Protective and Specialty Coatings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443335 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Protective and Specialty Coatings Market Size

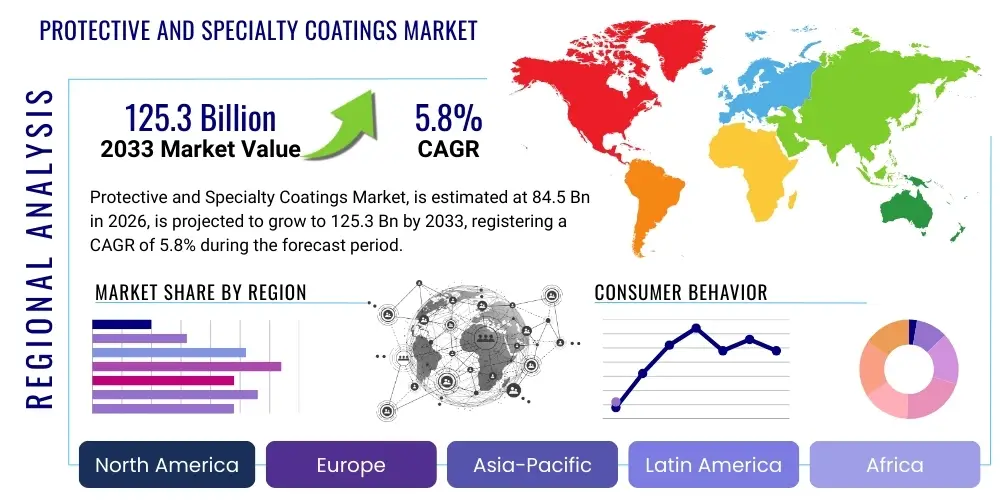

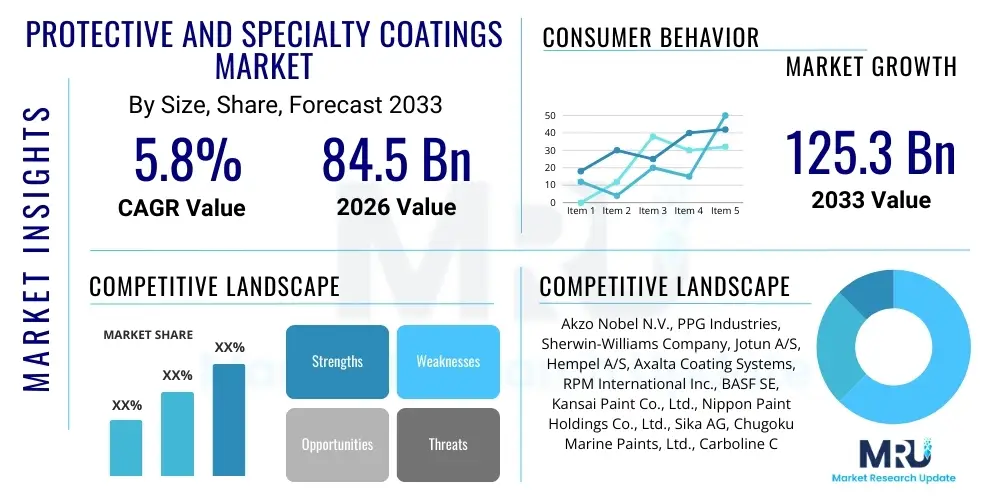

The Protective and Specialty Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 84.5 Billion in 2026 and is projected to reach USD 125.3 Billion by the end of the forecast period in 2033.

Protective and Specialty Coatings Market introduction

Protective and specialty coatings represent high-performance formulations designed to safeguard substrates—ranging from steel and concrete to advanced composites—against environmental degradation, abrasion, corrosion, and extreme temperatures. These coatings are indispensable in sectors where asset integrity and longevity are paramount, providing critical barriers that extend the service life of structures and equipment, thereby reducing maintenance costs and downtime. The market encompasses a broad range of chemical bases, including epoxy, polyurethane, acrylic, alkyd, and advanced fluoropolymers, each tailored for specific operational environments and performance criteria, such as chemical resistance, UV stability, or anti-fouling capabilities. The primary functions of these coatings move beyond mere aesthetics, focusing heavily on functionality and compliance with stringent industry safety standards, particularly in highly regulated industries like marine, oil and gas, and infrastructure development.

The product description spans thick-film protective paints used on bridges and ships to thin-film specialty formulations applied in electronics or medical devices. Major applications are concentrated in infrastructure (roads, bridges, wastewater treatment facilities), industrial structures (power plants, refineries), marine vessels (tankers, cargo ships), and aerospace components. The immediate benefits derived from the deployment of these materials include superior corrosion mitigation, enhanced durability, reduced need for capital replacements, and improved safety compliance. Specialty coatings, in particular, often impart unique functional properties, such as thermal management, anti-microbial surfaces, or electromagnetic shielding, making them crucial components in modern technological systems. These performance characteristics justify their higher cost compared to commodity paints and underscore their value proposition in demanding applications.

Driving factors sustaining market growth are multifaceted. Globally, accelerated urbanization and large-scale government investments in infrastructure rehabilitation and new construction, particularly across Asia Pacific and the Middle East, generate consistent demand. Furthermore, the oil and gas industry’s continued need for durable pipeline and storage tank protection, coupled with renewed emphasis on renewable energy infrastructure (wind turbines, solar farms) which require specialized coatings for extended outdoor exposure, significantly contributes to market expansion. Regulatory shifts towards low-VOC (Volatile Organic Compound) and environmentally friendly coating solutions are also compelling manufacturers to innovate with high-solids, powder, and waterborne technologies, opening new avenues for growth and specialization, even as they pose certain developmental challenges regarding performance parity with traditional solvent-borne systems. This dynamic interplay between performance requirements and regulatory compliance defines the market trajectory.

Protective and Specialty Coatings Market Executive Summary

The Protective and Specialty Coatings Market is characterized by robust business trends centered on sustainability, technological innovation, and consolidation among major players. Strategic business expansion is driven by the necessity for advanced corrosion protection solutions tailored for aging global infrastructure and new capital projects in emerging economies. Manufacturers are increasingly focusing R&D efforts on developing coatings with enhanced durability, quick-curing properties, and reduced environmental footprints, notably through waterborne and powder coating technologies, thereby aligning with global sustainability mandates and end-user demand for high-efficiency application methods. Mergers and acquisitions remain a key strategy for market participants to gain access to proprietary technologies, expand geographic reach, and consolidate market share, particularly in high-growth segments like specialized aerospace and medical coatings. The shift toward digitalization, including the integration of smart coatings and IoT monitoring capabilities, represents a fundamental trend redefining product offerings and maintenance services within industrial settings, positioning products as part of a connected asset management ecosystem rather than mere material suppliers.

Regionally, Asia Pacific (APAC) stands as the undisputed engine of growth, primarily fueled by massive infrastructure investments in China, India, and Southeast Asian nations, coupled with rapid industrialization and expansion in the marine and automotive sectors. North America and Europe, while demonstrating slower volume growth, maintain dominance in terms of technological maturity and high-value specialty coatings, driven by stringent regulatory frameworks and demand for sophisticated protective systems in sectors like aerospace, energy transition projects, and complex manufacturing. The Middle East and Africa (MEA) exhibit strong growth potential, linked directly to substantial oil and gas investment, coupled with large-scale urban development projects demanding resilient architectural and structural coatings. These regional trends underscore a global market characterized by segmented growth: high volume in APAC versus high value and regulatory compliance focus in Western markets.

Segment-wise, the market sees heightened activity in epoxy-based and polyurethane formulations due to their superior performance characteristics in heavy-duty applications. The infrastructure sector consistently remains the largest consumer, but significant growth acceleration is noted in the marine segment, propelled by increasing global shipping volumes and the mandatory adoption of high-performance anti-fouling coatings aimed at improving vessel efficiency and reducing ecological impact. Furthermore, specialty coatings used in electronics and healthcare are witnessing exceptional growth, driven by miniaturization trends and the need for biocompatible and highly durable protective layers. The emphasis on high-solids and 100% solids coatings across all segments reflects a universal trend towards maximizing film build and minimizing volatile emissions, addressing both performance needs and regulatory pressure simultaneously. This segmentation reflects the critical interplay between material science advancements and specific industrial application requirements.

AI Impact Analysis on Protective and Specialty Coatings Market

User inquiries regarding AI in the Protective and Specialty Coatings Market predominantly revolve around three critical areas: optimization of R&D cycles, enhancement of quality control and predictive maintenance, and efficiency improvements in manufacturing processes. Users frequently question how machine learning models can accelerate the discovery of novel coating chemistries, particularly concerning the development of sustainable, high-performance, low-VOC formulations, often asking, "Can AI predict coating performance under extreme conditions before physical testing?" Concerns also center on the deployment costs and data infrastructure requirements necessary to implement AI-driven quality checks in high-speed production environments, seeking clarity on the return on investment for adopting these advanced analytical tools. There is a strong expectation that AI will transition protective coatings from reactive maintenance products to proactive asset protection solutions by enabling highly accurate, real-time degradation monitoring and predicting necessary re-coating schedules, fundamentally altering traditional business models.

The primary themes emerging from user analysis highlight AI's role in drastically reducing the time-to-market for new products. Traditional coating development involves exhaustive trial-and-error physical testing across variables such as temperature, humidity, chemical exposure, and abrasion. AI algorithms can analyze vast datasets of existing material properties and performance results, identifying optimal formulations and synthesis routes, thereby minimizing the need for redundant experiments. This capability is particularly transformative in the specialty coatings sector, where custom formulations for niche applications, such as high-temperature aerospace components or complex medical devices, are often required. AI models can simulate long-term performance and failure modes with high fidelity, accelerating the regulatory compliance phase and increasing the reliability of the final product specifications significantly.

Furthermore, AI integration is crucial in operationalizing maintenance and quality assurance. In coating manufacturing, computer vision systems powered by AI are being utilized for highly accurate, automated quality checks, detecting microscopic defects, inconsistencies in film thickness, or incorrect color pigmentation in real-time, far exceeding human capability and consistency. On the application side, AI is enabling predictive maintenance protocols for end-users, especially in large industrial assets like offshore oil rigs or wind farms. Sensors embedded in or applied over the protective coating collect environmental and operational stress data, which AI models process to predict the remaining useful life of the coating. This shifts maintenance spending from fixed, scheduled intervals to condition-based interventions, resulting in optimized resource allocation, minimized unnecessary downtime, and maximized asset uptime, solidifying the transition toward smart, connected coating solutions.

- AI accelerates R&D by predicting novel, sustainable coating chemistries, reducing physical testing cycles.

- Machine Learning optimizes manufacturing processes, improving batch consistency and yield rates.

- AI-driven computer vision systems enhance quality control by detecting microscopic surface defects in real-time.

- Predictive maintenance models utilize IoT data from coated assets to forecast degradation and optimize recoating schedules.

- AI enables personalized formulation recommendations based on specific end-user environmental and operational parameters.

DRO & Impact Forces Of Protective and Specialty Coatings Market

The market dynamics for protective and specialty coatings are governed by a complex interplay of growth drivers, constraining factors, and inherent opportunities, which collectively define the impact forces shaping its trajectory. The predominant drivers include global infrastructure expansion and rehabilitation, coupled with increasing regulatory demands for superior anti-corrosion and fire-protective coatings in heavy industry and commercial construction. Simultaneously, the market faces significant restraints, primarily stemming from the inherent volatility and cost escalation of key petrochemical-derived raw materials, such as epoxy resins and titanium dioxide, which pressures manufacturers' profit margins and necessitates continuous price adjustments for end products. The market impact forces reflect a transition towards high-performance sustainability, where opportunities lie in developing and commercializing environmentally preferred coatings—specifically waterborne, powder, and high-solids systems—that meet strict VOC limits while maintaining or exceeding the performance of traditional solvent-borne counterparts. This dynamic creates a favorable environment for technological innovators but increases entry barriers for traditional, less flexible manufacturers.

Drivers: A major catalyst for market growth is the global imperative to maintain and expand essential infrastructure assets, including transport networks, water treatment facilities, and power generation plants. In developed regions, large-scale renovation and extension projects necessitate high-durability coatings designed for long-life cycles and minimal environmental intrusion during application. In emerging economies, rapid industrialization, particularly in sectors like petrochemicals and manufacturing, demands robust protective solutions for new capital equipment and facilities. Furthermore, the stringent safety and performance standards enforced by maritime regulatory bodies (like IMO) and aerospace authorities necessitate the continuous adoption of specialty coatings that offer enhanced fire resistance, anti-abrasion properties, and superior protection against highly corrosive environments. This regulatory push elevates the baseline performance requirements for products across all major application segments.

Restraints: The most significant restraint involves the fluctuating price and inconsistent supply of essential raw materials derived from the petrochemical sector. Raw material costs constitute a substantial portion of the overall production expense for coatings, and geopolitical instability or disruptions in the crude oil supply chain directly impact profitability across the value chain. Another critical constraint is the increasing complexity of environmental legislation, particularly concerning VOC emissions and the use of certain heavy metals or harmful additives. While driving innovation towards greener alternatives, compliance often requires substantial investment in new manufacturing processes and reformulation R&D, potentially leading to short-term cost increases and product reformulation challenges, especially for coatings that rely on traditional, high-solvent content chemistry to achieve specific performance benchmarks.

Opportunities: Significant growth opportunities are concentrated in the development of functional specialty coatings. This includes smart coatings integrated with sensors for condition monitoring, coatings with self-healing capabilities that automatically repair minor damage, and advanced thermal management coatings for critical electronics and aerospace components. The transition towards renewable energy infrastructure, specifically the requirement for durable, long-lasting coatings for offshore wind turbine towers and solar panel back sheets, provides a specialized, high-growth niche. Furthermore, expanding the accessibility of high-solids and 100% solids coatings into previously solvent-dominated applications offers manufacturers a pathway to satisfy performance requirements while meeting global environmental compliance targets, tapping into a premium segment of the market focused on both sustainability and unparalleled performance metrics.

Segmentation Analysis

The Protective and Specialty Coatings Market is comprehensively segmented based on Resin Type, Technology, Application, and End-Use Industry, reflecting the diversity of performance requirements and end-market needs. Analysis by Resin Type reveals the dominance of epoxy and polyurethane resins, owing to their excellent durability, chemical resistance, and versatility across industrial and marine environments. The segmentation by Technology highlights a crucial market shift, with traditional solvent-borne systems gradually ceding market share to environmentally preferred alternatives such as high-solids, waterborne, and powder coatings, driven by global regulatory pressures and sustainability initiatives. This trend signifies technological maturity and the successful bridging of the performance gap between solvent-based and greener formulations, particularly in heavy industrial uses where performance cannot be compromised. The structure of the market is highly application-specific, necessitating manufacturers to maintain a diversified portfolio capable of addressing the unique challenges presented by disparate environments, from subsea pipelines to high-friction aerospace components.

Segmentation by Application reveals that anti-corrosion coatings constitute the largest volume segment, reflecting the universal need for rust and degradation prevention across all industrial sectors, especially in marine and infrastructure projects operating under continuous corrosive stress. Meanwhile, specialty applications such as fire protection (intumescent coatings), thermal control, and anti-fouling demonstrate the highest growth potential due to tightening safety regulations and efficiency demands. The End-Use Industry segmentation underscores the market's reliance on sectors sensitive to capital expenditure cycles. Infrastructure and Marine industries are typically the largest consumers, demanding coatings that offer ultra-long service lives, while the automotive and aerospace sectors prioritize lightweight, high-performance specialty coatings tailored for extreme mechanical and thermal stresses. The complexity arising from these distinct needs necessitates focused R&D investment and specialized distribution channels tailored to regulatory requirements within each industry.

The segmentation strategy is essential for strategic market positioning and product development. Companies must align their offerings with specific segments—for instance, focusing on high-solids polyurethanes for bridge infrastructure or low-VOC acrylics for architectural construction—to maximize market penetration and pricing power. The increasing adoption of 100% solids technologies, particularly in pipeline and tank linings, is further fragmenting the market based on advanced application methodologies, such as plural component spray equipment. This technological evolution within segmentation allows end-users to select systems not only based on protective performance but also on adherence to increasingly stringent on-site volatile organic compound emission standards and efficient curing times, thereby speeding up project completion and minimizing environmental impact risks associated with large-scale coating applications.

- By Resin Type: Epoxy, Polyurethane, Acrylic, Polyester, Alkyd, Fluoropolymer, Others.

- By Technology: Solvent-Borne, Waterborne, Powder Coating, High-Solids & 100% Solids.

- By Application: Anti-Corrosion, Fire Protection (Intumescent), Anti-Fouling, Thermal Barrier, Weather Resistance, Abrasion Resistance, Chemical Resistance.

- By End-Use Industry: Marine (Vessels, Offshore Structures), Infrastructure (Bridges, Roads, Utilities), Oil & Gas (Pipelines, Refineries, Storage Tanks), Power Generation (Nuclear, Thermal, Renewables), Automotive & Transportation, Aerospace, General Industrial, Construction (Architectural & Structural), Others (Healthcare, Electronics).

Value Chain Analysis For Protective and Specialty Coatings Market

The value chain for the Protective and Specialty Coatings Market commences with upstream analysis, which is critically dominated by raw material suppliers. These suppliers provide essential components, including chemical precursors (epoxy resins, polyols, acrylic monomers), pigments (titanium dioxide, iron oxides), additives (catalysts, dispersants, flow agents), and solvents. The bargaining power of these upstream suppliers is significant, influenced by global commodity prices, particularly crude oil derivatives, and specialized chemical production capacity. Manufacturers strive to mitigate this risk through long-term supply contracts, vertical integration strategies, or diversification of raw material sourcing geographically. Innovation at this stage is focused on bio-based feedstocks and non-toxic alternatives to traditional pigments and solvents, responding directly to downstream demands for sustainable formulations.

The midstream section involves the core activities of coating manufacturing, encompassing formulation, mixing, grinding, quality control, and packaging. This stage is characterized by high capital investment in specialized manufacturing plants and continuous R&D expenditure required to meet complex performance specifications and regulatory requirements. Key manufacturers leverage proprietary formulation knowledge, technological prowess in dispersion and polymerization, and robust intellectual property to differentiate their products. The distribution channel plays a vital role in connecting manufacturers to diverse end-use markets. Distribution involves a mix of direct sales models for large industrial projects (e.g., selling directly to major marine shipyards or infrastructure contractors) and indirect sales through specialized technical distributors and authorized dealers, particularly for small-to-medium enterprises and maintenance, repair, and overhaul (MRO) activities. Distributors often provide essential value-added services such as technical support, localized inventory management, and application training.

Downstream analysis centers on the end-users and the actual application process. End-users span massive industries such as oil and gas, infrastructure, and marine, where coatings are applied by professional, certified applicators or specialized contractors. The success of the coating system heavily relies on proper surface preparation and application expertise, making the applicator a critical and influential part of the value chain. Failures in application, often due to poor surface preparation or environmental conditions, can lead to catastrophic asset failures, underscoring the necessity of stringent quality assurance at the downstream level. The downstream segment is highly service-intensive, requiring ongoing technical consultation, site inspections, and performance guarantees from both the manufacturer and the applicator, cementing the market’s reliance on deep technical competence and verifiable field performance history.

Protective and Specialty Coatings Market Potential Customers

Potential customers, or end-users/buyers, in the Protective and Specialty Coatings Market are highly diverse yet unified by the common need to protect capital-intensive assets from environmental degradation and extend operational lifespan. The primary demographic includes large-scale infrastructure developers, government transportation and public works agencies responsible for bridges, tunnels, and utilities, and major global shipping companies operating vast marine fleets. These customers purchase high volumes of standard protective coatings (epoxies, polyurethanes) and require verifiable, third-party certified performance data, often dictated by contractual agreements lasting decades. Their purchasing decisions are primarily influenced by total cost of ownership (TCO), durability claims, ease of application, and compliance with severe environmental and safety standards, particularly concerning VOC content and fire resistance.

A second major segment comprises industrial operators in the Oil & Gas, Power Generation, and Petrochemical sectors. These customers require highly specialized, engineered coatings capable of withstanding extreme conditions, including high temperatures, aggressive chemical exposure, and mechanical abrasion inside reactors, pipelines, and storage facilities. For instance, companies operating LNG terminals or coal-fired power plants are consistent purchasers of thermal barrier and chemical-resistant linings. For these users, performance stability under failure conditions is critical, leading them to favor niche specialty coating manufacturers offering customized solutions and intensive technical field support. The adoption of advanced coatings like fluoropolymers and specialized high-solids linings is driven by the necessity of minimizing operational risk and adhering to stringent API (American Petroleum Institute) or relevant industry specifications.

The third significant customer group involves manufacturers in high-value, highly regulated industries such as Aerospace, Automotive, and Healthcare/Electronics. These customers procure specialty coatings for their unique functional properties—such as EMI shielding, anti-microbial surfaces, or lightweight erosion protection for aircraft components. Purchasing decisions here are driven less by volume and more by highly specialized performance metrics, quality certifications, and the ability of the coating to integrate seamlessly into complex manufacturing processes. For example, aerospace companies require coatings that meet military or FAA specifications, while medical device manufacturers demand biocompatibility and sterilization resilience. These relationships are often collaborative, involving joint development agreements to create proprietary formulations tailored to cutting-edge technological requirements, emphasizing long-term partnership over transactional buying.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 84.5 Billion |

| Market Forecast in 2033 | USD 125.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Akzo Nobel N.V., PPG Industries, Sherwin-Williams Company, Jotun A/S, Hempel A/S, Axalta Coating Systems, RPM International Inc., BASF SE, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Sika AG, Chugoku Marine Paints, Ltd., Carboline Company, Wacker Chemie AG, Arkema Group, Covestro AG, KCC Corporation, Diamond Vogel, 3M Company, Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protective and Specialty Coatings Market Key Technology Landscape

The technological landscape of the Protective and Specialty Coatings Market is characterized by innovation focused on sustainability, multi-functionality, and enhanced durability under extreme conditions. A major thrust involves the maturation of environmentally compliant technologies, specifically the transition from traditional high-VOC solvent-borne systems to advanced waterborne, powder, and high-solids/100% solids coatings. Waterborne technology, once lagging in heavy-duty performance, is achieving parity with solvent-borne systems, particularly through specialized cross-linking chemistries that enhance moisture resistance and adhesion. Powder coatings are gaining ground in general industrial and automotive applications due to their zero-VOC profile, high transfer efficiency, and ability to form thick, durable films in a single coat, demanding advanced application systems such as electrostatic spray equipment and sophisticated curing ovens to maximize efficiency.

Another crucial area of technological advancement is the development of Smart Coatings and Nanotechnology integration. Smart coatings incorporate functional components that allow them to self-diagnose damage, self-heal minor cracks, or change color in response to corrosion indicators or temperature fluctuations. Nanotechnology is utilized to enhance existing coating properties; for example, incorporating carbon nanotubes or specialized ceramic nanoparticles can significantly increase scratch resistance, UV stability, and barrier protection against moisture and gases without compromising the coating's flexibility or application characteristics. These nano-additives allow formulators to engineer hybrid materials that offer performance far superior to conventional protective layers, opening new market segments in aerospace, defense, and high-end electronics where material performance is non-negotiable.

Furthermore, advancements in application technology are inherently linked to coating performance. The development of plural component spray equipment is critical for efficiently applying 100% solids epoxy and polyurethane systems that have short pot lives but offer immediate, high-build protection. Robotics and automation are increasingly deployed in high-volume settings like shipbuilding and automotive manufacturing to ensure uniformity, precision, and film thickness consistency, thereby minimizing defects and maximizing the protective integrity of the final layer. This integration of advanced material science with precision application engineering defines the competitive edge, enabling manufacturers to offer complete, optimized protection systems rather than just chemical components. The rapid-cure technology, employing UV or LED curing mechanisms, also represents a significant leap, drastically reducing downtime in high-speed manufacturing and maintenance environments, directly impacting overall operational efficiency for the end-user.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, driven primarily by massive investments in infrastructure development, rapid industrialization, and expansion of manufacturing bases, especially in China, India, and Southeast Asia. The region’s burgeoning automotive, marine (shipbuilding), and general industrial sectors necessitate large volumes of both protective and specialty coatings. Government initiatives like China’s Belt and Road Initiative and India's "Make in India" campaigns fuel demand for high-durability coatings for new ports, bridges, and industrial facilities. While competition is intense and pricing pressure is prevalent, the sheer scale of construction and industrial activities ensures continuous market expansion.

- North America: North America represents a mature market characterized by high regulatory standards, driving demand for premium, low-VOC, and high-solids coating systems. Growth is sustained by the continuous need for repair and rehabilitation of aging infrastructure, substantial investment in oil and gas pipelines, and a strong, technologically advanced aerospace and defense sector demanding highly specialized thermal and chemical-resistant coatings. The U.S. remains the dominant regional market, prioritizing sophisticated, high-performance protective measures over low-cost alternatives.

- Europe: The European market is heavily influenced by stringent environmental legislation, notably the REACH regulation, which pushes manufacturers towards sustainable and bio-based alternatives. The region is a leader in specialty coatings for automotive manufacturing, high-speed rail, and renewable energy (onshore and offshore wind farms). Growth is measured but focused on innovation, with a strong emphasis on functional coatings that offer energy efficiency benefits and ultra-long life cycles, thereby offsetting higher initial product costs through reduced maintenance expenditure.

- Middle East and Africa (MEA): MEA is experiencing significant growth, predominantly linked to massive capital expenditure in the oil and gas sector (upstream and downstream processing) and large-scale urban development projects in the GCC countries. The harsh, corrosive environment unique to the region mandates the use of highly robust, high-performance protective coatings for infrastructure, refineries, and desalination plants. While regulatory compliance is less uniform than in Europe, the performance requirement due to extreme weather conditions is exceptionally high, favoring durable epoxy and polyurethane systems.

- Latin America (LATAM): The LATAM market growth is episodic, tied closely to economic stability and investment cycles, particularly in Brazil and Mexico. Key demand drivers include expanding oil and gas exploration, mining operations requiring abrasion-resistant coatings, and general infrastructure projects. The market often balances between performance and cost efficiency, though international projects increasingly mandate the use of high-standard protective systems consistent with global norms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protective and Specialty Coatings Market.- Akzo Nobel N.V.

- PPG Industries

- Sherwin-Williams Company

- Jotun A/S

- Hempel A/S

- Axalta Coating Systems

- RPM International Inc.

- BASF SE

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Sika AG

- Chugoku Marine Paints, Ltd.

- Carboline Company

- Wacker Chemie AG

- Arkema Group

- Covestro AG

- KCC Corporation

- Diamond Vogel

- 3M Company

- Dow Inc.

Frequently Asked Questions

What is the primary factor driving demand for Protective and Specialty Coatings?

The primary driver is the necessity of infrastructure longevity and asset protection, particularly against corrosion and harsh environmental exposure in sectors like marine, oil and gas, and construction. Global infrastructure rehabilitation and new development projects necessitate durable, long-life coating systems to minimize maintenance expenditure and prevent catastrophic structural failure, making anti-corrosion performance paramount.

Which coating technology is growing fastest due to environmental regulations?

High-solids and 100% solids coating technologies, along with waterborne systems, are experiencing the fastest growth. This acceleration is directly attributed to stringent global environmental regulations, such as VOC limits imposed by regulatory bodies in North America and Europe, which mandate a move away from traditional high-solvent formulations towards eco-friendly alternatives that maintain superior performance characteristics.

How is AI specifically impacting the development of new protective coatings?

AI is significantly accelerating R&D cycles by utilizing machine learning algorithms to predict optimal coating formulations, assess material compatibility, and simulate long-term performance under various stress factors. This drastically reduces the time and cost associated with physical testing and speeds up the introduction of innovative, high-performance, and sustainable coating products to the market.

Which resin type dominates the Protective and Specialty Coatings Market?

Epoxy resins currently dominate the market due to their unparalleled adhesion, chemical resistance, and mechanical strength, making them the preferred choice for heavy-duty protective applications in industrial flooring, marine structures, and infrastructure. Polyurethane systems closely follow, often used as durable topcoats for UV stability and abrasion resistance over epoxy primers.

What are 'smart coatings' and where are they primarily used?

Smart coatings are specialty formulations integrated with functional components (often nanoscale) that enable responsive features, such as self-healing properties, corrosion indication through color change, or integrated sensors for condition monitoring. They are primarily used in high-value, critical applications like aerospace, complex pipelines, and naval vessels where real-time structural health monitoring is essential for predictive maintenance strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager