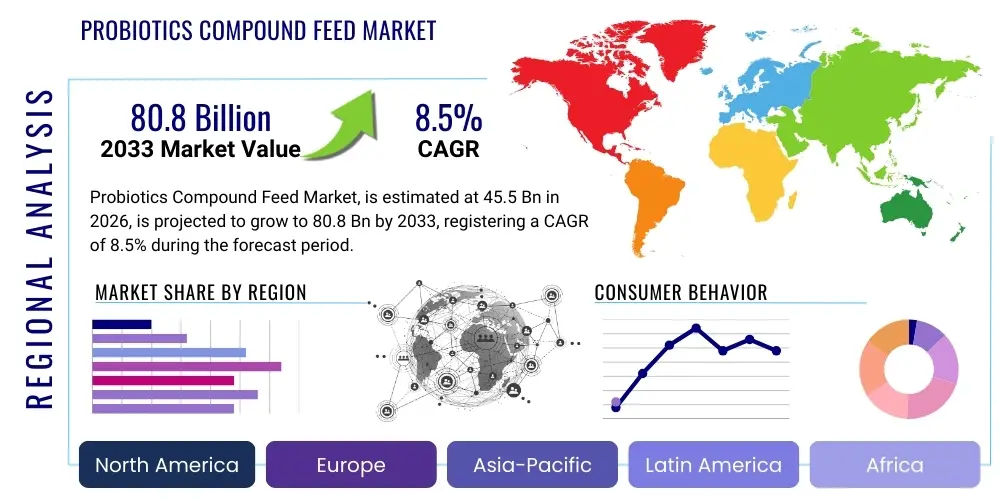

Probiotics Compound Feed Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443138 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Probiotics Compound Feed Market Size

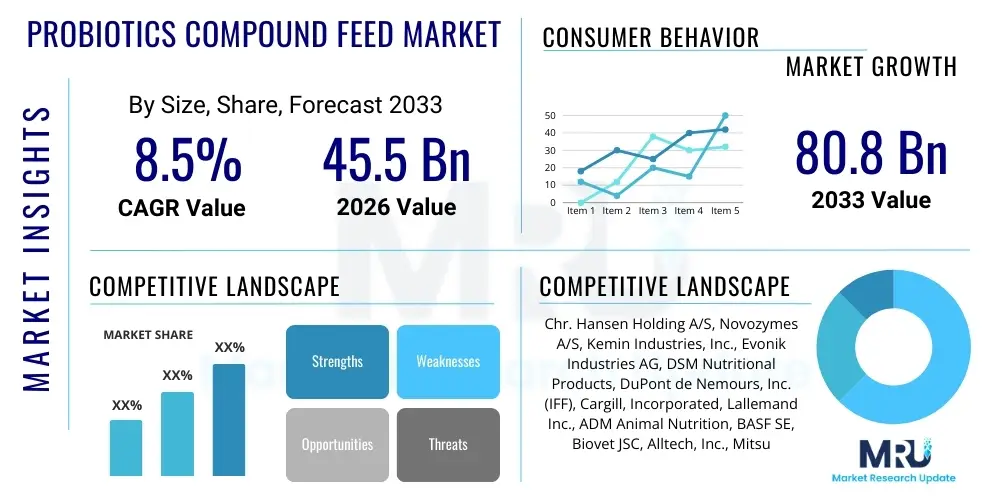

The Probiotics Compound Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 80.8 Billion by the end of the forecast period in 2033.

Probiotics Compound Feed Market introduction

The Probiotics Compound Feed Market encompasses the formulation and commercialization of livestock and aquaculture feed supplements containing beneficial live microorganisms. These microbial supplements, primarily consisting of bacterial species such as Lactobacillus, Bifidobacterium, Streptococcus, and yeast like Saccharomyces cerevisiae, are incorporated directly into compound feeds to enhance animal gut health, improve nutrient absorption efficiency, and bolster immune function. The fundamental mechanism involves competitive exclusion, where these beneficial microbes colonize the host's gastrointestinal tract, thereby inhibiting the proliferation of pathogenic bacteria like Salmonella and E. coli. This natural approach to health management is gaining traction globally as consumer demand for sustainably raised animal protein increases and regulatory pressures mandate the reduction or elimination of antibiotic growth promoters (AGPs) in livestock production.

Major applications of probiotics compound feed span across key livestock sectors, notably poultry (broilers and layers), swine (pigs), ruminants (cattle and sheep), and the rapidly expanding aquaculture industry (fish and shrimp). In poultry farming, these feeds are crucial for improving the Feed Conversion Ratio (FCR) and reducing mortality rates, particularly during stressful periods such as weaning or transportation. For swine, probiotics help stabilize the gut microbiota post-weaning, minimizing the incidence of diarrhea and maximizing growth performance. The benefits are multifaceted, extending beyond immediate health improvements to long-term operational efficiency, yielding higher quality meat and dairy products, and supporting environmentally sound farming practices by potentially reducing nitrogen and phosphorus excretion.

The market growth is primarily driven by critical factors including the global shift away from prophylactic antibiotic use in farm animals, catalyzed by increasing awareness of antimicrobial resistance (AMR) risks in human health. Furthermore, increasing global meat consumption, especially in developing economies of Asia Pacific, necessitates high-efficiency, sustainable animal production systems. Scientific advancements in microbial strain selection, genetic engineering to enhance probiotic robustness, and sophisticated microencapsulation techniques to ensure viability during feed processing and storage are further fueling adoption across large-scale commercial farming operations seeking optimized animal performance metrics.

Probiotics Compound Feed Market Executive Summary

The Probiotics Compound Feed Market is experiencing robust expansion, fundamentally driven by shifts in global regulatory frameworks and evolving consumer preferences favoring natural, antibiotic-free animal products. Business trends indicate a strong focus on strategic mergers and acquisitions among major feed manufacturers and specialized biotech firms, aimed at consolidating microbial strain portfolios and expanding geographic reach, particularly into high-growth markets like India, China, and Brazil. Investment is heavily concentrated in developing novel, temperature-stable, spore-forming probiotic strains that can withstand the high-temperature pelleting process typical of compound feed manufacturing, thereby maximizing efficacy and shelf life. Furthermore, key industry players are increasingly leveraging precision nutrition platforms and farm management software to integrate probiotic supplementation into highly customized, data-driven feeding regimes, enhancing overall operational transparency and performance tracking.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market segment, primarily due to the massive scale of its domestic poultry and swine industries, coupled with the rapid expansion of intensive aquaculture operations. Governments across major APAC economies are actively implementing regulations to curb antibiotic use, creating a massive vacuum that is being rapidly filled by probiotic solutions. Europe maintains a strong position, characterized by stringent existing regulations concerning animal welfare and antibiotic use, making it a mature market segment where adoption rates are already high, focusing now on optimizing dosage and specific application efficacy (e.g., early life nutrition). North America, while having robust market infrastructure, is showing accelerating growth driven by large-scale meat producers responding directly to consumer demand for natural products and seeking effective alternatives to maintain herd health post-antibiotic withdrawal.

Segment trends reveal that the poultry category consistently dominates the market share due to the short lifecycle and high throughput demands of broiler production, making performance gains from improved FCR economically critical. However, the aquaculture segment, particularly focused on shrimp and marine fish farming, is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is necessitated by the high stress environment in intensive aquaculture, which makes aquatic animals highly susceptible to bacterial diseases, thus requiring robust microbial intervention strategies. Ingredient segmentation highlights the increasing preference for multi-strain formulations and the growing adoption of yeast-based probiotics (e.g., Saccharomyces) for ruminants, focused on improving rumen function and nutrient breakdown efficiency in complex digestive systems.

AI Impact Analysis on Probiotics Compound Feed Market

Common user questions regarding AI’s impact on the Probiotics Compound Feed Market typically revolve around precision formulation capabilities, predictive health management, and optimization of supply chain logistics for sensitive biological products. Users are keen to understand how Artificial Intelligence can move the industry beyond generalized supplementation to personalized, real-time dosing strategies tailored to specific farm conditions, animal genetics, and environmental stressors. Key themes surfacing include concerns about data infrastructure required to implement these systems, the accuracy of predictive algorithms in forecasting disease outbreaks preventable by probiotics, and the potential for AI to identify novel, highly effective microbial strains from vast genomic databases. The overarching expectation is that AI will dramatically increase the efficacy and cost-effectiveness of probiotic interventions, ensuring maximum viability and impact while minimizing waste.

AI’s influence is profound in revolutionizing feed manufacturing, moving from static formulas to dynamic, responsive blends. Machine learning algorithms analyze continuous inputs from animal health monitoring systems, environmental sensors (temperature, humidity), and genomic data to recommend precise changes to the probiotic composition and inclusion rate. This level of algorithmic sophistication allows manufacturers to optimize the survival and colonization rate of specific probiotic strains under varying operational conditions, ensuring peak performance. Furthermore, AI models are essential in simulating the complex interactions between different microbial strains within the gut microbiome, accelerating the research and development phase for novel, multi-species probiotic products designed to target specific physiological challenges, such as mitigating the impact of heat stress or managing specific dietary transitions.

In terms of commercial strategy, AI tools are enhancing supply chain resilience. Given that many probiotic strains require temperature control and careful handling, predictive analytics optimize inventory management, transport routes, and storage conditions to minimize loss of viability between the manufacturing site and the farm gate. This technological integration is critical for maintaining product quality and guaranteeing efficacy upon consumption. Ultimately, AI transforms the probiotics compound feed offering from a standard additive to a highly sophisticated, data-driven solution that integrates seamlessly into modern, large-scale precision livestock farming, driving significant improvements in sustainability, animal health outcomes, and economic returns for producers.

- AI-Driven Precision Formulation: Machine learning optimizes probiotic inclusion rates based on real-time factors (genetics, health status, environmental data) to maximize FCR and immune response.

- Predictive Gut Health Modeling: Algorithms analyze microbiome data to predict susceptibility to specific pathogens, enabling prophylactic dosing adjustments before disease onset.

- Novel Strain Discovery: AI accelerates the screening of microbial genomic databases to identify and validate new, highly resilient probiotic strains with enhanced colonization efficiency.

- Optimized Supply Chain Logistics: Predictive analytics manage cold chain integrity and inventory for sensitive biological ingredients, minimizing viability loss during storage and transit.

- Automated Quality Control: Computer vision and AI systems ensure consistent dispersion and concentration of probiotic microencapsulations within the final compound feed pellets.

DRO & Impact Forces Of Probiotics Compound Feed Market

The Probiotics Compound Feed Market is subject to strong structural forces primarily driven by regulatory mandates and global health concerns. The primary driver is the widespread governmental crackdown and eventual bans on the use of antibiotic growth promoters (AGPs) in livestock farming across developed and rapidly developing nations, forcing the industry to seek effective, non-therapeutic alternatives like probiotics to maintain animal productivity and prevent disease. Concurrently, escalating consumer demand for organic, natural, and antibiotic-free meat and dairy products acts as a powerful pull factor, compelling large retailers and processors to implement sourcing standards that favor animals raised using natural gut health modifiers. This strong confluence of regulatory push and consumer demand ensures sustained investment and market expansion for probiotic feed solutions.

However, significant restraints temper the market’s explosive growth potential. A key challenge lies in the technical complexities associated with maintaining the viability and shelf stability of live microorganisms during the harsh processes of feed manufacturing, particularly high-heat pelleting. This necessitates costly and advanced microencapsulation technologies, which increase the final product cost. Furthermore, complex and inconsistent regional regulatory approvals for novel microbial strains pose a logistical hurdle, requiring extensive and costly efficacy and safety trials. Storage challenges, especially in developing regions lacking robust cold chain infrastructure, can compromise product quality, leading to skepticism among end-users regarding efficacy consistency. Another restraint is the variable efficacy observed in on-farm trials, often attributable to differing farm management practices, existing microbial load, and animal genetics, complicating standardization and large-scale adoption.

Opportunities within this market are substantial, particularly in the rapid expansion of intensive aquaculture, where disease outbreaks carry high economic risk and regulatory oversight is often less restrictive than in terrestrial livestock. The development of personalized probiotic blends tailored to specific geographic regions, animal species, or even individual genetic lines represents a massive untapped niche, leveraging genomic and microbiome analysis. The market also presents significant potential for functional ingredient synergy, where probiotics are combined with prebiotics (synbiotics), essential oils, or organic acids, creating more potent, holistic gut health solutions that address multiple physiological challenges simultaneously. Addressing the viability restraint through advancements in spore-forming bacteria and advanced protective matrix formulations remains the most lucrative avenue for technological differentiation and market capture.

Segmentation Analysis

The Probiotics Compound Feed Market is segmented based on critical factors including the type of animal to which the feed is administered, the specific strain of microorganism utilized, the form of the final product, and the geographic region. Segmentation by animal type is crucial as the physiological and dietary requirements, as well as the target gut microbiome composition, vary significantly across poultry, swine, ruminants, and aquaculture species, necessitating highly specific product formulations. Ingredient segmentation distinguishes between bacterial and yeast strains, reflecting differing mechanisms of action—for example, spore-forming bacteria known for robustness versus yeasts valued for their capacity to sequester mycotoxins and stimulate immune responses. Understanding these segments allows manufacturers to tailor marketing strategies and product development to address highly specialized needs within the global animal production industry, maximizing penetration across diverse operational scales and regulatory environments.

- Animal Type:

- Poultry (Broilers, Layers, Turkeys)

- Swine (Starter, Grower, Finisher)

- Ruminants (Cattle, Sheep, Goats)

- Aquaculture (Fish, Shrimp, Mollusks)

- Pets and Others (Companion Animals)

- Microorganism Type:

- Bacteria (Lactobacillus, Bifidobacterium, Bacillus, Streptococcus)

- Yeast (Saccharomyces cerevisiae, Aspergillus)

- Others (Fungi)

- Form:

- Dry (Powder, Pellets, Granules)

- Liquid/Gel

- Function:

- Immunity Enhancement

- Growth Promotion (Improved FCR)

- Disease Prevention (Pathogen Exclusion)

- Stress Mitigation

Value Chain Analysis For Probiotics Compound Feed Market

The value chain for the Probiotics Compound Feed Market commences with the rigorous upstream sourcing and selection of high-performing microbial strains. This initial stage involves intense R&D by specialized biotechnology companies and academic institutions to isolate, characterize, and genetically stabilize desirable strains that demonstrate high colonization potential, resilience to gastric acids, and stability during processing. Raw materials also include specialized carriers and encapsulating agents necessary to protect the live organisms. Quality assurance during the upstream phase is paramount, involving stringent microbiological testing and fermentation optimization to produce high-concentration, pure probiotic biomass. Suppliers of these core ingredients (e.g., purified cultures, proprietary blends) hold significant power due to the specialized knowledge required and the need for proprietary genetic rights.

The midstream involves the integration of these highly potent probiotic ingredients into the final compound feed formulation. Large-scale feed mills or specialized feed additive processors take the raw probiotic concentrates and incorporate them, often post-heat treatment, using advanced mixing and pelleting technologies that minimize temperature damage. Critical steps here include microencapsulation (to enhance thermostability) and precise dosing to ensure uniform distribution throughout the large feed batches. This manufacturing process demands high capital investment in specialized equipment and strict adherence to hygiene standards to prevent contamination. The downstream activities focus on distribution, moving the finished probiotic compound feed from the manufacturing plant to the end-users.

Distribution channels are multifaceted, utilizing both direct and indirect routes. Direct sales are common for large commercial farms, integrating strategic consulting and technical support services alongside product delivery. Indirect distribution utilizes a network of specialized feed distributors, agricultural cooperatives, and regional veterinary supply companies, particularly serving smaller-to-medium-sized farm operations. E-commerce platforms are emerging, offering specialized feed additives directly to niche markets such as pet owners or home-mixers. Effective downstream logistics require managing large volumes while adhering to necessary storage conditions, although the shift toward highly stable, spore-forming probiotics is mitigating some of the traditional cold chain complexities, making the product more accessible globally.

Probiotics Compound Feed Market Potential Customers

The primary potential customers and buyers in the Probiotics Compound Feed Market are large-scale commercial livestock and poultry integrators that operate highly efficient, vertically integrated production systems. These large entities, characterized by high animal density and stringent performance metrics (FCR, mortality rates), rely heavily on advanced nutritional inputs to maintain health without prophylactic antibiotics. They represent the largest volume buyers, often entering into long-term supply contracts for customized feed blends. Their purchasing decisions are driven by proven efficacy metrics demonstrated through robust scientific trials and the total economic benefit derived from reduced veterinary costs and improved weight gain, rather than simply the unit price of the supplement.

Another major customer segment includes aquaculture farms, particularly intensive operations managing high-value species like shrimp, salmon, and specific marine finfish. In aquaculture, the closed-system environment makes disease transmission rapid and catastrophic, positioning probiotics as a critical tool for maintaining water quality and gut health under stress conditions. These buyers require specialized, water-stable formulations that can be efficiently delivered to aquatic species. Furthermore, smaller, independent commercial farms and specialized breeding operations represent a fragmented but important customer base. While these customers purchase smaller volumes, they often prioritize specialized, high-performance supplements and are influenced heavily by local veterinary recommendations and cooperative purchasing programs.

Lastly, specialized feed manufacturers, who formulate and blend finished feeds for regional distribution, act as indirect but crucial customers. They purchase bulk probiotic concentrates and proprietary strain blends from biotech suppliers to incorporate into their own branded compound feeds, which are then sold to the final farmers. This segment requires assurances regarding blending compatibility, thermal stability, and regulatory compliance. The emerging customer base includes organic and niche meat producers who specifically market their products based on 'natural rearing' claims, prioritizing probiotics as a key differentiator and necessary component of their compliance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 80.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chr. Hansen Holding A/S, Novozymes A/S, Kemin Industries, Inc., Evonik Industries AG, DSM Nutritional Products, DuPont de Nemours, Inc. (IFF), Cargill, Incorporated, Lallemand Inc., ADM Animal Nutrition, BASF SE, Biovet JSC, Alltech, Inc., Mitsui & Co., Ltd., Novus International, Inc., Phileo Lesaffre Animal Care, Provita Eurotech Ltd., Neospark Drugs and Chemicals Pvt. Ltd., Calpis Co., Ltd. (Asahi Group), Unique Biotech, and Vetoquinol S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Probiotics Compound Feed Market Key Technology Landscape

The Probiotics Compound Feed Market is characterized by continuous technological innovation, largely centered on maximizing the viability and targeted efficacy of live microbial ingredients under industrial conditions. A fundamental technological advancement driving market acceptance is microencapsulation, which involves coating probiotic cells with a protective matrix (often polysaccharides or lipids) to shield them from high temperatures experienced during feed pelleting (often up to 85°C) and the acidic environment of the animal's stomach. Sophisticated techniques such as spray-drying, fluidized bed coating, and extrusion technologies are continually refined to improve the survival rate of sensitive non-spore-forming strains like Lactobacillus, ensuring a high concentration of live cells reaches the distal gut where colonization occurs.

Another critical area of development is the utilization of advanced genomics and molecular biology for strain selection and genetic engineering. Next-generation sequencing (NGS) allows researchers to rapidly analyze the entire genome of candidate probiotic strains, identifying genes responsible for adhesion, anti-pathogenic activity, and antibiotic resistance, thereby ensuring safety and effectiveness. This precision screening helps in formulating targeted probiotic blends, sometimes incorporating genetically modified strains engineered for enhanced survival or increased production of specific beneficial metabolites, such as short-chain fatty acids (SCFAs). Furthermore, the application of bioinformatics is becoming essential in understanding the complex interactions within the animal gut microbiome, enabling the design of 'smart' synbiotics that optimally combine a prebiotic substrate with a specific probiotic strain to maximize colonization and metabolic activity.

Beyond ingredient formulation, advancements in feed processing technology, such as specialized mixers and post-pelleting liquid application (PPLA) systems, are crucial for ensuring homogeneous distribution and reducing thermal degradation of heat-sensitive ingredients. PPLA involves applying the liquid probiotic suspension onto the surface of cooled feed pellets, bypassing the high-heat extrusion process entirely. While this avoids thermal damage, it necessitates improved storage conditions and rapid consumption. Overall, the technological landscape is moving towards highly stable, personalized, and functional feed additives, relying on robust encapsulation, deep genomic insights, and precise application machinery to deliver consistent performance in challenging commercial farming environments.

Regional Highlights

The global distribution of the Probiotics Compound Feed Market exhibits significant variations driven by regional livestock production scales, regulatory environments, and economic development levels. Asia Pacific (APAC) currently dominates the market both in terms of consumption volume and growth rate, primarily due to the massive scale of swine and poultry production in China, India, and Southeast Asian nations. The region is undergoing a rapid transition towards intensive farming practices and is concurrently implementing stricter control measures on AGP usage, creating an immense, immediate demand for probiotic alternatives to ensure the health of vast animal populations. Investment in aquaculture feed probiotics is particularly strong in coastal APAC countries, addressing high disease pressures in shrimp and fish farming.

Europe represents a mature and highly regulated market, where the complete ban on antibiotic growth promoters has been in effect for many years (EU Regulation 1831/2003). Consequently, probiotic adoption rates are high, and the focus is now on optimizing performance through next-generation strain development, often targeting specific animal welfare indicators and sustainable farming standards. Germany, France, and the Netherlands lead in technological adoption, particularly concerning precise dosing and highly specialized synbiotic formulations for dairy cattle and early-life piglet nutrition. Regulatory approval processes, governed by EFSA (European Food Safety Authority), are rigorous but provide a stamp of quality for globally marketed strains.

North America (primarily the US and Canada) is characterized by large, consolidated livestock operations and high R&D spending. While regulatory change towards AGPs has been slower than in Europe, consumer and retailer pressure has rapidly accelerated the voluntary transition towards "Raised Without Antibiotics" (RWA) programs, directly fueling probiotic demand. Innovation here focuses heavily on integrating microbial solutions with digital farming tools, using data analytics to prove economic return. Latin America (LATAM), particularly Brazil and Argentina, shows significant potential due to its status as a major global exporter of beef, poultry, and soy. While cost sensitivity remains a factor, the drive to meet international import standards for antibiotic-free products is pushing the adoption of quality probiotic feed additives.

- Asia Pacific (APAC): Market leader and fastest-growing region, driven by the industrialization of poultry and swine sectors in China and India. High demand stems from aquaculture expansion and aggressive governmental phase-out of AGPs.

- Europe: Mature market defined by high regulatory stringency (AGP ban). Focuses on high-value, sophisticated synbiotic products and advanced formulations for ruminant health and sustainability metrics.

- North America: Accelerating growth driven by retailer RWA programs and consumer demand for natural products. Strong emphasis on data integration (precision livestock farming) to validate probiotic efficacy and ROI.

- Latin America (LATAM): Emerging high-growth market, particularly in Brazil and Argentina, driven by the necessity to meet international export standards for antibiotic-free meat. Cost-effectiveness and locally adapted strains are key success factors.

- Middle East and Africa (MEA): Nascent market with potential, particularly in poultry sectors of Gulf Cooperation Council (GCC) countries and South Africa. Growth is dependent on improving logistics infrastructure and localized product viability testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Probiotics Compound Feed Market.- Chr. Hansen Holding A/S

- Novozymes A/S

- Kemin Industries, Inc.

- Evonik Industries AG

- DSM Nutritional Products

- DuPont de Nemours, Inc. (IFF)

- Cargill, Incorporated

- Lallemand Inc.

- ADM Animal Nutrition

- BASF SE

- Biovet JSC

- Alltech, Inc.

- Mitsui & Co., Ltd.

- Novus International, Inc.

- Phileo Lesaffre Animal Care

- Provita Eurotech Ltd.

- Neospark Drugs and Chemicals Pvt. Ltd.

- Calpis Co., Ltd. (Asahi Group)

- Unique Biotech

- Vetoquinol S.A.

Frequently Asked Questions

Analyze common user questions about the Probiotics Compound Feed market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using probiotics in compound feed for livestock?

The primary benefit is the enhancement of gut health and immune function, which directly improves the Feed Conversion Ratio (FCR), reduces reliance on antibiotic growth promoters (AGPs), and lowers animal mortality rates, leading to significant economic and sustainability gains for producers.

Which microbial strains are most commonly utilized in commercial probiotic compound feeds?

The most commonly utilized strains include spore-forming bacteria such as Bacillus subtilis and Bacillus licheniformis due to their high stability during feed processing, alongside non-spore-forming bacteria like various species of Lactobacillus and Bifidobacterium, and yeasts such as Saccharomyces cerevisiae.

How does the global ban on antibiotic growth promoters (AGPs) influence the market for probiotic feed?

The global regulatory phase-out of AGPs is the single strongest driver, creating a massive, mandated demand for effective alternatives. Probiotics are recognized as highly effective non-therapeutic solutions to maintain animal productivity and prevent enteric diseases in the absence of routine antibiotics.

What technological challenge must probiotic compound feed manufacturers overcome to ensure product efficacy?

Manufacturers must overcome the challenge of maintaining the viability of live microbial cells. This is achieved through advanced microencapsulation technologies and utilizing heat-stable, spore-forming strains, protecting the organisms from high temperatures during feed pelleting and gastric acids during digestion.

Which animal segment holds the largest market share in the probiotics compound feed industry?

The poultry segment, encompassing broiler and layer production, holds the largest market share globally. This dominance is due to the large scale of global poultry operations and the critical importance of optimizing FCR in their short production cycles, where probiotics yield measurable performance improvements.

Is there a difference in probiotic formulation for ruminants versus monogastrics like swine and poultry?

Yes, formulations differ significantly. Probiotics for monogastrics focus on intestinal colonization and competitive exclusion, while ruminant formulations (primarily yeast-based like Saccharomyces cerevisiae) often target improved rumen stability, fiber digestion efficiency, and pH balance in the foregut to enhance nutrient utilization.

What are synbiotics and why are they gaining traction in the animal nutrition sector?

Synbiotics are specialized functional blends combining probiotics (live beneficial microorganisms) and prebiotics (non-digestible feed ingredients that selectively nourish the probiotics). They gain traction because this combination offers a synergistic effect, maximizing the survival, colonization, and metabolic activity of the beneficial bacteria in the host's gut, offering superior health outcomes.

How does climate change affect the demand for probiotic compound feed?

Climate change increases the incidence and intensity of heat stress in livestock. Probiotics are increasingly utilized to mitigate the negative effects of heat stress, which often leads to gut permeability issues and reduced feed intake, by helping to stabilize the gut microbiome and reducing inflammatory responses, thereby maintaining productivity.

What role does genetic sequencing play in the development of new probiotic strains?

Genetic sequencing is essential for rapidly identifying novel microbial strains that possess superior traits, such as increased survival rates, targeted anti-pathogenic properties, or enhanced ability to produce beneficial metabolites. It ensures the safety profile and technical suitability of the strain for large-scale commercial application.

Are regulatory standards for probiotic feed ingredients uniform across different global regions?

No, regulatory standards are highly fragmented. Europe (EFSA) maintains the strictest approval process for live microorganisms as feed additives, requiring extensive data proving safety and efficacy. North America (FDA/AAFCO) and APAC nations have varying, often less stringent, or country-specific requirements, contributing to market complexity and requiring specialized compliance strategies.

Why is the aquaculture segment projected to have the highest growth rate for probiotic feed?

The aquaculture segment faces extreme disease pressure in intensive farming systems, and traditional antibiotic treatments are often inefficient and environmentally detrimental. Probiotics offer a highly effective and environmentally sound method to manage water quality, prevent vibriosis, and enhance fish and shrimp immune systems, driving rapid market adoption.

How do liquid probiotic additives differ from dry pelletized forms in application?

Liquid forms are often used in specialized applications, such as direct application onto day-old chicks or during water treatment, offering immediate action and higher live cell counts initially. Dry forms (pellets or powders) are incorporated directly into the bulk compound feed, prioritizing long-term stability and ease of large-scale inclusion for daily feeding.

What is the typical shelf life requirement for a high-quality probiotic compound feed?

A high-quality, thermostable probiotic compound feed typically requires a guaranteed shelf life of 6 to 12 months under standard storage conditions, ensuring that the minimum guaranteed inclusion rate of live Colony Forming Units (CFU) remains viable until the point of consumption on the farm.

How do probiotics contribute to environmental sustainability in livestock farming?

Probiotics enhance nutrient digestibility and absorption, leading to less undigested feed components being excreted. This results in reduced nitrogen and phosphorus run-off into the environment, mitigating water pollution and reducing the overall environmental footprint of livestock operations.

What financial risks are associated with switching from AGPs to probiotic feed programs?

The primary financial risk is the initial higher cost per ton of feed compared to traditional antibiotic supplements, coupled with the potential variability in efficacy if the farm management practices or environmental factors are not optimally controlled, requiring robust data collection to demonstrate consistent Return on Investment (ROI).

How is the concept of ‘personalized nutrition’ being applied within the probiotic feed market?

Personalized nutrition is emerging through the use of AI and diagnostic testing (like microbiome sequencing) to tailor probiotic strain combinations and inclusion rates based on the specific genomic background, current health status, and localized environmental challenges of a particular herd or flock, moving away from a one-size-fits-all approach.

What is the role of technical support in the sale of probiotic compound feed?

Technical support is crucial as probiotics require specific management and application protocols to succeed. Suppliers often provide extensive veterinary consultation, on-farm testing, and data analysis services to help producers integrate the feed effectively, monitor efficacy (e.g., FCR improvement), and troubleshoot potential issues, thereby enhancing customer retention.

Which factors influence a farmer's choice between different probiotic strains or products?

Farmers primarily consider proven efficacy data (especially local trial results), the stability and guaranteed CFU count of the product, the reputation and support offered by the supplier, the regulatory approval status for their region, and the overall cost-benefit ratio (ROI) derived from improved animal performance.

What key strategic partnerships are common in the probiotics compound feed value chain?

Common partnerships include collaboration between biotech companies (strain developers) and large feed manufacturers (global distribution and formulation expertise), and alliances between feed companies and digital agriculture technology providers to integrate real-time monitoring and dosing solutions.

Does the form of the feed (mash vs. pellet) impact the efficacy of the probiotic additive?

Yes, significantly. Pelletized feed requires the probiotic strain to withstand high temperature and pressure during production, necessitating highly stable encapsulated or spore-forming strains. Mash feed often allows for the inclusion of more sensitive, non-spore-forming strains since it bypasses the harsh heating process, potentially offering broader microbial diversity but requiring careful handling.

How do probiotics help in reducing feed costs indirectly?

Probiotics indirectly reduce feed costs by significantly improving the Feed Conversion Ratio (FCR). By optimizing the animal's digestive process and nutrient absorption efficiency, less feed input is required to achieve the same amount of weight gain or productivity, leading to better operational economics.

What is the difference between an enzyme and a probiotic in animal nutrition?

Enzymes (e.g., phytase, amylase) are non-living proteins added to feed to chemically break down complex anti-nutritional factors or improve nutrient availability. Probiotics are live microorganisms that modify the animal's gut microbial population to enhance overall gut function, competitive exclusion of pathogens, and immune response.

Why is Bacillus species favored for inclusion in high-heat pelletized feeds?

Bacillus species are favored because they form dormant spores. These spores are highly resistant to heat, pressure, and chemical stress, allowing them to survive the high-temperature pelleting process of compound feed manufacturing and subsequently germinate into active cells once they reach the animal's gastrointestinal tract.

What is the estimated growth trajectory for the probiotics compound feed market in the next five years?

The market is projected for robust growth, forecasted at a CAGR of 8.5% through 2033, driven primarily by continued regulatory pressure on antibiotics, expanding global meat consumption, and technological advancements in strain stability and targeted efficacy, particularly in the APAC and aquaculture sectors.

Beyond growth promotion, what major health issues do probiotic feeds address in swine production?

In swine production, probiotics are critical for mitigating post-weaning diarrhea (PWD) and managing enteric pathogens, helping stabilize the piglet's immature gut microbiome during stressful dietary and environmental transitions when they are most susceptible to illness and mortality.

How do advanced monitoring technologies enhance the effectiveness of probiotic programs?

Advanced technologies, such as IoT sensors, fecal sampling diagnostics, and AI-driven farm management platforms, provide continuous data on animal health and environmental conditions, allowing producers and feed companies to dynamically adjust probiotic formulations and dosing protocols for maximum impact and faster response to emerging health risks.

What impact do high raw material prices, particularly for grains, have on the probiotic compound feed market?

High raw material prices intensify the need for performance optimization. When feed inputs are expensive, producers are more willing to invest in high-efficacy additives like probiotics to improve FCR, ensuring they maximize the return on their costly feed investment and minimize waste.

Are there specific risks associated with using multi-strain probiotic formulations?

While multi-strain formulations can offer broader health benefits, the risk lies in potential antagonistic interactions between strains, where one strain inhibits the growth or function of another. Scientific validation and rigorous compatibility testing are crucial to ensure that all strains in a blend work synergistically.

What is the significance of the "dose rate" or CFU count in probiotic compound feed effectiveness?

The dose rate, expressed as Colony Forming Units (CFU) per gram or kilogram of feed, is critical. Efficacy is often dose-dependent; insufficient CFU delivery may result in failure to colonize the gut effectively, leading to minimal health or performance benefits. Guaranteed CFU counts must remain stable through the product's shelf life.

How do leading companies protect their proprietary probiotic strains and technologies?

Leading companies utilize intellectual property protection mechanisms, primarily through obtaining patents on specific microbial strains, unique genetic modifications, novel microencapsulation techniques, and specific usage claims or delivery methods, ensuring exclusivity and defending their technological investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager