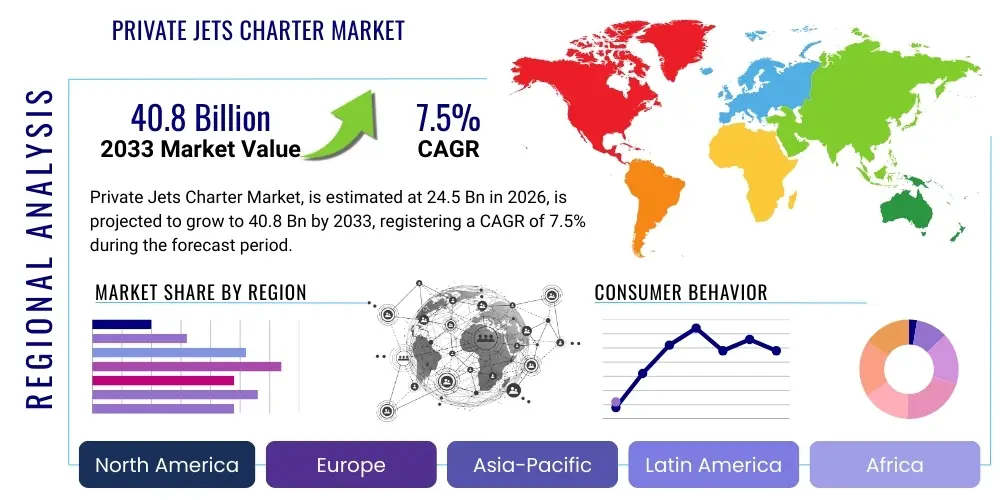

Private Jets Charter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441607 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Private Jets Charter Market Size

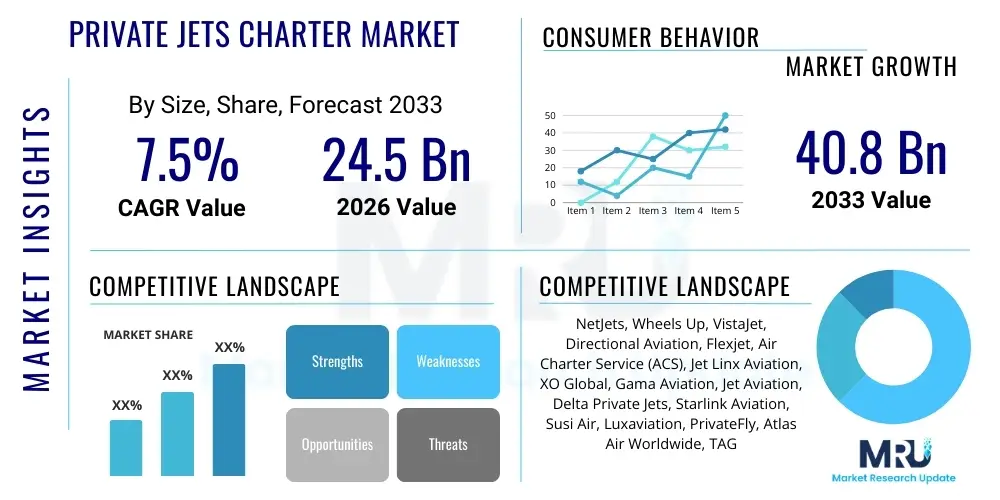

The Private Jets Charter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $40.8 Billion by the end of the forecast period in 2033.

Private Jets Charter Market introduction

The Private Jets Charter Market encompasses the provision of on-demand, non-scheduled air transport services utilizing aircraft ranging from light jets to long-range heavy jets, catering primarily to high-net-worth individuals (HNWIs), corporate executives, and government entities. This market segment offers unparalleled flexibility, privacy, and efficiency compared to commercial airlines, serving crucial functions in both business travel and high-end leisure aviation. Key services often include point-to-point charters, fixed-price memberships, and jet card programs, allowing users varying levels of commitment and accessibility to fleets operated by certified charter companies.

Product differentiation within the charter market is driven by aircraft size, range capabilities, and interior luxury, with major applications spanning corporate movements requiring rapid inter-city connectivity, emergency medical services (air ambulance), and exclusive leisure travel to remote or underserved locations. The inherent benefits, such as bypassing congested airports, customized scheduling, and enhanced security protocols, solidify its essential role for clients prioritizing time optimization and discretion. Furthermore, the market benefits from increasing globalization and the corresponding rise in ultra-high-net-worth populations seeking bespoke travel solutions.

Major driving factors include the post-pandemic shift in consumer preference toward private travel for health safety, the global expansion of business activities requiring flexible logistical support, and continuous technological improvements in fleet management and booking platforms that enhance accessibility. The market dynamics are highly sensitive to global economic health, geopolitical stability, and the availability of modern, fuel-efficient aircraft capable of meeting stringent environmental standards.

Private Jets Charter Market Executive Summary

The Private Jets Charter Market is experiencing robust acceleration driven by the persistent demand from the high-net-worth segment and significant technological integrations that streamline the booking process and operational efficiency. Current business trends highlight a strong movement towards digital transformation, with sophisticated online platforms and mobile applications replacing traditional brokerage models, offering real-time pricing and availability. Regionally, while North America and Europe remain the core revenue generators due to high concentration of corporate headquarters and established infrastructure, the Asia Pacific (APAC) and Middle East & Africa (MEA) regions are emerging as high-growth hotspots, fueled by rapid wealth creation and infrastructure development supporting private aviation. Segment trends indicate a notable preference shift towards mid-sized and super-midsize jets, which offer an optimal balance between operational cost efficiency and transatlantic range capabilities, catering effectively to both corporate and high-end leisure client bases seeking intercontinental connectivity without the expense of heavy jets.

AI Impact Analysis on Private Jets Charter Market

Common user questions regarding AI’s impact on the Private Jets Charter Market frequently revolve around operational optimization, dynamic pricing models, and enhanced safety protocols. Users are keen to understand how AI can reduce costs, predict maintenance needs, and personalize the booking experience. The primary themes emerging from this analysis focus on AI’s ability to move beyond simple automation into predictive analytics—specifically, optimizing flight paths in real-time to minimize fuel consumption and predicting peak travel patterns to efficiently reposition aircraft fleets. There is significant expectation that AI will revolutionize customer interaction by facilitating instantaneous and accurate charter quotes and ensuring that stringent safety standards are met through advanced maintenance scheduling and predictive fault detection, thereby addressing key concerns about reliability and pricing transparency.

- Enhanced dynamic pricing algorithms based on real-time supply, demand, and external variables.

- Predictive maintenance schedules for jet engines and components, drastically reducing unexpected delays (AOG situations).

- Optimized route planning considering weather, airspace congestion, and fuel efficiency via machine learning models.

- Personalized customer relationship management (CRM) and targeted charter recommendations based on travel history.

- Automated compliance and regulatory checks, ensuring flight safety and adherence to international aviation laws.

- Improved operational efficiency through automated crew scheduling and resource allocation.

DRO & Impact Forces Of Private Jets Charter Market

The Private Jets Charter Market is fundamentally driven by the increasing global population of Ultra-High-Net-Worth Individuals (UHNWIs) seeking bespoke travel solutions and the corporate requirement for time-critical, flexible travel, often necessitated by global expansion and merger activities. Conversely, the market faces significant restraints primarily centered on the extremely high operational costs associated with private jet ownership and charter services, coupled with mounting environmental scrutiny pushing operators toward mandatory investments in Sustainable Aviation Fuel (SAF) and quieter fleets. Opportunities abound in the integration of Advanced Air Mobility (AAM) concepts, particularly eVTOLs, which could eventually feed into the traditional charter ecosystem, alongside expansion into previously underdeveloped markets in Southeast Asia and Africa. These factors combine to exert powerful impact forces on market stability and growth trajectory, requiring significant capital investment and operational ingenuity to navigate.

The critical impact forces shaping the market environment include economic volatility and stringent global regulations, particularly concerning noise abatement and carbon emissions. Economic downturns can immediately suppress luxury spending, impacting both leisure and corporate charter utilization, while high oil prices directly inflate operational costs, often passed directly to the consumer, thereby reducing demand elasticity. Furthermore, increasing public and regulatory pressure to address aviation's carbon footprint compels charter operators to upgrade older fleets or invest heavily in new generation, more fuel-efficient aircraft, posing a significant capital expenditure challenge but simultaneously creating opportunities for green innovation and market differentiation.

The synergy between increasing globalization and the premium placed on time management remains a potent driver. For corporate clients, utilizing private charter services transforms travel time into productive work time, a strategic advantage that justifies the premium cost. Moreover, the enhanced security and privacy offered by private terminals and closed environments have become increasingly valuable, particularly in an era of heightened security concerns and data sensitivity. However, workforce shortages in highly specialized roles, such as qualified pilots and maintenance technicians, act as an ongoing operational restraint, limiting the scalability of charter fleets despite strong underlying demand.

- Drivers: Growing UHNWI population; Increasing need for flexible and secure corporate travel; Expansion of global business hubs; High demand for personalized travel experiences.

- Restraints: High operational and capital costs; Stringent environmental regulations and carbon tax pressures; Limited global infrastructure in secondary airports; Pilot and skilled technician shortages.

- Opportunities: Development of jet card programs and fractional ownership models; Integration of Sustainable Aviation Fuels (SAF); Untapped potential in emerging economies (e.g., Africa, Latin America); Technological advancements in booking and fleet management.

- Impact Forces: Economic cyclicality; Geopolitical instability affecting cross-border travel; Regulatory burdens; Technological disruption (e.g., AAM/eVTOL development).

Segmentation Analysis

The Private Jets Charter Market is comprehensively segmented based on several critical dimensions, including aircraft type, end-user application, and business model, allowing for detailed analysis of demand patterns and operator strategies. Segmentation by aircraft type—ranging from turboprops and light jets to ultra-long-range jets—is essential as it dictates the range, passenger capacity, and operational cost structure of the charter service. The segmentation by end-user, primarily categorized into corporate/business and leisure/private use, provides insight into the underlying economic drivers and behavioral patterns of the clientele, with corporate utilization often tied to mergers, acquisitions, and executive travel, while leisure use tends to be more seasonal and destination-driven.

Furthermore, the segmentation by business model—encompassing on-demand charter, fractional ownership, and jet card programs—reflects the differing commitment levels sought by clients. On-demand remains the most flexible option, while jet cards and fractional ownership offer guaranteed availability and fixed hourly rates, appealing to heavy users. Analyzing these segments is crucial for market participants to tailor their services, optimize fleet deployment, and identify niche growth areas, such as the growing demand for dedicated medical evacuation services utilizing specialized charter aircraft. This granularity ensures that market forecasts accurately reflect the specific dynamics influencing different service offerings.

The dominant segments currently include the mid-size jet category, which offers optimal efficiency for cross-continental travel, and the on-demand charter model, favored by intermittent users and those requiring ultimate flexibility. The growth in the jet card segment signifies a market maturation, where frequent flyers seek the convenience of committed service without the full burden of fractional ownership. Understanding the interplay between these segments is vital for new entrants to successfully position their assets and for established operators to manage fleet amortization and operational risk effectively.

- By Aircraft Type:

- Light Jets (e.g., Cessna Citation CJ series, Embraer Phenom 300)

- Mid-Size Jets (e.g., Cessna Citation Latitude, Gulfstream G150)

- Super Mid-Size Jets (e.g., Bombardier Challenger 350, Gulfstream G280)

- Large/Heavy Jets (e.g., Gulfstream G650, Bombardier Global 7500)

- Turbo-Prop Aircraft

- By End-User:

- Corporate/Business Travel

- Leisure/Private Travel

- Government & Military

- Air Ambulance/Medical Evacuation

- By Business Model:

- On-Demand Charter

- Jet Card Programs

- Fractional Ownership

- Lease Programs

Value Chain Analysis For Private Jets Charter Market

The value chain for the Private Jets Charter Market is complex and highly integrated, starting with the upstream phase involving Original Equipment Manufacturers (OEMs) who design, manufacture, and supply the actual aircraft (e.g., Bombardier, Gulfstream, Dassault). This upstream segment is capital-intensive and dictates the technological standard, fuel efficiency, and maintenance requirements for the entire ecosystem. Directly linked to OEMs are the maintenance, repair, and overhaul (MRO) providers and parts suppliers, which ensure the airworthiness and regulatory compliance of the multi-billion dollar fleets. Decisions made in the upstream concerning production rates and new aircraft technology directly impact the midstream service providers regarding fleet renewal and operational costs.

The midstream phase constitutes the core service delivery and includes charter operators, aircraft management companies, and brokers. Charter operators hold the necessary Air Operator Certificates (AOCs) and manage the physical fleet, pilots, and day-to-day scheduling. Brokers and charter marketplaces, both direct (online platforms) and indirect (traditional agents), connect the end-users to the available aircraft supply. These intermediary services are crucial for optimizing load factors and ensuring efficient asset utilization across geographically dispersed networks. The trend toward vertical integration, where large charter operators acquire brokerage capabilities, aims to capture more value across this middle segment.

The downstream phase involves the distribution channel and the end-users. Distribution is multifaceted, involving direct sales channels (operator-to-client), and indirect channels facilitated by brokers and travel management companies specializing in luxury logistics. The end-users, predominantly HNWIs and large multinational corporations, are the ultimate determinants of demand, prioritizing service quality, safety records, and price competitiveness. The seamless coordination between maintenance schedules (upstream), operational execution (midstream), and client servicing (downstream) is essential for maintaining high utilization rates and customer retention in this premium service industry.

Private Jets Charter Market Potential Customers

The primary customers of the Private Jets Charter Market are predominantly categorized into two distinct, high-value groups: High-Net-Worth Individuals (HNWIs) seeking personal and leisure travel, and Corporate Entities requiring efficient business logistics. HNWIs, particularly those with global business interests or multiple residences, utilize charter services for the unparalleled privacy, security, and time savings they afford, often chartering mid-to-heavy jets for transcontinental trips or smaller jets for short hops between properties. This segment values exclusivity and highly customized travel itineraries that commercial aviation cannot accommodate, driving demand for premium in-flight services and highly discreet operational procedures.

Corporate clients form the backbone of the market, primarily comprising C-suite executives, senior management teams, and specialized professional groups such as investment bankers or consultants who require rapid, direct access to multiple locations within tight deadlines. For these end-users, the ability to conduct sensitive meetings privately onboard and reduce travel overhead is a critical business advantage. Corporations often opt for fixed-term contracts, fractional ownership, or jet card programs to ensure predictable access and budgetary control, especially during periods of high M&A activity or global expansion requiring executive oversight on-site.

A growing niche customer base includes government entities for official travel, military contractors, and increasingly, specialized groups such as professional sports teams and entertainers. Sports teams, in particular, rely on charter services to manage grueling travel schedules and ensure athlete recovery and optimal performance by avoiding the logistical complications and public exposure associated with commercial flights. Furthermore, the specialized medical sector (air ambulance services) represents a vital segment, requiring fast response times and specialized aircraft configurations for critical patient transport, highlighting the market's role beyond luxury and pure business travel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $40.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NetJets, Wheels Up, VistaJet, Directional Aviation, Flexjet, Air Charter Service (ACS), Jet Linx Aviation, XO Global, Gama Aviation, Jet Aviation, Delta Private Jets, Starlink Aviation, Susi Air, Luxaviation, PrivateFly, Atlas Air Worldwide, TAG Aviation, Airshare, M&N Aviation, Clay Lacy Aviation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Private Jets Charter Market Key Technology Landscape

The technological landscape of the Private Jets Charter Market is rapidly evolving, driven primarily by the need for operational efficiency, enhanced customer experience, and strict regulatory compliance. A core element is the proliferation of advanced digital booking platforms and mobile applications that leverage sophisticated algorithms for instant quote generation, real-time aircraft tracking, and seamless scheduling integration. These platforms utilize API integrations with fleet management software and fuel providers to dynamically price charters based on current positioning and predicted flight demand, replacing the slower, opaque traditional brokerage model. Furthermore, integration with blockchain technology is being explored to enhance transparency in financial transactions and secure sensitive passenger data, addressing critical security concerns in a high-value transaction environment.

Operational technology focuses heavily on connectivity and maintenance. High-speed satellite connectivity (In-Flight Wi-Fi) is now standard, enabling passengers to maximize productivity during transit, reinforcing the value proposition of corporate charter services. Crucially, the adoption of advanced sensor technology and the Internet of Things (IoT) in aircraft components facilitates predictive maintenance. By continuously monitoring engine performance, hydraulic systems, and other critical parts, AI-driven analytics can forecast component failure before it occurs, drastically improving safety records and reducing expensive, unforeseen downtime (AOG). This shift from reactive to predictive maintenance optimizes fleet availability and contributes directly to reducing operational costs.

Sustainability technology represents a long-term critical trend. While full electric aircraft (eVTOLs) are still emerging, current technology efforts focus on the adoption and certification of Sustainable Aviation Fuel (SAF), which significantly reduces the carbon lifecycle footprint. Operators are increasingly investing in newer generation aircraft models equipped with advanced aerodynamics and engine designs (e.g., geared turbofan technology) optimized for lower fuel burn and reduced noise pollution, often mandatory for operating into noise-sensitive urban airports. This technological investment, while costly upfront, is vital for long-term viability and maintaining competitiveness against rising environmental regulations.

Regional Highlights

The Private Jets Charter Market exhibits significant regional variations in maturity, growth drivers, and client demographics, with North America retaining the largest market share due to its vast corporate structure, extensive airport infrastructure, and a high concentration of UHNWIs. The United States, in particular, dominates the charter sector with a well-established regulatory framework and a culture of using private aviation for business efficiency. Key regional dynamics in North America include intense competition among major jet card and fractional ownership providers and early adoption of advanced digital booking technologies. The demand here is consistently high, supported by the largest global fleet of business jets.

- North America (Dominant Market): Characterized by high market maturity, robust corporate demand, and the presence of major global players like NetJets and Flexjet. Growth is sustained by strong domestic business travel, technological investment in booking platforms, and a preference for jet card programs offering guaranteed access and fixed rates.

- Europe (Mature & Fragmented Market): Europe represents the second-largest market, exhibiting high demand for intra-continental travel, particularly between major financial centers like London, Geneva, and Paris. The market is highly fragmented due to diverse national regulations and varied taxation structures. Demand is heavily influenced by cross-border leisure travel and seasonal movements to popular Mediterranean destinations.

- Asia Pacific (APAC) (High-Growth Emerging Market): APAC is projected to experience the highest growth rate due to rapid wealth creation, increasing globalization of businesses in China, India, and Southeast Asia, and improving airport infrastructure. However, the market faces challenges related to stringent regulatory hurdles and airspace restrictions in certain countries. Demand often favors heavy, long-range jets suitable for connecting distant regional hubs and facilitating travel to North America and Europe.

- Middle East & Africa (MEA) (Luxury Focus): Demand in the Middle East is heavily concentrated on large-cabin, luxurious jets, driven by royal families, government officials, and high-net-worth individuals focused on premium travel to Europe and North America. Africa presents significant untapped potential, where private aviation is often a necessity rather than a luxury, bridging gaps in inadequate commercial airline connectivity, though growth is reliant on political stability and infrastructure investment.

- Latin America (Stabilizing Market): This region shows stable demand, primarily driven by wealthy families and natural resource exploration companies needing access to remote sites. Brazil and Mexico are the primary centers, though economic instability in some nations can lead to volatile demand for discretionary charter services.

Europe, while mature, is highly sensitive to regulatory changes emanating from the European Union Aviation Safety Agency (EASA) and struggles with fragmented operations across various national airspaces, which can complicate cross-border charter flights compared to the unified structure in the US. The European market sees strong seasonal peaks related to holidays and major events, requiring operators to efficiently manage fleet positioning across the continent. The increasing focus on sustainability is also a significant driver in Europe, pushing operators to adopt new engine technologies and offset carbon footprints aggressively to meet regional targets.

The Asia Pacific region, led by China and India, represents the frontier of market growth. Despite regulatory complexities, the rising number of billionaires and high-growth multinational operations necessitate private air travel. Operators entering this market must navigate complex customs procedures and secure local partnerships to ensure operational smoothness. Unlike Western markets, where light and mid-size jets are popular for domestic travel, APAC demand often skews toward heavy and ultra-long-range jets, reflecting the vast distances between major business hubs and global destinations, positioning this segment for substantial investment over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Private Jets Charter Market.- NetJets

- Wheels Up

- VistaJet

- Directional Aviation (Flexjet, Sentient Jet)

- Air Charter Service (ACS)

- Jet Linx Aviation

- XO Global (formerly XOJET)

- Gama Aviation

- Jet Aviation (a General Dynamics company)

- Delta Private Jets (now integrated with Wheels Up)

- Starlink Aviation

- Luxaviation Group

- PrivateFly

- Atlas Air Worldwide

- TAG Aviation

- Airshare

- M&N Aviation

- Clay Lacy Aviation

- Dassault Falcon Service

- Royal Jet

Frequently Asked Questions

Analyze common user questions about the Private Jets Charter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Jet Card Programs and On-Demand Charter?

Jet Card Programs require an upfront monetary commitment in exchange for fixed hourly rates and guaranteed availability, offering predictability. On-Demand Charter, conversely, involves booking a specific flight based on dynamic market rates at the time of inquiry, providing maximum flexibility but without rate guarantees.

How is AI impacting the cost of private jet charters?

AI is primarily used to optimize operational costs by implementing predictive maintenance, reducing unforeseen downtime, and enhancing route efficiency to minimize fuel consumption. These efficiencies generally lead to more competitive and dynamically optimized pricing for the end consumer, improving cost transparency.

Which regions are driving the highest growth in the Private Jets Charter Market?

The Asia Pacific (APAC) region, specifically countries like China and India, and the Middle East & Africa (MEA) are projected to exhibit the highest growth rates due to rapid UHNWI wealth creation, expanding business networks, and increasing necessity for private air connectivity.

What are the main environmental challenges facing private jet charter operators?

The main challenges involve stringent regulations regarding carbon emissions and noise pollution. Operators must invest heavily in Sustainable Aviation Fuel (SAF) adoption and modernize fleets with newer, more fuel-efficient aircraft to meet global decarbonization targets and address public scrutiny.

What types of aircraft are most preferred in the current market?

Mid-size and Super Mid-Size Jets (such as the Challenger 350 or Citation Latitude) are currently highly preferred. They offer an optimal balance of range for cross-continental travel, passenger capacity, and operational efficiency, making them versatile for both corporate missions and high-end leisure travel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager