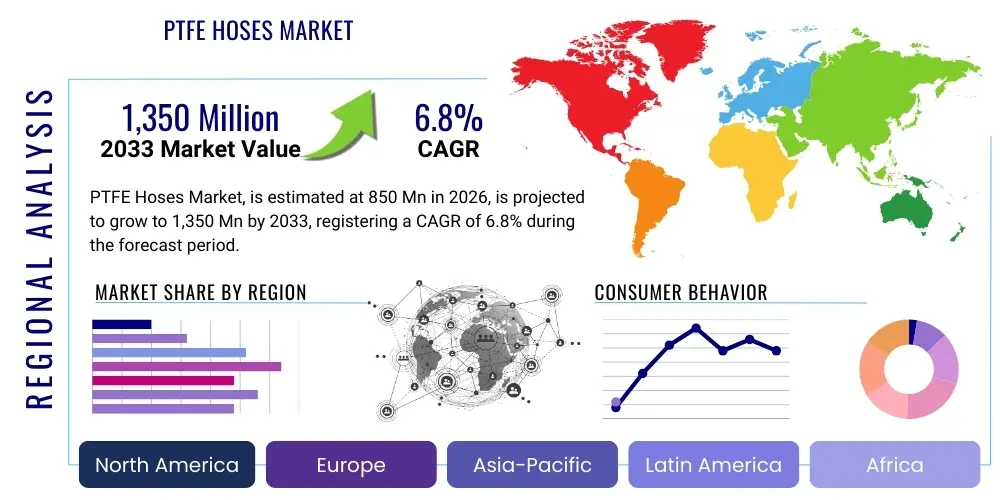

PTFE Hoses Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442192 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

PTFE Hoses Market Size

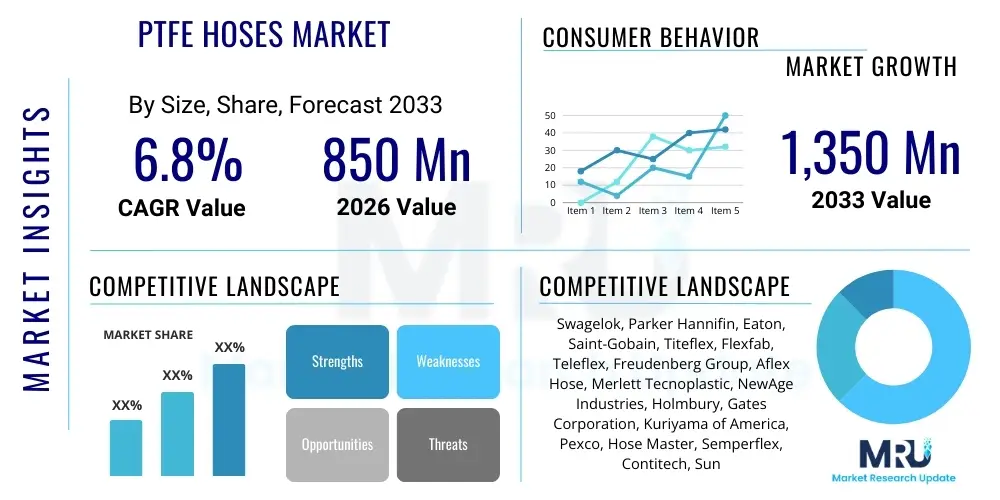

The PTFE Hoses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

PTFE Hoses Market introduction

The Polytetrafluoroethylene (PTFE) Hoses Market encompasses a specialized segment of industrial fluid handling systems, primarily driven by the material's exceptional chemical inertness, thermal stability, and low coefficient of friction. PTFE hoses are engineered for applications demanding high purity, resistance to extreme temperatures, and resilience against aggressive corrosive agents, making them indispensable in sectors where conventional rubber or metallic hoses fail to meet stringent operational standards. These hoses typically consist of an extruded PTFE liner, often reinforced externally with stainless steel wire braiding (SS304 or SS316) to handle high pressure and mechanical stress. The critical differentiation of PTFE hoses lies in their non-stick properties and non-contaminating nature, crucial for pharmaceutical, food and beverage, and semiconductor industries, ensuring product integrity and minimizing downtime associated with material degradation.

The adoption of PTFE hoses is accelerating across core industrial segments, most notably within the automotive, chemical processing, and aerospace industries. In automotive manufacturing, particularly within performance vehicles and electric vehicle (EV) cooling systems, PTFE hoses are utilized for brake lines, fuel injection systems, and transmission hoses due to their ability to withstand high temperatures and volatile fluid compositions without permeation. The chemical sector relies heavily on PTFE for transferring highly concentrated acids, bases, and solvents under pressure, guaranteeing zero chemical reaction between the fluid medium and the hose material. Furthermore, the burgeoning demand for lightweight and durable fluid conveyance solutions in commercial and military aircraft hydraulic and fuel systems solidifies the market's trajectory, emphasizing safety and reliability under extreme operational parameters.

Key driving factors propelling the PTFE Hoses Market growth include increasingly strict regulatory requirements pertaining to material purity and environmental safety in manufacturing processes globally. Regulatory bodies, such as the FDA (Food and Drug Administration) and the European Chemicals Agency (ECHA), impose stringent standards on materials used in sensitive applications, favoring chemically inert solutions like PTFE. Additionally, the rapid modernization of industrial infrastructure in emerging economies, coupled with significant technological advancements in hose construction—including convoluted designs for increased flexibility and conductive PTFE liners to dissipate static charge—are broadening the application scope and enhancing the market value proposition. The inherent benefits, such as extended service life and reduced maintenance needs compared to alternative materials, further cement PTFE hoses as a superior choice for critical fluid transfer applications.

PTFE Hoses Market Executive Summary

The global PTFE Hoses Market demonstrates robust growth momentum, characterized by persistent technological innovation aimed at enhancing flexibility, pressure ratings, and thermal performance. Business trends indicate a focus on strategic acquisitions and partnerships, allowing key market players to consolidate their positions, especially within niche high-pressure applications like aerospace hydraulics and ultra-pure fluid handling in biotechnology. Manufacturers are increasingly investing in sophisticated braiding machinery and advanced extrusion techniques to improve internal liner smoothness and reduce porosity, directly addressing end-user demands for higher flow rates and zero contamination risk. Furthermore, the market is witnessing a shift towards specialized product offerings, including carbon-impregnated anti-static liners and externally convoluted designs, mitigating risks associated with electrostatic discharge and improving bend radii crucial for tight-space installations in industrial machinery and engine compartments.

Regional dynamics highlight the Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive expansion in chemical processing, pharmaceutical manufacturing, and the automotive sector, particularly in China and India. Stringent governmental policies supporting infrastructure development and the increasing adoption of high-purity fluid systems in microelectronics production within countries like South Korea and Taiwan are key accelerators. Conversely, North America and Europe, while mature markets, maintain dominance in terms of technological adoption and value contribution, driven by stringent safety regulations in the oil and gas, and aerospace defense sectors. European markets are particularly focused on sustainable manufacturing practices, influencing the development of PTFE hoses that comply with REACH regulations and contribute to energy efficiency through optimized fluid dynamics.

Segment trends underscore the prominence of stainless steel braided PTFE hoses due to their superior pressure handling capabilities, positioning them as the largest segment by construction type. In terms of application, the Chemical Processing industry remains the foundational consumer, utilizing PTFE for its unparalleled resistance to highly corrosive media. However, the Automotive segment is exhibiting the highest projected growth rate, largely attributable to the transition towards electric and hybrid vehicles, which necessitates high-performance hoses capable of managing complex thermal management fluids and specialized lubricants in high-voltage battery systems. This segmental shift reflects broader industrial priorities centered on material durability, operational safety, and maximizing component lifecycle under increasingly severe operating conditions.

AI Impact Analysis on PTFE Hoses Market

User queries regarding AI in the PTFE Hoses market predominantly revolve around three key themes: predictive maintenance efficiency, optimization of complex manufacturing processes, and supply chain resilience. Consumers and industry stakeholders frequently ask how AI can detect subtle defects in hose braiding or lining integrity during production (Quality Control 4.0), and whether machine learning algorithms can predict the remaining useful life (RUL) of hoses installed in critical, high-stress environments like hydraulic systems in heavy machinery or aerospace structures. There is also significant interest in leveraging AI for optimizing the inventory management of specialized PTFE compounds and predicting demand fluctuations across diverse end-user sectors, such as anticipating the specific requirements for convoluted hoses versus smooth bore hoses based on predictive equipment failure rates in geographically disparate regions. The overarching expectation is that AI will minimize human error in manufacturing, reduce operational expenditure through optimized maintenance schedules, and accelerate material innovation by simulating performance characteristics under virtual stress tests.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally altering the value chain of the PTFE Hoses market, moving beyond traditional manufacturing automation into predictive and cognitive decision-making systems. In the manufacturing phase, AI algorithms are being deployed to monitor real-time sensor data from extrusion and braiding machines. These systems can instantly identify deviations in wall thickness consistency, braiding tension, or curing temperatures that are invisible to the naked eye or conventional statistical process control (SPC). This hyper-precision capability ensures defect rates are minimized, leading to higher product quality and reduced material waste, which is particularly critical given the high cost of PTFE resin. Furthermore, AI-driven digital twins of PTFE hose performance allow engineers to rapidly iterate designs, simulating scenarios involving extreme pressure cycling, corrosive exposure, and thermal shock before committing to physical prototyping, thereby significantly reducing time-to-market for specialized hose assemblies.

- AI-driven predictive maintenance systems extending PTFE hose service life in critical machinery.

- Optimization of complex braiding and extrusion parameters using ML for enhanced structural integrity.

- Improved supply chain logistics and inventory forecasting for specialized PTFE resin compounds.

- AI integration in Non-Destructive Testing (NDT) for automated, high-speed defect detection during quality assurance.

- Enhanced R&D through computational fluid dynamics and materials simulation powered by AI, accelerating the development of new lining formulations.

DRO & Impact Forces Of PTFE Hoses Market

The PTFE Hoses Market is governed by powerful internal dynamics driven by unparalleled material properties and external pressures related to cost and complexity. Drivers include the rising global demand for fluid conveyance solutions that meet rigorous hygiene standards, particularly in pharmaceutical and biotechnology sectors where sterility and non-leaching characteristics are paramount. The inherent chemical inertness of PTFE means it is the material of choice for aggressive media transfer, a need magnified by the increasing complexity of chemical synthesis processes globally. Complementing this is the accelerating trend toward vehicle electrification, requiring specialized, temperature-resistant hoses for battery cooling lines, where traditional rubber materials degrade rapidly under high thermal load and interaction with specialized coolant fluids. These factors, combined with regulatory push for safer materials, exert a strong positive influence on market growth.

However, the market faces significant restraints, primarily centered around the comparatively high initial material and manufacturing costs associated with PTFE. The specialized equipment required for PTFE extrusion and the complex, labor-intensive processes involved in achieving high-pressure braiding and assembly contribute to a premium price point, often deterring cost-sensitive end-users in less critical applications. Furthermore, while highly durable, PTFE hoses can be susceptible to permeation by certain extremely small molecular gases under specific conditions, and they exhibit cold flow (creep) when subjected to prolonged, high-stress clamping, requiring specialized fitting designs. These technical limitations necessitate careful material selection and design consideration, acting as constraints on universal adoption.

Opportunities for market expansion are abundant, particularly in emerging applications and geographical penetration. The primary opportunity lies in the shift towards advanced convoluted PTFE hose designs, offering superior flexibility and facilitating easier installation in confined spaces, addressing a key installation constraint of traditional smooth bore designs. Additionally, the rapid development of semiconductor manufacturing facilities, which demand ultra-high-purity (UHP) fluid handling systems free of any organic or inorganic contaminants, represents a lucrative niche for specialized PFA/PTFE hose solutions. Impact forces—the synthesis of drivers and restraints—indicate a strong momentum toward innovation, forcing manufacturers to focus on cost-reduction through process automation while simultaneously enhancing product performance to meet increasingly severe regulatory and application requirements.

Segmentation Analysis

The PTFE Hoses Market is comprehensively segmented based on Construction Type, Design, Material, Medium, End-User Industry, and Geography, reflecting the diverse application requirements across various industrial landscapes. Understanding these segments is crucial for strategic market planning, as the optimal PTFE hose specification varies dramatically depending on factors such as required pressure rating, fluid viscosity, operating temperature range, and necessity for flexibility or static dissipation. The dominance of certain segments, such as Stainless Steel Braided hoses in high-pressure environments, highlights the prioritization of mechanical strength and operational safety in critical applications. Conversely, the growth in convoluted designs points toward increasing user demand for installation ease and superior flexibility, particularly in machine tool and robotics applications where dynamic movement is required. Analyzing these granular segments provides insight into the underlying technological adoption rates and the specific material preferences driving procurement decisions in major end-user verticals globally.

- By Construction Type:

- Stainless Steel Braided Hoses

- Rubber Covered Hoses

- Fiber Braided Hoses

- Others (e.g., Silicone covered, PVC jacketed)

- By Design:

- Smooth Bore Hoses

- Convoluted Hoses (Heavy Wall, Light Weight)

- By Material Type (Liner):

- Virgin PTFE

- Conductive PTFE (Carbon Impregnated)

- Anti-Static PTFE

- By Medium:

- Chemicals

- Hydraulic Fluids

- Gases

- Air/Steam

- Food & Beverages

- By End-User Industry:

- Automotive (Brake Systems, Fuel Lines, Cooling)

- Aerospace & Defense (Hydraulic, Fuel Systems)

- Chemical Processing

- Pharmaceutical & Biotechnology

- Food & Beverage

- Oil & Gas

- Industrial & Machinery

- Semiconductor & Electronics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East & Africa (MEA)

Value Chain Analysis For PTFE Hoses Market

The value chain of the PTFE Hoses market begins with the upstream segment, dominated by specialized chemical manufacturers responsible for producing high-purity Fluoropolymer resins, primarily PTFE powder or pellets. This initial stage is highly centralized, with a limited number of global chemical giants controlling the supply of the raw material (e.g., DuPont, Daikin, Solvay). Fluctuations in the cost and availability of key fluorinated intermediates directly impact the pricing structure for downstream manufacturers. Quality control at this stage is crucial, as the chemical purity, molecular weight distribution, and particle size of the raw PTFE resin dictate the final performance characteristics, such as extrusion consistency and resistance to chemical leaching, vital for end-use industries like pharmaceuticals and semiconductors.

The midstream component involves the hose fabrication process, characterized by specialized manufacturing expertise in extrusion, braiding, and assembly. Manufacturers procure PTFE resins and reinforcing materials (like stainless steel wire) and utilize sophisticated equipment to extrude the PTFE liner (smooth bore or convoluted), followed by precision braiding to impart pressure resistance and mechanical strength. This stage requires significant capital investment in highly accurate machinery and adherence to stringent quality management systems (e.g., ISO 9001, AS9100 for aerospace components). Direct distribution channels involve large OEMs (Original Equipment Manufacturers) purchasing custom-engineered hose assemblies directly from the manufacturer, particularly in high-volume industries like automotive and heavy machinery.

The downstream segment includes distribution and end-user consumption. Indirect distribution relies heavily on regional distributors and specialized fluid power solution providers who stock standardized PTFE hose reels and fittings, offering cut-to-length services and minor customization to Maintenance, Repair, and Operations (MRO) clients. End-users span across diverse high-value sectors such as chemical processing, requiring complex systems installed by certified engineers, and aerospace, which necessitates highly traceable, certified components. The service component, including installation support, hose integrity testing, and specialized fitting consultation, adds significant value downstream, ensuring the PTFE assemblies function optimally under demanding operational loads throughout their lifecycle.

PTFE Hoses Market Potential Customers

Potential customers for PTFE hoses are concentrated in industrial sectors requiring fluid transfer solutions with superior thermal and chemical resistance, and non-contaminating properties. Primary customers include original equipment manufacturers (OEMs) in the automotive industry, specifically those specializing in high-performance engines, hybrid drivetrains, and electric vehicle battery thermal management systems. These OEMs require custom-length, pre-fitted assemblies for integration into complex vehicle designs. Another significant customer base lies within the chemical and petrochemical processing industries, where large-scale plants utilize PTFE hoses for bulk transfer of concentrated acids, bases, and aggressive solvents between reactors, storage tanks, and distillation units, valuing the material's near-universal corrosion resistance and ability to handle high process temperatures.

Furthermore, the pharmaceutical and biotechnology sectors represent high-growth potential customers, purchasing highly specialized, certified (FDA, USP Class VI compliant) smooth bore PTFE hoses. These end-users demand minimal particulate shedding and zero leaching for critical applications such as high-purity water systems, sterile product transfer, and fermentation media conveyance. The aerospace and defense sector constitutes a premium customer group, requiring hoses certified to military specifications (e.g., MIL-DTL standards) for hydraulic fluids, fuel delivery, and pneumatic systems on aircraft, prioritizing reliability under extreme pressure and temperature variations found at high altitudes. The purchasing criteria for these diverse customers vary, ranging from competitive pricing for commodity industrial applications to strict material traceability and performance certification for mission-critical, high-risk environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swagelok, Parker Hannifin, Eaton, Saint-Gobain, Titeflex, Flexfab, Teleflex, Freudenberg Group, Aflex Hose, Merlett Tecnoplastic, NewAge Industries, Holmbury, Gates Corporation, Kuriyama of America, Pexco, Hose Master, Semperflex, Contitech, Sunflex, Transfer Oil |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PTFE Hoses Market Key Technology Landscape

The technological landscape of the PTFE Hoses market is characterized by continuous refinement in extrusion, reinforcement, and assembly techniques aimed at optimizing mechanical performance and chemical stability. A primary area of innovation focuses on enhancing the liner’s structural integrity and reducing its porosity to prevent gas permeation and material leaching. Modern extrusion technology utilizes precision tooling and process control to create ultra-smooth bore linings, which minimizes internal friction, leading to optimized flow rates and easier cleaning (critical for Clean-In-Place processes in food and pharma). Additionally, manufacturers are developing multi-layer liners, combining PTFE with other fluoropolymers like PFA or FEP, to achieve application-specific characteristics, such as improved resistance to kinking or enhanced flexibility at extremely low temperatures, thereby expanding the operational envelope of the hoses.

Reinforcement technology, particularly in the domain of braiding, is another crucial area of focus. While stainless steel braiding (SS 304/316) remains the standard for high-pressure applications, advancements are being made in using high-tensile synthetic fibers like aramid or specialized carbon fiber wraps in applications where weight reduction is paramount, such as in aerospace or competitive motorsports. Furthermore, novel methods for bonding the PTFE liner to the external braid or cover are continuously being developed to prevent liner collapse under vacuum or expansion under high pressure cycling, significantly enhancing the fatigue life of the hose assembly. These technological improvements are often coupled with advanced Non-Destructive Testing (NDT) methodologies, including eddy current testing and X-ray inspection, to ensure the homogeneity of the braiding angle and consistency of the internal wall thickness before assembly.

Crucially, the assembly technology involving fittings and crimping is experiencing high innovation. Standard fittings can compromise the integrity of the PTFE liner or lead to cold flow issues over time. Manufacturers are developing proprietary, flare-less, and swivel fitting designs that ensure a robust seal without excessively stressing the PTFE material. The implementation of conductive (anti-static) PTFE liners, achieved through carbon impregnation, addresses a major safety concern in systems transferring non-conductive fluids (like solvents or fuels) by safely dissipating electrostatic charge build-up, preventing dangerous sparks and subsequent explosions. This integration of material science with precision engineering dictates the overall performance and safety standards achieved by modern PTFE hose systems, driving adoption in highly regulated industries.

Regional Highlights

The market dynamics for PTFE hoses vary considerably across key geographical regions, reflecting differing industrial bases, regulatory environments, and levels of technological maturity. North America, encompassing the United States and Canada, represents a high-value market driven primarily by the stringent demands of the aerospace and defense sectors, where PTFE hoses are mandated for high-reliability hydraulic and fuel systems. The region also maintains a strong presence in pharmaceutical and biotechnology manufacturing, necessitating UHP-compliant hoses. The emphasis here is on certified components, extended warranty periods, and technical service support, leading to a strong demand for premium, custom-engineered PTFE assemblies and maintaining a high average selling price for specialized products.

Europe constitutes a highly regulated and mature market, influenced significantly by directives such as REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and ATEX (Atmosphères Explosibles). This regulatory stringency drives demand for high-quality, traceable PTFE products, especially in the chemical, food and beverage, and precision manufacturing sectors. Germany and the UK are major hubs for industrial machinery, driving demand for flexible, convoluted PTFE hoses used in robotics and automation. The European focus on energy efficiency and sustainable manufacturing also encourages the adoption of hoses that minimize pressure drop and maintenance requirements, ensuring high operational uptime.

The Asia Pacific (APAC) region is poised for the most rapid growth, largely attributed to burgeoning industrialization and massive foreign direct investment in manufacturing capabilities, particularly in China, India, and Southeast Asian nations. The expansion of chemical processing plants, automotive production (including EV battery manufacturing), and microelectronics fabrication facilities are creating unprecedented demand for corrosion-resistant and ultra-pure PTFE fluid transfer lines. While pricing remains a critical competitive factor in APAC, the increasing emphasis on improving operational safety and reducing contamination risk, especially in the rapidly expanding pharmaceutical sector in India and China, is pushing users towards higher specification PTFE products, albeit at a more aggressive growth rate than their Western counterparts.

- North America: Market leader in aerospace and defense PTFE applications; high demand for certified, custom assemblies; strong growth driven by robust biotech investment.

- Europe: Highly regulated market focusing on REACH and ATEX compliance; strong adoption in complex industrial automation and food processing (EHEDG standards).

- Asia Pacific (APAC): Highest growth trajectory fueled by expansion in automotive (EV focus), chemical manufacturing, and semiconductor industries; increasing shift towards high-purity standards.

- Latin America (LAMEA): Growing demand linked to modernization of infrastructure and expansion of the oil & gas and agricultural chemical sectors, often prioritizing cost-effective standard braided hoses.

- Middle East & Africa (MEA): Demand concentrated in hydrocarbon processing and large infrastructure projects; focus on durable, high-pressure PTFE hoses for refinery operations and offshore platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PTFE Hoses Market.- Swagelok Company

- Parker Hannifin Corporation

- Eaton Corporation plc

- Saint-Gobain S.A.

- Titeflex Corporation (Smiths Group)

- Flexfab LLC

- Teleflex Incorporated

- Freudenberg Group

- Aflex Hose Ltd. (Watson-Marlow Fluid Technology Group)

- Merlett Tecnoplastic S.p.A.

- NewAge Industries Inc.

- Holmbury Inc.

- Gates Corporation

- Kuriyama of America, Inc.

- Pexco LLC

- Hose Master LLC

- Semperflex (Semperit Group)

- Contitech (Continental AG)

- Sunflex Sah Schlauch und Armaturen GmbH

- Transfer Oil S.p.A.

Frequently Asked Questions

Analyze common user questions about the PTFE Hoses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of PTFE hoses over conventional rubber or metal hoses?

PTFE hoses offer superior chemical inertness, making them resistant to nearly all corrosive fluids; exceptional temperature resistance, accommodating continuous operation from cryogenic temperatures up to 260°C; non-aging properties; and a non-stick surface that minimizes internal friction and facilitates non-contaminating fluid transfer. This combination makes them essential for high-purity and high-stress applications, offering extended service life and reduced operational risks compared to traditional materials.

In which specific industries is conductive (anti-static) PTFE liner required and why?

Conductive PTFE liners, typically achieved through carbon black impregnation, are mandatory in applications involving the transfer of non-conductive fluids such as fuels, solvents, or certain chemicals. When these fluids flow through the hose, they generate static electricity which, if not safely grounded, can build up sufficient energy to cause a spark and ignition, leading to catastrophic failure. Industries like chemical processing, oil and gas, and pharmaceutical manufacturing handling volatile organic compounds (VOCs) require conductive PTFE to comply with safety standards like ATEX regulations.

How does the design variation between smooth bore and convoluted PTFE hoses impact performance and application?

Smooth bore PTFE hoses provide the highest flow rates and are easiest to clean, making them ideal for high-purity or high-flow, stationary applications where maximizing throughput is critical, such as chemical plant piping. Convoluted hoses, characterized by helical or annular ridges, offer significantly greater flexibility and superior kink resistance, enabling tighter bend radii. This design is preferred for dynamic applications involving movement or where installation space is highly constrained, such as in robotics, machine tools, or specialized aerospace assemblies.

What is the major technical constraint limiting the broader adoption of PTFE hoses in general industrial use?

The most significant constraint is the material's susceptibility to cold flow, or creep, under sustained high pressure and temperature, particularly at the fitting connection points. While PTFE offers excellent chemical resistance, its lower mechanical strength compared to metals means that standard fittings can cause the material to gradually deform over time, potentially leading to seal failure or leakage. This necessitates the use of specialized, often proprietary, fitting designs and strict installation procedures, contributing to a higher overall system cost and installation complexity compared to conventional rubber hose assemblies.

Which geographical region is expected to drive the largest future demand for high-specification PTFE hoses?

The Asia Pacific (APAC) region is projected to drive the largest future demand for high-specification PTFE hoses. This surge is directly linked to massive investments in high-tech manufacturing sectors, specifically the rapid expansion of electric vehicle production (requiring complex PTFE thermal management lines), the establishment of new semiconductor fabrication facilities (demanding ultra-high-purity fluid transfer), and the modernization of chemical and pharmaceutical manufacturing infrastructure across China, India, and Southeast Asia, pushing stringent requirements for material purity and durability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager