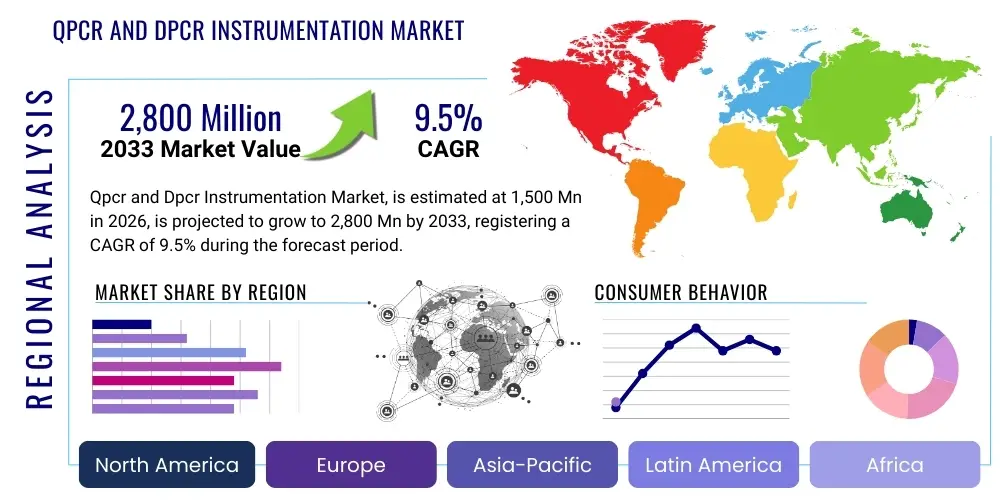

Qpcr and Dpcr Instrumentation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440777 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Qpcr and Dpcr Instrumentation Market Size

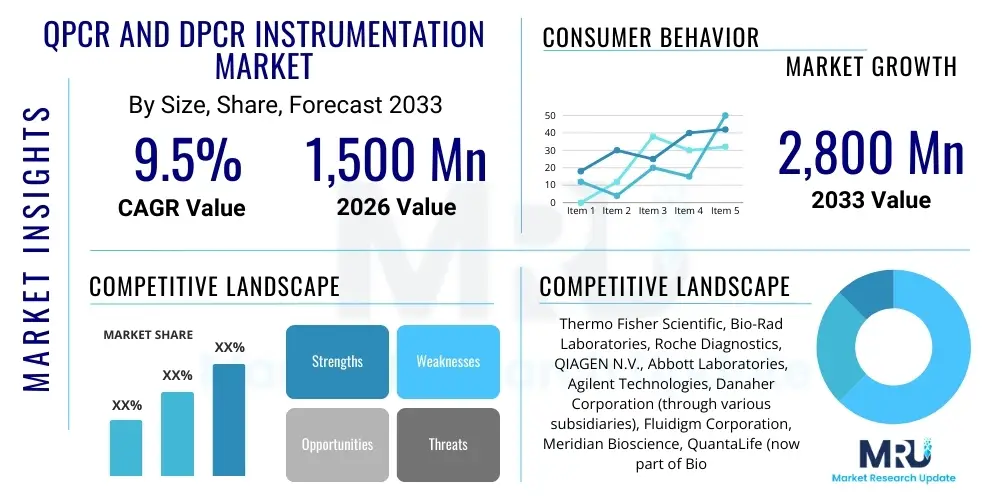

The Qpcr and Dpcr Instrumentation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1,500 Million in 2026 and is projected to reach USD 2,800 Million by the end of the forecast period in 2033.

Qpcr and Dpcr Instrumentation Market introduction

The Quantitative Polymerase Chain Reaction (qPCR) and Digital Polymerase Chain Reaction (dPCR) Instrumentation Market encompasses specialized equipment used for the precise measurement and analysis of nucleic acids (DNA and RNA). qPCR, also known as real-time PCR, monitors the amplification of targeted DNA molecules in real-time, allowing for accurate quantification of genetic material. This technique is fundamental in molecular biology research, clinical diagnostics, and drug development due to its high sensitivity and specificity. dPCR represents a third-generation PCR technology that offers absolute quantification without reliance on standard curves, achieving superior precision and sensitivity, particularly in detecting low-abundance targets, making it essential for liquid biopsy and early cancer detection.

Major applications of these instruments span across clinical diagnostics, including infectious disease testing (such as COVID-19 and HIV), oncology (mutation detection and monitoring minimal residual disease), and genetic disease screening. In research settings, they are indispensable for gene expression analysis, pathogen detection, and quality control in biological manufacturing. The versatility and robustness of both qPCR and dPCR instruments—ranging from benchtop systems suitable for high-throughput labs to compact, portable units—make them foundational tools in modern biological sciences. Key benefits include rapid turnaround time, high sensitivity, and the capacity for multiplexing, which enables simultaneous detection of multiple targets in a single reaction.

Driving factors for market growth include the increasing global prevalence of infectious and chronic diseases, which necessitates advanced and reliable diagnostic tools. Furthermore, substantial funding allocated towards genomics research, personalized medicine initiatives, and advancements in automation and miniaturization technology propel the adoption of both qPCR and dPCR systems. The rising demand for early and non-invasive diagnostic solutions, particularly utilizing the high precision offered by dPCR in oncology and prenatal testing, significantly contributes to the market expansion. The continuous development of user-friendly software and standardized protocols also lowers the barrier to entry for smaller laboratories and emerging markets.

Qpcr and Dpcr Instrumentation Market Executive Summary

The global Qpcr and Dpcr Instrumentation Market is undergoing significant evolution, driven by transformative business trends focusing on integration and automation. A major business trend involves the shift towards integrated systems that combine sample preparation, amplification, and analysis capabilities into single, streamlined platforms, enhancing workflow efficiency and reducing the risk of contamination. Furthermore, strategic mergers, acquisitions, and collaborations between technology providers and diagnostic companies are consolidating market expertise, particularly in developing assays tailored for high-growth areas like non-invasive prenatal testing (NIPT) and liquid biopsies. Manufacturers are also focusing on offering instruments optimized for high-throughput screening in pharmaceutical development and contract research organizations (CROs), catering to the accelerated pace of drug discovery.

Regionally, North America maintains market dominance, attributed to high R&D expenditure, the presence of key industry players, and favorable reimbursement policies for molecular diagnostics. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by improving healthcare infrastructure, rising awareness of personalized medicine, and large-scale government investments in healthcare technology across countries like China, India, and Japan. Europe follows a steady growth trajectory, characterized by stringent regulatory environments ensuring high standards for diagnostic accuracy and widespread adoption of PCR technologies in clinical settings. The push for localized manufacturing and decentralized testing facilities is a key regional trend observed globally.

Segment trends highlight the burgeoning demand for dPCR instruments, primarily due to their unparalleled precision in absolute quantification, critical for applications in rare mutation detection and microbial load quantification. While qPCR remains the dominant technology in terms of sheer volume of use in clinical labs, dPCR is rapidly gaining traction, particularly in research and specialized clinical niches. In terms of application, oncology holds the largest market share, driven by the increasing need for molecular monitoring of cancer progression and therapeutic efficacy. The consumables segment, including reagents, kits, and assay plates, continues to generate the most substantial revenue, demonstrating the operational sustainability and recurring revenue streams inherent in the market model.

AI Impact Analysis on Qpcr and Dpcr Instrumentation Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Qpcr and Dpcr workflow is fundamentally transforming data interpretation and experimental design. Common user questions often revolve around how AI can automate the complex data analysis generated by high-throughput PCR systems, particularly the accurate calling of positive/negative results, quantification in complex mixtures, and managing inherent noise and variability in dPCR droplet analysis. Users are highly interested in AI’s capability to accelerate the development of new diagnostic assays by predicting optimal primer and probe designs, thereby significantly reducing validation time and costs. Furthermore, there is considerable expectation that AI models will enhance the diagnostic utility of PCR data by correlating molecular findings with clinical outcomes with greater accuracy than traditional statistical methods, making real-time clinical decision support possible. The key themes summarized include automation of data quality control, enhanced diagnostic precision through pattern recognition, and optimization of complex multiplexing protocols.

AI algorithms are particularly effective in processing the vast and nuanced datasets produced by modern PCR instruments, addressing traditional bottlenecks related to manual data review and subjective interpretation. For instance, in dPCR, ML models can distinguish reliably between signal and background noise in thousands of partitions, improving the accuracy of rare event detection, which is crucial for applications such as monitoring circulating tumor DNA (ctDNA). Moreover, AI facilitates predictive maintenance for instrumentation, analyzing usage patterns and thermal cycling data to anticipate potential equipment failures, thereby minimizing downtime and ensuring the reliability necessary for regulated clinical laboratory environments. This automation extends the usability of these instruments to non-specialist personnel while maintaining analytical rigor.

The future influence of AI centers on creating 'smart' PCR devices capable of self-optimization and adaptive experimentation. These systems could dynamically adjust reaction parameters (like annealing temperatures or cycle numbers) based on real-time feedback and sample characteristics, moving beyond static protocols. This shift is critical for highly variable sample types, such as environmental samples or heterogeneous clinical specimens. Consequently, AI is not just a data analysis tool but a critical component for achieving higher standardization, better reproducibility across different laboratories, and pushing the sensitivity limits of both qPCR and dPCR technologies for emerging diagnostic needs, particularly in infectious disease surveillance and personalized medicine.

- AI drives automated interpretation of complex dPCR droplet data, enhancing precision in rare mutation detection.

- Machine Learning optimizes experimental protocols, predicting optimal thermal cycles and improving assay design efficiency.

- AI algorithms enable predictive maintenance and self-calibration of instruments, maximizing operational uptime.

- Integration of AI facilitates real-time quality control checks on amplification curves and reaction parameters, standardizing results.

- AI supports clinical decision-making by correlating quantitative PCR results with extensive patient data for personalized diagnostics.

DRO & Impact Forces Of Qpcr and Dpcr Instrumentation Market

The Qpcr and Dpcr Instrumentation Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the market's impact forces. The primary drivers include the escalating global prevalence of chronic diseases, such as cancer and inherited disorders, which mandates sensitive and specific molecular diagnostic tools. Concurrently, substantial governmental and private funding dedicated to genomic research, particularly in personalized medicine and companion diagnostics, fuels the demand for high-throughput and precise PCR platforms. The increasing adoption of dPCR in clinical oncology, stemming from its superior absolute quantification capabilities for monitoring minimal residual disease (MRD) and circulating tumor DNA (ctDNA), acts as a powerful market accelerator. Technological advancements leading to portable, integrated, and multiplexed PCR systems further simplify workflows and expand accessibility, particularly in point-of-care (POC) settings.

Restraints impeding market growth primarily center on the high initial capital investment required for advanced dPCR systems and the ongoing costs associated with proprietary reagents and consumables. This financial hurdle can limit adoption, particularly in resource-constrained research institutions and developing economies. Furthermore, the necessity for highly skilled personnel to operate and interpret complex PCR data, especially for sophisticated dPCR assays, poses a significant operational challenge. Regulatory complexities and the need for standardized quality control measures across diverse clinical applications also slow the pace of widespread commercial adoption, particularly for novel dPCR-based diagnostics aiming for FDA or CE-IVD approval. Standardization challenges in data normalization and inter-laboratory comparability remain persistent technical restraints.

Opportunities for expansion are abundant, particularly in emerging applications such as environmental testing, forensic science, and agricultural biotechnology, where high-sensitivity pathogen and genetic material detection is essential. The convergence of microfluidics and PCR technology presents an opportunity for developing highly integrated, low-cost diagnostic cartridges suitable for decentralized testing and global health initiatives. Moreover, the expanding field of transcriptomics and single-cell analysis relies heavily on ultrasensitive amplification methods, providing fertile ground for innovation in dPCR applications. Strategic partnerships focused on local manufacturing and distribution in high-growth regions like APAC and Latin America offer significant avenues for market penetration, leveraging the increasing prioritization of diagnostic capabilities in these regions. The enduring threat of new infectious disease outbreaks (pandemics) ensures sustained investment in rapid and reliable PCR-based detection platforms.

Segmentation Analysis

The Qpcr and Dpcr Instrumentation Market is comprehensively segmented based on technology type, product component, application, and end-user, providing a granular view of market dynamics and adoption patterns. The technology segment differentiates between the established quantitative PCR (qPCR) platforms, which dominate general clinical and research throughput, and the rapidly advancing digital PCR (dPCR) platforms, which specialize in high-precision absolute quantification necessary for demanding applications like liquid biopsies and rare event detection. The component segmentation highlights the significant revenue generated by consumables (reagents, assay kits, plates) compared to the initial instrument purchases. This recurring revenue stream is essential for market stability and reflects the continuous operational use of these technologies in laboratories worldwide. The application segmentation demonstrates the critical role of these instruments in clinical diagnostics, research, and specialized areas like forensics and agriculture, with clinical diagnostics being the most revenue-intensive category globally.

Product component analysis indicates that reagents and consumables account for the largest share of the market value, driven by the high volume of tests performed daily and the proprietary nature of many assay chemistries. Manufacturers continuously introduce optimized reagent kits that improve sensitivity, speed, and multiplexing capabilities, ensuring customer loyalty and repeat purchases. The instrumentation segment, encompassing real-time thermal cyclers, integrated dPCR systems, and specialized microfluidic controllers, sees slower replacement cycles but higher initial capital investment. The continuous innovation in instrumentation focuses on automation, increased well capacity, and enhanced data integration features, aimed at maximizing laboratory throughput and minimizing manual intervention.

End-user segmentation reveals that academic and research institutions remain fundamental consumers, driving methodological development and basic biological discovery, requiring versatile, state-of-the-art equipment. However, the largest and fastest-growing end-user segment is clinical diagnostic laboratories, including hospitals and reference labs, where high-volume testing for infectious diseases and molecular oncology mandates robust, validated, and often automated PCR systems. Pharmaceutical and biotechnology companies also represent a crucial segment, utilizing these instruments extensively for quality control, biomarker discovery, and clinical trial monitoring, prioritizing regulatory compliance and scalability in their instrumentation choices.

- Technology Type:

- Quantitative PCR (qPCR)

- Digital PCR (dPCR)

- Product Component:

- Instruments (Real-time Thermal Cyclers, Integrated dPCR Systems)

- Consumables and Reagents (Master mixes, Primers, Probes, Kits)

- Software and Services

- Application:

- Clinical Diagnostics (Infectious Disease Testing, Oncology, Genetic Testing)

- Research (Gene Expression Analysis, Pathogen Detection)

- Forensic Science and Paternity Testing

- Agricultural and Environmental Testing

- End-User:

- Hospitals and Diagnostic Centers

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

Value Chain Analysis For Qpcr and Dpcr Instrumentation Market

The value chain for the Qpcr and Dpcr Instrumentation Market begins with upstream activities focused on the meticulous sourcing and manufacturing of highly specialized components and raw materials. This includes the production of high-grade optical components (sensors, detectors, light sources), precision thermal control systems (Peltier elements), and microfluidic chips necessary for dPCR droplet generation and handling. Suppliers of proprietary chemical reagents, such as high-purity polymerases, nucleotides, fluorescent dyes, and specialized buffers, are critical upstream partners. Quality control at this stage is paramount, as the sensitivity of PCR relies heavily on the purity and stability of these foundational inputs. Key challenges include maintaining consistent supply chain integrity and managing intellectual property rights related to novel amplification chemistries.

The core midstream activity involves the actual design, assembly, and rigorous testing of the complex instrumentation. Manufacturers focus on R&D to integrate features like automation, miniaturization, and improved data processing capabilities (often involving embedded AI). Distribution channels are highly organized and bifurcated: direct sales channels are typically employed for large, sophisticated instruments sold to major academic centers and pharmaceutical clients, where direct technical consultation and maintenance services are necessary. Conversely, indirect channels, involving authorized regional distributors and specialized third-party logistics providers, are essential for reaching smaller clinical labs and international markets, particularly for the high-volume distribution of consumables and standard qPCR kits. The efficiency of the distribution network is crucial for maintaining the cold chain required for enzyme and reagent stability.

Downstream activities center on end-user adoption, maintenance, and support. This stage involves the sale, installation, and validation of the instruments, followed by extensive technical support, application training, and software updates provided by the manufacturers or their specialized service teams. The post-sale service component, including preventative maintenance contracts and rapid response to technical issues, is a significant differentiator in this market, impacting customer satisfaction and laboratory uptime. The value chain concludes with the clinical and research utilization of the data generated, where instruments become integral tools in patient diagnostics or scientific discovery, linking the instrument’s performance directly to actionable outcomes in personalized medicine and public health.

Qpcr and Dpcr Instrumentation Market Potential Customers

The primary consumers and potential buyers in the Qpcr and Dpcr Instrumentation Market are diverse institutions requiring high-precision molecular detection and quantification capabilities. Clinical diagnostic laboratories, including private reference labs and hospital pathology departments, represent the most significant customer segment due to the immediate need for rapid and reliable molecular testing for infectious diseases, cancer screening, and pharmacogenomics. These customers prioritize regulatory approval (e.g., IVD status), high throughput capacity, automation features, and robust technical support to ensure continuous operation and adherence to clinical guidelines. They are driven by patient volumes and the transition toward molecular pathology as the standard of care for numerous conditions.

Academic and governmental research institutions constitute the second major customer base. Scientists and researchers in biology, genetics, and public health departments rely on these instruments for fundamental research, grant-funded projects, and epidemiological studies. Their purchasing decisions are often driven by technological sophistication, flexibility for developing novel assays, and budget constraints, leading them to adopt both high-end dPCR systems for niche applications and standard qPCR platforms for routine gene expression work. Universities and national research centers frequently require instruments capable of multiplexing and integration with other genomic technologies like next-generation sequencing (NGS) preparation workflows.

Furthermore, pharmaceutical and biotechnology companies are high-value customers, utilizing qPCR and dPCR instrumentation extensively throughout the drug development lifecycle, from target validation and preclinical testing to monitoring therapeutic efficacy in clinical trials. They demand systems that meet strict GLP/GMP compliance standards, offer audit trails, and provide scalable solutions for large-scale screening and quality control of biopharmaceuticals. Finally, emerging customers include agricultural testing facilities (for genetically modified organism detection and pathogen screening in crops/livestock), environmental monitoring labs (for water quality and microbial analysis), and forensic science laboratories, all seeking the unparalleled sensitivity and reliability offered by modern PCR platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,500 Million |

| Market Forecast in 2033 | USD 2,800 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Bio-Rad Laboratories, Roche Diagnostics, QIAGEN N.V., Abbott Laboratories, Agilent Technologies, Danaher Corporation (through various subsidiaries), Fluidigm Corporation, Meridian Bioscience, QuantaLife (now part of Bio-Rad), Standard BioTools, Takara Bio, PerkinElmer, Canon Medical Systems, Becton, Dickinson and Company (BD) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Qpcr and Dpcr Instrumentation Market Key Technology Landscape

The technological landscape of the Qpcr and Dpcr Instrumentation Market is defined by continuous innovation focusing on increased sensitivity, multiplexing capabilities, automation, and system integration. A primary advancement is the maturation of microfluidics and lab-on-a-chip technologies, which are foundational for dPCR systems. These technologies enable the precise partitioning of reactions into thousands of microscopic chambers or droplets, dramatically increasing sensitivity and allowing for absolute quantification without calibration curves. Innovations in droplet generation and reading mechanisms, such as chip-based vs. plate-based systems, determine the throughput and ease of use for specific applications. For qPCR, technological evolution focuses on improving thermal uniformity across the reaction block, speeding up cycle times through advanced heating and cooling elements, and integrating high-resolution optical detection systems capable of handling multiple fluorescent dyes simultaneously for enhanced multiplexing. This push for greater multiplexing allows laboratories to screen for dozens of targets in a single reaction, saving time and precious sample material, which is critical in oncology.

Another pivotal technological trend is the drive toward system automation and connectivity. Modern qPCR and dPCR instruments are increasingly equipped with robotic liquid handling systems and integrated sample preparation modules, minimizing manual steps and reducing the risk of human error and contamination. This level of automation is essential for high-throughput diagnostic labs that process hundreds of samples daily. Furthermore, instruments are now designed with advanced connectivity features, enabling seamless data transfer, remote monitoring, and integration with Laboratory Information Management Systems (LIMS). This connectivity facilitates compliance, improves data security, and allows for the application of advanced computational tools, including AI, for real-time quality control and complex data analysis, establishing a true digital workflow environment.

The competitive differentiation also lies in the development of specialized assay chemistries and proprietary reagents. Companies are investing heavily in novel fluorescent dyes, quenchers, and polymerases optimized for fast cycling, superior thermal stability, and resistance to inhibitors often present in clinical samples. For dPCR, the focus is on robust partition stability and minimizing droplet coalescence to ensure accurate counting. The development of portable, battery-operated, and lower-cost systems designed specifically for point-of-care diagnostics and field surveillance in global health settings represents a disruptive technological thrust. These smaller, simplified devices leverage micro-electro-mechanical systems (MEMS) and low-power consumption optics to bring sophisticated molecular testing out of centralized laboratories and closer to the patient, thereby improving accessibility and reducing diagnostic delays globally.

Regional Highlights

Regional analysis reveals significant variation in the adoption rates and market penetration strategies for Qpcr and Dpcr instrumentation, heavily influenced by healthcare spending, regulatory frameworks, and research infrastructure across major geographical areas.

- North America: This region holds the largest market share, driven by robust funding for genomics research, the early and rapid adoption of cutting-edge technologies like dPCR in clinical oncology, and the strong presence of major market players. The U.S., in particular, benefits from a high volume of molecular diagnostic testing, favorable reimbursement policies, and extensive clinical laboratory infrastructure. Investment in personalized medicine and companion diagnostics ensures sustained growth, particularly within academic medical centers and large pharmaceutical R&D labs.

- Europe: Europe represents a mature market characterized by stringent regulatory environments (such as the IVDR), which foster high-quality, validated diagnostic systems. Key markets like Germany, the UK, and France show high adoption rates in infectious disease screening and forensic applications. Growth is steady, supported by collaborative research efforts (e.g., EU-funded projects) and a strong public healthcare system prioritizing preventative and early molecular diagnostics.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid expansion is attributed to improving healthcare infrastructure, massive government investments in R&D and genomic sequencing capabilities (especially in China and India), and the high prevalence of infectious diseases and increasing cancer rates. The region exhibits high demand for cost-effective, high-throughput systems and is becoming a major manufacturing hub for instruments and reagents, leading to competitive pricing strategies.

- Latin America (LATAM): Growth in LATAM is driven by increasing awareness of molecular diagnostics, gradual improvements in health spending, and the need for localized solutions to combat regional infectious diseases. Market expansion is often reliant on government procurement and partnerships with global manufacturers to upgrade existing laboratory infrastructure, focusing initially on established qPCR technology before transitioning to dPCR.

- Middle East and Africa (MEA): This region is characterized by fragmented market development, with significant spending concentrated in wealthier Gulf nations (e.g., UAE, Saudi Arabia) on high-end instrumentation for specialized clinics and research centers. The African continent shows growing adoption, particularly in public health programs focused on infectious disease surveillance (e.g., malaria, tuberculosis, HIV), often facilitated by international aid organizations, leading to demand for robust, portable, and low-maintenance qPCR systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Qpcr and Dpcr Instrumentation Market.- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Roche Diagnostics

- QIAGEN N.V.

- Abbott Laboratories

- Agilent Technologies

- Danaher Corporation (including Beckman Coulter and Cepheid)

- Fluidigm Corporation (now Standard BioTools)

- Meridian Bioscience

- QuantaLife (now part of Bio-Rad)

- Standard BioTools

- Takara Bio

- PerkinElmer

- Canon Medical Systems

- Becton, Dickinson and Company (BD)

- BioMérieux SA

- Eppendorf AG

- Promega Corporation

- Analytik Jena

- Micronit Microfluidics

Frequently Asked Questions

Analyze common user questions about the Qpcr and Dpcr Instrumentation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between qPCR and dPCR instrumentation?

The primary difference is the quantification method. qPCR provides relative quantification by measuring fluorescence during the amplification cycle, requiring a standard curve. dPCR provides absolute quantification by partitioning the sample into thousands of reactions, allowing for direct counting of positive and negative partitions without reliance on a reference standard, offering superior precision for rare targets.

Which applications are primarily driving the demand for dPCR instruments?

Demand for dPCR is chiefly driven by applications requiring ultra-high sensitivity and absolute quantification, notably in oncology for liquid biopsy (circulating tumor DNA detection), monitoring minimal residual disease (MRD), non-invasive prenatal testing (NIPT), and detecting low-level pathogens in infectious disease monitoring.

What are the main restraints impacting market growth in developing regions?

The main restraints are the high initial capital expenditure required for sophisticated dPCR equipment, the reliance on continuous supply of proprietary reagents, and the lack of readily available infrastructure and specialized technical expertise necessary for advanced molecular diagnostics in low-resource settings.

How is AI integrating into the Qpcr and Dpcr workflow?

AI integration focuses on automating complex data analysis, particularly for high-throughput dPCR systems, improving data quality control, optimizing assay protocols (primer design), and linking molecular results to clinical phenotypes, enhancing diagnostic accuracy and throughput efficiency.

Which segment accounts for the largest revenue share in the market?

The Consumables and Reagents segment consistently generates the largest revenue share. This is due to the high volume of recurring testing performed in clinical and research laboratories globally, which necessitates continuous purchase of master mixes, specialized polymerases, probes, and assay kits that are essential for the operation of both qPCR and dPCR systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager