Probiotics Flour Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442549 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Probiotics Flour Market Size

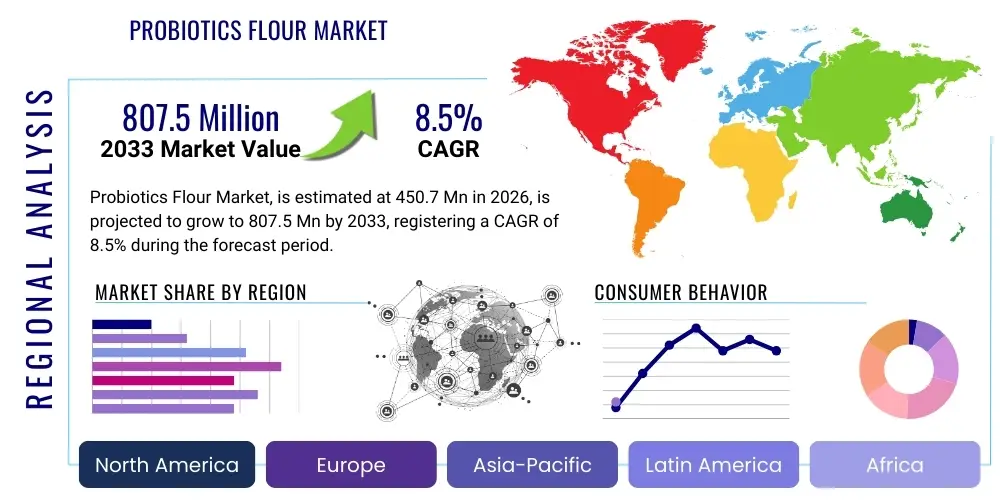

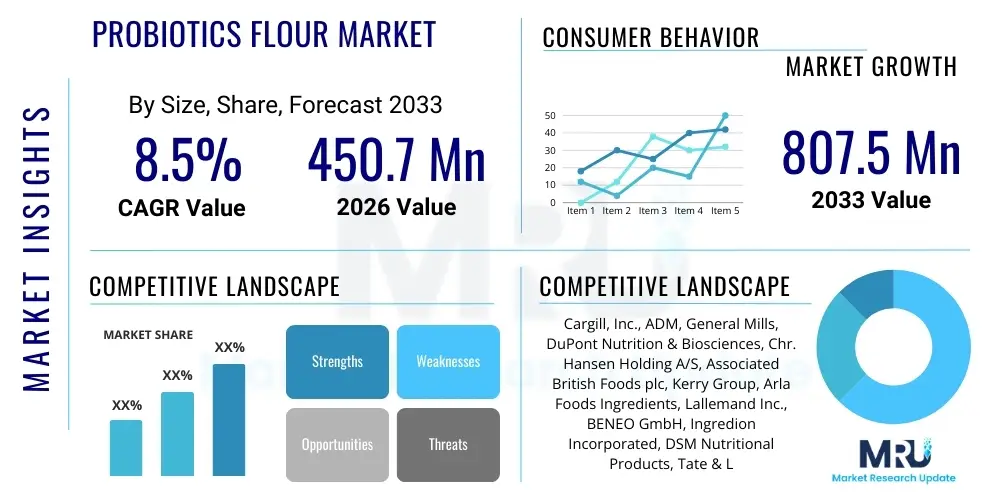

The Probiotics Flour Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.7 Million in 2026 and is projected to reach USD 807.5 Million by the end of the forecast period in 2033.

Probiotics Flour Market introduction

The Probiotics Flour Market represents a rapidly evolving niche within the broader functional food ingredients sector, defined by the integration of viable, health-benefiting microbial cultures into staple flour products used for baking and food production. This market segment is characterized by high technological sophistication, primarily focusing on maintaining the biological activity of delicate probiotic strains throughout the harsh conditions of processing, storage, and consumer preparation. These flours are not merely fortified but are engineered delivery systems, designed to ensure a measurable therapeutic dose of microorganisms reaches the lower gastrointestinal tract. The inherent appeal of this product lies in its ability to seamlessly incorporate significant health advantages into universally consumed food items, circumventing the need for consumers to adopt novel consumption routines or specialized supplements, thereby maximizing compliance and long-term consumption.

The core product offering involves specialized milling practices combined with advanced microencapsulation techniques. Unlike traditional flour, which serves purely as a carbohydrate matrix and structural component, Probiotics Flour is valued for its bioactive properties. The primary strains utilized include, but are not limited to, highly resilient species of Lactobacillus (e.g., L. acidophilus, L. rhamnosus) and Bifidobacterium (e.g., B. lactis, B. longum). The successful introduction of these cultures into flour depends critically on stability and bioavailability. Major applications extend across diverse food categories: ranging from industrial-scale bread production, which utilizes high volumes and seeks cost-effective stabilization, to niche applications in specialty baking mixes, performance nutrition bars, and extruded snack products. This versatility positions probiotic flour as a transformative ingredient across the entire spectrum of processed and prepared foods, enhancing the nutritional profile of widely accepted staples.

The market expansion is fundamentally driven by profound societal and scientific factors. Scientifically, there is an ever-increasing body of evidence linking dysbiosis—an imbalance in the gut microbiome—to a wide array of chronic conditions, including obesity, mental health disorders, and autoimmune diseases. This elevated scientific focus has translated directly into greater consumer literacy regarding digestive wellness. Economically, urbanization and busy lifestyles favor convenient, functional food solutions that can be consumed without major lifestyle adjustments. Key driving factors include the substantial growth in the global wellness movement, the rising prevalence of digestive issues (such as Irritable Bowel Syndrome), and technological breakthroughs that have significantly lowered the cost and increased the efficacy of thermal-stable probiotic cultures, making large-scale incorporation commercially viable. Furthermore, demographic shifts, particularly the growth of the aging population worldwide, which often requires dietary interventions to maintain digestive regularity and immune function, provide a sustained trajectory for market growth and premium product adoption.

Probiotics Flour Market Executive Summary

The Probiotics Flour Market is characterized by vigorous growth, underpinned by convergence between the milling industry and advanced biotechnology, positioning it at the forefront of the functional ingredients landscape. Strategic business trends indicate a critical focus on vertically integrated operations, where major ingredient suppliers are acquiring or partnering with specialized biotech firms to secure proprietary strains and encapsulation patents. This consolidation reflects the high value placed on intellectual property regarding strain stability and guaranteed cell count delivery. Furthermore, sustainability has emerged as a key differentiator; companies are increasingly adopting circular economy principles and sourcing non-GMO, organic flours, aligning with consumer demand for transparency and clean labeling. Investment in digital platforms for supply chain traceability, particularly concerning the temperature-sensitive nature of the ingredients, is also a burgeoning trend among industry leaders focused on maintaining product integrity across complex logistics networks.

Regionally, the market displays clear stratification. North America and Western Europe maintain market leadership due to high consumer willingness to pay a premium for verified health attributes, coupled with mature retail infrastructure capable of handling specialized food ingredients. These regions benefit from established consumer trust in functional products and proactive marketing campaigns linking diet to holistic health. However, the future epicenter of volume growth is unequivocally shifting towards the Asia Pacific (APAC) region, specifically in emerging economies like China and India, where rising disposable incomes intersect with rapid exposure to Western functional food concepts. Regional growth strategies emphasize adaptation to local staple ingredients; for instance, developing stable rice-based probiotic flours in Asia and corn-based variants in Latin America. Regulatory harmonization remains a challenge, with significant divergence between the stringent, pre-market approval systems of the EU and the generally broader acceptance routes in the US, requiring localized compliance strategies.

Segmentation trends highlight a pronounced shift in consumer preference away from ubiquitous wheat-based products towards specialized and alternative grain flours. The gluten-free segment, encompassing rice, oat, and lentil flours fortified with probiotics, is exhibiting exceptional compound annual growth, driven by medical necessity and elective dietary choices. In terms of application, while conventional bread remains the largest volume segment, functional snack bars and fortified breakfast cereals are demonstrating higher value growth, appealing directly to the on-the-go consumer seeking immediate health impact. The competitive landscape is becoming increasingly polarized, featuring a few large, diversified global ingredient powerhouses (e.g., IFF, Chr. Hansen) competing with specialized, high-tech boutique firms focused entirely on superior microencapsulation technology. Success hinges on verifiable clinical substantiation of strain efficacy, excellence in stabilizing cultures against thermal degradation, and achieving cost-efficiency in large-scale production without compromising viable cell count.

AI Impact Analysis on Probiotics Flour Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to revolutionize the entire value chain of the Probiotics Flour Market, addressing some of the industry's most persistent technical and commercial challenges. Common user inquiries often focus on how AI can enhance the efficacy of these products, specifically asking about predictive modeling for strain stability and how individualized dietary recommendations can be operationalized. Users are keen to understand if AI can move probiotic flour formulations beyond standardized offerings toward highly targeted, personalized nutritional solutions based on genomic or metabolomic data. Furthermore, concerns frequently arise about the scalability of complex fermentation processes, where traditional methods often suffer from high variability and low yields, areas where AI-driven optimization promises significant gains in efficiency and consistency.

In the research and development phase, AI significantly accelerates the identification and optimization of 'super strains' best suited for flour fortification. By analyzing vast databases of microbial genomes, fermentation kinetic data, and thermal stress response profiles, ML algorithms can predict which encapsulation method and which specific strain combination will yield the maximum survivability during the 200°C+ temperatures of baking. This predictive capacity drastically reduces the need for expensive, time-consuming wet-lab trials. Furthermore, AI models can simulate complex ingredient interactions, such as the compatibility between high-fiber flours and specific probiotic strains, thereby optimizing the final product formulation for both texture and functional integrity. This analytical power is essential for competitive advantage, allowing companies to launch highly stable and clinically effective products faster than competitors reliant on traditional empirical testing protocols.

AI also plays a critical role in optimizing industrial manufacturing and quality control, which is paramount for a functional product where efficacy depends on cell count. Sensors and AI-powered vision systems monitor blending processes in real-time, ensuring uniform distribution of the costly encapsulated probiotics, preventing sedimentation or clumping, and verifying consistency across massive batches. During storage and distribution, AI systems utilize multivariate data (temperature, humidity, time) collected from IoT sensors to create dynamic shelf-life models, providing highly accurate expiry predictions and significantly reducing logistical waste related to viability loss. Commercially, AI algorithms analyze fragmented market data, including consumer purchase patterns, geo-specific health trends (e.g., regional allergy outbreaks), and social media feedback, enabling producers to fine-tune marketing efforts, predict demand peaks for specific formulations (e.g., immune-support strains), and rapidly adjust inventory levels, ensuring maximal freshness and potency upon delivery to the consumer and optimizing resource deployment globally.

- AI optimizes probiotic strain selection for enhanced thermal stability and targeted health benefits using bioinformatics and genomic analysis.

- Machine learning algorithms enable hyper-personalized flour recommendations based on individual microbiome, lifestyle, and dietary data, driving custom formulation services.

- Predictive modeling and smart sensors facilitate real-time quality control, ensuring required Colony Forming Unit (CFU) integrity throughout the milling and blending processes.

- AI-powered process optimization reduces variance in large-scale fermentation and microencapsulation, lowering production costs and improving yield reliability.

- Natural Language Processing (NLP) analyzes global consumer sentiment and health forums to identify emerging unmet nutritional needs and inform agile product innovation cycles.

DRO & Impact Forces Of Probiotics Flour Market

The structural growth of the Probiotics Flour Market is fundamentally shaped by powerful synergistic forces: market drivers that create demand, constraints that temper expansion speed, and opportunities that define future strategic direction. The primary driver remains the monumental consumer shift toward preventative nutrition, fueled by widespread media coverage and confirmed scientific understanding of the Gut Microbiome Project. Consumers are actively seeking functional foods that integrate health benefits into existing dietary habits, and probiotic flour perfectly addresses this convenience-driven demand for 'effortless wellness.' Furthermore, technological advancements, specifically in second and third-generation microencapsulation (e.g., matrix embedding and multilayer coating), act as a critical enabling factor, overcoming the historical challenge of heat sensitivity, thereby expanding the applicability of probiotics into conventional baking processes that were previously prohibitive. The rising incidence of lifestyle diseases and dietary allergies also compels manufacturers to innovate with specialized, functional ingredients.

Despite these strong drivers, significant restraints temper the market’s velocity. The most impactful constraint is the inherent high cost of production, which involves sourcing highly purified strains, performing complex stabilization processes, and managing specialized supply chains that often require temperature control. This elevated cost translates into a substantial price premium over standard flours, creating friction in price-sensitive developing economies and hindering mass adoption globally. Secondly, the regulatory landscape remains a formidable obstacle; achieving approved, verifiable health claims (especially in regions like the European Union) requires multi-year, multi-million dollar clinical trials that are financially prohibitive for many small and medium-sized enterprises. The persistent technical challenge of guaranteeing high CFU counts throughout the product’s entire shelf life and consumption process also poses a risk of consumer dissatisfaction if products fail to meet expectations based on label claims.

The market's long-term viability is defined by substantial opportunities for innovation and geographical penetration. One major opportunity lies in hyper-specialization, developing flours with targeted strains intended for specific clinical cohorts, such as flours optimized for diabetic consumers (low glycemic index flours paired with strains that modulate blood sugar) or flours for athletes requiring optimized protein digestion and reduced inflammation. Furthermore, capitalizing on the rising global demand for plant-based and allergen-free products presents an opening for innovative formulations using alternative grain sources like ancient grains (teff, quinoa) or legumes. Geographical expansion into high-growth, underserved markets like Southeast Asia and Eastern Europe offers volume potential, provided cultural and dietary preferences are successfully accommodated. Strategic partnerships with major food manufacturers to integrate probiotic flours into mass-market processed foods (beyond artisanal bread) represent the pathway to achieving widespread consumer reach and maximizing impact force utilization.

Segmentation Analysis

Segmentation provides a crucial framework for understanding the diverse dynamics within the Probiotics Flour Market, allowing stakeholders to identify high-growth areas and tailor product development to specific consumer needs. The market’s segmentation is multidimensional, capturing differences in biological input (strain type), raw material base (flour source), intended use (application), and route to market (distribution). This analysis is essential because the profitability and growth prospects differ dramatically between, for example, a high-volume wheat-based bread segment and a niche, high-value oat-based baby food segment. Strategic decision-making, including pricing, research and development allocation, and partnership formation, relies on accurate assessment of these segmented market characteristics to maximize resource efficiency and market penetration.

The By Strain Type segmentation underscores the functional specialization inherent in the market. Lactobacillus strains currently command a larger market share due to their long history of use and proven benefits in general digestive and immune health, widely integrated into basic baked goods. However, the Bifidobacterium segment is witnessing accelerated growth as clinical research increasingly links specific strains to complex health outcomes, including mental health support (via the gut-brain axis) and specific irritable bowel syndrome management. The "Others" category, including yeasts like Saccharomyces boulardii, offers unique opportunities for producers targeting stability in highly acidic or processed foods. Successful players continuously invest in proprietary strains that offer superior performance and verifiable health claims to dominate specific functional niches and achieve premium pricing.

Segmentation by Flour Source reveals the market’s response to dietary shifts. While traditional Wheat Flour dominates in volume due to its ubiquity and excellent baking properties, the significant structural growth is observed in the Specialty Grains segment (e.g., amaranth, quinoa, millet) and certified gluten-free flours (rice, oat). This trend is driven by rising rates of gluten intolerance and a broader consumer preference for perceived healthier, minimally processed alternative grains. Application segmentation emphasizes market maturity; Baked Goods (especially conventional bread) account for the largest consumption volume, yet Supplements & Functional Foods, which utilize probiotic flour as a key ingredient base, offer the highest margin potential, targeting health-savvy individuals who prioritize functional efficacy over cost. The Distribution Channel analysis confirms the increasing importance of Online Retail, which facilitates direct-to-consumer sales for niche, premium, and specialized probiotic flour products with detailed educational content and greater control over product messaging and consumer engagement.

- By Strain Type: Lactobacillus (Largest share, general gut health, high volume usage), Bifidobacterium (Fastest growth, targeted health benefits including cognitive function), Others (e.g., Saccharomyces boulardii, specialized stability for complex matrices).

- By Flour Source: Wheat Flour (Highest volume, staple applications worldwide), Rice Flour (Leading gluten-free option, highly versatile), Oat Flour (Popular in healthy snacks and breakfast cereals), Corn Flour (Significant regional staple in Americas), Specialty Grains (e.g., Quinoa, Teff, high-margin, driven by clean label trends).

- By Application: Baked Goods (Bread, Cakes, Pastries - Major volume consumption and entry point), Snacks & Cereals (High growth area for on-the-go wellness and children's nutrition), Supplements & Functional Foods (Highest margin, clinically focused delivery systems), Baby Food (Highly regulated, premium segment focused on early digestive and immune development).

- By Distribution Channel: Supermarkets & Hypermarkets (Volume sales, mass market accessibility), Convenience Stores (Limited assortment, quick access), Online Retail (Key growth channel for specialty and niche products, direct consumer engagement), Specialized Health Stores (Premium positioning, detailed consumer consultation).

Value Chain Analysis For Probiotics Flour Market

The value chain for the Probiotics Flour Market begins with highly specialized upstream activities centered around microbial science and agricultural sourcing. Upstream analysis involves two distinct parallel paths: the cultivation of high-quality raw grain (wheat, rice, oats, etc.) and the high-tech, controlled fermentation and harvesting of specific probiotic strains. The cost and quality of the raw materials are heavily dependent on agricultural practices (e.g., organic vs. conventional sourcing) and efficient milling, requiring partnerships with certified growers. Critically, the probiotic path requires significant investment in patented strain selection and advanced microencapsulation technology—a critical value-add step that transforms a fragile biological culture into a heat-stable food ingredient. Companies specializing in encapsulation hold significant leverage in the early stages of the chain due to the technical barriers to entry and the direct impact on final product efficacy and shelf-life guarantee.

The midstream phase focuses on manufacturing and compounding. This involves industrial-scale blending where the encapsulated probiotics are uniformly mixed with the milled flour. Process efficiency here is paramount to minimize ingredient loss and ensure homogeneity, often requiring specialized, low-shear blending equipment to prevent damage to the microcapsules. The downstream value chain primarily deals with logistics, sales, and market penetration. Distribution channels are bifurcated into direct and indirect routes. Direct sales involve large, B2B contracts with major industrial food manufacturers (e.g., packaged bread companies, cereal producers), often requiring dedicated supply routes and technical integration support from the flour supplier regarding optimal usage parameters in high-speed production lines. This channel emphasizes consistency, technical specifications, and bulk pricing, relying heavily on long-term contractual relationships and economies of scale.

Indirect distribution involves retail and specialized channels. Here, the product is sold through third-party distributors, wholesalers, and specialized logistics firms to reach retail outlets (supermarkets, health stores) and, increasingly, consumers via e-commerce platforms. The specialized nature of probiotic flour means packaging must be robust (often utilizing moisture and oxygen barriers), and shelf-life management is tightly controlled to maintain the viable cell count until consumption. Online retail represents a high-growth distribution channel, offering manufacturers direct access to consumer feedback and enabling premium pricing strategies for highly specialized or niche formulations. This channel minimizes traditional retail margin compression but demands excellence in digital marketing, fulfillment logistics, and detailed customer education to ensure product understanding and satisfaction. Successful downstream operations require navigating varied regional regulations regarding ingredient labeling and verifiable health claim dissemination.

Probiotics Flour Market Potential Customers

The consumer base for Probiotics Flour is heterogeneous yet distinctly defined by segments seeking improved health outcomes through dietary staples. The largest potential customers, in terms of volume consumption and consistent demand, are major industrial baking and food processing companies. These multinational corporations (e.g., General Mills, Kellogg’s, Mondelez) seek to utilize probiotic flour to upgrade their existing product lines (bread, crackers, cereals) with functional health claims, thereby attracting the vast segment of health-aware consumers. These buyers require supply chain security, price stability, and verified stability data to ensure their mass-produced items maintain potency throughout the declared shelf life, making supplier technical support and comprehensive stability trials a critical purchase criterion.

A second, highly lucrative customer segment comprises specialized dietary and medical food manufacturers. This includes producers of infant formula, elderly nutrition supplements, and clinical weight management products. These customers prioritize clinical efficacy, high CFU counts, and highly specific strain types over cost. Their procurement processes are dictated by rigorous regulatory requirements for purity and claim validation, particularly in medically targeted products. The growth in personalized nutrition platforms also drives demand from smaller, innovative food tech companies focused on creating bespoke nutritional products tailored to individual health assessments, often incorporating probiotic flours as a base for custom meal kits or functional mixes requiring very specific ingredient profiles and verifiable functional outcomes.

Finally, direct consumers, reached primarily through retail and e-commerce, form the end-user base. This group includes home bakers and small-scale artisanal bakeries who value premium ingredients, clean labels, and specialized functional attributes (e.g., organic, non-GMO, specific gluten-free types). The demand from this segment is highly influenced by consumer education and the perceived value of investing in high-quality wellness ingredients for daily consumption, making transparency regarding strain origin and efficacy vital. Retail channels focus on convenience (supermarkets) while specialized health stores cater to the educated buyer seeking detailed product information and high-potency formulations. The overall customer ecosystem reflects a balance between mass-market volume demand and high-margin specialized application requirements, demanding tailored marketing and distribution strategies for each segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 807.5 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., ADM, General Mills, DuPont Nutrition & Biosciences, Chr. Hansen Holding A/S, Associated British Foods plc, Kerry Group, Arla Foods Ingredients, Lallemand Inc., BENEO GmbH, Ingredion Incorporated, DSM Nutritional Products, Tate & Lyle, Givaudan SA, Novozymes, Puratos Group, Döhler GmbH, MGP Ingredients, Lonza Group, IFF (International Flavors & Fragrances). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Probiotics Flour Market Key Technology Landscape

The Probiotics Flour Market is fundamentally technology-driven, relying heavily on breakthroughs in food science and biotechnology to deliver efficacious products. The paramount technological challenge is guaranteeing the survivability of live cultures when integrated into a dry matrix and subjected to extreme heat. The dominant enabling technology is sophisticated microencapsulation, which involves isolating and protecting individual probiotic cells. Advanced techniques, such as co-extrusion and complex coacervation, are superseding simpler methods like spray drying, offering superior protection against shear stress during mixing and thermal shock during baking. Researchers are continuously developing multi-layered encapsulants using bio-polymers and specialized lipid matrices to achieve time-released delivery, ensuring the cultures are not only stable during processing but also released optimally once they reach the specific pH environment of the colon, maximizing their therapeutic impact and minimizing losses in the stomach's acidic environment.

A second critical area of technological innovation is strain resilience and genomic engineering. Rather than solely relying on encapsulation, significant R&D effort is focused on selecting and cultivating naturally robust strains (often spore-forming bacteria or highly stress-tolerant Lactobacillus strains) that exhibit intrinsic heat and desiccation resistance. Furthermore, the application of high-throughput screening technologies, often accelerated by AI, allows producers to rapidly test thousands of potential strains for compatibility with different flour types and baking conditions, minimizing cross-reactivity issues. This focus on bio-selection minimizes the cost and complexity associated with heavy encapsulation while simultaneously ensuring a higher baseline CFU count in the raw ingredient, which simplifies the quality control process for industrial buyers and reduces the risk of product failure in the downstream chain.

Finally, packaging and analytical verification technologies form a key part of the landscape. Given that residual moisture and oxygen are major threats to probiotic viability, the market utilizes advanced barrier packaging materials, including metallized films and specialized modified atmosphere packaging (MAP), to maintain the requisite low water activity throughout the product's shelf life. For quality assurance, the adoption of advanced analytical instruments like flow cytometry and quantitative PCR (qPCR) has become standard. These technologies allow for rapid, accurate quantification of viable versus non-viable cells, providing verifiable proof of potency required for rigorous regulatory compliance and maintaining consumer trust. Traceability solutions, often leveraging blockchain technology, are also emerging to document the temperature and environmental history of the delicate ingredients throughout the entire farm-to-shelf supply chain, ensuring unparalleled transparency and integrity management.

Regional Highlights

North America maintains its dominant position in the Probiotics Flour Market, driven by a highly mature functional food market and extensive consumer engagement with preventative health products. The regulatory environment, primarily overseen by the FDA, allows for swift market entry, often through the GRAS (Generally Recognized as Safe) pathway, provided robust safety data is available. This regulatory clarity has fostered rapid product innovation, particularly in specialty goods like baking mixes, cereal bars, and performance nutrition products. The US market is characterized by high consumption of both wheat-based and alternative grain flours, making it a lucrative target for diversified product portfolios. Key regional drivers include substantial investment in advertising, linking gut health to immunity and mental wellness, and the robust infrastructure supporting temperature-controlled transportation and storage necessary for maintaining probiotic viability across vast distances.

Europe, while possessing a comparable level of market maturity to North America, is distinguished by its regulatory rigor, particularly under the European Food Safety Authority (EFSA). The difficulty in obtaining approved health claims means manufacturers must emphasize general wellness positioning or focus on unique technological features (e.g., superior stability and clean sourcing). Western European countries, such as Germany, the UK, and the Benelux nations, exhibit high demand for organic and non-GMO probiotic flours, reflecting a cultural emphasis on clean labeling and traceability. Eastern Europe represents an emerging sub-region, with market growth accelerating as disposable incomes rise and consumers transition from traditional diets to incorporating imported functional staples. The regional focus on combating conditions like celiac disease also ensures steady growth for certified gluten-free probiotic variants, often commanding a significant price premium due to specialized milling and certification costs.

Asia Pacific (APAC) stands out as the primary growth engine for the market, expected to register the highest CAGR throughout the forecast period. This explosive growth is attributable to rapid demographic and economic shifts: increasing disposable incomes, accelerated urbanization, and a growing incidence of lifestyle diseases demanding nutritional intervention. Countries like China and India present enormous scale opportunities, driven by local adaptation—developing probiotic flours based on native grains or traditional recipes suitable for regional cuisine staples. Japan and South Korea, already global leaders in functional food innovation, emphasize clinical research and specialized products, particularly in the premium baby food sector where probiotic enrichment is highly valued by parents for early immune system development. However, challenges persist regarding fragmented regulatory frameworks across various APAC nations and establishing efficient cold chain logistics networks in vast, developing areas that lack sophisticated infrastructure.

Latin America (LATAM) shows promising, albeit localized, growth, concentrated mainly in economic powerhouses like Brazil, Mexico, and Argentina. Market growth here is stimulated by improving retail infrastructure, increasing investment by global players, and a gradual increase in health consciousness among urban middle and upper classes, particularly concerning digestive health. The predominant challenge in LATAM is the sensitivity to the premium pricing associated with functional ingredients, necessitating the development of more cost-effective stabilization solutions. The Middle East and Africa (MEA) region remains highly nascent, with demand largely confined to high-income Gulf Cooperation Council (GCC) countries. Consumption is driven by expatriate populations and high-end retail channels. Development requires overcoming infrastructural gaps in refrigeration and substantial consumer education to integrate probiotic flours into local dietary staples beyond basic supplements, focusing primarily on high-value, imported goods in the immediate term.

- North America: Market leader, driven by high consumer spending, swift regulatory processes (GRAS), and strong market linkage between gut health and chronic disease prevention.

- Europe: Mature market, characterized by strict EFSA claim regulations, driving innovation in technological stability and clean-label certifications, strong growth in gluten-free segments.

- Asia Pacific (APAC): Highest projected CAGR, propelled by urbanization, rising incomes in China and India, and high demand in the lucrative baby food and fortified snack sectors, demanding localization of raw materials.

- Latin America (LATAM) & MEA: Emerging markets with localized growth; potential constrained by price sensitivity and infrastructural deficiencies, focused on urban specialty retail penetration and imported premium brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Probiotics Flour Market, highlighting their strategic initiatives, product portfolios, and market positioning. These companies are central to technological advancements in stabilization and encapsulation.- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- General Mills

- International Flavors & Fragrances (IFF) (including former DuPont Nutrition & Biosciences assets)

- Chr. Hansen Holding A/S

- Associated British Foods plc (ABF)

- Kerry Group

- Arla Foods Ingredients

- Lallemand Inc.

- BENEO GmbH

- Ingredion Incorporated

- DSM Nutritional Products

- Tate & Lyle

- Givaudan SA

- Novozymes

- Puratos Group

- Döhler GmbH

- MGP Ingredients

- Lonza Group

- Bunge Limited

Frequently Asked Questions

Analyze common user questions about the Probiotics Flour market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological advancement ensures the viability of probiotics in flour during industrial production?

The primary advancement is advanced microencapsulation technology. This method coats the delicate probiotic cells with protective barriers (such as specialized lipids or bio-polymers) that shield them from mechanical shear, moisture, and the high temperatures typically encountered during blending and baking processes, thereby preserving the required CFU count.

How does Probiotics Flour specifically contribute to immune system function?

Probiotics Flour delivers beneficial bacteria to the gut, where a significant portion of the body’s immune cells reside. By enhancing the balance and diversity of the gut microbiome, it aids in regulating immune response, reducing systemic inflammation, and potentially preventing pathogen colonization, thereby bolstering overall immunity.

What are the main constraints limiting the rapid mass adoption of Probiotics Flour globally?

The key constraints include the high initial cost of stabilized probiotic ingredients, which results in a significant price premium over conventional flour, and the complexity of obtaining and verifying robust regulatory approval for specific health claims in stringent markets like the European Union (EFSA).

Which geographical region is expected to demonstrate the fastest growth rate in the Probiotics Flour Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid urbanization, substantial increases in disposable income, and a growing consumer appreciation for functional and preventative nutrition across densely populated countries like China and India.

How is Artificial Intelligence (AI) influencing the development of new Probiotics Flour products?

AI is used to optimize the selection of highly resilient probiotic strains via genomic analysis, analyze complex fermentation processes to improve yields, and model personalized nutritional recommendations based on consumer biometric data, leading to more effective and targeted product formulations with enhanced stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager