PTFE Hollow Fiber Membranes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442099 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

PTFE Hollow Fiber Membranes Market Size

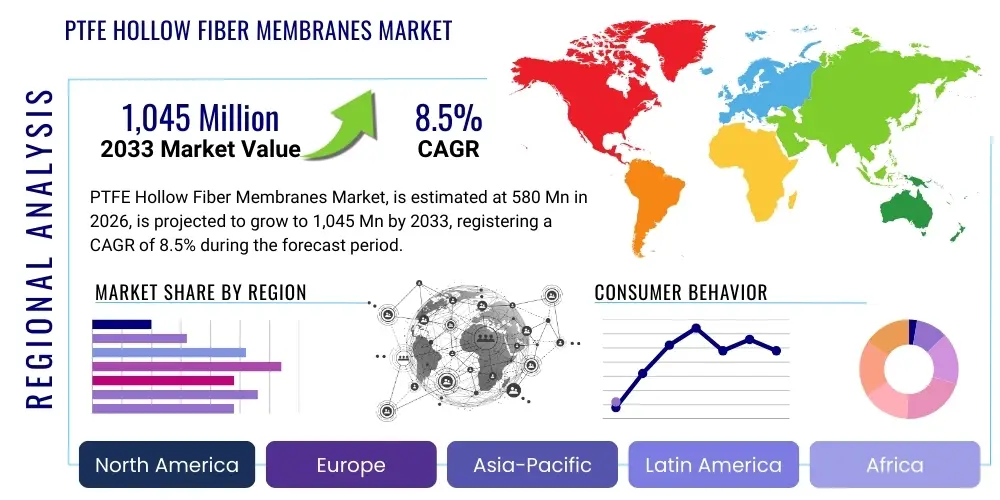

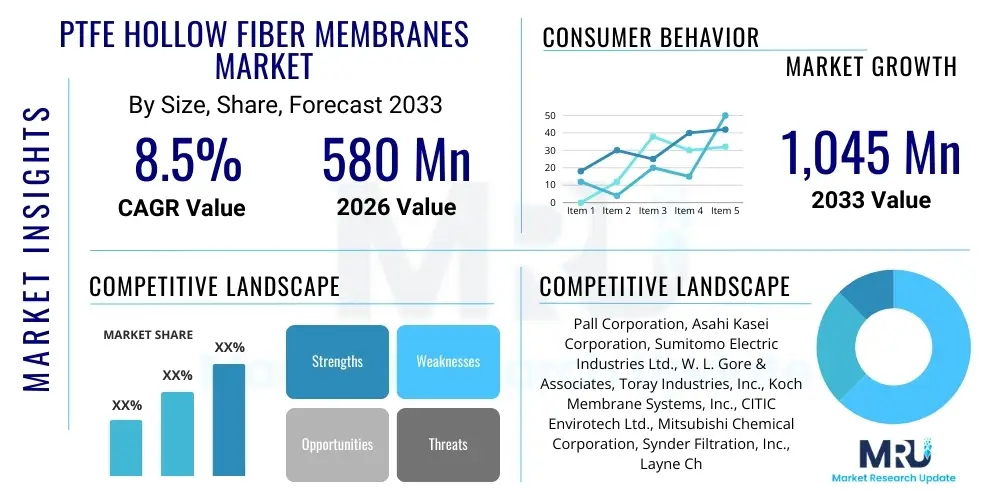

The PTFE Hollow Fiber Membranes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $1,045 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global demand for advanced separation technologies in critical sectors such as industrial water treatment, municipal wastewater recycling, and stringent air filtration applications. The inherent chemical resistance, superior thermal stability, and mechanical strength of Polytetrafluoroethylene (PTFE) position these hollow fibers as preferred materials over traditional polymeric membranes, particularly in harsh operating environments and chemical processing where high purity standards are mandatory. Furthermore, the continuous technological advancements focused on improving flux rates and anti-fouling characteristics contribute significantly to market acceleration.

PTFE Hollow Fiber Membranes Market introduction

The PTFE Hollow Fiber Membranes Market encompasses the production, distribution, and application of highly specialized semi-permeable membranes fabricated from Polytetrafluoroethylene, shaped into slender, cylindrical tubes with a central hollow bore. These membranes function as highly efficient selective barriers, integral to processes requiring precise molecular separation, filtration, and purification across various industries. PTFE, renowned for its inertness, offers exceptional resistance to chemical corrosion, high temperatures, and UV degradation, making these fibers indispensable for aggressive media handling and long-term durability in complex systems. The superior performance attributes of PTFE hollow fibers enable their widespread adoption in demanding applications where membrane integrity and chemical compatibility are paramount for operational success and safety.

Major applications for PTFE hollow fiber membranes span critical infrastructure and manufacturing sectors, including advanced water and wastewater treatment, where they are deployed in Membrane Bioreactors (MBR) and ultrafiltration systems for removing suspended solids, bacteria, and pathogens. They are also crucial in industrial gas separation, notably for dehumidification and solvent recovery due to their hydrophobic properties. Additionally, the medical and healthcare segments utilize these membranes in blood oxygenators and sterilizing filters, benefiting from PTFE’s biocompatibility and chemical stability. Their intrinsic benefits, such as high porosity, narrow pore size distribution, and low maintenance requirements, translate directly into improved process efficiency, reduced energy consumption, and superior end-product quality across all deployment scenarios.

Key market driving factors include increasingly strict environmental regulations mandating higher quality effluent discharge and enhanced industrial emissions control, particularly concerning volatile organic compounds (VOCs) and particulate matter. The rapid urbanization and industrialization across emerging economies amplify the need for reliable water reclamation technologies, favoring the deployment of PTFE hollow fiber systems due to their reliability and resistance to corrosive feedwater. Furthermore, ongoing innovation in membrane module design and surface chemistry modification techniques, aimed at minimizing fouling and extending membrane lifespan, continually broadens the applicability and commercial viability of PTFE hollow fibers, reinforcing their market growth trajectory.

PTFE Hollow Fiber Membranes Market Executive Summary

The PTFE Hollow Fiber Membranes Market is experiencing robust growth driven by structural shifts toward sustainable industrial practices and heightened regulatory scrutiny concerning environmental discharges. Current business trends indicate a strong emphasis on integration, with leading manufacturers focusing on developing comprehensive modular solutions that simplify installation and maintenance for end-users, especially within the high-volume municipal water sector. Innovation is concentrated on enhancing membrane longevity through novel anti-fouling coatings and optimizing module packing density to achieve higher throughput in smaller footprints. Furthermore, strategic partnerships between PTFE suppliers and system integrators are increasing to provide tailored solutions for challenging separation problems in the chemical and pharmaceutical industries, moving the market away from generic membrane sales toward specialized engineering services.

Regional trends reveal Asia Pacific (APAC) as the primary engine of market expansion, catalyzed by massive infrastructure investments in water sanitation, rapid industrial expansion, and governmental initiatives addressing chronic water scarcity issues, particularly in China and India. North America and Europe, while mature markets, maintain high demand due to rigorous environmental standards and the continuous need for upgrading aging water infrastructure with advanced membrane technologies. These regions are also leading the adoption of PTFE membranes in high-value applications like solvent filtration and demanding industrial gas purification, focusing heavily on operational efficiency and energy reduction as primary competitive advantages. The Middle East and Africa (MEA) are emerging as significant growth areas, driven by necessity for desalination and water reuse, utilizing the robust nature of PTFE fibers to handle highly saline and complex feed streams.

Segment trends highlight the dominance of the Water & Wastewater Treatment application segment, particularly the sub-segment focused on Membrane Bioreactors (MBR), which leverage PTFE’s stability for biological filtration processes. From a segmentation perspective based on type, the Hydrophobic PTFE membranes hold a commanding market share, crucial for gas separation, aeration, and dehumidification processes where water vapor rejection is essential. However, the Hydrophilic PTFE membrane segment is projected to exhibit the fastest growth, fueled by advancements in surface modification techniques that allow PTFE to be used effectively in demanding aqueous filtration environments while offering enhanced fouling resistance compared to traditional hydrophobic states. The industrial end-use sector, encompassing chemical processing and manufacturing, represents the fastest-growing customer base, valuing the chemical inertness of PTFE over cost concerns.

AI Impact Analysis on PTFE Hollow Fiber Membranes Market

User queries regarding AI's influence on the PTFE Hollow Fiber Membranes market frequently center on how machine learning algorithms can optimize complex manufacturing processes, enhance predictive maintenance schedules, and improve the efficiency of filtration system operations. Users are keen to understand if AI can reduce the substantial energy consumption associated with membrane filtration and if it can accurately predict and mitigate membrane fouling, which remains a primary operational challenge. Key themes emerging from this analysis include the expectation that AI will standardize quality control during fiber spinning, automate defect detection, and provide real-time operational feedback to maintain optimal flux and recovery rates in field installations. Concerns often revolve around the initial investment costs for integrating sensor technology and AI platforms, and the need for skilled personnel to manage these sophisticated digital systems within traditional water treatment facilities.

- Optimization of Manufacturing Parameters: AI and machine learning algorithms are utilized to analyze vast datasets collected during the extrusion and stretching processes, optimizing variables like temperature, shear rate, and draw ratio to ensure highly consistent pore size distribution and structural integrity across fiber batches, minimizing defects.

- Predictive Maintenance and Life Cycle Extension: AI systems analyze sensor data (pressure drop, flow rates, water quality metrics) in real-time to predict the onset of irreversible fouling or physical damage, enabling proactive maintenance scheduling rather than reactive cleaning, thereby maximizing uptime and extending the effective service life of the PTFE membrane modules.

- Enhanced System Automation and Control: Integration of AI-powered control systems allows for dynamic adjustment of cleaning cycles, backwash frequency, and transmembrane pressure (TMP) based on immediate process conditions and predicted fouling tendencies, leading to substantial reductions in chemical usage and overall operating energy requirements.

- Improved R&D for Novel Coatings: AI accelerates material science research by simulating the interaction of various anti-fouling surface modifications and feedwaters, dramatically speeding up the identification of optimal chemical treatments for creating tailored hydrophilic PTFE surfaces resistant to specific contaminants.

- Smart Water Quality Management: AI processes high-frequency analytical data from the treated water stream, ensuring continuous compliance with stringent regulatory standards and providing immediate alerts or adjustments in flow dynamics if contamination risks are detected downstream of the PTFE membrane unit.

DRO & Impact Forces Of PTFE Hollow Fiber Membranes Market

The PTFE Hollow Fiber Membranes market is dynamically shaped by a compelling balance of growth drivers (D), significant restraints (R), and expansive opportunities (O), collectively modulated by powerful impact forces. Key drivers include accelerating industrialization and the critical global need for reliable, high-purity water resources, compounded by legislative pressure for stringent environmental controls across multiple jurisdictions. Restraints primarily involve the relatively high initial capital expenditure required for PTFE-based systems compared to conventional filtration technologies, coupled with the complex, energy-intensive nature of maintaining optimal flux in large-scale membrane operations. Opportunities are vast, focused on market penetration into emerging economies, technological advancements yielding ultra-low-fouling surfaces, and the diversification of applications beyond water treatment into advanced solvent recovery and demanding pharmaceutical filtration.

The primary impact forces acting on this market can be categorized into technological evolution, regulatory environment shifts, and shifts in raw material economics. Technological innovation acts as a force multiplier, constantly lowering operational expenditures (OPEX) by improving flux and durability, thereby overcoming the initial barrier of high capital expenditure (CAPEX). Conversely, the volatility in the pricing and supply chain stability of specialized PTFE resins and associated processing chemicals acts as a restraining force, potentially slowing the adoption rate in cost-sensitive applications. Regulatory frameworks, particularly those defining permissible levels of contaminants in discharged water and air, serve as a consistent and powerful driver, compelling industries globally to invest in superior separation solutions like PTFE hollow fibers to ensure compliance and avoid severe penalties.

The synthesis of these elements dictates the market trajectory. The strong inherent demand fueled by necessity (water scarcity) and legislation provides a foundational resilience. However, the market’s ability to maximize growth hinges on successfully addressing the cost and complexity restraints through continuous technological iteration, ensuring that PTFE hollow fibers offer an undeniable long-term total cost of ownership advantage over competing materials. The identification and commercialization of new, high-value niches, particularly in advanced separations involving aggressive chemicals or high-temperature environments where PTFE excels, represent crucial opportunities for maximizing future growth and stabilizing revenue streams against economic downturns.

Segmentation Analysis

The PTFE Hollow Fiber Membranes Market is fundamentally segmented based on critical functional and application-specific parameters, allowing for detailed market assessment and strategic targeting. The primary segmentation criteria involve membrane Type (defining its surface chemistry and use-case suitability), Application (the sector or process where the membrane is deployed), and End-Use Industry (the ultimate organization utilizing the technology). This structure provides a granular view of market dynamics, revealing that performance characteristics such as hydrophobicity or hydrophilicity directly influence adoption across industrial gas drying and aqueous filtration, respectively. The distinct separation needs of the various application sectors—ranging from life sciences demanding ultra-purity to municipal utilities requiring high volume throughput—drive differentiated product development and market positioning strategies among key competitors globally.

- By Type:

- Hydrophobic PTFE Hollow Fiber Membranes

- Hydrophilic PTFE Hollow Fiber Membranes

- By Application:

- Water & Wastewater Treatment (including MBR, Ultrafiltration, Microfiltration)

- Industrial Gas Separation and Dehumidification

- Medical & Healthcare (e.g., Blood Oxygenators, Sterile Filtration)

- Chemical Processing and Solvent Recovery

- Food & Beverage Processing

- By End-Use Industry:

- Municipal Utilities

- Industrial (Power Generation, Chemical, Oil & Gas)

- Healthcare and Pharmaceutical

- Food & Beverage

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For PTFE Hollow Fiber Membranes Market

The value chain for the PTFE Hollow Fiber Membranes Market begins intensely at the upstream level with the sourcing and preparation of specialized raw materials, primarily high-grade PTFE resins and sophisticated solvent systems required for the spinning process. Due to the highly specialized nature of the polymer and the technical complexity of creating a defect-free hollow fiber structure, the upstream segment is characterized by high barriers to entry and often involves close relationships between material suppliers and core membrane manufacturers. The quality and purity of the PTFE resin directly dictate the final membrane performance attributes, such as pore size uniformity and overall mechanical strength. Manufacturing relies heavily on proprietary spinning and stretching techniques, which transform the raw polymer into the precise hollow fiber structure, followed by essential post-treatment modifications to control surface chemistry (hydrophilic treatment) and module assembly (potting and sealing).

The midstream phase is dominated by membrane fabricators and module assemblers, who manage the intricate process of creating ready-to-use membrane modules. This involves highly controlled environments and stringent quality checks to ensure integrity against leakage and to certify filtration performance parameters (flux and rejection rates). The output is then transferred to the downstream segment, involving distribution channels that span both direct sales to large, integrated engineering, procurement, and construction (EPC) firms, and indirect sales through specialized distributors and system integrators. Direct channels are typical for large municipal projects or strategic industrial clients requiring customized solutions, offering manufacturers greater control over installation and service quality. Indirect channels, conversely, facilitate market access to smaller industrial users and regional markets, leveraging the local expertise and logistical networks of the partners.

The ultimate downstream recipients are the end-users who deploy the modules within larger systems, such as water treatment plants or gas drying units. System integrators play a crucial role here, combining the PTFE membrane modules with necessary peripheral equipment—pumps, piping, pretreatment stages, and automation controls—to deliver a functional filtration solution. Post-sale services, including maintenance, periodic cleaning (chemical or physical backwash), and eventual module replacement, form a continuous revenue stream and are critical for long-term customer relationships. The efficiency of the distribution channel and the technical support provided downstream are crucial factors influencing customer satisfaction and market share, particularly given the technical complexity and high cost of these systems, requiring specialized engineering support for optimal operation.

PTFE Hollow Fiber Membranes Market Potential Customers

Potential customers for PTFE Hollow Fiber Membranes are highly diverse but unified by a common requirement for separation technologies that can withstand aggressive chemical environments, high temperatures, or demands for extremely high purity output. The largest category includes large-scale municipal water authorities and governmental agencies responsible for urban water supply and wastewater management, particularly those adopting advanced Membrane Bioreactor (MBR) technology for water reuse initiatives. The industrial sector represents an equally critical customer base, encompassing chemical manufacturers needing solvent filtration, power generation facilities requiring ultra-pure boiler feedwater, and petrochemical companies engaged in complex gas separation tasks. These industrial buyers value the chemical inertness and long lifespan of PTFE membranes, which minimize downtime and reduce the risk of cross-contamination in critical processes.

The healthcare and pharmaceutical industries are premium buyers, utilizing PTFE hollow fibers for applications such as sterile air filtration, precise separation in biotechnology processes, and as core components in blood oxygenators. In these fields, the material’s biocompatibility and ability to achieve absolute sterilization are non-negotiable requirements, justifying the higher cost associated with PTFE technology. Furthermore, the burgeoning field of food and beverage processing, particularly in breweries and dairies, increasingly relies on PTFE membranes for reliable microfiltration and cold sterilization, seeking to eliminate heat treatment that can degrade product quality. Consequently, the potential customer base is segmented by need: municipal customers focus on volume and cost-efficiency within robust operational parameters, while industrial and healthcare customers prioritize material performance, chemical resistance, and absolute process reliability above all other factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $1,045 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pall Corporation, Asahi Kasei Corporation, Sumitomo Electric Industries Ltd., W. L. Gore & Associates, Toray Industries, Inc., Koch Membrane Systems, Inc., CITIC Envirotech Ltd., Mitsubishi Chemical Corporation, Synder Filtration, Inc., Layne Christensen Company, Toyobo Co., Ltd., Kobo Membrane, 3M Company, Parker Hannifin Corporation, Lenntech BV, Tianjin MOTIMO Membrane Technology, Alfa Laval AB, DowDuPont Specialty Products, Membrana GmbH (now part of 3M), Pureflow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PTFE Hollow Fiber Membranes Market Key Technology Landscape

The technological landscape of the PTFE Hollow Fiber Membranes market is dominated by advancements in material science and sophisticated manufacturing processes designed to enhance membrane performance and longevity. The core technology revolves around the preparation of the PTFE solution followed by extrusion and specialized thermal stretching. Unlike conventional polymer membranes, PTFE fibers are often produced using a paste extrusion and sintering process, demanding extremely precise control over temperature and pressure to create the micro-porous structure without compromising the polymer's inherent chemical resistance. Key innovation focuses on refining the stretching phase, which determines the final pore size and porosity, aiming for narrower pore size distributions to improve filtration efficiency and reduce transmembrane pressure requirements, ultimately leading to lower energy consumption during operation.

A significant area of technological focus is surface modification, specifically converting the naturally hydrophobic PTFE surface to a functional hydrophilic state for aqueous applications without sacrificing chemical stability. Techniques such as plasma treatment, graft polymerization, and the application of durable hydrophilic coatings are crucial in this effort. Successful surface modification minimizes fouling—the buildup of organic and inorganic matter that hinders flow—by reducing the adhesion forces between the contaminants and the membrane surface. This directly addresses the biggest operational challenge in water treatment, extending the cleaning cycles and operational lifespan of the membrane modules, thereby significantly reducing the total cost of ownership for end-users and maximizing system uptime and efficiency.

Furthermore, module design technology, particularly in areas like potting and sealing integrity, remains critical. The fibers must be securely encased within the module housing without blocking the active membrane area, ensuring mechanical stability under fluctuating pressure conditions. Advanced computational fluid dynamics (CFD) modeling is increasingly used to optimize flow patterns within the module, ensuring uniform distribution of feed water or gas and preventing localized concentration polarization, which can exacerbate fouling. Future technological advancements are expected to integrate smart sensor technology directly into the membrane fibers or modules, allowing for real-time monitoring of performance parameters and facilitating predictive maintenance strategies, often powered by AI algorithms for autonomous system optimization.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for PTFE Hollow Fiber Membranes, driven by rapid industrialization, burgeoning population, and severe water stress, especially in China, India, and Southeast Asian nations. Government mandates focusing on infrastructure development, coupled with heavy investments in new wastewater treatment facilities and recycling systems, ensure sustained high demand. The region’s dominance in chemical and pharmaceutical manufacturing further fuels the need for specialized, chemically resistant separation technologies.

- North America: This region maintains a mature market driven primarily by stringent environmental regulations enforced by bodies like the EPA, pushing industries to adopt the most efficient separation technologies for emissions and wastewater compliance. High levels of technological sophistication, early adoption of advanced MBR technology, and a strong presence of pharmaceutical and semiconductor manufacturing demanding ultra-pure water sustain high demand, particularly for high-performance, complex PTFE modules.

- Europe: Characterized by proactive environmental policies and a focus on circular economy principles, the European market is stable and highly specialized. Demand is strong for high-end applications like industrial gas dehumidification, solvent recovery (due to tight VOC regulations), and innovative water reuse projects. The focus here is less on volume growth and more on technological integration, energy efficiency, and low-maintenance solutions across Germany, the UK, and France.

- Latin America: This region presents significant growth potential, albeit from a smaller base. Market expansion is correlated with increasing foreign investment in mining, oil & gas, and manufacturing sectors, all of which require robust solutions for managing complex industrial effluents. Infrastructure modernization efforts in countries like Brazil and Mexico are steadily driving the adoption of proven membrane technologies for municipal use.

- Middle East and Africa (MEA): The MEA region exhibits specialized demand, dominated by applications in desalination and the treatment of highly saline and complex industrial water sources, particularly in the UAE, Saudi Arabia, and Qatar. PTFE’s superior chemical and thermal stability is highly valued in these harsh environments, supporting long-term operation under demanding conditions where traditional membranes fail quickly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PTFE Hollow Fiber Membranes Market.- Pall Corporation

- Asahi Kasei Corporation

- Sumitomo Electric Industries Ltd.

- W. L. Gore & Associates

- Toray Industries, Inc.

- Koch Membrane Systems, Inc.

- CITIC Envirotech Ltd.

- Mitsubishi Chemical Corporation

- Synder Filtration, Inc.

- Layne Christensen Company

- Toyobo Co., Ltd.

- Kobo Membrane

- 3M Company

- Parker Hannifin Corporation

- Lenntech BV

- Tianjin MOTIMO Membrane Technology Co., Ltd.

- Alfa Laval AB

- DowDuPont Specialty Products

- Membrana GmbH (now part of 3M)

- Pureflow Inc.

Frequently Asked Questions

Analyze common user questions about the PTFE Hollow Fiber Membranes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of PTFE hollow fibers over other polymer membranes?

PTFE hollow fibers offer unparalleled chemical inertness, high thermal stability (up to 260°C), superior mechanical strength, and excellent resistance to fouling and biofouling. This makes them ideal for treating aggressive chemicals, high-temperature fluids, and complex wastewater streams where conventional polymeric membranes would rapidly degrade or fail.

In which industries are Hydrophobic PTFE membranes most critically used?

Hydrophobic PTFE membranes are essential in industrial gas separation, particularly for air and gas drying (dehumidification), solvent recovery, and gas-liquid contacting processes. Their high water contact angle ensures efficient rejection of water vapor while allowing gas permeation, preventing system corrosion and contamination.

How does the cost of PTFE hollow fiber systems compare to traditional filtration methods?

The initial capital expenditure (CAPEX) for PTFE hollow fiber systems is typically higher than for traditional microfiltration or non-membrane techniques. However, their exceptional longevity, reduced maintenance frequency, superior chemical resistance, and lower lifetime operational expenditure (OPEX) often yield a significantly better Total Cost of Ownership (TCO) over a 10-15 year operational cycle, especially in demanding applications.

What technological challenges are manufacturers currently focusing on in the PTFE market?

Manufacturers are heavily focused on reducing membrane fouling through the development of durable, permanent hydrophilic surface modification techniques for aqueous use. They are also working on optimizing membrane module design to increase packing density and flux, thereby lowering the energy consumption required for filtration processes and simplifying field maintenance.

Which geographical region shows the highest growth potential for PTFE Hollow Fiber Membranes?

The Asia Pacific (APAC) region, particularly driven by large-scale water recycling and pollution control initiatives in China and India, exhibits the highest growth potential. Rapid industrial expansion and increasing regulatory enforcement demanding clean water standards are the primary catalysts for this robust market expansion in APAC.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager