Provider Data Management (PDM) Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443548 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Provider Data Management (PDM) Software Market Size

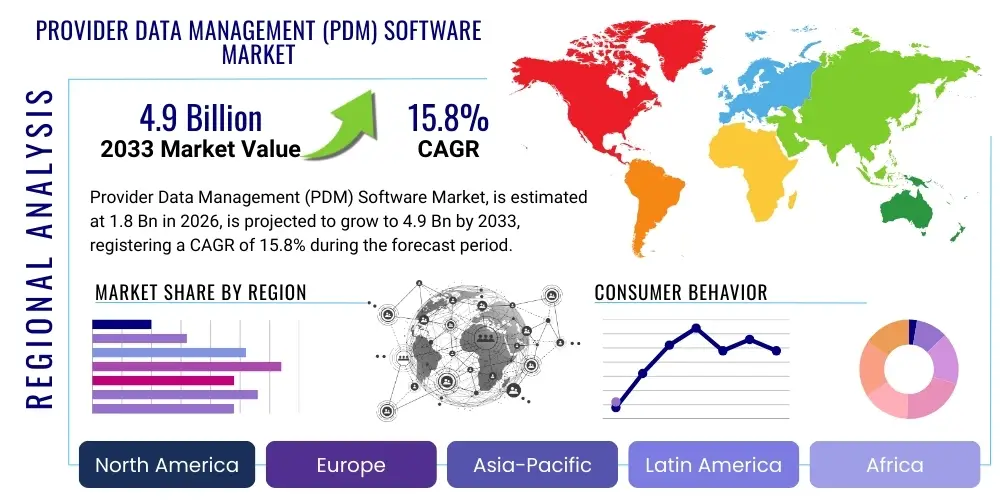

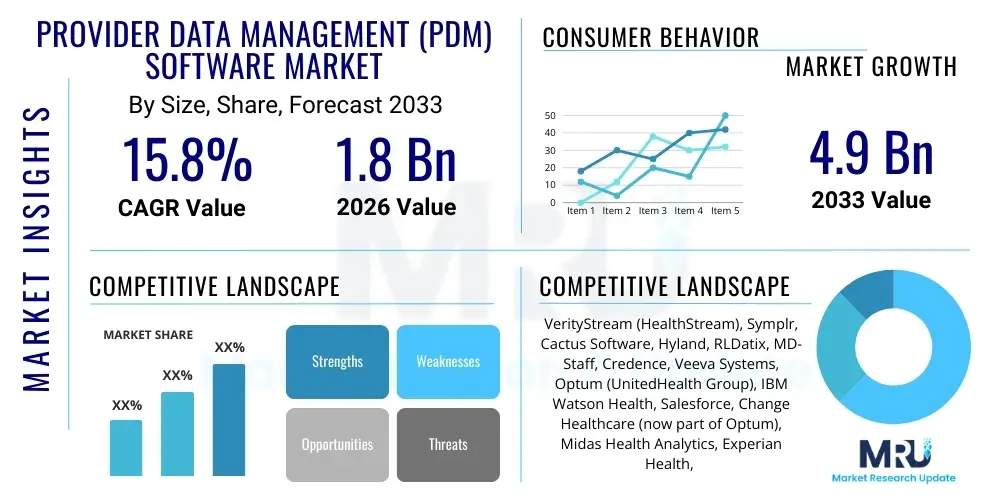

The Provider Data Management (PDM) Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

This robust expansion is fundamentally driven by the escalating complexity of healthcare networks, increasing regulatory scrutiny, and the critical need for accurate, standardized provider data across the entire healthcare ecosystem. PDM solutions are moving beyond basic credentialing and enrollment to encompass comprehensive lifecycle management, including network adequacy analysis, risk assessment, and precise claims routing. Healthcare organizations, both payers and providers, recognize that faulty or outdated provider data directly impacts operational efficiency, financial leakage, and compliance adherence, thereby prioritizing investments in sophisticated PDM platforms that leverage cloud architecture and integrated workflow capabilities.

The transition toward value-based care models further catalyzes market growth. Accurate provider directories are essential for patient access, seamless referral management, and ensuring compliance with federal mandates such as the No Surprises Act, which necessitates transparent and accessible provider information. Moreover, the integration of PDM with core enterprise systems—including Electronic Health Records (EHR) and Customer Relationship Management (CRM) platforms—is enhancing the utility of these solutions, making them foundational infrastructure for modern healthcare administration. This demand for integrated, real-time data synchronization across disparate systems underpins the significant forecasted CAGR.

Provider Data Management (PDM) Software Market introduction

The Provider Data Management (PDM) Software Market encompasses specialized technological solutions designed to collect, validate, maintain, and disseminate accurate information pertaining to healthcare providers, facilities, and associated administrative data throughout their lifecycle within a health system or payer network. PDM solutions act as the single source of truth for critical provider information, including licensing, certifications, professional history, network status, demographic details, and specialized taxonomy codes. The primary product offering includes modular software platforms that support functionalities such as credentialing, privileging, enrollment, directory management, and network analysis, often delivered via Software-as-a-Service (SaaS) models for enhanced scalability and accessibility. Major applications span across payer organizations needing to maintain compliant, robust provider directories and manage claims processing efficiently, and provider organizations requiring streamlined credentialing and quality management processes to ensure optimal patient care delivery.

The benefits derived from adopting sophisticated PDM software are multifaceted, centered around mitigating operational risks, reducing administrative costs, and improving the overall quality of care coordination. Key driving factors include the increasingly stringent regulatory landscape, notably concerning network adequacy and directory accuracy; the expansion of complex care delivery models like Accountable Care Organizations (ACOs) which demand integrated data visibility; and the pervasive industry shift towards digital transformation, requiring automated, error-free data handling. Furthermore, the inherent inefficiency and high cost associated with manual, siloed data management systems compel healthcare stakeholders to invest in centralized PDM platforms that enhance data integrity and accelerate time-to-market for new network products.

The market is defined by continuous innovation focused on integrating advanced capabilities, particularly machine learning for automated data validation and robotic process automation (RPA) for streamlining workflow bottlenecks. This technological evolution transforms PDM from a compliance tool into a strategic asset that supports business intelligence, network strategy formulation, and enhanced provider relationship management. The growth trajectory is also influenced by the necessity of managing large-scale, dynamic networks comprising thousands of individual practitioners and organizational entities, where data volatility necessitates robust, real-time management systems to ensure continuous compliance and operational effectiveness.

Provider Data Management (PDM) Software Market Executive Summary

The Provider Data Management (PDM) Software Market is currently characterized by significant consolidation and technological advancement, reflecting major business trends focused on enterprise-wide platform integration and cloud adoption. Key business trends include the shift from siloed point solutions to unified PDM platforms that integrate credentialing, network management, and claims data validation, driven by vendors acquiring niche specialists to offer comprehensive suites. Regionally, North America maintains market dominance due to early adoption, stringent regulatory demands (e.g., CMS rules on directory accuracy), and high penetration of advanced healthcare IT infrastructure, while Asia Pacific exhibits the fastest growth, propelled by rapid modernization of healthcare systems and government initiatives to digitalize provider records. Segment trends indicate strong preference for SaaS-based deployment models across all end-users due to lower capital expenditure and faster deployment cycles, alongside accelerated investment in services components, specifically outsourced data validation and maintenance, highlighting the persistent challenge of managing data quality internally.

From a technology perspective, the executive summary highlights the increasing reliance on AI and ML to tackle the chronic issue of provider data inaccuracy, automating verification processes, and predicting data decay. This trend is crucial as stakeholders seek to reduce the administrative burden associated with compliance and manual reconciliation. Financial investment is heavily skewed towards solutions that demonstrate measurable return on investment (ROI) through reduced administrative costs, minimized claims denial rates resulting from incorrect data, and avoidance of regulatory penalties. The competitive landscape is intensely focused on feature differentiation, particularly regarding integration capabilities with major EHR systems and the ability to handle multi-payer, multi-state regulatory requirements within a single platform.

In summary, the PDM market is transitioning from purely reactive compliance tools to proactive strategic enablers. Payers are utilizing PDM to optimize network design and patient steering, while providers leverage it for rapid onboarding and seamless communication. The immediate future is defined by accelerated cloud migration, deep utilization of cognitive technologies for data quality assurance, and continued pressure from regulatory bodies demanding real-time accuracy and transparency, ensuring PDM remains a high-priority investment area for health systems globally.

AI Impact Analysis on Provider Data Management (PDM) Software Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the PDM market frequently revolve around its potential to solve pervasive data accuracy and maintenance challenges. Users ask: "How can AI reduce the manual effort in verifying provider credentials?" "Will machine learning eliminate 'ghost' providers from directories?" and "What is the timeline for AI integrating predictive analytics for provider network optimization?" These inquiries highlight the high expectation that AI/ML will fundamentally shift PDM from a reactive data entry task to a proactive data intelligence function, specifically targeting automated data cleansing, identifying discrepancies across multiple sources, and significantly enhancing the speed of initial credentialing and re-credentialing processes. Concerns often center on data privacy, algorithmic bias, and the necessary expertise required to manage sophisticated AI models, indicating a market eager for automation but cautious about deployment integrity and ethical considerations.

The integration of AI, including Machine Learning (ML) and Natural Language Processing (NLP), is rapidly becoming a mandatory feature within next-generation PDM solutions, moving beyond simple automation to cognitive data management. AI algorithms are deployed to continuously monitor and compare provider data against hundreds of primary sources (licensing boards, OIG exclusions lists, NPI databases), flagging inconsistencies and automating the initiation of verification workflows. This capability directly addresses the core market challenge of "data decay," where provider information changes frequently. Predictive models, powered by AI, are also beginning to forecast changes in provider status or demographic information, allowing PDM systems to proactively prompt updates, thereby ensuring high directory accuracy rates essential for regulatory compliance and operational efficiency, especially concerning claims processing and referral routing.

Furthermore, AI-driven solutions are impacting decision support within PDM, specifically aiding network managers in assessing network adequacy. By analyzing geographical distribution, specialty coverage, and utilization patterns against demographic demand, ML models can recommend strategic adjustments to provider networks. NLP is critical in parsing unstructured data found in provider contracts, certifications, and correspondence, transforming textual information into structured data points suitable for the PDM database. This comprehensive application of AI positions PDM software not just as a data repository, but as an intelligent, self-optimizing platform crucial for strategic healthcare planning and maintaining a competitive edge in value-based care markets.

- Automated Data Validation and Discrepancy Detection: AI uses ML to cross-reference thousands of external data points, ensuring real-time data integrity and reducing manual verification effort by up to 60%.

- Predictive Data Decay Modeling: ML algorithms forecast when provider data points (e.g., location, network status) are likely to change, triggering proactive update workflows.

- Natural Language Processing (NLP) for Credentialing: NLP extracts key data elements from complex, unstructured documents (CVs, applications, board certifications) automatically.

- Enhanced Fraud and Abuse Detection: AI models analyze provider behavior and network affiliations to identify potential fraudulent patterns during the enrollment and monitoring phases.

- Network Adequacy Optimization: ML assists payers in simulating and optimizing provider network coverage based on patient accessibility and specialty needs.

DRO & Impact Forces Of Provider Data Management (PDM) Software Market

The PDM Software Market is shaped by a strong combination of accelerating drivers and constraining factors, balanced by significant opportunities that collectively dictate market dynamics and the direction of technological investment. The primary drivers include increasing complexity in regulatory mandates requiring stringent data accuracy (e.g., federal transparency rules and state-specific network adequacy laws), the escalating volume and velocity of provider data resulting from expanding, decentralized healthcare networks, and the critical financial imperative to reduce administrative waste associated with manual data handling and inaccurate claims processing. These drivers compel organizations to seek robust, automated PDM solutions to mitigate financial penalties and operational disruptions. The impact forces are generally high, pushing organizations towards rapid digital transformation of their credentialing and directory maintenance functions.

However, market growth is tempered by notable restraints, predominantly the high initial implementation costs associated with migrating from legacy systems and the challenges of integrating new PDM platforms with existing, heterogeneous IT infrastructure (EHRs, billing systems) that often rely on outdated data standards. Furthermore, resistance to change and the inherent difficulty in achieving universal data governance across diverse internal departments and external partners pose significant adoption hurdles. The lack of standardized data formatting and shared identifiers among various state and federal entities also complicates automated data exchange, requiring significant vendor investment in flexible integration layers.

The market opportunities are substantial, primarily driven by the ongoing shift towards value-based care and the rise of digital health. PDM is positioned as a foundational technology for these models, enabling precise measurement of quality metrics and efficient care coordination across integrated delivery networks (IDNs) and ACOs. The untapped potential in emerging markets, coupled with the opportunity to embed advanced technologies like blockchain for secure, decentralized credential sharing and AI for real-time data maintenance, promises sustained, high-growth expansion throughout the forecast period. The strategic application of PDM software in risk management and provider performance analytics represents a high-value opportunity, transforming PDM into a decision-support tool rather than merely a compliance utility.

Segmentation Analysis

The PDM Software Market is comprehensively segmented based on various technical and operational parameters, reflecting the diverse needs of the healthcare ecosystem. Key segmentation criteria include the system components offered (software platforms versus managed services), deployment methods (cloud-based being dominant over on-premise solutions), the functional capabilities provided (ranging from core credentialing to complex network management), and the specific end-user category (payers, providers, ACOs, and government entities). Analyzing these segments provides crucial insight into where investment is concentrated and how technological adoption patterns vary across different stakeholders. The preference for flexible, scalable solutions continues to drive the dominance of the Cloud deployment segment, while the increasing complexity of regulatory and administrative tasks fuels the high demand for managed services, enabling organizations to outsource the operational burden of continuous data validation and maintenance.

Functional segmentation is particularly important as organizations seek specialized tools. Credentialing and privileging remain baseline requirements, but advanced capabilities such as physician directory management and network adequacy modeling are seeing the fastest growth, driven by legal mandates for directory accuracy and strategic business needs for network optimization. Furthermore, the segmentation by end-user clearly delineates the specific use cases; payers emphasize directory accuracy and claims alignment to minimize fraud and maximize compliance, whereas providers prioritize rapid onboarding and streamlined privileging processes to enhance physician recruitment and operational throughput. This granularity in segmentation confirms that PDM vendors must offer modular, adaptable solutions capable of addressing niche requirements within the broader market structure.

- By Component:

- Software (Platform Licenses)

- Services (Implementation, Training, Consulting, Managed Services)

- By Deployment Model:

- Cloud-Based

- On-Premise

- By End-User:

- Payers (Health Insurance Companies, Third-Party Administrators)

- Providers (Hospitals, Health Systems, Ambulatory Centers, IDNs)

- Accountable Care Organizations (ACOs) and Clinically Integrated Networks (CINs)

- Government and Regulatory Agencies

- By Functionality:

- Credentialing and Re-credentialing

- Provider Directory Management and Transparency

- Network Management and Adequacy Analysis

- Provider Enrollment and Contracting

- Quality Management and Performance Monitoring

Value Chain Analysis For Provider Data Management (PDM) Software Market

The value chain for the PDM Software Market begins with the upstream activities centered on core technology development and foundational data acquisition. Upstream analysis involves the development of proprietary algorithms, database architecture, and integration layers (APIs) by software vendors, often leveraging advanced technologies like AI/ML for data cleansing and normalization. Key inputs include raw provider data sourced from licensing bodies, government registers (e.g., NPI), and existing internal databases. The challenge at this stage is data standardization and achieving high latency in data synchronization, requiring strong relationships with primary source data providers and investment in robust data governance frameworks. Vendors must focus heavily on secure, scalable cloud infrastructure development to support the massive data processing requirements inherent in comprehensive PDM.

The downstream component of the value chain focuses on the distribution, implementation, and application of the PDM solution within the end-user organizations (payers and providers). Distribution channels are primarily direct, involving vendors selling enterprise licenses and professional services directly to large health systems and insurance companies, ensuring deep customization and extensive technical support. Indirect distribution often includes partnerships with healthcare IT consulting firms, system integrators, and sometimes Value-Added Resellers (VARs) who bundle PDM solutions with broader enterprise resource planning (ERP) or EHR implementation projects. Post-sale activities, including ongoing maintenance, managed data services, and continuous software updates to reflect regulatory changes, form a critical part of the downstream value proposition, ensuring sustained customer lifetime value.

The success of the PDM value chain hinges on effective collaboration between the technology developers and the end-users, ensuring that the software capabilities align precisely with complex operational and compliance needs. Direct channels are favored for large-scale, strategic deployments requiring tailored integration with legacy systems. Indirect channels play a significant role in penetrating smaller, fragmented markets or providing complementary expertise during complex migrations. Ultimately, value is created by translating raw, disparate provider data into a centralized, actionable, and compliant single source of truth, thereby reducing operational friction and improving financial and clinical outcomes for the purchasing organization.

Provider Data Management (PDM) Software Market Potential Customers

The primary potential customers and buyers of Provider Data Management (PDM) software span the entire spectrum of the healthcare delivery and financing system, unified by the need to manage complex, dynamic provider information accurately for operational efficiency and regulatory compliance. End-users include large integrated health systems and hospitals that require PDM for managing credentialing and privileging across their extensive medical staff, ensuring regulatory adherence and maintaining patient safety standards. Furthermore, ambulatory care centers and large group practices also constitute a growing customer base, increasingly needing automated solutions as they take on greater risk and manage multi-site operations.

On the financing side, health insurance payers—including national, regional, and specialty insurance carriers, as well as Third-Party Administrators (TPAs)—represent the most significant customer segment. Payers rely on PDM to maintain accurate provider directories, which is critical for member access, compliance with state and federal transparency mandates (like the No Surprises Act), and ensuring claims are processed correctly against contracted rates and network status. Inaccurate data in this sector leads directly to regulatory fines, member dissatisfaction, and financial losses due to improper claims adjudication, making PDM a mission-critical investment.

Finally, emerging healthcare models such as Accountable Care Organizations (ACOs), Clinically Integrated Networks (CINs), and specialty networks are rapidly becoming high-value customers. These organizations, focused on coordinated, value-based care, require PDM software to track quality metrics, manage physician alignment, and demonstrate network adequacy to meet shared savings goals. Government health agencies and regulatory bodies also utilize specialized PDM tools for public health infrastructure management, tracking licensure compliance, and managing large government health programs like Medicare and Medicaid, completing the diverse end-user landscape for PDM solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VerityStream (HealthStream), Symplr, Cactus Software, Hyland, RLDatix, MD-Staff, Credence, Veeva Systems, Optum (UnitedHealth Group), IBM Watson Health, Salesforce, Change Healthcare (now part of Optum), Midas Health Analytics, Experian Health, Availity, Kyruus, Health Commerce, Intelerad Medical Systems, Health Catalyst, Meridian Medical Management. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Provider Data Management (PDM) Software Market Key Technology Landscape

The PDM Software Market is undergoing a rapid technological transformation, moving from static database management to dynamic, intelligent platforms. The foundational technology remains centralized master data management (MDM) repositories, designed to harmonize data from multiple internal and external sources, ensuring a single, accurate view of the provider. Modern PDM solutions rely heavily on cloud-native architectures (specifically SaaS), which provide the necessary scalability, continuous updates, and accessibility required by dispersed healthcare organizations and regulatory bodies. The move to microservices architecture facilitates modular development, allowing end-users to adopt specific functionalities (e.g., directory management) independently and integrate them seamlessly with existing enterprise systems using robust Application Programming Interfaces (APIs). These API-first strategies are crucial for addressing the industry's complex integration requirements with systems like Epic, Cerner, and various claims processing engines.

The most impactful technological evolution involves the incorporation of cognitive computing capabilities. Artificial Intelligence (AI) and Machine Learning (ML) are deployed extensively for automated data quality assessment and maintenance. ML algorithms are trained on vast datasets to identify and flag discrepancies, automate primary source verification (PSV) processes, and predict data decay, drastically reducing the manual workload historically associated with credentialing and directory upkeep. Natural Language Processing (NLP) further enhances this capability by interpreting unstructured data—such as physician CVs, disciplinary reports, and contract language—transforming them into structured, verifiable data points for rapid processing. Blockchain technology is also emerging as a promising, though nascent, layer for secure, immutable sharing of verified provider credentials across different organizations, potentially eliminating redundant verification processes in the future, thus dramatically accelerating the provider onboarding lifecycle.

Furthermore, technology is focused on enhancing user experience and workflow optimization. Robotic Process Automation (RPA) is increasingly used to manage repetitive, rule-based tasks such as data entry and cross-system validation checks, improving throughput and accuracy. Interactive web portals and mobile applications are essential components, providing providers with self-service tools for updating their information and managing application submissions, thereby ensuring higher engagement and more timely data refreshes. The convergence of these technologies—Cloud, AI/ML, and RPA—defines the competitive edge in the PDM market, positioning leading vendors who can integrate these features into a seamless, highly compliant platform as market leaders capable of meeting the stringent demands of modern healthcare administration and regulatory oversight.

Regional Highlights

The global PDM Software Market exhibits varied growth patterns and maturity levels across different geographical regions, heavily influenced by regulatory environments, IT expenditure in healthcare, and the complexity of local healthcare delivery systems.

- North America (NA): Dominates the global market share, primarily driven by the United States due to its highly complex and fragmented payer-provider landscape, stringent compliance requirements (e.g., HIPAA, state-level network adequacy laws, and the No Surprises Act), and high rate of adoption of advanced healthcare IT solutions. The region is characterized by early and continuous investment in sophisticated PDM platforms, with high demand for AI-driven automation tools. Canada also contributes significantly, focusing on streamlining credentialing processes across provincial health systems.

- Europe: Represents a mature market characterized by diverse regulatory environments across member states. Growth is steady, fueled by governmental initiatives focusing on digital transformation of public health services and the consolidation of regional healthcare networks. Key drivers include GDPR compliance for sensitive data handling and efforts to standardize cross-border credentialing, particularly in Western European nations with established healthcare IT infrastructure.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC is experiencing exponential growth due to massive investments in healthcare infrastructure modernization, increasing private sector participation in insurance, and large-scale government initiatives to digitalize provider data across populous countries like India and China. While starting from a lower base, the need for efficient management of vast provider networks, coupled with rapid urbanization and expansion of health coverage, drives strong demand for scalable, cloud-based PDM solutions.

- Latin America (LATAM): Exhibits moderate growth. Market adoption is fragmented but growing, spurred by increasing penetration of private insurance schemes and efforts in countries like Brazil and Mexico to improve transparency and efficiency in public healthcare administration. Challenges include budget constraints and varying levels of IT maturity across nations, leading to a higher preference for cost-effective, modular PDM solutions.

- Middle East and Africa (MEA): Emerging market driven primarily by Gulf Cooperation Council (GCC) countries investing heavily in world-class healthcare facilities and mandatory health insurance schemes. PDM adoption is accelerating to support the rapid recruitment of international medical professionals and manage complex expatriate provider network requirements, with significant demand for cloud deployment and managed services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Provider Data Management (PDM) Software Market.- VerityStream (HealthStream)

- Symplr

- Cactus Software

- Hyland

- RLDatix

- MD-Staff

- Credence

- Veeva Systems

- Optum (UnitedHealth Group)

- IBM Watson Health

- Salesforce

- Change Healthcare (now part of Optum)

- Midas Health Analytics

- Experian Health

- Availity

- Kyruus

- Health Commerce

- Intelerad Medical Systems

- Health Catalyst

- Meridian Medical Management

Frequently Asked Questions

Analyze common user questions about the Provider Data Management (PDM) Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Provider Data Management (PDM) Software and why is it crucial for healthcare compliance?

PDM software is a centralized platform for maintaining accurate, up-to-date information about healthcare providers, facilities, and networks. It is crucial for compliance because regulatory bodies mandate real-time accuracy for provider directories (e.g., No Surprises Act) and require rigorous credentialing processes, preventing financial penalties and ensuring patient safety.

How is AI transforming the efficiency of provider credentialing and directory accuracy?

AI, specifically Machine Learning (ML) and Natural Language Processing (NLP), automates primary source verification (PSV), identifies discrepancies across multiple databases, and parses unstructured documents. This automation reduces manual effort, accelerates the time required for onboarding providers, and proactively addresses data decay, significantly improving directory accuracy.

Which deployment model (Cloud vs. On-Premise) is currently preferred in the PDM Market?

The Cloud-Based (SaaS) deployment model is overwhelmingly preferred. Cloud solutions offer superior scalability, lower total cost of ownership (TCO), faster deployment, and automatic software updates essential for managing continuous regulatory changes and integrating with other cloud-based healthcare systems.

What are the biggest challenges organizations face when implementing a new PDM solution?

Major challenges include integrating the PDM system with existing, often proprietary legacy IT infrastructure (EHRs, billing systems), ensuring high data quality during initial migration, and overcoming organizational resistance to standardizing complex internal workflow processes.

Beyond compliance, what strategic benefits does advanced PDM software offer to payers?

Strategic benefits include enhanced network adequacy modeling for optimal patient access, improved claims adjudication efficiency due to accurate provider-payer alignment, reduced administrative costs, and better overall provider relationship management and contracting capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager