Prescription Dermatology Therapeutics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443347 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Prescription Dermatology Therapeutics Market Size

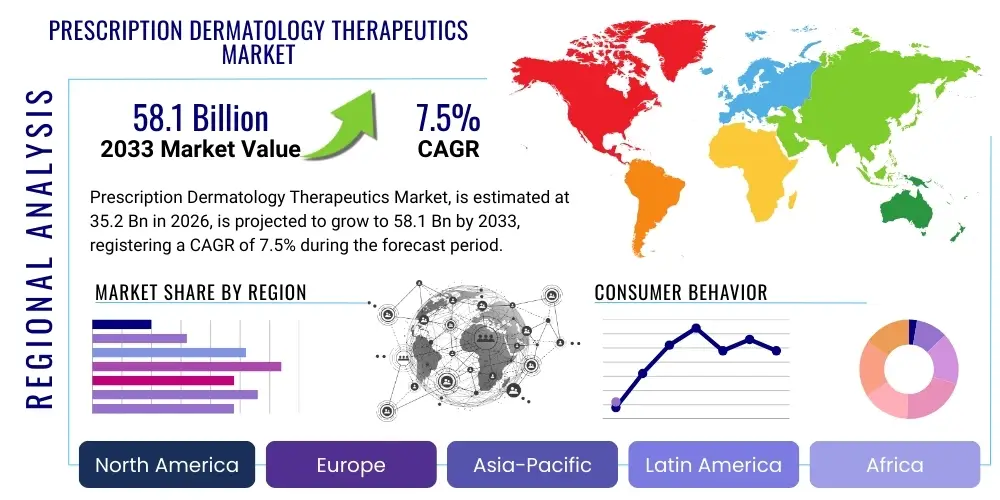

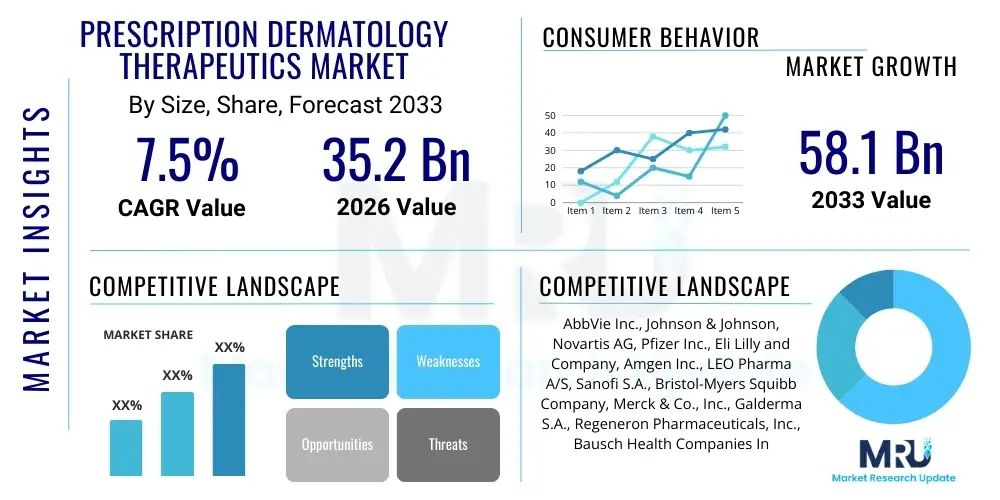

The Prescription Dermatology Therapeutics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $35.2 Billion in 2026 and is projected to reach $58.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating prevalence of chronic inflammatory skin conditions such as psoriasis, atopic dermatitis, and acne vulgaris globally, coupled with significant advancements in targeted biological and small molecule therapies. The increased patient awareness regarding treatment options and improved diagnosis rates, particularly in developing economies, further contribute substantially to this market growth trajectory.

Prescription Dermatology Therapeutics Market introduction

The Prescription Dermatology Therapeutics Market encompasses a broad spectrum of pharmaceutical agents, including topical, oral, and injectable formulations, developed specifically for the treatment of various skin disorders requiring professional medical intervention. These disorders range from common conditions like severe acne, eczema (atopic dermatitis), and fungal infections, to complex autoimmune and chronic inflammatory diseases such as psoriasis, lupus erythematosus, and blistering diseases. Products in this market include high-potency corticosteroids, retinoids, novel immunomodulators, systemic anti-infectives, and, most importantly, advanced biologics that target specific inflammatory pathways like TNF-alpha, IL-17, and IL-23. The fundamental role of these therapeutics is to manage symptoms, induce remission, prevent disease progression, and significantly improve the quality of life for patients suffering from persistent or severe dermatological ailments, which often have profound psychosocial implications.

The core of this market is shifting rapidly from conventional generic treatments towards highly sophisticated, targeted therapies, including biosimilars and novel small molecules, such as Janus Kinase (JAK) inhibitors. This paradigm shift is fueled by a deeper understanding of the molecular pathogenesis of dermatological diseases, enabling the development of drugs with superior efficacy profiles and reduced systemic side effects compared to traditional immunosuppressants. Major applications span inflammatory disorders, skin cancers, infectious conditions, and genetic skin defects. Key driving factors include the aging global population, which is more susceptible to skin malignancies and chronic inflammatory diseases; increased environmental pollution leading to higher incidences of hypersensitivity reactions; and substantial investment in dermatology R&D focused on unmet clinical needs, particularly in refractory disease populations. Furthermore, the expansion of teledermatology and enhanced patient adherence programs are improving access and utilization of these prescription-only medicines, bolstering market expansion.

Prescription Dermatology Therapeutics Market Executive Summary

The Prescription Dermatology Therapeutics Market is characterized by intense innovation and dynamic competition, fundamentally shifting away from legacy treatments to embrace high-value specialty drugs. Business trends indicate a strong prioritization of pipeline development for biologics and advanced systemic therapies, particularly those targeting complex inflammatory cascades relevant to psoriasis, hidradenitis suppurativa, and severe atopic dermatitis. Mergers and acquisitions remain pivotal, allowing large pharmaceutical companies to secure promising late-stage assets and expand their therapeutic portfolios, especially in the high-growth biologics segment. Regional trends show North America maintaining dominance due to robust reimbursement frameworks, high healthcare spending, and the presence of major biopharma R&D hubs. However, the Asia Pacific region is demonstrating the fastest growth rate, fueled by improving healthcare infrastructure, rising disposable incomes, and increasing patient pools demanding access to novel treatments. Segment trends highlight biologics as the fastest-growing product class, outpacing traditional topical and oral medications due to their superior efficacy and specific mechanisms of action, despite carrying a higher cost burden. Within disease segments, the treatment of chronic inflammatory conditions, particularly atopic dermatitis and psoriasis, drives the majority of revenue, reflecting the high recurrence rate and chronicity of these diseases, requiring long-term pharmacological management and contributing significantly to the sustained demand for highly effective prescription options.

AI Impact Analysis on Prescription Dermatology Therapeutics Market

User inquiries frequently revolve around how Artificial Intelligence (AI) can revolutionize the historically visual and diagnostic-heavy field of dermatology. Common questions focus on AI’s capability to accelerate the identification of novel therapeutic targets, optimize the selection and stratification of patients for complex clinical trials, enhance the precision of drug delivery mechanisms, and, most frequently, improve diagnostic accuracy for conditions like skin cancer and inflammatory disorders through advanced image analysis. Users are particularly keen on understanding AI’s role in predicting patient response to expensive biological therapies, thereby reducing treatment costs and enhancing treatment efficacy through personalized therapeutic approaches. The key themes emerging from this analysis include expectations surrounding improved R&D efficiency, better clinical outcomes via precision medicine, and the integration of AI-powered tools into teledermatology platforms to expand access to expert diagnosis and monitoring, ultimately streamlining the development and deployment of new prescription dermatological agents.

AI’s influence is pervasive, extending from early-stage drug discovery, where machine learning algorithms analyze vast biological datasets to pinpoint previously unknown pathways relevant to dermatopathology, to post-market surveillance. In drug development, AI models are used to predict the toxicity and efficacy of potential drug candidates before synthesis, significantly cutting down on lead optimization time and costs. Furthermore, in clinical practice, diagnostic AI tools, often leveraging deep learning for image recognition, are demonstrating performance comparable to, or exceeding, that of human experts in classifying pigmented lesions and assessing disease severity (e.g., PASI scores for psoriasis). This convergence of advanced computational power with therapeutic strategy is expected to make future prescription dermatology treatments more personalized, efficient, and widely accessible.

- Accelerated identification of novel drug targets and molecular pathways.

- Optimization of clinical trial design, including predictive modeling for patient recruitment and response.

- Enhanced precision diagnostics using deep learning for skin image analysis (e.g., melanoma detection).

- Personalized medicine through AI-driven prediction of treatment efficacy for biologics and small molecules.

- Improved adherence monitoring and patient engagement via smart digital platforms and teledermatology integration.

DRO & Impact Forces Of Prescription Dermatology Therapeutics Market

The market dynamics are significantly shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities, all contributing to the overall impact forces exerted on market growth. Key drivers include the rapidly rising global incidence of chronic inflammatory skin diseases, driven partly by lifestyle and environmental changes, coupled with substantial breakthroughs in therapeutic modalities such as targeted biologics and oral JAK inhibitors, which offer superior efficacy compared to conventional treatments. However, the market faces considerable restraints, primarily the high cost associated with specialty dermatological drugs, creating access and affordability issues, particularly in emerging economies or for uninsured patient populations, alongside stringent regulatory pathways required for novel biological entities and the impending threat of biosimilar and generic erosion upon patent expiration of blockbuster drugs.

Opportunities for growth are plentiful, centered around the untapped potential of precision medicine in dermatology, utilizing genetic and biomarker data to tailor treatment plans, thereby improving outcomes and reducing healthcare waste. Furthermore, the expansion of digital health tools, including teledermatology services and AI-supported diagnostic systems, provides avenues for wider patient reach and efficient disease management. These forces combine to create a highly competitive environment where innovation in drug delivery systems and strategic pricing remain critical for market success. The overall impact force is strongly positive, driven by high unmet medical needs in chronic conditions and continuous scientific innovation, although moderated by healthcare budgetary constraints and regulatory pressures demanding robust long-term safety data for new treatments.

The industry is also grappling with the challenge of ensuring equitable access to high-cost specialty treatments. While novel biologics offer life-changing results for severe conditions, reimbursement mechanisms often lag behind innovation, creating significant commercial hurdles. Consequently, companies must increasingly invest in real-world evidence generation to demonstrate the long-term cost-effectiveness of their products to payers. This necessity to prove value beyond clinical efficacy is a major structuring impact force, compelling manufacturers to adopt integrated patient support programs and flexible pricing models to maintain market penetration against rising generic competition in less complex dermatological disease areas.

Segmentation Analysis

The Prescription Dermatology Therapeutics Market is segmented based on the drug class, route of administration, indication, and distribution channel, providing a granular view of specific growth areas and competitive dynamics. Segmentation by drug class reveals the shift toward targeted therapies, where biologics and immunomodulators dominate revenue generation due to their use in chronic, high-cost indications like psoriasis and atopic dermatitis. Traditional segments, such as corticosteroids and antibiotics, maintain a significant volume share but are experiencing slower value growth. Analyzing the market by indication shows that inflammatory disorders constitute the largest segment, driven by high patient prevalence and the need for continuous, long-term therapeutic management, whereas dermatological oncology represents a high-growth, albeit smaller, segment driven by targeted cancer therapies. Understanding these segments is crucial for stakeholders to tailor R&D investments and commercial strategies effectively, focusing on areas with both high unmet clinical needs and strong potential for premium pricing, especially within the systemic treatment categories that offer superior patient convenience and compliance compared to extensive topical regimens.

The route of administration segmentation highlights the strategic importance of oral and injectable formulations, which are favored for severe systemic diseases, offering better compliance and systemic action compared to topical products which dominate the mild-to-moderate segment. Furthermore, the distribution channel breakdown emphasizes the crucial role of hospital pharmacies and specialty pharmacies for dispensing high-cost, complex biologic agents, often requiring specific storage and patient counseling protocols, distinct from the retail pharmacy channel that handles the majority of generic topical and oral prescriptions. This intricate segmentation reflects the diverse nature of dermatological conditions, requiring a tailored approach from drug development through to commercialization and patient support, ensuring that the right therapy reaches the right patient setting efficiently and effectively. This detailed segmentation aids in projecting growth based on specific therapeutic breakthroughs and changing prescribing patterns influenced by clinical guidelines and payer policies across different healthcare systems globally.

- By Drug Class:

- Corticosteroids

- Biologics (TNF Inhibitors, IL Inhibitors, etc.)

- Immunomodulators (Calcineurin Inhibitors, JAK Inhibitors)

- Retinoids

- Antifungals and Antibiotics

- Others (Dermocosmetics and specialized formulations)

- By Route of Administration:

- Topical

- Oral

- Injectable (Subcutaneous, Intravenous)

- By Indication:

- Psoriasis

- Atopic Dermatitis (Eczema)

- Acne Vulgaris and Rosacea

- Skin Cancer (Melanoma and Non-melanoma)

- Fungal and Viral Skin Infections

- Other Inflammatory Dermatoses (e.g., Hidradenitis Suppurativa)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Specialty Pharmacies and Mail Order

Value Chain Analysis For Prescription Dermatology Therapeutics Market

The value chain for prescription dermatology therapeutics is a multi-stage, complex process beginning with intensive research and development (R&D), representing the upstream segment. Upstream activities involve drug discovery, target identification, preclinical testing, and rigorous clinical trials (Phase I, II, and III). This phase is capital-intensive and high-risk, characterized by high collaboration between academic institutions, biotech startups, and major pharmaceutical companies, especially focused on developing biologics and novel small molecules. The complexity of understanding skin pathophysiology, coupled with the need for systemic safety profiles, necessitates significant investment in biomarker identification and advanced formulation technologies. Successful progression through the R&D stage dictates the entry of high-value, patent-protected assets into the downstream pipeline.

The downstream segment encompasses manufacturing, distribution, and commercialization. Manufacturing of biologics is particularly demanding, requiring specialized, often proprietary, cell culture and purification processes, necessitating strict adherence to Good Manufacturing Practices (GMP). Distribution channels are highly specialized, often relying on cold chain logistics for temperature-sensitive biologic products, and involve direct channels to specialty pharmacies and hospitals. Indirect channels, primarily retail and mail-order pharmacies, handle the bulk of topical and oral prescriptions. Critical players in this phase include third-party logistics providers, wholesalers, and payers/insurers, who exert significant control over market access through formulary placement and reimbursement policies. The efficiency of the distribution network and effective commercial strategies, including professional marketing and patient education, are paramount for maximizing market penetration and securing premium pricing for specialty treatments, thereby linking successful R&D output directly to patient utilization and market profitability.

Prescription Dermatology Therapeutics Market Potential Customers

The primary potential customers and end-users of prescription dermatology therapeutics are diverse, segmented mainly by their setting of care and the severity of the patient population they serve. Dermatology Clinics and specialized private practice dermatologists represent the most significant segment, as they are the direct prescribers and managers of chronic and complex skin conditions, requiring a steady supply of both topical, generic, and specialty systemic medications. Hospitals, particularly those with dedicated dermatology departments and cancer centers, are critical customers for high-cost injectable biologics and chemotherapy agents used in severe or inpatient dermatological conditions, such as severe blistering disorders, aggressive psoriasis, or advanced skin malignancies. Furthermore, specialty pharmacies and mail-order services serve a crucial role as intermediaries, managing the dispensing and patient services for biologics and oral specialty drugs, often navigating complex prior authorization and reimbursement requirements on behalf of the patient, ensuring patient adherence to long-term chronic treatments. This complex ecosystem of healthcare providers and dispensing channels collectively drives the demand for prescription dermatology therapeutics, focusing on improving patient outcomes and quality of life.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $35.2 Billion |

| Market Forecast in 2033 | $58.1 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AbbVie Inc., Johnson & Johnson, Novartis AG, Pfizer Inc., Eli Lilly and Company, Amgen Inc., LEO Pharma A/S, Sanofi S.A., Bristol-Myers Squibb Company, Merck & Co., Inc., Galderma S.A., Regeneron Pharmaceuticals, Inc., Bausch Health Companies Inc., Sun Pharmaceutical Industries Ltd., Almirall S.A., Viatris Inc., Dermavant Sciences, Inc., Incyte Corporation, UCB S.A., GlaxoSmithKline plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prescription Dermatology Therapeutics Market Key Technology Landscape

The technology landscape for prescription dermatology therapeutics is dominated by innovation in targeted molecular mechanisms and sophisticated drug delivery systems designed to improve efficacy, minimize systemic exposure, and enhance patient compliance. A major technological focus lies in developing biological agents that specifically modulate inflammatory pathways, such as inhibitors targeting the IL-17, IL-23, and IL-4/IL-13 cytokines, which have fundamentally altered the treatment paradigm for moderate-to-severe psoriasis and atopic dermatitis. Furthermore, the advent of orally administered small molecule inhibitors, notably the JAK inhibitors, represents a significant technological leap, offering systemic efficacy without the need for injections, which is highly valued by patients. These targeted systemic approaches are the product of advanced screening and molecular biology techniques aimed at identifying precise pathways of dermatological disease pathogenesis, moving beyond broad immunosuppression.

Beyond the active pharmaceutical ingredients, significant technological effort is directed toward advanced drug delivery systems. These include specialized topical formulations such as microemulsions, liposomal delivery systems, and microneedle patch technology, all engineered to enhance the penetration of therapeutic agents through the epidermal barrier while limiting systemic absorption and associated side effects. For instance, microneedle patches offer a minimally invasive method to deliver biologics or highly potent small molecules directly into the skin layers, potentially reducing the required dose and improving local drug concentration. Nanotechnology is also being explored to encapsulate active ingredients, improving their stability, bioavailability, and targeted release kinetics. These technological advancements are crucial for maintaining patent protection and competitive advantage, enabling the market to offer treatments that are not only highly effective but also more convenient and safer for long-term management of chronic conditions, thereby driving continued adoption of novel prescription products.

In addition to pharmacological innovation, digital health technologies are increasingly integrated into the therapeutic landscape. Teledermatology platforms utilizing high-resolution imaging and secure data transmission are crucial for monitoring chronic conditions and expanding access to care, particularly in rural or underserved areas. The use of Artificial Intelligence and Machine Learning in clinical decision support systems helps dermatologists in differential diagnosis and in selecting the optimal, individualized treatment regimen based on patient characteristics and predicted drug response. This technological integration transforms the patient care journey from simple prescription dispensing to a comprehensive, digitally supported therapeutic experience, improving outcomes and fostering a more efficient use of high-value prescription medicines.

Regional Highlights

Geographic analysis of the Prescription Dermatology Therapeutics Market reveals distinct patterns in market maturity, regulatory environment, and growth rates, emphasizing the heterogeneous nature of healthcare delivery worldwide. North America, particularly the United States, represents the largest and most valuable market segment. This dominance is attributable to high patient awareness, sophisticated healthcare infrastructure, rapid adoption of novel, high-cost biological therapies, and favorable pricing and reimbursement policies that support premium pricing for branded pharmaceuticals. The high concentration of major pharmaceutical and biotechnology companies and substantial investment in dermatology R&D further solidify its leading position, driving global innovation and establishing clinical standards that influence other regions. The region's market size is significantly propelled by the high prevalence of chronic conditions like psoriasis and atopic dermatitis, coupled with advanced screening programs for skin cancer, ensuring continuous demand for specialized prescription drugs.

Europe constitutes the second-largest market, characterized by stringent, yet relatively harmonized, regulatory processes overseen by the European Medicines Agency (EMA) and diverse national health systems that heavily influence market access and pricing. Key markets such as Germany, France, and the UK are major revenue contributors, driven by government focus on reducing the burden of chronic diseases and increasing access to advanced therapies. However, price negotiations and health technology assessments (HTAs) often lead to lower net prices compared to the US, necessitating strategic commercialization efforts. Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period. This rapid expansion is driven by the massive and growing patient population, improving economic conditions leading to increased healthcare expenditure, and governmental initiatives to modernize healthcare infrastructure and enhance drug accessibility. Countries like China and India, with their burgeoning middle class and expanding domestic pharmaceutical manufacturing capabilities, are becoming crucial strategic targets for global pharmaceutical companies seeking volume-driven growth and expanding their market penetration for specialized dermatological treatments.

Latin America and the Middle East & Africa (MEA) regions represent emerging markets with high unmet needs but face challenges related to variable economic stability, fragmented regulatory environments, and limitations in healthcare access and insurance coverage. Growth in these regions is heavily reliant on the successful implementation of affordable access programs, the introduction of biosimilars to lower treatment costs for biologics, and targeted governmental initiatives to combat infectious and inflammatory skin diseases. Although smaller in current market share, these regions offer long-term potential for volume growth as healthcare systems mature and patient ability to pay for prescription specialty care improves, making them increasingly relevant in the global strategic planning of major therapeutic providers.

- North America: Market leader due to high spending, robust R&D, and rapid uptake of biologics and targeted oral therapies.

- Europe: Second largest market, driven by advanced economies and established healthcare systems, focusing on price-value assessments (HTAs).

- Asia Pacific (APAC): Fastest-growing market fueled by large patient pool, improving infrastructure, and rising chronic disease prevalence in populous nations like China and India.

- Latin America (LATAM): Emerging market characterized by increasing demand for specialty care, reliant on biosimilar adoption and expanding insurance coverage.

- Middle East & Africa (MEA): High unmet needs, growth concentrated in affluent Gulf Cooperation Council (GCC) countries with high potential for specialized dermatological services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prescription Dermatology Therapeutics Market.- AbbVie Inc.

- Johnson & Johnson

- Novartis AG

- Pfizer Inc.

- Eli Lilly and Company

- Amgen Inc.

- LEO Pharma A/S

- Sanofi S.A.

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- Galderma S.A.

- Regeneron Pharmaceuticals, Inc.

- Bausch Health Companies Inc.

- Sun Pharmaceutical Industries Ltd.

- Almirall S.A.

- Viatris Inc.

- Dermavant Sciences, Inc.

- Incyte Corporation

- UCB S.A.

- GlaxoSmithKline plc.

Frequently Asked Questions

Analyze common user questions about the Prescription Dermatology Therapeutics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the prescription dermatology therapeutics market?

Market growth is primarily driven by the escalating global incidence of chronic inflammatory skin conditions like psoriasis and atopic dermatitis, coupled with significant technological advancements in targeted therapies, particularly the introduction and rapid adoption of highly effective biologics and Janus Kinase (JAK) inhibitors.

Which therapeutic class holds the largest market share in dermatology?

Biologics currently command the largest revenue share within the prescription dermatology therapeutics market due to their high efficacy in treating moderate-to-severe chronic conditions and their premium pricing structure, fundamentally reshaping the treatment landscape for diseases such as psoriasis and hidradenitis suppurativa.

How is Artificial Intelligence impacting dermatological drug development?

AI is accelerating dermatological drug development by aiding in the discovery of novel targets, optimizing patient selection for clinical trials, and enhancing diagnostic precision through image analysis, which collectively reduces R&D costs and shortens time-to-market for new prescription treatments.

What are the primary restraints affecting the market expansion?

Key restraints include the extremely high cost of specialty dermatological drugs, which often challenges reimbursement and patient access, alongside the ongoing threat of generic and biosimilar erosion following the patent expiration of market-leading pharmaceutical products.

Which geographical region is expected to experience the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR) due to expanding healthcare infrastructure, rising disposable incomes, increasing patient awareness, and large, untapped patient populations in major economies like China and India demanding modern prescription therapies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager