Pyrethrin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442679 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Pyrethrin Market Size

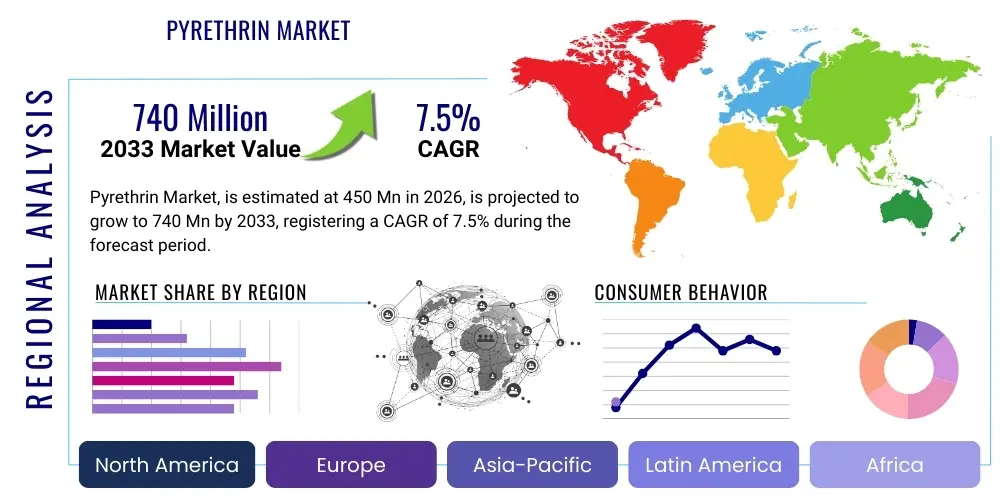

The Pyrethrin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% CAGR between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 740 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising global demand for effective, fast-acting insecticides derived from natural sources, particularly in agricultural settings where conventional pesticides face increasing regulatory scrutiny due to environmental persistence and toxicity concerns. Pyrethrins, known for their rapid knockdown effect and low mammalian toxicity, are increasingly being adopted as a crucial component in Integrated Pest Management (IPM) strategies worldwide.

Pyrethrin Market introduction

The Pyrethrin market encompasses the production, distribution, and consumption of naturally occurring insecticidal compounds derived from the flowers of Chrysanthemum cinerariifolium. Pyrethrins are potent neurotoxins to insects, offering quick paralysis and death, but they degrade rapidly in the environment upon exposure to sunlight and air, ensuring minimal residual activity. Major applications span agricultural crop protection, household insect control (aerosols, sprays), public health initiatives (vector control against mosquitoes and flies), and animal health products (flea and tick treatments). The primary benefit of pyrethrins lies in their high efficacy coupled with favorable environmental and toxicological profiles, making them a preferred solution where safety is paramount.

Key driving factors for market growth include stringent government regulations restricting the use of organophosphate and carbamate insecticides, coupled with growing consumer preference for organic and biologically derived pest control solutions. Furthermore, the increasing incidence of vector-borne diseases globally necessitates effective public health interventions, bolstering the demand for pyrethrins in vector control programs. Technological advancements in extraction and formulation techniques, aimed at improving photostability and efficacy, are also contributing significantly to market accessibility and performance across diverse climatic conditions.

Pyrethrin Market Executive Summary

The Pyrethrin market is characterized by robust business trends focusing on sustainable sourcing and advanced formulation technologies, ensuring rapid market expansion, particularly in high-value agricultural exports and certified organic produce sectors. Regional dynamics highlight Asia Pacific (APAC) as the fastest-growing market, driven by intense agricultural production and increasing public health expenditure, while North America and Europe maintain dominance in high-end household and animal health applications, governed by strict regulatory frameworks favoring natural products. Segment trends indicate that the Agriculture segment holds the largest market share due to the necessity of crop protection against key pests, with the natural pyrethrin sub-segment gaining significant traction as consumers and regulators increasingly prioritize genuinely bio-based inputs. The shift towards synthetic analogs (pyrethroids) in certain volume applications, while a restraint, is balanced by the persistent demand for pure, natural pyrethrin in sensitive and certified environments.

AI Impact Analysis on Pyrethrin Market

Common user inquiries regarding AI’s influence on the Pyrethrin market center on optimizing extraction yields, predicting pest outbreaks to refine application timing, and developing smart formulation strategies that enhance compound stability. Users are particularly interested in how AI-driven predictive modeling can mitigate risks associated with reliance on natural sourcing (like weather volatility impacting chrysanthemum harvests) and how machine learning can accelerate the identification of novel, synergistic inert ingredients to boost pyrethrin efficacy against resistant strains. The consensus suggests AI will revolutionize R&D and supply chain management, shifting the focus from broad-scale application to highly targeted, data-informed pest control strategies, ultimately increasing the cost-effectiveness and sustainability of pyrethrin use across agriculture and public health.

- AI-driven Predictive Analytics: Optimizing cultivation and harvesting schedules for Chrysanthemum cinerariifolium, maximizing pyrethrin yield per hectare based on localized climatic data.

- Precision Application Systems: Integrating AI and remote sensing (drones/satellites) to identify exact infestation hotspots, minimizing overall insecticide use and reducing environmental impact.

- Supply Chain Optimization: Utilizing machine learning algorithms to forecast demand fluctuations and manage global inventories, stabilizing volatile pricing inherent to naturally sourced materials.

- Resistance Management: Employing AI to analyze large genomic datasets of target pests, helping to quickly detect evolving resistance mechanisms and guide the development of synergistic formulations.

- Automated Quality Control: Implementing computer vision systems for real-time monitoring of pyrethrin extract purity during processing and refinement phases.

DRO & Impact Forces Of Pyrethrin Market

The market for pyrethrin is significantly shaped by distinct drivers, restraints, and opportunities, culminating in a strong impetus towards sustainable and specialized product development. The primary driver is the widespread global adoption of Integrated Pest Management (IPM) practices, which prioritize low-toxicity, biodegradable inputs like pyrethrin, particularly for crops destined for export or organic certification. Concurrently, increasing regulatory pressure from bodies like the EPA and EU's European Food Safety Authority (EFSA) to phase out more hazardous synthetic pesticides creates a substantial market gap that pyrethrins are uniquely positioned to fill. This shift is compounded by consumer demand for safer environments, directly translating into higher sales in household and public health sectors.

Restraints primarily revolve around the inherent challenges of natural sourcing. Pyrethrin production is inherently tied to agricultural commodity cultivation, making supply lines susceptible to weather-related crop failures, geopolitical instability in growing regions (primarily Kenya, Rwanda, and Australia), and high variability in yield and purity. Furthermore, the cost of extracting, purifying, and formulating natural pyrethrin is considerably higher than producing large volumes of synthetic pyrethroids, limiting its use in broad-acre, low-margin applications. Another critical restraint is the rapid photodecomposition of the natural compound, necessitating complex stabilization formulations for field applications, and the growing concern over insect resistance development due to prolonged, non-discriminatory use.

Significant opportunities arise from innovation in formulation chemistry, specifically developing microencapsulation technologies and UV protectants that extend the effective residual life of pyrethrin in outdoor settings without sacrificing its favorable environmental profile. Expansion into niche high-value markets, such as cannabis cultivation, where pesticide regulation is extremely strict, and high-end organic animal husbandry, presents strong growth avenues. Moreover, utilizing genetic engineering and modern breeding techniques to develop high-yield chrysanthemum cultivars promises to mitigate supply constraints and reduce overall production costs, positioning pyrethrins as a more economically competitive option against synthetic alternatives in the long term. These factors collectively create a positive impact force, driving specialization and premiumization in the market.

Segmentation Analysis

The Pyrethrin market is systematically segmented based on source, application, and formulation type to address diverse user requirements and market dynamics. Understanding these segments is crucial for stakeholders to tailor production and marketing strategies. The market structure reflects a bifurcated demand: one for pure, high-grade natural extracts favored by the organic sector and another for high-volume, cost-effective formulations used in vector control and conventional agriculture. The key segments define market trajectory, with application in agriculture dominating consumption volume, while the household sector commands premium pricing due to regulatory and safety demands for indoor use.

- By Source: Natural Pyrethrin, Synthetic Pyrethroids (often used synonymously in generalized market context but chemically distinct).

- By Application: Agriculture (Crop Protection), Household & Commercial (Indoor Pest Control), Public Health (Vector Control, e.g., Mosquitoes, Flies), Animal Health (Veterinary Products).

- By Form: Liquid (Emulsifiable Concentrates, Suspension Concentrates), Powder, Aerosol, Oil-based Solutions.

Value Chain Analysis For Pyrethrin Market

The Pyrethrin value chain is intricate, starting from the specialized cultivation of chrysanthemums, primarily concentrated in equatorial high-altitude regions. Upstream analysis involves flower farming, raw material harvesting, and the immediate drying and stabilization of the flower heads to preserve pyrethrin content. Midstream activities focus on the crucial extraction and purification processes, where complex solvent extraction methods are employed to create crude extract, which is then refined into highly concentrated oleoresins or technical-grade active ingredients (AI). This stage is capital-intensive and requires significant chemical engineering expertise. The downstream analysis involves the formulation of the technical grade material into end-use products—such as emulsifiable concentrates, dusts, or pressurized aerosols—which necessitates rigorous quality control to ensure efficacy and stability. Distribution channels are highly specialized, utilizing both direct sales to large agricultural cooperatives, multinational consumer goods companies (for household products), and indirect routes through specialized agrochemical distributors, veterinary suppliers, and public health procurement agencies. The direct channel offers greater margin control, while the indirect channel ensures wide geographical reach and local technical support.

Pyrethrin Market Potential Customers

The potential customers for pyrethrin and its formulated products are highly diverse, spanning multiple economic sectors but generally categorized into professional and consumer end-users. Primary end-users in the professional segment include large-scale agricultural enterprises, particularly those focusing on high-value crops (fruits, vegetables, ornamentals) and certified organic farming operations, where pyrethrin’s rapid action and short pre-harvest interval are indispensable. Governmental and non-governmental organizations involved in public health are major buyers for vector control programs, utilizing pyrethrin for area spraying and treatment of mosquito nets. In the consumer space, potential customers include households and commercial facility managers requiring immediate, non-persistent indoor pest control solutions. Veterinary clinics and animal health companies constitute another key segment, purchasing formulated pyrethrin for topical flea and tick control products, driven by the need for quick efficacy and low toxicity to mammals when applied externally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 740 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Chemical Co. Ltd., Bayer AG, Syngenta AG, FMC Corporation, UPL Ltd., Heranba Industries Ltd., Gharda Chemicals International, McLaughlin Gormley King Company (MGK), Zhejiang Wynca Chemical Group, SinoHarvest Group, Prentiss Incorporated, Red Eagle International, Fine Agrochemicals Ltd., Tagros Chemicals India Ltd., Dow AgroSciences (Corteva Agriscience), Nufarm Ltd., Certis USA LLC, Biological Solutions Group, Ken-Bio Holdings, and BASF SE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pyrethrin Market Key Technology Landscape

The Pyrethrin market’s technological evolution is centered on overcoming the inherent weaknesses of the natural compound, namely its poor stability under UV light and high production costs. The most critical technological advancements involve sophisticated extraction and purification processes, utilizing supercritical fluid extraction (SFE) techniques which offer higher purity and lower environmental impact compared to traditional solvent-based methods. These techniques result in a cleaner, more concentrated technical material, reducing the presence of unwanted waxes and resins, thus improving formulation stability. Furthermore, advancements in analytical chemistry, particularly high-performance liquid chromatography (HPLC), are essential for mandatory regulatory compliance, ensuring the precise quantification of the six active components of pyrethrin and verifying product authenticity and quality.

On the formulation front, the industry heavily relies on advanced encapsulation technologies. Microencapsulation involves embedding pyrethrin molecules within a protective polymer shell, which acts as a barrier against UV degradation, dramatically extending the product's effective residual activity in outdoor environments. This technology is vital for applications requiring longer efficacy, such as perimeter treatments and mosquito control. The use of specialized synergists, most notably piperonyl butoxide (PBO), remains a crucial technological approach, not only boosting the intrinsic insecticidal activity of pyrethrin but also inhibiting the insect's detoxification enzymes, thereby mitigating the development of pest resistance and improving knockdown speed.

Finally, biotechnology is emerging as a significant long-term technological driver. Research focused on genetically modifying or conventionally breeding C. cinerariifolium cultivars to achieve higher pyrethrin yields per plant is ongoing, promising to stabilize supply and reduce the cost of the raw material. Similarly, exploring alternative bio-production pathways, such as engineering yeast or bacteria to synthesize pyrethrin molecules in fermentation tanks, represents a potentially revolutionary shift that could completely decouple production from agricultural constraints and weather variability. These combined technological thrusts are enhancing pyrethrin's competitiveness against synthetic alternatives while maintaining its appeal as a bio-derived solution.

Regional Highlights

The global Pyrethrin market exhibits distinct consumption and regulatory patterns across major regions, influencing strategic decision-making and investment flows. North America, particularly the United States and Canada, represents a mature market characterized by stringent EPA regulations that highly favor pyrethrin in household pest control and specialized agricultural applications like organic produce and post-harvest protection. The region's high consumer spending power and proactive approach to managing vector-borne diseases ensure sustained demand for premium pyrethrin formulations. Furthermore, the rapid growth of the legal cannabis industry in several states has generated a substantial niche market, as pyrethrin is one of the few permitted insecticides due to its low residual presence.

Europe stands out due to its exceptionally strong commitment to sustainability and the rigorous demands of the Biocidal Products Regulation (BPR) and REACH regulations. This regulatory environment has severely restricted many conventional synthetic pesticides, thereby creating a significant competitive advantage for pyrethrin and its synergistic formulations. The agricultural sector, driven by subsidies and consumer trends toward ecological farming, relies heavily on natural inputs, supporting steady growth. However, the region’s market size is somewhat constrained by the limited cultivation of the raw material within the continent, leading to high reliance on imports, primarily from East Africa and Oceania.

Asia Pacific (APAC) is projected to be the engine of market expansion, driven primarily by high agricultural intensity, large public health burdens associated with endemic vector-borne diseases (Dengue, Malaria), and rapid urbanization leading to increased household pest issues. Countries like India, China, and Southeast Asian nations are increasing investment in modern agricultural practices and vector control programs, creating massive volume demand. While synthetic pyrethroids dominate much of the volume market due to cost-effectiveness, the rising middle class and governmental focus on improving food safety standards are boosting the adoption of higher-cost, natural pyrethrin, especially in key export-oriented agricultural zones. The region is also becoming a center for synthetic pyrethroid manufacturing, influencing global pricing dynamics.

Latin America and the Middle East & Africa (MEA) regions present considerable growth potential. Latin America’s vast agricultural lands and ongoing struggles with tropical vectors ensure consistent demand for control agents, with pyrethrin often funded through international aid for public health campaigns. The MEA region is crucially important not only as a major consumption area (due to high incidence of insect pests and vectors) but also as the primary source of natural pyrethrin raw materials, particularly Kenya, which dictates much of the global supply stability and raw material pricing. Investment in improved farming techniques in these source countries is critical to stabilize the global market supply chain.

- North America: Leading adopter of pyrethrin in niche, high-value agriculture and indoor environments; strong regulatory framework favoring bio-based products; key market for high-end household aerosols.

- Europe: Driven by stringent BPR and REACH regulations; high demand for natural inputs in organic farming; market growth constrained by reliance on imports for raw material.

- Asia Pacific (APAC): Highest volume growth due to intense agricultural activity and urgent public health needs (vector control); rapidly improving quality standards boosting natural pyrethrin adoption.

- Latin America: Significant consumption driven by large-scale agriculture (soy, fruit) and persistent vector control challenges; market influenced by commodity pricing and regional aid programs.

- Middle East and Africa (MEA): Crucial as the primary source region for natural pyrethrin raw material (e.g., Kenya); consumption driven by public health initiatives and combating agricultural pests in arid zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pyrethrin Market.- Sumitomo Chemical Co. Ltd.

- Bayer AG

- Syngenta AG

- FMC Corporation

- UPL Ltd.

- Heranba Industries Ltd.

- Gharda Chemicals International

- McLaughlin Gormley King Company (MGK)

- Zhejiang Wynca Chemical Group

- SinoHarvest Group

- Prentiss Incorporated

- Red Eagle International

- Fine Agrochemicals Ltd.

- Tagros Chemicals India Ltd.

- Dow AgroSciences (Corteva Agriscience)

- Nufarm Ltd.

- Certis USA LLC

- Biological Solutions Group

- Ken-Bio Holdings

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Pyrethrin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Pyrethrin and Pyrethroids?

Pyrethrins are naturally occurring insecticidal compounds extracted directly from chrysanthemum flowers, characterized by rapid degradation in sunlight and low mammalian toxicity. Pyrethroids are synthetic chemical analogs developed to offer enhanced photostability, persistence, and often greater potency, making them suitable for broader agricultural applications.

How does the volatility of the Pyrethrin supply chain impact market pricing?

Pyrethrin supply is highly dependent on agricultural output in key growing regions (mainly Kenya and Tasmania), making the supply chain vulnerable to adverse weather, pests, and political instability. This volatility directly leads to price fluctuations, creating uncertainty for end-users and driving research into synthetic bioproduction methods to stabilize supply.

Which application segment currently drives the highest growth in the Pyrethrin Market?

While the Agriculture segment maintains the largest volume share, the Public Health segment, driven by global initiatives and government spending on vector control against diseases like malaria and dengue fever, is projected to experience the fastest growth, particularly in high-incidence regions of APAC and MEA.

What technological advancement is key to extending the outdoor efficacy of Pyrethrin?

Microencapsulation technology is the most critical advancement. This process involves encasing the active pyrethrin molecule in a polymer shell, which slows down the compound's exposure to UV light and air, significantly extending its residual effectiveness in field and exterior environments without compromising its natural breakdown profile.

How is insect resistance management addressed in Pyrethrin formulations?

Resistance is managed primarily through the inclusion of chemical synergists, such as Piperonyl Butoxide (PBO), which interfere with the insect’s natural detoxification mechanisms. Additionally, IPM strategies advocate for rotating pyrethrin use with insecticides of different modes of action to slow the development of broad-spectrum resistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pyrethrin Market Size Report By Type (Pyrethrin 1, Pyrethrin 2, Pest Type, Lepidoptera, Sucking Pests, Coleoptera, Diptera, Mites, And Others), By Application (Household, Crop Protection, Commercial And Industrial, Animal Health, And Public Health Applications), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pyrethrin Market Statistics 2025 Analysis By Application (Household Products, Public Hygiene, Agriculture & Pesticides), By Type (50% Pyrethrin, 20% Pyrethrin, Other, 50% pyrethrin is the largest segment of pyrethrin, with a market share of more than 58% in the year 2018.), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager