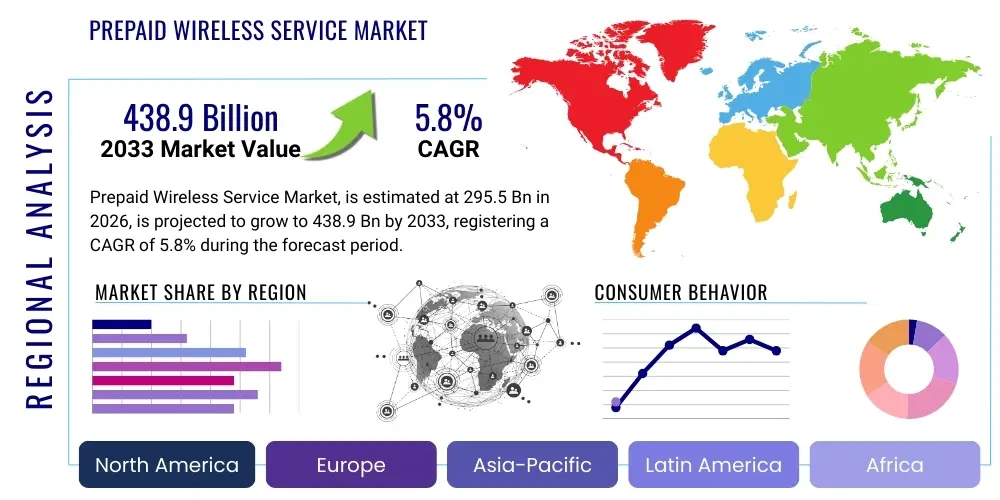

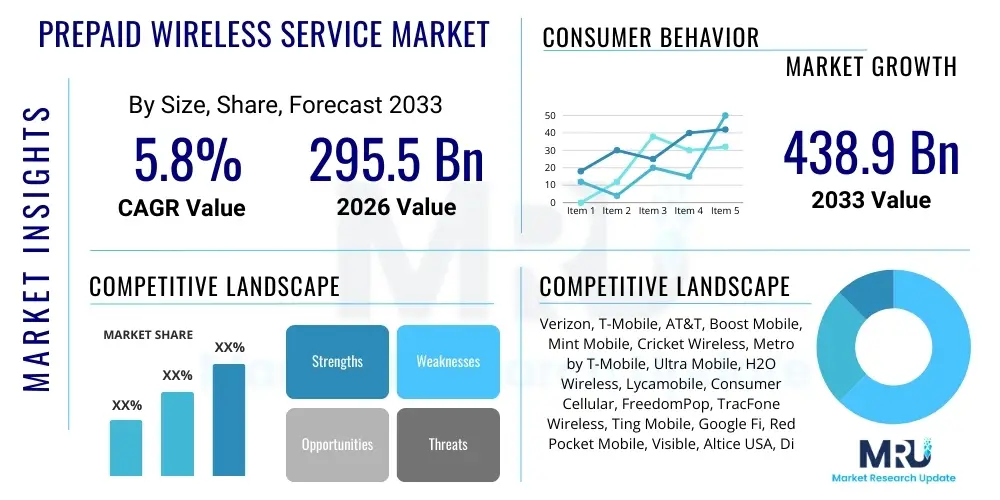

Prepaid Wireless Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442605 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Prepaid Wireless Service Market Size

The Prepaid Wireless Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 295.5 Billion in 2026 and is projected to reach USD 438.9 Billion by the end of the forecast period in 2033.

Prepaid Wireless Service Market introduction

The Prepaid Wireless Service Market encompasses mobile telecommunication services paid for in advance by the consumer, offering flexibility and controlling expenditure without necessitating long-term contracts or credit checks. This model is fundamentally characterized by the pay-as-you-go structure, where users purchase airtime, data, or bundled plans upfront, allowing them to manage connectivity based on immediate needs and financial capacity. The market caters significantly to budget-conscious consumers, international travelers, migrant workers requiring flexible communication options, and individuals lacking the credit history required for traditional postpaid services. Prepaid services are delivered by both Mobile Network Operators (MNOs) directly and Mobile Virtual Network Operators (MVNOs) that leverage the infrastructure of MNOs to offer distinct branding and pricing strategies.

Key product offerings within the prepaid segment range from basic voice and text packages to advanced data-centric plans, including unlimited data options, international calling bundles, and specialized Machine-to-Machine (M2M) communication packages. Major applications of prepaid wireless services include daily communication, mobile internet access, mobile payment processing, and connecting secondary devices such as tablets and hotspots. The inherent transparency and affordability of prepaid models make them highly attractive in emerging economies where financial liquidity and cost management are primary concerns for consumers. Furthermore, the increasing availability of affordable smartphones has lowered the barrier to entry, propelling the demand for flexible data plans.

The primary driving factors fueling the expansion of this market include the escalating global demand for mobile broadband, particularly in regions with high mobile penetration but low contract adoption; the competitive environment fostered by MVNOs continually introducing aggressive, value-driven pricing; and the global trend toward digital inclusion, which relies heavily on accessible mobile connectivity. The introduction of 5G networks, initially concentrated in postpaid segments, is gradually filtering down to prepaid offerings, improving service quality and speeds, thereby enhancing the overall value proposition of prepaid plans and attracting new segments of users who previously preferred contract-based services.

Prepaid Wireless Service Market Executive Summary

The Prepaid Wireless Service Market is experiencing robust growth, primarily driven by demographic shifts favoring flexible consumption models and intensified competition among MNOs and MVNOs. Business trends indicate a strategic shift by major network operators to consolidate their prepaid brands or launch specialized digital-only sub-brands to capture younger, digitally native consumer bases. A major trend involves the integration of advanced digital self-service platforms, leveraging apps and AI-driven chatbots to minimize operational costs associated with physical storefronts and customer support, enhancing profitability despite lower average revenue per user (ARPU). Furthermore, mergers and acquisitions, particularly where large MNOs acquire established MVNOs or smaller regional players, are reshaping the competitive landscape and stabilizing pricing pressures in key markets.

Regionally, the Asia Pacific (APAC) and Latin America regions are leading the market expansion in terms of subscriber volume, propelled by rapid urbanization, high population density, and persistent demand for affordable internet access. North America and Europe, while being mature markets, are witnessing growth predominantly through the diversification of prepaid offerings—specifically targeting niche markets such as IoT device connectivity, temporary visitor plans, and high-data-use individuals seeking alternatives to premium postpaid rates. Regulatory interventions aimed at improving mobile number portability (MNP) and reducing termination rates are also positively impacting consumer choice and market fluidity globally.

Segment trends highlight the significant growth of data-centric prepaid plans, driven by the proliferation of video streaming, social media usage, and remote work necessities. Value-Added Services (VAS), such as mobile financial services (MFS) and bundled content subscriptions, are increasingly critical differentiators, moving prepaid services beyond simple connectivity provision. The distribution channel segment shows a pronounced shift towards online retail and specialized e-commerce platforms, allowing consumers to purchase SIM cards and activate plans instantaneously, bypassing traditional physical points of sale. This digitalization reduces acquisition costs and facilitates dynamic pricing strategies tailored to specific online consumer behavior.

AI Impact Analysis on Prepaid Wireless Service Market

Common user questions regarding AI's impact on prepaid wireless services frequently center on themes such as personalized plan recommendations, the efficiency of AI-powered customer service, and data security concerns related to usage pattern analysis. Users are particularly interested in whether AI will lead to fairer, usage-optimized pricing structures and faster resolution of service issues. Conversely, concerns often revolve around potential job displacement in traditional customer service roles and the ethical implications of using deep learning models to predict and influence consumer switching behavior. Overall, the market anticipates AI as a transformative tool for operational efficiency and hyper-personalization, essential for maintaining profitability in the high-volume, low-margin prepaid sector.

AI is fundamentally changing how prepaid wireless providers manage customer relationships and optimize network performance. In customer experience, AI-driven chatbots and virtual assistants handle a vast majority of routine inquiries, such as balance checks, top-up instructions, and basic troubleshooting, allowing human agents to focus on complex, high-value interactions. This shift significantly reduces customer support overheads, a crucial factor for prepaid profitability. Predictive analytics, fueled by AI, enables carriers to accurately forecast network capacity demands in specific geographies and time periods, optimizing capital expenditure on infrastructure upgrades and ensuring consistent quality of service (QoS) for data-heavy prepaid users.

Furthermore, AI algorithms are instrumental in developing sophisticated churn prediction models. By analyzing vast datasets of top-up frequency, data consumption habits, and customer service interaction history, carriers can identify subscribers likely to defect to a competitor. This allows for the timely deployment of personalized retention offers, ranging from bonus data packages to tailored promotional rates. On the pricing front, AI facilitates dynamic pricing strategies, adjusting plan costs and features in real-time based on competitive analysis and local demand fluctuations, ensuring that prepaid plans remain highly competitive and maximized for revenue generation while meeting consumer value expectations.

- AI-driven personalized plan recommendations enhancing ARPU and customer relevance.

- Deployment of intelligent chatbots leading to substantial reduction in customer support operational costs.

- Advanced predictive analytics optimizing network infrastructure planning and resource allocation.

- Improved fraud detection and security protocols using machine learning to identify anomalous usage patterns.

- Real-time dynamic pricing adjustments maximizing competitive advantage and revenue yield.

- Enhanced churn prediction models facilitating targeted, effective retention campaigns.

DRO & Impact Forces Of Prepaid Wireless Service Market

The Prepaid Wireless Service Market dynamic is defined by a strong interplay of affordability drivers, infrastructural limitations, and innovative service expansion opportunities. The core driver is the inherent flexibility and cost-control offered by prepaid models, which resonate strongly with diverse global demographics, particularly those sensitive to fluctuating economic conditions or lacking access to formal credit. However, the market faces significant restraints, including intense price wars that compress margins and the persistent perception among some consumer segments that prepaid service quality (QoS) is inferior to contract-based offerings, especially concerning network priority and latency. The shift towards unlimited data postpaid plans, often offered at competitive introductory rates, also acts as a constraint, potentially siphoning high-value users away from the prepaid segment.

Opportunities for growth are primarily centered on technological advancements, specifically the rollout of 5G technology into the prepaid space, which allows carriers to offer high-speed, low-latency connectivity, bridging the perceived quality gap with postpaid services. Additionally, the increasing demand for specialized IoT connectivity (e.g., smart meters, telematics) where flexible, pay-as-you-go data models are often preferred, presents a substantial niche market. Strategic partnerships with digital content providers or mobile financial services platforms also create lucrative avenues for offering integrated value-added services, enhancing customer stickiness and increasing the average transaction size.

Impact forces shape the competitive intensity and market structure. The high impact of competitive rivalry, driven by numerous MVNOs vying for market share with aggressive pricing, mandates constant innovation in service packaging. Regulatory frameworks concerning spectrum allocation, number portability, and consumer protection exert a moderate but crucial impact, ensuring fair competition and consumer transparency. Technological advancements, such as eSIM proliferation and network virtualization (NFV), provide carriers with tools to rapidly scale services and reduce deployment costs, acting as a major positive influence on profitability potential within the prepaid ecosystem.

- Drivers: High affordability and financial control; increasing mobile penetration in emerging economies; flexible, no-contract service structures.

- Restraints: Intense price competition leading to margin compression; perceived service quality disparities compared to postpaid; regulatory complexities regarding cross-border roaming and taxation.

- Opportunity: Introduction of 5G prepaid services and specialized IoT connectivity plans; expansion of Mobile Financial Services (MFS) integration; increased adoption of digital distribution channels.

- Impact Forces: Intense competitive rivalry (High); Regulatory intervention and consumer protection standards (Medium); Technology substitution risk (Medium-Low).

Segmentation Analysis

The Prepaid Wireless Service Market is segmented across various dimensions, including service type, demographics, and distribution channels, reflecting the diverse consumption behaviors and economic landscapes globally. Analyzing these segments is critical for carriers to develop targeted marketing campaigns and product portfolios that maximize penetration in specific consumer groups. The segmentation strategy employed by carriers often dictates the MVNOs they partner with or the sub-brands they launch, ensuring specialized plans are optimized for factors like data usage intensity, international communication needs, and budget constraints.

From a service type perspective, data consumption remains the fastest-growing segment, eclipsing traditional voice and SMS revenues, driven by the necessity of mobile internet for social and economic participation worldwide. Demographic segmentation highlights the market's reliance on budget consumers and high-turnover segments like students and migrant workers who prioritize flexibility over long-term commitments. The rise of eSIM technology is poised to disrupt the traditional segmentation by simplifying the switching process and enabling users to manage multiple profiles (prepaid/postpaid) on a single device, demanding more sophisticated personalized offers from service providers.

Geographically, while mature markets focus on high-ARPU prepaid users via specialized data packages (e.g., specific plans for gamers or content creators), emerging markets continue to prioritize affordability and accessibility. The optimization of these segments requires detailed analysis of local infrastructure quality (3G vs. 4G/5G availability) and cultural preferences regarding top-up mechanisms, such as reliance on physical scratch cards versus digital wallet transactions. Successful market players are those who can effectively blend digital distribution efficiency with localized physical presence for customer acquisition and support.

- By Service Type:

- Voice Services (Basic connectivity)

- Data Services (Mobile broadband, dominant growth segment)

- Value-Added Services (VAS - Mobile money, content subscriptions, international calling)

- By Demographics/End-User:

- Budget Consumers (Primary focus on low cost)

- Youth/Students (High data needs, low commitment)

- Migrant Workers/International Travelers (High international calling/roaming needs)

- IoT Devices (M2M communication, specialized low-data plans)

- By Distribution Channel:

- Online Retail & E-commerce (Digital acquisition, fast growth)

- Storefronts (Carrier-owned physical stores)

- Independent Dealers/Third-Party Retailers (Traditional, widespread presence)

- By Technology:

- 4G/LTE

- 5G

Value Chain Analysis For Prepaid Wireless Service Market

The value chain of the Prepaid Wireless Service Market commences with the upstream segment, dominated by telecommunication equipment manufacturers and software vendors who supply the core network infrastructure (RAN, core network components, OSS/BSS systems) essential for service delivery. Key upstream activities involve high capital expenditure on spectrum acquisition and the deployment of 5G infrastructure. Effective supply chain management in this phase, particularly concerning network gear standardization and vendor negotiation, directly impacts the long-term operational costs of the carriers, which is critical for maintaining competitive prepaid pricing.

The central phase of the value chain involves the Mobile Network Operators (MNOs) or Mobile Virtual Network Operators (MVNOs). MNOs focus on core network operation, spectrum management, and capacity planning. MVNOs, conversely, focus intensely on marketing, branding, customer acquisition, and developing differentiated prepaid product packages, leveraging the wholesale capacity purchased from MNOs. This middle segment is characterized by complex tariff management, fraud prevention mechanisms, and efficient lifecycle management of the prepaid subscriber base, including activation, top-up processing, and regulatory compliance (e.g., SIM registration).

The downstream analysis focuses heavily on distribution channels and the interaction with the end-user. Distribution is highly fragmented, encompassing direct sales (online portals, carrier stores) and indirect channels (independent dealers, convenience stores, and large format retail). The prevalence of prepaid services in cash-based economies makes physical points of sale for top-up essential, although digital distribution (apps, websites, digital wallets) is rapidly gaining dominance in mature markets due to its cost efficiency and convenience. Effective management of the distribution network, ensuring wide accessibility and minimizing commission leakage, is paramount for prepaid market success.

Prepaid Wireless Service Market Potential Customers

The primary customer base for the Prepaid Wireless Service Market consists of individuals seeking stringent control over their monthly telecommunication expenses, ensuring they never incur unexpected overage charges. This segment includes budget-conscious consumers who view mobile services as a necessity but prioritize cost minimization, often favoring services that allow granular management of data usage and expenditure. Prepaid plans eliminate the requirement for credit checks and long-term financial commitments, making them the preferred choice for students, young adults entering the workforce, and low-income households who may not qualify for or desire contract services.

A substantial and growing segment comprises migrant workers and international tourists who require temporary, flexible connectivity solutions that often include specialized international calling or roaming packages. These users benefit significantly from the ability to activate and deactivate service quickly without penalties. Furthermore, the market targets users who require secondary mobile lines, such as those used for business testing, children's first phones, or dedicated mobile hotspots for remote work environments, where a flexible, pay-as-you-go data plan is more practical than a dedicated contract.

The evolving customer profile also encompasses enterprises utilizing prepaid connectivity for Machine-to-Machine (M2M) applications and Internet of Things (IoT) deployments, particularly in logistics, asset tracking, and smart metering. For these applications, small, predictable data consumption plans billed on a recurring prepaid basis offer simpler financial management and deployment scalability compared to complex contractual agreements. Therefore, potential customers span both individual consumers prioritizing budget control and corporate entities seeking flexible, scalable M2M connectivity solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 295.5 Billion |

| Market Forecast in 2033 | USD 438.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon, T-Mobile, AT&T, Boost Mobile, Mint Mobile, Cricket Wireless, Metro by T-Mobile, Ultra Mobile, H2O Wireless, Lycamobile, Consumer Cellular, FreedomPop, TracFone Wireless, Ting Mobile, Google Fi, Red Pocket Mobile, Visible, Altice USA, Dish Network, Telefonica, Vodafone, Orange S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prepaid Wireless Service Market Key Technology Landscape

The technological landscape underpinning the Prepaid Wireless Service Market is rapidly evolving, driven primarily by network infrastructure upgrades and digitalization of service delivery mechanisms. The transition from 4G/LTE to 5G is the single most significant technological factor, enabling carriers to offer substantially higher data speeds and lower latency, which directly addresses the historical perception that prepaid services offer inferior network quality. While 5G deployment is costly, carriers are strategically introducing 5G access tiers within their premium prepaid plans to justify higher ARPU and attract data-hungry subscribers who were previously exclusive to postpaid contracts. This technology parity helps retain value-driven customers migrating from high-cost plans.

Another crucial technology is the proliferation of Mobile Virtual Network Enablers (MVNEs) and highly flexible Business Support Systems (BSS) and Operations Support Systems (OSS). These systems facilitate the rapid provisioning and management of diverse prepaid offerings, allowing both MNOs and MVNOs to implement dynamic pricing, manage complex tariff hierarchies, and integrate value-added services seamlessly. The modularity and cloud-native architecture of modern BSS/OSS platforms significantly lower the time-to-market for new prepaid products, crucial for responding quickly to aggressive competitive moves, particularly from digital-only MVNO brands.

Furthermore, the adoption of eSIM (embedded Subscriber Identity Module) technology is fundamentally reshaping the distribution and activation process. eSIMs eliminate the need for physical SIM cards, simplifying switching between carriers and enabling instant activation via QR codes or digital downloads. This technology drastically improves the customer onboarding experience, reduces logistical costs for carriers, and supports the trend toward entirely digital prepaid brand experiences. Alongside eSIMs, network virtualization technologies (NFV and SDN) are improving network efficiency and lowering the operational expenditure (OpEx) for MNOs, providing the necessary cost advantage to sustain competitive pricing in the prepaid segment.

Regional Highlights

The global Prepaid Wireless Service Market exhibits significant regional disparities in terms of maturity, growth trajectory, and competitive structure. These differences necessitate tailored strategies for service provisioning and pricing.

- Asia Pacific (APAC): This region dominates the market in terms of subscriber volume and holds the highest growth potential, fueled by massive, rapidly urbanizing populations in India, Indonesia, and China. Prepaid services are foundational for digital inclusion due to high penetration rates of mobile devices coupled with a general lack of consumer credit access. The focus here is on mass-market affordability, basic data plans, and robust distribution through independent dealers.

- Latin America (LATAM): LATAM is characterized by high price sensitivity and economic volatility, making prepaid services highly popular. Countries like Brazil and Mexico demonstrate strong growth, driven by fierce competition among regional carriers and the critical role of mobile services for financial inclusion (mobile money). Carriers often bundle services heavily to provide enhanced value, utilizing tiered data plans to manage network load effectively.

- North America: While historically dominated by postpaid contracts, North America represents a mature, high-value prepaid market. Growth is primarily driven by MVNOs and sub-brands targeting niche segments (e.g., budget users, seniors, specific ethnic groups) with aggressive, often unlimited data prepaid plans (e.g., those offered by Metro by T-Mobile and Visible). The focus is on offering service parity with postpaid, including 5G access and digital-first customer experiences.

- Europe: European markets show varying levels of prepaid adoption, with Eastern and Southern Europe generally having higher penetration than Western Europe. Competition is intense, often involving transnational carriers (Vodafone, Orange). The market is moving toward flexible, monthly rolling contracts that blur the line between traditional prepaid and postpaid, driven by stringent regulatory limits on contract lock-ins and strong consumer desire for flexibility.

- Middle East and Africa (MEA): This region is heavily reliant on prepaid services due to fragmented infrastructure and lower disposable income in many areas. Rapid expansion of mobile banking and high adoption of mobile-based payment solutions heavily utilize prepaid connectivity. Challenges include regulatory fragmentation and the need for localized infrastructure investment to extend coverage beyond major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prepaid Wireless Service Market.- Verizon

- T-Mobile

- AT&T

- Boost Mobile

- Mint Mobile

- Cricket Wireless

- Metro by T-Mobile

- Ultra Mobile

- H2O Wireless

- Lycamobile

- Consumer Cellular

- FreedomPop

- TracFone Wireless

- Ting Mobile

- Google Fi

- Red Pocket Mobile

- Visible

- Altice USA

- Dish Network

- Telefonica

- Vodafone

- Orange S.A.

Frequently Asked Questions

What is the primary factor driving the growth of the Prepaid Wireless Service Market?

The primary factor driving growth is the increasing global demand for affordable mobile connectivity, coupled with the financial flexibility and lack of contractual commitment offered by prepaid models. This is particularly crucial in emerging markets and among budget-conscious consumers worldwide who prioritize cost control.

How is 5G technology influencing prepaid service adoption?

5G technology is positively influencing adoption by allowing carriers to offer high-speed, low-latency services comparable to postpaid plans within the prepaid segment. This helps diminish the perception of inferior service quality associated with prepaid, attracting higher-value, data-intensive users.

What role do MVNOs play in the competitive landscape of the prepaid market?

Mobile Virtual Network Operators (MVNOs) play a crucial role by increasing competitive intensity. They lease network infrastructure from MNOs and focus on highly targeted, innovative prepaid packages with aggressive pricing, often catering to niche demographics that traditional large carriers overlook.

Which distribution channel is experiencing the fastest growth in prepaid sales?

Online retail and e-commerce platforms are experiencing the fastest growth in prepaid sales. Digital distribution channels enable carriers to streamline the customer acquisition process, utilize eSIM technology, and reduce operational costs associated with physical storefronts and independent dealer commissions.

What are the main restraints impacting the profitability of prepaid wireless services?

The main restraints are the intense price competition across global markets, which consistently pressures Average Revenue Per User (ARPU) and profit margins, and the ongoing challenge of retaining high-value subscribers who may transition to competitive, contract-free postpaid plans.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager