Protein Degradation Therapy Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443531 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Protein Degradation Therapy Market Size

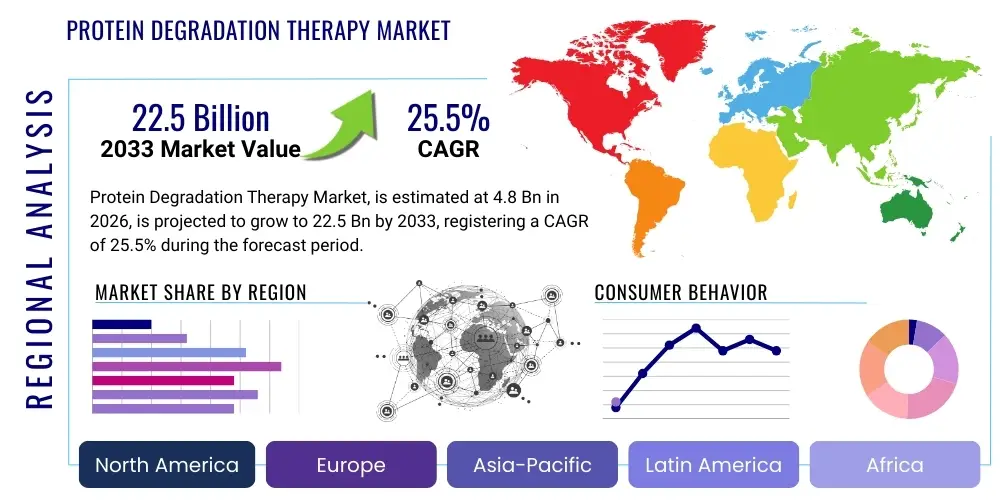

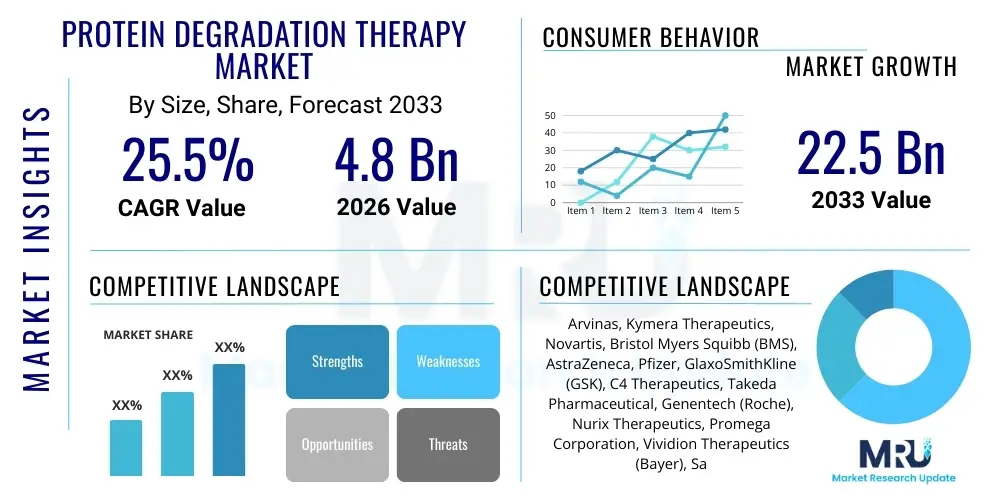

The Protein Degradation Therapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 22.5 Billion by the end of the forecast period in 2033.

Protein Degradation Therapy Market introduction

The Protein Degradation Therapy (PDT) market encompasses innovative therapeutic modalities focused on eliminating disease-causing proteins rather than merely inhibiting their function. This disruptive field is primarily driven by the development of Targeted Protein Degradation (TPD) technologies, notably PROteolysis TArgeting Chimeras (PROTACs) and molecular glues. These approaches leverage the cell's natural ubiquitin-proteasome system (UPS) to selectively tag and destroy pathogenic proteins, including those traditionally considered 'undruggable' by conventional small-molecule inhibitors. The core mechanism involves utilizing small molecules that recruit an E3 ligase enzyme to the target protein, facilitating ubiquitination and subsequent degradation by the proteasome. This catalytic mechanism means that lower drug concentrations can achieve significant therapeutic effects, offering a paradigm shift in drug development, particularly within oncology, immunology, and neurodegenerative disorders. The introduction of PDT promises higher efficacy, broader target range, and potentially reduced resistance mechanisms compared to traditional pharmacological interventions.

Major applications for Protein Degradation Therapy span across severe chronic diseases, with oncology currently dominating the market landscape due to the ability of TPD agents to target critical oncogenic drivers and resistance mechanisms previously inaccessible. Furthermore, the inherent advantages of catalytic activity—where a single TPD molecule can facilitate the destruction of multiple target protein molecules—lead to enhanced potency and sustained effect. The product description of TPD agents involves complex, often bi-functional or tri-functional, small molecules designed for specific E3 ligase recruitment (such as Cereblon or VHL) and high-affinity binding to the target protein. This precision targeting enhances selectivity, minimizing off-target toxicity, which is a significant benefit over traditional chemotherapy or broad enzyme inhibitors. The ability to degrade structural or scaffolding proteins, in addition to enzymatic targets, further expands the therapeutic scope of PDT.

Driving factors for the accelerated growth of this market include substantial investment from both venture capital and major pharmaceutical companies, evidenced by numerous high-value partnerships and licensing agreements focused on expanding TPD libraries and clinical pipelines. Technological advancements in optimizing linker chemistry, understanding E3 ligase biology, and developing oral bioavailability for these complex molecules are paramount. The successful progression of several PROTAC and molecular glue candidates into late-stage clinical trials, demonstrating favorable safety profiles and promising efficacy in resistant cancers, fuels market optimism. Additionally, the growing global incidence of chronic diseases, coupled with the urgent need for novel therapies against previously intractable targets, solidifies the foundational demand for Protein Degradation Therapy solutions globally.

Protein Degradation Therapy Market Executive Summary

The Protein Degradation Therapy (PDT) market is characterized by robust business trends centered on strategic collaborations between specialized biotechnology firms, which possess proprietary TPD platforms, and established pharmaceutical giants providing necessary funding, regulatory expertise, and manufacturing scale. A key business trend involves the shift from targeting known oncogenic proteins to exploring novel E3 ligase recruitment strategies and developing non-oncology applications, notably in Alzheimer's and Parkinson's diseases. Segment trends highlight the dominance of the PROTAC modality, although molecular glues are rapidly gaining traction due to their simpler structure and growing clinical success, particularly concerning established drugs like thalidomide derivatives. The application segment remains heavily focused on hematological malignancies and solid tumors, yet investment in inflammation and infectious disease targets is accelerating, diversifying future revenue streams. This dynamic environment necessitates continuous R&D investment to overcome challenges related to bioavailability, specificity, and resistance mechanisms.

Regionally, North America, particularly the United States, maintains its position as the global hub for PDT innovation, driven by high R&D spending, a favorable regulatory environment (especially for breakthrough designations), and the presence of leading academic and industrial research institutions specializing in structural biology and chemical biology. Europe also demonstrates significant activity, focused on basic research and early-stage development, supported by strong governmental funding initiatives like Horizon Europe. However, the Asia Pacific region, especially China and Japan, is emerging as a critical growth engine, characterized by increasing outsourcing of clinical trials and rapid adoption of advanced biopharmaceutical manufacturing techniques. These regional trends are underpinned by the global competitive pressure to be the first to market with orally available, highly selective TPD agents, influencing global pricing and access strategies.

Overall, the market is defined by a high barrier to entry due to the technical complexity of developing bi-functional molecules, yet the potential for high returns attracts continuous investment. Key performance indicators monitored by stakeholders include the successful identification of novel E3 ligases, optimization of linker technology for improved pharmacokinetics, and clinical trial success rates, particularly in Phase II and Phase III studies involving biomarker selection. The competitive landscape is intensely concentrated among a few early-mover biotechnology firms, forcing major pharmaceutical companies to engage in strategic acquisitions to secure TPD pipelines. The long-term executive outlook remains highly optimistic, predicting that PDT will transition from a niche therapeutic area to a mainstream pillar of modern medicine within the next decade, significantly altering treatment paradigms across multiple disease areas.

AI Impact Analysis on Protein Degradation Therapy Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Protein Degradation Therapy (PDT) market frequently revolve around accelerating the design and synthesis cycle of PROTACs and molecular glues, specifically focusing on how AI can predict E3 ligase interactions and optimize linker chemistry. Common questions explore AI’s role in identifying novel, therapeutically relevant E3 ligases, predicting the degradation efficiency (DP50) of potential candidates, and streamlining hit-to-lead optimization in TPD discovery, which is notoriously complex due to the molecules' tri-component nature (binder, linker, E3 ligase recruiter). Users are concerned about whether AI can reduce the experimental burden associated with synthesizing and testing thousands of chemical entities, thereby cutting R&D costs and shortening the timeline to Investigational New Drug (IND) submission. The prevailing expectation is that AI and machine learning (ML) will serve as essential tools for navigating the vast chemical space of potential TPD agents, moving beyond traditional, slower screening methods and enabling precision medicine approaches by correlating molecular features with patient-specific degradation profiles.

- AI accelerates target identification by analyzing high-throughput screening data and complex proteomic datasets to identify suitable degradation targets, particularly 'undruggable' proteins.

- Machine learning models predict the optimal binding affinities between the target protein, the E3 ligase, and the specific ligand required for effective tri-partite complex formation.

- Generative AI designs novel PROTAC structures and linker chemistries, optimizing parameters like length, rigidity, lipophilicity, and metabolic stability to improve oral bioavailability and pharmacokinetics.

- Predictive analytics enhance the understanding of E3 ligase biology, helping researchers screen for novel E3 ligase recruiters beyond the commonly used VHL, Cereblon, and MDM2, diversifying TPD platforms.

- AI supports clinical trial optimization by identifying patient subpopulations most likely to respond to a specific TPD agent, based on genetic and proteomic biomarkers, enhancing personalized medicine applications.

- Deep learning algorithms are used for predicting potential off-target effects and toxicity profiles of complex bi-functional degraders early in the preclinical stage, minimizing late-stage attrition.

- Computational modeling simulates the degradation kinetics (DP50, Dmax) and cellular uptake of TPD molecules, drastically reducing the required number of physical synthesis and testing cycles.

DRO & Impact Forces Of Protein Degradation Therapy Market

The Protein Degradation Therapy (PDT) market is profoundly shaped by powerful impact forces driven by groundbreaking scientific discovery, countered by significant developmental hurdles unique to this class of compounds. The primary driver is the extraordinary potential of TPD to target approximately 85% of the human proteome previously inaccessible to conventional inhibitors, effectively revolutionizing drug discovery by rendering 'undruggable' targets druggable. This expanded scope addresses massive unmet medical needs, particularly in advanced or resistant cancers, neurodegenerative diseases, and autoimmune disorders. Furthermore, the catalytic nature of degradation—where the TPD molecule is recycled—means these agents can exert sustained effects even at very low doses, potentially reducing dosing frequency and improving patient adherence. Substantial financial backing from investors, coupled with government initiatives promoting biopharmaceutical innovation, provides the necessary capital infusion to sustain high-risk, high-reward R&D activities across the entire value chain.

Conversely, significant restraints temper the market's rapid expansion. The principal restraint centers on the complex pharmacology and chemistry required for developing orally bioavailable TPD agents. The molecules are often large (exceeding Lipinski's Rule of Five), poorly permeable, and metabolically unstable, posing severe challenges in achieving optimal pharmacokinetics and pharmacodynamics (PK/PD). Regulatory uncertainty also represents a bottleneck, as these novel mechanisms of action require new frameworks for preclinical testing and clinical safety evaluation, particularly regarding understanding and mitigating potential degradation-induced resistance mechanisms (e.g., E3 ligase downregulation or mutation). Manufacturing challenges related to the large-scale synthesis of these sophisticated bi-functional molecules further limit production capacity and increase development costs, posing a significant hurdle for smaller biotechnology firms.

Opportunities within the PDT space are vast and diverse, centering on the identification and validation of novel E3 ligases, moving beyond the established Cereblon and VHL pathways. Exploring tissue-specific E3 ligases could enable targeted degradation with minimized systemic side effects, unlocking therapeutic potential in non-oncology areas such as cardiology and ophthalmology. The development of next-generation degradation platforms, including lysosome-targeting chimeras (LYTACs) and antibody-based degraders, presents avenues for targeting extracellular and membrane proteins, vastly expanding the therapeutic repertoire. The impact forces indicate that the competitive pressure for first-in-class assets in areas like KRAS degradation or tauopathy treatment will accelerate clinical development timelines. Ultimately, successful resolution of PK/PD challenges and regulatory harmonization will transform PDT from a promising technology into a dominant market force, displacing conventional small-molecule inhibitors in targeted therapy regimens across the globe.

Segmentation Analysis

The Protein Degradation Therapy market segmentation is critical for understanding the varied technological approaches and the concentration of commercial activity across therapeutic areas. The market is primarily segmented based on Modality, focusing on the chemical mechanism used to induce degradation (PROTACs, Molecular Glues, and others). It is also segmented by Application (Oncology, Neurology, Immunology, etc.) which reflects the predominant use cases driving current revenue, and by Technology (Targeting Ligands, E3 Ligase Ligands, Linkers) which addresses the underlying components and innovations shaping R&D efforts. This structure allows stakeholders to assess competitive intensity, technological maturity, and the most promising commercial avenues for investment. The dominance of oncology applications reflects the urgent clinical need and the initial success of targeting high-value cancer proteins, while the technical segmentation underscores the continuous innovation required in linker chemistry and E3 ligase recruitment to improve drug characteristics like oral bioavailability and specificity.

- By Modality:

- PROTACs (Proteolysis Targeting Chimeras)

- Molecular Glues

- LYTACs (Lysosome-Targeting Chimeras)

- AUTACs (Autophagy-Targeting Chimeras)

- DUBTACs (Deubiquitinase-Targeting Chimeras)

- By Application:

- Oncology

- Hematological Malignancies

- Solid Tumors

- Neurological Diseases (e.g., Alzheimer’s Disease, Parkinson’s Disease)

- Immunological and Inflammatory Diseases

- Infectious Diseases

- Others (e.g., Rare Genetic Disorders)

- Oncology

- By End-User:

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- By Mechanism/Technology:

- E3 Ligase Target (VHL, Cereblon, MDM2, Novel E3s)

- Linker Chemistry (PEG Linkers, Alkyl Linkers, Peptidyl Linkers)

- Target Protein Class (Kinases, Transcription Factors, Scaffolding Proteins)

Value Chain Analysis For Protein Degradation Therapy Market

The Value Chain for the Protein Degradation Therapy market is distinctively complex, beginning with extensive upstream research and development activities focused heavily on biological target identification, validation, and the exploration of novel E3 ligases beyond the commonly used Cereblon and VHL. The upstream segment is dominated by specialized biotechnology firms and academic institutions engaged in chemical biology and structural biology, utilizing advanced computational tools (including AI) to design and optimize the tri-partite complex formation essential for degradation. Key activities involve screening for high-affinity target ligands and E3 ligase recruiters, followed by sophisticated medicinal chemistry to engineer the linker component that ensures optimal spatial arrangement. This phase requires high intellectual property investment and generates core assets (proprietary TPD platforms, E3 ligase libraries, and specific degradation candidates) that define a company’s competitive edge.

The downstream analysis focuses on preclinical development, clinical trials, manufacturing, and commercialization. Once a lead compound is optimized in the upstream phase, large pharmaceutical partners typically assume responsibility for the capital-intensive and time-consuming clinical development process (Phase I through III). A critical choke point in the downstream chain is manufacturing; the large, often non-traditional molecular structure of PROTACs necessitates specialized synthetic chemistry techniques, requiring significant investment in Current Good Manufacturing Practices (cGMP) facilities capable of handling complex API synthesis. Failure at this stage can severely delay market entry, emphasizing the reliance on specialized contract development and manufacturing organizations (CDMOs) with expertise in highly complex bi-functional molecules.

The distribution channel for approved Protein Degradation Therapies, predominantly in oncology, follows standard pharmaceutical pathways, utilizing both direct and indirect sales channels. Direct channels involve dedicated specialty sales forces targeting major oncology centers and academic hospitals where treatment decisions for complex cancers are made. Indirect channels rely on established pharmaceutical wholesalers and distributors to manage logistics and inventory for widespread regional availability. Due to the high cost and specialized nature of these treatments, reimbursement strategies are critical, often involving direct negotiation with payers and government healthcare systems. The successful navigation of the downstream distribution—ensuring cold chain management if necessary and securing favorable formulary placement—is essential for maximizing market penetration and achieving peak sales potential for these innovative medicines.

Protein Degradation Therapy Market Potential Customers

The primary potential customers and end-users of Protein Degradation Therapy products are the specialized healthcare providers who prescribe these treatments, including oncologists, hematologists, and, increasingly, neurologists and rheumatologists, particularly those practicing in major academic medical centers and specialized cancer treatment facilities. These prescribers rely on innovative therapies for patients who have failed standard care, have developed resistance to conventional inhibitors, or suffer from diseases where no effective treatment currently exists (addressing the 'undruggable' proteome). The immediate customer base is therefore defined by high unmet medical need populations, necessitating strong clinical evidence demonstrating superior efficacy or survival benefits over existing standards of care. Due to the precision and novelty of the mechanism, early adopters are concentrated in tertiary care settings capable of complex diagnostics and management of novel side effect profiles.

A secondary, yet crucial, customer segment comprises the large pharmaceutical and biotechnology companies themselves, acting as strategic buyers and licensees of proprietary TPD platforms, technologies, and preclinical assets developed by niche biotech firms and research institutions. These large entities acquire TPD technologies to augment their existing pipelines, secure intellectual property related to novel E3 ligases, and gain a competitive edge in targeted therapy. Their demand is driven by the need for pipeline diversification, risk reduction through collaboration, and accessing sophisticated chemical libraries and computational tools necessary for TPD discovery. This segment fuels the upstream market, driving significant transaction volume through mergers, acquisitions, and strategic research partnerships that validate the underlying technology.

Finally, academic and government research institutions represent an important end-user segment, utilizing TPD agents as sophisticated biological tools to study protein function, degradation kinetics, and cellular signaling pathways. These institutions purchase research-grade degraders and related components (ligands, linkers, chemical intermediates) for basic science investigations, contributing to the foundational knowledge that informs future clinical development. Their demand is generally driven by grant funding cycles and the pursuit of novel biological insights, forming a critical feedback loop into the early stages of the TPD value chain by identifying new therapeutic targets and optimizing current degradation strategies. The long-term commercial success of PDT relies on the successful translation of research insights from this segment into clinically viable products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 22.5 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arvinas, Kymera Therapeutics, Novartis, Bristol Myers Squibb (BMS), AstraZeneca, Pfizer, GlaxoSmithKline (GSK), C4 Therapeutics, Takeda Pharmaceutical, Genentech (Roche), Nurix Therapeutics, Promega Corporation, Vividion Therapeutics (Bayer), Sanofi, Merck KGaA, Shanghai Hengrui Pharmaceuticals, Cullgen, Biogen, Amgen, Servier |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protein Degradation Therapy Market Key Technology Landscape

The technological landscape of the Protein Degradation Therapy market is highly dynamic and characterized by continuous innovation in chemical biology and drug design methodologies. The core technology revolves around the design of bi-functional molecules, primarily PROTACs, which structurally consist of three key components: a ligand that binds to the target protein, a ligand that recruits an E3 ubiquitin ligase, and a chemical linker connecting the two. Recent technological advancements focus heavily on optimizing the linker—specifically its length, rigidity, and hydrophobic properties—to ensure optimal ternary complex formation, which is the necessary state for effective ubiquitination. Furthermore, there is significant investment in developing robust high-throughput screening assays that can accurately measure ternary complex formation kinetics and subsequent degradation efficiency (DP50), moving beyond simple binding assays to functional cellular readouts, often utilizing advanced microscopy and flow cytometry techniques for real-time monitoring of protein turnover.

Beyond the established PROTAC platform, the landscape is rapidly diversifying into next-generation degradation technologies addressing different cellular targets and compartments. For instance, Lysosome-Targeting Chimeras (LYTACs) are an emerging platform designed to degrade extracellular and membrane-bound proteins, which are inaccessible to cytoplasm-based PROTACs, by harnessing the lysosomal degradation pathway rather than the proteasome. Similarly, Autophagy-Targeting Chimeras (AUTACs) leverage the autophagy pathway for the degradation of large protein aggregates or organelles. These technological extensions significantly broaden the scope of TPD to include targets relevant in metabolic, autoimmune, and neurodegenerative conditions. The technological competition is fiercely centered on which platform can achieve the highest therapeutic index—the optimal balance between potency, selectivity, and pharmacokinetic properties, especially oral bioavailability.

A crucial technological component is the continuous discovery and characterization of novel E3 ligases. Currently, the vast majority of clinical candidates utilize VHL or Cereblon, yet the human genome contains hundreds of potential E3 ligases, many of which exhibit tissue-specific expression patterns. Identifying ligands for these novel E3s is paramount, as it offers the potential for highly selective, tissue-restricted degradation, significantly reducing systemic toxicity. Research institutions and dedicated biotech firms are deploying advanced chemoproteomics and mass spectrometry techniques, often guided by AI algorithms, to map the binding pockets and structural requirements of these underexplored ligases. Successful technological breakthroughs in this area will unlock novel therapeutic windows, driving the next major wave of clinical candidates and maintaining the high growth trajectory of the Protein Degradation Therapy market through the forecast period and beyond.

Regional Highlights

- North America (Dominant Market Share): The United States leads the global market, underpinned by an ecosystem of robust venture capital funding, specialized biotechnology firms (e.g., Arvinas, Kymera Therapeutics), and close collaboration between academia (e.g., Yale, Dana-Farber) and industry. High R&D expenditure, particularly on complex chemistry and early clinical trials for oncology assets, solidifies its position. Favorable regulatory pathways, such as the FDA's accelerated approval process for breakthrough therapies, facilitate rapid translation of TPD discoveries into clinical candidates. The region holds the largest concentration of intellectual property related to key TPD platforms, including PROTAC design and E3 ligase recruiters.

- Europe (Strong Research Foundation): European countries, especially the UK, Germany, and Switzerland, demonstrate strong capability in fundamental chemical biology and protein science, often supported by public funding mechanisms. While commercialization typically lags the US, the region is highly active in preclinical optimization and securing early-stage partnerships with US-based biotech firms. Regulatory bodies, such as the European Medicines Agency (EMA), are actively engaging in dialogues to establish appropriate guidelines for this novel class of therapeutics, influencing market access and patient adoption across major European economies.

- Asia Pacific (Fastest Growth Trajectory): The APAC region, driven by countries like China, Japan, and South Korea, is poised for the fastest CAGR due to increasing investment in domestic biotech innovation and expanding contract research and manufacturing capabilities (CROs/CDMOs). China, in particular, is rapidly accelerating its TPD pipeline through government initiatives promoting innovative drug development and significant investment in local PROTAC developers. Japan remains a leader in structural biology and pharmaceutical science, contributing key insights into molecular glue development. This region is becoming increasingly important for late-stage clinical trials and large-scale manufacturing due to competitive operational costs.

- Latin America, Middle East, and Africa (Emerging Opportunities): While currently holding a smaller market share, these regions represent opportunities driven by increasing healthcare access and improving regulatory standards. Market activity is primarily focused on importing established TPD therapies, although localized clinical trials are beginning to emerge, particularly in countries with strong clinical research infrastructure like Brazil and Israel. Future growth depends heavily on patent expiration and the establishment of local biomanufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protein Degradation Therapy Market.- Arvinas

- Kymera Therapeutics

- Novartis

- Bristol Myers Squibb (BMS)

- AstraZeneca

- Pfizer

- GlaxoSmithKline (GSK)

- C4 Therapeutics

- Takeda Pharmaceutical

- Genentech (Roche)

- Nurix Therapeutics

- Promega Corporation

- Vividion Therapeutics (Bayer)

- Sanofi

- Merck KGaA

- Shanghai Hengrui Pharmaceuticals

- Cullgen

- Biogen

- Amgen

- Servier

Frequently Asked Questions

Analyze common user questions about the Protein Degradation Therapy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between Protein Degradation Therapy (PDT) and conventional small-molecule inhibition?

The key difference lies in the mechanism of action. Traditional inhibitors block the active site of a protein, requiring continuous high concentrations to maintain function suppression. PDT, primarily through PROTACs and molecular glues, uses a catalytic mechanism leveraging the cell's ubiquitin-proteasome system to permanently tag and destroy the entire protein, allowing for sustained efficacy at lower doses and enabling the targeting of proteins without enzymatic activity ('undruggable' targets).

What are PROTACs and Molecular Glues, and how do they differ in structure and function?

Both are forms of Targeted Protein Degradation (TPD). PROTACs are bi-functional molecules with three components: a target binder, an E3 ligase binder, and a linker, designed to induce proximity between the target and the degradation machinery. Molecular glues are typically simpler, smaller molecules that directly alter the surface of an E3 ligase or a target protein, forcing them into a stable complex necessary for ubiquitination. Molecular glues are generally easier to formulate but harder to discover rationally than PROTACs.

Which therapeutic area currently sees the highest level of investment and clinical activity in the PDT market?

Oncology dominates the Protein Degradation Therapy market, particularly in the treatment of hematological malignancies (blood cancers) and specific solid tumors. This focus is due to the technology's ability to overcome drug resistance pathways and target critical oncogenic drivers, such as transcription factors and kinases, which were previously considered difficult or impossible to inhibit effectively with traditional small molecules.

What are the primary technical challenges facing the commercialization of TPD agents?

The main technical challenges center on optimizing the physicochemical properties of TPD agents. Because these molecules are large and structurally complex, they often violate traditional rules for drug-likeness (like Lipinski’s Rule of Five), leading to issues with poor cellular permeability, low oral bioavailability, and metabolic instability, which must be overcome to achieve effective clinical drug candidates.

How is AI influencing the future R&D pipeline for Protein Degradation Therapy?

Artificial Intelligence (AI) is crucial for accelerating TPD discovery by enabling rational design. AI tools predict optimal linker chemistries, screen vast libraries for novel E3 ligase recruiters, model ternary complex formation kinetics, and identify suitable targets by analyzing complex proteomic data, significantly speeding up the preclinical optimization phase and reducing associated costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager