Preschool Furniture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443319 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Preschool Furniture Market Size

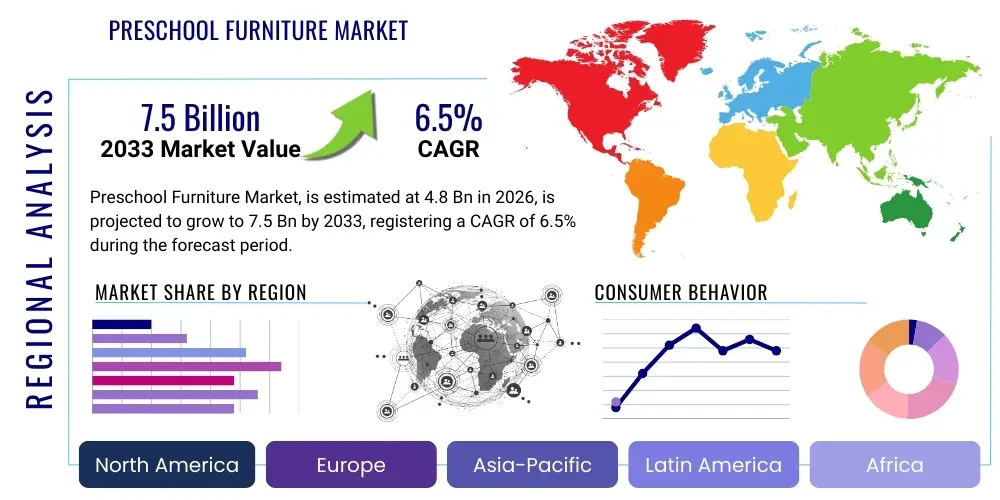

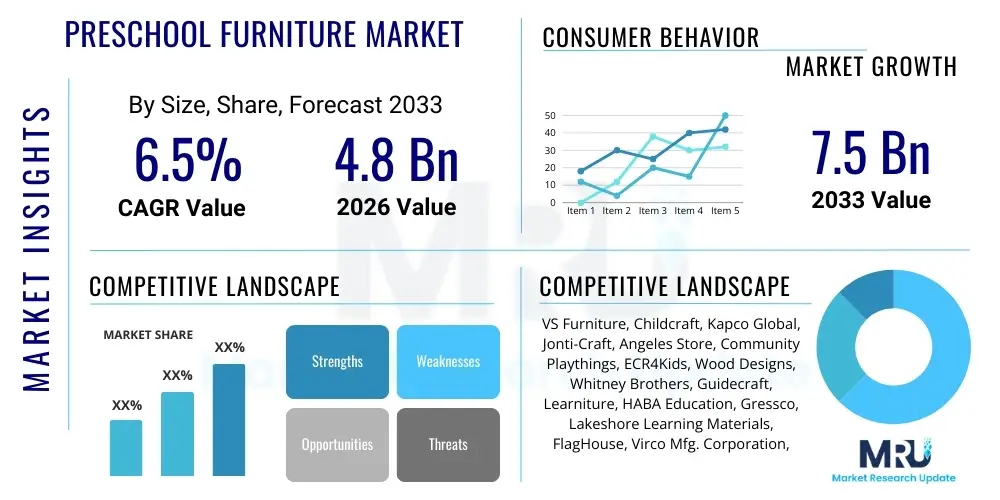

The Preschool Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by increasing global awareness regarding the importance of Early Childhood Education (ECE) and the resultant expansion of formal preschool enrollment across developing and developed economies. Investment in infrastructure upgrades and adherence to evolving international safety standards are primary catalysts propelling market valuation throughout the forecast timeframe.

Preschool Furniture Market introduction

The Preschool Furniture Market encompasses specialized furnishings designed for children aged 2 to 5 years, focusing on safety, ergonomics, durability, and developmental appropriateness. This segment includes a wide array of products such as adjustable tables, stackable chairs, storage units, nap cots, and specialized activity centers tailored to support various pedagogical models, including Montessori, Reggio Emilia, and traditional play-based learning. These products are crucial elements in creating a supportive and stimulating environment that facilitates cognitive, social, and motor skill development in young learners. The primary objective of these furnishings is to enhance the functionality of learning spaces while minimizing physical risks associated with child use.

Major applications of preschool furniture are centered within dedicated ECE institutions, including public and private preschools, kindergartens, daycare centers, and in-home care facilities. The demand is heavily driven by governmental initiatives globally to standardize ECE infrastructure and the rapid urbanization leading to increased reliance on formal childcare solutions. Benefits extend beyond basic utility, impacting educational outcomes by promoting independence, organization, and focus among children. Ergonomic design, which ensures proper posture and comfort, is a key selling point, directly contributing to the well-being and engagement levels of students during extended learning periods.

Key driving factors include stringent regulatory requirements mandating child-safe materials and designs, coupled with shifting parental preference towards aesthetically pleasing and environmentally sustainable furniture options. The integration of modular and flexible furniture systems that can adapt to different learning activities (e.g., group work, individual reading, or sensory play) is also boosting market demand. Furthermore, the rising investment in infrastructure development across Asia Pacific and Latin America, focusing on establishing robust ECE systems, provides significant impetus for market expansion. The continuous innovation in materials, such as non-toxic plastics and sustainably sourced wood, ensures long-term market vitality and relevance.

Preschool Furniture Market Executive Summary

The Preschool Furniture Market is exhibiting robust growth, propelled by strong business trends focusing on sustainability, modularity, and technological integration, primarily aimed at improving safety and educational efficacy. Key business strategies involve vertical integration to control the supply chain of certified non-toxic materials, alongside significant investments in design R&D to meet evolving ergonomic and aesthetic standards. Manufacturers are increasingly offering customizable solutions and full classroom fit-outs, moving away from selling individual units, thus catering to large institutional purchasing requirements and ensuring cohesive learning environments. Digital platforms are playing a vital role in B2B transactions, streamlining procurement for school administrators and allowing for detailed material transparency.

Regionally, the market presents a dichotomy: mature markets like North America and Europe are driven by replacement cycles, regulatory updates (e.g., lead content restrictions, fire retardancy), and demand for premium, high-durability products. Conversely, the Asia Pacific (APAC) region is characterized by explosive growth in new construction of ECE centers, fueled by increasing birth rates and substantial government investment in education infrastructure, positioning APAC as the highest growth potential region. Latin America and MEA are nascent but rapidly developing, focusing on affordable, scalable solutions that meet basic international safety benchmarks, indicating future high growth rates as economic conditions improve and ECE penetration rises.

Segment trends demonstrate a pronounced shift toward wood-based furniture due to its perceived natural aesthetic, durability, and sustainable credentials, despite the higher initial cost compared to plastic alternatives. The modular segment, encompassing movable and multifunctional tables and storage units, is rapidly gaining share as schools prioritize flexible classroom layouts that support varied instructional methods. Within the end-user category, private schools and franchised daycare chains are the primary revenue generators, exhibiting strong demand for high-end, branded furniture designed for specific pedagogical approaches. Customization and personalization of furniture based on classroom themes or learning objectives represent a critical segment trend influencing purchasing decisions across the institutional sector.

AI Impact Analysis on Preschool Furniture Market

User inquiries regarding AI's impact on the Preschool Furniture Market primarily revolve around how technology can enhance safety monitoring, personalize learning experiences, and streamline facility management, without compromising the crucial physical and tactile nature of early childhood education. Key concerns often address data privacy related to child tracking, the cost-effectiveness of integrating sophisticated sensors, and whether 'smart' furniture detracts from traditional play. Users seek clarity on specific applications, such as using AI to adjust desk heights based on real-time biometric input or leveraging computer vision to analyze and optimize classroom flow and furniture arrangement to maximize engagement and safety compliance. The central theme is leveraging AI for background support and predictive maintenance, rather than direct instruction, ensuring furniture remains primarily a physical tool for development.

The integration of Artificial Intelligence in the preschool furniture market, though currently niche, focuses predominantly on enhancing administrative efficiency and passive safety features. This involves embedding sensors within furniture elements—such as chairs, tables, and storage—that collect usage data regarding occupancy, duration of activity, and physical proximity. This data, analyzed by AI algorithms, helps facility managers monitor utilization rates, optimize cleaning schedules, and predict maintenance needs, leading to reduced operational costs and increased product longevity. Furthermore, AI-driven analysis of classroom layout usage provides valuable feedback to manufacturers regarding ideal design configurations that maximize educational outcomes and safety compliance.

While fully autonomous furniture is impractical and undesirable in this age group, AI contributes significantly to the next generation of 'smart' classroom environments. For instance, smart storage systems might use AI to track inventory of educational materials stored within them, automating restocking alerts. Similarly, predictive modeling can utilize AI to flag potential hazards, such as an unusual concentration of children in one area or misuse of equipment, relaying warnings to educators in real time. This technological evolution supports the educator by automating compliance and environment optimization, allowing them to focus more intensely on pedagogical engagement rather than logistical oversight.

- AI-driven sensor integration for usage monitoring and predictive maintenance of furniture assets.

- Optimization of classroom layout and furniture configuration using AI analysis of spatial utilization data.

- Development of smart ergonomic adjustments, such as automated chair height modifications based on biometric input (e.g., child's height detected via sensors).

- Enhanced inventory tracking in storage units using embedded sensor systems linked to AI platforms.

- Real-time safety alerts generated by AI processing video feeds or sensor data related to potentially hazardous furniture use.

DRO & Impact Forces Of Preschool Furniture Market

The dynamics of the Preschool Furniture Market are shaped significantly by interconnected Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces dictating market evolution. Key drivers include rigorous government mandates worldwide focusing on standardized Early Childhood Education (ECE) infrastructure and safety, leading to mandatory replacements or upgrades of older, non-compliant furniture. Concurrently, the increasing disposable income in emerging economies, coupled with growing awareness among parents regarding the benefits of structured ECE environments, fuels demand for high-quality, specialized products. These positive forces establish a strong foundation for sustained market expansion and premium product adoption.

However, the market faces considerable restraints, primarily the high initial investment cost associated with purchasing durable, non-toxic, and certified preschool furniture. Budgetary limitations in public school systems and independent daycare facilities often necessitate trade-offs, sometimes favoring lower-cost, less durable alternatives, particularly in price-sensitive regions. Additionally, the fragmented nature of the market, characterized by numerous small, regional manufacturers, presents challenges in maintaining consistent international quality standards and supply chain efficiency, sometimes leading to regulatory compliance hurdles and delayed procurement cycles for institutions.

Significant opportunities lie in the rapidly expanding customization and modular furniture segments, catering to modern pedagogical requirements for flexible and multi-functional classroom designs. The rising global focus on sustainability presents a major avenue for manufacturers to innovate using recycled, bio-based, or certified sustainable materials (e.g., FSC-certified wood), aligning with corporate social responsibility goals and parental preferences. Furthermore, penetrating the fast-growing home learning environment segment, especially post-pandemic, through durable, design-focused furniture suitable for domestic use represents a valuable expansion opportunity outside the traditional institutional sphere. These opportunities, if effectively capitalized upon, are poised to mitigate the restraints and significantly accelerate market growth over the forecast period.

Segmentation Analysis

The Preschool Furniture Market is analyzed based on product type, material, and end-user, providing a granular view of demand patterns and growth areas. Product segmentation, encompassing seating, tables, storage, and activity centers, dictates the functional requirements within a classroom, with modular storage units showing the fastest growth due to their utility in maximizing space efficiency. Material segmentation is crucial, differentiating between wood, plastic, and metal, reflecting variations in cost, durability, weight, and adherence to sustainability standards, with wood currently dominating due to aesthetic and environmental appeal. End-user segmentation distinguishes between institutional buyers (daycares, preschools) and individual/home use, with institutional procurement forming the largest and most stable revenue base.

- By Product Type:

- Seating (Chairs, Benches, Stools)

- Tables and Desks (Activity Tables, Adjustable Desks)

- Storage Units (Shelving, Cabinets, Cubbies)

- Activity Centers and Play Equipment

- Nap/Rest Furniture (Cots, Sleep Mats)

- By Material:

- Wood (Solid Wood, Engineered Wood/Plywood)

- Plastic (Polyethylene, Polypropylene)

- Metal (Steel, Aluminum)

- Other Materials (Foam, Sustainable Composites)

- By End User:

- Preschools and Kindergartens (Public and Private)

- Daycare Centers and Childcare Facilities

- Home Use and Individual Buyers

Value Chain Analysis For Preschool Furniture Market

The value chain for the Preschool Furniture Market begins with the upstream segment, primarily involving raw material procurement, which is increasingly focused on certified sustainable and non-toxic sources. Key inputs include lumber (FSC certified wood being preferred), high-grade non-toxic plastics (often phthalate-free), and specialized metal components for frames and joints. Relationships with raw material suppliers are critical, as the quality and safety certification of the final product depend heavily on the source material compliance. Manufacturers often engage in rigorous vetting processes to ensure compliance with international standards such as EN 71 (European Safety Standard) and CPSIA (Consumer Product Safety Improvement Act in the US). Efficiency in this phase minimizes waste and ensures cost-competitive production.

The midstream segment involves design, manufacturing, and assembly. Furniture design is highly specialized, requiring expertise in child ergonomics and pedagogical functionality, necessitating continuous collaboration with educators and ECE specialists. Manufacturing processes include cutting, molding, finishing (using non-VOC paints and sealants), and assembly, often demanding specialized machinery for complex joinery and safety mechanisms. Branding and quality control are paramount, as durability and safety certification (e.g., GREENGUARD certification for air quality) significantly influence institutional purchasing decisions. Large manufacturers often manage extensive in-house R&D departments to drive innovation in modularity and material science.

The downstream segment focuses on distribution and sales. Direct distribution channels are prominent for large institutional buyers (major school districts or large daycare chains), often involving specialized B2B sales teams and contract furniture dealers who manage installation and servicing. Indirect distribution utilizes e-commerce platforms, educational supply wholesalers, and specialized retail outlets, particularly catering to smaller independent centers or home consumers. Logistics pose a significant challenge due to the bulky nature of the furniture, requiring efficient warehousing and specialized shipping to minimize damage. Post-sale services, including warranty and replacement parts, are essential components of maintaining long-term relationships with educational institutions.

Preschool Furniture Market Potential Customers

The primary consumers of preschool furniture are institutional entities within the Early Childhood Education (ECE) sector, which includes private and public preschools, kindergartens, and large franchised daycare center networks. These customers exhibit high volume purchasing needs and prioritize stringent adherence to safety standards, durability, and ergonomic design suitable for prolonged institutional use. Their purchasing cycle is typically planned and involves tender processes or multi-year contracts, focusing heavily on certifications (e.g., BIFMA, GREENGUARD) and supplier reputation for reliability and capacity to provide integrated classroom solutions. Furthermore, governmental bodies often act as customers when procuring furniture for subsidized or public ECE programs, emphasizing cost-effectiveness alongside fundamental safety compliance.

A rapidly growing segment of potential customers includes specialized educational facilities, such as Montessori and Reggio Emilia schools, which require highly specific, often natural wood-based, child-sized furnishings designed to support distinct pedagogical philosophies. These customers are less price-sensitive and prioritize furniture that fosters independence, natural curiosity, and hands-on learning, often sourcing from niche manufacturers specializing in these educational models. The requirement here is less about basic seating and more about specialized activity stations, low open shelving, and adaptable work surfaces tailored to specific learning zones.

Individual consumers and home-based childcare providers constitute the third significant customer segment. While purchasing smaller quantities, this segment is highly influenced by retail trends, aesthetics, and ease of assembly. The COVID-19 pandemic accelerated demand for high-quality, multifunctional children's furniture for dedicated home learning areas. These buyers are typically reached through e-commerce channels and specialized children's goods retailers, emphasizing attractive design, dual-purpose functionality (e.g., storage combined with seating), and recognized brand names that signify trust and non-toxicity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VS Furniture, Childcraft, Kapco Global, Jonti-Craft, Angeles Store, Community Playthings, ECR4Kids, Wood Designs, Whitney Brothers, Guidecraft, Learniture, HABA Education, Gressco, Lakeshore Learning Materials, FlagHouse, Virco Mfg. Corporation, Scholar Craft, KI Furniture, Smith System, Fleetwood Furniture |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Preschool Furniture Market Key Technology Landscape

The technological landscape of the Preschool Furniture Market is centered less on digital computation and more on advancements in materials science, manufacturing processes, and ergonomic design precision. A primary focus is on developing sustainable composite materials and bio-plastics that maintain the necessary strength and durability while being entirely non-toxic and easily recyclable. Techniques like high-pressure lamination and precision CNC machining are essential for creating seamless, non-snag surfaces and ensuring tight tolerances required for safety certifications. Furthermore, the application of non-VOC (Volatile Organic Compound) and antimicrobial coatings represents a crucial technological shift, enhancing hygiene and air quality within learning environments, directly addressing health and safety concerns raised by institutions and parents.

The manufacturing technology driving modularity and flexibility is critical. Manufacturers are utilizing advanced tooling and standardized connection systems (e.g., interlocking mechanisms, specialized casters) that allow educators to quickly reconfigure classroom layouts without requiring specialized tools. This focus supports dynamic learning environments mandated by modern pedagogical approaches. Another significant technological area involves the deployment of smart sensing technology, typically through non-intrusive, embedded sensors (discussed in the AI section), which monitor furniture integrity, usage patterns, and potentially weight distribution to signal potential safety risks or the need for maintenance, thereby extending the lifecycle and optimizing asset management.

Beyond material innovation, the technology landscape includes sophisticated Computer-Aided Design (CAD) and simulation software used extensively during the product development phase. These tools allow designers to rigorously test ergonomic parameters, structural load limits, and tip-over resistance digitally, significantly reducing the time and cost associated with physical prototyping and certification processes. This technological adoption ensures that new products not only comply with the most stringent global safety standards (e.g., ASTM, ISO standards for ECE) but are also optimized for pedagogical effectiveness, resulting in highly precise, safe, and developmentally appropriate furniture solutions tailored to specific age groups.

Regional Highlights

The Preschool Furniture Market exhibits distinct growth patterns and maturity levels across different geographical regions, heavily influenced by local economic development, educational policies, and demographic trends. Understanding these regional variations is crucial for manufacturers establishing effective market penetration strategies.

- North America (NA): Characterized as a mature market with high demand driven primarily by replacement cycles, facility upgrades, and strict adherence to federal and state safety regulations (e.g., CPSIA). The US and Canada show a high preference for premium, durable, and certified furniture (GREENGUARD certified). Growth is steady, focused on innovation in ergonomic design and smart classroom integration.

- Europe: A highly segmented market with significant variation between Western and Eastern Europe. Western Europe (Germany, UK, Nordic countries) focuses heavily on sustainability (FSC certification is mandatory in many areas) and child-centered design derived from established pedagogical models (e.g., Scandinavian design influence). The market is driven by high quality standards (EN 71) and refurbishment projects rather than new institutional builds.

- Asia Pacific (APAC): Represents the fastest-growing region, fueled by massive government investment in compulsory ECE infrastructure, particularly in China, India, and Southeast Asian nations. Urbanization and rising middle-class disposable income are driving the establishment of new, high-quality private preschools. The region’s growth is volume-driven, although quality standards are rapidly catching up to Western norms.

- Latin America (LATAM): An emerging market characterized by increasing public sector investment in basic education infrastructure. Demand is price-sensitive, focusing on affordable yet safe plastic and laminated wood options. Market growth is moderate but expected to accelerate as regulatory environments stabilize and economic growth allows for greater educational spending across Brazil, Mexico, and Chile.

- Middle East and Africa (MEA): This region is diverse, with the GCC countries (UAE, Saudi Arabia) showing high demand for luxury, imported furniture for international schools, prioritizing aesthetic and high-tech features. In contrast, Africa's market remains largely constrained by funding, focusing on basic, durable, locally manufactured solutions. The market offers high potential for affordable, scalable products aligned with foundational education initiatives.

North America maintains a leading position in market share due to its established ECE ecosystem and high spending capacity per student. The regional emphasis is strongly placed on the development of specialized learning environments, driving demand for furniture that facilitates sensory integration, STEM activities, and flexible configurations. Suppliers in this region often compete based on extensive warranties, comprehensive customer support, and sophisticated fulfillment logistics capable of handling large-scale institutional orders.

APAC’s explosive growth is attributed to demographic tailwinds and supportive government policies aimed at universalizing access to preschool education. Countries like China have initiated large-scale infrastructure projects requiring bulk procurement of standardized furniture, favoring manufacturers with high production capacity and competitive pricing models. The challenge in this region is the vast diversity in local regulations, requiring manufacturers to adapt products for specific localized safety and cultural requirements, driving intense localization efforts in both design and material sourcing.

Europe’s market stability reflects its long-established commitment to early childhood development, characterized by regulatory rigor that often surpasses international norms, particularly concerning environmental impact. Manufacturers operating here must demonstrate high compliance with recycling mandates and sustainable sourcing practices. The focus is increasingly on modular systems that optimize space utilization in older, smaller urban school buildings, catering to educational trends emphasizing nature-based and minimalist design philosophies that integrate the classroom setting with the natural environment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Preschool Furniture Market.- VS Furniture

- Childcraft

- Kapco Global

- Jonti-Craft

- Angeles Store

- Community Playthings

- ECR4Kids

- Wood Designs

- Whitney Brothers

- Guidecraft

- Learniture

- HABA Education

- Gressco

- Lakeshore Learning Materials

- FlagHouse

- Virco Mfg. Corporation

- Scholar Craft

- KI Furniture

- Smith System

- Fleetwood Furniture

Frequently Asked Questions

Analyze common user questions about the Preschool Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most critical safety standards governing preschool furniture globally?

The most critical global safety standards include EN 71 (European Toy Safety Directive) and national standards like the US Consumer Product Safety Improvement Act (CPSIA). These standards mandate non-toxic materials (e.g., low lead content, phthalate-free plastics), structural stability, and rigorous testing for pinch points, entrapment risks, and tip-over hazards (e.g., ASTM F2373).

How is the shift towards sustainable materials impacting the cost of preschool furniture?

The increasing demand for sustainably sourced materials, such as FSC-certified wood and recycled plastics, generally leads to higher initial procurement costs compared to conventional materials. However, these materials often offer superior durability and longer lifecycles, leading to reduced long-term replacement expenses and enhanced marketability for institutions focused on environmental responsibility.

What is modular furniture and why is it preferred in modern preschool classrooms?

Modular preschool furniture consists of adaptable, interchangeable units (tables, seating, storage) that can be easily reconfigured to support different activities—such as individual work, large group lessons, or sensory play. It is preferred because it maximizes space efficiency, promotes flexible teaching methodologies, and allows classrooms to quickly adjust to changing educational needs without costly renovations.

Which geographical region is expected to demonstrate the highest growth rate in the Preschool Furniture Market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by significant government infrastructure investments in early childhood education (ECE) in large economies like China and India, coupled with rising disposable incomes supporting increased enrollment in formal ECE facilities.

What is the role of ergonomic design in preschool seating and tables?

Ergonomic design ensures that furniture dimensions (height, depth, angle) are appropriately scaled for specific age groups (typically 2-3 years and 4-5 years) to promote correct posture, reduce physical strain, and enhance concentration. Proper ergonomics are vital for children’s spinal development and overall comfort during extended learning sessions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager