Pro AV Sales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441477 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Pro AV Sales Market Size

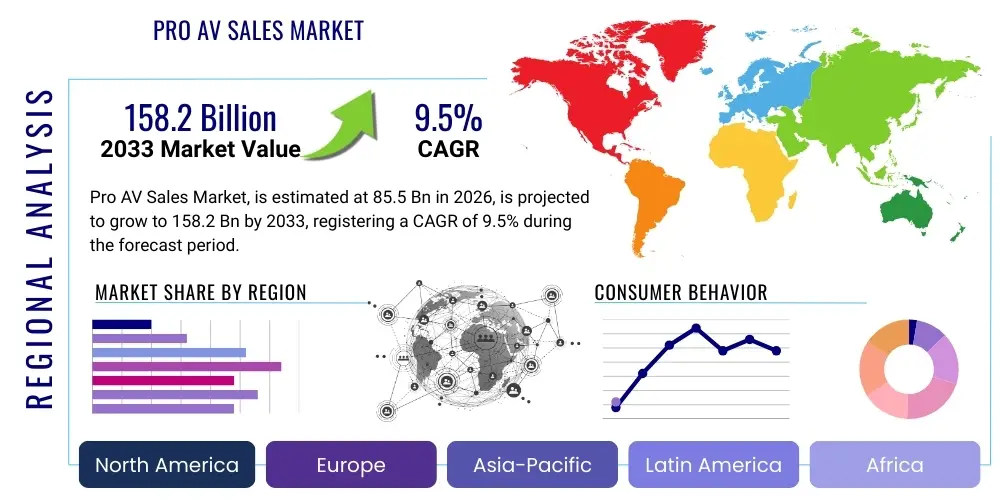

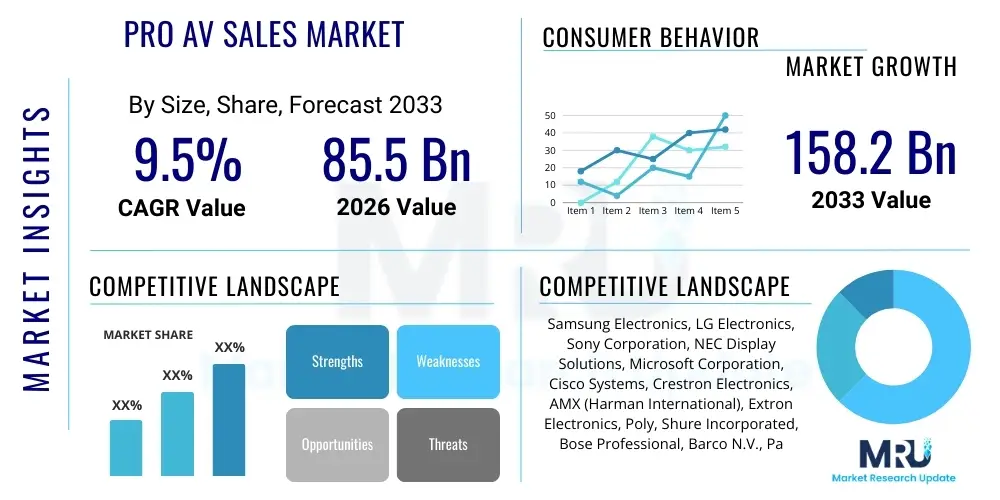

The Pro AV Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 158.2 Billion by the end of the forecast period in 2033.

Pro AV Sales Market introduction

The Professional Audio Visual (Pro AV) Sales Market encompasses the provision of integrated technologies, hardware, software, and comprehensive services designed to enhance communication, collaboration, and dynamic presentation across various institutional, commercial, and public sector settings globally. This critical sector is defined by the convergence of traditional AV equipment, such as professional-grade displays, specialized audio components, and projection systems, with advanced Information Technology (IT) network infrastructure. This integration yields sophisticated solutions including unified communication (UC) platforms, extensive digital signage networks, and highly reliable command and control environments, addressing the complex operational needs of modern enterprises and public bodies.

The proliferation of sophisticated hybrid work and learning models, accelerated by global events, stands as a primary catalyst accelerating market adoption. Pro AV solutions deliver significant organizational benefits, notably improving operational efficiency through the centralization of system management, ensuring superior decision-making capabilities facilitated by advanced visualization tools, and fostering higher levels of audience or employee engagement through dynamic content delivery mechanisms. The market trajectory indicates a profound shift away from the traditional model of standalone hardware sales toward the provision of integrated, software-defined solutions and comprehensive managed services, which offer clients significantly greater flexibility, scalability, and simplified operational expenditure (OpEx) models tailored to evolving organizational requirements.

Major applications for Pro AV technology span across crucial enterprise functions, including corporate collaboration spaces (such as huddle rooms, executive boardrooms, and specialized training centers), educational institutions requiring advanced hybrid learning and lecture capture setups, and expansive retail environments utilizing interactive digital signage for advanced personalized marketing. Critical driving factors underpinning this robust market expansion include the continuous advancements leading to cost reduction in high-resolution display technologies (e.g., fine-pitch LED and Micro-LED), the widespread standardization and integration of 4K and emerging 8K resolution standards, and the fundamental market migration toward networked AV (AV-over-IP) architectures. This technological transition significantly streamlines system deployment and management, simultaneously enabling unprecedented flexibility in content routing and distribution across geographically dispersed wide-area networks (WANs).

Pro AV Sales Market Executive Summary

The global Pro AV Sales Market is undergoing a rapid, technology-driven transformation, characterized by robust digital integration and a strategic imperative toward supporting ubiquitous hybrid operational infrastructures. Current business trends indicate a strong, enterprise-wide prioritization of unified communications as a service (UCaaS) integration, which is driving substantial demand for certified, high-quality, and highly reliable conferencing equipment capable of integrating seamlessly with existing complex enterprise IT frameworks. Furthermore, the expansion of the experience economy is fueling significant parallel growth in the demand for immersive display technologies, including large format video walls and specialized projection systems, utilized extensively in premium retail, large entertainment venues, and public informational spaces, requiring personalized and highly impactful user experiences.

From a regional perspective, North America firmly retains its leadership position in terms of market size and technological maturity, primarily due to high domestic technological adoption rates, substantial enterprise investment in infrastructural modernization, and the foundational presence of leading global technology providers who champion early adoption of advanced AV-over-IP standards. Conversely, the Asia Pacific region is clearly projected to achieve the highest Compound Annual Growth Rate over the forecast period, a trend largely propelled by rapid urbanization, massive government and private sector investment in infrastructure development projects, and increasing public spending on educational modernization and comprehensive smart city initiatives, particularly notable across emerging economic powerhouses such as China and India.

Analysis of market segmentation trends highlights the burgeoning demand for fixed, high-impact installation solutions, specifically interactive flat panel displays and sophisticated centralized control systems, directly resulting from the permanent reconfiguration of corporate campuses and educational facilities to accommodate post-pandemic hybrid modalities. Within the service category, the volume and value of managed services are demonstrably outpacing traditional installation and maintenance services, a trend that reflects the increasing complexity and IT dependency of modern networked AV systems which necessitate specialized, outsourced technical expertise for secure, proactive maintenance and comprehensive system lifecycle management. The corporate vertical continues to represent the single largest end-user segment, yet the education, government, and healthcare sectors are rapidly accelerating their investment, particularly focusing on remote patient monitoring systems, highly secure collaborative environments, and next-generation hybrid learning infrastructure deployments.

AI Impact Analysis on Pro AV Sales Market

Common user questions regarding the pervasive influence of Artificial Intelligence (AI) on the Pro AV Sales Market frequently cluster around critical themes such as the potential for operational automation, the necessity for improved, intuitive user experience design, and the tangible benefits of predictive maintenance capabilities. End-users and system integrators alike are intensely interested in understanding how AI algorithms can simplify the operation of inherently complex AV systems, automate routine meeting procedures (e.g., through intelligent auto-tracking cameras and speaker identification), and generate highly actionable analytics concerning physical space utilization and specific content consumption metrics. Key concerns invariably focus on the complex ethical and practical implications of data privacy when implementing AI-powered features like facial recognition or voice analysis within sensitive corporate and governmental environments, alongside the fundamental requirement for system integrators to acquire the necessary, advanced expertise to successfully implement these data-intensive, intelligent systems.

Artificial Intelligence is rapidly evolving to fundamentally reshape the value proposition derived from modern Pro AV systems, successfully transitioning them from being relatively static presentation tools into intelligent, proactive communication and collaboration platforms. AI-driven algorithms are actively enhancing crucial system components by enabling automated room scheduling optimization, intelligently minimizing energy consumption based on real-time occupancy detection, and ensuring seamless, automated interoperability between disparate, multi-vendor AV systems within a large enterprise. For the sales and integration segments of the value chain, AI tools are proving invaluable in system design optimization by running complex simulations, accurately predicting potential deployment bottlenecks, and automatically performing calibration of intricate audio and video parameters, collectively leading to significant reductions in installation time and substantial improvements in long-term system reliability post-deployment.

The strategic integration of machine learning capabilities directly into AV management software is facilitating highly sophisticated remote monitoring and advanced predictive analytics that were previously unattainable. This transformative shift empowers service providers to transition their business models decisively from a reactive, break-fix repair methodology to proactive, scheduled maintenance paradigms, allowing them to accurately identify and address potential equipment failures or performance degradation well before any operational impact occurs. Furthermore, AI is now indispensable for enabling effective natural language processing (NLP) within cutting-edge conferencing solutions, enabling instantaneous, highly accurate transcription, automated language translation services, and the generation of smart, prioritized meeting summaries, all of which contribute directly and measurably to improved post-meeting productivity and significantly enhance the calculated Return on Investment (ROI) for end-users.

- Implementation of automated meeting orchestration and resource scheduling using real-time occupancy sensors and advanced facial detection technology.

- Deployment of predictive maintenance and remote fault diagnostics capabilities driven by machine learning algorithms analyzing historical and real-time system performance data.

- Substantial enhancement of acoustic performance through AI-powered noise cancellation, acoustic echo cancellation, and intelligent voice pickup optimization techniques.

- Enabling personalized content delivery and accurate audience measurement for sophisticated, large-scale digital signage and advertising networks.

- Integration of real-time automated transcription, captioning, and language translation services directly into global conferencing and collaborative platforms.

- Significant improvement in energy efficiency and environmental system calibration through intelligent, environment-aware control and automation mechanisms.

DRO & Impact Forces Of Pro AV Sales Market

The Pro AV Sales Market is propelled by powerful macro-level drivers, primarily including the indispensable global demand for comprehensive digital transformation across commercial enterprises, educational institutions, and the rapidly expanding entertainment sector, coupled with the mandatory strategic requirement for sustained investment in hybrid work and learning technologies. Key restraints significantly impacting market velocity largely stem from the substantial initial capital expenditure required for complex, enterprise-wide integrated AV installations, which often presents a high barrier to entry, particularly limiting rapid adoption among Small and Medium Enterprises (SMEs). Simultaneously, tremendous opportunities are arising from the rapid maturation and standardized development of AV-over-IP network infrastructure and the increasing acceptance of flexible, subscription-based AV services (AVaaS), designed specifically to mitigate high upfront costs and offer superior scalability and technology agility. These interconnected forces collectively dictate the market’s evolutionary path, accelerating the pervasive shift toward network-centric solutions while critically emphasizing the need for highly secure, standardized, and commercially cost-effective deployment models.

Critical market drivers include the exponential, sustained growth in end-user demand for ultra-high-definition display technologies, specifically 4K and emerging 8K resolution, across large venue installations and premium corporate and governmental settings, operating in tandem with the essential need for integrating robust, layered cybersecurity measures directly into all networked AV solutions. The industry's irreversible migration from decades-old legacy analog AV systems to fully digital, standardized, network-based ecosystems necessitates significant capital investment but promises vast operational efficiency gains, simplified maintenance, and remote management capabilities. Nevertheless, a major operational restraint is the persistent, pervasive scarcity of highly specialized technical talent specifically capable of designing, implementing, and expertly managing the converged IT/AV systems—this resource bottleneck critically slows down complex, large-scale project deployment, especially noticeable in rapidly developing economies where technical training infrastructures lag behind market demand.

Significant greenfield opportunities are continually emerging in highly specialized, high-value niche markets, such as complex simulation and advanced extended reality (XR) training environments utilized heavily by industrial, defense, and specialized medical sectors. Furthermore, the global imperative for environmental sustainability acts as a powerful, overarching impact force, pressuring major manufacturers to develop and commercialize increasingly energy-efficient hardware and adopt rigorous circular economy practices for comprehensive equipment lifecycle management and disposal. The singular, most dominant impact force driving long-term structural market growth is the irreversible blurring and eventual functional merger of Information Technology (IT) and professional Audio Visual (AV) domains, rendering AV systems as essential, mission-critical components of the broader enterprise IT network infrastructure, thereby ensuring sustained capital investment regardless of broader macroeconomic fluctuations or short-term budget cycles.

Segmentation Analysis

The segmentation of the Pro AV Sales Market offers a highly detailed roadmap of technological adoption, commercial viability, and specialized focus areas, critically allowing stakeholders across the value chain to strategically allocate research and development resources based on granular, verifiable demand patterns. By Product Type, the market analysis meticulously distinguishes between core display technologies—which include high-resolution flat panel displays, immersive projection systems, and advanced seamless LED video walls—and mission-critical ancillary components such as professional audio solutions (e.g., beamforming microphones, adaptive processors, and line array speakers), sophisticated video conferencing endpoints, and centralized, high-reliability control and automation systems. This precise distinction is fundamentally crucial because the increasing inherent complexity of network-centric installations dictates that control systems and specialized management software now often account for a disproportionately high share of the total solution value, effectively shifting the market emphasis from commodity hardware sales to comprehensive integrated systems expertise and intellectual property, often necessitating specialized and continuous technical training for sales engineers and system integrators.

Service segmentation is demonstrably gaining accelerated importance, accurately reflecting the market’s necessary pivot toward long-term lifecycle management, operational integrity, and guaranteed reliability. While installation and core integration services remain absolutely essential for the physical deployment of complex networked environments, the most dynamic and financially significant growth trajectory is observed within the category of managed services. Managed AV services encompass advanced remote monitoring, proactive fault detection using AI, comprehensive cybersecurity management for all connected AV network endpoints, and continuous system optimization, successfully enabling end-users to outsource the daily operational complexity of maintaining high-availability, enterprise-grade AV infrastructure. This sophisticated service model is highly attractive to demanding corporate clients and financially constrained government entities seeking predictable operational expenses (OpEx) and contractual guaranteed uptime, simultaneously transforming the traditional single-transaction sales event into a profitable, long-term strategic partnership focused on optimizing system performance and ensuring rapid, economical technological refresh cycles without incurring massive upfront costs.

End-user segmentation reveals a highly nuanced and sector-specific demand landscape. The Corporate sector reliably dominates total market share, driven by persistent and non-negotiable ongoing investment in standardized, global meeting room solutions (spanning small huddle rooms to expansive executive briefing centers) necessary for efficient multinational collaboration and assured operational continuity in the distributed global economy. However, the most explosive expansion in adoption rates is currently evident in verticals such as Retail and Hospitality, which are heavily leveraging high-impact experiential AV solutions, including interactive digital kiosks, massive curved LED displays for architectural integration, and advanced ambient audio systems, directly linking their AV investment to improved tangible consumer engagement metrics and brand differentiation. Furthermore, the Government/Military sector continues to be a demanding buyer, requiring highly secure, environmentally rugged, and inherently reliable command and control room setups, consistently favoring proprietary, certified, high-security AV technology, often driving specialized compliance requirements and demanding robust vendor stability, thereby maintaining a necessary premium pricing structure for relevant defense and public safety contracts.

- By Product Type: Displays (Flat Panel, Projection, Fine-Pitch LED, Interactive Displays), Audio Equipment (Microphones, Mixers, Amplifiers, Loudspeakers, DSPs), Conferencing Systems (Video Endpoints, Audio Endpoints, UC Peripherals), Control Systems (Centralized Controllers, Network Switchers), Lighting and Staging Equipment.

- By Service Type: Installation and System Integration, Maintenance and Technical Support, Managed Services (Monitoring, Remote Management, AVaaS), Consulting and Design Services.

- By End User: Corporate (Large Enterprise, SME, Huddle Spaces), Education (K-12, Higher Education, Lecture Halls), Government/Military (Command & Control, Training), Hospitality (Hotels, Resorts), Retail (Digital Signage, Store Experience), Media and Entertainment (Studios, Theatres), Healthcare (Visualization, Telemedicine), Large Venues/Stadia.

- By Technology: Analog AV, Digital AV (HDMI, HDBaseT), AV-over-IP (SDVoE, Dante, NDI).

Value Chain Analysis For Pro AV Sales Market

The Pro AV sales value chain is characteristically complex and structurally multi-layered, beginning systematically with the upstream fundamental component manufacturing phase. This phase primarily involves the high-volume fabrication of specialized semiconductors, the production of high-resolution display panels (LCD, OLED, LED), and the meticulous creation of specialized audio transducers and optics. These critical base components are sourced globally from specialized suppliers and feed directly into the Original Equipment Manufacturers (OEMs), such a Sony, Samsung, and Crestron, who undertake the sophisticated design, engineering, and final assembly of the marketable AV products (e.g., integrated video walls, standardized conferencing units, and complex control processors). Upstream operational efficiency is highly dependent on securing stable supply chains, particularly for high-demand microprocessors, high-capacity memory, and premium 4K/8K components, factors which critically influence final product cost structures and overall market pricing stability across various geographies.

The essential mid-stream segment of the value chain is decisively dominated by professional distribution networks and highly specialized system integration firms. Distributors function as crucial logistical intermediaries, expertly managing complex, time-sensitive inventory and coordinating extensive logistics between the diverse group of international manufacturers and the multitude of final-stage system integrators. System integrators (SIs) fulfill the single most crucial role in the entire sales process; their responsibilities span detailed client consultation, custom system architecture design, procurement of specific components, complex field installation, and expert software programming. SIs must possess deep, current expertise in both specialized IT networking protocols and diverse AV technology standards, effectively translating broad client functional requirements into verifiable, operational, integrated technical solutions.

Downstream activities are intensely focused on the final end-user deployment phase and comprehensive post-sales support and ongoing service provision. This critical phase encompasses routine preventive maintenance, essential equipment lifecycle management, and the increasingly profitable realm of managed services, which are typically delivered through comprehensive, long-term service contracts. The accelerating market shift towards consumption-based AV-as-a-Service (AVaaS) models is fundamentally restructuring the downstream dynamics, placing a far greater financial emphasis on establishing lucrative, recurring revenue streams generated through continuous remote monitoring, rapid security patching, and essential software updates, rather than relying solely on single, substantial upfront sales commissions. The operational efficiency and long-term profitability of the downstream segment rely critically on establishing strong, reliable relationships with expert integrators and ensuring continuous technical training to proficiently handle highly sophisticated, rapidly evolving networked AV deployments.

Pro AV Sales Market Potential Customers

Potential customers for the Pro AV Sales Market are remarkably diversified, encompassing virtually every institutional and commercial sector that requires reliable, enhanced capabilities for internal and external communication, high-impact presentation, or seamless collaboration. The primary and most reliably dominant target demographic remains the large corporate enterprise sector, specifically encompassing global organizations actively undergoing major digital transformation initiatives and systematically modernizing their physical office and collaboration spaces to robustly support agile and permanent hybrid operational models. Key organizational decision-makers include Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and specialized Facilities Managers, all of whom are intently focused on leveraging strategic AV investments to measurably optimize employee productivity, enhance collaboration efficiency, and maximize overall real estate utilization.

Educational institutions, ranging from smaller K-12 school districts to expansive research universities, represent another absolutely vital and rapidly growing customer segment. Their current purchasing decisions are fundamentally driven by the urgent need for robust, seamless remote learning capabilities, professional-grade, high-fidelity lecture capture systems, and highly interactive classroom technologies that are proven to effectively facilitate superior student engagement across simultaneous physical and digital learning environments. Furthermore, large government and highly specialized military agencies constitute significant, premium-value buyers, perpetually demanding highly secure, high-reliability conferencing systems, technologically advanced command and control centers, and complex simulation and specialized training environments, often mandating the use of specific, industry-certified security protocols and specialized vendor security clearances.

Moreover, the hospitality and retail sectors are demonstrating accelerated growth as potential customers, strategically leveraging Pro AV technologies to significantly enhance and personalize the end-customer experience. High-end hotels deploy sophisticated, integrated digital signage systems, ambient atmospheric lighting, and immersive audio solutions across all public areas, while major retailers utilize interactive displays, massive curved LED video walls, and customized software systems for dynamic advertising and providing personalized, highly engaging in-store consumer experiences. These consumer-facing customers prioritize technological solutions that offer maximum visual impact, guarantee robust operational reliability 24/7, and provide centralized, intuitive content management capabilities, directly linking their critical AV investment expenditures to quantifiable consumer engagement metrics and long-term revenue generation goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 158.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Electronics, Sony Corporation, NEC Display Solutions, Microsoft Corporation, Cisco Systems, Crestron Electronics, AMX (Harman International), Extron Electronics, Poly, Shure Incorporated, Bose Professional, Barco N.V., Panasonic Corporation, Christie Digital Systems, Biamp Systems, QSC, ClearOne, Audinate, Milestone AV Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pro AV Sales Market Key Technology Landscape

The technological architecture of the Pro AV Sales Market is undergoing a rapid and decisive transition, migrating from traditional, discrete analog components to intricate, fully interoperable digital networks explicitly engineered based on standard Internet Protocol (IP) networking standards. The single most significant technology driving this fundamental transformation is AV-over-IP, which strategically utilizes standard commercial network infrastructure (such as Ethernet switches and cabling) to reliably transmit massive volumes of high-resolution audio and video signals, effectively replacing restrictive, distance-limited proprietary cabling standards. This critical shift dramatically reduces overall installation costs, significantly enhances system scalability across large campuses or global offices, and vastly simplifies centralized, remote system management, thereby positioning AV deployments as standard, secure nodes on the broader enterprise IT network.

Another fundamentally critical technological area involves the continuous and aggressive evolution of visual display technology, specifically marked by the rapidly increasing mass adoption of fine-pitch LED video walls and the emerging, next-generation Micro-LED display technology. These advanced display technologies offer unparalleled specifications, including superior brightness levels, truly seamless scaling capabilities without visible bezels, exceptional contrast ratios, and significantly improved energy efficiency when compared to legacy LCD or conventional projection systems, making them the preferred choice for demanding large venue installations and high-impact, permanent digital signage deployments. Concurrently, the exponential growth of unified communications (UC) platforms, principally driven by leading software solutions such as Microsoft Teams and Zoom Rooms, has necessitated the specialized development and certification of optimized peripheral hardware (e.g., smart cameras, integrated soundbars, and beamforming microphones) specifically designed for these UC environments, with an overriding focus on intuitive ease of use and consistent, high-fidelity performance.

Furthermore, the contemporary AV technology architecture is concentrating intensely on software-defined AV systems, sophisticated control layers, and robust, integrated security protocols. Modern, enterprise-grade Pro AV solutions now universally integrate complex control and monitoring software that facilitates necessary functions like remote asset management, sophisticated usage analytics generation, and mandatory proactive security patching—an absolute requirement given that AV devices are increasingly deployed as network-addressable IoT endpoints. Influential standards bodies like the SDVoE Alliance, AES, and AVIXA are actively driving global industry standards to ensure seamless interoperability and consistency across vendors, thus reducing overall system integration complexity and dramatically increasing end-customer confidence in the adoption of complex, multi-vendor solutions. Finally, the strategic integration of high-bandwidth 5G connectivity is becoming increasingly relevant, particularly supporting mobile, remote, and temporary AV deployments essential for remote broadcasting, live event settings, and high-speed data transmission requirements.

Regional Highlights

Detailed regional analysis critically underscores the varying levels of technological maturity, distinct infrastructure readiness, and divergent investment priorities within the Pro AV Sales Market across major global economic zones. North America, encompassing the mature markets of the United States and Canada, remains the largest single generator of revenue globally. This dominance is driven by extremely high rates of early adoption of advanced concepts such as fully integrated SDVoE (Software Defined Video over Ethernet) ecosystems and AI-enhanced, highly automated collaboration tools. The region’s formidable market strength is substantially bolstered by the presence of a massive, technologically advanced corporate and government base, which ensures a perpetual demand flow for premium, high-availability, mission-critical AV solutions. Furthermore, intense competitive pressures in this region drive continuous, rapid technology refresh cycles, typically resulting in an accelerated migration to the newest video standards like 4K and 8K resolution, and mandatory, robust security integration within all networked AV systems to comply with increasingly stringent enterprise cybersecurity policies, effectively maintaining high average selling prices (ASPs).

The Asia Pacific (APAC) region is convincingly projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the entire forecast period, establishing itself as the engine for global volume growth. This accelerated expansion is fundamentally attributed to massive economic development, expansive infrastructure investment in commercial and residential real estate, unprecedented corporate headquarters construction, and substantial government financial commitments toward massive smart city programs and population-level digital education initiatives across high-population economies like China, India, and Indonesia. While localized price sensitivity remains a practical factor in many sub-regions, the sheer volume and velocity of new construction projects and the escalating demand from the expanding middle class for high-quality entertainment and sophisticated retail experiences fuel enormous annual demand for entry-to-mid-level display technologies, public address systems, and standardized conference room solutions, ensuring that APAC consistently commands the highest volume of annual unit sales worldwide.

Europe holds a significant and stable market share, distinguished by a mature, albeit geographically fragmented, market structure with a strong collective emphasis on stringent environmental sustainability (mandating energy-efficient hardware), high technological standardization (influenced heavily by EU directives), and the systematic modernization of public sector infrastructure, particularly in healthcare and administration. Western European nations, including Germany, the UK, and the Nordics, are pioneers in the deployment of true AV-as-a-Service (AVaaS) models, favoring predictable operational expenditure (OpEx) over unpredictable capital expenditure (CapEx), driving the adoption of flexible, subscription-based access to hardware and comprehensive support services. Meanwhile, emerging regions, including Latin America and the Middle East & Africa (MEA), are experiencing highly localized, event-driven booms. The MEA, specifically the Gulf Cooperation Council (GCC) states, is investing colossal sums into dedicated tourism infrastructure and high-profile international events, generating substantial, though often project-based, demand for complex, high-impact projection mapping, immersive audio, and cutting-edge large-format display solutions, often necessitating the sourcing of best-in-class integration expertise from global markets.

- North America (NA): Dominant market leader characterized by high corporate IT spending, early adoption of UCaaS, and rapid conversion to advanced, secured AV-over-IP architectures.

- Asia Pacific (APAC): Fastest-growing region globally, driven by massive urbanization, new commercial construction volumes, and government investment in digital infrastructure and educational technology deployments.

- Europe (EU): Mature market focused on sustainable, energy-efficient AV systems, strong regulatory adherence, and pioneering adoption of flexible AV-as-a-Service (AVaaS) business models.

- Latin America (LATAM): Developing market segment fueled by increasing government investment in public education and the accelerating growth of corporate and retail modernization projects.

- Middle East & Africa (MEA): Growth highly concentrated around large government-backed infrastructure projects, tourism sector investment, and significant demand for high-impact, large venue display and audio systems for entertainment complexes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pro AV Sales Market.- Samsung Electronics

- LG Electronics

- Sony Corporation

- NEC Display Solutions

- Microsoft Corporation

- Cisco Systems

- Crestron Electronics

- AMX (Harman International)

- Extron Electronics

- Poly

- Shure Incorporated

- Bose Professional

- Barco N.V.

- Panasonic Corporation

- Christie Digital Systems

- Biamp Systems

- QSC

- ClearOne

- Audinate

- Milestone AV Technologies

Frequently Asked Questions

Analyze common user questions about the Pro AV Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Pro AV Sales Market?

The primary factor is the ubiquitous requirement for hybrid work and learning environments, necessitating extensive integration of high-quality, reliable unified communication (UC) and collaboration technologies into physical spaces, thereby accelerating the convergence of AV and IT networks and driving infrastructure refresh cycles.

How is AV-over-IP technology transforming system integration?

AV-over-IP (Networked AV) is transforming integration by enabling the transmission of high-resolution audio and video data over standard, scalable IT network infrastructure, drastically simplifying proprietary cabling, enhancing system flexibility, and allowing for centralized, software-based remote management and monitoring.

Which end-user segment is anticipated to exhibit the fastest growth rate?

The Education and Healthcare end-user segments are anticipated to show the fastest growth rate, driven by the persistent need for remote learning solutions, sophisticated lecture capture systems, advanced medical visualization, and the deployment of remote patient monitoring facilities utilizing high-definition, integrated AV equipment.

What role does Artificial Intelligence (AI) play in modern Pro AV solutions?

AI plays a critical role in automating core system functions, including intelligent meeting orchestration, automated camera framing, acoustic noise suppression, proactive predictive maintenance, and generating essential usage analytics to optimize costly real estate utilization and greatly enhance overall user experience and productivity.

What are the main financial challenges restricting market penetration?

The main financial challenge is the high initial capital expenditure (CapEx) typically required for sophisticated, fully integrated Pro AV installations. This cost barrier is increasingly being mitigated by the rapid growth and widespread adoption of flexible, subscription-based AV-as-a-Service (AVaaS) models, shifting CapEx to OpEx.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager