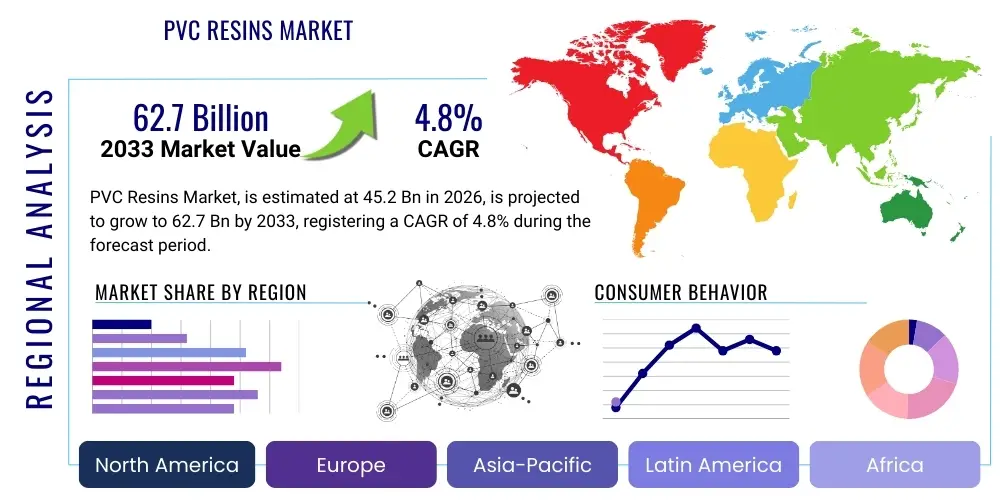

PVC Resins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442049 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

PVC Resins Market Size

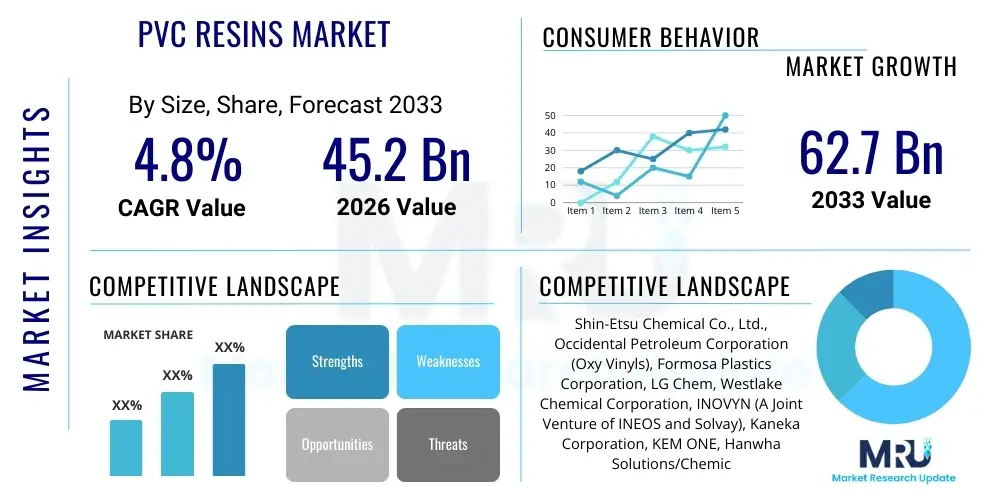

The PVC Resins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 62.7 Billion by the end of the forecast period in 2033.

PVC Resins Market introduction

Polyvinyl Chloride (PVC) resin is a versatile thermoplastic polymer widely recognized for its durability, chemical resistance, and cost-effectiveness, making it one of the most produced plastics globally. The primary types include Suspension PVC (S-PVC), Emulsion PVC (E-PVC), and Mass PVC (M-PVC), each tailored for specific applications ranging from rigid pipes to flexible films. S-PVC dominates the market due to its ease of processing and suitability for calendering, extrusion, and molding, particularly for construction materials.

The product's inherent properties, such as excellent insulation characteristics and flame retardancy, solidify its position in highly regulated sectors like electrical wiring and construction. Major applications span across building and construction (pipes, fittings, window profiles, siding), automotive (underbody coatings, interior components), medical devices (blood bags, tubing), and packaging (blister packs, films). Its robust performance profile, coupled with low manufacturing costs relative to alternative materials, positions PVC resin as an indispensable component in global industrial output, facilitating significant infrastructural development across emerging economies.

Driving factors for sustained market growth include rapid urbanization, especially in Asia Pacific, leading to escalating demand for infrastructure and housing projects. Furthermore, technological advancements focused on improving the environmental profile of PVC, such as the development of bio-based plasticizers and enhanced recycling infrastructure, are counteracting historical concerns regarding environmental impact, ensuring its continued relevance in modern material science and engineering applications.

PVC Resins Market Executive Summary

The PVC Resins market is characterized by robust demand driven primarily by the global resurgence in construction activities and significant investments in water management infrastructure. Business trends indicate a strategic shift towards specialty grades of PVC, including high-impact modified and rigid PVC formulations, catering to higher performance requirements in industries such as automotive and healthcare. Furthermore, key market players are focusing heavily on backward integration and operational efficiency enhancements to mitigate raw material price volatility, particularly concerning ethylene and chlorine costs, ensuring stable supply chains and competitive pricing structures in a highly consolidated market landscape.

Regionally, Asia Pacific (APAC) stands as the undisputed epicenter of market expansion, fueled by massive government spending on public infrastructure in nations like China, India, and Southeast Asian countries. While mature markets in North America and Europe face stricter regulatory scrutiny regarding phthalate plasticizers and end-of-life management, the focus here is shifting towards advanced recycling technologies and sustainable, non-toxic formulations, promoting a circular economy approach for PVC. The competitive intensity remains high, pushing companies to invest in differentiated products and improved compounding processes to capture niche application areas, such as high-density flooring and medical tubing.

Segmentation trends highlight the dominance of the pipe and fittings application segment due to extensive use in water, sewage, and drainage systems globally. However, the profiles and tubes segment, utilized heavily in windows and door frames, is exhibiting the highest growth trajectory, reflecting the global trend toward energy-efficient building standards. Suspension PVC (S-PVC) remains the volume leader by type, though Paste PVC (P-PVC) is gaining momentum due to its suitability for specialized applications like synthetic leather and automotive sealants, demanding higher flexibility and ease of processing.

AI Impact Analysis on PVC Resins Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the PVC Resins market center predominantly on optimization, sustainability, and quality control. Users frequently inquire about AI's role in predicting polymerization reaction outcomes, optimizing feedstock ratios (ethylene/chlorine), and managing complex regulatory compliance related to restricted substances. Key concerns revolve around the initial investment costs for implementing AI systems and the need for specialized data infrastructure to handle the vast amounts of processing data generated during large-scale PVC manufacturing. Expectations are high regarding AI’s ability to drive efficiency improvements, minimize waste, and accelerate the development of innovative, environmentally sound PVC formulations.

The integration of machine learning and advanced analytics is transforming manufacturing processes, moving the industry toward 'smart factories.' AI algorithms are now crucial in optimizing energy consumption during the highly exothermic polymerization stage, significantly reducing operational expenses and enhancing the overall sustainability profile of PVC production. Furthermore, predictive modeling enables manufacturers to anticipate equipment failure and schedule proactive maintenance, thereby maximizing uptime and increasing plant utilization rates, critical factors in a capital-intensive industry like petrochemicals.

In the domain of R&D and supply chain management, AI facilitates rapid screening of potential non-phthalate plasticizers, reducing the time-to-market for sustainable products. Additionally, AI-driven supply chain platforms provide real-time visibility into logistics and inventory, allowing producers to dynamically respond to sudden shifts in raw material prices or logistical disruptions. This enhanced agility is vital for maintaining margins in a commodity market sensitive to global economic volatility, ultimately improving market resilience.

- AI-driven optimization of polymerization kinetics for enhanced yield and reduced batch cycle time.

- Predictive maintenance schedules for reactors and extrusion equipment, minimizing unplanned downtime.

- Machine learning algorithms for optimizing plasticizer blending and compounding processes to meet specific product performance criteria (e.g., flexibility, thermal stability).

- Advanced forecasting of raw material prices (ethylene, chlorine) and demand patterns to optimize procurement strategies.

- Automated quality control systems using computer vision and AI to detect defects in extruded profiles and films during manufacturing.

- Acceleration of R&D for sustainable PVC alternatives and advanced chemical recycling methodologies.

- Optimization of energy consumption in manufacturing plants through real-time energy management systems.

DRO & Impact Forces Of PVC Resins Market

The PVC Resins market trajectory is powerfully influenced by the dynamic interplay of market Drivers, regulatory Restraints, and technological Opportunities. The primary driver is the pervasive, indispensable demand from the global building and construction industry, particularly the accelerating infrastructure development in developing nations. Conversely, the market faces significant restraints, chiefly stringent environmental legislation, especially in OECD countries, targeting the phasing out of traditional plasticizers and demanding greater accountability for post-consumer waste management. These forces collectively shape the competitive environment, pushing manufacturers toward innovation and regulatory compliance.

Key drivers include substantial global growth in residential and commercial construction, requiring durable and cost-effective materials like PVC for piping, window frames, and flooring. Furthermore, the increasing focus on advanced water conservation and distribution networks, particularly in water-stressed regions, mandates the widespread use of PVC pipes and fittings due to their corrosion resistance and longevity. The medical sector’s reliance on disposable PVC-based medical devices also provides a stable, high-value demand stream, driven by expanding healthcare access globally.

Restraints are primarily linked to environmental and health concerns, particularly surrounding the production of vinyl chloride monomer (VCM) and the use of heavy metal stabilizers (though largely replaced) and phthalate plasticizers. These regulations necessitate substantial R&D expenditure to develop safer alternatives, potentially increasing short-term production costs. However, these challenges simultaneously unlock significant Opportunities: advancements in chemical recycling technologies (e.g., VinyLoop process), the development of bio-based PVC precursors, and the commercialization of non-phthalate plasticizers present avenues for achieving circularity and improving the industry’s environmental footprint, thus securing PVC's future viability.

Segmentation Analysis

The PVC Resins market is broadly segmented based on the type of resin, the application area, and the manufacturing process. This segmentation is crucial for understanding specific market dynamics, as different grades of PVC resins are optimized for diverse performance requirements, ranging from high rigidity in construction to high flexibility in specialized medical and automotive components. Suspension PVC (S-PVC) constitutes the largest volume share due to its versatility and dominant use in rigid applications, while Paste PVC (P-PVC) and Emulsion PVC (E-PVC) command higher value shares driven by specialized applications requiring plastisols and high surface quality products.

Application segmentation reveals the profound dependence of the market on the construction sector, followed by electrical/electronics and automotive industries. Regional variations dictate the prevalence of specific grades; for instance, European markets prioritize advanced, fire-retardant rigid PVC profiles for energy-efficient buildings, whereas Asian markets drive massive demand for basic pipe and fittings PVC grades. The increasing shift towards specialized formulations, such as chlorinated PVC (C-PVC) for high-temperature fluid handling and oriented PVC (PVC-O) for high-pressure water mains, represents key growth niches within the overall market structure.

- By Type:

- Suspension PVC (S-PVC)

- Emulsion PVC (E-PVC)

- Paste PVC (P-PVC)

- Others (Mass PVC, Co-Polymers)

- By Application:

- Pipes and Fittings

- Profiles and Tubes

- Films and Sheets

- Wire and Cables

- Bottles

- Others (Flooring, Medical Devices, Footwear)

- By End-Use Industry:

- Construction

- Automotive

- Electrical and Electronics

- Packaging

- Healthcare

- Footwear and Apparel

Value Chain Analysis For PVC Resins Market

The PVC Resins value chain is highly integrated, starting from basic petrochemical feedstocks and extending through complex processing to final end-use applications. The upstream segment is dominated by the production of key raw materials: ethylene (derived from crude oil or natural gas) and chlorine (produced through chlor-alkali electrolysis). The reaction of ethylene and chlorine yields ethylene dichloride (EDC), which is then cracked to produce vinyl chloride monomer (VCM). High energy intensity and capital costs characterize the upstream operations, making raw material pricing and stable feedstock supply critical factors influencing downstream profitability.

The core manufacturing process involves the polymerization of VCM to produce PVC resin powder, a stage characterized by significant technological barriers and the dominance of a few large, globally integrated chemical producers. This resin is then sold to midstream compounders and processors. These compounders mix the base PVC resin with various additives—plasticizers, stabilizers, lubricants, and fillers—to create customized PVC compounds suitable for specific processing techniques (e.g., extrusion, injection molding, calendering). The quality and composition of these compounds are crucial, especially as regulatory pressures increase regarding hazardous additives.

The downstream segment includes fabricators who mold, extrude, or thermoform the compounded PVC into finished products such as pipes, window frames, films, and cables. Distribution channels are typically tiered, involving direct sales to large end-users (e.g., major construction firms, automotive OEMs) and indirect distribution through wholesalers, distributors, and specialized retailers for smaller volume sales. The efficiency of this distribution network, particularly in regions with fragmented construction markets, significantly impacts the final product cost and market penetration. Continuous innovation in additive technology and efficient processing methods is essential throughout the value chain to maintain competitiveness and meet evolving performance and sustainability standards.

PVC Resins Market Potential Customers

Potential customers for PVC resins are exceptionally broad, reflecting the material’s wide applicability across diverse industrial sectors. The single largest consumer base remains the building and construction sector, encompassing civil engineering projects, residential housing developers, and commercial infrastructure firms that require durable materials for piping, window profiles, roofing membranes, and flooring. These customers prioritize longevity, low maintenance, and compliance with strict building codes, making rigid PVC (uPVC) a preferred choice for long-life cycle applications such as water and sewage systems.

Another major segment includes manufacturers in the electrical and electronics industry, which utilizes PVC extensively for wire and cable insulation due to its excellent dielectric properties and intrinsic flame retardancy. Automotive manufacturers constitute a growing segment, purchasing flexible PVC compounds for interior components (dashboards, seating), underbody protection, and wiring harnesses where chemical resistance and thermal stability are essential. Furthermore, the healthcare industry represents a high-value customer base, demanding specialized, sterile grades of flexible PVC for single-use medical equipment like intravenous tubing, blood bags, and catheters, where biocompatibility and ease of sterilization are paramount.

The remaining potential customers include packaging companies, particularly those utilizing blister packaging and shrink wrap films, footwear manufacturers requiring flexible PVC for soles and boots, and manufacturers of consumer goods and apparel utilizing synthetic leather (derived from PVC plastisols). The purchasing decisions of these end-users are primarily driven by material cost-effectiveness, performance characteristics (e.g., flexibility, impact resistance), and increasingly, the environmental certifications and sustainability profile of the PVC resins supplied.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 62.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co., Ltd., Occidental Petroleum Corporation (Oxy Vinyls), Formosa Plastics Corporation, LG Chem, Westlake Chemical Corporation, INOVYN (A Joint Venture of INEOS and Solvay), Kaneka Corporation, KEM ONE, Hanwha Solutions/Chemical Division, SABIC, Ercros S.A., Mexichem (Orbia), China National Chemical Corporation (ChemChina), Vynova Group, Shintech Inc., Reliance Industries Limited, PTT Global Chemical, Tosoh Corporation, VESTOLIT GmbH (Mexichem), Finolex Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PVC Resins Market Key Technology Landscape

The technological landscape of the PVC Resins market is characterized by continuous refinement of existing polymerization processes and intense focus on developing advanced compounding and recycling solutions to meet modern sustainability mandates. The dominant production technology remains Suspension Polymerization (S-PVC), valued for its cost efficiency and ability to produce high-volume, versatile resins suitable for rigid applications. However, significant R&D efforts are channeled into optimizing reactor design and reaction controls (often using advanced analytics and sensors) to ensure precise control over particle morphology, size distribution, and porosity, which directly influence the processability and final product quality of the PVC compound.

A critical area of technological innovation lies in the realm of plasticizers and heat stabilizers. Due to regulatory pressures, there is a substantial shift away from traditional ortho-phthalates towards non-phthalate alternatives such as terephthalates (DOTP), citrates, and bio-based plasticizers derived from renewable sources. Similarly, advancements in heat stabilizers involve transitioning from lead and cadmium-based systems to safer alternatives like calcium-zinc (Ca-Zn) stabilizers, which offer comparable performance while enhancing environmental and health profiles. Manufacturers who successfully integrate these specialized additives gain a competitive advantage in compliance-sensitive markets like Europe and North America.

Furthermore, technology focused on the circular economy is rapidly evolving. Chemical recycling processes, such as pyrolysis or solvolysis tailored specifically for PVC waste, aim to de-polymerize the material back into its constituent monomers (VCM) or valuable petrochemical fractions, overcoming the limitations of mechanical recycling, especially for highly contaminated or composite PVC products. Simultaneously, technologies like high-performance compounding, including twin-screw extrusion systems, are being optimized to efficiently blend recycled PVC content with virgin resin and advanced additives, maintaining the required physical properties for high-specification end-use applications, thereby reducing the industry's reliance on virgin fossil fuels and minimizing landfill impact.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for PVC Resins globally, dominated by massive infrastructure investments, rapid urbanization, and industrial expansion in China, India, and Southeast Asia. The region’s demand is heavily concentrated in the construction sector for pipes, profiles, and cables. Favorable government policies supporting affordable housing and urban development, particularly in India, continue to drive exponential consumption, although the market remains highly price-sensitive and competitive.

- North America: The North American market is characterized by high consumption per capita, driven by sustained demand from the construction sector (especially for housing and energy-efficient window systems) and a robust automotive industry. Strict adherence to non-phthalate plasticizer standards and increasing focus on sustainable sourcing are key trends. The U.S. infrastructure bill also presents a significant opportunity, driving demand for PVC pipes and specialized materials for modernization projects.

- Europe: Europe exhibits moderate growth but leads in technological adoption and sustainability initiatives. The market is defined by stringent environmental regulations (REACH) and a powerful commitment to the circular economy (VinylPlus). This necessitates high investment in advanced recycling techniques and the mandatory use of Ca-Zn stabilizers and non-phthalate plasticizers. Demand is concentrated in high-performance applications like medical tubing and energy-saving building profiles.

- Latin America (LATAM): Growth in LATAM is variable, tied closely to the economic stability and infrastructure spending in major economies like Brazil and Mexico. Demand is stable for construction materials, particularly basic piping for water and sanitation projects. The region is a net importer of technology and high-grade specialty PVC, but local production capacity is expanding to meet localized needs.

- Middle East and Africa (MEA): The MEA region shows strong potential, driven by large-scale construction projects (especially in the Gulf Cooperation Council countries) and efforts to improve water and sanitation systems in Africa. Demand is sensitive to global commodity prices, but ongoing mega-projects in Saudi Arabia and UAE (e.g., NEOM) ensure high demand for specialized PVC construction materials over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PVC Resins Market.- Shin-Etsu Chemical Co., Ltd.

- Occidental Petroleum Corporation (Oxy Vinyls)

- Formosa Plastics Corporation

- LG Chem

- Westlake Chemical Corporation

- INOVYN (A Joint Venture of INEOS and Solvay)

- Kaneka Corporation

- KEM ONE

- Hanwha Solutions/Chemical Division

- SABIC

- Ercros S.A.

- Mexichem (Orbia)

- China National Chemical Corporation (ChemChina)

- Vynova Group

- Shintech Inc.

- Reliance Industries Limited

- PTT Global Chemical

- Tosoh Corporation

- VESTOLIT GmbH (Mexichem)

- Finolex Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the PVC Resins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the current growth of the PVC Resins Market?

The primary driver is the robust, ongoing expansion of the global building and construction industry, particularly the accelerating pace of urbanization and large-scale infrastructure projects (such as water piping and housing) across Asia Pacific and other developing regions, requiring cost-effective, durable materials like PVC.

Which type of PVC resin dominates the global market volume?

Suspension PVC (S-PVC) resin dominates the global market volume share. S-PVC is preferred due to its superior processability for rigid applications, making it the material of choice for the high-volume production of pipes, fittings, and window profiles utilized extensively in the construction sector.

How are environmental regulations impacting the PVC Resins industry in Europe?

Environmental regulations, particularly under the EU's REACH framework, are profoundly impacting the European market by mandating the phase-out of traditional heavy metal stabilizers and certain phthalate plasticizers. This forces manufacturers to adopt advanced, sustainable alternatives like Calcium-Zinc (Ca-Zn) stabilizers and non-phthalate plasticizers.

What is the role of technology in enhancing the sustainability of PVC?

Technology plays a critical role through the development of bio-based plasticizers, non-phthalate additives, and highly efficient chemical recycling processes (depolymerization), which collectively improve the PVC life cycle, reduce dependence on virgin feedstocks, and align the material with circular economy objectives.

Which end-use application is projected to show the highest growth rate during the forecast period?

The Profiles and Tubes application segment, utilized predominantly in energy-efficient window and door frames (uPVC profiles), is projected to exhibit one of the highest growth rates, driven by stricter energy conservation standards and increasing demand for durable, low-maintenance building materials globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager