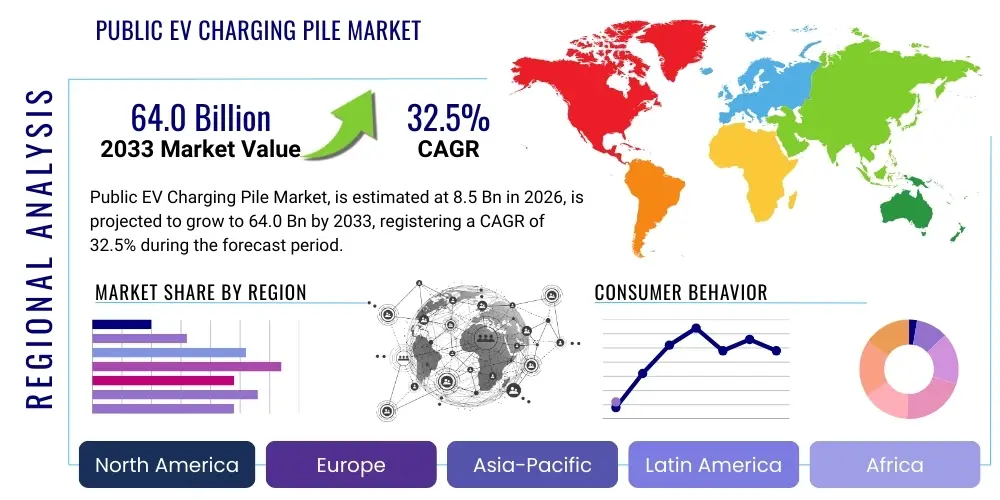

Public EV Charging Pile Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443201 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Public EV Charging Pile Market Size

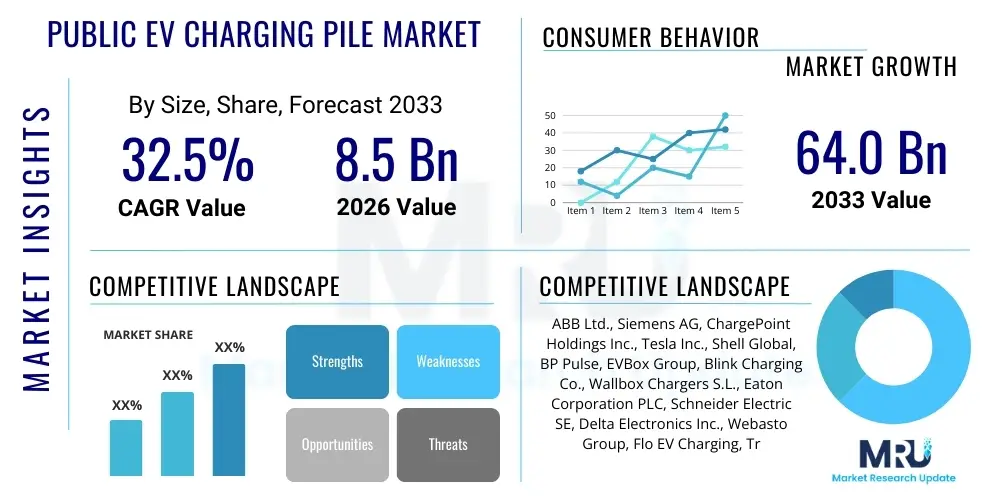

The Public EV Charging Pile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 32.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 64.0 Billion by the end of the forecast period in 2033.

Public EV Charging Pile Market introduction

The Public EV Charging Pile Market encompasses the infrastructure, hardware, and software systems designed to provide electric vehicle (EV) charging services in publicly accessible locations such as parking lots, retail centers, highway rest stops, municipal properties, and dedicated charging hubs. This infrastructure is critical for alleviating range anxiety, supporting the mass adoption of electric vehicles, and achieving global decarbonization goals set by various governments. The market includes a diverse range of charging solutions, categorized primarily by power output and charging speed, namely Level 2 AC chargers (slower, destination charging) and DC Fast Chargers (DCFC), which are essential for long-distance travel and rapid turnaround requirements. Product offerings span from sophisticated charging management platforms and energy storage integration systems to robust, weather-resistant hardware designed for high utilization rates and interoperability across different vehicle models and payment systems.

Major applications for public EV charging piles are predominantly found in urban and peri-urban areas where the density of electric vehicle ownership necessitates widespread infrastructure support. Key applications include fleet charging depots, essential services infrastructure, and high-traffic corridors enabling intercity EV travel. The fundamental benefit driving this market is the enablement of electric mobility, fostering sustainable urban planning, and creating new revenue streams for site hosts and charging network operators (CPOs). Furthermore, the integration of public charging piles with smart grid technologies allows for dynamic load management and optimized energy distribution, enhancing grid stability and reducing operational costs during peak demand periods. The shift toward interoperable standards and robust network connectivity is pivotal for market maturity and user acceptance.

Driving factors for the substantial growth observed in this market segment are multi-faceted, stemming from rigorous regulatory mandates, substantial government subsidies, and burgeoning consumer demand for EVs, particularly battery electric vehicles (BEVs). Global policies promoting zero-emission vehicles, coupled with tax incentives and charging infrastructure funding programs (such as those in the U.S. and the EU), provide a strong financial impetus. Technological advancements in battery capacity and charging efficiency, particularly the development and deployment of ultra-fast charging capabilities (350 kW and above), are crucial in making EV ownership more practical and appealing to a broader consumer base. The increasing involvement of major automotive manufacturers, energy companies, and independent technology providers in building robust charging ecosystems further accelerates deployment rates and improves service quality across different geographies.

Public EV Charging Pile Market Executive Summary

The Public EV Charging Pile Market is experiencing a paradigm shift characterized by intensified competition among Charging Point Operators (CPOs), significant technological advancements in ultra-fast DC charging, and a pronounced focus on optimizing network utilization through smart grid integration. Current business trends indicate a move toward subscription-based charging models and roaming agreements that enhance user convenience and foster cross-network compatibility. Investment activity is heavily concentrated in strategic partnerships between utility companies and technology providers aimed at mitigating grid constraints and maximizing the integration of renewable energy sources into the charging infrastructure. Regionally, Asia Pacific, particularly China and certain Southeast Asian countries, dominates the installed base due to robust government support and massive domestic EV sales volumes. However, North America and Europe are exhibiting the fastest growth rates driven by substantial public and private funding initiatives focused on establishing continental charging backbones.

Segment trends reveal a rapid proliferation of DC Fast Charging solutions, which are becoming the preferred public charging option over traditional Level 2 AC installations, reflecting the market’s responsiveness to consumer demands for quicker charge times. Hardware segmentation is increasingly bifurcated between high-power highway charging and more modest, networked urban destination charging solutions. Software and service segments are evolving rapidly, focusing on sophisticated features like predictive maintenance, dynamic pricing based on energy costs, and advanced user interface technologies accessible via mobile applications. Business models are shifting away from pure hardware sales toward holistic, managed service offerings, often bundling energy management, software licensing, and operational maintenance for site hosts. This comprehensive approach ensures higher reliability and better returns on infrastructure investment, stabilizing the long-term growth trajectory of the ecosystem.

Key strategic priorities for stakeholders include securing prime real estate locations, ensuring high uptime reliability through modular and resilient hardware designs, and standardizing communication protocols (like OCPP) to facilitate seamless integration and remote management. The competitive environment necessitates continuous innovation in payment processing security, user experience design, and interoperability across various vehicle types (CCS, CHAdeMO, and NACS standards). Furthermore, regulatory mandates surrounding accessibility, equity, and reliability metrics are forcing CPOs to enhance their network planning and deployment strategies, particularly in underserved communities and remote areas. The confluence of favorable policies, aggressive technological innovation, and scalable digital platforms is defining the competitive landscape and propelling the Public EV Charging Pile Market toward mass infrastructure maturity.

AI Impact Analysis on Public EV Charging Pile Market

User queries regarding the impact of Artificial Intelligence (AI) on the Public EV Charging Pile Market frequently revolve around four core themes: optimization of energy consumption, reliability and predictive maintenance, dynamic pricing strategies, and personalized user experience. Consumers and industry professionals are keenly interested in how AI can solve the inherent complexities of managing massive, distributed energy loads without destabilizing the electrical grid. Key expectations center on AI's ability to forecast charging demand accurately based on traffic patterns, weather, and local events, enabling utilities and CPOs to proactively manage power distribution. Concerns often surface regarding data privacy, the potential for AI-driven price manipulation, and the necessary cybersecurity measures to protect networked charging infrastructure from sophisticated cyber threats. Overall, the market expects AI to transition charging piles from simple dispensing units into intelligent, self-optimizing energy nodes that improve efficiency and reduce operational expenditures significantly.

AI's influence is pivotal in optimizing the utilization of public charging infrastructure, which historically suffers from periods of underutilization followed by severe congestion. By employing machine learning algorithms, Charging Point Operators can achieve unparalleled efficiency in resource allocation. For example, AI can analyze real-time usage data alongside historical patterns to recommend optimal locations for new pile deployment, ensuring maximum coverage and minimizing investment risks. Furthermore, in the realm of grid integration, AI manages vehicle-to-grid (V2G) technology, optimizing the two-way energy flow by deciding when an EV battery can discharge energy back to the grid to meet peak demand or absorb surplus renewable energy, turning individual charging piles into vital grid assets. This sophisticated level of energy balancing requires high-speed, decentralized AI processing.

The operational efficiency gained through AI extends directly into predictive maintenance and fault diagnosis, dramatically improving the user experience by increasing charger uptime. Instead of relying on reactive repairs, AI systems analyze diagnostic data streams (temperature, voltage fluctuations, charging session durations) to predict component failure weeks in advance, enabling preemptive maintenance scheduling. This proactive approach minimizes downtime, which is a critical measure of success for public networks. From a consumer perspective, AI algorithms personalize the charging experience by learning user preferences, suggesting optimal charging times based on current energy prices or availability, and guiding drivers to the least-congested charging stations, thereby elevating the overall reliability and perceived value of public charging services.

- AI-driven Predictive Maintenance: Reduces equipment downtime by forecasting mechanical and electrical failures, leading to higher reliability and uptime.

- Dynamic Load Balancing: Optimizes power distribution across multiple charging piles simultaneously, preventing grid overload and maximizing energy efficiency during peak hours.

- Demand Forecasting: Utilizes machine learning to predict regional charging needs based on variables like traffic, weather, and time of day, informing infrastructure planning.

- Optimized Pricing Strategy: Implements dynamic pricing models based on real-time electricity costs, demand levels, and time-of-use tariffs to incentivize off-peak charging.

- V2G Optimization: Manages bidirectional energy flows between EVs and the grid, maximizing revenue potential and supporting grid stability.

- Enhanced User Navigation: Provides real-time information on charger availability, wait times, and route optimization to the nearest functional unit via mobile apps.

- Cybersecurity and Anomaly Detection: Continuously monitors network traffic and operational parameters to identify and mitigate cyber threats or fraudulent activities.

DRO & Impact Forces Of Public EV Charging Pile Market

The market is primarily driven by robust governmental mandates and financial incentives aimed at accelerating EV adoption rates globally, which directly translates into demand for ubiquitous charging infrastructure. Significant restraints include the substantial capital expenditure required for widespread DC fast charging deployment, coupled with ongoing challenges related to securing adequate electrical grid capacity and streamlining the permitting processes in dense urban environments. Opportunities are emerging through the integration of renewable energy sources directly into charging hubs and the development of intelligent software platforms that enable complex energy management services, such as V2G functionality. These elements—Drivers, Restraints, and Opportunities—collectively shape the Impact Forces, which are currently exerting a strong positive pressure, particularly as technological improvements lower the cost of high-power charging solutions and legislative support solidifies long-term investment viability.

Key drivers include the global push for sustainability and the explicit decarbonization targets set by major economies. The rapid advancement of battery technology, leading to larger EV ranges, necessitates higher power output chargers to keep charging times manageable, thereby accelerating DCFC deployment. Furthermore, the standardization efforts globally, such as the increasing adoption of the CCS standard and the migration toward the North American Charging Standard (NACS), reduce compatibility issues and encourage consumer confidence. Restraints often manifest as systemic barriers: grid limitations require costly upgrades to substations and distribution infrastructure. Moreover, the lack of standardized payment methods and the fragmentation of charging networks in certain regions contribute to user frustration and decelerate adoption rates outside of core metropolitan areas. Regulatory hurdles, particularly around safety standards and interoperability, also present ongoing challenges that must be overcome through industry collaboration.

Opportunities are being capitalized upon through technological innovation focusing on modular and scalable charging hardware that is easier and cheaper to deploy. The convergence of energy storage systems (ESS) with charging piles provides a buffer against grid limitations, enabling ultra-fast charging even in areas with constrained power supply, thereby unlocking new deployment locations. Furthermore, the development of sophisticated software analytics and data monetization strategies allows CPOs to offer differentiated services and improve profitability. The collective impact forces show a strong trajectory favoring growth, driven by substantial public investments (e.g., NEVI program in the US, AFIR in the EU) and private sector commitments from automotive OEMs and oil/gas majors pivoting toward energy services. These investments amplify the rate of infrastructure build-out, making public charging increasingly accessible and reliable, ultimately mitigating range anxiety and cementing the foundation for mass EV mobility.

Segmentation Analysis

The Public EV Charging Pile Market is segmented based on several key operational and technical characteristics, allowing for targeted market strategies and infrastructure development. Primary segmentation criteria include the type of charger (AC or DC), the level of power output, the application site (e.g., retail, commercial fleet, highway), and the components (hardware, software, services). The dominance of Level 2 AC chargers in destination and overnight parking contrasts sharply with the strategic importance of DC fast chargers along major transit routes. The segmentation by component highlights the increasing importance of sophisticated software platforms and ancillary services in managing, operating, and monetizing the physical charging assets, transforming the market from a hardware-centric industry into a service-oriented energy management ecosystem.

- By Charger Type:

- AC Charging Piles (Level 2)

- DC Charging Piles (DC Fast Charging, Ultra-Fast Charging)

- By Connector Type:

- Combined Charging System (CCS)

- CHAdeMO

- North American Charging Standard (NACS)

- Type 2 (AC)

- By Application Site:

- Commercial Public Parking (Retail, Shopping Malls)

- Workplace Charging

- Fleet Charging (Taxi, Bus, Delivery Vehicles)

- Highway and Rest Area Charging

- Government/Municipal Charging Stations

- By Component:

- Hardware (Charging Station Unit, Power Electronics, Cables)

- Software (Charging Management Systems (CMS), Payment Platforms)

- Services (Installation, Maintenance, Cloud Services, Network Management)

- By Power Output:

- Less than 50 kW

- 50 kW to 150 kW (Standard DCFC)

- 150 kW to 350 kW (High-Power DCFC)

- Above 350 kW (Ultra-Fast Charging)

Value Chain Analysis For Public EV Charging Pile Market

The value chain for the Public EV Charging Pile Market is intricate, involving multiple specialized stakeholders from raw material suppliers to the end consumer. The upstream segment primarily involves the manufacturing of power electronics, semiconductor components, power modules, and specialized materials like copper and advanced plastics for enclosures and cabling. Key upstream activities include research and development focused on improving power conversion efficiency and thermal management within the charging units. Suppliers in this segment are crucial for determining the overall cost, quality, and longevity of the charging hardware. Strategic sourcing and inventory management are vital upstream considerations, particularly given current global supply chain volatilities affecting semiconductor availability and raw material costs, which significantly influence deployment schedules and infrastructure investment feasibility.

The midstream activities center on the integration, deployment, and management of the charging infrastructure. This stage involves hardware assembly, quality control, specialized electrical contracting for installation, and, critically, the development and maintenance of the Charging Management Systems (CMS) and associated cloud platforms. Charging Point Operators (CPOs) and e-Mobility Service Providers (EMSPs) dominate this segment, focusing on network planning, site acquisition, regulatory compliance, and establishing interoperability standards (OCPP implementation). Distribution channels are highly fragmented, relying on a mix of direct sales to large fleet operators or government entities, and indirect sales through certified distributors, value-added resellers (VARs), and electrical utility partnerships. The distribution strategy must address complex logistical challenges, including managing specialized heavy equipment and coordinating highly skilled installation teams across diverse geographical regions.

The downstream portion of the value chain focuses squarely on the user experience and long-term asset monetization. This includes the provision of charging sessions, customer support, billing, payment processing, and ancillary services such as loyalty programs or integration with local retail services. Direct interactions with end-users occur primarily through mobile applications and the charging station interface itself. The success of the downstream operation hinges on maintaining high asset uptime, delivering seamless roaming capabilities across different networks, and effective utilization of the collected usage data for predictive analytics and pricing optimization. Utility partnerships are increasingly significant downstream, as they facilitate favorable electricity tariffs and enable participation in demand response programs, creating additional revenue streams beyond the energy sale itself. This integrated approach ensures the financial viability and scalability of the public charging ecosystem.

Public EV Charging Pile Market Potential Customers

Potential customers for public EV charging infrastructure represent a diverse collection of entities, ranging from public sector organizations seeking to fulfill environmental mandates to large private enterprises focused on fleet electrification and customer amenity provision. The primary end-users or buyers of public charging pile infrastructure are commercial site hosts such as owners and operators of retail establishments, shopping centers, and hospitality venues (hotels, restaurants). These customers procure charging solutions either to attract EV-driving patrons, increasing foot traffic and dwell time, or to meet local building codes requiring EV readiness. For this group, key purchasing criteria include ease of installation, robust network reliability, and compatibility with standardized payment systems, often preferring networked Level 2 AC solutions augmented by strategic DC fast charging.

Another major segment comprises government agencies, municipalities, and urban planning bodies who invest in public charging infrastructure to support city fleet electrification, comply with air quality standards, and provide essential services to their constituents. These public buyers often prioritize large-scale, resilient networks, focusing heavily on interoperability and long-term maintenance contracts, frequently utilizing public-private partnership models for deployment funding. Furthermore, large commercial entities managing logistics and delivery fleets, such as warehousing companies and ride-sharing services, constitute a rapidly expanding customer base. Their procurement is highly focused on scalable, high-utilization DC fast charging depots, often coupled with intelligent fleet management software and advanced energy storage solutions to ensure operational continuity and minimize energy costs.

Finally, electric utilities and Charging Point Operators (CPOs) themselves are core customers, purchasing sophisticated hardware and complex software solutions for their own large-scale network build-outs. Utilities often purchase charging infrastructure as part of mandated grid modernization or transportation electrification programs. CPOs, meanwhile, are the sophisticated buyers of high-power DC charging hardware, requiring advanced telemetry, remote diagnostic capabilities, and robust cybersecurity features, as their entire business model depends on the reliability and efficiency of these assets. Their buying decisions are driven by total cost of ownership (TCO), scalability, and adherence to evolving communication and safety standards, seeking vendor partners who can provide end-to-end solutions including managed services and guaranteed uptime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 64.0 Billion |

| Growth Rate | 32.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, ChargePoint Holdings Inc., Tesla Inc., Shell Global, BP Pulse, EVBox Group, Blink Charging Co., Wallbox Chargers S.L., Eaton Corporation PLC, Schneider Electric SE, Delta Electronics Inc., Webasto Group, Flo EV Charging, Tritium DCFC Limited, Alfen N.V., Efacec, Kempower, Star Charge, XCharge |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Public EV Charging Pile Market Key Technology Landscape

The technological landscape of the Public EV Charging Pile Market is characterized by rapid advancements focused on increasing power density, improving energy efficiency, and enhancing network interoperability. A primary technological focus is the continuous development of Silicon Carbide (SiC) based power electronics, which significantly reduce energy losses during AC/DC conversion, enabling smaller, more efficient, and faster charging units. This transition is essential for reaching the 350 kW and higher power levels required for next-generation EVs. Furthermore, liquid cooling technologies are becoming standard for ultra-fast charging cables and power modules, effectively managing the extreme thermal stress generated by high current flow, ensuring both safety and longevity of the charging piles in high-utilization public settings.

Another crucial technological pillar involves the evolution of communication standards and network intelligence. The Open Charge Point Protocol (OCPP) remains the dominant industry standard for communication between the charging station (pile) and the Charging Management System (CMS), facilitating remote management, software updates, and reliable billing. OCPP 2.0.1, in particular, introduced crucial functionalities supporting ISO 15118 (Plug & Charge), which enables seamless, secure authorization and billing simply by plugging the vehicle in. This focus on software and connectivity transforms the charging pile into a smart device capable of participating in sophisticated grid services, leveraging APIs and cloud computing for real-time data analysis and system optimization. The shift towards open standards is critical for fostering a competitive and interoperable market environment.

Emerging technologies shaping future deployments include the integration of Battery Energy Storage Systems (BESS) directly at the charging hub level. BESS allows operators to decouple charging demand from immediate grid supply, mitigating demand charges, facilitating the integration of intermittent renewable energy sources, and enabling ultra-fast charging capabilities even in areas with limited local transformer capacity. Wireless charging (inductive technology) is also undergoing pilot programs for public applications, particularly in fleet and taxi queuing areas, promising reduced wear and tear on cables and enhanced convenience, though technical hurdles related to efficiency and power transfer consistency remain. Finally, advanced cybersecurity measures, incorporating blockchain technology for secure transaction validation and hardware root-of-trust authentication, are becoming indispensable to protect these critical networked energy assets.

Regional Highlights

- Asia Pacific (APAC): APAC, led overwhelmingly by China, holds the largest market share in terms of installed public charging piles globally. The region benefits from aggressive government mandates, significant public infrastructure investment, and a massive domestic EV manufacturing base. Growth in South Korea, Japan, and India is accelerating, driven by favorable subsidy schemes and initiatives aimed at improving inter-city connectivity. China's focus remains on establishing dense urban charging networks and rolling out high-power solutions along key national highways.

- Europe: Europe exhibits robust growth, heavily influenced by the European Green Deal and the Alternative Fuels Infrastructure Regulation (AFIR), which mandates specific deployment targets along the Trans-European Transport Network (TEN-T). Key markets like Germany, Norway, and the Netherlands prioritize interoperability, standardization (CCS dominance), and the integration of renewable energy sources. Regulatory certainty and standardized roaming platforms are major regional drivers, fostering large-scale investments by utility companies and major oil corporations pivoting toward e-mobility services.

- North America: The market is experiencing explosive growth, largely catalyzed by the U.S. National Electric Vehicle Infrastructure (NEVI) Formula Program and state-level incentives, focusing on building a reliable, interconnected charging network along designated Alternative Fuel Corridors. The U.S. and Canada are characterized by a strong push toward high-power DC charging. The adoption of the NACS standard by major automakers is forcing market players to rapidly transition hardware to support multi-standard charging solutions, impacting competitive dynamics and future infrastructure planning.

- Latin America (LATAM): Although currently smaller, the LATAM market is poised for significant expansion, driven by urbanization and commitments from countries like Brazil and Mexico to introduce EV-friendly policies and expand public transport electrification. Investment is primarily concentrated in metropolitan areas, often through public-private consortia focused on fleet operations (e.g., e-bus charging infrastructure).

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven by oil-rich nations like the UAE and Saudi Arabia investing in EV ecosystems as part of long-term economic diversification strategies. These markets often favor high-end, technologically advanced DC charging solutions integrated with smart city initiatives. Deployment remains concentrated in major urban centers, with infrastructure quality being a significant competitive differentiator.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Public EV Charging Pile Market.- ABB Ltd.

- Siemens AG

- ChargePoint Holdings Inc.

- Tesla Inc.

- Shell Global

- BP Pulse

- EVBox Group

- Blink Charging Co.

- Wallbox Chargers S.L.

- Eaton Corporation PLC

- Schneider Electric SE

- Delta Electronics Inc.

- Webasto Group

- Flo EV Charging

- Tritium DCFC Limited

- Alfen N.V.

- Efacec

- Kempower

- Star Charge

- XCharge

- Fastned B.V.

- SemaConnect (now part of Blink Charging)

- Allego N.V.

- Power Electronics

- Phoevos

Frequently Asked Questions

Analyze common user questions about the Public EV Charging Pile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor accelerating the growth of the Public EV Charging Pile Market?

The primary accelerating factor is substantial, sustained government funding and legislative support, such as the U.S. NEVI program and European AFIR mandates, which provide financial incentives for widespread infrastructure deployment and drive higher EV adoption rates globally.

How is DC Fast Charging technology influencing the public charging infrastructure landscape?

DC Fast Charging (DCFC) is fundamentally transforming the market by enabling significantly faster charging times (30 minutes or less), mitigating range anxiety, and making long-distance EV travel practical, leading to a shift in investment priority from Level 2 AC to high-power DC solutions.

What role does standardization, such as OCPP and NACS, play in market development?

Standardization is crucial for interoperability and consumer confidence. OCPP (Open Charge Point Protocol) ensures seamless communication between charging hardware and network management software, while the increasing adoption of NACS (North American Charging Standard) simplifies vehicle compatibility and reduces hardware fragmentation.

What are the main financial and operational challenges facing Charging Point Operators (CPOs)?

CPOs face high upfront capital expenditure for hardware and grid upgrades, coupled with regulatory and permitting complexities. Operationally, maintaining high uptime reliability and managing energy costs, particularly high demand charges from utilities, remain significant challenges that require advanced energy management systems.

How is AI being utilized to improve the efficiency of public EV charging networks?

AI is employed for dynamic load balancing, real-time demand forecasting, and predictive maintenance. These applications optimize energy distribution, reduce operational costs, prevent grid strain during peak usage, and drastically improve charger reliability by preemptively scheduling repairs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager