanium alloys are employed for sports watches requiring superior strength-to-weight ratios. Furthermore, the integration of complex finishing techniques, such as micro-blasting, galvanizing, and specific polishing methods (e.g., Geneva stripes, anglage), remains an essential component of the technological landscape, demanding specialized machinery and highly refined skills to achieve the aesthetic standards expected of premium products.

Digital technologies are strategically implemented to enhance the customer experience and optimize production. This includes the use of highly sophisticated Computer Numerical Control (CNC) machinery for milling cases and plates with micron-level precision, often supplemented by AI for quality assurance checks. For logistics and anti-counterfeiting, technologies like Near Field Communication (NFC) chips embedded in documentation or blockchain ledgers are being adopted to provide immutable proof of provenance and ownership, thereby protecting the investment value for collectors. Hybrid watches represent a technology niche where traditional mechanical movements are housed alongside subtle, digitally connected modules for basic smart functionalities, catering to consumers who demand both heritage and connectivity.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing market, driven primarily by China, Hong Kong, and rapidly ascending luxury markets like India and Southeast Asia. This region's demand is characterized by consumers seeking instantly recognizable luxury brands and high-value pieces suitable for gifting and status display. The expansion of exclusive retail spaces in major metropolitan areas directly correlates with the region’s increasing penetration of luxury goods.

- Europe: Europe remains the heart of the Premium Watch Market, dominating in both production (Switzerland) and consumption, particularly among ultra-high-net-worth individuals who value heritage, artisanal excellence, and complicated horology. France, Germany, and the UK are strong consumption hubs, emphasizing traditional mechanical timepieces and supporting independent watchmakers who prioritize artistic finishing.

- North America: The North American market is sophisticated, characterized by strong demand for both established luxury brands and emerging micro-brands. Consumer preference here is often driven by investment potential and functional complications (e.g., tool watches, chronographs). E-commerce penetration is higher than in other regions, with robust activity in the authenticated pre-owned market.

- Middle East and Africa (MEA): Luxury watch consumption in the MEA region is concentrated primarily in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia). Demand is typically focused on high-jewelry watches and ultra-luxury timepieces made of precious metals, often purchased through exclusive private client channels. Gifting and cultural celebrations drive seasonal spikes in demand.

- Latin America: While smaller, the Latin American market shows potential, especially in Brazil and Mexico, though it faces challenges related to import duties and economic instability. Consumers here generally favor recognizable, globally advertised brands that signify stability and established prestige.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Premium Watch Market.- Richemont Group (Cartier, Vacheron Constantin, A. Lange & Söhne, IWC Schaffhausen, Jaeger-LeCoultre)

- The Swatch Group (Omega, Longines, Breguet, Blancpain)

- LVMH Moët Hennessy Louis Vuitton (TAG Heuer, Hublot, Zenith, Bulgari)

- Rolex SA

- Patek Philippe SA

- Audemars Piguet Holding SA

- Kering SA (Gucci, Ulysse Nardin, Girard-Perregaux)

- Seiko Holdings Corporation (Grand Seiko)

- Breitling SA

- Chopard Group

- Hermes International

- Citizen Watch Co. Ltd.

- Franck Muller

- Richard Mille

- Bremont Watch Company

- F.P. Journe

- Parmigiani Fleurier

- Urwerk SA

- H. Moser & Cie.

- MB&F (Maximilian Büsser & Friends)

Frequently Asked Questions

Analyze common user questions about the Premium Watch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Premium Watch Market?

The primary drivers include the expanding global population of High-Net-Worth Individuals (HNWIs), increasing investment in limited-edition and artisanal mechanical timepieces due to their perceived value retention, and aggressive digital marketing strategies that emphasize brand heritage and exclusivity. Furthermore, the strong integration of the authenticated pre-owned segment stabilizes consumer confidence in long-term value, fueling primary market demand across Asia Pacific and North America.

How is the secondary market influencing the sale of new luxury watches?

The secondary market significantly influences new luxury watch sales by establishing transparent valuation benchmarks and fostering a sense of collectability and liquidity. High resale values for certain models (often driven by scarcity and brand desirability) signal a robust investment potential, which encourages first-time buyers and collectors to purchase those specific models new, thereby artificially constraining supply and driving brand prestige.

Which geographic region demonstrates the highest growth potential in the Premium Watch sector?

The Asia Pacific (APAC) region, particularly Mainland China and emerging Southeast Asian economies, exhibits the highest growth potential. This rapid expansion is sustained by significant wealth creation, a cultural emphasis on luxury gifting, and increasing accessibility through expanding retail infrastructure. Demand in APAC often focuses on instantly recognizable luxury brands with high aesthetic and status appeal.

What is the role of technology, beyond traditional mechanics, in defining a premium watch?

Technology is increasingly vital in materials science and anti-counterfeiting efforts. Modern premium watches utilize advanced materials like silicon for escapement components (enhancing accuracy and magnetism resistance) and high-tech ceramics for scratch-proof casings. Furthermore, digital technologies such as blockchain and NFC are employed to establish immutable provenance records, safeguarding the authenticity and investment value of the timepiece.

What distinguishes 'Haute Horlogerie' (Ultra-Luxury) from standard luxury watches?

Haute Horlogerie denotes the highest tier of premium watchmaking, distinguished by exceptional mechanical complexity (complications like tourbillons, minute repeaters, perpetual calendars), hand-finishing of all movement components (often to specific aesthetic standards like the Geneva Seal), extremely limited production, and prices typically exceeding $25,000. These watches represent artisanal skill and intellectual property more than mass-produced luxury items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager