Pressure Washer Trailers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442129 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Pressure Washer Trailers Market Size

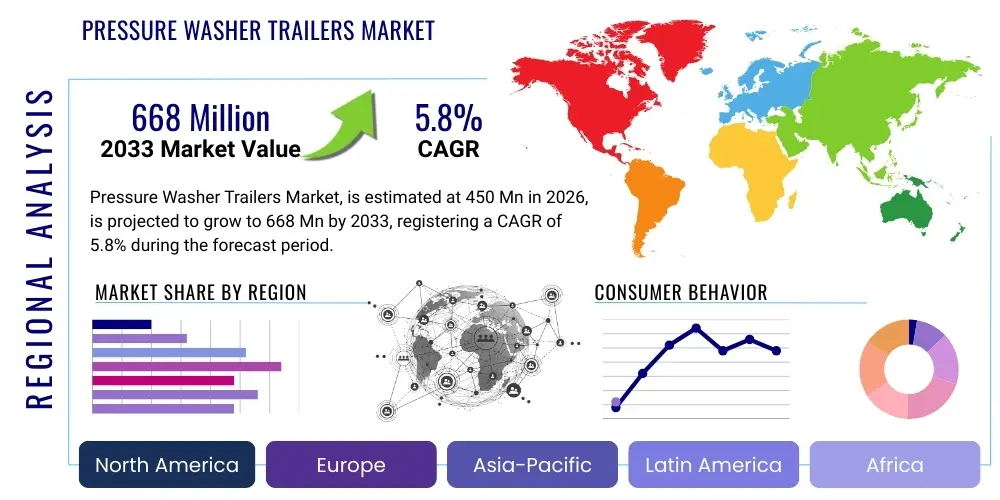

The Pressure Washer Trailers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Pressure Washer Trailers Market introduction

Pressure washer trailers represent mobile, self-contained washing systems designed for heavy-duty commercial and industrial cleaning applications where portability, robust power output, and extended operational independence are essential. These integrated systems typically combine a high-pressure washer unit, a substantial water storage tank, a reliable power source—most commonly industrial-grade diesel or gasoline engines—specialized hose reels capable of managing hundreds of feet of high-pressure hose, and often include chemical injection or hot water heating systems, all mounted securely onto a durable, road-legal trailer chassis. The capability to carry significant water reserves (often 300 to 1000 gallons) means operators can undertake large-scale cleaning projects in locations lacking readily available utility hookups, significantly enhancing project flexibility and reducing reliance on external infrastructure. Key applications extend across rigorous construction site cleanup, municipal sanitation, critical infrastructure maintenance (including bridge decks, tunnel washing, and graffiti removal), pavement rehabilitation, and specialized tasks such as industrial surface preparation before coating or painting, demanding precision and immense power. These assets are crucial for maintaining regulatory compliance and extending the lifespan of public and private assets.

The core market growth trajectory is fundamentally driven by the accelerating global pace of construction and infrastructure development, particularly in emerging economies, which generates continuous demand for post-construction cleanup and maintenance. Simultaneously, the trend toward outsourcing facilities management and specialized industrial cleaning tasks to third-party contractors boosts the purchasing power and fleet requirements of professional service providers. These contractors require equipment that maximizes labor efficiency and minimizes downtime. Furthermore, increasingly stringent regulatory standards across various industries—such as hygiene requirements in food processing plants and strict cleanliness mandates for transportation assets—necessitate the use of professional-grade, high-capacity cleaning equipment like trailer-mounted units. The inherent design benefits of these systems—including superior operational safety features, significantly enhanced cleaning effectiveness compared to smaller portable units, and drastically reduced job setup times—solidify their position as indispensable investments for any organization engaged in large-scale mobile maintenance.

Technological refinement within the sector, focusing on greater fuel efficiency for power generation and water conservation mechanisms, is critical to maintaining market viability amidst rising operational costs and environmental scrutiny. Modern trailer systems are increasingly incorporating advanced safety interlocks, improved ergonomics for deployment and winding of lengthy hoses, and durable components designed to withstand the harsh vibrations and operational stresses of industrial environments. The versatility of these mobile platforms, allowing for customization with auxiliary equipment such as vacuum recovery systems for environmentally sensitive jobs, further expands their market penetration across niche high-compliance sectors, ensuring long-term demand and continuous technological investment from manufacturers. The market is seeing sustained demand for hot water units due to their enhanced ability to dissolve heavy oils and grease, crucial in sectors like fleet maintenance and manufacturing.

Pressure Washer Trailers Market Executive Summary

The Pressure Washer Trailers Market exhibits robust business trends primarily centered on optimization, customization, and sustainable operations. Manufacturers are observing an accelerated demand for high-efficiency pumps and engines compliant with the latest global emission standards (e.g., EU Stage V, EPA Tier 4 Final), reflecting a market push towards reduced environmental impact and lower long-term fuel costs. Customization is no longer a niche but a standard expectation, with end-users demanding specific integrations such as specialized burner systems for extreme cold environments, multi-user capability platforms, and integrated chemical mixing systems for precise application control. The most defining business trend is the strong performance of the rental sector, which serves as a crucial procurement avenue, particularly for smaller contractors seeking to minimize capital expenditure and larger firms needing flexible fleet augmentation during peak season demands, driving stable demand for standardized, rugged rental-grade units.

Segment trends indicate a pronounced and sustained shift towards higher-capacity, hot water trailers (those rated above 4000 PSI and equipped with efficient burners) as industrial cleaning complexity increases. Hot water systems offer significantly faster and more effective removal of heavy grease, oil, and biological contaminants compared to cold water units, making them essential across transportation, manufacturing, and food service sectors. The high-pressure segment is also benefiting from specialized applications like hydro-blasting for surface preparation and paint removal, where pressures often exceed 6000 PSI, requiring specialized, heavy-duty trailer designs and safety features. Furthermore, the increasing integration of digital technologies, including IoT sensors for monitoring fuel, water levels, and usage patterns, provides valuable data insights that are becoming a key competitive differentiator for manufacturers supplying large fleet operators, improving utilization and maintenance predictability.

Geographically, the market landscape is dominated by the maturity and consistent demand originating from North America and Western Europe, attributed to well-established regulatory frameworks, advanced infrastructure, and high labor rates necessitating efficient machinery. The dominance of these regions is maintained by frequent replacement cycles and continuous technological upgrades. However, the Asia Pacific region, particularly its rapidly industrializing nations, represents the future growth epicenter. Led by massive infrastructure build-out projects in countries like India and Indonesia, and sustained manufacturing sector growth in China, APAC is forecast to record the highest Compound Annual Growth Rate (CAGR). This regional expansion is currently characterized by a preference for durable, cost-effective equipment, with a gradual but definite move toward premium, technology-integrated models as local regulatory standards begin to align with global benchmarks for safety and environmental performance, particularly concerning engine emissions.

AI Impact Analysis on Pressure Washer Trailers Market

Analysis of common user questions reveals key themes regarding AI integration in the Pressure Washer Trailers Market, centering primarily on optimization, predictive maintenance, and operational efficiency. Users are keenly interested in how AI can inform routing and resource allocation for mobile cleaning fleets, minimize downtime through predictive failure alerts for high-wear components like pumps and burners, and potentially optimize cleaning effectiveness by adjusting pressure and flow based on real-time surface dirt analysis. Concerns also revolve around the cost of integrating such advanced systems into traditional equipment and the necessity for specialized training, though the expectation is that AI will significantly lower operational costs and improve service delivery quality. The market anticipates AI will eventually allow for semi-autonomous operation, optimizing fuel and water use while ensuring compliance with pressure limits for specific surfaces.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration, temperature, and pressure data from pumps and engines, forecasting component failure before critical breakdown, thereby maximizing uptime and scheduling service proactively.

- Optimized Fleet Management: Utilization of machine learning for dynamic scheduling and route optimization, minimizing fuel consumption and travel time for mobile cleaning crews, crucial for large geographical service areas.

- Automated Diagnostics: AI-driven systems provide instant, high-accuracy troubleshooting and error detection via integrated sensors, reducing reliance on manual technician diagnosis and accelerating repair times.

- Cleaning Parameter Calibration: Future integration involves AI analyzing surface type and soil level via visual or thermal sensors to automatically adjust water pressure, temperature, and detergent mixture, optimizing cleaning efficiency and preventing accidental surface damage.

- Inventory and Supply Chain Forecasting: ML models predict regional demand for specific trailer configurations and high-wear replacement parts based on seasonal usage patterns and planned regional infrastructure projects, improving stock levels.

- Regulatory Compliance Monitoring: AI can monitor and log operational parameters (e.g., runoff pressure, noise levels) to automatically generate reports proving compliance with local environmental and noise regulations.

DRO & Impact Forces Of Pressure Washer Trailers Market

The Pressure Washer Trailers Market dynamics are intensely influenced by critical drivers, infrastructural restraints, and significant strategic opportunities, creating a complex impact matrix that mandates continuous technological adaptation and strategic market positioning. Primary drivers include the global commitment to infrastructure renewal and expansion, particularly the maintenance cycles of critical public assets such as highways, airports, and public transportation networks, which require reliable and high-throughput mobile cleaning. Furthermore, regulatory mandates concerning industrial hygiene, surface preparation quality (e.g., pre-coating standards in shipbuilding and construction), and mandatory safety cleanups in hazardous environments fundamentally necessitate the use of powerful, certified pressure washing equipment that only trailer systems can reliably provide. This strong regulatory push, coupled with the rising cost of labor globally, emphasizes the need for equipment that maximizes worker productivity, making integrated trailer units highly attractive assets.

In contrast, the market faces inherent financial and environmental restraints. The significant initial capital expenditure required for purchasing a fully equipped, high-capacity pressure washer trailer often represents a barrier to entry for smaller, independent contractors, pushing many towards short-term rental options instead of direct ownership. More critically, the increasingly complex web of environmental regulations poses substantial challenges. Rules governing wastewater runoff containment and disposal, especially in sensitive urban and coastal areas, often require additional investment in complementary vacuum recovery and filtration systems, adding to the total operational cost and complexity. Manufacturers must also navigate strict engine emission standards (like EPA Tier 4 Final and EU Stage V) which necessitate costly, sophisticated exhaust after-treatment systems, inflating the manufacturing cost of diesel-powered units, which are otherwise highly favored for their power density and longevity and high efficiency in heavy-duty, continuous operation.

Despite these barriers, strategic opportunities abound, primarily centered on technological innovation and market access. The expanding equipment rental market remains the single most important access point, providing consistent sales volume and allowing manufacturers to standardize their inventory while offering flexible ownership options to end-users. Furthermore, the opportunity to develop truly eco-friendly solutions, specifically those utilizing advanced battery packs for urban, low-noise operation or next-generation sustainable fuel sources, provides a pathway to market differentiation in highly regulated European and North American cities aiming for zero-emission zones. Finally, penetrating niche, high-value industrial sectors, such as precision cleaning in the aerospace or nuclear power industries, by offering highly customized, ultra-high-pressure trailers with advanced safety interlocks and certified componentry, offers sustained, high-margin revenue streams that major players are aggressively pursuing, driving technological leadership.

Segmentation Analysis

The Pressure Washer Trailers Market is characterized by granular segmentation across crucial performance and application parameters, enabling manufacturers to address the highly varied demands of professional cleaning services. The core division by power source—diesel, gasoline, and alternative fuels (propane/electric)—directly reflects the operational environment and power requirements; diesel units offer maximum torque, longevity, and high-pressure capability favored in heavy construction and industrial use, while gasoline units appeal to mid-tier commercial cleaners requiring a balance of power and portability. The emerging segment of electric/propane units is driven by environmental compliance requirements in densely populated or enclosed spaces where exhaust emissions are prohibited or heavily restricted, prompting innovation in battery life and power conversion efficiency and generating less noise pollution, an important factor in urban centers.

Further delineation by pressure capacity (PSI) is fundamental, separating the market into low-pressure units for general commercial cleaning, medium-pressure units for fleet washing and municipal sanitation, and the highly specialized high-pressure systems (exceeding 5000 PSI). These ultra-high-pressure units are essential for hydro-blasting, surface preparation, paint, and rust removal, tasks which require specialized engineering to handle extreme force and ensure operator safety. Coupled with this, the water heating mechanism segmentation—cold water vs. hot water units—is a major determinant of utility; the demand for hot water units is consistently higher in industrial and food processing sectors due to the vastly improved efficacy in dissolving grease, oil, and sanitizing surfaces, commanding a price premium in the market and proving essential for specific regulatory requirements.

Finally, the end-use application segmentation reveals where primary purchasing power resides. The construction and infrastructure sector, propelled by large government and private contracts, remains the largest consumer segment, demanding rugged, high-flow systems. However, the municipal and public works sector offers stability, requiring consistent procurement for year-round sanitation and maintenance. The transportation segment, encompassing fleet washing for trucks, buses, and rail assets, is highly sensitive to operational efficiency and fuel consumption, favoring automated systems and robust trailer designs that minimize cleaning cycle times. Understanding these intricate segment demands allows stakeholders to tailor product features—from anti-siphon backflow preventers for municipal use to specialized corrosion-resistant materials for maritime applications—ensuring optimal market fit and competitive advantage through specialization.

- By Power Source:

- Diesel-Powered: High power density, preferred for continuous, heavy-duty industrial and construction applications requiring maximum performance.

- Gasoline-Powered: More affordable, easier maintenance, dominant in medium-duty commercial cleaning and growing segments of rental fleets due to lower initial capital outlay.

- Electric/Propane/Alternative Fuel: Growing segment driven by noise and emission restrictions in urban and indoor environments, focused on sustainability.

- By Pressure Capacity (PSI):

- Low Pressure (Below 3000 PSI): Residential/Light Commercial and specialized surface cleaning where high force could cause damage.

- Medium Pressure (3000 – 5000 PSI): Standard professional grade, fleet cleaning, and general municipal sanitation tasks.

- High Pressure (Above 5000 PSI): Heavy industrial hydro-blasting, surface preparation, paint and concrete removal, demanding extreme engineering tolerance.

- By Trailer Type/Tank Capacity:

- Single Axle (Low Capacity, <500 Gallons): Compact, higher maneuverability, suitable for quick-response or urban tasks, minimizing towing restrictions.

- Tandem Axle (Medium to High Capacity, 500-1000+ Gallons): Standard for industrial, construction, and remote site operations, providing maximum water reserve for prolonged use.

- Customized Skid Mounts/Flatbeds: Designed for permanent integration onto utility vehicles or specific service truck chassis, maximizing available bed space.

- By End-Use Application:

- Construction and Infrastructure: Highest demand segment, focused on removal of construction residue, concrete, and heavy equipment cleaning.

- Municipal and Public Works: Driven by sanitation, graffiti removal, and public asset maintenance compliance, requiring reliable, all-weather operation.

- Industrial and Manufacturing: Requires hot water and high pressure for processing equipment and specialized facility sanitation and cleaning adhering to hygiene standards.

- Transportation (Fleet Washing): Focus on fast throughput and detergent dispensing efficiency for large vehicle fleets, including rail and trucking.

- Facilities Management and Commercial Cleaning: Routine maintenance of commercial properties and parking areas, often demanding versatile pressure settings.

- Rental Fleets: Key purchasers of ruggedized, standardized models offering high ROI flexibility for diverse customer needs.

- By Heating Mechanism:

- Cold Water Pressure Washers: Simple mechanics, suitable for general dirt and debris removal where heat is not essential.

- Hot Water Pressure Washers: Essential for oil, grease, paint, and sanitization, offering superior cleaning efficacy and faster drying times, commanding a premium price point.

Value Chain Analysis For Pressure Washer Trailers Market

The Pressure Washer Trailers Market value chain initiates with a highly specialized upstream procurement process, where component quality dictates the final product's performance and reliability. Key upstream inputs include high-efficiency, industrial-grade engines (such as those from reputable suppliers adhering to strict emission standards like Cummins, Honda, or specialized diesel manufacturers), and highly durable pump assemblies (often sourced from global leaders like Interpump Group or CAT Pumps, specializing in triplex plunger technology with ceramic components). High-grade steel is required for the chassis and trailer frame to ensure structural integrity and road safety compliance, alongside specialized poly tanks designed to manage sloshing and resist chemical corrosion. Supplier relationship management in this phase is critical, as access to reliable, compliant engines and high-performance pumps directly impacts manufacturing capacity, product quality, and the ability to meet market demand for both power and equipment longevity. Component standardization, especially for high-wear parts, is a strategic priority to facilitate global aftermarket service.

The core manufacturing and assembly stage involves intricate engineering to integrate these powerful components safely onto the mobile platform. This is where proprietary technology and intellectual property create competitive advantage, particularly in designing heat dispersion systems for hot water units, ensuring optimal weight distribution for legal towing limits, and incorporating advanced safety features like pressure relief systems and automated shutdown mechanisms. Customization plays a massive role here; manufacturers often build to order, adapting flow rates, adding specialized hose reels (powered or manual), integrating chemical metering systems, and installing protective enclosures to specific client requirements, especially for military, oil and gas, or highly specialized municipal contracts. This stage requires skilled labor and stringent quality control checks to meet diverse regulatory standards across global markets, including US DOT compliance for road-worthy trailers and local road safety regulations in Europe and APAC, adding complexity to the manufacturing process.

Downstream distribution is characterized by a dual approach maximizing market reach. Direct sales are primarily handled for large fleet transactions—such as sales to national rental companies (e.g., United Rentals, Sunbelt Rentals) or major government bodies—allowing manufacturers to negotiate volume pricing, maintain close customer relationships, and provide direct technical training on complex systems. Conversely, the majority of sales to small-to-mid-sized contractors are facilitated through an extensive indirect channel network comprising authorized dealers, industrial equipment distributors, and dedicated power washer specialists. These indirect partners provide essential localized inventory, spare parts supply, financing solutions, and crucial, immediate after-sales service and warranty support, which is paramount given the intense operational environment pressure washer trailers endure. The success of a manufacturer is heavily reliant on the capability and geographical coverage of this downstream service network, ensuring rapid response times for maintenance and repair, thus minimizing costly customer downtime and enhancing perceived product reliability.

Pressure Washer Trailers Market Potential Customers

Potential customers for pressure washer trailers represent a diverse array of commercial, industrial, and municipal entities requiring robust, mobile, and high-performance surface cleaning capabilities that exceed the capacity of standard portable units. The primary end-users are large-scale commercial cleaning and facilities maintenance contractors who utilize these trailers as their core asset for large-area jobs, such as cleaning parking garages, large commercial facades, undertaking comprehensive post-construction cleanup, and specialized restoration projects. Their buying decisions are heavily influenced by the need for maximum duty cycles, high capacity (water and pressure), and total cost of ownership (TCO) driven by fuel efficiency, reliability, and low routine maintenance requirements. They prioritize systems that minimize labor input while maximizing cleaning throughput.

Another highly significant customer base comprises government agencies and municipal public works departments. These entities utilize pressure washer trailers for essential public infrastructure maintenance, including cleaning bridges, tunnel walls, road surfaces, sanitation vehicles, and maintaining city assets like parks and public buildings. For public sector buyers, key purchasing criteria include mandatory compliance with environmental standards, advanced operational safety features, noise reduction capabilities for urban use, and long-term reliability supported by manufacturer service agreements. These users often require customized units compliant with strict municipal vehicle standards and integrated with specialized equipment like chemical containment systems or sign-cleaning attachments.

Furthermore, specialized industrial sectors constitute a high-value, niche segment. This includes organizations in the oil and gas industry requiring specialized hydro-blasting units for pipeline and refinery maintenance, maritime services needing corrosion-resistant trailers for shipyard and vessel cleaning, and heavy manufacturing plants focused on machinery degreasing and floor sanitation. These industrial applications often demand unique customization, such as ultra-high-pressure capabilities (over 10,000 PSI) or explosion-proof certifications for hazardous areas. The rental sector itself is a major intermediary customer, purchasing large volumes of standardized, rugged trailers to offer flexible leasing options to the smaller contractor market, influencing manufacturers to balance customization with mass-production efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alfred Kärcher SE & Co. KG, Hotsy, Landa, Alkota Cleaning Systems, Inc., Simpson Pressure Washer Division, Mi-T-M Corporation, Pressure-Pro, Water Dragon, Hydro Tek Systems, Inc., CAM Spray, Daimer Industries, Inc., General Pump, Interpump Group S.p.A., Pressure Washer Products, Inc., American Pressure Inc., Power Line Industries, Blast-Pro, Inc., John Deere, FNA Group, CAT Pumps. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pressure Washer Trailers Market Key Technology Landscape

The technological sophistication of the Pressure Washer Trailers Market is increasingly blurring the line between traditional mechanical equipment and advanced digital assets. Fundamental technology revolves around the continuous refinement of the pressure generation system. Modern industrial pumps are almost exclusively triplex plunger pumps utilizing ceramic pistons and specialized seals, capable of delivering extremely high GPM (gallons per minute) and PSI (pounds per square inch) while resisting abrasive wear and chemical corrosion. Advances in variable flow and pressure technology allow operators to fine-tune output for different jobs without sacrificing engine efficiency, a major leap forward from fixed-output systems. Crucially, engine technology is driven by global environmental mandates; the adoption of electronically controlled common rail fuel injection systems and complex exhaust gas recirculation (EGR) and diesel particulate filter (DPF) systems is standard for high-performance diesel units, ensuring compliance with strict Tier 4 Final/Stage V standards and maximizing fuel economy under heavy, continuous loads. This focus on compliance drives significant R&D investment.

Digital integration, defined by the implementation of Internet of Things (IoT) connectivity and telematics, represents the most transformative technological shift. These systems incorporate rugged GPS trackers, engine control unit (ECU) interfaces, and various pressure and temperature sensors to collect operational data. This data provides fleet managers with real-time insights into asset location, utilization rates, idle time, water consumption metrics, and required maintenance intervals based on actual engine hours or performance degradation. This shift from calendar-based maintenance to predictive maintenance drastically enhances fleet uptime and optimizes resource allocation by anticipating component failure. Furthermore, digital controls are increasingly being used to manage burner temperature and ignition sequence in hot water units, ensuring consistent performance, reducing the risk of fuel waste or overheating, and providing integrated diagnostic trouble codes that simplify on-site repair and minimize the reliance on expert technicians for basic troubleshooting.

Beyond core machinery, advancements in trailer construction and safety are prominent. Manufacturers are employing CAD-optimized chassis designs to improve tow stability and reduce tongue weight, enhancing operator safety and legal compliance across diverse towing vehicle classes. Material science innovations are evident in protective coatings applied to steel frames to resist harsh chemical exposure and rust, extending the asset life significantly, a critical factor in salty or corrosive industrial environments. Specialized water recovery systems, increasingly integrated directly onto the trailer chassis, utilize advanced filtration membranes or flocculation processes to manage regulated wastewater runoff, addressing the primary environmental concern facing commercial pressure washing operators. This integration of filtration and recovery technology positions the trailer not just as a cleaning tool, but as a fully compliant environmental management unit, mandatory for high-compliance projects and regulated urban environments, enhancing overall market utility and complexity.

Regional Highlights

- North America: This region holds the largest market share, driven by a highly developed, expansive construction sector, extensive highway and infrastructure networks requiring constant maintenance, and a robust, competitive equipment rental industry. The US and Canada exhibit high demand for large, high-pressure, diesel-powered units, often customized for specialized services like municipal road striping removal or large-scale commercial property rehabilitation. Stringent OSHA and environmental regulations also necessitate the use of advanced, compliant equipment, favoring market leaders focused on telematics, technology, and advanced safety systems to protect operators and comply with federal standards.

- Europe: Characterized by stringent environmental mandates (e.g., Euro emission standards and strict water runoff and noise pollution regulations), the European market shows a strong preference for efficient, compact, and often alternative-fueled (propane, battery-electric) pressure washer trailers, particularly in dense urban areas where emission restrictions are tight. Germany, the UK, and France are key markets, driven by specialized cleaning services in the advanced manufacturing sector and extensive cultural heritage maintenance projects. The rental market is highly competitive and mature, influencing purchasing decisions towards modular and multi-functional designs that offer high versatility for diverse job requirements and easy compliance checks.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This growth is predominantly fueled by massive, ongoing government investments in new infrastructure development, rapid urbanization, and industrial expansion in nations such as China, India, and Indonesia. Initial demand often centers on rugged, basic, high-capacity diesel units that prioritize raw power and affordability, but as regulatory frameworks mature, especially concerning imported equipment standards and environmental impact, there is an accelerating transition towards higher-efficiency, technologically advanced models that offer better Total Cost of Ownership (TCO) and regulatory compliance.

- Latin America: This region exhibits steady, though often localized, demand, largely concentrated in industrial centers—especially the mining, oil and gas, and major manufacturing hubs in Brazil, Mexico, and Chile. The market remains highly price-sensitive, often leading to a strong presence of local assembly manufacturers and refurbished equipment sales. International players are gaining traction by offering tailored financing options, durable, low-maintenance units, and robust service agreements. Demand is driven by sanitation needs, agricultural equipment cleaning, and essential transportation fleet maintenance, often requiring cold water and high PSI for removal of difficult soils.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) states due to massive construction and ambitious mega-project activity (e.g., in Saudi Arabia and UAE). The extreme operational environment (high heat, pervasive dust, and often limited water access) necessitates highly specialized, heavy-duty trailers with advanced cooling systems, robust dust filtration for engines, and high-capacity water tanks, favoring models known for exceptional durability and minimal vulnerability to high-temperature breakdowns. Infrastructure projects, oil and gas facility maintenance, and growing water desalination plant maintenance requirements are primary demand drivers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pressure Washer Trailers Market.- Alfred Kärcher SE & Co. KG

- Hotsy, a division of Kärcher North America

- Landa, a division of Kärcher North America

- Mi-T-M Corporation

- Alkota Cleaning Systems, Inc.

- Simpson Pressure Washer Division (FNA Group)

- Pressure-Pro (FNA Group)

- Water Dragon (FNA Group)

- Hydro Tek Systems, Inc.

- CAM Spray

- Daimer Industries, Inc.

- General Pump, a subsidiary of Interpump Group S.p.A.

- Interpump Group S.p.A. (Component Supplier/OEM)

- Pressure Washer Products, Inc.

- American Pressure Inc.

- Power Line Industries

- Blast-Pro, Inc.

- John Deere (Rental and Distribution Channel Influence)

- EnviroSpec, Inc.

Frequently Asked Questions

Analyze common user questions about the Pressure Washer Trailers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the growth of the Pressure Washer Trailers Market?

Market growth is predominantly driven by increasing global infrastructure spending, the expansion of commercial cleaning and facility maintenance outsourcing, and the mandatory application of high-efficiency cleaning protocols across construction and municipal sectors, necessitating reliable, mobile high-power equipment.

Which pressure washer trailer segment is expected to see the fastest adoption?

The hot water pressure washer segment, particularly tandem-axle units above 4000 PSI, is projected to witness the fastest adoption due to their superior capability in handling heavy industrial cleaning, degreasing, and sanitation requirements crucial across manufacturing, transportation, and specialized high-compliance end-uses.

How is technology impacting operational costs for pressure washer trailer users?

Integration of telematics, advanced engine management systems (ECUs), and IoT sensors significantly lowers operational costs by optimizing fuel consumption, enabling highly accurate predictive maintenance to minimize unplanned downtime, and improving overall asset utilization rates across large rental and contractor fleets.

What is the regional outlook for market expansion?

While North America and Europe currently hold the largest market shares due to established regulatory environments and mature rental markets, the Asia Pacific region is forecast to demonstrate the highest Compound Annual Growth Rate (CAGR) driven by extensive urbanization and large-scale infrastructure development projects.

What are the main restraints hindering market penetration?

The market faces restraints primarily due to the high initial capital investment required for heavy-duty, customized trailers and increasing regulatory complexities related to strict environmental controls concerning noise levels, engine emissions (Tier 4 Final/Stage V), and wastewater effluent management, requiring costly compliance equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager