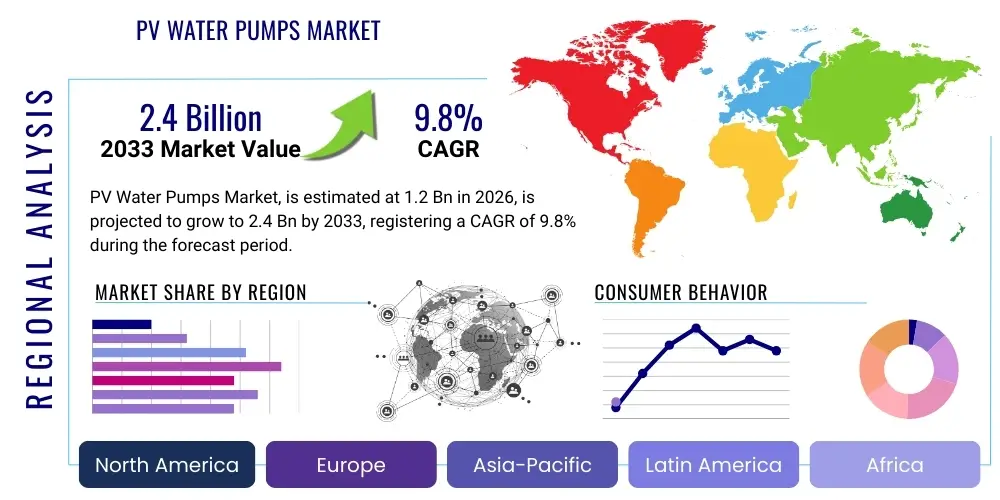

PV Water Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442292 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

PV Water Pumps Market Size

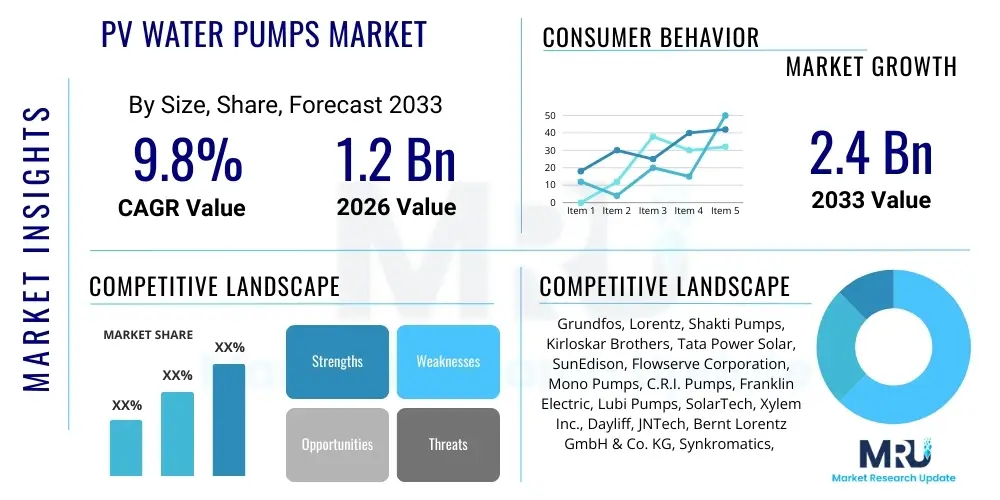

The PV Water Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

PV Water Pumps Market introduction

The Photovoltaic (PV) Water Pumps Market represents a critical segment within the renewable energy landscape, focusing on systems that utilize solar energy converted directly into electrical power to drive water lifting and distribution mechanisms. These systems are predominantly employed in remote, decentralized areas lacking reliable grid infrastructure, providing sustainable solutions primarily for agricultural irrigation, livestock watering, and crucial domestic water supply. The core system architecture typically comprises a solar array (PV modules), a high-efficiency pump controller, and the pump unit itself, which can be either submersible for deep wells or surface-mounted for shallow sources. Technological advancements, particularly the widespread adoption of highly efficient Brushless DC (BLDC) motors and sophisticated Maximum Power Point Tracking (MPPT) controllers, have drastically improved system performance and reliability, ensuring optimal energy harvest and water output even under suboptimal solar irradiation conditions. This market is fundamentally driven by the escalating global imperative for sustainable water management and agricultural productivity, particularly across rapidly industrializing and developing economies in the Asia Pacific and African continents, where conventional energy sources are either prohibitively expensive or extremely unreliable.

Major applications of PV water pumps span across the agricultural sector, which remains the dominant consumer, utilizing these systems for precision irrigation tailored to various crop types and farm sizes, ranging from smallholder plots to large commercial plantations. Beyond agriculture, the drinking water segment is experiencing exponential growth, propelled by international and governmental initiatives focused on achieving Sustainable Development Goal 6 (SDG 6), ensuring universal access to clean and affordable water. The operational benefits of PV pumps are substantial: they eliminate recurrent fuel costs associated with diesel pumps, drastically reduce carbon emissions, and require minimal long-term maintenance due to fewer moving parts and the inherent robustness of solar technology. These advantages offer a compelling economic and environmental value proposition, especially when compared against the volatile pricing and logistical complexities of fossil fuels in remote locations. Furthermore, government subsidies and supportive regulatory frameworks specifically promoting solar energy adoption for irrigation act as powerful catalysts, lowering the initial investment barrier for potential end-users, thereby accelerating market penetration and scaling capabilities.

The technological evolution of PV pumping systems is also facilitating expansion into higher-power applications and integration with complex water distribution networks. Modern systems often feature modular designs, allowing for easy scalability to meet increasing water demands, and incorporation of smart monitoring capabilities. Remote telemetry systems now allow users and maintenance providers to track parameters such as daily water yield, system efficiency, and potential fault conditions from a central location, enhancing management efficiency and minimizing downtime. Key driving factors include the sustained reduction in PV module manufacturing costs, global concerns regarding climate change and water scarcity, and the robust demand for food security which relies heavily on dependable irrigation infrastructure. The versatility, durability, and low long-term operating expenses of PV water pumps solidify their position as indispensable tools for sustainable decentralized water access across diverse geographical and climatic zones, enabling socioeconomic growth and improved public health outcomes in underserved rural communities.

PV Water Pumps Market Executive Summary

The PV Water Pumps Market is currently experiencing dynamic growth, characterized by significant technological convergence and geographically varied adoption rates, positioning it as a pivotal solution for global water and energy challenges. Key business trends show a strong market shift towards systems offering integrated battery storage or hybrid power solutions, ensuring water availability during non-solar hours or critical peak demand periods, thereby enhancing system reliability for sensitive applications. Manufacturers are strategically focusing on innovation in control electronics, specifically developing more intelligent MPPT algorithms and incorporating IoT connectivity for superior asset management, remote performance monitoring, and advanced fault detection. This pursuit of 'smart' pumping solutions is driving competitive differentiation, alongside aggressive pricing strategies driven by economies of scale in PV module production. Consolidation within the market is observed as major global fluid technology companies acquire niche solar pumping specialists to quickly integrate advanced solar capabilities into their core product offerings, aiming for comprehensive market coverage from micro-irrigation to municipal water schemes.

Regional trends distinctly underscore the immense market potential residing in emerging economies. Asia Pacific maintains its dominant market share due to substantial governmental support for solar irrigation, particularly in high-volume agricultural countries such as India and China, which are grappling with rapid industrial expansion and acute water resource depletion. Meanwhile, the African continent is emerging as the fastest-growing market, propelled by the fundamental need for decentralized water solutions amidst pervasive grid deficit. International aid and NGO intervention, alongside burgeoning microfinance options like Pay-As-You-Go (PAYG) models, are facilitating mass deployment across Sub-Saharan regions for both agricultural sustainability and basic human water access. Conversely, mature markets in North America and Europe focus on niche, high-value applications, emphasizing robust system durability, superior efficiency, and compliance with stringent environmental regulations concerning water usage and resource protection, favoring high-quality, long-lifespan components and sophisticated system monitoring protocols.

Segmentation analysis reveals the continued supremacy of submersible pumps owing to their reliable performance in deep groundwater applications, a necessity in arid and semi-arid regions reliant on borehole extraction. However, the medium-to-high power rating segment (1 kW to >5 kW) is demonstrating the highest growth velocity, reflecting the transition from small-scale domestic use to large-scale commercial farming and community water projects demanding greater throughput and pressure head. Application-wise, while agriculture remains the primary segment, the drinking water supply application is gaining significant traction due to concerted global efforts to enhance public health infrastructure in rural areas. The underlying trend across all segments is the increasing consumer demand for reliable, maintenance-free operation and the availability of accessible financing, which is compelling the industry to streamline distribution logistics and expand localized technical support networks across the primary growth geographies.

AI Impact Analysis on PV Water Pumps Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the PV Water Pumps Market consistently focus on the transformation of operational resilience, enhancement of resource efficiency, and the potential for system autonomy. Key questions frequently posed include: "How can AI algorithms optimize water usage in solar irrigation systems based on predicted weather patterns?", "What is the expected reduction in pump maintenance costs achievable through AI-driven predictive analytics?", and "Are AI-enabled PV pumps economically viable for smallholder farmers?" These lines of inquiry reveal that users see AI as a crucial mechanism for transcending the limitations of traditional, static pumping schedules and reactive maintenance protocols. There is a palpable expectation that AI and Machine Learning (ML) will elevate PV pumps from simple solar-to-mechanical conversion devices into sophisticated, self-managing hydrological assets capable of maximizing productivity and mitigating operational risks associated with fluctuating environmental inputs and mechanical wear, addressing core concerns regarding efficiency and system longevity in resource-constrained settings.

The integration of AI and ML is fundamentally altering the performance envelope of PV water pumping systems by introducing predictive capabilities and dynamic control strategies that traditional electronics cannot achieve. AI algorithms are deployed to analyze complex, multi-variable data streams, including solar irradiance forecasts, historical performance metrics, real-time motor diagnostics (vibration, temperature, current draw), and external data such as soil moisture levels and localized weather models. This extensive processing capability allows for highly refined optimization of the pump operating profile. For instance, ML models can predict the onset of component degradation, such as bearing wear or impeller imbalance, allowing for scheduled, preemptive maintenance, thereby dramatically reducing the risk of catastrophic failure and associated downtime. Furthermore, in irrigation applications, AI generates dynamic pumping schedules that precisely match water application to crop needs and minimize losses due to evaporation or deep percolation, achieving a level of water use efficiency critical for sustainable agriculture in arid zones.

Beyond predictive maintenance and irrigation scheduling, AI is enhancing the core function of the MPPT controller itself. Advanced ML-based MPPT algorithms can learn the unique electrical characteristics of the solar array under various partial shading scenarios and ambient temperatures, consistently ensuring the pump draws maximum power more effectively than heuristic-based traditional tracking methods. This improvement translates directly into higher daily water yield. While initial concerns about complexity and cost are valid, manufacturers are mitigating these through edge computing, embedding lightweight, pre-trained AI models directly into the pump controller hardware, minimizing reliance on constant cloud connectivity and simplifying field deployment. Ultimately, AI integration shifts the PV pump value proposition from pure energy savings to comprehensive water resource intelligence, providing system owners, especially large commercial farmers and water utilities, with unparalleled control, efficiency, and resource sustainability, which far outweighs the incremental cost and complexity introduced by intelligent control systems.

- Enhanced Predictive Maintenance: AI analyzes vibration, temperature, and current data to forecast component failure, reducing unexpected downtime and maintenance costs by up to 30%.

- Dynamic MPPT Optimization: ML algorithms adapt energy harvest strategies in real-time, surpassing traditional tracking efficiency under partial shading or rapid cloud changes, leading to higher daily water output.

- Precision Irrigation Scheduling: AI integrates meteorological, soil moisture, and crop data to optimize pumping timing and volume, ensuring maximum water use efficiency (WUE) and resource preservation.

- Autonomous Fault Diagnosis: Systems autonomously identify and isolate complex electrical or mechanical anomalies, providing remote notification and facilitating quicker troubleshooting by technicians.

- Improved System Sizing and Design: AI tools leverage complex historical climate patterns and hydrogeological data to accurately size PV arrays and pumps for site-specific demands, preventing costly undersizing or oversizing errors during installation.

- Cybersecurity and Anomaly Detection: Machine learning identifies unusual operational parameters or data transfer patterns indicative of system intrusion or unauthorized manipulation, crucial for protecting critical water infrastructure assets.

DRO & Impact Forces Of PV Water Pumps Market

The operational landscape of the PV Water Pumps Market is profoundly influenced by a complex nexus of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces shaping its market expansion and technological direction. Foremost among the Drivers is the critical energy access deficit across global agricultural regions; the pervasive lack of reliable grid electricity makes solar pumping systems the essential, decentralized solution for water requirements. This is strongly supported by the dramatic, sustained decrease in the cost of photovoltaic modules, which has fundamentally improved the long-term economic viability and shortened the financial payback period for PV systems compared to fluctuating and often subsidized diesel fuel. Furthermore, proactive governmental policies, including substantial national subsidies, tax credits, and preferential procurement schemes aimed at promoting solar irrigation (as seen in India and several African nations), provide crucial financial impetus, enabling widespread adoption among cost-sensitive smallholder farmers and communities, solidifying the market’s positive trajectory.

Despite these powerful drivers, several persistent Restraints temper the market’s full potential. The single most significant obstacle remains the high initial capital expenditure (CAPEX) associated with purchasing and installing a high-quality PV pumping system, which often exceeds the financial capacity of low-income farmers without access to robust credit or favorable financing. Technical restraints include the intrinsic intermittency of solar energy, meaning pumping is limited to daylight hours unless coupled with expensive battery storage, which adds significant system cost and complexity. Logistical and human capital deficits also pose a major challenge: the scarcity of locally trained technical personnel in remote installation areas leads to poor system integration, inadequate maintenance, and reduced system lifespan, undermining user confidence and necessitating specialized, expensive support from centralized urban centers. Moreover, poorly regulated deployment risks exacerbating groundwater depletion in sensitive hydrological zones, requiring careful policy intervention to ensure long-term sustainability.

Opportunities for strategic growth are concentrated in financial innovation and integrated technology development. The deployment of micro-financing and the scaling of Pay-As-You-Go (PAYG) business models are crucial opportunities, effectively lowering the upfront financial barrier and enabling market access for millions of underserved rural customers by distributing the cost over time. Technically, significant opportunities exist in the development of highly integrated systems that combine PV pumping with advanced water conservation techniques, such as drip or micro-sprinkler irrigation, maximizing water use efficiency and system ROI. Furthermore, the expansion into the large-scale municipal and industrial sectors, moving beyond traditional small-scale agriculture, presents high-value opportunities for high-power, customized solar pump installations capable of operating with advanced energy management protocols. The convergence of these driving forces and strategic opportunities creates a strong positive net impact force, forecasting sustained, high-CAGR growth, contingent upon the successful mitigation of initial cost restraints through innovative financing and localized skill development programs.

Segmentation Analysis

Market segmentation for PV water pumps is a critical analytical tool used by industry stakeholders to accurately map supply against diversified global demand, enabling the strategic development of customized product lines and targeted marketing campaigns. The market is primarily delineated across dimensions of product type, operational power rating, specific application, and motor technology, reflecting the complex requirements imposed by varying hydrogeological and end-user contexts. Product type segmentation distinguishes between submersible pumps, which are designed to operate submerged deep within boreholes, offering superior lift capability and robustness for extracting groundwater; and surface pumps, which are installed above ground near the water source, typically used for lower-lift applications such as drawing water from rivers, ponds, or storage tanks. This fundamental distinction is vital, as it determines installation complexity, operational capacity, and the suitability for local water resource access, with submersible variants generally dominating due to widespread groundwater reliance.

The segmentation by power rating is instrumental in identifying the market's commercialization maturity. It is typically categorized into Low Power (up to 1 kW), primarily serving household domestic use and small garden irrigation; Medium Power (1 kW to 5 kW), which forms the industry workhorse segment, catering to the vast majority of small and medium-sized farm irrigation and community water distribution systems; and High Power (above 5 kW), which addresses the demanding requirements of large-scale commercial agribusinesses, municipal water treatment facilities, and certain industrial applications requiring substantial throughput. The pronounced shift in demand towards the medium and high-power categories signifies the increasing maturity of solar pumping as a reliable solution for commercial operations, moving beyond subsistence-level usage. Analyzing this power distribution is key to understanding where manufacturing investment and R&D efforts should be concentrated to meet the rapidly scaling demands of modern agricultural and public infrastructure projects.

Further granularity is achieved through application and motor type segmentation. Application segmentation confirms agriculture (irrigation) as the overwhelming revenue generator, reflecting the global focus on enhancing food security through reliable water access. However, the drinking water supply segment is characterized by the fastest year-on-year growth rate, fueled by global sanitation and public health initiatives. Motor type analysis highlights the dominance of high-efficiency Brushless DC (BLDC) motors, celebrated for their longevity and superior performance under fluctuating solar inputs, often replacing older, less efficient AC systems requiring complex inverters. This detailed segmentation not only informs product development—such as rugged BLDC submersible pumps tailored for high-lift, high-flow agricultural use—but also provides strategic insights into regional market entry, emphasizing that while cost sensitivity dictates choices in Africa and APAC, technical superiority and resource efficiency drive adoption in North America and Europe.

- By Product Type:

- Submersible Pumps (Deep well and Borehole applications)

- Surface Pumps (Shallow water sources, reservoirs, and tanks)

- By Power Rating:

- Up to 1 kW (Low Power - Domestic/Small Garden)

- 1 kW to 5 kW (Medium Power - Core Small/Medium Farm Irrigation)

- Above 5 kW (High Power - Commercial Agriculture/Municipal Systems)

- By Application:

- Agriculture (Irrigation for cash crops and staples)

- Drinking Water Supply (Domestic & Community water points)

- Livestock Watering (Ranches and remote grazing lands)

- Industrial & Commercial (e.g., Remote mining dewatering, Aquaculture, Water treatment circulation)

- By Motor Type:

- Brushless DC (BLDC) Motors (High efficiency, low maintenance)

- AC Motors (Used with VFD controllers for high-power needs)

- Brushed DC Motors (Low cost, phasing out due to maintenance)

Value Chain Analysis For PV Water Pumps Market

The Value Chain for the PV Water Pumps Market is a complex sequence commencing with specialized upstream component manufacturing, progressing through intricate system integration and global distribution, and culminating in crucial downstream installation and support services. Upstream activities involve the sourcing and production of critical raw materials, notably high-purity silicon for PV cells, advanced magnetic materials for BLDC motors, and specialized power electronics used in MPPT controllers and inverters. Component suppliers, particularly PV module manufacturers, dictate the fundamental economics of the market through their pricing strategies and efficiency innovations. Collaboration in the upstream segment focuses heavily on materials science to enhance PV panel durability against environmental stress (e.g., sand, heat) and optimizing motor design for peak hydraulic performance under variable solar input, ensuring the longevity and efficiency required for remote, unattended operation.

The midstream segment involves the core activity of PV water pump manufacturing, encompassing system design, component assembly, and quality assurance testing. System integrators play a vital role here, bundling the PV panels, controllers, pumps, and mounting hardware into complete, ready-to-install kits, often customized based on regional requirements for lift height and flow rate. Distribution channels are highly fragmented yet strategically crucial. Direct sales channels are typically employed for large, complex governmental or commercial projects where specialized technical oversight and bulk ordering are required. Conversely, indirect channels rely on extensive networks of authorized dealers, agricultural equipment retailers, and specialized solar energy distributors to achieve last-mile connectivity in rural areas. Effective logistics management is paramount in the midstream, especially in moving bulky PV panels and specialized pumping equipment across challenging and underdeveloped infrastructure networks prevalent in key growth markets like Sub-Saharan Africa and rural Asia.

Downstream activities center on installation, commissioning, maintenance, and after-sales service, which critically determines customer satisfaction and system lifespan. Proper installation requires specialized technical training to ensure correct plumbing, electrical connections, and optimal array orientation. The demand for post-installation support is increasing, driving the adoption of digital tools; remote monitoring systems allow manufacturers or third-party service providers to diagnose issues without costly site visits, dramatically improving system uptime and reducing operational expenditures for the end-user. The success of the downstream market is intrinsically linked to the development of localized technical skills and the availability of genuine spare parts. Channels that offer comprehensive service contracts and performance guarantees, leveraging digital monitoring, are increasingly preferred by commercial buyers, while localized micro-entrepreneurial installers are key to reaching the highly decentralized base of smallholder farmers.

PV Water Pumps Market Potential Customers

The market for PV water pumps targets a diverse and expansive set of end-users whose demands range from basic sustenance requirements to large-scale industrial water management, all unified by the need for reliable, decentralized water access. The largest customer cohort is comprised of smallholder farmers and medium-sized agricultural enterprises globally, particularly in regions where irrigation is essential for crop survival and yield stability, but grid power is either absent or economically unfeasible. These customers are primarily motivated by operational cost savings derived from eliminating diesel consumption, improved water security, and the ability to enhance crop cycles, but they remain highly sensitive to the initial capital outlay. Their preference is for robust, reliable systems offered through accessible financing mechanisms, often facilitated by government subsidies or dedicated microcredit programs targeting agricultural modernization and energy independence.

Another significant customer segment includes large commercial agricultural operations (agribusinesses), such as corporate farms, fruit orchards, and sophisticated greenhouses, which require high-power (>5 kW) PV pumping systems integrated with complex automation and water conservation technologies like precision drip irrigation. For this segment, the buying criteria emphasize system longevity, guaranteed high performance (flow rate and pressure), and seamless integration with existing farm management software via IoT capabilities. Furthermore, municipal governments and community organizations constitute a crucial customer base, procuring PV water pumps for the vital purpose of supplying drinking water to remote villages, schools, and health clinics, often under the mandate of achieving national health and development goals. These buyers prioritize system reliability, adherence to water quality standards, and comprehensive service agreements that guarantee continuous operation for public services.

Niche industrial and commercial applications form the third category of potential customers. This includes the mining industry, utilizing PV pumps for dewatering processes in remote extraction sites where deploying grid infrastructure is impractical; the aquaculture sector, relying on solar pumps for reliable water circulation and aeration; and tourist or ecological resorts seeking to operate entirely off-grid with minimal environmental footprint. These industrial buyers require highly specialized, durable pumps capable of handling unique fluid properties, and they are willing to pay a premium for custom-engineered solutions that offer self-sufficiency and high operational efficiency. The strategic approach to securing these various customer segments necessitates a dual strategy: mass-market accessibility and ease of financing for small farmers, combined with high-specification customization and integrated digital services for large commercial and governmental clients, ensuring all facets of demand are effectively captured.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Lorentz, Shakti Pumps, Kirloskar Brothers, Tata Power Solar, SunEdison, Flowserve Corporation, Mono Pumps, C.R.I. Pumps, Franklin Electric, Lubi Pumps, SolarTech, Xylem Inc., Dayliff, JNTech, Bernt Lorentz GmbH & Co. KG, Synkromatics, Wenger Engineering GmbH, Tega Industries Ltd., Deep Blue Solar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PV Water Pumps Market Key Technology Landscape

The PV Water Pumps Market is technologically defined by continuous innovations aimed at maximizing energy conversion efficiency, extending component durability, and enabling sophisticated control mechanisms essential for remote operation. The most transformative shift has been the industry-wide migration toward high-efficiency Brushless DC (BLDC) motors, which are highly preferred over legacy brushed DC motors and standard AC induction motors due to their superior efficiency curve and substantially reduced maintenance requirements, thanks to the elimination of wear-prone carbon brushes. BLDC motors are inherently optimized to synchronize with the variable power output characteristic of a solar array, allowing the pump system to efficiently start and operate even during periods of low solar irradiance. This enhanced motor technology directly translates into higher daily water yields and greater longevity, which are paramount performance metrics for farmers investing in solar solutions for critical irrigation needs in remote areas.

The pump controller remains the technological brain of the system, with Maximum Power Point Tracking (MPPT) being the cornerstone feature. Modern MPPT controllers employ highly complex digital signal processors and algorithms to continuously track and operate the PV array at its peak power output point, mitigating losses from temperature variations, partial shading, and dust accumulation. Recent technological advancements in controllers include the integration of sophisticated monitoring and protection features, such as soft-start functionality to reduce mechanical stress, active protection against dry running (shutting down the pump when water levels drop), and integrated diagnostics for rapid fault identification. For high-power applications, Variable Frequency Drives (VFDs) paired with standard AC motors are becoming increasingly sophisticated, allowing the frequency and voltage supplied to the motor to be modulated precisely based on available solar input, enabling high-volume pumping capacity with robust, commercially available AC components.

Further driving the technology landscape is the pervasive adoption of digitalization and Internet of Things (IoT) capabilities. Premium PV pumping systems now routinely incorporate telemetry and remote monitoring hardware, utilizing cellular (GSM) or, for extremely remote sites, satellite communication to transmit real-time operational data. This data includes flow rates, pressure head, cumulative energy produced, and motor diagnostics, which are vital for predictive maintenance planning, ensuring system performance verification for regulatory compliance, and enabling sophisticated water resource management. This shift towards smart technology positions PV pumps not merely as mechanical devices but as intelligent, network-enabled assets capable of autonomously optimizing their performance based on historical data and real-time environmental conditions, ensuring optimal resource allocation and minimum Total Cost of Ownership (TCO) over the system's operational lifetime, significantly improving the industry’s professional service delivery capabilities.

Regional Highlights

Regional market dynamics profoundly influence the adoption and product preferences within the PV Water Pumps Market, reflecting variations in climate, agricultural reliance, energy access, and regulatory support. Asia Pacific (APAC) currently holds the dominant market share, primarily driven by massive government commitments to solarize agriculture, particularly in India, where schemes like the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) incentivize the replacement of diesel and grid-connected pumps with solar alternatives. This widespread institutional support, coupled with the region's vast agricultural footprint and increasing groundwater depletion, ensures a high-volume, high-growth market centered on cost-efficient and durable medium-power submersible pumps. China is also a major contributor, focusing on agricultural modernization and supplying low-cost components globally, solidifying APAC’s role as the manufacturing and consumption epicenter for solar pumping technology.

The African continent represents the region with the most rapid projected growth, characterized by overwhelming market potential due to extremely low grid electrification rates and the critical reliance on unreliable, expensive diesel generators for water supply. Sub-Saharan Africa, including countries such as Kenya, South Africa, and Morocco, is the key growth engine, with adoption heavily supported by international development financing, non-governmental organizations (NGOs), and innovative financing models like PAYG solar solutions. The market in Africa prioritizes ruggedness, simplicity of installation, and accessibility, focusing on small-to-medium power systems designed for community water points and subsistence farming. The structural necessity for decentralized, reliable water access in this region positions it as a long-term strategic priority for global pump manufacturers seeking expansive growth beyond mature markets, necessitating localized distribution and technical support infrastructure.

North America and Europe constitute mature, high-value markets where the focus shifts from volume to highly efficient, specialized applications. In North America, PV pumps are predominantly used in niche areas such as off-grid livestock watering on remote ranches, specialized agricultural operations (e.g., vineyards), and environmentally sensitive areas requiring autonomous systems. European adoption, concentrated in Southern EU countries facing water stress (Spain, Italy, Greece), emphasizes high-quality, smart integration with water conservation technologies, driven by stringent environmental regulations and the need to maximize Water Use Efficiency (WUE) in sophisticated commercial farming. Latin America, particularly Brazil, is experiencing strong growth fueled by large-scale commodity agriculture and the need to electrify remote rural areas, positioning the region as a significant market for high-capacity systems capable of handling large-volume irrigation needs for exports, demonstrating high diversity in regional product requirements and adoption drivers.

- Asia Pacific (APAC): Market leader by volume, driven by massive government subsidies, particularly in India (KUSUM scheme), focusing on high-volume replacement of diesel pumps for agriculture; strong emphasis on cost-efficiency and localized manufacturing.

- Africa: Fastest growth trajectory due to high energy costs, low grid access, and humanitarian need for water security; adoption facilitated by international aid and microfinance (PAYG); requires rugged, easy-to-install small-to-medium power systems.

- North America: Mature market focused on premium, specialized applications (remote ranching, off-grid residential) where reliability and minimal maintenance are prioritized; slow but stable growth in niche segments.

- Europe: Adoption centered on high-efficiency, integrated smart systems for precision irrigation (viticulture, horticulture) in Southern European countries; driven by strict environmental regulations and high standards for quality components.

- Latin America (LATAM): Emerging robust market propelled by the expansion of large commercial agriculture (Brazil, Argentina) and the need for reliable remote energy solutions; demand for high-capacity systems for irrigation exports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PV Water Pumps Market.- Grundfos

- Lorentz

- Shakti Pumps

- Kirloskar Brothers

- Tata Power Solar

- SunEdison

- Flowserve Corporation

- Mono Pumps

- C.R.I. Pumps

- Franklin Electric

- Lubi Pumps

- SolarTech

- Xylem Inc.

- Dayliff

- JNTech

- Bernt Lorentz GmbH & Co. KG

- Synkromatics

- Wenger Engineering GmbH

- Tega Industries Ltd.

- Deep Blue Solar

Frequently Asked Questions

What is the primary driving factor for the growth of the PV Water Pumps Market?

The primary driving factor is the lack of reliable grid electricity access coupled with the rapidly declining cost of photovoltaic (PV) modules. This makes solar pumping a significantly more cost-effective and sustainable alternative to traditional diesel pumps, especially in agricultural regions across Asia and Africa seeking energy independence and reduced operational expenses.

Are solar water pumps only viable for deep boreholes and wells?

No, PV water pumps are categorized into submersible pumps, suited for deep boreholes, and surface pumps, designed for shallow water sources like rivers, ponds, and cisterns. The application depends entirely on the required lifting height (head) and water source availability, ensuring versatility across diverse hydrogeological settings for efficient water management.

How does government policy influence the adoption rate of PV water pumps?

Government policies, particularly subsidy programs and financial incentives (e.g., in India and parts of Africa), significantly accelerate market adoption by drastically reducing the high initial capital investment required. These incentives make the technology accessible to smallholder farmers and support large-scale national efforts toward sustainable irrigation, energy transition, and water security goals.

What technological advancement is most critical to the efficiency of modern PV pump systems?

The most critical advancement is the integration of high-efficiency Brushless DC (BLDC) motors combined with sophisticated Maximum Power Point Tracking (MPPT) controllers. This combination ensures optimal power extraction from the solar array and reliable, long-lasting pump operation even under fluctuating solar radiation, maximizing water yield throughout the daylight hours.

What are the main operational challenges of PV water pumping systems?

The primary operational challenges include the intermittency of solar power (requiring pumping only during sunlight or necessitating expensive battery storage), the risk of groundwater over-extraction without proper regulatory oversight, and the lack of standardized technical training for installation, maintenance, and repair in highly decentralized, remote installation sites.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager