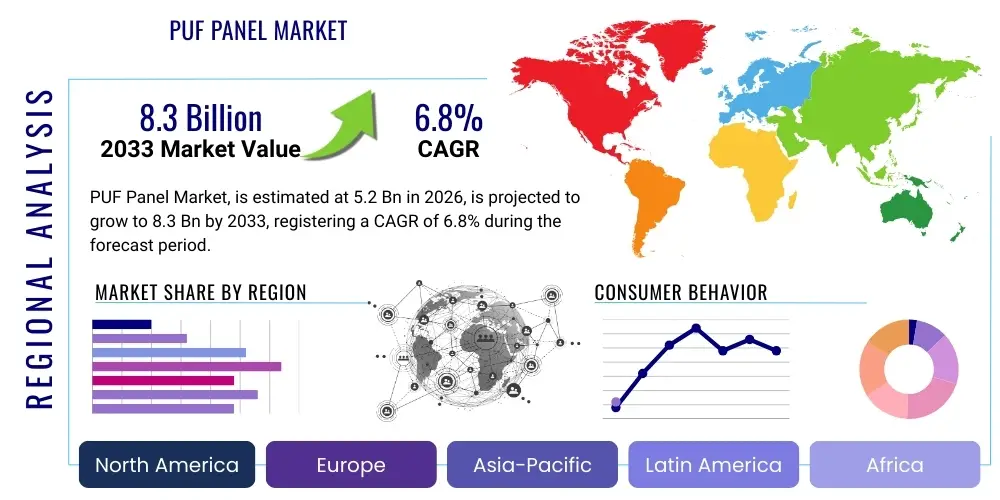

PUF Panel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441978 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

PUF Panel Market Size

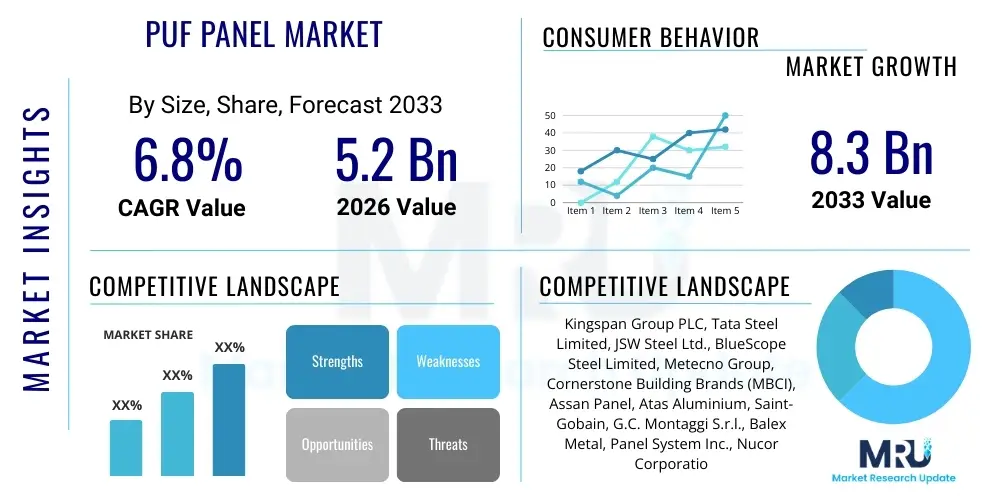

The PUF Panel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

The market expansion is fundamentally driven by the escalating global focus on energy conservation and the stringent enforcement of building energy efficiency codes across developed and rapidly developing economies. Polyurethane Foam (PUF) panels offer superior thermal insulation properties compared to traditional building materials, making them essential for high-performance envelopes in commercial, industrial, and cold storage applications. The increasing construction activity, particularly in Asia Pacific, coupled with governmental incentives for green building certifications, solidifies the foundational demand for these lightweight, high-strength composite panels.

Furthermore, the rapid expansion of the cold chain logistics sector, driven by pharmaceutical distribution and the burgeoning global trade of perishable goods, provides a critical impetus for the PUF panel market. These panels are the primary material choice for constructing cold rooms, controlled atmosphere warehouses, and refrigerated transport vehicles due to their excellent temperature control capabilities and hygiene properties. The shift from discontinuous to continuous manufacturing processes also enhances production efficiency and panel quality, driving down unit costs and expanding market accessibility across diverse end-use sectors, thereby sustaining the projected CAGR over the forecast period.

PUF Panel Market introduction

The Polyurethane Foam (PUF) Panel Market encompasses the manufacturing, distribution, and utilization of structural composite panels composed of a rigid PU foam core sandwiched between two outer facings, typically made of pre-painted galvanized iron (PPGI) or aluminum sheets. These panels serve primarily as insulation and structural elements in construction, characterized by exceptional thermal resistance, high strength-to-weight ratio, and ease of installation. Product variations include standard PUF and higher fire-resistant Polyisocyanurate (PIR) panels, catering to different regulatory and performance requirements.

Major applications of PUF panels span the entire construction ecosystem, ranging from infrastructure projects and industrial facilities to commercial buildings and specialized controlled environments. Key sectors include cold storage facilities (warehouses, freezers), commercial construction (malls, offices, hospitals), and residential buildings seeking enhanced energy efficiency. The core benefits derived from utilizing PUF panels include significantly reduced energy consumption for heating and cooling, rapid construction timelines, inherent structural stability, and superior resistance to moisture and fungal growth, contributing directly to lower lifecycle costs for building owners.

Market growth is predominantly driven by increasing regulatory mandates promoting net-zero energy buildings and the global urbanization trend necessitating efficient, scalable construction solutions. Specific driving factors include the booming demand for refrigerated logistics (cold chain), technological advancements in foam formulations resulting in better environmental profiles (e.g., non-CFC blowing agents), and the macroeconomic shift toward pre-fabricated and modular construction techniques, where lightweight insulated panels are instrumental for speed and performance consistency.

PUF Panel Market Executive Summary

The PUF Panel Market is characterized by robust commercial trends emphasizing sustainable building practices and optimized supply chain infrastructure. Business trends indicate a strong move toward high-performance PIR panels over standard PUF, driven by stricter fire safety regulations globally, particularly in industrial and high-occupancy commercial structures. Consolidation among major manufacturers is ongoing, focusing on vertical integration from raw material sourcing to specialized fabrication to maintain competitive pricing and quality control. Furthermore, digitalization in design and engineering, utilizing Building Information Modeling (BIM), is streamlining the incorporation of PUF panels into complex architectural projects, enhancing efficiency and reducing material wastage on site.

Regionally, Asia Pacific (APAC) stands as the dominant market in terms of volume and exhibits the highest growth rate, fueled by massive infrastructure development in China, India, and Southeast Asian nations, coupled with rapidly developing cold chain requirements. North America and Europe, while mature, demonstrate stable growth driven by retrofitting projects focused on mandatory energy efficiency upgrades and the increasing adoption of sustainable, bio-based PUF formulations. The Middle East and Africa (MEA) region present significant opportunities, largely linked to large-scale urban development projects and the critical need for effective thermal insulation against extreme climatic conditions.

Segment trends reveal that the Application segment dominated by the Industrial and Cold Storage sectors due to the essential requirement for precise temperature control and durable construction. Based on Type, composite panels featuring metal facings (PPGI/Aluminum) hold the largest share, although emerging segments like sandwich panels with specialized polymer facings are gaining traction in non-traditional applications. The focus within segmentation remains heavily skewed towards improving R-values (thermal resistance) and achieving better fire classifications (B or A ratings), reflecting the market's commitment to high-performance, safety-compliant products.

AI Impact Analysis on PUF Panel Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the PUF Panel Market primarily revolve around optimizing manufacturing efficiency, improving raw material utilization, and predicting structural performance in real-world applications. Key themes identified include the expectation that AI will minimize variability in the foam core density, a critical quality control metric, and enhance inventory management for customized panel sizes. Concerns center on the capital expenditure required for integrating advanced sensing and AI platforms into existing continuous laminating lines and the need for specialized personnel to manage predictive maintenance models. Expectations are high that AI will lead to the development of novel, high-performance foam formulations through rapid computational chemistry simulations, accelerating R&D cycles.

AI adoption is strategically targeted at the operational nexus of the market. In the manufacturing phase, machine learning algorithms analyze sensor data from blending and curing processes to dynamically adjust chemical inputs, ensuring optimal expansion rates and adhesion strength, thereby reducing defects and material waste. This precision is vital, as the quality of thermal performance is directly linked to the microscopic uniformity of the PU foam structure. Furthermore, AI-driven demand forecasting allows manufacturers to precisely align production schedules with erratic construction project timelines, optimizing logistics and significantly decreasing warehousing costs for bulky finished panels.

Beyond production, AI plays an increasing role in the downstream applications, particularly in smart building management and cold chain optimization. AI systems monitor the performance of installed PUF panels by analyzing thermal imaging data and interior climate metrics, identifying potential thermal bridges or performance degradation over time. This predictive maintenance capability extends the operational lifespan of high-value assets like cold storage warehouses, providing actionable insights to facility managers and reinforcing the long-term value proposition of high-quality insulated panels.

- AI optimizes chemical blending ratios for consistent foam density and thermal R-value.

- Predictive analytics minimizes downtime of continuous panel manufacturing lines.

- Machine learning algorithms enhance demand forecasting for customized panel orders.

- AI integration assists in quality control by detecting structural defects during lamination.

- Smart building systems use AI to monitor and maintain optimal thermal performance of PUF panel envelopes.

DRO & Impact Forces Of PUF Panel Market

The PUF Panel Market is powerfully influenced by a synergy of drivers, restraints, and opportunities that dictate its growth trajectory and competitive landscape. Primary drivers include the global imperative for energy-efficient construction, supported by mandatory building codes such as those in the EU and increasingly stringent standards in North America and APAC. This mandatory compliance pushes developers towards high R-value materials like PUF and PIR panels. Simultaneously, the immense global growth in the cold chain sector—fueled by e-commerce expansion, global food trade, and complex pharmaceutical supply chains (e.g., vaccines)—creates sustained, non-cyclical demand for specialized insulated construction.

However, the market faces significant restraints, primarily stemming from the volatility and supply chain disruption related to key raw materials, specifically Isocyanates (like MDI) and Polyols, which are petroleum derivatives. Fluctuations in crude oil prices and petrochemical capacity expansions directly impact production costs and margin stability for panel manufacturers. Additionally, historical environmental concerns associated with certain blowing agents (though largely mitigated by newer HFC/HFO technologies) continue to pose a perceptual challenge and increase regulatory scrutiny regarding the overall environmental footprint of the product lifecycle.

Opportunities for profound market growth lie in continuous innovation toward sustainable solutions and expansion into underdeveloped markets. The rising acceptance of bio-based polyols and low Global Warming Potential (GWP) blowing agents presents a critical pathway for compliance with 'green building' initiatives and capturing environmentally conscious market share. Furthermore, the burgeoning demand for modular and off-site construction methods, particularly for affordable housing and rapid industrial deployment, offers PUF panels a competitive edge due to their light weight and rapid assembly properties, positioning the market for aggressive expansion in emerging economies.

Segmentation Analysis

The PUF Panel Market is extensively segmented across multiple dimensions, including type of core material, application, facing material, and end-use industry, each category reflecting distinct performance requirements and market dynamics. This detailed segmentation allows manufacturers to tailor product lines precisely, addressing varying regulatory environments regarding thermal performance and fire safety. The differentiation between standard PUF (Polyurethane) and high-performance PIR (Polyisocyanurate) is critical, with PIR rapidly capturing market share in structures where stringent fire resistance (higher temperature tolerance) is mandatory, such as large industrial facilities and public buildings.

Segmentation by application highlights the dominant role of the cold storage segment, which demands panels optimized for minimal thermal conductivity and hygiene standards. Conversely, the commercial and industrial construction segments focus more on panels that balance thermal efficiency with structural load-bearing capacity and architectural aesthetics. Furthermore, the facing material segmentation is important; while pre-painted galvanized iron (PPGI) remains the standard for durability and strength, the use of aluminum is preferred in corrosive environments, and specialized composite facings are used where weight reduction is paramount.

Geographically, market segmentation reveals a clear trend of high-volume consumption in APAC, driven by rapid infrastructure build-out, contrasting with the high-value, specification-driven demand in mature markets like Europe, where energy efficiency standards necessitate premium, high R-value insulation panels. Understanding these segment nuances is vital for strategic market entry and product development, allowing firms to leverage regional construction cycles and specific regulatory landscapes effectively.

- By Type:

- Standard PUF Panels

- PIR Panels (Polyisocyanurate)

- By Facing Material:

- Metal-Faced Panels (PPGI, Aluminum, Stainless Steel)

- Non-Metal Faced Panels (FRP, Plywood, OSB)

- By Application:

- Cold Storage and Refrigeration

- Industrial Buildings (Factories, Warehouses)

- Commercial Buildings (Offices, Retail, Hospitals)

- Residential Buildings

- By End-Use Industry:

- Construction

- Logistics and Transportation

- Manufacturing

- Pharmaceutical and Healthcare

Value Chain Analysis For PUF Panel Market

The value chain for the PUF Panel Market commences with the upstream supply of core chemical components: Isocyanates (primarily MDI) and Polyols, alongside various additives such as catalysts, blowing agents, and flame retardants. This upstream segment is dominated by major petrochemical and chemical companies, which exert significant influence over raw material pricing due to high barriers to entry and consolidation. Panel manufacturers, the central fabrication stage, procure these chemicals and utilize highly specialized, capital-intensive continuous laminating equipment to produce the finished insulated panels, integrating them with procured facing materials like steel coils.

The midstream process involves transforming raw chemicals into finished panels and subsequent processing, such as cutting, profiling, and nesting, based on project specifications. Distribution channels are highly critical due to the bulky, low-density nature of the product. Direct channels are often utilized for large, custom industrial projects where manufacturers deal directly with major developers or contractors, ensuring precise specifications and timely delivery. Conversely, indirect channels rely heavily on specialized construction distributors, wholesale suppliers, and regional dealers who provide inventory management and last-mile logistics support to smaller and mid-sized construction firms.

Downstream analysis focuses on the end-use application and installation. Specialized installation contractors are often required due to the need for airtight and thermally bridged installations, particularly in cold storage and high-specification building envelopes. The profitability throughout the chain is influenced by operational efficiency in manufacturing, the ability to mitigate raw material price risks through hedging or long-term contracts, and the effectiveness of the distribution network in minimizing transportation damage and lead times to the construction site. Effective management of this complex value chain is crucial for maintaining competitive advantage in the specialized construction material sector.

PUF Panel Market Potential Customers

The potential customer base for the PUF Panel Market is highly diversified, spanning key economic sectors that prioritize thermal efficiency, structural speed, and hygiene control. A primary segment consists of commercial and industrial property developers focused on large-scale facilities such as data centers, logistics parks, and sprawling manufacturing plants. These buyers prioritize quick construction timelines and long-term operational savings derived from reduced energy consumption, making PUF panels an ideal choice for constructing high-performance building envelopes.

The cold chain industry represents another critical cluster of potential customers, encompassing third-party logistics (3PL) providers specializing in temperature-controlled warehousing, pharmaceutical manufacturers needing validated storage environments, and large food processing and distribution companies. For these buyers, the non-negotiable requirements are high insulation values, moisture resistance, and adherence to strict hygiene and validation standards (e.g., FDA/GMP compliance), areas where the seamless, high-performance nature of PUF panels excels.

Furthermore, government and institutional buyers, involved in public housing projects, hospitals, and educational facilities, are increasingly becoming key customers, particularly as public procurement mandates emphasize sustainable and energy-efficient construction. Lastly, specialized builders focused on modular and prefabricated structures, including temporary accommodations or remote site offices, rely on PUF panels for their lightweight, easy-to-assemble nature, facilitating rapid deployment and relocation capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kingspan Group PLC, Tata Steel Limited, JSW Steel Ltd., BlueScope Steel Limited, Metecno Group, Cornerstone Building Brands (MBCI), Assan Panel, Atas Aluminium, Saint-Gobain, G.C. Montaggi S.r.l., Balex Metal, Panel System Inc., Nucor Corporation, Alubond U.S.A., Isoltema S.p.A., Sino Composite Co. Ltd., Rautaruukki Corporation, Zamil Steel Holding Co., Isopan S.p.A., Haining Enze Panel Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PUF Panel Market Key Technology Landscape

The technological landscape of the PUF Panel Market is characterized by continuous process optimization and innovation in foam chemistry aimed at enhancing thermal performance, fire resistance, and environmental sustainability. A central technology is the shift from discontinuous batch processes to highly automated, continuous lamination lines, which ensures consistent panel thickness, adhesion quality, and superior surface finish at high production speeds. This technology is crucial for achieving the tight tolerances required by large-scale commercial and industrial construction projects, minimizing installation errors and maximizing thermal efficiency.

Material science advancements represent another critical area. A major technological focus is the development and implementation of low Global Warming Potential (GWP) blowing agents, such as hydrofluoroolefins (HFOs), replacing older hydrofluorocarbons (HFCs) to align with global environmental protocols like the Kigali Amendment. Simultaneously, research into bio-based polyols derived from sustainable sources (e.g., soy or castor oil) is gaining traction, allowing manufacturers to reduce the reliance on petrochemical feedstocks while maintaining or even improving the foam's structural and insulation properties, catering to the burgeoning demand for "green" construction materials.

Furthermore, technology is being applied at the interface between the panel and the building system. This includes the development of sophisticated joint systems—such as interlocking or tongue-and-groove profiles—that effectively eliminate thermal bridging, a common weak point in building envelopes. The increasing integration of PUF panels with digital manufacturing (Industry 4.0) involves utilizing computerized numerically controlled (CNC) cutting and routing equipment to produce complex geometric shapes and specific penetrations directly on the line, ensuring precise, custom-fit panels that accelerate on-site assembly and minimize construction waste.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, type, and utilization of PUF panels worldwide, influenced heavily by climate, regulatory environment, and construction activity.

- Asia Pacific (APAC): This region is the largest and fastest-growing market, driven by massive infrastructure spending, rapid urbanization, and industrialization in economies like China, India, and Southeast Asia. The booming demand for cold chain logistics and affordable housing, coupled with improving energy efficiency standards, ensures continuous high-volume market growth.

- North America: Characterized by high-value projects and strict performance specifications. Growth is fueled by the renovation of aging commercial infrastructure, stringent energy codes (especially Title 24 in California), and strong demand from the data center and refrigerated transportation sectors, which demand premium PIR products.

- Europe: A mature market focused intensely on sustainability and high energy efficiency mandates (e.g., nearly zero-energy buildings or NZEB targets). The region leads in the adoption of advanced, low-GWP blowing agents and bio-based panel technologies, with a strong emphasis on retrofitting existing building stock to meet EU energy directives.

- Latin America (LATAM): Exhibits moderate growth linked to infrastructure modernization and increasing investment in food processing and storage facilities. Market volatility often stems from economic uncertainty, but the long-term potential in residential and commercial construction remains substantial as energy costs rise.

- Middle East and Africa (MEA): Growth is primarily project-driven, highly dependent on large-scale governmental investment in commercial real estate and leisure infrastructure (e.g., Saudi Arabia’s Vision 2030). The extreme climatic conditions necessitate highly effective thermal insulation solutions, making PUF/PIR panels essential for energy management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PUF Panel Market.- Kingspan Group PLC

- Tata Steel Limited

- JSW Steel Ltd.

- BlueScope Steel Limited

- Metecno Group

- Cornerstone Building Brands (MBCI)

- Assan Panel

- Atas Aluminium

- Saint-Gobain

- G.C. Montaggi S.r.l.

- Balex Metal

- Panel System Inc.

- Nucor Corporation

- Alubond U.S.A.

- Isoltema S.p.A.

- Sino Composite Co. Ltd.

- Rautaruukki Corporation

- Zamil Steel Holding Co.

- Isopan S.p.A.

- Haining Enze Panel Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the PUF Panel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between PUF and PIR panels in construction?

The primary difference lies in fire resistance and chemical composition. PUF (Polyurethane) panels offer excellent thermal insulation, while PIR (Polyisocyanurate) panels have a modified chemical structure that provides significantly enhanced fire resistance, typically achieving higher fire ratings required for large industrial and public buildings.

How do PUF panels contribute to achieving green building certifications?

PUF panels contribute significantly by drastically improving a building’s thermal envelope, leading to substantial energy savings for heating and cooling. Furthermore, modern panels utilize low-GWP blowing agents and are increasingly incorporating bio-based polyols, supporting prerequisites for certifications like LEED and BREEAM.

What is driving the high demand for PUF panels in the cold chain logistics sector?

The demand is driven by the necessity for precise, reliable temperature control and minimized energy loss in refrigerated warehouses and vehicles. PUF panels offer the highest thermal resistance (R-value) per inch compared to many traditional insulating materials, essential for maintaining cold temperatures efficiently and meeting hygiene standards.

Are raw material price fluctuations a significant constraint in the PUF Panel Market?

Yes, raw material price fluctuations are a critical restraint. The core chemical components, MDI (Isocyanate) and Polyols, are petrochemical derivatives, making panel production costs highly sensitive to volatility in the global crude oil and chemical feedstock markets.

Which geographical region exhibits the fastest growth potential for PUF panel adoption?

The Asia Pacific (APAC) region currently exhibits the fastest growth potential, propelled by massive government investment in infrastructure, widespread urbanization, and the aggressive expansion of industrial and commercial cold storage facilities across major developing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager