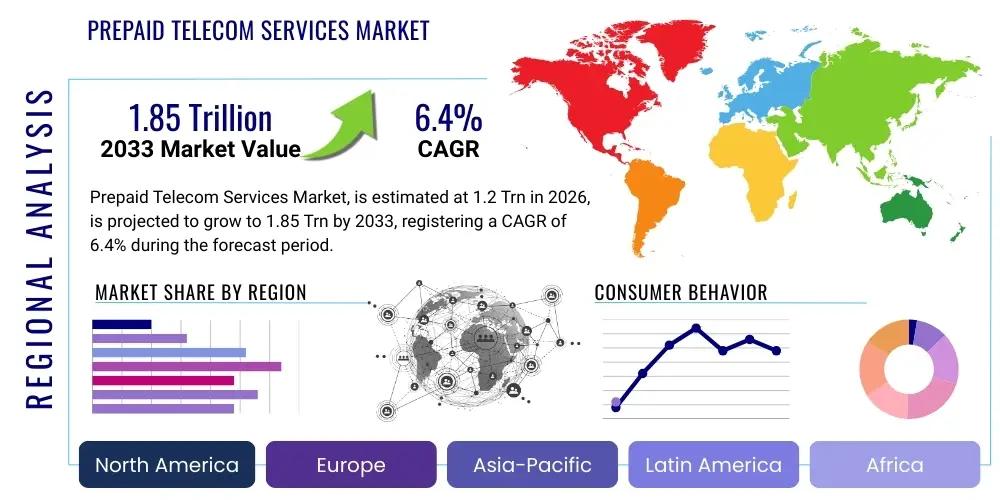

Prepaid Telecom Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442170 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Prepaid Telecom Services Market Size

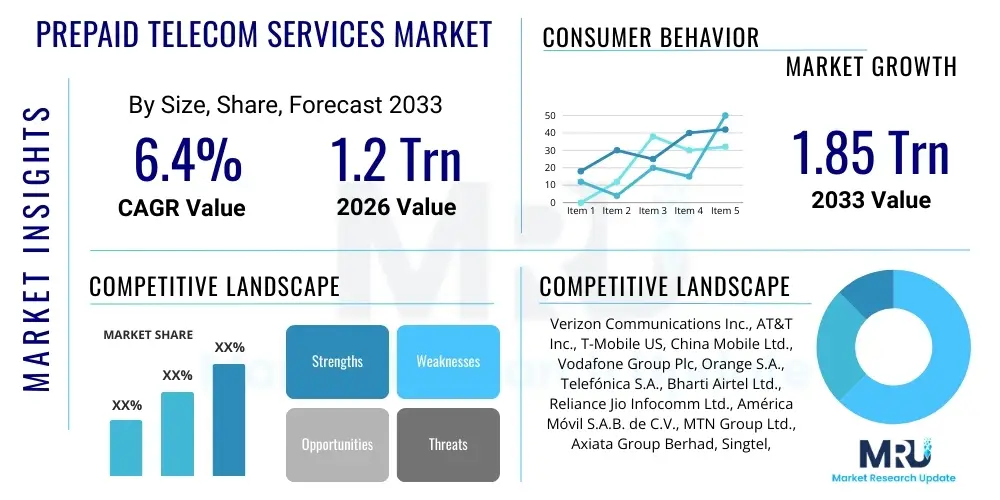

The Prepaid Telecom Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4% between 2026 and 2033. The market is estimated at $1.2 Trillion USD in 2026 and is projected to reach $1.85 Trillion USD by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating proliferation of mobile connectivity across developing economies, coupled with consumer preference for flexible, commitment-free telecommunication packages. Prepaid models offer crucial accessibility to users who may lack formal banking access or prefer stringent cost control over their communication expenses, making them foundational to global digital inclusion initiatives.

Prepaid Telecom Services Market introduction

The Prepaid Telecom Services Market encompasses all mobile and fixed-line communication services where the user pays for the service usage upfront, before consumption. This model contrasts sharply with postpaid services, offering consumers greater control over spending and avoiding contract obligations. Products within this market segment include prepaid SIM cards, top-up vouchers, data bundles, and specific voice minute packages. Major applications span personal communication, mobile internet access, mobile banking, and value-added services such as short message service (SMS) and multimedia messaging service (MMS). The flexibility inherent in prepaid models, particularly the ability to customize plans based on immediate need, positions them as the preferred choice for a vast segment of the global population, especially the younger demographic and residents of high-churn markets.

The primary benefits driving the massive adoption of prepaid telecom services include cost management, no credit checks, instant activation, and accessibility to basic telecommunication services for low-income populations. The structure of prepaid services inherently manages risk for both the consumer and the service provider, as providers secure payment prior to service delivery, minimizing bad debt, while consumers avoid unexpected billing charges. Furthermore, the ecosystem is rapidly evolving to incorporate high-speed data access, transitioning from simple voice and SMS to complex 4G and 5G data packages, supporting demanding applications like streaming and high-resolution video conferencing.

Key driving factors accelerating market expansion involve the exponential rise in smartphone penetration globally, particularly in emerging economies across Asia Pacific, Africa, and Latin America. Government initiatives promoting digital literacy and mobile financial services further solidify the necessity of readily available, affordable communication access. The competitive landscape among Mobile Network Operators (MNOs) and Mobile Virtual Network Operators (MVNOs) continually drives innovation in pricing and bundle offerings, making prepaid services increasingly attractive. Technological advancements, such as eSIM technology and sophisticated network infrastructure deployments (like 5G), are creating opportunities for premium prepaid packages, blurring the lines traditionally separating prepaid and postpaid market advantages.

Prepaid Telecom Services Market Executive Summary

The Prepaid Telecom Services Market is characterized by intense price competition, rapid technological iteration, and substantial geographic disparities in growth and maturity. Current business trends indicate a strong shift towards data-centric prepaid bundles, catalyzed by the ubiquitous demand for mobile video content, social media connectivity, and productivity applications. Service providers are leveraging advanced data analytics and personalization tools to minimize churn and maximize Average Revenue Per User (ARPU) within the prepaid segment, moving beyond basic connectivity to offer integrated digital lifestyle packages. Strategic partnerships between MNOs, content providers, and mobile money operators are crucial to sustaining differentiation and market share.

Regional trends highlight the Asia Pacific (APAC) and Middle East & Africa (MEA) regions as the foremost growth engines, driven by their massive, young, and mobile-first populations, coupled with relatively low fixed-line penetration. These regions benefit from late-mover advantages, adopting 4G and 5G technologies quickly and skipping older fixed infrastructure. North America and Europe, while mature, are seeing growth driven by Mobile Virtual Network Operators (MVNOs) targeting niche demographics with hyper-competitive prepaid pricing, catering to budget-conscious users and international travelers. Regulatory environments across all regions play a pivotal role, influencing spectrum allocation, pricing floors, and mandatory quality-of-service standards, creating both opportunities and constraints for market players.

Segmentation trends reveal significant diversification in prepaid offerings. The data segment is overwhelmingly dominant, necessitating continuous investment in network capacity and speed. Within service offerings, Value-Added Services (VAS) such as mobile financial services, cloud storage, and premium content subscriptions are showing strong growth, enabling MNOs to diversify revenue streams beyond core connectivity. Demographic segmentation emphasizes tailored offers for youth and migrant workers, leveraging flexibility and affordability. The competitive dynamics necessitate agility, with successful firms adopting digital-first customer acquisition strategies and integrating self-service portals to manage large prepaid user bases efficiently and cost-effectively, ensuring high customer satisfaction despite high usage volumes.

AI Impact Analysis on Prepaid Telecom Services Market

Common user inquiries regarding AI's influence on prepaid telecom services frequently revolve around personalized pricing, the elimination of manual customer service, and data security implications. Users question how AI models can predict their consumption patterns to offer 'just-in-time' top-up recommendations or custom data packs that truly match their needs, rather than generic bundles. A significant concern is whether increased automation via chatbots and AI assistants will lead to a diminished quality of human support for complex billing or network issues. Furthermore, the ethical use of vast amounts of consumer usage data, analyzed by AI algorithms to drive marketing and product development, is a recurring theme, focusing on transparency and privacy.

The operational and strategic integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the prepaid telecom landscape, shifting the focus from mass-market offerings to hyper-individualized customer experiences. AI-powered churn prediction models allow operators to proactively identify customers at risk of switching and deploy targeted retention offers, significantly improving loyalty in a typically volatile segment. Automation via robotic process automation (RPA) and intelligent chatbots handles the vast majority of routine prepaid queries, such as balance checks, data usage reports, and plan activation, enabling MNOs to dramatically reduce operational expenditure while ensuring 24/7 customer support availability. This enhances efficiency and allows human agents to concentrate on complex, high-value interactions.

Furthermore, AI algorithms are critical in optimizing network performance and managing traffic surges, especially important for the data-heavy prepaid segment. Predictive maintenance informed by AI minimizes downtime and ensures a consistent Quality of Service (QoS), which is paramount for customer satisfaction. On the business intelligence front, AI provides deep insights into demographic consumption patterns, allowing operators to launch geographically specific or time-sensitive promotional prepaid campaigns with high accuracy and return on investment. The future of prepaid services is inextricably linked to AI's ability to create dynamic, real-time pricing models that adjust based on network load, historical usage, and competitive pressures, optimizing revenue generation without sacrificing affordability for the end-user.

- AI-driven personalized bundle recommendation, optimizing ARPU and customer relevance.

- Enhanced customer experience through intelligent chatbots and natural language processing (NLP) for rapid query resolution.

- Predictive analytics for reducing customer churn by identifying at-risk users early.

- Real-time network capacity management and optimized traffic routing using ML algorithms.

- Fraud detection and security enhancements through behavioral analysis and anomaly detection systems.

DRO & Impact Forces Of Prepaid Telecom Services Market

The Prepaid Telecom Services Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive dynamics and growth trajectory, often referred to as Impact Forces. The primary drivers revolve around global smartphone penetration and the demographic composition of emerging markets, where affordability and flexibility are non-negotiable consumer requirements. These forces push operators to continually expand network coverage, even into remote areas, ensuring that basic and advanced digital services are accessible to the maximum population. The governmental push for digital economies and mobile banking further embeds prepaid connectivity as a socio-economic necessity, rather than just a luxury communication tool.

However, the market faces significant restraints, chiefly characterized by ferocious price competition and the resulting compression of profit margins. The ease of switching service providers (low barriers to exit) translates into high customer churn rates, compelling operators to expend considerable resources on retention strategies. Furthermore, stringent regulatory environments regarding spectrum pricing, roaming tariffs, and mandatory Know Your Customer (KYC) procedures impose compliance costs and occasionally slow down the time-to-market for innovative prepaid offerings. The continuous need for capital expenditure (CapEx) to upgrade 4G networks and deploy 5G infrastructure, while balancing the revenue generated by typically lower ARPU prepaid users, presents a substantial financial challenge.

Opportunities for expansion are abundant, particularly through strategic pivot points such as the integration of IoT connectivity solutions, where a prepaid model is highly suitable for device provisioning and management. The proliferation of Value-Added Services (VAS), including mobile money, entertainment streaming subscriptions, and cloud gaming access bundled with prepaid data packages, offers substantial avenues for revenue diversification beyond traditional voice and basic data. Furthermore, the untapped potential of rural digitalization initiatives, supported by low-cost infrastructure and tailored, micro-payment prepaid plans, promises long-term sustainable growth. These impact forces necessitate strategic agility, focusing on digital transformation to optimize operational costs while simultaneously innovating product offerings to capture wallet share.

Segmentation Analysis

The Prepaid Telecom Services Market is comprehensively segmented based on the type of service offered, the identity of the service provider, the demographic profile of the user base, and the geographic location. This multi-dimensional segmentation allows market participants to tailor their infrastructure investment, marketing campaigns, and pricing strategies to specific consumer needs and regional economic realities. Segmentation provides crucial clarity on where the highest revenue potential resides, particularly highlighting the transition from voice-dominant usage to data-centric consumption patterns globally. Understanding these segments is vital for effective product development and competitive positioning within the dynamic telecom environment, especially given the varying regulatory requirements and technological maturity across different markets.

The dominant segmentation reflects the shift towards high-speed data usage, where bundled services encompassing voice, data, and VAS are becoming standard. Service provider segmentation, contrasting MNOs with MVNOs, demonstrates varying business models; MNOs leverage extensive infrastructure investment for coverage and speed, while MVNOs capitalize on flexibility and competitive pricing aimed at niche markets. Demographic segmentation ensures that products are aligned with income levels and communication habits, providing optimized packages for both high-consumption data users (e.g., streaming teenagers) and basic connectivity users (e.g., rural populations requiring voice and basic mobile money services). The continuous evolution of these segments underscores the need for service providers to maintain flexible and modular billing systems.

- By Service Type:

- Voice Services (Minutes, National/International Calls)

- Data Services (4G, 5G, Specific Data Bundles)

- Value-Added Services (VAS) (SMS, MMS, Mobile Banking, Content Subscriptions)

- By Service Provider:

- Mobile Network Operators (MNOs)

- Mobile Virtual Network Operators (MVNOs)

- By Demographic:

- Youth and Students

- Adult Professionals

- Migrant Workers and International Travelers

- Rural and Low-Income Populations

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Prepaid Telecom Services Market

The value chain for prepaid telecom services is complex, starting with core network infrastructure and extending through service delivery platforms to the end consumer. Upstream analysis primarily focuses on the procurement and management of essential resources, notably spectrum acquisition and network technology deployment, including the installation of base stations, fiber optic backbones, and core switching equipment. Key upstream suppliers include technology vendors (e.g., Ericsson, Huawei, Nokia) providing radio access network (RAN) and core network solutions, and regulatory bodies managing spectrum licenses. Efficient spectrum utilization and timely network modernization are critical upstream activities that dictate the quality and speed of the final prepaid service offering.

The midstream phase involves the core operations of the Mobile Network Operators (MNOs) or Mobile Virtual Network Operators (MVNOs). This includes designing tariff plans, managing billing and charging systems (BSS/OSS), handling customer registration and KYC processes, and manufacturing/distributing SIM cards and prepaid scratch cards. This stage also encompasses the development of Value-Added Services (VAS) platforms and the integration of mobile financial services. For prepaid services, the efficiency of the charging platform is paramount, ensuring real-time consumption tracking and immediate service suspension upon depletion of credit, thereby minimizing revenue leakage and ensuring customer trust in the billing mechanism. MVNOs focus more heavily on marketing and customer service, leveraging leased infrastructure.

Downstream analysis concentrates on the distribution channels and direct engagement with the end-users. Distribution relies heavily on a hybrid model incorporating both direct channels, such as company-owned retail stores and online e-commerce portals, and indirect channels, including vast networks of authorized retailers, convenience stores, third-party recharge agents, and mobile money platforms. The effectiveness of the indirect channel is particularly crucial for the prepaid segment, as it ensures ubiquitous access to top-up services, often in remote or rural locations. Optimization of these channels, utilizing digital recharge options and fostering strong partnerships with local agents, directly impacts market penetration and customer convenience, which are critical metrics in the high-volume prepaid market.

Prepaid Telecom Services Market Potential Customers

Potential customers for the Prepaid Telecom Services Market are highly diverse but generally characterized by a strong preference for cost control, flexibility, and minimal commitment. The largest demographic segment comprises individuals in developing economies who are accessing digital services for the first time, often relying on mobile devices as their sole method of internet access and financial transactions. This group demands highly affordable, customizable data packs suitable for basic usage such as messaging and social media, typically preferring micro-top-ups that match their immediate cash flow capabilities. Educational institutions and universities also represent a significant segment, with students requiring affordable, high-speed data for remote learning and entertainment.

Another major segment includes migrant workers and international travelers who require short-term, region-specific connectivity without the complexities or high costs of international roaming or long-term contracts. Prepaid services are ideally suited for these temporary or mobile users, offering immediate activation and local tariff rates. Similarly, households or individuals seeking backup communication solutions, or those with poor credit histories preventing access to postpaid contracts, form a loyal customer base for prepaid services. The simplicity and accessibility of the prepaid model are the key determinants for adoption across these various customer profiles, making it essential for operators to maintain straightforward activation and recharge processes.

Furthermore, the rapidly expanding Internet of Things (IoT) ecosystem presents a growing segment of machine-to-machine (M2M) communication devices that utilize prepaid connectivity. These devices, ranging from smart meters and asset trackers to connected vehicles, often require minimal, consistent data usage, making a pay-as-you-go or long-life prepaid plan a far more economical and manageable solution than a contract-based service. The sheer volume of anticipated IoT connections globally suggests that this B2B segment will become increasingly important, demanding specialized prepaid tariffs optimized for low bandwidth, high durability, and extended validity periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Trillion USD |

| Market Forecast in 2033 | $1.85 Trillion USD |

| Growth Rate | 6.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon Communications Inc., AT&T Inc., T-Mobile US, China Mobile Ltd., Vodafone Group Plc, Orange S.A., Telefónica S.A., Bharti Airtel Ltd., Reliance Jio Infocomm Ltd., América Móvil S.A.B. de C.V., MTN Group Ltd., Axiata Group Berhad, Singtel, Etisalat Group, Deutsche Telekom AG, STC Group, SoftBank Corp., KT Corporation, Zain Group, PLDT Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prepaid Telecom Services Market Key Technology Landscape

The Prepaid Telecom Services Market is highly dependent on continuous technological advancement, primarily revolving around enhanced network infrastructure and sophisticated charging/billing systems. The migration from 3G/2G to 4G LTE and the ongoing deployment of 5G technologies are foundational, providing the speed and low latency required to support data-intensive prepaid bundles, which are crucial for maintaining competitiveness in saturated urban areas and enabling new services like mobile streaming and cloud gaming. Network function virtualization (NFV) and software-defined networking (SDN) are also key, allowing operators to manage network resources dynamically, scaling capacity quickly in response to fluctuating prepaid demand and optimizing CapEx.

A central technological component unique to the prepaid segment is the Online Charging System (OCS), which facilitates real-time credit deduction and usage control. Modern OCS platforms integrate seamlessly with AI and ML frameworks to analyze usage patterns instantly, enabling the deployment of micro-segmentation and personalized offers, such as timely data top-ups or specific hourly bundle promotions. Furthermore, the increasing adoption of eSIM technology simplifies the activation and provisioning process for prepaid users, eliminating the need for physical SIM card handling and accelerating customer acquisition, particularly for IoT devices and international roaming customers seeking local service instantly upon arrival.

Blockchain technology, while still nascent, is showing promise in securing transactions related to prepaid airtime and mobile financial services, increasing transparency and reducing fraud in the vast network of third-party distributors. Security technologies, including advanced encryption and robust identity verification mechanisms integrated into mobile apps, are crucial for building user trust, especially as prepaid accounts increasingly handle sensitive mobile money transactions. The overall technological landscape emphasizes digitization, automation, and real-time responsiveness to support the massive volume and complexity inherent in managing millions of individual, transaction-based prepaid customer accounts efficiently across various geographic locations and regulatory frameworks.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market due to its immense population, high youth demographic, and rapid smartphone penetration, especially in India, China, and Indonesia. Growth is primarily driven by the transition from voice-centric to affordable, high-volume 4G and 5G data packages, coupled with aggressive competitive pricing and government pushes for digital financial inclusion, making prepaid services the default choice for internet access.

- Middle East and Africa (MEA): Represents the fastest-growing region, characterized by low fixed-line infrastructure, high mobile penetration, and reliance on mobile money services. Prepaid models are essential for economic participation and are deeply integrated with mobile financial transactions (M-Pesa, etc.). Operators are heavily investing in 4G coverage extension and localized prepaid bundles addressing specific community needs.

- Latin America (LATAM): Exhibits robust growth, driven by consumer sensitivity to price and preference for contract-free options. The region is seeing significant activity from MVNOs challenging established MNOs with innovative, data-rich prepaid plans. Regulatory stability, though sometimes inconsistent, encourages foreign direct investment in telecom infrastructure modernization.

- North America: A mature market where prepaid services cater predominantly to budget-conscious consumers, low-credit individuals, and the tourist/migrant worker segments. Growth is stable, propelled by aggressive MVNOs utilizing the capacity of major carriers (Verizon, AT&T, T-Mobile) to offer highly competitive, no-contract smartphone plans, often including unlimited data capped at lower speeds.

- Europe: Characterized by high penetration rates and regulatory pressures (e.g., GDPR). Prepaid services remain popular for cost control, secondary devices, and international travelers. The market is segmented, with Central and Eastern Europe showing faster growth than Western Europe, where convergence products (fixed and mobile bundles) are more prevalent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prepaid Telecom Services Market.- Verizon Communications Inc.

- AT&T Inc.

- T-Mobile US

- China Mobile Ltd.

- Vodafone Group Plc

- Orange S.A.

- Telefónica S.A.

- Bharti Airtel Ltd.

- Reliance Jio Infocomm Ltd.

- América Móvil S.A.B. de C.V.

- MTN Group Ltd.

- Axiata Group Berhad

- Singtel

- Etisalat Group

- Deutsche Telekom AG

- STC Group

- SoftBank Corp.

- KT Corporation

- Zain Group

- PLDT Inc.

Frequently Asked Questions

Analyze common user questions about the Prepaid Telecom Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What key factors are driving the growth of the Prepaid Telecom Services Market?

Growth is primarily driven by increased smartphone accessibility, the strong demand for flexible and contract-free service options, particularly in high-churn developing markets, and the rapid deployment of 4G and 5G network infrastructure making high-speed data affordable for the mass market.

How is 5G technology influencing prepaid service offerings globally?

5G enables operators to create premium, high-speed prepaid data bundles suitable for demanding applications like cloud gaming and advanced streaming. It increases network capacity, allowing for more competitive pricing and better Quality of Service (QoS) for all prepaid users, thereby minimizing the traditional performance gap with postpaid plans.

What role do Mobile Virtual Network Operators (MVNOs) play in the prepaid segment?

MVNOs are crucial disruptors, leveraging leased infrastructure to offer highly specialized and aggressive prepaid pricing plans targeting niche demographics (e.g., ethnic groups, youth, or specific low-usage segments), thereby intensifying competition and driving down prices across the overall market structure.

Which geographical region holds the highest potential for prepaid market expansion?

The Asia Pacific (APAC) region currently holds the largest market share, but the Middle East and Africa (MEA) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by its massive mobile-first population and the essential integration of mobile connectivity with financial services (mobile money).

What are the main technological challenges facing prepaid telecom providers?

The key challenge is managing the vast volume of micro-transactions in real-time, requiring sophisticated and efficient Online Charging Systems (OCS). Additionally, the continuous need for large capital expenditure in 5G network upgrades while dealing with intense price pressure and high customer churn rates poses a significant financial hurdle for operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager