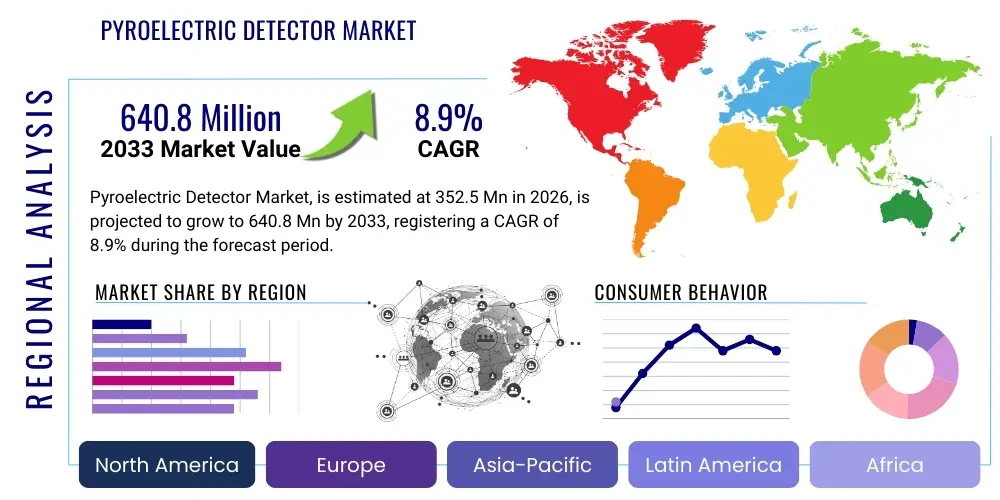

Pyroelectric Detector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442347 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Pyroelectric Detector Market Size

The Pyroelectric Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 352.5 Million in 2026 and is projected to reach USD 640.8 Million by the end of the forecast period in 2033. This growth trajectory is fueled by the escalating adoption of passive infrared (PIR) sensors in smart home automation systems, coupled with increasing demand for highly sensitive gas detection and spectroscopy applications across industrial and environmental monitoring sectors. The inherent stability and low power consumption characteristics of pyroelectric technology make it a preferred choice for battery-powered, long-duration sensing solutions, supporting sustained expansion across diverse end-use verticals globally.

Pyroelectric Detector Market introduction

Pyroelectric detectors are sophisticated thermal sensors that utilize the pyroelectric effect—the ability of certain materials to generate an electrical charge proportional to a change in temperature. Unlike photon detectors, pyroelectric detectors operate independent of the incident radiation wavelength and function efficiently at room temperature, eliminating the need for complex cooling systems, which significantly reduces overall system cost and operational complexity. These devices primarily convert infrared radiation, such as heat emitted by humans or gases, into an electrical signal, forming the backbone of crucial technologies across modern infrastructure.

The primary applications of pyroelectric detectors span critical areas including security and surveillance (Passive Infrared motion sensing), industrial process control (temperature and flame sensing), and environmental monitoring (CO2 and gas analysis). Furthermore, they are integral components in advanced non-contact thermometry and specialized infrared spectroscopy systems used in medical diagnostics and chemical identification. Their robust performance, combined with their low manufacturing cost relative to highly specialized infrared sensing arrays, positions them favorably in high-volume consumer electronics and cost-sensitive industrial measurement applications, driving consistent market penetration.

Key driving factors underpinning the market expansion include the massive global push toward smart infrastructure and energy-efficient building management systems, where PIR sensors are essential for lighting control and occupancy detection. The burgeoning market for high-performance gas sensing instruments in pollution control and industrial safety, demanding reliable, drift-free detection capabilities, further amplifies the demand for pyroelectric solutions. The continuous advancement in material science, particularly the utilization of thin-film ferroelectrics and MEMS integration, is also improving the sensitivity and speed of these detectors, unlocking new potential in high-frequency applications previously dominated by higher-cost alternatives.

Pyroelectric Detector Market Executive Summary

The Pyroelectric Detector Market exhibits dynamic growth propelled primarily by the intersection of industrial automation and consumer-centric smart technologies. Business trends indicate a strong shift towards miniaturization and integration, with manufacturers focusing on integrating detectors into MEMS platforms to enhance performance characteristics while reducing physical size and power consumption. Regional trends underscore Asia Pacific’s (APAC) dominance as a manufacturing hub for these components, simultaneously positioning North America and Europe as early adopters due to stringent regulatory standards concerning energy efficiency and safety systems, such as advanced fire and gas detection infrastructure. This dual dynamic creates opportunities for localized innovation in high-sensitivity niche markets while capitalizing on mass production capabilities in Eastern economies.

Segment trends reveal that the Dual/Multi-element detector segment, often used in complex PIR and flame detection systems, holds the largest market share due to its superior immunity to false positives caused by environmental noise. Concurrently, the application segment for Gas Sensing is projected to experience the fastest CAGR, driven by regulatory mandates requiring continuous monitoring of greenhouse gases (GHGs) and volatile organic compounds (VOCs) across industrial sites and urban environments. Technological advancements are focused on developing materials like Lithium Tantalate (LiTaO3) and advanced ceramic compounds that offer improved thermal stability and enhanced responsivity, addressing existing limitations related to temperature fluctuations and response time in field deployments.

Strategic growth avenues for market participants include vertical integration to control the supply chain of specialty pyroelectric materials and collaborative partnerships with IoT platform providers to ensure seamless integration into connected ecosystems. Furthermore, the defense and aerospace sectors are increasingly exploring high-frequency pyroelectric arrays for specialized thermal mapping and target acquisition, creating premium market opportunities. The market remains competitive, necessitating continuous innovation in sensor packaging, signal processing algorithms, and noise reduction techniques to maintain relevance against competing technologies like microbolometers and thermopiles, especially in high-resolution imaging applications.

AI Impact Analysis on Pyroelectric Detector Market

Common user questions regarding AI’s impact on pyroelectric detectors center around how machine learning can minimize false positives, enhance data accuracy in complex environments, and integrate these simple sensors into sophisticated smart systems. Users frequently inquire about the feasibility of AI-driven predictive maintenance enabled by the detectors’ thermal monitoring capabilities and how AI improves the spectral analysis performed by pyroelectric-based spectrometers. The core themes revolve around leveraging AI to transition pyroelectric sensors from simple on/off switches (as in basic PIR systems) to highly nuanced, data-generating components capable of complex pattern recognition and autonomous decision-making in security, industrial control, and medical diagnostics.

AI significantly enhances the operational effectiveness of pyroelectric detectors, particularly in applications where differentiating between relevant signals and background noise is critical. By applying deep learning algorithms to the raw thermal data collected by these sensors, AI systems can effectively filter out environmental disturbances such as sudden light changes, air conditioning movements, or minor temperature drifts, drastically reducing the occurrence of false alarms in security and building automation contexts. Furthermore, AI facilitates complex pattern recognition, enabling smart PIR systems not just to detect motion, but to classify the nature of the moving object (e.g., human vs. pet vs. machinery), thereby providing more actionable and reliable output data.

In advanced industrial and medical applications, AI is instrumental in processing time-series data from pyroelectric sensors used in gas analysis and spectroscopy. Machine learning models can be trained on vast spectral libraries to identify minute gas concentrations or specific chemical signatures with greater speed and precision than traditional lookup methods. This capability accelerates R&D processes, improves industrial emissions monitoring accuracy, and allows for rapid, non-invasive diagnostic screening based on thermal signatures. The integration of edge computing capabilities alongside pyroelectric arrays enables real-time, low-latency AI processing directly at the sensor node, which is paramount for mission-critical applications like automated manufacturing safety systems and instant medical screening.

- AI significantly reduces false positives in security and building automation by learning complex environmental noise patterns.

- Machine learning enhances the classification capability of PIR sensors, differentiating between human presence, animals, and machinery.

- AI optimizes spectral analysis for pyroelectric-based gas detectors, improving accuracy and speed in identifying chemical compounds.

- Predictive maintenance schedules are enabled by analyzing long-term thermal drift patterns captured by pyroelectric sensors, indicating equipment wear.

- Integration with edge AI minimizes data latency, allowing for real-time autonomous decision-making in connected systems.

DRO & Impact Forces Of Pyroelectric Detector Market

The Pyroelectric Detector Market is influenced by a balanced set of market dynamics, where strong drivers rooted in global urbanization and technological mandates are partially counteracted by limitations imposed by competing technologies and material constraints. Key drivers include the exponential growth of the Internet of Things (IoT) ecosystem, which relies heavily on low-power, accurate thermal sensing for device activation and environmental awareness. Furthermore, increasing regulatory requirements globally for energy efficiency in commercial and residential buildings mandate the installation of occupancy sensors, primarily based on PIR technology. The expanding use of non-dispersive infrared (NDIR) sensors for CO2 and methane detection in HVAC systems and pollution control further bolsters demand, as pyroelectric detectors are the fundamental sensing element in NDIR configurations. These forces exert substantial upward pressure on market growth, necessitating high-volume, standardized production capabilities.

Restraints primarily revolve around the inherent limitations of the technology, notably the relatively slower response time compared to sophisticated photon detectors and the challenge of high sensitivity to ambient temperature fluctuations, which can introduce drift if not properly compensated. A significant restraint is the aggressive competition posed by advanced microbolometers, especially in high-resolution thermal imaging systems, and by highly sensitive thermopiles, which often offer superior long-term stability in certain industrial process monitoring applications. Furthermore, the reliance on specialized materials like Lithium Tantalate (LiTaO3) presents supply chain complexities and cost volatility, posing a hurdle for high-volume, low-cost applications where margins are tight. Successfully mitigating temperature compensation requirements through improved packaging and integrated electronics remains a critical challenge for mass-market adoption.

Opportunities for market growth are abundant, particularly in niche high-value applications. The development of advanced pyroelectric materials using nanotechnology, such as nanostructured ferroelectrics, promises enhanced responsiveness and reduced size, opening pathways into highly miniaturized portable medical devices and advanced spectroscopy. The growing global focus on food safety and quality control provides an emerging market for pyroelectric spectroscopy systems capable of rapid contaminant detection. Moreover, the integration of pyroelectric sensors into sophisticated automotive systems for cabin climate control, passenger detection, and even non-contact vehicle health monitoring offers a high-growth, high-margin opportunity, capitalizing on the automotive industry’s drive towards enhanced safety and automated driving features. Successful navigation of these opportunities requires significant investment in material science R&D and strategic partnerships with system integrators.

Segmentation Analysis

The Pyroelectric Detector Market segmentation provides a detailed structural view of the diverse product offerings and their specialized applications across various industrial landscapes. The market is primarily segmented based on the type of material used (e.g., LiTaO3, DTGS, Ceramics), the sensor configuration (single, dual, quad elements, arrays), the operational frequency, and the final end-use application (PIR, Gas Sensing, Spectroscopy, etc.). Analyzing these segments is crucial for understanding specific market dynamics, technological preferences, and the relative value generated by different product variations, enabling market participants to tailor their strategies effectively to high-growth niches. The dominance of dual-element sensors reflects the massive deployment in standard motion detection where noise reduction is prioritized.

Segmentation by Application is particularly informative, illustrating the rapid maturation of traditional PIR sensing in consumer electronics and building automation, while simultaneously highlighting the accelerating demand in sophisticated Gas Sensing and Analytical Instrumentation segments. Gas sensing, driven by NDIR technology for measuring CO2 and hydrocarbons, requires detectors with specific wavelength filtering capabilities and high long-term stability. The convergence of these applications necessitates manufacturers to offer a broad product portfolio, ranging from standardized, low-cost PIR chips to custom-engineered, highly stable arrays for military or medical diagnostics. The interplay between material science advancements and application requirements defines the competitive landscape within each segment, encouraging specialized component optimization.

Further granularity exists within the End-User segment, clearly differentiating between high-volume, standardized markets like Consumer Electronics and specialized, performance-driven markets such as Defense & Aerospace and Medical. While Consumer Electronics demands extreme cost-efficiency and miniaturization, the Defense sector prioritizes reliability, wide temperature range operation, and high-frequency performance. This distinct market behavior necessitates unique distribution channels, regulatory compliance expertise, and product lifetime expectations for each end-user group. Understanding this segmentation enables focused marketing, efficient resource allocation, and targeted R&D efforts toward segments offering the highest potential return on investment (ROI).

- By Material Type: Lithium Tantalate (LiTaO3), Deuterated Triglycine Sulfate (DTGS), Ceramics, Polymers/Thin Films.

- By Sensor Configuration: Single Element, Dual Element, Quad Element, Linear Arrays.

- By Application: Passive Infrared (PIR) Sensing, Gas Analysis (NDIR), Non-Contact Thermometry, Spectroscopy, Flame Detection.

- By End-User Industry: Building Automation & HVAC, Consumer Electronics, Automotive, Healthcare & Medical, Defense & Aerospace, Industrial and Environmental Monitoring.

Value Chain Analysis For Pyroelectric Detector Market

The value chain for the Pyroelectric Detector Market begins with the highly specialized Upstream Analysis involving the sourcing and refinement of key ferroelectric materials, predominantly Lithium Tantalate (LiTaO3), specialized ceramics, and advanced polymers. This stage is crucial as the purity and crystal quality of these raw materials directly determine the detector's sensitivity, response time, and thermal stability. Material suppliers, often concentrated in specific geographical regions with expertise in crystal growth and refinement, exert significant control over the initial cost structure. Specialized chemical processing and micro-fabrication techniques follow, where the pyroelectric material is cut, polished, and deposited onto substrates, requiring high-precision engineering and cleanroom facilities, distinguishing specialized component manufacturers from general electronics assembly firms.

The Midstream component focuses on the fabrication and integration stage, often leveraging Micro-Electro-Mechanical Systems (MEMS) techniques to integrate the detector element with sophisticated Readout Integrated Circuits (ROICs), signal conditioning electronics, and specialized infrared filter windows. This integration process dictates the detector's final form factor and functionality (e.g., single-chip PIR sensor vs. multi-element linear array). Manufacturers who control both the material processing and the MEMS integration possess a competitive advantage, enabling faster iteration and customization. The complexity here lies in packaging the sensitive detector element in hermetically sealed environments to ensure long-term stability and prevent degradation from environmental moisture or contaminants.

Downstream analysis highlights the distribution channels and the ultimate system integration. Products are distributed through two primary channels: Direct Sales to Original Equipment Manufacturers (OEMs) and Indirect Sales via specialized regional distributors and value-added resellers (VARs). Direct sales dominate the high-volume consumer electronics and large industrial contract segments, where components are deeply integrated into products like smart thermostats or industrial gas analyzers. Indirect channels serve smaller R&D labs, regional system integrators, and niche manufacturers who require smaller batch sizes and extensive technical support. The final value addition occurs when the detector is incorporated into a larger system (e.g., a security camera, an NDIR gas sensor module, or a smart lighting fixture), requiring specialized calibration and software integration expertise provided by the end-product manufacturer.

Pyroelectric Detector Market Potential Customers

Potential customers for pyroelectric detectors represent a diverse array of industries, unified by the need for reliable, passive, and cost-effective infrared sensing capabilities. The most significant customer base resides within the Building Automation and HVAC sector, encompassing manufacturers of smart thermostats, centralized climate control systems, occupancy sensors for energy management, and sophisticated fire and flame detectors. These end-users demand high reliability, low power draw for battery operation, and robust performance in varying indoor environments. Their purchasing criteria often prioritize long-term component availability and seamless integration capabilities with established communication protocols like Zigbee or Wi-Fi, making standardized, low-cost PIR modules highly attractive.

A rapidly expanding segment of high-value customers includes manufacturers of Industrial Safety and Environmental Monitoring Equipment, specifically those producing Non-Dispersive Infrared (NDIR) gas analyzers for methane, carbon dioxide, and refrigerant leak detection. These customers require highly stable single or dual-element detectors optimized for specific infrared wavelengths corresponding to target gas absorption bands. The critical nature of these applications—often involving industrial process control or compliance with environmental regulations—translates into a willingness to invest in premium, high-stability components and custom filtering solutions, thereby demanding close collaboration between the detector manufacturer and the instrumentation firm.

Other key buyers include Security System Providers, Automotive Manufacturers, and Medical Device Companies. Security providers utilize these detectors for their vast installed base of intrusion alarms and surveillance systems. Automotive customers are increasingly integrating them into cabin climate control systems for passenger detection and potential non-contact temperature screening. The Medical sector employs specialized pyroelectric arrays for advanced non-invasive thermometry and potentially for breath analysis diagnostics. Across all these segments, the purchasing decision is fundamentally driven by the detector's ability to offer reliable performance without requiring active cooling, providing a strong competitive edge in portable and energy-constrained device markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 352.5 Million |

| Market Forecast in 2033 | USD 640.8 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Excelitas Technologies, Murata Manufacturing Co., Ltd., Texas Instruments Incorporated, Hamamatsu Photonics K.K., Honeywell International Inc., Nippon Ceramic Co., Ltd., InfraTec GmbH, TE Connectivity Ltd., Ophir Optronics Solutions Ltd. (Newport Corporation), Laser Components GmbH, Sensor Electronic Technology, Inc., Dexter Research Center, Heraeus Sensor Technology GmbH, Boston Electronics Corporation, DIAS Infrared GmbH, Pyreos Limited, Smiths Interconnect, Advanced Photonix, Inc., Thorlabs, Inc., Gentherm Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pyroelectric Detector Market Key Technology Landscape

The core technological evolution in the pyroelectric detector market centers on advanced material engineering and sophisticated micro-fabrication techniques, specifically leveraging MEMS technology. Traditional pyroelectric elements relied on bulk crystals, which limited response time and required complex manufacturing. The current trend involves the development and application of thin-film ferroelectric materials, such as thin-film Lithium Tantalate or PZT (Lead Zirconate Titanate), deposited using techniques like sputtering or chemical vapor deposition. This shift towards thin films dramatically reduces the thermal mass of the detector element, significantly enhancing its responsivity (signal strength per incident radiation) and improving the operational speed, allowing pyroelectric devices to compete effectively in modulation frequency ranges previously inaccessible to them. Furthermore, the ability to deposit these materials directly onto silicon substrates facilitates seamless integration with standard CMOS readout circuitry, paving the way for low-cost, high-volume production of complex arrays.

A crucial technological area is the refinement of Micro-Electro-Mechanical Systems (MEMS) integration. By fabricating the sensitive element on a micro-machined membrane, manufacturers can achieve superior thermal isolation from the substrate, which is essential for maximizing the temperature change within the pyroelectric material upon IR absorption. MEMS-based fabrication allows for the creation of multi-element configurations, such as linear and two-dimensional arrays, which were historically cost-prohibitive. This technological leap supports the development of compact, low-resolution thermal imaging sensors and advanced spectral analysis arrays for use in spectroscopy and multi-gas detection modules. The ongoing challenge is balancing thermal isolation with mechanical stability, ensuring the detectors remain robust under typical operating conditions and resistant to mechanical shock or vibration, particularly in automotive and industrial environments.

Beyond the sensing element itself, advancements in integrated electronics and signal processing are fundamentally reshaping the performance profile of pyroelectric detectors. Modern detectors increasingly incorporate on-chip signal conditioning, temperature compensation circuits, and digital output interfaces directly within the detector package. This integration reduces external component count, simplifies system design for OEMs, and, crucially, addresses the fundamental limitation of pyroelectric technology—its sensitivity to ambient temperature drift. By using proprietary algorithms and internal reference sensors, the integrated electronics compensate for drift in real-time, delivering a highly stable and accurate output signal. Furthermore, the incorporation of narrow-band optical filters precisely tuned to specific gas absorption lines is a key technology for enhancing the specificity and sensitivity of NDIR gas sensor modules, widening the application scope across regulated industries requiring high accuracy in gas concentration measurements.

Regional Highlights

- North America: North America represents a mature and high-value market for pyroelectric detectors, characterized by stringent regulatory standards and high rates of early technology adoption, particularly within the smart infrastructure and defense sectors. The region’s strong focus on energy efficiency, driven by initiatives in states like California, mandates the use of advanced occupancy sensing solutions, solidifying the demand for high-quality PIR detectors in commercial and residential construction. Furthermore, a substantial portion of the global R&D activities in aerospace and defense technology takes place here, driving demand for specialized, high-performance pyroelectric arrays for military applications, target detection, and advanced spectroscopy. The robust presence of key semiconductor and system integration companies ensures rapid market uptake of new, miniaturized technologies, placing a premium on sophisticated, integrated sensor solutions.

- Europe: Europe is a vital market driven primarily by stringent environmental protection legislation, demanding high-precision gas sensing and monitoring equipment. The region's regulatory framework, particularly related to HVAC energy consumption (e.g., EU Ecodesign Directive), necessitates the deployment of millions of highly reliable occupancy sensors in both new and retrofitted buildings, significantly boosting the demand for dual-element and quad-element pyroelectric sensors. Furthermore, the strong presence of the automotive industry and specialized medical device manufacturing in countries like Germany and Switzerland creates consistent demand for customized, highly reliable pyroelectric solutions tailored for vehicle safety and non-contact diagnostic applications. Emphasis here is placed on certified quality and compliance with RoHS and REACH standards.

- Asia Pacific (APAC): APAC is the fastest-growing region and the global manufacturing epicenter for pyroelectric detectors and related final products. Countries like China, Japan, and South Korea house the world’s largest production capacities for consumer electronics, smart home devices, and affordable industrial monitoring equipment, leading to immense, volume-driven demand for cost-effective pyroelectric sensors. Rapid urbanization, coupled with burgeoning industrialization in Southeast Asian nations, fuels the need for enhanced security systems, fire detection, and basic environmental monitoring infrastructure. While the demand is heavily skewed towards high-volume, standardized PIR modules, emerging markets within APAC are also showing increased adoption of advanced NDIR gas sensors to tackle severe air quality and industrial safety challenges, ensuring a diversified growth pattern across the region.

- Latin America, Middle East, and Africa (LAMEA): This combined region offers significant latent potential, with growth primarily concentrated in urban centers and oil & gas operations. The Middle East, with its massive infrastructure projects and high reliance on oil and gas exploration, drives steady demand for high-stability, reliable flame and gas detection systems where pyroelectric detectors are standard components. In Latin America, the growing adoption of smart security solutions in commercial spaces and high-end residential areas contributes to market expansion. Growth here is often linked to foreign direct investment and the adoption of technologies previously proven in North American and European markets, making affordability and ease of integration critical success factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pyroelectric Detector Market.- Excelitas Technologies Corp.

- Murata Manufacturing Co., Ltd.

- Hamamatsu Photonics K.K.

- Nippon Ceramic Co., Ltd. (Nicera)

- InfraTec GmbH

- TE Connectivity Ltd.

- Honeywell International Inc.

- Texas Instruments Incorporated

- Ophir Optronics Solutions Ltd. (Newport Corporation)

- Laser Components GmbH

- Dexter Research Center, Inc.

- Pyreos Limited

- Heraeus Sensor Technology GmbH

- Sensor Electronic Technology, Inc.

- Smiths Interconnect

- Boston Electronics Corporation

- DIAS Infrared GmbH

- Advanced Photonix, Inc.

- Flir Systems (Teledyne FLIR)

- Gentherm Inc.

Frequently Asked Questions

Analyze common user questions about the Pyroelectric Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of pyroelectric detectors over microbolometers and thermopiles?

Pyroelectric detectors offer significant advantages in low-power applications due to their high responsivity without the need for cryogenic cooling or complex stabilization circuits. They are generally less expensive than microbolometers, offer faster response times than standard thermopiles, and are inherently robust and stable for long-term use in passive infrared (PIR) sensing and gas analysis applications, making them highly suitable for battery-operated devices and simple motion detection.

How is the growth of the IoT ecosystem driving demand for pyroelectric sensors?

The IoT ecosystem relies heavily on ubiquitous, energy-efficient sensors for smart homes, building automation, and industrial monitoring. Pyroelectric detectors, particularly in dual-element configurations, are essential for low-power occupancy and motion detection (PIR) in smart thermostats and lighting controls, acting as key enablers for energy management systems and enhancing the overall functionality and connectivity of smart devices by providing reliable, context-aware input data.

Which material type holds the largest market share in the pyroelectric detector segment?

Lithium Tantalate (LiTaO3) currently dominates the market share due to its superior pyroelectric coefficient, excellent thermal stability, and established reliability in commercial applications. LiTaO3 is widely used in high-performance dual and quad-element PIR sensors and specialized NDIR gas detection modules, balancing high sensitivity with manufacturing feasibility and long-term operational consistency across varying temperature ranges.

What role does Artificial Intelligence (AI) play in optimizing pyroelectric detector performance?

AI significantly optimizes pyroelectric performance primarily by utilizing machine learning algorithms to filter complex environmental noise and reduce false positives, especially in security and building automation. AI-driven signal processing enhances the detection reliability of PIR sensors by classifying objects and patterns, while in spectroscopy, AI models accelerate and improve the accuracy of chemical and gas identification based on the detector's output data.

What are the key application trends projected for the fastest growth rate?

The fastest growth rate is projected for the Gas Sensing application segment, driven by the global imperative for tighter environmental monitoring, industrial safety compliance, and increased integration of NDIR CO2 sensors in HVAC systems for improved indoor air quality management. The development of advanced, highly specific pyroelectric elements optimized for distinct gas absorption spectra is fueling this rapid expansion into regulated industrial and commercial markets worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager