Protein Crystallization and Crystallography Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442722 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Protein Crystallization and Crystallography Market Size

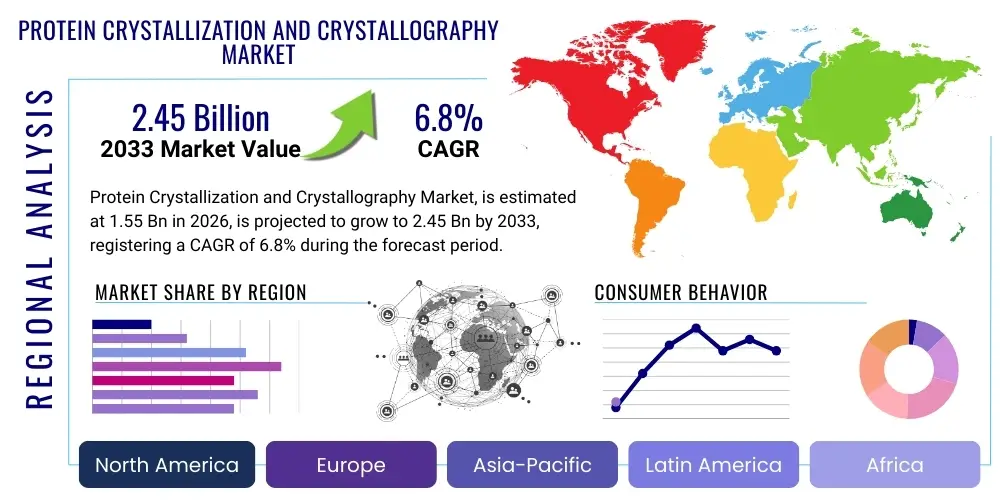

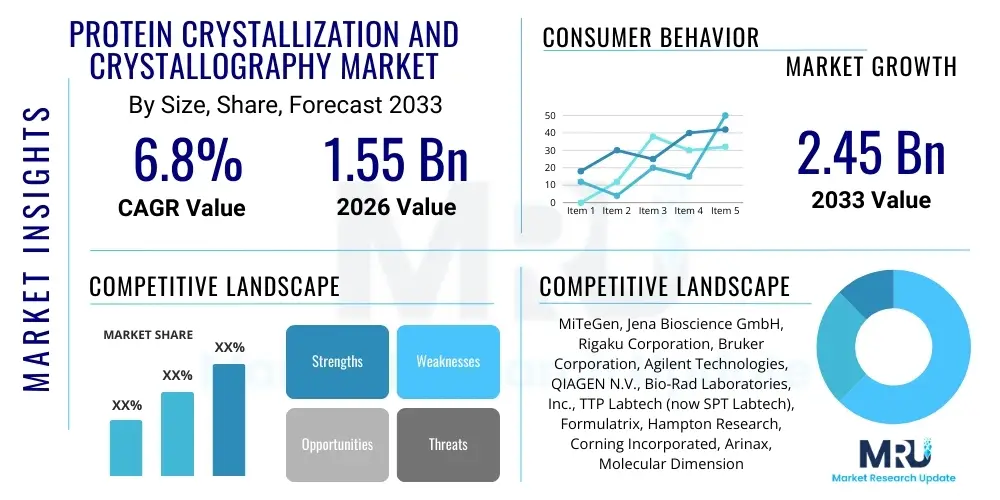

The Protein Crystallization and Crystallography Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the increasing global emphasis on structural biology research, particularly in pharmaceutical and biotechnology sectors, where understanding three-dimensional protein structures is fundamental for rational drug design and development. The technological advancements in automated crystallization systems, high-throughput screening, and detector technologies are also crucial catalysts supporting this substantial market expansion.

The valuation reflects the critical role that macromolecular crystallography plays in modern scientific inquiry, extending beyond traditional academic research into commercial applications such as personalized medicine and agricultural biotechnology. Investments in synchrotron facilities globally, which provide high-intensity X-ray sources essential for data collection, significantly underpin the operational viability and growth potential of this market. Furthermore, the rising prevalence of chronic and complex diseases, necessitating the identification of novel therapeutic targets, continuously boosts the demand for detailed protein structure analysis, thereby expanding the market size consistently year over year throughout the forecast period.

Protein Crystallization and Crystallography Market introduction

The Protein Crystallization and Crystallography Market encompasses the technologies, instrumentation, and consumables utilized to determine the atomic and molecular structure of proteins. Protein crystallization, the initial and often rate-limiting step, involves transforming highly purified proteins into ordered crystalline arrays suitable for X-ray diffraction analysis. Crystallography, predominantly X-ray crystallography, then uses these crystals to decipher the three-dimensional structure, providing crucial insights into biological function, mechanism of action, and interaction sites. This field is paramount in structural biology and drug discovery, enabling the visualization of ligand-protein binding and guiding structure-based drug design (SBDD).

Major applications of this technology include the development of novel therapeutics, vaccine design, understanding protein-protein interactions, and elucidating enzymatic mechanisms. The benefits derived from these processes are immense, allowing researchers to design compounds that selectively target specific binding pockets, thereby minimizing off-target effects and accelerating the pre-clinical validation phase. Driving factors for market growth include significant government and private funding directed toward proteomics research, the expanding pipeline of complex biologics requiring structural elucidation, and continuous technological refinements, such as microfluidics and improved robotic systems, which enhance crystallization success rates and reduce material consumption.

Protein Crystallization and Crystallography Market Executive Summary

The Protein Crystallization and Crystallography Market is characterized by vigorous business trends focusing on integration and automation. Key industry players are investing heavily in high-throughput robotic platforms capable of handling thousands of crystallization trials simultaneously, thereby addressing the long-standing bottleneck associated with manual screening. A significant trend involves the hybridization of structural biology techniques, particularly the complementary utilization of Cryo-Electron Microscopy (Cryo-EM) alongside X-ray crystallography, expanding the scope of analyzeable proteins, especially challenging membrane proteins and large complexes. The market also exhibits a strong trend towards cloud-based data processing and AI-driven image analysis, streamlining data interpretation and accelerating structure determination.

Regionally, North America maintains market dominance due to substantial R&D expenditure by major pharmaceutical companies and the presence of world-class academic institutions and synchrotron facilities. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly developing biotechnology ecosystems in countries like China, India, and South Korea, coupled with rising government investment in biomedical research infrastructure. Segment trends indicate that the consumables segment, including crystallization screening kits and reagents, holds a considerable market share, driven by the recurring need for trial components, while the instrumentation segment sees high growth due to the adoption of advanced automated liquid handling systems and specialized imaging equipment.

AI Impact Analysis on Protein Crystallization and Crystallography Market

Common user questions regarding AI's impact on protein crystallization center around its ability to overcome the historical challenges of the technique, specifically asking: "Can AI reliably predict crystallization conditions?", "How does machine learning improve X-ray diffraction data quality?", and "Is AI reducing the need for iterative manual screening?". Users are highly focused on predictive modeling capabilities, expecting AI algorithms to analyze vast libraries of previous crystallization data to suggest optimized screening matrices, thereby dramatically reducing costs, time, and sample consumption. The key concerns revolve around the transparency and robustness of these predictive models, particularly when applied to novel or highly complex proteins that lack extensive prior structural data. Expectations are high for AI to fully automate the entire workflow, from initial sample quality assessment to final structure refinement, ultimately democratizing access to high-resolution structural information.

AI's primary influence is establishing smart laboratories where iterative experimentation is minimized. Machine learning (ML) models are adept at interpreting crystal growth images, distinguishing between true crystals, precipitates, and amorphous material with high accuracy, a task traditionally reliant on expert human interpretation. Furthermore, AI is crucial in optimizing beamline allocation and managing massive datasets generated by synchrotron experiments, facilitating rapid processing and validation. Deep learning techniques are also being applied to protein structure prediction (AlphaFold being a prime example), which, while not replacing crystallography, provides invaluable starting models and target validation information, making the subsequent experimental steps more focused and efficient.

The integration of AI tools promises to transform the efficiency and accessibility of structural biology. By applying predictive analytics to protein sequence characteristics, stability parameters, and solution conditions, researchers can select the most probable successful trials, drastically lowering the failure rate inherent in crystallization screens. This shift from high-throughput brute-force screening to intelligent, targeted experimentation is driving market demand for AI-integrated crystallization robotics and software solutions, repositioning crystallography from a high-risk, low-yield endeavor to a more systematic and predictable scientific process.

- Enhanced prediction of optimal crystallization conditions using Machine Learning (ML).

- Automated crystal image analysis and classification, improving throughput and reliability.

- Optimization of X-ray diffraction data processing and automated structure refinement algorithms.

- Intelligent robotic liquid handling and automated screening matrix design.

- Integration with structural databases to provide context and refine experimental design.

DRO & Impact Forces Of Protein Crystallization and Crystallography Market

The Protein Crystallization and Crystallography Market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate its evolution. Key drivers include the escalating global demand for detailed structural information essential for structure-based drug design (SBDD), the increasing prevalence of complex diseases requiring novel therapeutic targets, and significant governmental and private investments into life sciences research infrastructure, particularly specialized synchrotron facilities. These factors collectively push the market forward by expanding the user base and increasing the perceived value of structural data.

However, substantial restraints temper this growth. The high initial capital investment required for crystallography instrumentation (such as automated imagers, liquid handling systems, and specialized X-ray generators) poses a barrier to entry for smaller academic and commercial labs. Furthermore, the intrinsic technical complexity of the process—particularly the difficulty in crystallizing certain classes of proteins, like membrane proteins—remains a persistent scientific challenge. The necessity for highly purified protein samples, often in large quantities, adds to the complexity and cost, limiting throughput and accessibility.

Opportunities for market growth lie primarily in technological innovation. The development of advanced microfluidic crystallization techniques minimizes sample consumption, addressing a major restraint. The burgeoning adoption of automation, robotics, and integrated AI/ML software offers solutions to complexity and throughput issues. Moreover, the increasing integration of crystallography with complementary techniques like Cryo-EM and Free Electron Lasers (FELs) opens new application avenues for previously intractable biological systems. These opportunities promise to expand the market footprint, making structural biology accessible to a broader range of research activities across various therapeutic areas and industrial applications, from biotechnology to advanced materials science.

Segmentation Analysis

The Protein Crystallization and Crystallography Market is segmented primarily based on the core components necessary for structural determination: Technology, Product, Application, and End-User. Analyzing these segments provides a granular understanding of market dynamics and adoption rates. The segmentation by Product includes instruments (e.g., automated crystallization systems, X-ray generators, detectors) and consumables (e.g., crystallization screens, reagents, plates), with consumables typically driving recurring revenue. Technological segmentation separates established methods like X-ray crystallography from emerging high-growth techniques like neutron crystallography and electron crystallography (Cryo-EM), reflecting the transition towards handling larger and more complex targets. This structure enables stakeholders to identify specific high-growth niches within the broader structural biology domain.

Application segmentation focuses heavily on drug discovery and development, a sector that relies fundamentally on high-resolution protein structures for lead optimization and mechanism elucidation. Other crucial applications include proteomics, genome mapping, and academic research. The segmentation by End-User distinguishes between highly capitalized pharmaceutical and biotechnology companies, which drive demand for high-throughput automated systems, and academic and government research institutes, which often focus on basic research but require access to shared high-end facilities like synchrotrons. These diverse segments require tailored product offerings and strategic marketing approaches, reflecting the specialized nature of the equipment and expertise required across the value chain.

- By Technology:

- X-ray Crystallography

- Cryo-Electron Microscopy (Cryo-EM)

- Neutron Crystallography

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- By Product:

- Instruments (Crystallization Systems, Detectors, Consumables Handling Robotics, X-ray Generators)

- Reagents & Consumables (Crystallization Screening Kits, Plates, Purification Resins)

- By Application:

- Drug Discovery & Development

- Proteomics

- Structural Genomics

- Academic & Basic Research

- By End User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Government Organizations & Contract Research Organizations (CROs)

Value Chain Analysis For Protein Crystallization and Crystallography Market

The value chain for the Protein Crystallization and Crystallography Market is highly complex, spanning basic research and sophisticated manufacturing. Upstream analysis involves suppliers of high-purity chemicals and biological materials, crucial for producing the necessary buffers, salts, and high-quality protein reagents used in crystallization screens. Key upstream activities also include the development and manufacturing of specialized hardware components such as precision robotic arms, fluidics systems, and advanced X-ray detectors. The quality and reliability of these upstream inputs directly influence the success rate of the downstream structural determination process, making supplier qualification and material control critical components of the value proposition.

Midstream activities center on the core processes of protein expression, purification, crystallization screening, and optimization, often performed by specialized core facilities, academic labs, or pharmaceutical R&D departments. This stage relies heavily on the instrumentation providers who manufacture automated liquid handlers, crystallization imagers, and X-ray diffraction systems. The distribution channel is predominantly direct for high-capital equipment, involving specialized sales teams providing installation, training, and ongoing technical support due to the highly technical nature of the products. For consumables like screening kits and reagents, distribution often involves specialized scientific supply distributors, offering both direct and indirect sales channels to reach a diverse global user base efficiently.

Downstream analysis focuses on the final application of the derived structural data. End-users include pharmaceutical and biotech companies utilizing structures for rational drug design (SBDD), academic researchers publishing findings, and CROs offering structural services. The output—the solved protein structure—drives therapeutic development, making the final data analysis and interpretation steps paramount. The strong reliance on both direct sales (for high-value instruments and complex custom services) and indirect sales (for recurring consumables and basic equipment) characterizes the optimized distribution network, ensuring comprehensive market coverage across global research ecosystems.

Protein Crystallization and Crystallography Market Potential Customers

The primary potential customers and end-users of the Protein Crystallization and Crystallography Market are entities deeply engaged in fundamental life science research and therapeutic development. Pharmaceutical and major biotechnology companies represent the largest segment of high-volume customers, driven by the critical need for high-resolution structural data to inform their drug pipelines, ranging from small molecules to complex biologics. These corporate entities require robust, high-throughput, and fully automated systems capable of handling a vast array of target proteins under stringent timelines, seeking to minimize the time-to-market for new therapeutic agents.

Academic and government research institutes form the second major customer base, focusing heavily on basic science, disease mechanism elucidation, and structural genomics initiatives. While these customers often operate under tighter budgetary constraints compared to industry, their collective demand for services and instrumentation, often accessed through core facility models or shared national synchrotron sources, ensures sustained market relevance. Furthermore, Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) specializing in structural biology services constitute a rapidly growing customer segment. These organizations leverage advanced crystallization and diffraction technologies to provide specialized structural determination services outsourced by both pharmaceutical clients and smaller biotech startups, capitalizing on expertise and equipment efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MiTeGen, Jena Bioscience GmbH, Rigaku Corporation, Bruker Corporation, Agilent Technologies, QIAGEN N.V., Bio-Rad Laboratories, Inc., TTP Labtech (now SPT Labtech), Formulatrix, Hampton Research, Corning Incorporated, Arinax, Molecular Dimensions, Avantium Technologies, Danaher Corporation (through subsidiaries), Merck KGaA, Emerald Bio, Art Robbins Instruments, Tecan Group, Thermo Fisher Scientific Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protein Crystallization and Crystallography Market Key Technology Landscape

The technology landscape of the Protein Crystallization and Crystallography Market is defined by continuous innovation aimed at overcoming key biological and logistical bottlenecks inherent in the process. The dominant technology remains X-ray crystallography, which provides atomic-resolution structures critical for rational drug design. However, significant technological evolution is observed in peripheral systems, including automated liquid handling robots (dispensing nano-liter volumes with high precision) and advanced imaging systems (incorporating sophisticated optics and automated crystal recognition software). The integration of robotics minimizes human error and significantly increases the capacity for high-throughput screening, allowing researchers to rapidly test hundreds of unique crystallization conditions.

A crucial technological shift involves the development and increasing utilization of advanced X-ray sources and detectors. Synchrotron light sources, providing highly brilliant and focused X-ray beams, are essential for collecting high-quality diffraction data from increasingly smaller or poorly diffracting crystals. Furthermore, the commercial availability of Free Electron Lasers (FELs) has enabled Serial Femtosecond Crystallography (SFX), allowing structures to be determined from microcrystals before radiation damage occurs, opening avenues for studying dynamic processes. Detector technology has evolved rapidly, with the advent of large area, high-speed detectors significantly reducing data collection time and improving data quality, ultimately accelerating structure determination cycles.

Complementary techniques are also reshaping the technological landscape. Cryo-Electron Microscopy (Cryo-EM) has gained immense traction, particularly for large protein complexes and membrane proteins that are recalcitrant to crystallization, offering a synergistic approach to structural analysis. Meanwhile, microfluidic devices are gaining popularity in crystallization optimization, offering highly controlled environments for crystal growth using minimal sample volumes, directly addressing the restraint of high protein sample consumption. This multi-faceted technological evolution—encompassing automation, improved X-ray sources, faster detectors, and micro-scale methodology—is collectively driving the market toward greater efficiency and broader application scope.

Regional Highlights

The global Protein Crystallization and Crystallography Market exhibits distinct regional dynamics, dictated by R&D investment levels, academic output, and the concentration of pharmaceutical and biotechnology hubs.

- North America (U.S. and Canada): Dominates the global market share due to exceptionally high R&D spending in the biopharmaceutical sector, the dense presence of major biotechnology corporations, and significant investment in cutting-edge synchrotron facilities and structural biology centers. The rapid adoption of automated systems and advanced Cryo-EM techniques further solidifies its leading position. The U.S. remains the primary innovation hub for new crystallization and data analysis software.

- Europe (Germany, UK, France): Constitutes a mature market, holding the second largest share, characterized by robust government funding for structural biology, large-scale initiatives like the European Synchrotron Radiation Facility (ESRF), and strong academic collaborations. The region excels in advanced materials science research utilizing crystallography alongside pharmaceutical applications.

- Asia Pacific (APAC) (China, Japan, South Korea, India): Projected to be the fastest-growing region during the forecast period. Growth is fueled by increasing foreign direct investment in biomedical R&D, rising government focus on building domestic biopharmaceutical capabilities, and the rapid establishment of new life science research centers and shared-access structural biology facilities. China, in particular, is a powerhouse for both research output and infrastructure expansion.

- Latin America (LATAM) and Middle East & Africa (MEA): Represent emerging markets characterized by growing structural biology initiatives, though market penetration is comparatively lower. Growth in these regions is driven by increasing healthcare expenditure and international collaborations aimed at establishing modern research infrastructure and adopting necessary high-end instrumentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protein Crystallization and Crystallography Market.- MiTeGen

- Jena Bioscience GmbH

- Rigaku Corporation

- Bruker Corporation

- Agilent Technologies

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- SPT Labtech (formerly TTP Labtech)

- Formulatrix

- Hampton Research

- Corning Incorporated

- Arinax

- Molecular Dimensions

- Avantium Technologies

- Danaher Corporation (through subsidiaries)

- Merck KGaA

- Emerald Bio

- Art Robbins Instruments

- Tecan Group

- Thermo Fisher Scientific Inc.

Frequently Asked Questions

Analyze common user questions about the Protein Crystallization and Crystallography market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Protein Crystallization Market?

The primary driver is the accelerating demand for high-resolution structural information in Structure-Based Drug Design (SBDD), coupled with significant global R&D investments in proteomics and structural genomics aimed at identifying novel therapeutic targets for complex diseases.

How is AI transforming the protein crystallization workflow?

AI, specifically Machine Learning, is optimizing workflows by predicting optimal crystallization conditions, automating the analysis and classification of crystal images, and streamlining the processing of vast X-ray diffraction datasets, thereby dramatically reducing sample consumption and time.

Which region currently holds the largest share in the Crystallography market, and why?

North America holds the largest market share, predominantly due to its substantial R&D expenditure by leading pharmaceutical and biotechnology companies, alongside the presence of advanced research infrastructure, world-class academic institutions, and dedicated national synchrotron facilities.

What are the main technical challenges limiting broader adoption of protein crystallography?

Major limitations include the high capital cost of advanced instrumentation, the inherent technical difficulty in crystallizing challenging targets like membrane proteins, and the continuous requirement for high-purity protein samples in sufficient quantity.

Is Cryo-EM replacing traditional X-ray Crystallography in structural biology?

Cryo-EM is generally complementary, not purely replacement. While Cryo-EM excels at large complexes and membrane proteins that are difficult to crystallize, X-ray crystallography still offers superior atomic resolution for well-behaved proteins and remains the gold standard in Structure-Based Drug Design (SBDD).

The preceding analysis represents a formal and comprehensive overview of the Protein Crystallization and Crystallography Market. The market dynamics reflect a blend of enduring scientific challenges and rapid technological advancements, driven fundamentally by the imperative to understand biological function at the molecular level. Continuous innovation in automation and computational methods, particularly the application of Artificial Intelligence, is projected to fundamentally reshape the productivity and accessibility of structural biology tools, ensuring sustained market expansion in the foreseeable future. Strategic investment in infrastructure, especially in the rapidly developing APAC region, will be critical to capitalizing on global growth opportunities. The market trajectory indicates a strong shift towards integrated platforms that combine crystallization, imaging, and advanced data processing, moving the field towards fully automated structure determination pipelines that accelerate drug discovery efforts worldwide. Furthermore, the sustained investment from major pharmaceutical entities confirms the long-term indispensable nature of high-resolution structural data in modern biomedical research.

The market for protein crystallization and crystallography consumables is showing increasing resilience, largely due to the cyclical nature of research and the need for constant optimization trials. Manufacturers of crystallization screens and plates are innovating rapidly, offering micro-scale dispensing options and specialized formulations designed for problematic proteins, directly addressing user feedback regarding sample conservation. This sub-segment’s stability provides a reliable revenue base for key market players, balancing the cyclical, high-capital sales of specialized instrumentation. The overall market health is supported by the foundational role these techniques play in academic grant-funded research globally, where structural elucidation is often a mandatory component for high-impact publications and subsequent clinical translation.

Future growth will be significantly influenced by regulatory frameworks governing drug approvals and the pressure on pharmaceutical companies to demonstrate high target specificity, making precise structural knowledge non-negotiable. As complex biological targets, such as G-protein coupled receptors (GPCRs) and multi-domain assemblies, become more prevalent in drug pipelines, the demand for sophisticated, hybrid structural tools capable of handling these challenging molecules will surge. The market is thus poised for a period of robust investment in R&D aimed at refining existing techniques and integrating new structural methodologies, ensuring that crystallography remains a central pillar of translational biomedical science globally through 2033 and beyond. This expansion is essential for keeping pace with the increasing complexity of modern biological problems.

The competitive landscape is characterized by a mix of specialized vendors focusing solely on crystallization products (reagents, plates, automation) and large, diversified life science conglomerates that offer integrated solutions encompassing X-ray generators, detectors, and software. This competitive duality encourages both specialized innovation in niche areas and comprehensive system integration. Smaller, agile companies often drive technological breakthroughs in microfluidics and software, while major corporations leverage their extensive distribution networks and existing customer bases within pharmaceutical and academic sectors to dominate the high-capital instrument market. Strategic partnerships between instrumentation providers and software developers, particularly those specializing in AI/ML tools, are becoming increasingly common, reflecting the market’s pivot towards smart, data-driven structural biology solutions necessary for high-throughput operational efficiency and enhanced structural success rates.

Regional variations in market maturity heavily dictate the current demand profile. In established markets like North America and Europe, the focus is on upgrading older equipment with automated, high-resolution replacements and adopting advanced Cryo-EM and AI integration services. Conversely, emerging markets in APAC are characterized by foundational investment, often seeking full-suite solutions for establishing new core facilities from the ground up, driving demand for packaged instruments and extensive training and support services. This geographical segmentation of demand requires manufacturers to maintain flexible product portfolios and differentiated pricing strategies tailored to various levels of technological readiness and budgetary constraints across the globe. Such regional nuances are critical for effective market penetration and sustainable growth across the forecast horizon.

Addressing environmental sustainability is also emerging as a subtle but growing factor in the market. There is an increasing preference for technologies, such as microfluidics, that minimize the use of chemical reagents and protein samples, reducing waste and cost. While not a primary driver, the sustainability profile of instruments and consumables is becoming an important consideration for research institutions aiming to meet organizational environmental targets. Instrument manufacturers are responding by designing more energy-efficient X-ray sources and optimizing liquid handling systems for minimal reagent consumption. This environmental consciousness, combined with efficiency gains from automation and AI, contributes to a healthier operational environment for structural research, reinforcing the market’s long-term viability and positive impact on scientific endeavors worldwide.

The stringent quality control required for generating research-grade proteins, which precedes the crystallization step, indirectly influences the crystallography market. Companies specializing in protein purification systems and characterization tools (such as mass spectrometry and dynamic light scattering) are crucial upstream partners. Failures in protein quality often lead directly to crystallization failures, reinforcing the need for tight integration and standardization across the entire sample preparation and analysis workflow. As research increasingly targets difficult, unstable, or post-translationally modified proteins, the demand for sophisticated pre-crystallization characterization tools grows, presenting synergistic market opportunities for providers offering end-to-end solutions that guarantee sample quality and increase the probability of successful structure determination.

Regulatory support for drug development, particularly incentives for developing structural knowledge of novel targets, continues to bolster the market. Government agencies recognize the efficiency gains provided by SBDD, leading to sustained or increased funding for structural biology infrastructure, especially public access beamlines and national research laboratories. These institutional investments serve as critical anchor points for the entire market, providing the high-end, capital-intensive resources—like synchrotrons—that few individual research labs could afford. The stability provided by these large public sector investments acts as a foundation upon which private sector innovation in automation and consumables can flourish, ensuring that the market is robust against short-term economic fluctuations and maintains a strong long-term growth forecast based on essential scientific utility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager