Puncture Resistant Boots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442555 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Puncture Resistant Boots Market Size

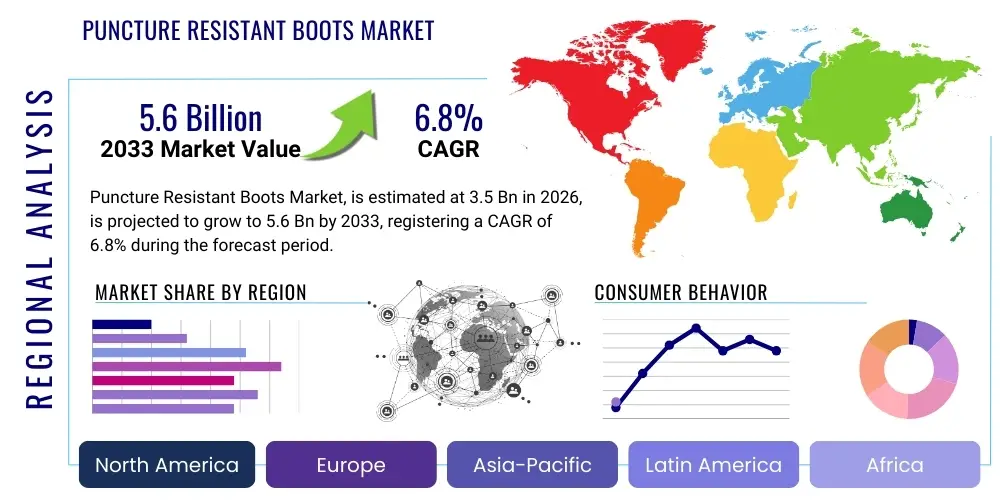

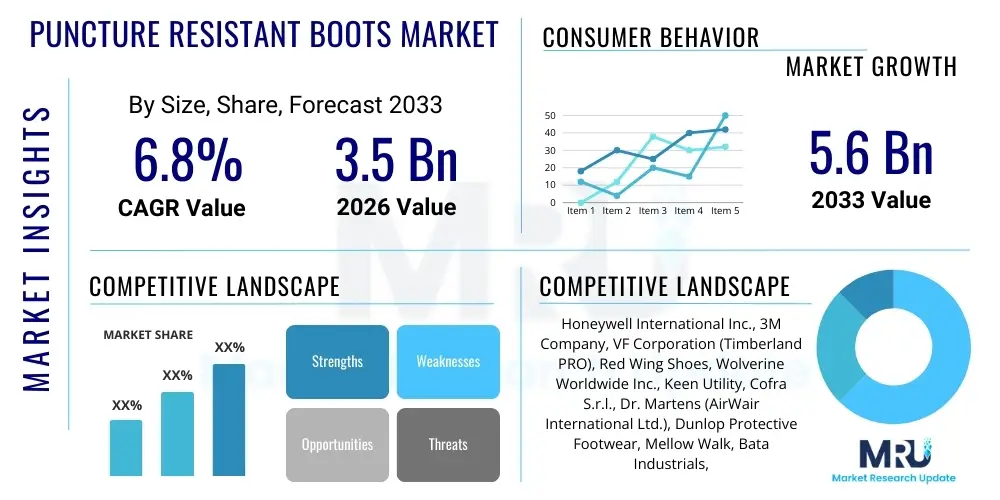

The Puncture Resistant Boots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Puncture Resistant Boots Market introduction

The Puncture Resistant Boots Market encompasses specialized safety footwear designed to protect the wearer's feet from penetration by sharp objects, such as nails, metal shards, glass, or biological hazards present in demanding work environments. These boots are mandated across various heavy and high-risk industries to comply with stringent occupational safety and health standards set by regulatory bodies like OSHA, ANSI, ISO, and EN. The essential feature of this footwear is the incorporation of a protective midsole—either a steel plate (metallic) or a woven composite material like Kevlar or specific textiles (non-metallic)—positioned above the outsole to prevent intrusion. The primary goal is mitigating severe foot injuries, which are common in construction, mining, and waste management sectors, thereby ensuring worker well-being and reducing associated corporate liability.

Product categories within this market range significantly in material composition, including vulcanized rubber for chemical resistance, polyurethane for lightweight durability, and specialized leather composites offering superior abrasion resistance. The technological evolution has shifted focus towards non-metallic protective layers, which often provide better flexibility, reduced weight, and improved thermal insulation, a critical factor for comfort and prolonged use in varied climatic conditions. Demand is intrinsically linked to industrial activity, particularly the boom in global infrastructure development, coupled with increased regulatory enforcement globally, compelling employers to adopt higher standards of Personal Protective Equipment (PPE).

Major applications span diverse industrial settings where underfoot hazards are prevalent. Benefits extend beyond direct injury prevention; these boots contribute significantly to overall workplace safety metrics, reduced downtime due to accidents, and improved worker confidence and morale. Key driving factors include rigorous governmental safety regulations, heightened awareness among workers regarding occupational hazards, and continuous innovation by manufacturers to produce lighter, more comfortable, yet highly protective footwear that meets or exceeds evolving performance standards, particularly concerning flexible sole protection without compromising puncture resistance capability.

Puncture Resistant Boots Market Executive Summary

The Puncture Resistant Boots Market exhibits robust growth driven primarily by escalating globalization of manufacturing and construction sectors, necessitating uniform safety standards. Key business trends include a significant shift toward lightweight composite materials (like aramid fiber midsoles) over traditional steel plates, addressing user demand for enhanced comfort and reduced fatigue during long shifts. Manufacturers are focusing on integrating smart features, such as RFID tracking for PPE management and advanced ergonomic designs, to gain a competitive edge. The market is increasingly competitive, marked by strategic mergers and acquisitions aimed at expanding regional distribution networks and bolstering technology portfolios, particularly in highly regulated segments like pharmaceuticals and chemical processing.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, propelled by massive governmental investments in infrastructure projects in China, India, and Southeast Asian nations, coupled with rapidly developing industrial safety legislation. North America and Europe, while mature, maintain strong demand, driven by stringent enforcement of existing safety protocols and the high cost associated with workplace injuries. Latin America and MEA show potential, tied to burgeoning oil and gas exploration and mining activities, necessitating specialized, high-durability puncture-resistant footwear tailored for extreme environmental conditions, such as high heat or chemical exposure.

Segment trends reveal that the manufacturing and construction sectors remain the largest application segments, demanding durable, versatile footwear. Within materials, polyurethane and high-performance rubber compounds are gaining traction due to their superior longevity and resistance to degradation from oils and chemicals. The non-metallic (textile/fabric) protection segment is expected to outpace metallic protection growth, attributed to the trend toward metal-detector-friendly footwear required in high-security or electronic manufacturing facilities. Segmentation based on certification standards (e.g., ASTM F2413 vs. EN ISO 20345) plays a crucial role in procurement decisions, particularly for multinational corporations standardizing their PPE supply chains globally to ensure cross-border compliance and worker protection consistency.

AI Impact Analysis on Puncture Resistant Boots Market

User inquiries regarding AI's influence typically revolve around predictive maintenance, supply chain optimization, and advanced material development. Common questions ask whether AI can design smarter, lighter materials for puncture plates, how AI tools can forecast regulatory changes affecting boot design, and if automated quality control systems can enhance defect detection during manufacturing. Users are deeply concerned with ensuring that material innovations maintain necessary safety integrity while reducing environmental footprint. The overarching expectation is that AI will streamline the entire lifecycle of safety footwear, from optimizing raw material procurement based on predictive cost models to personalizing fit and protective characteristics using biomechanical data derived from worker habits and specific job risks, ultimately leading to boots that are safer, more comfortable, and produced more sustainably and cost-effectively.

- AI-driven material informatics accelerates the discovery and testing of novel composite fabrics and non-metallic puncture-resistant polymers, optimizing strength-to-weight ratios.

- Predictive analytics models are used in demand forecasting, inventory management, and optimizing the distribution network, reducing warehousing costs and improving response times for industrial clients.

- Automated visual inspection systems utilizing machine learning algorithms enhance quality control, identifying micro-fractures or manufacturing inconsistencies in midsoles and soles with greater accuracy than manual checks.

- AI analyzes vast amounts of incident data (accidents, near-misses) across industries to provide real-time feedback for product design refinement, ensuring boot features directly address prevalent injury mechanisms.

- Integration of smart sensors (IoT) in boots, monitored and analyzed by AI, allows for personalized health tracking (fatigue, gait analysis) and alerts for hazardous environments, turning passive PPE into active safety devices.

- AI platforms assist in navigating complex global regulatory landscapes (OSHA, CE, CSA), ensuring new boot designs comply instantly with specific regional safety standards, speeding up market entry.

DRO & Impact Forces Of Puncture Resistant Boots Market

The trajectory of the Puncture Resistant Boots Market is shaped by a complex interplay of stringent safety legislation, rapid infrastructure growth, and inherent constraints related to material science and user acceptance. The primary driver is the pervasive governmental push for improved occupational safety across developed and developing economies, mandating the use of certified protective footwear in high-risk sectors like utilities and heavy engineering. These regulations impose significant financial penalties for non-compliance, forcing corporate procurement of high-quality PPE. Simultaneously, the global boom in construction and renewable energy projects provides a continuous demand baseline, requiring durable footwear for large workforces operating in dynamically hazardous environments. Innovation focused on blending safety with comfort, such as flexible, non-metallic anti-penetration layers and advanced ergonomic designs, acts as a crucial internal market driver, overcoming traditional resistance to bulky safety footwear.

However, the market faces significant restraints. The most prominent constraint is the ongoing challenge of striking an optimal balance between maximal puncture resistance and necessary flexibility. Highly rigid soles, while protective, cause user discomfort and fatigue, impacting compliance rates. Furthermore, the reliance on specialized raw materials, particularly advanced composites, exposes manufacturers to volatile supply chain disruptions and high material costs, which are often passed on to end-users. The prevalence of counterfeit safety products, particularly in emerging markets, poses a severe threat, undermining certified manufacturers' market share and, more critically, compromising worker safety due to unverified protection capabilities. This necessitates continuous investment in brand protection and consumer education.

Opportunities abound, particularly in the realm of material sustainability and smart technology integration. The growing demand for eco-friendly safety products opens avenues for boots made from recycled materials or biodegradable composites without compromising EN/ASTM standards. Furthermore, the integration of Internet of Things (IoT) sensors within the footwear, enabling features like real-time foot mapping, impact monitoring, and environmental hazard detection (e.g., proximity to high voltage or extreme temperature), transforms safety boots into active monitoring tools. The untapped potential in specialized sectors, such as cleanroom environments (requiring anti-static, non-shedding, puncture-resistant features) and specialized healthcare waste management, presents lucrative niche expansion opportunities. Impact forces, driven predominantly by regulatory tightening and technological breakthroughs in lightweight protective materials, consistently push the market toward higher performance and greater compliance adherence globally.

Segmentation Analysis

The Puncture Resistant Boots Market is systematically segmented based on the type of protective material used in the midsole, the overall boot material, the intended end-user application, and the certification standards achieved. This multifaceted segmentation helps manufacturers tailor their offerings precisely to the demanding requirements of various industries, ensuring specific hazards are addressed effectively, whether they be sharp waste in manufacturing plants, heavy machinery risks in construction, or chemical exposure in oil and gas fields. Analysis across these segments highlights the critical shift from traditional metallic plates to advanced composite technologies, optimizing the trade-off between protection and wearer comfort, which is central to high-volume procurement decisions across major industrial corporations seeking to minimize operational risks and maximize worker productivity.

- By Material Type (Boot Construction):

- Rubber

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Leather Composites

- Advanced Synthetics (Microfiber/Textile Blends)

- By Midsole Protection Technology:

- Steel Plate Midsole (Metallic)

- Fabric Midsole (Kevlar/Aramid/Textile Composite – Non-Metallic)

- Ceramic-based Plates (High-end specialized applications)

- By Application/End-User Industry:

- Construction

- Oil & Gas and Petrochemicals

- Mining and Quarrying

- Manufacturing and Heavy Industry

- Chemical and Pharmaceuticals

- Waste Management and Recycling

- Logistics and Warehousing

- Agriculture and Forestry

- Healthcare and Medical Waste Handling

- By Type (Height):

- Ankle Boots

- Mid-Calf Boots

- Knee-High Boots

Value Chain Analysis For Puncture Resistant Boots Market

The value chain for puncture resistant boots begins with upstream analysis, focusing on the sourcing and processing of specialized raw materials critical for safety features. This includes the manufacturing of high-tensile steel for metallic plates, and the chemical synthesis of advanced aramid fibers (like Kevlar or related high-strength textiles) required for non-metallic midsoles. Other essential inputs are high-quality polymers (PVC, PU) for injection molding and vulcanized rubber compounds for outsoles, procured from specialized chemical and material processing companies. Fluctuations in the cost of these petrochemical-derived materials significantly impact the final manufacturing cost. Maintaining stringent quality control at this stage is paramount, as the protective integrity of the final product hinges on the material specifications and consistency provided by these upstream suppliers.

The midstream stage involves the core manufacturing processes: component preparation, stitching, lasting, injection molding of soles, and crucially, the precise insertion and sealing of the puncture-resistant midsole unit. Key players typically operate advanced, certified manufacturing facilities to meet global standards (e.g., ISO 9001, complying with EN and ASTM testing protocols). Distribution channels are highly complex due to the regulated nature of the product. Direct sales often occur through large B2B contracts with major industrial entities (e.g., global mining corporations or automotive manufacturers) ensuring bulk compliance and technical support. Indirect distribution utilizes specialized industrial safety distributors, general PPE wholesalers, and increasingly, specialized e-commerce platforms focused on industrial safety gear, offering wider reach to SMEs and individual contractors. The complexity of inventory management, dealing with various sizes, fits, and country-specific certifications, necessitates sophisticated logistics.

Downstream analysis focuses on the end-user interaction and post-sale services. End-users are primarily occupational safety officers and procurement managers who prioritize certified compliance, durability, and ergonomic performance. Direct distribution ensures better technical service, customization options (e.g., corporate branding), and crucial training on product use and maintenance. Indirect channels rely heavily on the knowledge base of specialized retailers. The market success is heavily influenced by rapid stock replenishment and adherence to localized safety mandates, demanding high efficiency in the supply chain to minimize worker downtime. Post-purchase elements, such as product warranties and recycling initiatives for worn-out boots, are becoming increasingly important factors influencing major procurement decisions due to growing emphasis on corporate social responsibility (CSR) and sustainability efforts.

Puncture Resistant Boots Market Potential Customers

The primary customer base for puncture resistant boots consists of large industrial entities and governmental organizations operating in sectors characterized by significant environmental hazards and strict regulatory oversight regarding worker safety. These potential customers include multinational construction and engineering firms responsible for major infrastructure projects (roads, bridges, commercial buildings), where debris and exposed steel pose constant penetration risks. Furthermore, extensive demand originates from the global oil and gas industry, encompassing upstream drilling, midstream pipelines, and downstream refining, where workers encounter sharp tools, metal fragments, and corrosive materials that necessitate maximum sole protection combined with chemical and slip resistance. Procurement is typically centralized, driven by safety budgets and compliance officers rather than individual worker preference, emphasizing consistency and adherence to global safety benchmarks.

Beyond heavy industry, key customers include mining and quarrying operations, dealing with fragmented rock and machinery hazards, and the manufacturing sector, especially automotive, heavy machinery, and metalworking plants, where sharp swarf and dropped components are perennial risks. The waste management and recycling industry represents a rapidly expanding customer segment, demanding boots capable of resisting penetration from medical waste, glass shards, and sharp metal objects often found in mixed refuse streams. Increasingly, specialized healthcare facilities and laboratories that handle sharp biological waste or fragile glass apparatus are also becoming significant buyers of low-profile, often anti-static, puncture-resistant footwear that meets hygiene requirements while maintaining critical safety features, showcasing market expansion into non-traditional hazardous environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., 3M Company, VF Corporation (Timberland PRO), Red Wing Shoes, Wolverine Worldwide Inc., Keen Utility, Cofra S.r.l., Dr. Martens (AirWair International Ltd.), Dunlop Protective Footwear, Mellow Walk, Bata Industrials, Sesto Senso, MSA Safety Inc., Liberty Shoes Ltd., Uvex Safety Group, Schuller, G&F Workwear, Hultafors Group AB, Jallatte S.p.A., ELTEN GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Puncture Resistant Boots Market Key Technology Landscape

The Puncture Resistant Boots Market is characterized by a rapid evolution in material science aimed at maximizing protection while minimizing weight and bulk, fundamentally driven by compliance and comfort requirements. The key technology landscape is dominated by the strategic choice between metallic and non-metallic protective midsoles. Traditional steel plates offer high, reliable protection but add significant weight and rigidity, potentially impacting worker biomechanics and contributing to fatigue. In contrast, the non-metallic approach, leveraging advanced woven fabrics like aramid fibers (e.g., Kevlar, Twaron) or similar high-density textile composites, allows for a flexible, full-coverage sole protection that is significantly lighter, thermally insulating, and non-magnetic, making the footwear suitable for environments with metal detectors or sensitive electronic equipment, representing a crucial technological shift.

Beyond the midsole, core technological advancements focus on outsole compounds and structural design. Manufacturers utilize specialized dual-density polyurethane injection molding techniques to combine a durable, abrasion-resistant outer layer with a softer, shock-absorbing inner layer for enhanced cushioning and reduced stress on joints. Furthermore, advanced rubber formulations are employed to provide superior slip resistance (meeting standards like SRC or SRA) and chemical resistance, essential for industries such as petrochemicals and food processing. The use of waterproofing technologies, specifically breathable membranes (e.g., proprietary or Gore-Tex-like materials), is also prominent, ensuring feet remain dry without compromising thermal regulation, a critical factor for comfort and hygiene in diverse outdoor applications and wet environments.

A burgeoning technological trend involves the incorporation of smart boot features via integrated IoT sensors. These sensors monitor internal boot conditions (temperature, humidity), external environmental factors (exposure to certain chemicals or radiation), and the wearer's movements (gait analysis, sudden impacts, fatigue levels). Data collected via these smart components can be transmitted wirelessly to safety management systems, allowing employers to proactively monitor worker health and safety compliance in real-time. This merging of physical protection with digital monitoring capability transforms the safety boot from a static protective item into a dynamic data source, greatly enhancing overall occupational risk management and contributing to predictive maintenance strategies for the boots themselves, optimizing their replacement cycle and ensuring maximum protective efficacy throughout their lifespan.

Regional Highlights

- North America: This region maintains a strong, mature market, heavily regulated by OSHA and ANSI standards (specifically ASTM F2413). Demand is stable and driven by high labor costs and strict liability laws, incentivizing companies in construction, manufacturing, and oil & gas to invest in premium, high-specification footwear. The U.S. and Canada prioritize durable, high-comfort designs, often leading technological adoption in smart safety features and advanced composite materials.

- Europe: The market is defined by rigorous EN ISO 20345 standards, requiring CE marking and demanding clear adherence to protection classes (e.g., S3 or S5 standards which mandate puncture resistance). Growth is steady, fueled by environmental and sustainability mandates, prompting manufacturers to develop eco-friendly boot materials. Germany, the UK, and France are key consumers, particularly in the automotive and chemical sectors, demanding highly specialized, often anti-static and chemical-resistant, puncture-proof solutions.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, attributed to rapid urbanization, massive infrastructure spending (e.g., China’s Belt and Road Initiative, India’s construction boom), and the gradual institutionalization of mandatory safety norms, often influenced by international standards. Though cost sensitivity remains a factor, the massive workforce size ensures huge volume potential. Countries like China, India, and South Korea are seeing substantial investment in localized manufacturing and strict adherence to recently enacted domestic safety regulations.

- Latin America (LATAM): Market expansion is closely tied to the volatile but growing mining, agriculture, and resource extraction sectors, particularly in Brazil, Chile, and Mexico. Demand focuses on robust, durable, and highly protective boots suitable for challenging tropical and mountainous environments. Regulatory enforcement is increasing, although standardization across the region remains less uniform than in North America or Europe, leading to a fragmented market structure relying on imports of internationally certified products.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries due to massive construction and petrochemical projects (Saudi Arabia, UAE, Qatar). The demand here is unique, requiring boots tailored for extreme heat, high abrasion, and chemical exposure, alongside mandatory puncture resistance. Africa’s burgeoning mining and infrastructure development also contribute, prioritizing durable, cost-effective safety solutions that can withstand harsh operating conditions and prolonged use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Puncture Resistant Boots Market.- Honeywell International Inc.

- 3M Company

- VF Corporation (Timberland PRO)

- Red Wing Shoes Company, Inc.

- Wolverine Worldwide Inc. (Bates, CAT Footwear)

- Keen Utility

- Cofra S.r.l.

- Dr. Martens (AirWair International Ltd.)

- Dunlop Protective Footwear

- Mellow Walk Footwear Inc.

- Bata Industrials

- Sesto Senso

- MSA Safety Incorporated

- Liberty Shoes Ltd.

- Uvex Safety Group

- Schuller GmbH

- G&F Workwear

- Hultafors Group AB

- Jallatte S.p.A.

- ELTEN GmbH

Frequently Asked Questions

Analyze common user questions about the Puncture Resistant Boots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between metallic (steel) and non-metallic (Kevlar/Textile) puncture resistant midsoles?

Metallic midsoles (steel plates) offer maximum protection against larger objects and greater resistance to compression, but are heavier, less flexible, and conduct temperature. Non-metallic midsoles, typically made from high-strength woven fabrics (like Kevlar), are lighter, more flexible, cover a larger surface area of the foot, are thermally insulating, and are metal-detector friendly, making them preferred for comfort and certain high-security environments.

Which industrial sectors are the primary users of puncture resistant safety boots?

The primary industrial sectors driving demand include Construction (due to nails, debris, and sharp waste), Mining and Quarrying (sharp rock fragments and metal debris), Oil & Gas (pipelines, drilling sites, and hazardous materials), and Waste Management/Recycling (glass, syringes, and sharp contaminants). These sectors are subject to the most stringent safety mandates regarding foot protection.

How do international safety standards (EN ISO 20345 vs. ASTM F2413) affect market entry?

Market entry requires strict adherence to regional safety standards. EN ISO 20345 is standard in Europe, defining protection classes like S3 (which mandates penetration resistance). ASTM F2413 is standard in North America, specifying minimum performance requirements for protective footwear. Compliance with both certifications is often necessary for global manufacturers seeking broad market penetration and ensures product credibility and legal use.

What are the key ergonomic considerations manufacturers are addressing to improve user compliance?

Key ergonomic improvements focus on reducing weight through advanced composite materials, enhancing flexibility of the sole unit to allow natural foot movement, improving shock absorption through dual-density PU midsoles, and integrating breathable waterproof membranes to manage foot climate, all aimed at minimizing fatigue and maximizing comfort during extended work periods, thereby increasing compliance.

Is the integration of smart technology changing the definition of puncture resistant safety footwear?

Yes, smart technology is transitioning safety boots from passive protection to active safety devices. Integrated IoT sensors monitor real-time worker safety factors (fatigue, sudden impact) and environmental hazards, transmitting data to safety management systems. This convergence enhances protective capacity by enabling proactive risk mitigation beyond static puncture resistance.

The Puncture Resistant Boots Market, fundamentally driven by the imperative of occupational safety, is experiencing a transformative phase characterized by material innovation and digital integration. As global regulatory bodies intensify scrutiny on workplace hazards, particularly in high-risk environments such as complex infrastructure projects and rapidly evolving industrial landscapes, the demand for certified, high-performance protective footwear continues its upward trajectory. This stringent regulatory backdrop ensures that the market is inherently non-negotiable regarding quality and compliance, distinguishing certified producers from lower-tier suppliers and reinforcing the value of advanced safety technologies. The strategic decision by major corporations to standardize on premium Personal Protective Equipment (PPE) across their international operations further stabilizes market demand and encourages investment in research and development aimed at enhancing product efficacy under various global operating conditions, ranging from extreme cold to intense chemical exposure zones.

A critical analysis of material trends shows a discernible shift in preference towards non-metallic protective layers, a movement catalyzed by end-user demands for lightweight designs that do not compromise protective capability. While traditional steel components remain vital in heavy engineering and certain legacy applications requiring maximal compression resistance, the superior flexibility, non-magnetic properties, and comparable puncture resistance offered by advanced aramid and textile composites are increasingly defining the premium segment of the market. This technological leap addresses the long-standing industry challenge of mitigating worker fatigue associated with wearing heavy safety boots over long shifts, thereby directly improving adoption rates and overall safety outcomes. Furthermore, this material innovation is closely coupled with advancements in outsole technology, focusing on achieving superior coefficients of friction in diverse, often oily or wet, industrial environments, a necessity underscored by the high incidence of slip-and-fall injuries.

Geographically, market expansion is heavily concentrated in the Asia Pacific region, fueled by unprecedented levels of urbanization and state-sponsored infrastructure development, which generate a massive requirement for industrial safety gear. While North America and Europe provide a consistent, high-value demand for technologically advanced products, the sheer volume potential and rapidly maturing regulatory frameworks in APAC, particularly in emerging industrial economies, position it as the key growth engine for the forecast period. The market's future will be dictated by how successfully manufacturers can merge regulatory compliance with sustainability goals, incorporating recycled or lower-impact materials without sacrificing the core requirement of puncture integrity, while simultaneously integrating 'smart' features that offer real-time safety insights and operational efficiencies to major industrial customers across all key global regions, thereby securing a competitive and sustainable market position.

Continuous innovation in manufacturing processes, such as 3D printing for customized components and advanced robotic assembly, is improving production scalability and consistency. These manufacturing advancements allow for precise integration of complex protective elements, ensuring that every boot meets exacting standards regardless of high-volume production requirements. The convergence of strict safety mandates, technological progress in material science, and the increasing globalization of industrial operations collectively guarantees sustained positive momentum for the Puncture Resistant Boots Market, making it a pivotal component of the broader industrial safety equipment ecosystem. The emphasis on whole-life cost of ownership, rather than merely initial purchase price, is becoming a decisive factor for major institutional buyers, favoring brands that demonstrate long-term durability, certified compliance, and verifiable ergonomic benefits for their substantial workforces.

The market environment also reflects evolving labor practices and demographic shifts. With an aging workforce in developed nations, there is an amplified need for safety footwear that offers superior support and reduced stress on joints, increasing the demand for highly cushioned and ergonomically validated designs. Manufacturers are responding by collaborating with podiatrists and occupational health specialists to develop boot last shapes and insole technologies that provide medical-grade support while maintaining industrial-level protection, further diversifying the product portfolio beyond basic safety specifications. This attention to worker well-being serves not only as a sales differentiator but also as a demonstration of corporate commitment to employee health, which resonates strongly in competitive labor markets. Consequently, puncture resistant boots are evolving into highly engineered protective systems that address multiple facets of occupational health and safety simultaneously, solidifying their status as indispensable PPE in hazardous industries globally.

In terms of competitive dynamics, the market is characterized by a mix of large, diversified multinational corporations (like Honeywell and 3M) that leverage extensive safety portfolios and smaller, highly specialized footwear manufacturers (like Red Wing and Cofra) known for deep expertise in specific industrial niches. Strategic partnerships between material suppliers and boot manufacturers are crucial for co-developing next-generation protective textiles that can achieve superior penetration resistance ratings while being significantly lighter than current standards. Furthermore, intellectual property rights concerning proprietary midsole fabrication techniques and advanced polymer blends are key competitive barriers, ensuring that leading innovators maintain a technical advantage in the premium segment. The ability to navigate complex import/export regulations and maintain localized certification across multiple geographic regions remains a core operational challenge and a competitive requirement for market leadership in this essential safety segment.

The extensive and specialized nature of the Puncture Resistant Boots Market demands rigorous categorization of product offerings to meet the specific requirements of various hazardous environments. For instance, boots designed for the chemical industry must not only prevent penetration but also offer high resistance to corrosive agents, often requiring specific vulcanized rubber or specialized polymer compounds in the sole and upper construction, far exceeding the general requirements for a construction site boot. Similarly, the agricultural sector, though less often associated with heavy industry, requires puncture resistance primarily against biological hazards like hypodermic needles in veterinary settings or sharp plant debris, often prioritizing lightweight, easy-to-clean materials over extreme durability against heavy impacts, demonstrating the vast spectrum of end-user needs that drive segmentation complexity.

Technological advancement is not confined solely to the protective plate itself but extends deeply into the construction methods employed. For example, direct injection molding (DIM) techniques, where the sole is chemically bonded to the upper without traditional stitching, drastically enhance the boot’s waterproofness and overall durability, minimizing weak points where puncture hazards might exploit structural deficiencies. This continuous improvement in bonding strength and material integrity is essential for boots designated for highly saturated environments, such as flood control or offshore marine operations, where structural failure can compromise the effectiveness of the protective features. Furthermore, the integration of advanced anti-fatigue footbeds and arch supports, sometimes custom-fitted through digital scanning technologies, addresses the previously mentioned ergonomic constraints, transforming safety footwear into a proactive health tool rather than a restrictive safety mandate. This level of specialization ensures sustained market growth driven by continuous product innovation rather than reliance solely on regulatory mandate compliance.

The critical success factors in the Puncture Resistant Boots Market include attaining swift certification approvals, achieving an optimal price-performance ratio that appeals to both high-specification industrial buyers and cost-conscious emerging markets, and maintaining an exceptionally reliable supply chain capable of handling global distribution complexities. Companies that invest proactively in sustainable material sourcing and verifiable ethical manufacturing practices are increasingly gaining favor among multinational buyers who prioritize Corporate Social Responsibility (CSR) in their procurement policies, providing a non-price competitive advantage. This emphasis on ethical sourcing and reduced environmental footprint, particularly concerning the disposal of complex composite materials at end-of-life, is expected to become a defining market trend over the forecast period, pushing manufacturers toward developing modular designs or boots made from fully recyclable polymers. The overall market dynamics thus reflect a sophisticated interplay between strict safety science, manufacturing efficiency, and ethical corporate governance.

Addressing the specific needs of niche markets is also a powerful growth strategy. For instance, the demand for non-slip, anti-static, puncture-resistant boots for electronic assembly cleanrooms or pharmaceutical manufacturing floors requires footwear that minimizes particulate shedding and static discharge, combining multiple, stringent safety features into a single, high-cost product category. This specialization allows manufacturers to command premium pricing and insulate themselves from intense price competition found in more generalized segments like basic construction safety footwear. The ability of a manufacturer to offer a comprehensive portfolio that covers the full spectrum of industrial hazards—from impact and penetration resistance to chemical and electrical hazard protection—determines their overall strength and penetration across the global safety footwear landscape.

The shift towards digital B2B commerce platforms is fundamentally changing how puncture resistant boots are sold, particularly to small and medium enterprises (SMEs) and individual contractors. While large corporations still rely on direct negotiation and customized contracts, SMEs increasingly utilize specialized online marketplaces for rapid procurement, relying heavily on product specifications, verified customer reviews, and clear certification data presented digitally. This necessitates that manufacturers enhance their digital content strategies (AEO/GEO) to ensure product visibility and transparency regarding compliance documentation. The ongoing trend of global worker migration further emphasizes the need for universally recognized sizing and protection standards, streamlining procurement processes for international projects and ensuring that workers receive the appropriate protective gear regardless of their country of origin or employment location, thereby unifying safety standards under global best practices.

Finally, the long-term profitability of this market segment is deeply intertwined with macro-economic stability and global expenditure on infrastructure. Periods of strong economic growth tend to correlate directly with heightened activity in construction, manufacturing, and resource extraction, all core drivers for puncture resistant boot sales. Conversely, economic downturns can lead to deferred capital expenditure on PPE, though regulatory mandates tend to cushion the impact. Therefore, manufacturers must maintain flexible production capacities and robust supply chain resilience to manage fluctuating demand cycles while consistently innovating to meet the evolving safety challenges presented by modern industrial practices, particularly those involving increasingly automated or complex operational environments where traditional hazards persist alongside new technological risks. This sustained focus on both reliability and innovation defines the competitive structure of the global market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager